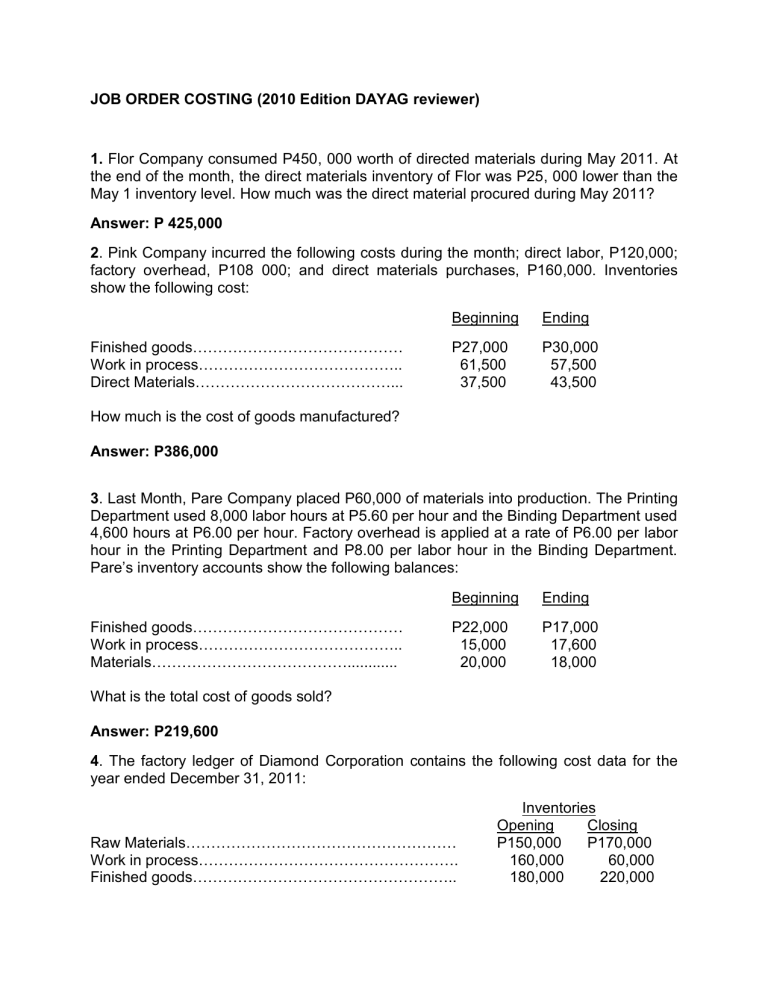

JOB ORDER COSTING (2010 Edition DAYAG reviewer) 1. Flor Company consumed P450, 000 worth of directed materials during May 2011. At the end of the month, the direct materials inventory of Flor was P25, 000 lower than the May 1 inventory level. How much was the direct material procured during May 2011? Answer: P 425,000 2. Pink Company incurred the following costs during the month; direct labor, P120,000; factory overhead, P108 000; and direct materials purchases, P160,000. Inventories show the following cost: Finished goods…………………………………… Work in process………………………………….. Direct Materials…………………………………... Beginning Ending P27,000 61,500 37,500 P30,000 57,500 43,500 How much is the cost of goods manufactured? Answer: P386,000 3. Last Month, Pare Company placed P60,000 of materials into production. The Printing Department used 8,000 labor hours at P5.60 per hour and the Binding Department used 4,600 hours at P6.00 per hour. Factory overhead is applied at a rate of P6.00 per labor hour in the Printing Department and P8.00 per labor hour in the Binding Department. Pare’s inventory accounts show the following balances: Finished goods…………………………………… Work in process………………………………….. Materials…………………………………............ Beginning Ending P22,000 15,000 20,000 P17,000 17,600 18,000 What is the total cost of goods sold? Answer: P219,600 4. The factory ledger of Diamond Corporation contains the following cost data for the year ended December 31, 2011: Raw Materials……………………………………………… Work in process……………………………………………. Finished goods…………………………………………….. Inventories Opening Closing P150,000 P170,000 160,000 60,000 180,000 220,000 Raw Materials Used………………………………………. Total Manufacturing costs charged to production during the year (including raw materials, direct labor and factory overhead applied at the rate of 50% of direct labor cost)……………… 652,000 1,372,000 Compute the: (1) cost of raw materials purchased and (2) direct labor charged to production during the year: Answer: (1) P672,000; (2) P480,000 5. National Marketing Corp. uses a job-order costing system. It has three production departments, X, Y, and Z. The manufacturing cost budget for 2011 is as follows: Direct Materials……………………………… Direct Labor…………………………………. Manufacturing overhead……………………. Dept. X Dept.Y Dept. Z P600,000 200,000 600,000 P400,000 500,000 100,000 P200,000 400,000 200,000 For Job No. 01-90 which was completed in 2011, direct materials cost was P75,000 and direct labor cost was as follows: Dept. X………………………………………………………………………… Dept. Y…………………………………………………………………………. Dept. Z………………………………………………………………………… P 40,000 100,000 20,000 The corporation applies manufacturing overhead to each job order on the basis of direct labor cost, using departmental rates predetermined at the beginning of the year based on the manufacturing cost budget. The total manufacturing cost of Job No. 01-90 which was completed in 2011 is: Answer: P385,000 6. The following data were taken from the records of Best Company. 08/31/2011 09/30/2011 Inventories: Raw Materials…………………………………… P ? Work-in-process………………………………… 80,000 Finished goods………………………………… 60,000 P 50,000 95,000 78,000 Raw Materials purchases, P 46,000 Factory overhead, 75% of direct labor cost, P63,000 Selling and administrative expenses, 12.5% of sales, P25,000. Net income for September, 2011, P25,000. What is the cost of raw materials inventory on August 31, 2011? Answer: P40,000 7. Vat Corporation manufactures rattan furniture sets for export and uses the job order cost system in accounting for its costs. You obtained from the corporation’s books and records the following information for the year ended December 31, 2011; The work in process inventory on January 1 was 20% less than the work in process inventory on December 31. The total manufacturing costs added during 2008 was P900,000 based on actual direct materials and direct labor but with manufacturing overhead applied on actual direct labor pesos. The manufacturing overhead applied to process was 72% of the direct labor pesos, and it was equal to 25% of the total manufacturing costs. The cost of goods manufactured, also based on actual direct materials, actual direct labor and applied manufacturing overhead, was P850,000. The cost of direct materials used and the work-in-process inventory on December 31,2011: Answer: Direct Material Used P362,000 Work-in-process Inventory P250,000 8. Fusion Company has the following data on April 30, 2011: April manufacturing overhead…………………………………………. Decrease in ending inventories: Materials…………………………………………………………. Goods in Process………………………………………………. Increase in ending inventory: Finished Goods………………………………………………… P30,101.80 2,430.00 590.00 1,320.00 The manufacturing overhead amounts to 50% of the direct labor, and the direct labor and manufacturing overhead combined equal 50% of the total cost of manufacturing. All materials are purchased F.O.B shipping point. What is the cost of goods manufactured? Answer: P181,200.80 9. The Fork Corporation manufactures one product and accounts for cost by a job-order cost system. You have obtained the following information for the year ended December 31, 2011 from the corporation’s books and records; Total manufacturing cost added during 2011 based on actual direct materials, actual direct labor and applied factory overhead on actual direct labor cost………………………………………….. P1,000,000 Cost of goods manufactured based on actual Direct materials and direct labor and Applied factory overhead…………………………………………… 970,000 Applied factory overhead to work in process Based on direct labor cost………………………………………….. 75% Applied factory overhead for the year, based On total manufacturing cost………………………………………… 27% Beginning work in process inventory was 80% of ending work in process inventory. Compute the cost of direct materials used for year ended December 31, 2011. Answer: P370,000 10. Tarzan Co. Employs a job order cost system. Its manufacturing activities in July, 2011, its first month of operation, are summarized as follows: 1201 Direct Materials…………………………. P 7,000 Direct labor cost………………………… P6,600 Direct labor hours………………………. 1,100 Units produced…………………………. 200 JOB NUMBERS 1202 1203 1204 P5,800 P11,600 P5,000 P6,000 P8,400 P2,400 1,000 1,400 400 100 1,000 300 Manufacturing overhead is applied at a rate of P2 per direct labor hour for variable overhead, P3 per hour for fixed overhead. Jobs 1201, 1202 and 1203 were completion in July. What is the cost of the completed jobs? Answer: P62,900 11. Job No. 010 has, at the end of the second week in April, an accumulated total cost of P4,200. In the third week. P1,010 of direct materials were used on the Job. Twenty (20) hours of direct labor services were applied to the job at a cost of P5 per hour. Manufacturing overhead was applied at the basis of P2.50 per direct labor hour for fixed overhead and P2 per hour for variable overhead. Job No. 010 was the only job completed during the third week. The total cost of Job Order No. 010 is: Answer: P 5,400 12. The Work-in-Process account of the Malinta Company which uses a job order cost system follows: Work- in-Process April 1 Balance……………..P 25,000 Finished Goods………..P 125,450 Direct Materials…………. 50,000 Direct labor…………….. 40,000 Overhead Applied……. 30,000 Overhead is applied to production at a predetermined rate, based on direct labor cost. The work in process on April 30 represents the cost of Job No. 456, which has been charged with direct labor cost of P3,000 and Job No. 789, which has been charged with applied overhead of P2,400. The cost of direct materials charged to Job No. 456 and Job No. 789 amounted to: Answer: P 8,700. 13. The following information were taken from the accounting records of Yanni Music Company for 2011: Increase in raw materials inventory Decrease in finished goods inventory Raw Materials purchases Direct labor payroll Factory overhead Freight out P 45,000 150,000 1,290,000 600,000 900,000 135,000 The cost of raw materials used during the period amounted to: Answer: P1,245,000. 14. Precise, Inc. manufactures specialized precision electronics kits. In late March, Job order #0311 and #0322 were started. Estimated materials cost were P90,000 for both orders (60% for #0311) while direct labor hours were estimated at 700 for #0311 and 400 for #0322. Labor rate is P18 per hour while variable overhead rate is P10 per hour. By the end of April, 755 of the required material have been issued to production in the amount of P90,000 and both job orders have been 50% converted with 360 hours charged to #0311 and 180 hours charged to #0322 at the hourly rates given. The total cost charged to Job Order #0311 was: Answer: P64,080. 15. Handy Crafts manufactures to customers’ specifications. The company uses a job order cost system and, for the month of May, 2011, summarized the following information. Beginning work in process inventory (five partially completed jobs) Orders completed (eighteen) Orders shipped out (fourteen) Materials requisitioned Direct labor cost Overhead= 150% of direct labor cost. P 300,000 2,400,000 2,000,000 1,700,000 800,000 The month-end work in proves inventory was: Answer: P 1,600,000. 16. Ambo, Inc. manufactured 50,000 kilos of compound Am in 2011 at the following costs: Opening work-in-process of P 88,125. Materials of P182,500 of which 90% is direct materials Labor of P242,500 of which 93% is direct labor Closing work-in-process of P67,500. Factory overhead is 125% of direct labor cost and includes indirect materials and indirect labor. The cost of goods manufactured is: Answer: P 692,306 17. Burger Co.’s materials purchase during 2011 are P25,590 and materials put into production are directed materials, respectively, worth P18,500 and P7,090. The total factory payroll is P74,000 of which P50,000 represents direct labor. Other factory overhead cost to process. Sales, Cost of goods sold, and the cost of goods manufactured, respectively, are P130,000, P120,000, and P128,000. By what amount did the company’s closing goods in process inventory exceed its opening goods in process inventory? Answer: P 3,590 18. Steak Co. is a manufacturing concern using the perpetual inventory system. The following materials inventory account data is provided: Beginning balance Other debits to the account Excess of ending inventory over beginning inventory P 275,000 825,000 55,000 How much is the cost of materials issued to production? Answer: P 770,000 19. The following selected information pertains to Ajax processing Co.: direct materials, P62,500; indirect materials, P12,500; factory payroll, P75,000 of direct labor and P11,250 of indirect labor; and other factory overhead incurred, P37,500. The total conversion cost was: Answer: P 136,250 20. Pistahan Corporation is a manufacturing company engaged in the production of a single special product known as “Marvel”, Production costs are accumulated with the use of a job-order-cost system. The following information is available as of June 1, 2011. Work-in-process Direct materials inventory P 10,710 48,600 In analyzing the job-order cost sheets, the records disclosed that the composition of the work-in-process inventory on June 1, 2011 was as follows: Direct material used Direct labor (900 hours) Factory overhead applied P 3,960 4,500 2,250 P 10,710 The following manufacturing activity occurred during the month of June 2011: Purchased direct materials costing P60,000 Direct labor worked 9,900 hours of P5 per hour Factory overhead of P2.50 per direct labor hour was applied to production. At the end of June 2011, the following information was gathered in connection with the inventories: Inventory of work-in-process: Direct Materials used P 12,960 Direct labor (1,500 hours) Factory overhead applied 7,500 3,750 P 24,210 P 51,000 Inventory of direct materials Compute the cost of goods manufactured: Answer: P118,350 21. Johnson uses a job order cost system and applies factory overhead to production orders on the basis of direct-labor cost. The overhead rate for 2011 is 200% for Department A and 50% for Department B. Job 123, started and completed during 2011, was charged with the following costs: Direct material Direct labor Factory overhead applied Department A B P 25,000 P 5,000 ? 30,000 40,000 ? The total manufacturing cost associated with Job 123 should be Answer: P135,000 22. The Following data are obtained from Gianne Manufacturing Company: Cost of goods manufactured is P187,500 Inventory variations are as follows: raw materials ending inventory is one-third based on raw materials beginning; no initial inventory of work-in-process, but at the end of period P12,500 was on hand; finished goods inventory was four times as large at end of period as at the start. Net income after taxes amounted to P26,000, income tax rate is 35%. Purchase of raw materials amounted to net income before taxes. Breakdown of costs incurred in manufacturing cost was as follows: Raw material consumed Direct labor Overhead 50% 30% 20% Compute the amount raw material beginning inventory: Answer: P90,000. 23. The following cost data were taken from the records of a manufacturing company: Depreciation on factory equipment Depreciation on sales office P 1,000 500 Advertising Freight-out (shipping) Wages of production workers Raw materials used Sales salaries and commissions Factory rent Factory insurance Materials Handling Administrative salaries 7,000 3,000 28,000 47,000 10,000 2,000 500 1,500 2,000 Based upon the above information, the manufacturing cost incurred during the year was: Answer: P80,000 24. Data pertaining to Lam Co.’s manufacturing operations: Inventories Direct Materials Work-In-Process Finished goods 4/1 P 18,000 9,000 27,000 4/30 P 15,000 6,000 36,000 Additional information for the month of April: Direct Materials purchased Direct labor payroll Direct labor rate per hour Factory overhead rate per direct labor hour P 42,000 30,000 7.50 10.50 For the month of April, cost of goods manufactured was: Answer: P 118,000 25. Carley Products has no work-in-process or finished goods inventories at the close of business on December 31, 2011. The balances of Carley’s accounts as of December 31,2011 are as follow: Cost of goods sold General selling and administrative expenses Sales Factory overhead control Factory overhead applied Carley Products’ income before income taxes 2011 is” Answer: P 608,000 P 2,040,000 900,000 3,600,000 700,000 648,000 26. A Company had the following total usage of direct labor and direct materials Direct Labor (P8 per hour) Direct Materials (P10 per pound) Hours 400 Pounds 300 Incomplete job #101 has used 20 hours of direct labor and 8 pounds of direct materials. Factory overhead is applied at the rate of 200% per direct labor peso. What is the balance in work-in-process relating to job #101? Answer: P 560 debit 27. The Childers Company manufactures widgets. During the fiscal year just ended, the company incurred prime costs of P1,500,000 and conversion costs of P1,800,000. Overhead is applied at the rate of 200& of direct labor cost. How much of the above costs represent material cost? Answer: P900,000. 28. Ajax Corporation transferred P72,000 of raw materials to its production department in February and incurred P37,000 of conversion costs (P22,000 of direct labor and P15,000 of overhead). At the beginning of the period, P14,000 of inventory (material and conversion costs) was in process. At the end of the period, P18,000 of inventory was in process. What was the cost of goods manufactured? Answer: P105,000 29. Luna Co.’s year-end manufacturing costs were as follows: Direct materials and direct labor Depreciation of manufacturing equipment Depreciation of factory building Janitor’s wages for cleaning factory premises P500,000 70,000 40,000 15,000 How much of these costs should be inventoried for external reporting purposes? Answer: P625,000 30. Blum Corp. which manufactured plastic coated metal clips. The information was among Blum’s year-end manufacturing costs. Wages Machine operators Maintenance workers Factory foremen P200,000 30,000 90,000 Materials Used Metal wire P500,000 Lubricant for oiling machinery Plastic coating 10,000 380,000 Blum’s year-end: Answer: Direct Labor P200,000 Direct Materials P880,000 31. Hamilton Company uses job order costing. Factory overhead is applied to production at a determined rate of 150% of direct-labor cost. Any over-or under applied factory overhead is closed to the cost of goods sold account at the end of each month. Additional information is available as follows: Job 101 was the only job in process at January 31, 2011, with accumulated costs as follows: Direct materials Direct labor Applied factory overhead P4,000 2,000 3,000 P 9,000 Jobs 102,103 and 104 were started during February. Direct materials requisitions foe February totaled P26,000. Direct-labor cost of P20,000 was incurred for February. Actual factory overhead was P32,000 for February. The only job still in process at February 28, 2011 was Job 104, with costs of P2,800 for direct materials and P1,800 for direct labor. The cost of goods manufactured for February 2011 was: Answer: P77,700 32. Using the same information in No. 31, any over- or under applied factory overhead should be closed to the cost of goods sold account at February 28,2011, in the amount of Answer: P2,000 under applied. 33. Under Pick Company’s job order costing system, manufacturing overhead is applied to work-in-process using a predetermined annual overhead rate. During Jnuary2011, Picks transactions included the following: Direct materials issued to production Indirect materials issued to production Manufacturing overhead incurred Manufacturing overhead applied P90,000 8,000 125,000 113,000 Direct labor costs 107,000 Pick has neither beginning nor enough ending work-in-process inventory. What was the cost of jobs completed in January 2011? Answer: P310,000 34. A company manufactures pipes and uses a job order costing system. During May, the following jobs were started (no other jobs were in process) and the following costs were incurred: Materials requisitioned Direct Labor Job X P10,000 5,000 P15,000 Job Y P20,000 4,000 P24,000 Job Z P15,000 2,500 P17,500 Total P45,000 11,500 P56,500 In addition, estimated overhead of P300,000 and direct labor costs of P150,000 were estimated to be incurred during the year. Actual overhead of P24,000 was incurred in May; overhead is applied on the basis of direct labor pesos. If only Job X and Job Z were completed during the month, the appropriate entry to record the initiation of all jobs would be Answer: Work-in-process Direct Materials Direct Labor Applied factory overhead P79,500 P45,000 11,500 23,000 35. Tastee-Treat Company prepares, packages, and distributes six frozen vegetables in two different sized containers. The different vegetables and different sizes are prepared in large batches. The company employs a normal cost job order costing system. Manufacturing overhead is assigned to batches by a predetermined rate on the basis of direct labor hours. The manufacturing overhead costs incurred by the company during two recent years (adjusted for changes using current prices and wage rate) are presented below. Direct labor hours worked............................ Manufacturing overhead costs incurred (adjusted for changes in current Prices and wage rate): Indirect labor…………………… Employee benefits…………….. Supplies…………………………. Power…………………………… Head and light ………………………. Supervision ………………………….. 2011 2,760,000 2012 2,160,000 P11,040,000 4,140,000 2,760,000 2,208,000 552,000 2,865,000 P8,640,000 3,240,000 2,160,000 1,728,000 552,000 2,625,000 Depreciation ………………….. Property taxes and insurance……….. Total overhead costs 7,930,000 3,005,000 P34,500,000 7,930,000 3,005,000 P29,880,000 What is the variable overhead rate? Answer: P7.70 36. Using the same information in No. 35, what will be the total overhead rate for a 2,300,000 direct labor hour level of activity in 2012? Answer: P13.46 37. Regan Company operates its factory on a two-shift basis and pays a late-shift differential of 15%. Regan also pays a premium of 50% for overtime work. Since Regan manufactures only for stock, the cost system provides for uniform direct\labor hourly charges for production done without regard to shift worked or work done on an overtime basis. Overtime and late-shift differentials are included in Regan’s factory overhead application rate. The May payroll for production workers is as follows: Wages at basis direct-labor rates …………………………… P325,000 Shift differentials ………………………………………………. 25,000 Overtime premiums ……………………………………….. 10,000 For the month of May, what amount of direct labor should Regan charge to work-inprocess? Answer: P325,000 38. Woodman Company applies factory overhead on the basis of direct labor hours. Budget and actual data for direct labor and overhead for the year are as follows: Direct labor hours Factory overhead costs Budget P600,000 720,000 Actual P550,000 680,000 The factory overhead for Woodman for the year is Answer: Underapplied by P20,000 39. At the beginning of the year, Smith Inc. budgeted the following: Units Sales Less: 10,000 P100,000 Total variable expenses 60,000 Total fixed expenses Net Income 20,000 20,000 Factory overhead: Variable Fixed P30, 000 10,000 There were no beginning inventories. At the end of the year, there was no work-inprocess; total factory overhead incurred in the year was P39, 500; and underapplied factory overhead was P1,500. Factory overhead was applied on the basis of budgeted unit production. How many units were produced this year? Answer: P9,500 40. A company manufactures plastic products for the home and restaurant market. The company also does contract work for other customers and utilizes a job order costing system. The flexible budget covering next year’s expected range of activity is Direct labor hours Machine hours Variable O/H costs Fixed O/H costs Total O/H costs 50,000 40,000 P100,000 150,000 P250,000 80,000 64,000 P160,000 150,000 P310,000 110,000 88,000 P220,000 150,000 P370,000 A predetermined overhead rate based on direct labor hours is used to apply total overhead. Management has estimated that 100,000 direct labor hours will be used next year. The predetermined overhead rate per direct labor hour to be used to apply total overhead to the individual jobs next year is Answer: P3.50 41. Schneider, Inc. had the following information relating to 2011. Budgeted factory overhead Actual factory overhead Applied factory overhead Estimated labor hours P74, 800 P78, 300 P76, 500 44,000 If Schneider decides to use the actual results from 2011 to determine the 2012 overhead rate, what will the 2012 overhead rate be? Answer: P1.740 42. The XYZ Company uses a predetermined overhead rate. XYZ prepared the following budget at the beginning of the year: Direct labor cost Factory overhead Direct labor hours Machine hours P12, 000 P25, 000 9,000 1,500 During the month of January, the cost sheet for order number 100 indicates P20 of raw materials, P50 of direct labor, 10 hours of direct labor, and 5 machine hours. Order number 100 consists of 49 units of product. CXYZ applies overhead based on direct labor cost. What amount of overhead should be applied to order number 100? Answer: P104.17 43. At the end of the last fiscal year, Baehr Company had the following account balance. Overapplied Overhead P1, 000 Cost of goods sold 980,000 Work-in-process inventory 38,000 Finished goods inventory 82,000 The most common treat of the overapplied overhead would be to Answer: Credit it to cost of goods sold. 44. The appropriate method for the disposition of underapplied or overapplied factory overhead. Answer: depends on the significance of the amount. 45. During the current accounting period, manufacturing company purchased P70,000 of raw materials, of which P50,000 of direct materials and P5,000 of indirect materials were used in production. The company also incurred P45,000 of total labor costs and P20,000 of other factory overhead costs. An analysis of the work-in-process control account revealed P40,000 of direct labor costs. Based upon the above information, what is the total amount accumulated in the factory overhead control account? Answer: P30,000 A company allocate overhead to jobs in process using direct labor costs, raw material costs, and machine hours. The overhead application rates for the current year are: 100% of direct materials 20% of raw materials P117 per machine hour A particular production run incurred the following costs: Direct labor, P8,000 Raw materials, P2,000. A total of 140 machine hours were required for the production run. What is the total cost that would be charged to the production run? Answer: P34,780 47. Pane Company uses a job costing system and applies overhead to products on the basis of direct labor cost. Job No. 75, the only job in process on January 1, had the following costs assigned as of that date: direct materials, P40,000; direct labor, P80,000; and factory overhead, P120,000. The following selected costs were incurred during the year. Traceable to jobs: Direct materials. Direct labor. Not traceable to jobs: Factory materials and supplies. Indirect labor. Plant maintenance. Depreciation on factory equipment Other factory costs. P178,000 345,000 P46,000 235,000 73,000 29,000 76,000 P523,000 456,000 Pane's profit plan for the year included budgeted direct labor of P320,000 and factory overhead of P448,000. Assuming no work-in-process on December 31, Pane's overhead for the year was Answer: P24,000 overapplied 48. Avery Co. Uses a predetermined factory overhead rate based on direct labor hours. For the month of October, Avery's budgeted overhead was P300,000 based on a budgeted volume of 100,000 direct labor hours. Actual overhead amounted to P325,000 with actual direct labor hours totaling 110,000. How much was the overapplied or underapplied overhead? Answer: P5, 000 overapplied 49. The following is a standard cost variance analysis report on direct labor cost for a division of a manufacturing company: Job. 213 215 217 219 221 Actual Hours at Actual Wages P3,243 15, 345 6,754 19,788 3,370 Actual Hours at Standard Wages P3,700 15,675 7,000 18,755 3,470 Standard Hours at Standard Wages P3,100 15,000 6,600 19,250 2,650 What is the total flexible budget direct labor variance for the division? Answer: P1,900 unfavorable 50. Cannon Cannery, Inc. Estimated its factory overhead at P510,000 for the year, based on a normal capacity of 100,000 direct labor hours. Standard direct labor hours for the year totaled 105,000, while the factory overhead control account at the end of the year showed a balance of P540,000. How much was the underapplied factory overhead for the year? Answer: P4,500 51. Summit Company provided the inventory balances and manufacturing cost data for the month of January. Under Summit's cost system any over-or underapplied overhead is closed to the cost of goods account at the end of the calendar year. Inventories: January 1. January 31 Direct Materials P30,000 P40,000 Work-in-process P15,000 20,000 Finished Goods 65,000 50,000 Factory overhead applied Cost of goods manufactured Direct materials used Actual factory overhead Month of January P150,000 515,000 190,000 144,000 What would cost of goods sold be if under- or overapplied overhead were closed to cost of goods sold? Answer: P524,000 52. Using the same information in No. 51, what would cost of goods sold be if under- or overapplied overhead were allocated to inventories and cost of goods sold? Answer: P524,700 53. Worley Company has underapplied overhead of P45,000 for the year. Before disposition of the underapplied overhead, selected year-end balances from Worley's accounting records were: Sales Cost of goods sold Direct materials inventory Work-in-process inventory Finished goods inventory P1,200,000 720,000 36,000 54,000 90,000 Under Worley’s cost accounting system, over- or underapplied overhead is allocated to appropriate inventories and CGS based on year-end balances in its year-end income statement, Worley should report CGS of Answer: P757,500 Costs of Quality: Spoilage and detective units 54. Harper Co's Job 501 for the manufacture of 2,200 coats, which was completed during August at the unit cost presented below. Final inspection of Job 501 disclosed 200 spoiled coats which were sold to a jobber for P6,000. Direct materials Direct labor Factory overhead(includes an allowance of P1 for spoiled work) P20 18 18 P56 Assume that spoilage loss is charged to all production during August. What would be the unit cost of the good coats produced on Job 501? Answer:P56.00 55. Using the same information in No. 54, assume instead that the spoilage loss is attributable to the exacting specifications of Job 501 and is charged to this specific job. What would be the unit cost of good coats produced on Job 501? Answer: P57.50 56. Under Heller Company's job order cost system, estimated costs of defective work(considered normal in the manufacturing process) are included in the predetermined factory overhead rate. During March, Job No. 210 for 2,000 hand saws was completed at the following costs per unit. Direct materials P5 Direct labor 4 Factory Overhead (applied at 150% of direct labor costs) 6 P15 Final inspection disclosed 100 defective saws, which were reworked at a cost of P2 per unit for direct labor, plus overhead at the predetermined rate. The defective units fall within the normal range. What is the total rework cost and to what account should it be charged? Answer: P500 to factory overhead control 57. During March, Hart Company incurred the following costs on Job 109 for the manufacture of 200 motors: Original cost accumulation: Direct materials P660 Direct labor 800 Factory overhead (150% of DL ) 1,200 P2, 660 Direct costs of reworking 10 units: Direct materials Direct labor Answer: P15.80 P100 160 P260 58. Using the same information in No. 57, assuming the rework cost were attributable to internal failure or charged to factory overhead, what is the cost per finished unit of Job 109? Answer: P13.30 59. Condotti Company's Job 205 for the manufacture of 6,600 coats was completed during August 2011 at the following unit costs: Direct materials Direct labor Factory overhead (include an allowance of P50 spoiled work) P1500 1,000 500 P3,000 Final inspection of Job 205 disclosed 600 spoiled coats which were sold to a jobber for P600,000. Assume that spoilage loss is charged to all production duroing August 2011. What would be the unit cost of the good coats produced on Job 205? Answer: P3000 60. Using the same information in No. 59, assuming the spoilage loss attributable to exacting specifications or chargeable to particular job, what would be the unit cost of the good coats produced on Job 205? Answer: P3,145 61.Simpson Company manufactures electric drills to the exacting specifications of various customers. During April 2011, Job 403 for the production of 1,100 drills was completed at the following costs per unit: Direct materials…………………………………………………… Direct labor………………………………………………………… Applied factory overhead………………………………………… Total………………………………………………………………… P10 8 12 P30 Answer: P32 62. Some units of output failed to pass final inspection at the end of the manufacturing process. The production and inspection supervisors determined that the incremental revenue from reworking the units exceeded the cost of rework. The rework of the defective units was authorized, and the following costs were incurred in reworking the units: Materials requisitioned from stores: Direct materials:………………………………………… Miscellaneous supplies……………………………….. Direct labor……………………………………………………… P5,000 P300 P14,000 Answer: Work-in-process inventory control for P5,000 and factory overhead control for P35,300 63. In a job order accounting situation, assume that there are P45,000 of charges to a given job consisting of 25,000 material, P10,000 direct labor, and P10,000 applied overhead. The job yields 500 units of a product of which 100 are rejected as spoiled with no salvage value. The cost of the spoilage is determined to be P9,000. If the firm wishes to use this job as the basis for setting a spoilage standard for comparison to future work, the conceptually superior way to express the spoilage rate would be Answer: 25 % of good outputs. 64. Gumamela Mfg. Co.started 150 units in process on job order #13. The prime costs placed in a process consisted of P30,000 and P18,000 for materials and direct labor, respectively, and a pre-determined rate was used to charge factory overhead to production at 133-1/3% of the direct labor cost. Upon completion of the job order, units equal to 20% of the good output were rejected for failing to meet strict quality control requirements. The company sells rejected units as scrap at only 1/3 of production cost, and bills customers at 150percent of production cost. If the rejected units were ascribed to company failure, the billing price of job order #13 would be: Answer: P90,000 65. Using the same information in No. 64, and if the rejected units were ascribed to customer action, the billing price of job order #13 would be: Answer: P102,000 Service Cost Allocation 66. Boa Corp. distributes service department overhead costs directly to producing departments without allocation to the other service department. Information for the month of June is as follows: Overhead costs incurred...... Service provided to departments: Maintenance........................ Utilities............................... Producing-A Producing-B Totals Service Departments Maintenance Utilities P20,000 P10,000 --20% 40% 40% 100% 10% -30% 60% 100% The amount of maintenance department costs distributed to Producing-A department for June was Answer: P10,000 67. UST allocates support department costs to its individual schools using the step method. Information for May 2011 is as follows: Costs incurred Service percentages provided to: Maintenance Power School of Education School of Technology Support Department Maintenance Power P99,000 P54,000 --20% 30% 50% 100% 10% --20% 70% 100% What is the amount of May 2008 support department costs allocated to School of Education? Answer: P46,100 68. Hartwell Company distributes the sevice department overhead costs directly to producing departments without allocation to the other service departments. Information for the month of January is presented as follows: Overhead costs incurred Service provided to: Maintenance department Utilities department Producing department A Producing department B Maintenance P18, 700 --20% 40% 40% Utilities P9, 000 10% --30% 60% The amount of utilities department costs distributed to producing department B for January should be Answer: P6,000 69. Using the same information in No. 68, and assume instead that Hartwell Company distributes the service departments’ overhead costs based on the step-down method. Which of the following methods is true? Answer: Allocate maintenance expense to departments A and B and the utilities department. 70. Using the same information in No.68, and under the step-down method, how much of Hartwell’s utilities department cost is allocated between department A and B? Answer: P 12,740 71. Using the same information in No.68, and that Hartwell Company distributes service department overhead costs based on the reciprocal method, what would be the formula to determine the total maintenance costs? Answer: M= P18,700+.10U 72. Using the same information in No.68, and that Hartwell Company distributes utilities department overhead costs based on the reciprocal method, what would be the formula to determine the total utilities costs? Answer: U=P9,000+.20M 73. AJD Company has two service departments (A and B) and two producing departments (X and Y). data provided are as follows: Direct costs………………… Services performed by Dept. A………….. Services performed By Dept. B………….. Service Departments A B P150 P350 40% 20% Operating Departments X Y P5,000 P6,000 40% 20% 70% 10% AJD Company uses the direct method to allocate service department costs. The service department cost allocated to Department Y is: Answer: P87.50 74. Using the same information in No. 73, what is the total cost for Department X: Answer: P5,295.83 75. Using the same information in No. 73, except that step-down is used to allocate service department costs. Department A costs are allocated first. The service department cost allocated to Department Y is: Answer: P75.00 76. Using the same information in Nos. 73 and 75, what is the total cost for Department X: Answer: P5,375.00 77. Using the same information in No. 73, except that the reciprocal method is used to allocate service department costs. The service department cost allocated to department Y is: Answer: P85.00 78. Using the same information in Nos. 74 and 77, what is the total cost for Department X: Answer: P5,085.00 79. A company has two service departments (S1 and S2) and two production departments (P1 and P2). Departmental data for January were as follows: S1 S2 Costs incurred:……………………. Service provided to: S1…………………………………… S2…………………………………… P1…………………………………… P2…………………………………… P27,000 -10% 50% 40% P18,000 20% -30% 50% What are the total allocated service department costs to P2 if the company uses the reciprocal method of allocating its service department costs? (Round calculations to the nearest whole number.) Answer: P23,051 80. Computer Complex, which offers two main services: (1) Time on a time- shared computer system and (2) Proprietary computer programs. Computer time is provided by the operation department (Op) and programs of each service used by each department for a typical period is presented below. User Op…………………………………………………… P…………………………………………………….. Sold to customers………………………………… Total………………………………………………… Op -30% 70% 100% P 40% -60% 100% In a typical period, the operation department spends P4, 500 and the programming department spends P2, 500. Under the step-down method, what is the cost of the computer time and the computer programs or sale? Answer: TIME P3,150 PROGRAMS: P3,850 81. Using the same information in No. 68, using the reciprocal method what is the solution to the service cost allocation problem? Answer: Op = 4,500+.40P; P = 2,500+.30Op 82. A hospital has a P100, 000 expected utility bill this year. The janitorial, accounting, and orderlies departments are service functions to the operating, hospital rooms, and laboratories departments. Floor space assigned to each department is Department Janitorial………………………………………………… Accounting……………………………………………… Orderlies………………………………………………… Operating……………………………………………….. Hospital Rooms………………………………………... Laboratories……………………………………………. Square Footage 1,000 2,000 7,000 4,000 30,000 6,000 50,000 How much of the P100, 000 will eventually become the hospital department total costs, assuming a direct allocation based on square footage is used? Answer: P75,000 Items 83 and 84 are based on the following information: Fabricating and Fishing are the two production departments of a manufacturing company. Building Operations and Information Services are service departments that provide support to the two production departments to allocate the service department costs to the production departments. Square footage is used to allocate building operations, and computer time is used to allocate information services. The costs of the service departments and relevant operating data for the departments are as follows: Costs: Labor and benefit……………. costs Other traceable costs………... Total…………………………… Operating Data: Square feet occupied Computer time………………. (in hours) Building Operations Information Services P200,000 P300,000 350,000 P550,000 900,000 1,200,000 5,000 200 10,000 Fabricating Finishing 16,000 1,200 24,000 600 83. If the company employs the direct method to allocate the costs of the service departments, then the amount of building operations costs allocated to fabricating would be Answer: P220,000 84. If the company employs the step method to allocate the costs of the service departments and information services costs are allocated first, then the total amount of service department costs (Information Services and Building Operations) allocated to Finishing would be Answer: P762,000 Items 85 through 89 are based on the following information: The managers of Rochester Manufacturing are discussing ways to allocate the cost of service departments such as Quality Control and Maintenance to the production departments. To aid them in this discussion the controller has provided the following information: Quality Control Maintenance Machining Budgeted overhead costs before allocation……. P350,000 Budgeted machine hours… -Budgeted directed labor hours -Budgeted hours of service: Quality control………… -Maintenance…………. 10,000 P200,000 --- P400,000 50,000 -- 7,000 -- 21,000 18,000 Assembly Total P300,000 P1,250,000 -50,000 25,000 25,000 7,000 12,000 35,000 40,000 85. If Rochester Manufacturing uses the direct method of allocating service department costs, the total service costs allocated to the assembly department would be Answer: P167,500 86. Using the direct method, the total amount of overhead allocated to each machine hour at Rochester Manufacturing would be Answer: P15.65 87. If Rochester Manufacturing uses the step- down method of allocating service costs beginning with quality control, the maintenance costs allocated to the Assembly Department would be Answer: P108,000 88. If Rochester Manufacturing uses the reciprocal method of allocating service costs, the total amount of quality control costs(rounded to the nearest peso) to be allocated to the other departments would be Answer: P421,053 89. If Rochester Manufacturing decides not to allocate service costs to the production departments, the overhead allocated to each direct labor hour in the Assembly Department would be Answer: P12.00 Items 90 and 91 are based on the following information. M&P Tool has three service departments that support the production area. Outlined below is the estimated overheard by department for the upcoming year. Service Departments Receiving……………………. Repair………………………... Total………………………….. Production Departments Assembly……………………. Bolting……………………….. Estimated Overhead P25,000 35,000 10,000 Number of Employees 2 2 1 25 12 The Repair Department supports the greatest number of departments, followed by the Tool Department. Overhead cost is allocated to departments based upon the number of employees. 90. Using the direct method of allocation, how much of the Repair Department’s overhead will be allocated to the Tool Department? Answer: Zero 91. Using the step-down method of allocation, the allocation from the Repair Department to the Tool Department would be Items 92 and 93 are based on the following information: The Photocopying Department provides photocopy services for both Departments A and B and has prepared its total budget using the following information for next year: Fixed costs………………………….. Available capacity………………….. Budgeted usage Department A………………. Department B………………. Variable cost……………………….. P100,000 4,000,000 pages 1,200,000 pages 2,400,000 pages 0.03 per page 92. Assume that the single- rate method of cost allocation is used and the allocation base is budgeted usage. How much photocopying cost will be allocated to Department B in the budget year? Answer: P875 93. Assume that the dual rate cost allocation method is used and the allocation basis is budgeted usage for fixed costs and actual usage for variable costs. How much cost would be allocated to Department A is 1,400,000 pages and actual usage for Department B is 2,100,000 pages? Answer: P75,333 94. Dext stores has three stores and one service center. The percentage of service used in the current year are store A, 25%; store B, 40%; and store C, 45%. The expected long-term budgeted usages are store A, 30%; store B, 30%; and store C, 40%. The service center costs were budgeted at P450,000 fixed and P550,000 variable. Actual fixed costs were P430,000 and actual variable costs were P570,000. Dexter allocates the budgeted variable costs of the central unit based on actual use of the unit service, and allocates budgeted fixed costs based on expected long- term use of the unit’s services. Service center costs allocated to store B are: Answer: P355,000 95. In allocating factory service department costs to producing departments, which one of the following items would most likely be used as an activity base? Answer: Units of electric power consumed MUSOR, Sittie Saimah B. V- BS Accountancy