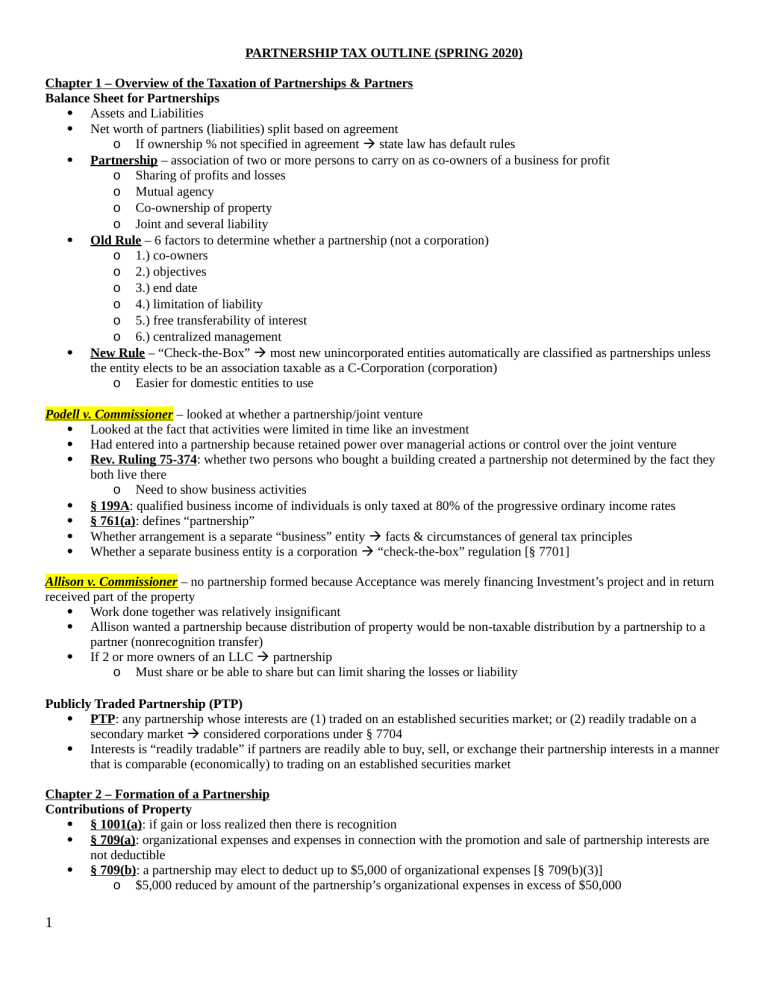

PARTNERSHIP TAX OUTLINE (SPRING 2020) Chapter 1 – Overview of the Taxation of Partnerships & Partners Balance Sheet for Partnerships Assets and Liabilities Net worth of partners (liabilities) split based on agreement o If ownership % not specified in agreement state law has default rules Partnership – association of two or more persons to carry on as co-owners of a business for profit o Sharing of profits and losses o Mutual agency o Co-ownership of property o Joint and several liability Old Rule – 6 factors to determine whether a partnership (not a corporation) o 1.) co-owners o 2.) objectives o 3.) end date o 4.) limitation of liability o 5.) free transferability of interest o 6.) centralized management New Rule – “Check-the-Box” most new unincorporated entities automatically are classified as partnerships unless the entity elects to be an association taxable as a C-Corporation (corporation) o Easier for domestic entities to use Podell v. Commissioner – looked at whether a partnership/joint venture Looked at the fact that activities were limited in time like an investment Had entered into a partnership because retained power over managerial actions or control over the joint venture Rev. Ruling 75-374: whether two persons who bought a building created a partnership not determined by the fact they both live there o Need to show business activities § 199A: qualified business income of individuals is only taxed at 80% of the progressive ordinary income rates § 761(a): defines “partnership” Whether arrangement is a separate “business” entity facts & circumstances of general tax principles Whether a separate business entity is a corporation “check-the-box” regulation [§ 7701] Allison v. Commissioner – no partnership formed because Acceptance was merely financing Investment’s project and in return received part of the property Work done together was relatively insignificant Allison wanted a partnership because distribution of property would be non-taxable distribution by a partnership to a partner (nonrecognition transfer) If 2 or more owners of an LLC partnership o Must share or be able to share but can limit sharing the losses or liability Publicly Traded Partnership (PTP) PTP: any partnership whose interests are (1) traded on an established securities market; or (2) readily tradable on a secondary market considered corporations under § 7704 Interests is “readily tradable” if partners are readily able to buy, sell, or exchange their partnership interests in a manner that is comparable (economically) to trading on an established securities market Chapter 2 – Formation of a Partnership Contributions of Property § 1001(a): if gain or loss realized then there is recognition § 709(a): organizational expenses and expenses in connection with the promotion and sale of partnership interests are not deductible § 709(b): a partnership may elect to deduct up to $5,000 of organizational expenses [§ 709(b)(3)] o $5,000 reduced by amount of the partnership’s organizational expenses in excess of $50,000 1 § 721(a): no gain or loss shall be recognized to a partnership or to partners on a contribution of property to the partnership in exchange for an interest o Transferors do not have to be in control of partnership immediately after the exchange of property (amount of partnership % regarding interest = not important) o § 721 does not apply to an exchange/transfer of property for a noncompensatory option (call option or warrant to acquire a partnership interest) but does apply to the exercise of the option Seen when a creditor enters into a debt-for-equity- exchange when the partnership’s indebtedness is for unpaid rent, royalties, or interest on indebtedness § 722: contribution of encumbered property to a partnership recharacterized as cash transaction o If entire liability allocated to partner before the property is contributed to the entity then transaction will yield some measure of liability relief unless the entire liability continues to be allocated to the contributing partner following the debt assumption by the entity o Constructive distribution triggers the rules governing operating distributions by a partnership o Partner’s basis in partnership interest is equal to the sum of cash + adjusted basis of property contributed to partnership § 723: partner’s basis in contributed property is transferred to partnership § 724: sometimes the partnership will recognize the same character of gain or loss that partner would have recognized on the sale of the property § 731 & § 733: distribution of cash is considered a return of capital o Reduces partner’s outside basis (not below 0) by the amount of distribution o Relieved debt allocated to other partners that have contributed cash to partnership and outside basis of each is increased accordingly § 731(a): balances books by treating excess of the constructive cash distribution over partner’s outside basis as gain from the sale or exchange of partner’s acquired partnership interest § 733: a distribution may not reduce a partner’s basis below zero (0) § 741: gain treated as capital gain o Any gain recognized because of contribution of property with recourse liabilities in excess of basis results from the constructive cash distribution from the partnership (not from partner) § 752: governs treatment of partnership liabilities; a partner who contributes property encumbered by nonrecourse debt is first allocated that portion of the liability equaling the gain that would be allocated to that partner under section 704(c) if the property were sold at the time of the contribution for an amount equal to the liability o Balance of liability allocated under the flexible general rule in accordance with partner’s share of partnership profits o § 752(a): any increase in a partner’s share of partnership liabilities as if it were a cash contribution by the partner to the partnership increasing partner’s outside basis under § 722 o § 752(b): any decrease in a partner’s share of liabilities is treated as if it were a cash distribution to the partner decreasing partner’s outside basis under sections 705(a) and 733 Liabilities that would be deductible when paid are disregarded o § 752(c): a liability to which property is subject shall be treated as a liability of the owner to the extent of the FMV of the property “Syndication Expenses” are not deductible because fees for services An increase to outside and inside basis under sections 722 & 723 is only allowed when a partner recognizes gain under § 721(b) on a contribution of an asset to a partnership that would be treated as an “investment company” under section 351 if partnership were incorporation Partnership Liability = recourse liability to extent any partner bears the economic risk of loss of liability o If no one bears risk then nonrecourse liability Share of Recourse Liabilities = portion of liability partner bears to extent partner would be required to pay if the partnership were unable to do so o Generally may not exceed obligation amount to be contributed in future Nonrecourse Liabilities: no partner has personal liabilities Crane v. Commissioner – taxpayers who acquire property subject to a debt generally include the debt amount in their cost basis (i.e., like paying cash) on the assumption that the loan will be paid Taxpayers who sell encumbered property generally must include the debt relief in amount realized Partner’s outside basis includes their share of partnership liabilities and partner is treated as receiving cash equivalent when partnership liability is extinguished 2 Partner’s Interest A partner’s interest in partnership profits is determined by taking into account all facts and circumstances relating to the economic arrangement of the partners Partners allowed to specify their interests in partnership profits for purposes of allocating nonrecourse liabilities Commissioner v. Tufts – the amount realized by the partnership on the disposition of the land subject to nonrecourse debt includes at least the amount of the debt relief even if the debt exceeds the value of the property Partner’s Outside Basis Outside basis comprised of 2 components: o (1) pre-tax capital: basis attributable to items that increase partner’s book capital account; and o (2) basis attributable to partnership liabilities [§ 752 allocation] Timing & Method of distribution of gains and losses are determined by partnership agreement o May be made as profits are earned, before they are earned (draws), or in the absence of profits o May differ distributions until they dissolve the partnership or liquidate a partner’s interest If securities sold (not distributed) and appreciation is realized any gain or loss will be reflected on the partnership balance sheet because securities will have been converted into cash o § 704(c)(1)(A): pre-contribution gain must be allocated solely to the contributing partner when the partnership sells the securities Chapter 3 – Operations of a Partnership (General Rules) Tax Consequences to the Partnership – Aggregate and Entity Principles § 701: a partnership is not a taxable entity it is a conduit and the income, deductions, credit and other tax attributes generated by partnership activities flow to the partners who separately report their distributive shares of these items § 702(b): provides that the character of a partnership item taxed to the partners is to be determined as if such item were realized directly from the source from which realized by the partnership or incurred in the same manner as incurred by the partnership § 703(a): requires a partnership to determine its own taxable income and provides rules designed to preserve the character of capital gains, charitable contributions, foreign taxes, and other items that may be subject to special treatment in the hands of the partners § 703(b): provides that the partnership will select its accounting method and make various elections affecting the computation of taxable income Demirjian v. Commissioner – the nonrecognition of gain election had to be made between the partnership (not individuals); focus on § 1033 Schneer v. Commissioner – fees earned by a partner in his individual capacity for services reasonably associated with a partnership’s business activity are partnership income if paid to the partnership Was treated as partnership income and assignment-of-income doctrine does not apply because the fees were not yet earned Taxable Year § 706(a): requires a partner to include their share of partnership income, losses, and other items in their tax return for the taxable year § 706(b)(1)(B): generally requires a partnership to determine its taxable year by reference to a series of mechanical rules related to the taxable year of its partners unless the partnership can establish a “business purpose” for sing a different taxable year o If 1 or more partners having a majority interest in partnership profits and capital have the same taxable year then the partnership also must use that year o If do not have the same taxable year then partnership must use the taxable year used by the “principal partners” (own 5% or more) A business purpose for a different year may be established under either: 3 (1) 25% Test – a natural business year exists if 25% or more of the partnership’s gross receipts for the selected years are earned in the last 2 months; or o (2) All Facts & Circumstances Test § 444: partnerships may elect a taxable year other than the year required by the mechanical tests in section 706(b)(1)(B) under certain conditions o Escape mechanical rules but does not apply to partnerships using a taxable year that is based on a business purpose o Subject to new tax under § 7519 § 705(a): requires that adjustments be made to the partner’s outside basis to reflect the tax results from partnership operations o Outside basis increased by share of the partnership’s (1) taxable income and (2) tax-exempt income o Outside basis decreased by (1) distributions from the partnership under § 733 and (2) the partner’s share of partnership loss and (3) his share of partnership expenditures which are not deductible in arriving at taxable income and not properly capitalized Rev. Ruling 68-79 – since the partnership held the stock for more than 6 months the gain realized by the partnership is long-term capital gain o Qualified Business Income (QBI) Corporate income tax rate = 21% § 199A: income tax deduction to individuals, trusts, and estates equal to 20% of the “qualified business income” generated through a sole proprietorship, partnership, LLC, S Corporation, trust, or estate o When fully available lowers tax rate applicable to such income from 37% to 29.6% 80% of 37 o Not allowed in computing adjusted gross income but available to all taxpayers o Designed to deny or limit deduction high-income taxpayers who conduct either: (1) service-oriented businesses; or (2) businesses that do not have large employee benefits or a mix of low payrolls & a significant investment in depreciable real estate and equipment QBI: net amount of qualified items of income, gain, deduction and loss that are effectively conducted with the conduct of a qualified trade or business in the U.S. and are included or allowed in determining taxable income for the taxable year o Excludes trade or business that provides services as an employee Key Issue: whether taxpayer’s rental real estate activity can be a qualified trade or business o Safe Harbor – will qualify if at least 250 hours of services are performed annually with respect to the business by the owner or others (employees and independent contractors) o “Services”: include maintenance, repairs, rent collection, payments of expenses, services to tenants, and efforts to rent the property o Requires taxpayer to maintain separate books & records and bank accounts for the business Capital gains and losses excluded under § 1231 if 1231 gains > 1231 losses then all gains and losses are long-term capital gains/losses and will be excluded o If ordinary gains/losses included in QBI Compensation income is excluded from QBI because wages are services provided but income earned by sole proprietor or an independent contractor generally qualify as QBI Labor or Services for Pass-Through Entities S-Corporation shareholder treated as employee so reasonable compensation is not QBI but pro rata share of corporation’s net business profits generally will qualify for the 20% deduction Partnership QBI does not include: (1) any guaranteed payment to partner; or (2) any payment to a partner in a nonpartner capacity Once QBI added up multiply each QBI for each trade/business by 20% o Generally deduction of § 199A equals sum of separate calculations § 199A deduction may not exceed 20% of the excess of the taxpayer’s taxable income minus (-) the net capital gain o Usually only applies when the bulk of taxpayer’s taxable income consists of QBI QBI Thresholds: o $157,000 for single taxpayer o $315,000 for married taxpayers 4 After threshold hit then (1) certain service activities excluded and (2) a cap is imposed on amount deductible for a trade/business by reference to W-2 wages § 199A excludes any “specified service trade or business” (SSTB) from “qualified trade or business” includes any trade/business involving services in health, law, accounting, actuarial science, arts, consulting, athletics, financial services, and any trade/business that the principal asset is the reputation or skill of employees/owners Deductible Amount Limited (to the greater of): o (1) 50% of W-2 wages regarding the qualified trade/business; or o (2) sum of 25% of W-2 wages and 2.5% of the unadjusted basis right after acquisition of all the qualified property use in the trade/business § 199A: reduces the tax rates that apply to QBI (tax deduction of 20%) o Excludes any SSTB unless income of taxpayer below certain limit Pass-through forms do not face the “double tax” that apply to C-Corporations o C-Corporations and S-Corporations are not eligible for § 199A Deduction is generally limited to 50% of the owner’s share of the pass-through W-2 wages Partnerships & LLCs can allocate items of income, deduction, etc. in any manner that has “substantial economic effect” o Can allocate QBI however they want QBI does not include “reasonable compensation” paid by an S-Corporation o Rule does not apply to partnerships o Limitations on Partnership Losses § 704(d): a partner’s distributive share of partnership loss (including capital loss) is allowable as a deduction only to the extent of the partner’s outside basis at the end of the partnership’s taxable year in which the loss occurred o Can still be allocated to a partner If the partnership has both ordinary and capital losses then the partner’s loss is allocated to reflect the composition of the partnership’s loss Carryover loss is generally personal to each individual partner if a partner sells his or her partnership interest then the seller’s previously deferred losses will disappear and not carry over to the buyer o Carryover loss also terminates if a partner dies At-Risk Limitations § 465: individuals, partners, and certain closely held corporations are subject to at-risk rules o Seeks to limit a taxpayer’s deductible losses from a range of business and investment activities to the amount that the taxpayer is “at-risk” regarding those activities o As for a Partnership – at-risk rules applied on a partner-by-partner basis (not partnership level) o In General – rules applied separately to each “activity” the partnership is engaged in unless an exception applies Initial at-risk amount includes: o 1.) cash contributions to the activity; o 2.) adjusted basis of other property contributed by taxpayer to the activity; and o 3.) amounts borrowed for use in the activity for which the taxpayer is personally liable or which are secured by property of the taxpayer to the extent of the FMV of the encumbered property Basis Limitations vs. At-Risk Limitations: main difference is that nonrecourse liabilities of the partnership will increase a partner’s outside basis but a taxpayer is not considered at risk with respect to nonrecourse loans and similar arrangement where the taxpayer has no economic risk o Any loss disallowed by § 465 may be carried over and deducted when the taxpayer becomes at risk, the partnership disposes of the activity, or the taxpayer disposes of his partnership interest Partner is at-risk with respect to his share of partnership recourse debt o Recourse Debt: a creditor must be able to sue the partner under state law and the funds must be borrowed from someone who has no interest in the activity in which the funds are used Taxpayers still considered at risk with respect to certain nonrecourse debt/financing o Applies to nonrecourse financing obtained from commercial lenders or the government o Nonrecourse Financing = “Qualified” if nonconvertible debt and incurred by taxpayer with respect to the holding of real estate and is borrowed from a “qualified person or gov’t instrument Qualified Person: any person actively and regularly engaged in the business of lending money who is not related to the borrower and is not the seller of the property, a relative of the seller or a person who receives a fee with respect to the 5 taxpayer’s investment in the real property, or a relative of such a fee recipient (examples: bank, savings & loan assoc., insurance company, or pension fund) Even related persons will be treated as “qualified” if they are regular money lenders and the loan is commercially reasonable and on substantially the same terms as loans to unrelated persons Partnership a partner’s share of any qualified nonrecourse financing is determined on the basis of the partner’s share of partnership liabilities under § 752 o Amount at-risk may not exceed the total amount of qualified nonrecourse financing at the partnership level Hubert Enterprises v. Commissioner – LCL classified as a partnership for tax purposes and agreement required a member with a deficit capital account balancing following liquidation of the membership interest to restore the deficit balance at that time LCL’s members were not at-risk for the recourse liabilities because the notes were not personally guaranteed and members are not personally liable for debts/liabilities of the company under state law Emershaw v. Commissioner – partner is not personally liable for the repayment of any of the partnership’s recourse liabilities because its obligations to contribute additional funds was avoidable simply by not liquidating the partnership Passive Loss Limitations § 469: enacted to restrict taxpayers from using deductions and other losses generated from certain passive investment activities to “shelter” income from other sources o Disallows the current deductibility of losses and use of credits from “passive activities” o If losses exceed passive income then excess may be carried forward and deducted against future net income from passive activities o Disallowed losses from a particular activity may be deducted in full on a taxable disposition of the entire activity Limitations aimed at tax shelters (not taxpayers) by focusing on the passive investor “Passive Activity” – any activity involving the conduct of any trade or business that the taxpayer does not “materially participate” (involved on a regular, continuous, and substantial basis in the operation of the activity) o Materially Participate – 7 tests to determine this (pg. 102) Materially Participate standard not appropriate in most rental activities because presumed that all rental activities are “passive” Passive activity does not include a working interest in any oil or gas well that a taxpayer holds directly or through an entity that does not limit the taxpayer’s liability with respect to the drilling or operation of the property o Exception does not apply to a limited partnership that the taxpayer is not a general partner of Portfolio Income (dividends, interest, capital gains from sale of securities) – not considered arising from a “passive activity” General Partners – whether “passive activity” requires examination of each activity of a general partner o Definition of “activity” is important because previously suspended losses from a passive activity become currently deductible upon the taxpayer’s disposition of his entire interest in the activity Limited Partners – “materially participate” if: o 1.) participate in activity for more than 500 hours during taxable year; o 2.) materially participated in the activity for any 5 tax years during the 10 years preceding the taxable year; or o 3.) activity is a “personal service activity” and the limited partner materially participated in the activity for any 3 tax years preceding the taxable year A limited partner’s share of income receive for the performance of services is not treated as income from a passive activity Publicly Traded Partnerships (PTPs) § 7704: a PTP generally is taxed as a corporation o PTP – a partnership whose interests are traded on an established securities market or are readily tradable on a secondary market If 90% of the gross income of a PTP is “qualifying income” then PTP is not taxed as a corporation If PTP taxed as partnership net income that passes through to partners is treated as portfolio income which may not be offset by losses from passive activities o Partner’s passive losses from a PTP that is taxed as a partnership may be deducted only against passive income from the same PTP 6 o Unused losses are suspended and carried forward until that PTP has passive income or until the partner completely disposes of his interest in the partnership Net Investment Income Tax § 1411: 3.8% net investment income tax Gross income from a trade or business is included in the net investment income tax base if the business is a passive activity with respect to the taxpayer o § 469 provisions apply the rules for determining when a taxpayer materially participates in an activity have gained a far broader practical application as they are now relevant to every profitable business activity Limitation on Excess Business Income § 461(l): disallows a current deduction for any “excess business loss” of a noncorporate taxpayer o Loss limitation applies at the partner level to the partner’s distributive share of all partnership tax items from trades or businesses attributable to the partnership Disallowed excess business losses are carried forward and part of taxpayer’s net operating loss carryforward in subsequent taxable years Chapter 4 – Partnership Allocations [§ 704(b)] Introduction Nontax difference between Partnerships and Corporations = greater flexibility for partners to custom tailor their economic arrangements o Partners have considerable latitude to structure allocations of profits and losses, the amount and timing of distributions of cash or property, and the compensation paid to partners who render services to the enterprise through the partnership agreement Partnership agreement can provide priority returns to partners on their invested capital or for services and it can specify how much each partner is entitled to receive if firm liquidated Majority of allocations provisions influenced by economic considerations that would be present even without an income tax system Subchapter K has largely accommodated the flexible economic arrangements that have been the hallmark of the partnership under state law § 704(a): a partner’s distributive share of income, gain, loss, deduction or other tax items shall be determined by the partnership agreement § 704(b): if there is no allocation agreement, then distributive shares are determined for tax purposes in accordance with the partner’s interest in the partnership (taking into account all facts & circumstances) o Provides that particular items or the entire amount of partnership income or loss will be allocated in accordance with the partners’ interests in the partnership if an agreed allocation lacks substantial economic effect o § 704(b)(2): all-purpose standard for testing validity of allocations of a partnership’s tax items § 704(c): defines the partnership agreement as including any modifications up to the time for filing the partnership’s tax return o Permits partners to make Special Allocations – allocations that differ from the partners’ respective interests in partnership capital Subchapter K additional income and character shifting opportunities are presented when a partner makes a tax-free contribution of an asset with a built-in gain or loss to a newly formed or ongoing partnership, and the contributed property is later sold or distributed, or where the contributed asset is depreciable Orrisch v. Commissioner – the Crisafis and the Orrisches formed a partnership to buy apartment buildings and orally agreed to share profits and losses equally. The partnership only realized losses from 1963 to 1965. The losses were used by the Orrisches to offset other income, and the Crisafis did not have any income to offset. In 1966, the partners amended the partnership agreement so that all depreciation would be allocated to Orrisches. Issue: whether the special allocation was designed to avoid income tax and should be disregarded Holding: Yes – the allocation should be disregarded and amounts of each of the partners’ deductions for the depreciation of partnership property must be determined in accordance with the ratio used generally in computing their distributive shares of the partnership’s profits and losses o If given deduction then outside basis and book value (i.e., interest in the partnership) is reduced o Should have required Orrisches to make up negative capital accounts upon (1) liquidation of the partnership or (2) sale of property at a loss 7 Notes: Look at: o (1) whether the allocation had “substantial economic effect”; or o (2) whether the allocation may actually affect the dollar amount of the partners’ shares of the total partnership income or loss independently of tax consequences Tax Reform Act of 1976: incorporated the “substantial economic effect” test in § 704(b) o The propriety of bottom line allocations also evaluated under the substantial economic effect test Act provides that an allocation of overall income or loss or of any item of income, gain, loss, deduction, or credit shall be controlled by the partnership agreement if the partner receiving the allocation can demonstrate that it has “substantial economic effect” o If an allocation made by the partnership is set aside a partner’s share of the income, gain, loss, deduction or credit will be determined in accordance with his interest in the partnership o In determining a “partner’s interest in the partnership” all relevant facts and circumstances are taken into account o Relevant Factors: interest of respective partners in profits and losses if different from the that in taxable income or loss, cash flow, and their rights to distributions of capital upon liquidation Section 704(b) Basic Rules If a partnership agreement provides for an allocation there are three ways under the regulations in which the allocation will be respected: o (1) the allocation can satisfy the standards for having substantial economic effect o (2) taking into account all facts and circumstances, the allocation can be in accordance with the partner’s interest in the partnership o (3) the allocation can be deemed to be in accordance with the partner’s interest in the partnership under one of several special rules that apply to specific tax items 2 part safe harbor test to determine if a partnership allocation has “substantial economic effect” : o 1.) an allocation must have “economic effect” – meaning the allocation must be consistent with the economic business deal of the partners Test satisfied if partnership agreement complies with a series of mechanical requirements o 2.) “Substantiality” test for the economic effect of an allocation to be substantial there must be a reasonable possibility that the allocation will affect substantially the dollar amounts to be received by the partners from the partnership apart from tax consequences If partnership agreement is silent as to partners’ distributive shares of income, losses and other tax items, or if a special allocation is found wanting because it lacks substantial economic effect the partners’ respective shares of income, loss and other items are determined in accordance with the partners’ respective interests in the partnership o Partners’ interest determined by taking into account all the facts and circumstances § 704(b) applies to all allocations of specific items of income, gain, loss, deductions and credits as well as to allocations of partnership net (i.e., bottom line) taxable income and loss o Substantial Economic Effect Test applied on an annual basis to determine the validity of an allocation for the year involved Maintenance of Partners’ Capital Accounts Allocation is valid only if it is consistent with the underlying economic arrangement of the partners o Look at Capital Account – represents a partner’s equity in the partnership and identifies the amounts the partners would be entitled to receive if and when their interests in the partnerships were liquidated To satisfy “Economic Effect” prong of safe harbor test the capital accounts rules must be incorporated in the partnership agreement Capital accounts are considered properly determined and maintained only if each partners capital account is increased by: o (1) amount of money contributed to the partnership by the partner; o (2) FMV of property contributed by the partner to the partnership; and o (3) allocations to the partner of partnership income and gain, including tax-exempt income Decreased by: o (1) amount of money distributed to the partner by the partnership; o (2) FMV of property distributed to the partner by the partnership; 8 (3) allocations to the partner of partnership expenditures that are not deductible or properly chargeable to capital account; and o (4) allocations of partnership loss and deduction These rules are designed to determine the “book value” of each partner’s interest in the firm o Result: a partners capital account may differ significantly from his outside basis, especially where the partnership has liabilities Because capital accounts reflect the value of contributed property (not its tax basis), further adjustments may be required to ensure that capital accounts are adjusted by book income (not taxable income) FMV agreed upon by partners in an arm’s length negotiation will control if the partners have sufficiently adverse interests o Theory: if valuation is hammered out between genuinely adverse parties then abuse is unlikely If capital accounts are not maintained properly reallocation in accordance with the partners’ interests in the partnership Book capital accounts do not necessarily reflect the ongoing FMV of a partner’s equity interest o Not automatically adjusted to reflect fluctuations in the FMV of partnership assets Regulations allow partnerships to restate assets at their current FMV only in certain instances – usually when there exists an independent economic justification for the revaluation, including: o (1) admission of a new partner to the partnership; o (2) distribution in complete or partial liquidation of a partner’s interest in the firm; o (3) grant partnership interest as consideration for the provision of services to the partnership; or o (4) where substantially all of the partnership’s property (excluding money) consists of marketable securities, provided adjustments are made for “substantial non-tax business purpose” o In these circumstances restatement are permissible only if partnership agreement so provides and a set of rules are followed o Economic Effect – The Big Three If there is an economic benefit or burden corresponding to the allocation the partner to whom the allocation is made must receive the benefit or bear the burden Process of testing “Economic Effect”: o 1st – Three-pronged test o 2nd – Flexible alternate test o 3rd – Narrowly applicable fallback test of “economic effect equivalence” Primary Test (“The Big Three”) – an allocation will have economic effect only if through the life of the partnership the partnership agreement provides that: o (1) capital accounts must be determined and maintained in accordance with the rules of Section 1.704-1(b)(2) (iv) of the regulations o (2) upon a liquidation of the partnership or of an partner’s interest, liquidating distributions must be made in accordance with the positive capital account balances of the partners o (3) if a partner has a deficit balance in his capital account following the liquidation of his interest in the partnership, he must be unconditionally obligated to restore the deficit by the later of: (a) the end of the taxable year of the liquidation of the partner’s interest, or (b) 90 days after the date of the liquidation The Big Three Rationale: unless tax allocations of income or loss are accompanied by increases or decreases to the partner’s capital accounts, there is no way to assure that the tax consequences ever will reflect the partners’ economic business deal o Since the partners’ ultimate economic stakes in the partnership are measured by their capital accounts, all allocations and other significant financial events in the life of the partnership must be reflected in those capital accounts o Prongs 2 & 3 – ensure the validity of this premise by requiring that the amounts partners will receive on liquidation are determined by their positive capital accounts Since a negative capital account indicates that the partner is in debt to the partnership – regulations require that the partner must satisfy that debt on or before a liquidation Deficit Restoration Requirement issue in LPs and LLCs because limited partners and members of an LLC typically are unwilling to make such an open-ended commitment o But regulations provide an alternate test to avoid this problem and preserve special allocations of losses as long as they do not reduce a partner’s capital account below zero 9 Alternate Economic Effect – Basic Rules If a partnership agreement satisfies the first 2 prongs but fails to include an unconditional deficit make-up provision regulations provide an alternate test for economic effect o Looks to both the effect of an allocation on a partner’s capital account and the extent of any partial obligation by the partner to restore a deficit or make additional capital contributions to the partnership Allocation will have economic effect to the extent that it does not create or increase a deficit in the partner’s capital account and the agreement includes a qualified income offset provision o Rational: a partner who receives an allocation of losses still suffers a corresponding economic burden as long as the allocation does not create a capital account deficit or exceed any additional amounts that the partner has agreed to contribute to the partnership in the future If an allocation of loss would create or increase a deficit in a partner’s capital account loss must be reallocated in accordance with the partner’s interests in the partnership Alternate Economic Effect – Special Rules To prevent partners from attempting to manipulate the alternate test for economic effect regulations require that partners must reduce their capital accounts by distributions that are reasonably expected as of the end of the partnership year in which the loss allocation was made Qualified Income Offset (QIO) – provision in the partnership agreement stating that any partner who has a deficit capital account as a result of unexpectedly receiving a distribution must be allocated items of future income or gain in an amount and manner sufficient to eliminate any remaining deficit balance as quickly as possible o Sort of like a capital account alarm because an unanticipated distribution has created a deficit balance in a partner’s capital account beyond that which the partner is obligated to restore the foundation of the alternate test for economic effect is compromised o At that point previous allocations of loss to the partner will no longer have economic effect because intervening distribution created a deficit balance that the partner does not have to restore Allocation triggered by a QIO must consist of a pro rata share of each item of partnership income and gain for the taxable year and regulations deem such an allocation to be in accordance with the partner’s interest in the partnership o QIO requires partners with positive capital accounts to shift income otherwise allocable to them to the partners with deficit capital accounts until those deficits are eliminated o At that point QIO is turned off and allocations called for under the partnership agreement once again take prominence Economic Effect Equivalence If an allocation fails to meet either the primary or alternate tests for economic effect regulations offer relief if the allocation has “economic effect equivalence” o Allocations are deemed to have economic effect if the partnership agreement ensures that a liquidation of the partnership as of the end of each partnership taxable year will produce the same economic results as if The Big Three were satisfied “Substantiality” 2nd Major Test – looks to whether the economic effect of an allocation is “substantial” both in the year of the allocation and over the life of the partnership Valid – if it has economic effect and is substantial Substantiality Standard: the economic effect of an allocation is considered to be substantial if there is a reasonable possibility that the allocation will affect substantially the dollar amounts to be received by the partners from the partnership independent of tax consequences [§ 1.704-1(b)(2)(i)(a)] Standard clarifies that an allocation that yields the same balances in the partners’ capital accounts that would be produced absent the allocation will not satisfy the substantiality requirement Regulations require the allocation to potentially yield a meaningful variance in the partners’ capital account balances [a variance that could “substantially” alter the partners’ rights to pre-tax income] After-Tax – General Rule Regulations provide that the economic effect of the allocation is not substantial if at the time the allocation became part of the partnership agreement: o (1) the after-tax consequences of at least one partner may be enhanced compared to such consequences if the allocation were not contained in the partnership agreement; and 10 Usually always satisfied § 1.704-1(b)(2)(i)(a)(1) o (2) there is a strong likelihood that the after-tax economic consequences of no partner will be substantially diminished compared to such consequences if the allocation were not contained in the partnership agreement asks whether there exists a reasonable possibility that any partner might face a substantial detriment If not – the special allocation is effectively guaranteeing that no partner is exposed to a material risk of realizing a worse after-tax result (suggests that the partners are making tax-driven allocations to the detriment of the public) § 1.704-1(b)(2)(i)(a)(2) Determining after-tax economic benefit or detriment to partner look at tax consequences that result from interaction of the allocation with other tax attributes of the partner unrelated to the partnership After-Tax Test requires consequences of allocation be analyzed on a present-value, after-tax basis Shifting & Transitory Allocations Regulations identify 2 scenarios in which an allocation or set of allocations will lack substantiality: o (1) instances of shifting the allocations; and o (2) transitory allocations Concern: an initial allocation will be offset by one or more later allocations resulting in no significant economic consequences to the partners by reducing their total tax liability o Shifting if offsetting allocations occur within the same taxable year o Transitory if the allocations span two or more taxable years Shifting Allocation – the economic effect of an allocation within one partnership taxable year is not substantial if at the time the allocation becomes part of the partnership agreement there is a “strong likelihood” that the capital accounts of the partners will be unaffected by the allocation and the total tax liability of the partners will be less than if there had been no such allocations [§ 1.704-1(b)(2)(i)(b)] Transitory Allocation – lack substantial economic effect if the partnership agreement provides for the “possibility” over two or more taxable years that an “original allocation” will be largely offset by one or more “offsetting allocations” and at the time the allocations became part of the agreement there is a “strong likelihood” that the partners’ capital accounts will emerge unaffected by the allocations and the partners enjoy a reduction in their total tax liability for the period involved [§ 1.704(b)(2)(i)(c)] o Regulations presume the requisite “strong likelihood” if the allocations in fact resulted in no material change to the partners’ capital accounts and taxes were reduced relative to what would have occurred if there had been no special allocation “Substantial” Compared to What? Whether allocation is shifting, transitory, or fails the general after-tax rule regarding “substantiality” – compare it to the result if the allocation were not contained in the partnership agreement o Means comparison is made to the allocation that would be made if it were determined in accordance with partners’ interests in the partnership (disregarding allocation that is being tested) If an allocation does not have substantial economic effect because it is not substantial item will be reallocated according to the partners’ interests in the partnership o The partners’ interests are determined by how they economically share the item Safe Harbors – 5 Year Rule & Basis Equals FMV Additional rules where an offsetting allocation is likely but won’t occur a while An allocation and a subsequent offsetting allocation will not be considered transitory (will not fail the substantiality test) if there is a strong likelihood that the offsetting allocation will not be made within 5 years from the original allocation o Regulations presume that the adjusted tax basis of partnership property will be equal to FMV and adjustments to the tax basis of property will be matched by corresponding changes in its FMV Special allocation are “transitory” were it not for the presumption that FMV always equals adjusted basis under that assumption, even if it is plainly wrong, there can’t be a strong likelihood that the original cost recovery deductions will be offset by the later offsetting allocations of gain on sale Revenue Ruling 99-43 – special allocations lack substantiality when partners amend partnership agreement to specially allocate COD income and book items from a related revaluation after the events creating such items have occurred if the overall 11 economic effect of the special allocations on the partners’ capital accounts does not differ substantially from the economic effect of the original allocations in partnership agreement Default Reallocations – Partners’ Interest in the Partnership If a partnership agreement is silent tot eh partners’ distributive shares or an allocations lacks substantial economic effect partners’ share of gain, loss, deduction or credit is determined in accordance with the partners’ interest in the partnership [standard = economic arrangement of the partners] Partners Interest in the Partnership – the manner in which the partners have agreed to share the economic benefit or burden corresponding to the item that is allocated (accounting for all facts & circumstances relating to the economic arrangement of the partners) Partners’ Interest in Partnership – determined by reference to the item that is allocated o The sharing arrangement for the allocated item may not correspond to the overall economic arrangement of the partners Factors to determine a partners’ interest in the partnership: o (1) the relative contributions of the partners to the partnership; o (2) the interests of the partners in economic profits and losses if they differ from their interests in taxable income or loss; o (3) the interests of the partners in cash flow and other nonliquidating distributions; and o (4) the rights of the partners to distributions of capital upon liquidation Principle: the reallocated item is to be shared according to the manner in which the partners share the economic benefit or burden of the item o If a two-person partnership agreement provides for an equal division of profits and losses and equal liquidating distributions but allocates cost recovery deductions to only one partner then the special allocations lacks an economic effect o Since arrangement demonstrates that the partners intend to equally share risk & rewards the cost recovery deductions would be split equally between the 2 partners because that is their interest in the partnership Special rule if an allocation is upset because the partnership agreement fails to include an unlimited deficit make-up provision o If the first 2 requirements of The Big Three are met and the substantiality rules have not been breached then rule provides that the disallowed portion of the allocation are to be determined by comparing: 1.) manner in which distributions & contributions would be made if all partnership property were sold at book value and the partnership were liquidated following the end of the taxable year in which the allocation relates with 2.) manner in which distributions & contributions would be made if all partnership property were sold at book value and the partnership were liquidated immediately following the end of the prior taxable year o Purpose: to reallocate items lacking economic effect to the partner who bears the economic loss corresponding to the item Special Rules Allocations of Depreciation Recapture – allocations of depreciation recapture cannot have substantial economic effect because classifying a portion of the gain as recapture merely changes its tax character o If depreciation recapture can be allocated in the same manner as total gain more likely that a partner may receive an allocation of recapture gain in excess of the partner’s share of depreciation from the property o A partner’s share of recapture gain generally is equal to the lesser of (1) the partner’s share of the total gain from the disposition of the property or (2) the total amount of depreciation previously allocated to the partner with respect to the property o A partner’s allocation of recapture gain may be limited by that partner’s share of total gain Allocations of Tax Credits – allocations of tax credits are generally not reflected in the partners’ capital accounts cannot have economic effect o Tax credits and recapture of tax credits generally must be allocated in accordance with the partners’ interests in the partnership o If a partnership expenditure that gives rise to a tax credit also gives rise to valid tax allocations of loss or deduction partners’ interests in the partnership with respect to such credit shall be in the same proportion as the partner’s distributive share of the loss or deduction 12 Allocations Attributable to Nonrecourse Debt Many partnerships finance their acquisitions of property largely with nonrecourse debt Crane – permits taxpayer to include the amount of a nonrecourse mortgage acquisition debt in the cost basis of the encumbered property o But – the economic risk of those taxpayers is limited to their cash investment and any loans for which they are personally liable If the value of the property declines below debt amount owner is free to walk away and leave creditor to bear the economic loss to the extent that the property does not satisfy the debt When a partnership finances depreciable property with nonrecourse debt economic burden of the resulting cost recovery deductions is borne by the partners only to the extent of their investments of cash and other property or their shares of recourse debt o Cost recovery deductions in excess of partnership’s equity & recourse borrowings are attributable to the nonrecourse debt and economic risk of property borne by lender Allocation of deduction or loss lacks economic effect unless reflects corresponding economic burden to partner no allocation of deductions regarding nonrecourse debt can have substantial economic effect Borrowers cannot escape the tax burden of including the full amount of the debt in their amount realized on a disposition of the encumbered property (including foreclosure) Commissioner v. Tufts – a taxpayer recognizes gain on a disposition at least to the extent that the nonrecourse debt exceeds the adjusted basis of the property (regardless of the actual value of the asset) Partnership Minimum Gain – gain represented by the excess of nonrecourse debt over basis o Amount of gain that the partnership would realize if it disposed of partnership property subject to a nonrecourse liability in full satisfaction of the debt and for no other consideration Nonrecourse Deductions – deductions that create or increase partnership minimum gain o Example: by reducing the adjusted basis of an asset that secures nonrecourse debt below the amount of the debt o Allocation of nonrecourse deductions cannot have economic effect but regulations generally permit a partnership to allocate these deductions to partners to whom the related minimum gain will be allocated (tax payback) Tax Payback accomplished by a “minimum gain chargeback” – a provision in partnership agreement that requires partnership to allocate minimum gain to those partners to whom the nonrecourse deductions were previously allocated o These matching allocations eventually neutralize each other in the partners’ capital accounts Regulations treat a partner’s share of partnership minimum gain as an increase to the partner’s obligation to restore a deficit capital account balance for the alternate test for economic effect o Deficit restoration obligation – made up when partnership minimum gain is reduced Safe Harbor Test – incorporate these concepts o If pass test allocations of nonrecourse deductions deemed to be made in accordance with the partners’ interests in the partnership o If fails test nonrecourse deductions are allocated according to the partners’ overall economic interests in the partnership Partnership Minimum Gain Partnership Minimum Gain – amount of gain that partnership would realize if it disposed each of its properties that is subject to a nonrecourse liability for no consideration other than satisfaction of the debt Is created in two situations: o (1) as the adjusted basis of the encumbered property is reduced below the amount of the nonrecourse liability (i.e., by cost recovery deductions); or o (2) as the amount of the nonrecourse liability is increased in excess of the adjusted basis of the property (i.e., on a refinancing) An increase in partnership minimum gain results when a partnership incurs a nonrecourse liability that exceeds the adjusted basis of the property encumbered by the new debt Nonrecourse Deductions Nonrecourse Deductions – deductions that relate to a net increase in partnership minimum gain o Commonly are cost recovery deductions that reduce the adjusted basis of depreciable property below the amount of nonrecourse debt secured by the property 13 Also arise on a refinancing where the proceeds of a nonrecourse liability that increase partnership minimum gain are not distributed by the partnership o Since not distributed regulations assume they will be spent by the partnership and generate deductions that are attributable to the additional nonrecourse borrowing Distribution of Nonrecourse Liability Proceeds Allocable to an Increase in Minimum Gain A partnership distribution may cause a partner to wind up with a deficit capital account that exceeds the partner’s obligation to restore a deficit If partnership agreement complies with the alternate test for economic effect distribution triggers an allocation of gross income to the distribute partner under a qualified income offset provision o Harsh Result cure provided – example: year 4, the partnership generated $20,000 without recourse and securing the debt with a 2nd mortgage on building. The partnership distributes the $20,000 proceeds – $18,000 to investor and $2,000 to developer. Regulations call this a distribution of nonrecourse liability proceeds allocable to an increase in minimum gain Since no recourse deductions partnership unable to allocate the minimum gain to a partner to whom the corresponding nonrecourse deductions were allocated Solution: to allocate (“charge back”) the minimum gain generated by the borrowing to the partners to whom the loan proceeds are distributed o Chargeback avoids triggering a qualified income offset and an undesired current tax liability for distributes who have negative capital accounts that exceed their deficit restoration obligations Partner’s Share of Partnership Minimum Gain Central Premise – even in the absence of a deficit restoration provision, nonrecourse deductions may reduce a partner’s capital account below zero (0) to the extent of a partner’s share of partnership minimum gain o Reasoning: those deductions will be “recaptured” and charged back to the partner that they were allocated to and increase that partner’s capital account when partnership disposes of the property Partners must keep track of their own shares of partnership minimum gain in order to: o (1) determine the extent to which they may have a capital account deficit without triggering a qualified income offset; o (2) ensure that they are allocated their appropriate share of partnership minimum gain when it is recognized by the partnership; and o (3) properly determine their share of partnership nonrecourse liabilities under § 752 Partner’s share of partnership minimum gain at end of year = sum of nonrecourse deductions allocated to the partner through life of partnership and the partner’s share of distributions of nonrecourse liability proceeds allocable to an increase in minimum gain minus (–) partner’s share of any prior net decreases in partnership minimum gain Minimum Gain Chargeback Regulations permit an allocation of nonrecourse deductions and other events to reduce a partner’s capital account below zero (0) to the extent of that partner’s share of minimum gain Permitted even though allocations do not have economic effect because in the future the partner will be taxable on his share of that minimum gain and partner’s capital account will be increased accordingly Payback Time – if a decrease in a partner’s share of minimum gain then must do something to allocate gain to the partner and to make a corresponding increase in that partner’s capital account o Regulations generally require (for any taxable year which there is a net decrease in a partner’s share of minimum gain) that partner must be allocated—through a minimum gain chargeback provision—income & gain equal to the net decrease in the partner’s share of minimum gain o Most obvious transactions triggering a decrease in partnership minimum gain disposition of property subject to nonrecourse debt Decrease in partnership minimum gain also occurs when principal amount due on a nonrecourse liability is reduced or when a partnership liability is converted from nonrecourse to recourse o Result: minimum gain chargeback rule operates differently o If a partnership contributes capital to partnership that is used to pay all/part of the partnership’s nonrecourse debt that partner’s share of partnership minimum gain will decrease but partner’s capital contribution increases his capital account by the total decrease in minimum gain 14 No need to allocate additional income to partner in order to make an appropriate restoration of his negative capital account Regulations provide a partner is not subject to a minimum gain chargeback if the decrease in the partner’s share of minimum gain is attributable to the partner’s own capital contribution that is used to pay the partnership’s nonrecourse debt o Similar policy when all/part of partnership debt is converted from nonrecourse to recourse because of a guarantee, refinancing, or a comparable arrangement No minimum gain chargeback to a partner to the extent that the partner bears the economic risk of loss for the new recourse liability Final exception – a minimum gain chargeback is not triggered if it would cause a distortion in the economic arrangement among the partners & there is insufficient other income to correct the distortion Safe Harbor Test Allocations of “nonrecourse deductions” will be respected if four requirements met: (1) throughout life of partnership – partnership agreement must satisfy the requirements of either (i) The Big Three test or (ii) the alternative test for economic effect; (2) in first taxable year that the partnership has nonrecourse deductions and thereafter for the life of the partnership – nonrecourse deductions must be allocated in a manner that is reasonably consistent with allocations (having substantial economic effect) of some other significant partnership item attributable to property securing the nonrecourse liabilities of the partnership (other than allocation of minimum gain) o Requires allocation of nonrecourse deductions to be reasonably consistent with allocations of some other “significant partnership item” attributable to the property (3) in first year that the partnership has nonrecourse deductions or makes a distribution of proceeds of a nonrecourse liability allocable to an increase in partnership minimum gain – the partnership agreement must contain a minimum gain chargeback o Only requires you to include minimum gain chargeback provision in agreement o Application of minimum gain chargeback is routine partnership likely will realize enough gain on a disposition or foreclosure of the encumbered property to eliminate deficit capital accounts of partners who enjoyed the tax benefits or received distributions of nonrecourse liability proceeds o Principle #1: allocations of nonrecourse deductions will be respected even if capital account below zero (0) if the partnership agreement requires a subsequent allocation of partnership income or gain – consisting of (1) partner’s proportionate share of the minimum gain realized on a later disposition of the property or (2) if partnership minimum gain is decreased without disposition, of sufficient items of partnership income to offset the earlier deductions and bring the partner’s capital account back up to zero (0) o Principle #2: distributions of nonrecourse loan proceeds can reduce a partner’s capital account below zero without triggering a qualified income offset (at least to the extent of the minimum gain to be charged back to the partner) (4) all other material allocations and capital account adjustments under the partnership agreement must comply with the basic § 704(b) regulations o Requires that allocations of other material items (other than nonrecourse deductions) must have substantial economic effect o Limited partnerships usually seek to validate allocations of other partnership items under the alternate economic effect test agreement of partnership with nonrecourse debt should include (1) a qualified income offset and (2) a minimum gain chargeback that complies with regulations governing nonrecourse deductions QBI Allocations – partnerships & multiple-owner LLCs are not required to set apart reasonable compensation for partners or owners who provide services through the entity, for which the entity receives what amounts to service compensation. Instead, the proposed regulations state that partners and LLC owners are deemed to “realize” directly any item of income, deduction, etc. including in their distributive shares in the entity Exceptions: (1) “guaranteed payments” regarded as ordinary income; and (2) § 707(a) as payments not based on recipient’s partner status, which may be capital or ordinary with reduction for the basis of property transferred to the partnership Target Allocations § 704(b) designed to prevent partners from creating tax-driven allocations to reduce their tax liability without altering the economic results of the venture 15 “Cash-Follows-Tax” Approach – essence of the substantial economic effect safe harbor that focuses on the partners’ capital accounts Most business & investment ventures are driven by the economics of the business deal (not tax deferral) o Goal in drafting partnership agreement ensure that operating and liquidating distributions will be made in a manner consistent with the parties’ economic bargain o Partners that focus on the economics of their venture prefer to state the economic results they want to achieve or how the cash proceeds will be distributed Issue: how target allocations or targeted capital account approach are impacted under § 704(b) o Targeted capital account approach requires partnership to follow a liquidation schedule that may not be governed by the book capital accounts o Result: fails liquidation requirement of the substantial economic effect safe harbor so all target allocations have to be evaluated to determine if they were consistent with the partners’ interest in the partnership standard o Exception: allocation can satisfy the economic effect prong even if there is no provision requiring partnership to make liquidating distributions in accordance with positive book capital account balances satisfies economic effect equivalence standard Economic Effect Equivalence Standard – an allocation will be deemed to have economic effect if a liquidation at the end of the year would produce a result identical to that achieved if the partnership had maintained capital accounts in accordance with § 704(b) and agreed to liquidate in accordance with positive capital account balances o Result: when targeted capital account balances governing distributions equal the book capital account balances the target allocations can satisfy the economic effect prong of the substantial economic effect safe harbor Chapter 5 – Partnership Allocations: Income-Shifting Safeguards Allocations with respect to Contributed Property When partners contribute property to a partnership in exchange for an interest in the firm partners do not recognize gain or loss and their basis in the contributed property carries over to partnership o § 704(a): gain or loss on the disposition of the contributed property would be allocated in accordance with the partnership agreement o Would enable partners to shift income/loss for tax purposes without any corresponding economic benefit/burden and cause distortions in the timing & character of future income/loss § 704(c)(1)(A): items of income, gain, loss and deduction with respect to property contributed by a partner to a partnership shall be shared among the partners so as to take account of the variation between the basis of the property to the partnership and its FMV at the time of the contribution o No substantial economic effect no change to the partner’s capital accounts Section 704(c) “Property”: property that at the time of its contribution to the partnership has a FMV (book value) that differs from contributing partner’s adjusted tax basis o If property’s book value > adjusted basis difference is a “built-in gain” o If adjusted basis > property’s book value difference is a “built-in loss” Regulations permit partnership to make allocations using any method consistent with § 704(c) Three Allocations Methods: o 1.) Traditional Method o 2.) Traditional Method with Curative Allocations o 3.) Remedial Method Each method subject to a general anti-abuse rule an allocation method is not reasonable if the contribution of property and the corresponding allocation of tax items are made with a view to shifting the tax consequences of the built-in gain or loss among the partners in a way that substantially reduces the present value of their aggregate tax liability o Cannot use more than one allocation method for § 704(c) property and a partnership must use a method that is reasonable under the facts & circumstances § 704(c) must be applied on a “property-by-property” basis – except property with identical tax characteristics may be aggregated for purposes of determining whether built-in gains & loss exist Partnership may disregard or defer the application of § 704(c) in a single year if there is a “small disparity” between the book value and the adjusted basis of the contributed property Section 704(c) Allocation Methods Traditional Method 16 As to sales of contributed property generally requires a partnership to allocate any built-in gain or loss to the contributing property As to noncontributing partners goal is to allocate tax gain/loss equal to shares of book gain or loss Difference between tax basis and fair market (book) value of contributed property at the time of the contribution requires a partnership to keep two sets of accounts: o (1) Account for “Book” purposes Book items reflect the economic arrangement of the partners and used in testing the substantial economic effect of an allocation o (2) Account for “Tax” purposes Tax items determined with reference to the partners’ distributive shares of the corresponding book items Traditional Method imposes a ceiling rule the total gain or loss allocated to the partners may not exceed the tax gain or loss realized by the partnership Traditional Method with Curative Allocations Permits a partnership to make reasonable curative allocations of other partnership tax items of income, gain, loss or deduction to correct ceiling rule distortions Curative Allocation: an allocation made solely for tax purposes that differs from the partnership’s allocation of the corresponding book item o Has no economic effect and not reflected in the partners’ capital accounts Curative Allocation is REASONABLE only if: o 1.) does not exceed the amount necessary to offset the effect of the ceiling rule; and o 2.) income or loss allocated is of the same character and has the same tax consequences as the tax item affected by the ceiling rule Curative allocations may be made to correct ceiling rule distortions from a prior taxable year if they are made over a reasonable period of time and were authorized by the partnership agreement in effect for the year that the property was contributed Cures ceiling rule distortions only if the partnership has enough recognized tax gain or loss of the appropriate type from another source Remedial Method Allows the partnership to restore its book to good health by creating the tax gain or loss of the appropriate type needed to offset ceiling rule distortions o Solely tax allocations that have no effect on the partnership’s book capital accounts Process: if ceiling rule results in a book allocation to a noncontributing partner that differs from partner’s corresponding tax allocation partnership can make a remedial allocation to the noncontributing partner equal to the full amount of the contributing property o Goal: to make a total tax allocation to the noncontributing partner equal to that partner’s share of book gain or loss Remedial allocation must have the same effect on each partner’s tax liability as the item limited by the ceiling rule – example: if the tax item limited by the ceiling rule is a loss from the sale of a contributed capital asset then the offsetting remedial allocation to the contributing partner must be capital gain Planning Aspects Not mandatory for the remedial method to assure that the ceiling rule distortions are corrected regardless of other income or loss realized by the partnership Partnership may adopt any reasonable method in making § 704(c) allocations (including the traditional method with its potential for book/tax disparities) o Regulations offer taxpayers some flexibility in dealing with contributed property and permit the partnership to use different methods for different properties Characterization of Gain/Loss on Disposition of Contributed Property § 704(c)(1)(A): prevents income shifting by allocating any built-in gain or loss to contributing partner § 724: seeks to prevent the conversion of gain or loss through contributions of property to a new or existing partnership o Section 724 applies to 3 categories of contributed property: (1) unrealized receivables 17 (2) inventory items (3) capital loss property Unrealized Receivables – rights to payment for goods or services that have not been previously included in income providing (in the case of goods) that the sales proceeds would be treated as received from the sale or exchange of noncapital assets o Unrealized receivables represent ripe transactions that will produce ordinary income/loss Section 724(a) provides that any gain or loss recognized by the partnership on the disposition of unrealized receivables will be ordinary Inventory Items – includes familiar category of noncapital assets and any other property which upon sale by the contributing partner would not be considered as a capital or Section 1231 asset o Items retain their ordinary income taint under § 724(b) for 5 years after their contribution to the partnership then character of contributed inventory items determined at partnership level Capital Loss Property – any capital asset held by the contributing partner which had an adjusted basis in excess of its FMV immediately before it was contributed to the partnership o If partnership sells capital loss property at a loss § 724(c) requires the built-in loss at the time of the contribution to retain its character as a capital loss for a period of 5 years from the date of the contribution o Any additional loss accruing while the property is held by the partnership is characterized at the partnership level § 724(d)(3) – prevents partnership from attempting to remove the taint inflicted by § 724 be exchanging the contributed asset for other property in a nonrecognition transaction because the § 724 taint applies to any substituted basis property resulting from such transaction unless property is stock of a C corporation acquired in an exchange governed by § 351 o In case of substituted basis property the 5-year taint period begins on the date that the original property was contributed to the partnership Depreciation of Contributed Property § 704(c)(1)(A) – also applies to the allocation of depreciation, amortization, and depletion deductions with respect to contributed property o Example: if partner contributes depreciable property with a tax basis less than (>) the property’s book value (FMV at time of contribution) § 704(c) seeks to ensure that the noncontributing partners are not deprived of their legitimate share of the partnership’s tax depreciation Traditional Method tax depreciation on contributed property is allocated first to the noncontributing partner in an amount equal to his share of book depreciation and the balance of tax depreciation is allocated to the contributing partner o Book and tax depreciation must be computed using same depreciation method & recovery period o Allocation of depreciation under § 704(c)(1)(A) using this method can be affected by ceiling rule Remedial Method ceiling rule distortions from depreciation of contributed property are corrected by a tax allocation of additional depreciation to the noncontributing partner in an amount equal to the full amount of the limitation caused by the ceiling rule and a simultaneous offsetting allocation of ordinary income to the contributing partner o Portion of partnership’s book basis in contributed property that equals the tax basis of property at the time of contribution is depreciated under the same method used for tax depreciation generally over the property’s remaining recovery period at the time of contribution o The amount by which the book basis exceeds the tax basis (excess book basis) is depreciated using any applicable recovery period and depreciation method available to the partnership for newly acquired property Effects of § 168(k) Bonus Depreciation § 168(k) – taxpayer may take 100% bonus depreciation on any qualified property placed in service between 9/27/2017 and 1/1/2023 o Example: if a taxpayer expenses the cost of qualifying property under § 168(k) and then contributes it to a partnership before 2023, then under the traditional method and § 704(c) the ceiling rule will be implicated the partnership’s basis in the property is zero (0) and there will be no tax depreciation available to allocate to the noncontributing partners If partnership used traditional method with curative allocations could make total curative allocations of depreciation from other assets to the noncontributing partners equal to their shares of book depreciation from the contributed property in order to correct the ceiling rule distortion o Also a curative allocation of ordinary income can be made to contributing partner 18 Total amount of the curative allocations of either (1) depreciation to noncontributing partners, or (2) ordinary income to contributing partner, will equal the noncontributing partners’ share of the property’s FMV [could be the 100% deducted under § 178(k)] o Result: equivalent to the noncontributing partners having expensed their shares of the property’s book value under § 168(k) Remedial Method generally divides book depreciation into 2 components: o (1) tax basis of the property at time of contribution would be zero (0) o (2) excess book basis equal to the FMV of the property at time of contribution less its tax basis of zero (0) only figure remaining is the excess book basis that will equal the FMV of the property at time of contribution o Year of Contribution – ceiling rule would apply because there is no available tax depreciation and the partnership must make a remedial allocation of depreciation to noncontributing partners Partnership’s book depreciation on the property presumably will be 100% bonus depreciation in the year of acquisition under § 168(k) Noncontributing partners would receive allocations of tax depreciation equal to their shares of that book depreciation Contributing partner receives an equal remedial allocation of income to support the deduction provided to noncontributing partners Question: what method will partnership want to use as to contributed property that has been fully deducted under § 168(k)? o Noncontributing Partners want to avoid traditional method and apply one of the two alternative methods so they can benefit from depreciation deductions attributable to the book value of the property at time of contribution o Contributing Partners generally want traditional method to avoid tax cost of either losing a share of other deductions or an allocation of ordinary income under the other two methods If tax rates of the partners were substantially disparate or if partners were related then contributing partner might forgo traditional method IRS not bound by partnership’s § 704(c) method choice and each method is subject to an anti-abuse rule o IRS reserves power to recast contributions of property to avoid tax results inconsistent with the intent of Subchapter K Another problem with contributed property when a new partner is admitted to an existing partnership o § 704(b) regulations require application of § 704(c) principles Distributions of Contributed Property Old Rule: § 704(c) was originally limited to partnership sales of contributed property o Result: a contributing partner could avoid an allocation of built-in gain or loss if the partnership distributed the contributed property to another partner (rather than selling it) o Since partnership generally does not recognize gain or loss on a distribution of property contributing partner not taxed on distribution and any built-in gain is shifted to distribute partner o Result: because a distribution of property can generally be made tax free to a contributing partner, a contributing partner can also postpone an allocation of built-in gain or loss but end up with substitute property if partnership distributed property other than the contributed property to the contributing partner § 704(c)(1)(B) & § 737: mixing bowl transactions (two results above) precluded if the transactions occur within 7 years of the contribution of the property Anti-Abuse Rules for Loss Property If partner contributes property with a built-in loss to a partnership that transaction may set the stage for shifting the loss to another partner or result in the partners benefiting more than once from the loss o Issue: no effect if the contributing partner leaves the partnership Regulations provide that if a partner transfers a partnership interest built-in gain or loss must be allocated to the transferee partner as it would have been allocated to the transferor partner o Impact: while § 704(c)(1)(A) prevents shift of a pre-contribution loss to other partners, current regulations generally require that a pre-contribution loss be shifted to a transferee of the contributing partner § 704(c)(1)(C) – if contributed property has a built-in loss (i.e., excess of adjusted basis over FMV at time of contribution) then (1) built-in loss is taken into account only in determining the amount of items allocated to the contributing partner; and (2) in determining the amount of items allocated to other partners the partnership’s basis in the contributed property shall be treated as being the FMV of the property at time of contribution 19 Result: prevents partners and transferee partners from benefiting from a built-in loss in property contributed by another partner Proposed Regulations – address mechanics of § 704(c)(1)(C) limitation by separating the inside basis attributable to such contributed property into 2 components: o (1) inside basis common to partnership equal to FMV of the property at time of contribution o (2) special inside basis adjustment allocated to contributing partner equal to excess of basis of the contributed property over its FMV at time of contribution [§ 704(c)(1)(C) basis adjustment] Contributing partner is allocated any depreciation or amortization deductions attributable to the special basis adjustment and inside basis adjustment is taken into account in determining contributing partner’s distributive share of gain or loss realized by partnership on sale of the property The special inside basis adjustment exists for the exclusive benefit of the contributing partner o Impact: basis adjustment does not carry over to a transferee of all or a portion of the contributing partner’s equity interest by gift and does not transfer to a purchase of the contributing partner’s interest for value If the contributed built-in loss property is subsequently distributed to a partner other than the contributing partner special inside basis adjustment is preserved for the contributing partner through its allocation among the remaining assets of the partnership Partnership Interests Acquired by Gift or Purchase from a Family Member § 704(e) – addresses the prospect of individuals using the partnership form to effectively assign income to family members or other persons having a similarly close connection by first making gratuitous transfers of partnership interests and alter making income allocations to the donee partners Commissioner v. Culbertson – held that the ultimate question (after considering the facts and circumstances) was whether the parties in good faith had a bona fide intent to join together and conduct a business as partners o Congress decided to settle issue by eliminating former § 704(e)(1) and moving the definition of “partner” to § 761(b) intended to clarify that the threshold determination of whether a partnership exists for tax purposes still turns on the existence of a bona fide intent to conduct business as partners under the Culbertson standard Ownership of a capital interest in a capital-intensive partnership alone is not sufficient to establish he holder as a partner for tax purposes Purpose of § 704(e)(1) – ensure that income generated by a partnership is not improperly assigned to family members and others who received their interest as gifts o Requires that the donor’s partner’s services be adequately compensated and that the rate of return on the donee’s capital not exceed the rate of return on the donor’s capital Section 704(e) applies to all gift situations and to any interest in a partnership acquired from a “family” member by purchase o Allocations Where Partners’ Interests Vary During the Year If partner sells part of their interest during the year or if the proportionate interests of the partners change as a result of the entry of a new partner then a capital contribution by an existing partner, a partial liquidation, a gift, or for some other reason, a method must be found to determine each partner’s respective share of income, losses, deductions and other partnership items o Statutory regime must guard against the prospect of pre-existing partners assigning income or loss to a partner who acquires a partnership interest later in the year § 706(c)(2)(B) – if a partner disposes of less than their entire partnership interest then the partnership taxable year will not close with respect to that partner § 706(d)(1) – when partner’s interests change during the taxable year then each partner’s distributive share of partnership income or loss is determined by taking into account the partners’ varying interests in the partnership during the year o Means that if A is a 1/3 partner in the ABC Partnership for the first half of the year and a ¼ partner for the balance then A generally must be allocated 1/3 of each partnership item for the first 6 months and ¼ of those items for the 2nd half of the year o Rules are intended to preclude a partner who acquires their interest toward the end of the year from receiving the benefits of a retroactive allocation of deductions and losses incurred prior to their admission to the partnership Partnerships can use 2 methods to determine the distributive shares of the partners whose interests change during the taxable year: o 1.) Interim Closing of the Books Method – treats each segment of a taxable year as if it were a separate distributive share period 20 Traces income and deduction items to the particular segment of the taxable year which is proper under the partnership’s accounting method Result: a partnership using this method may compute a net capital loss for a segment of the taxable year even though the partnership has a net capital gain for the entire year and may choose among several accounting conventions to determine when segments within that taxable year begin or end o 2.) Proration Method – partnership waits until the year ends and then prorates most partnership items throughout the year using a mandatory calendar day convention (gov’t can only use this) Result: partners’ distributive shares are based on the number of days that they were members of the firm and in most cases it is not necessary to trace when income and expense items were received or paid Both methods partnership’s taxable year divided into segments (specific time periods during year) o 1st Segment – begins on the first day of the partnership’s taxable year and ends at the end of the day specified by using accounting conventions o Additional Segments – similarly determined if further changes occur during the remainder of the year and the partnership then must determine the items of income, gains, losses, deductions, and credits of the partnership for each segment Exceptions – to require allocation methods: 1.) permit changes in allocations of the distributive shares of partnership items among partners who have been members of the partnership for the entire taxable year 2.) special safe harbor – if there is a change in any partner’s interest in a services partnership then the partnership and the partner may choose to determine the partners’ distributive shares of partnership items using any reasonable method to account for the varying interests provided the allocations are valid under § 704(b) 3.) extraordinary items – must be allocated among the partners at the time of day the item occurred (regardless of the method or accounting convention otherwise used by the partnership) o Extraordinary items generally include gains or losses from the disposition of most types of property and several more specialized tax items Anti-Avoidance Rules § 706(d)(2)(A) – requires cash method partnerships to allocate certain specified cash basis items to the time during the taxable year that the items are economically attributable (regardless when they are paid) o Puts cash basis partnerships on an accrual basis with respect to the specified items for purposes of determining distributive shares when the interests of the partners vary during the year o Allocable cash basis items are defined as interest, taxes, payments for services or for the use of property, and any other items specified by the Service o Seems to block income shifting when a partnership pays a deductible expense in a year other than that to which the item is economically attributable Chapter 6 – Partnership Liabilities Introduction § 704(d) – limits the deductibility of a partner’s share of partnership losses to the partner’s outside basis in their partnership interest o Partner’s outside basis also measures the extent to which a cash distribution results in the recognition of gain or loss and the partner’s gain or loss on the sale of their partnership interest o Each partner’s outside basis depends on their share of partnership liabilities Recourse Liabilities generally allocated in proportion to partner’s respective shares of partnership losses on the theory that loss-sharing ratios are the best indication of which partners would be responsible for paying the liabilities if the partnership can’t Nonrecourse Liabilities generally allocated by reference to the partners’ respective shares of partnership profits on assumption that those debts will be paid from profits or assets of the partnership Limited Partners not liable for partnership losses beyond original capital contribution and any additional contributions that partners are required to make o Result: limited partners generally are not allocated partnership recourse liabilities beyond the amounts they are obligated to contribute to the partnership or pay to the creditor in the future § 752 – allocate recourse liabilities by using the same kind of economic risk of loss analysis that is employed in testing partnership allocations under § 704(b) 21 Allocating nonrecourse liabilities by reference to partners’ profit-sharing ratios take into account partnership minimum gain and § 704(c) minimum gain Principal reason for including liabilities in a partner’s outside basis – to support the deductions claimed by the partner for items attributable to those liabilities o Liability Defined Under § 752 liability does not extend to all legally enforceable payment obligations but only to those obligations that give rise to a tax benefit o Obligation is a liability if, when, and to the extent that incurring the obligation: 1.) creates or increases the basis of any of the obligor’s assets (including cash); 2.) gives rise to an immediate deduction to the obligor; or 3.) gives rise to an expense that is not deductible in computing the obligor’s taxable income and is not properly chargeable to capital o A liability of a cash method taxpayer that is deductible when paid and certain contingent or contested liabilities or obligations that are devoid of economic reality are disregarded Recourse Liabilities A partnership liability is a recourse liability only to the extent that a partner or any person related to a partner bears the economic risk of loss with respect to that debt Liability treated as nonrecourse to extent that no partner or related person bears economic risk of loss o Result: economic risk of loss concept is critical classifying a liability as recourse or nonrecourse Recourse Liabilities the extent to which a partner bears the economic risk of loss also must be determined in order to allocate the debt o Generally the partner bears the economic risk of loss for a partnership liability to the extent that they ultimately would be obligated to pay the debt if all partnership assets were worthless and all partnership liabilities were due & payable Determining risk of loss take into account each partner’s obligations to pay creditor or contribute funds to the partnership and all other economic arrangements or legal obligations between partners and between any partners and the partnership’s creditors o Result: funds borrowed on a nonrecourse basis but personally guaranteed by a partner who has no right of reimbursement from another partner Nonrecourse liabilities for which a partner or related person has pledged their own property as security subject that partner to an economic risk of loss and are recourse liabilities to the extent of the value of the security Nonrecourse loans from a partner to partnership are treated as recourse liabilities expose the lending partner to an economic risk of loss Constructive Liquidation Economic Risk of Loss based on concept of a constructive liquidation of the partnership Worst Case Scenario: regulations assume that all the partnership’s liabilities become due and payable in full, any separate property pledged (directly or indirectly) by a partner to secure a partnership liability is transferred to the creditor in full or partial satisfaction of that liability and all the rest of the partnership’s assets (including cash) become worthless o Partnership deemed to dispose of all of its now worthless assets in a taxable transaction for no consideration o Gains and losses on these deemed dispositions are then allocated among the partners in accordance with the partnership agreement books and capital accounts adjusted accordingly; and the partnership is deemed to liquidate Worst case scenario assumes that a partner bears the economic risk of loss for the net amount that they must pay directly to creditors or contribute to the partnership at the time of the deemed liquidation Determining partner’s payment obligation take into account all facts and circumstances, including (1) contractual obligations outside the partnership agreement, (2) obligations imposed by the partnership agreement, (3) obligations imposed by state law, and (4) the value of any property pledged by the partner to secure any partnership liability o Amount of a partner’s gross payment obligation is reduced to the extent of any right to reimbursement leaving partner’s net payment obligation as ultimate measure of partner’s potential economic risk of loss 22 Purpose: regulations seek to determine where the buck stops with respect to the responsibility for any recourse liability Regulations assume that recourse liability actually will be paid by the partners to the extent that they are personally obligated to do so even if partner’s net worth is less than amount of obligation (unless facts and circumstances indicate a plan to circumvent or avoid the obligation) Determining partner’s payment obligations & reimbursement rights obligations that are subject to contingencies that make it unlikely that the obligation will ever be discharged are disregarded o If an obligation need not be satisfied within a reasonable period of time then only its discounted present value is taken into account o Regulatory Guidance on Guarantees & Indemnity Agreements Service wrestled with how to treat secondary payment obligations (those provided by parties other than the primary obligor) that appear driven by the prospect of allocating outside basis to a partner while permitting that partner to avoid meaningful economic exposure with respect to the liability o Originally focused on bottom-dollar guarantees guarantor obligated to ensure that lender receives amount less than entire liability and only after lender has exhausted its other remedies Service promulgated temporary regulations to address the treatment of guarantees with little or no economic risk as part of guidance addressing a broad group of obligations referred to as bottom dollar payment obligations o Payment obligations outside this category are not respected as recourse A guarantee provided by a partner will be considered a “bottom dollar payment obligation” and disregarded unless the partner is or would be liable up to the full amount of such partner’s payment obligation if, and to the extent that, any mount of the partnership liability is not otherwise satisfied o Result: if a partner could avoid satisfying the entire amount of the guarantee when the creditor is not paid in full then the guarantee will not be respected as a recourse obligation Bottom Dollar Payment Obligations cover guarantees and indemnity agreements o Indemnity agreement not characterized as bottom dollar payment obligation when partner indemnifying another party with respect to a separate payment obligation is liable to pay the indemnified amount in full, without condition o Other party’s payment obligation must be respected for § 752 purposes (indemnified obligation cannot be a bottom dollar payment obligation) 2 Exceptions to definition of Bottom Dollar Payment Obligation: o (1) 10-Year Grace Zone – a payment obligation will not be disregarded as a bottom dollar payment obligation if the obligor has exposure for at least 90% of the liability to which the payment obligation relates o (2) does not include an agreement to pay a fixed percentage of every dollar of the liability to which the payment obligation relates Therefore guarantee of a vertical slice of a partnership liability will not be disregarded for purposes of determining a partner’s share of a liability Proposed Regulations – augment anti-abuse rule in § 752 provision disregards a payment obligation if the facts and circumstances indicate that a principal purpose of the arrangement is to eliminate the partner’s economic risk of loss with respect to that obligation or create the appearance of the partner bearing the economic risk of loss when the substance of the arrangement is otherwise o Non-exclusive list of factors that may indicate a plan to circumvent/avoid payment obligation: 1.) partner not subject to commercially reasonable contractual restrictions that protect the likelihood of payment; 2.) partner not required to periodically provide commercially reasonable documentation regarding the partner’s financial condition to the benefited party; 3.) term of the payment obligation ends prior to the term of the partnership liability and prior to events that increase the economic risk of loss to the obligor; 4.) plan or arrangement exists which the primary obligor holds money or liquid assets in an amount that exceeds the reasonable foreseeable needs of the obligor; 5.) payment obligation does not permit the creditor to promptly pursue payment upon default on the partnership liability; 6.) case of a guarantee or similar arrangement – terms of partnership liability would be substantially the same had the partner not provided the guarantee; and 7.) creditor benefiting from obligation did not receive executed documents with respect to the payment obligation before or within reasonable period after creation of the obligation 23 o Result: Service has indicated that not all payment obligations will simply be taken at face value for purposes of determining which partners bear the economic risk of loss with respect to a recourse liability under § 752 Nonrecourse Liabilities Nonrecourse liability: if no partner bears the economic risk of loss for a partnership liability o Usually allocated to partners in accordance with their respective shares of partnership profits 3 Step Approach – under which a partner’s share of nonrecourse liabilities is the sum of: o (1) partner’s share of partnership minimum gain determined in accordance with § 704(b); o (2) case of nonrecourse liabilities secured by contributed property – amount of gain that the partner would recognize under § 704(c) if the partnership disposed of that property in a taxable transaction in full satisfaction of the liabilities and no other consideration; o (3) partner’s share of any remaining (“excess”) nonrecourse liabilities, determined in accordance with partner’s share of partnership profits Partner’s Share of Partnership Profits General rule for allocation of nonrecourse liabilities nonrecourse liabilities are allocated in proportion to the partners’ interests in partnership profits o If no special allocations then nonrecourse liabilities are simply allocated in accordance with the partners’ interests in the partnership Possibilities expand when the partnership agreement provides for special allocations of profits o If partnership purchases an asset subject to a nonrecourse liability then any specification of the partners’ interests in the partnership agreement will be respected for § 752 purposes as long as it is reasonably consistent with an allocation of any significant item of partnership income or gain Regulations provide some alternative methods for allocating nonrecourse liabilities: o 1.) excess nonrecourse liabilities may be allocated in accordance with the manner in which it is reasonably expected that the deductions attributable to those liabilities will be allocated o 2.) case of contributed property subject to a nonrecourse liability – partnership may first allocate an excess nonrecourse liability to the contributing partner to the extent that § 704(c) gain on the property is greater than the gain resulting from the liability exceeding the basis of the property The method selected for allocating excess nonrecourse liabilities may vary year-to-year Partners’ Share of Partnership Minimum Gain If partnership has generated minimum gain – rule for allocation of nonrecourse liabilities directly follows rule for allocation of the deductions and distributions attributable to those liabilities Liabilities are first allocated in accordance with each partner’s share of partnership minimum gain A principle purpose for including partnership liabilities in the partners’ outside basis is to support the deductions that will be claimed by the partners for items attributable to those liabilities Minimum gain allocation rule also applies where the minimum gain is triggered by a distribution of the proceeds of a nonrecourse loan o The distribute partner (to whom the minimum gain is allocated under § 704(b) regulations) is the partner to whom the nonrecourse liability that generates the minimum gain will be allocated Partners’ Shares of Section 704(c) Gain If property contributed to a partnership is subject to a nonrecourse liability in excess of its adjusted basis then the property has a built-in gain (equal to the excess of liabilities over basis) o Similar to partnership minimum gain The built-in gain is partnership minimum gain under § 704(b) is potentially § 704(c) gain o To extent of the minimum § 704(c) gain – the nonrecourse liability secured by the contributed property is allocated to the same partner to whom this minimum built-in gain is allocated under section 704(c) There may be a minimum amount of gain built into an asset (as a result of nonrecourse liabilities in excess of basis) which is neither minimum gain nor Section 704(c) gain Revenue Ruling 95-41: illustrates the approach of the regulations for determining a partner’s share of nonrecourse liabilities and how to apply the different § 704(c) allocation methods when determining a partner’s share of nonrecourse liabilities Part-Recourse, Part-Nonrecourse Liabilities 24 After properly bifurcating the debt the recourse portion is allocated under the rules for recourse liabilities and the nonrecourse portion is allocated separately under the rules for nonrecourse liabilities Tiered Partnerships Regulations provide special rules for allocation of liabilities of tiered partnerships o Example: assume that A and B form the AB general partnership and agree to share profits and losses equally. A and B each contribute $5,000 to AB, which has no liabilities, and AB then contributes $10,000 cash to the ABCDEF general partnership in exchange for a 1/3 interest in partnership profits and losses. ABCDEF borrows $120,000 on a nonrecourse basis in order to purchase land. AB’s basis in its ABCDEF partnership interest equals its $10,000 cash contribution plus its 1/3 share of partnership debt ($40,000), for a total outside basis of $50,000. Regulations provide that the liabilities of a subsidiary partnership that are properly allocated to an upper-tier (“parent”) partnership are treated as liabilities of the upper-tier partnership for purposes of again applying § 752 to the partners of the parent o Result: AB’s $40,000 share of ABCDEF’s liability reallocated $20,000 each to A and B and increases each partner’s outside basis by $20,000 to $25,000 Chapter 7 – Compensating the Service Partner Payments for Services – General Rules Distributive shares represent the partners’ annual return on their interests in the partnership and generally are based on their contributed capital and the services they may render in their capacities as partners o But partners can wear many different hats when they engage in business dealings with their partnership 1954: Congress veered toward the entity approach by dividing partner-partnership transactions for services into the following 3 broad categories: o (1) Transactions between a partnership and a partner who is not acting in his capacity as a partner Treated by § 707(a)(1) for all purposes as transactions between the partnership and an unrelated third party; o (2) “Guaranteed Payments” (i.e., payments to a partner in their partner capacity for services) Treated by § 707(c) for some purposes as payments of compensation to an unrelated third party but for other purposes (principally timing) as a distributive share; and o (3) Any other payments to partners in their capacity as such which fall outside the ambit of § 707 and thus are treated as part of a partner’s distributive share and when paid to the partner are governed by the distribution rules of § 731 Congress strengthened this structure with rules to prevent partners from exploiting the flexibility of the partnership form by engaging in maneuvers to defer income, accelerate deductions, convert the character of income and losses and the like Partner Acting in Nonpartner Capacity Determining proper tax treatment of compensatory payments to a service provider who also owns an equity interest in the partnership – critical question = whether the service provider is acting as a partner or in some other capacity o If they are not acting as a partner tax consequences of arrangement determined under § 707(a)(1) as if that individual had no other relationship with the partnership o If they partner provides the services in their capacity as a partner tax consequences of arrangement generally will be governed by § 704(b) (as a distributive share) if the payment is dependent on partnership profits and by § 707(c) (as a guaranteed payment) if it is not Pratt v. Commissioner – taxpayers were general partners of 2 limited partnerships formed to develop and operate a shopping center. Under partnership agreements, they were paid management fees based on % of gross rentals. Partners were cash method taxpayers but partnership used the accrual method. The fees were accrued and deducted by the partnership but there not actually paid to the partners during the taxable years at issue. Issue: what is the proper tax classification of the fees 25 Holding: they were to receive the management fees for performing services within the normal scope of their duties as general partners and pursuant to the partnership agreement no indication that any one of the general partners were engaged in a transaction with the partnership other than in their capacity as a partner o If partner is not acting in capacity as a partner then substance of the transaction will govern (its form will not govern) o Record indicates that in managing the partnership they were acting in their capacity as partners since they performed basic duties of partnership business according to the partnership agreement Notes: Tax Court held that if a partner performs services that are ongoing and integral to the business of the partnership then they are acting in their capacity as a partner Nonpartner status is more likely to exist when a partner is acting in an independent capacity – rendering services of a limited technical nature or in connection with a specific transaction Tax Stakes Timing and character of a partner’s and the partnership’s income or losses may differ depending on whether a payment is classified under § 707(a)(1) or as a distributive share The character of items classified as a distributive share is determined at the partnership level and those items pass through to the partners in the year in which the partnership’s taxable year ends But if § 707(a)(1) applies the partner and the partnership generally determine their character and timing consequences as if they were dealing as unrelated parties o Result: § 707(a)(1) payments for services are always ordinary income to the recipient and are taxed depending on whether the recipient is a cash or accrual method taxpayer o Payor ordinarily may deduct such payments as a business expense in accordance with its method of accounting subject to the capitalization requirement of § 263 Some cases – these technical differences between § 707(a)(1) payments and distributive shares may be relatively inconsequential More complex situations – the tax distinctions between § 707(a)(1) payments and allocations of distributive shares may shift the character of income among the partners To prevent taxpayers from exploiting the mismatching of income and deductions in the partnership setting Congress extended the timing restraints of § 267 to transactions between partners and partnerships § 267(a)(2): provides that a deduction may not be taken prior to the year in which the amount is includible in the gross income of the payee an accrual method partnership may not deduct an item owed to a cash method partner prior to the year in which the item is paid and properly included in the payee’s income Section 707(a)(1) Payments for Services – Treatment Under § 199A § 199A(c)(4)(C): qualified business income does not include any payment described in § 707(a) to a partner for services rendered with respect to the partnership’s trade or business o 2018 regulations employ this grant of authority to broadly exclude § 707(a)(1) payments from the definition of qualified business income o Regulations also provide that if a § 707(a)(1) payment is deductible by the partnership and properly allocable to its trade or business then it will reduce qualified business income Partners as Employees Armstrong v. Phinney – suggested that a 5% partner who managed a 50,000 acre cattle ranch owned by the partnership was also an employee for purposes of excluding the value of meals and lodging provided to him and his family under § 119 o Concluded that it is now possible for a partner to stand in any one of a number of relationships with its partnership (including those of creditor-debtor, vendor-vendee, and employee-employer) In response – IRS took a hard line in opposing the prospect of an individual’s dual status as a partner and employee and rejected the reasoning of the Armstrong case o IRS position: a partner providing services to the entity in a third-party capacity can do so only as an independent contractor but can be problematic for a partnership or LLC that desires to provide relatively minor equity interests to employees as part of an incentive compensation plan The receipt of an equity interest may terminate the service partner’s status as an employee (thereby subjecting the new partner to the more onerous self-employment tax regime) and depending on the amounts involved, requiring the payment of quarterly estimated taxes Disguised Payments – Section 707(a)(2)(A) 26 If a partnership pays a partner for services in a transaction governed by § 707(a)(1) and the expense is capital in nature then the partnership must treat the payment for tax purposes as if it were made to an unrelated third party o The timing ramifications of structuring a payment to a partner for services as an allocation rather than as a payment governed by § 707(a)(1) would be dramatic if the parties could convert a capital expenditure into the equivalent of a currently deductible expenses § 707(a)(2)(A): prevents taxpayers from disguising payments for services to achieve this timing advantage o If (1) a partner performs services for a partnership (2) there is a related direct or indirect partnership allocation and distribution to the partner, and (3) when viewed together, the performance of such services and the allocation/distribution are properly characterized as a transaction between the partnership and a partner acting in a non-partner capacity the transaction is treated as a transaction between the partnership and a person who is not a partner The amount paid to the partner in consideration for the services is treated as a payment for services provided to the partnership and, where appropriate, the partnership must capitalize these amounts or treat such amounts consistent with their characterization o The partnership must treat the purported allocation to the partner performing services as a payment to a nonpartyer in determining the remaining partners’ shares of taxable income or loss Congress did not intend to apply this new provision in cases in which a partner receives an allocation for an extended period to reflect his contribution of services to the partnership and the facts and circumstances indicate that the partner is receiving the allocation in his capacity as a partner o But Congress did intend the provision apply to allocations that are determined to be related to the performance of services for the partnership and when viewed together with distributions to have the substantive economic effect of direct payments for such services under the facts and circumstances Regulations will provide (when appropriate) that the purported partner performing services for the partnership is not a partner at all for tax purposes o If it is determined that the service performer actually is a partner – Congress believed that the factors described below should be considered in determining whether the partner is receiving the putative allocation and distribution in his capacity as a partner [see § 707(a)(1)]: o 1st Factor – whether the payment is subject to an appreciable risk as to amount Partners extract the profits of the partnership with reference to the business success of the venture and third parties generally receive payments which are not subject to this risk Usually the MOST important factor o 2nd Factor – whether the partner status of the recipient is transitory Transitory partner status suggests that a payment is a fee o 3rd Factor – whether the allocation and distribution that are made to the partner are close in time to the partner’s performance of services for the partnership An allocation close in time to performance of services is more likely related to services o 4th Factor – whether, under all the facts & circumstances, it appears that the recipient became a partner primarily to obtain tax benefits for himself or the partnership which would not have been available if he had rendered services to the partnership in a 3rd party capacity o 5th Factor – relates to purported allocations/distributions for services, whether the value of the recipient’s interest in general and continuing partnership profits is small in relation to the allocation in question suggesting that the purported allocation is a fee Especially significant if the allocation for services is for a limited period of time In cases of allocations that are only partly determined to be related to the performance of services for the partnership provision applies to that portion of the allocation which is reasonably determined to be related to the services provided to the partnership Notes: The proposed regulations are aimed at arrangements where managers of private equity partnerships seek to convert ordinary fee income into more lightly taxed long-term capital gain by waiving all or part of their management fees in exchange for an additional interest in the future profits of the partnership Since management fees are taxable as ordinary income and most future profits of private equity funds are taxable as long-term capital gains the tax savings from a fee waiver can be considerable over the life of a fund o But economics only make sense if the waiver arrangement is structured to eliminate or at least minimize any economic risk to the manager with respect to the management fee the exact type of disguised payment arrangement that § 707(a)(2)(A) was intended to prevent Proposed regulations apply a “facts and circumstances” test to find disguised payments for services 27 o o Most important factor – whether arrangement lacks significant entrepreneurial risk to the service provider relative to the overall risk of the partnership at the time the parties enter into or modify the arrangement Regulations list additional factors creating a presumption that an arrangement lacks significant entrepreneurial risk unless that presumption can be rebutted by clear and convincing evidence If facts & circumstances demonstrate that there is a high likelihood that the service provider will receive an additional allocation of income regardless of the overall success of the partnership’s business then the arrangement will be presumed to lack significant entrepreneurial risk Guaranteed Payments Guaranteed Payments: payments by a partnership to a partner for services which are determined without regard to partnership income Services Context guaranteed payment resembles a salary and are fixed amounts o They resemble distributive shares in that they relate to services that are an integral part of the partnership’s ongoing activities o They are made to partners in their capacity as partners rather than as unrelated third parties Tax Context hybrid; like § 707(a)(1) payments, they are treated for some purposes as made to a person who is not a member of the partnership o Are taxable to the partner as ordinary income regardless of the amount or character of the partnership’s taxable income and are deductible by the partnership under § 162 [subject to the capitalization requirement of § 263] Timing Context guaranteed payments resemble distributive shares in that they are included in income for a partner’s taxable year within or with which ends the partnership taxable year in which the partnership deducted such payments as paid or accrued under its method of accounting o Partner must include them in income whether or not they are received Need mechanism to ensure that partner is not taxed a second time when the payment is actually received § 707(c): implies that a guaranteed payment is treated as a distributive share for all purposes other than characterization of the partner’s income and allowance of a deduction to the partnership but the Service does not construe it as broadly Gaines v. Commissioner – the four limited partnerships accrued and claimed deductions for guaranteed payments but Gaines Properties never received any of the guaranteed payments and did not report them in its income. Commissioner determined that Gaines Properties should have reported as income the guaranteed payments accrued and deducted by the limited partners. Commissioner disallowed portions of the deductions that the limited partnerships claimed for these guaranteed payments because some of the portions were capital expenditures and not currently deductible. Holding: guaranteed payments should be included in the recipient partner’s income in the partnership taxable year ending with or within which the partner’s taxable year ends and in which the tax accounting treatment of the transaction is determined at the partnership level o Nothing indicates that includability in the recipient partner’s income was intended to be dependent on deductibility at the partnership level cannot recognize income pro rata as deductions are allowed to partnership § 706(a) determines timing of allocation Revenue Ruling 69-180 – advice on proper method for computing the partners’ distributive shares of the partnership’s ordinary income and capital gains under certain circumstances Allows a partnership to treat some of its payments to a service rendering partner as allocation of ordinary income and as guaranteed payments o Can provide guaranteed payments only in the year(s) that there are not sufficient profits For purposes of § 61(a) [gross income] and § 162(a) [trade or business expenses] to the extent determined without regard to the income of the partnership, payments to a partner for services or the use of capital shall be considered as made to one who is not a member of the partnership For purposes of § 61(a) guaranteed payments are regarded as a partner’s distributive share of ordinary income so the payment is includible in gross income of the recipient as ordinary income and is deductible by the partnership from its ordinary income as a business expense Guaranteed Payments for Services – Treatment Under Section 199A § 199A(c)(4)(B): provides that qualified business income does not include any guaranteed payments for services rendered with respect to the partnership’s trade or business 28 But – any partnership deduction allowed for the guaranteed payment reduces qualified business income if the deduction is properly allocable to the partnership’s trade or business Unlike wages of S Corporation – guaranteed payments in the partnership setting are not included in W-2 wages for purposes of determining the limitations on the § 199A deduction that apply to high-income taxpayers o Revenue Ruling 2007-40 – is a transfer of partnership property to a partner in satisfaction of a guaranteed payment under § 707(c) a sale or exchange under section 1001? Or a distribution under § 731? – deals with how partnership will be taxed because if sale/exchange then partnership must realize gain A transfer of partnership property to a partner in satisfaction of a guaranteed payment under § 707(c) is a sale or exchange under section 1001 and not a distribution under § 731 Section 707(c) seems to be enacted to make it clear that a partner realizes ordinary income as a result of receiving payments for services in their partner capacity o Section 707(a) does the same for partners who are compensated for their services while acting in a nonpartner capacity Partnership Equity Issued in Exchange for Services § 721 – provides nonrecognition of gain or loss when a partner contributes property in exchange for an interest in the partnership o Property – does not include services because they are ephemeral and do not leave behind an identifiable continuing capital investment in the business A partner who receives a partnership interest in exchange for services is being compensated and should realize income under § 61(a) partner takes a § 1012 “tax cost” basis in the partnership interest equal to the amount that is included in income Service partner may receive a capital interest – generally defined as an interest in both the future earnings and the underlying assets (i.e., the “capital”) of the partnership o A partner who has a capital interest is entitled to a share of the partnership’s net assets in the even the partner withdraws or the partnership is liquidated o Cannot receive a capital interest if services have not yet been rendered Alternatively: a partner can receive only a profits interest that entitles them to a share of future earnings but gives them no current right to a distribution of a share of the partnership’s capital in the event of a withdrawal or liquidation Receipt of a Capital Interest for Services Service partner who receives a capital interest realizes ordinary income equal to the value of the interest received minus amount paid for the interest § 83 – determines timing of income and broadly applies to all transfers of property in connection with the performance of services o If interest is received without restrictions income is realized upon its receipt o If the interest is transferred subject to substantial restriction then § 83(a) provides that its FMV is included in gross income when the restrictions lapse A partner whose interest will be forfeited unless they continue to manage the partnership’s business for 5 years may defer any inclusion of income until the interest is free of restrictions o Amount to be included in income is the excess of the FMV of the interest at the time the partner’s rights have vested over the amount paid for the interest A transferee of restricted property is permitted to elect under § 83(b) to include the value of the property in income at the time of its receipt o If a § 83(b) election is made then transferee may not take any deduction if the property is subsequently forfeited The service partner receiving a restricted interest is thus faced with a “gambler’s choice” o If a partnership interest has minima value upon receipt but is expected to appreciate by the time the restrictions lapse then service partners usually are motivated to make the election in hope that the future appreciation in the property will be taxed at preferential capital gains rates at a later date when the property is sold Transfer of a capital interest for services may cause the partnership to recognize gain o Example: manager receives 1/3 capital interest in a partnership previously formed by Proprietor and Investor and the partnership’s sole asset is land with a value of $120,000 and an adjusted basis of $45,000 transfer of capital interest to manager can be viewed as 2 step transaction: 29 (1) the transfer of a 1/3 undivided interest in the land from the partnership to manager as compensation for their services; and Involves the transfer of appreciated property in a § 83 compensatory transfer to manager and thus is a taxable event (2) the contribution of that interest back to the partnership by manager A tax-free contribution of managers interest in the land back to partnership under § 721 and manager’s “tax cost” basis is transferred to the partnership under § 723 McDougal v. Commissioner Facts: The McDougals and the McClanahans became partners in the ownership of Iron Card, a valuable horse, which the McDougals had bought for $10,000. When they became partners McClanahan had trained and cured Iron Card of “protein allergy” by a home remedy. McDougal gave the McClanahans the interest in the partnership, describing it as a “gift” in the transfer document. Later McDougal claimed a $30,000 deduction for the transfer as payment to McClanahan for his prior work, assuming the horse to have been worth $60,000 at the time of making McClanahan a partner. The IRS didn’t allow McDougal the $30,000 deduction he claimed, arguing that the transfer was a gift, and that the partnership still held the horse with a $10,000 basis. Held: Making the McClanahans partners was not a gift by the McDougals, given the training and curing background of the horse by McClanahan. The more important holding is this: When on the formation of a joint venture, a party contributing appreciated assets satisfies an obligation by granting his obligee a capital interest in the venture, he is deemed first to have transferred to the obligee an undivided interest in the assets contributed, equal in value to the amount of the obligation so satisfied. He and the obligee are deemed thereafter and in concert to have contributed those assets to the joint venture. (255) Notes: Crescent Holdings v. Commissioner – tax court addressed the tax treatment of profits attributable to an unvested capital interest in a partnership held by an individual service provider (Fields) o Facts: Fields received a 2% capital interest in a partnership in exchange for his agreement to provide services for the benefit of the partnership but the interest was subject to forfeiture if Fields terminated his employment within 3 years after the partnership’s formation. Fields did not make a § 83(b) election with respect to the partnership interest. Partnership allocated a large amount of income in respect of Field’s 2% interest but none of those profits were distributed o Claim: Fields contended that he could not be taxed on a share of undistributed partnership income while his interest remained unvested because he was not yet a partner in the entity as a result of the operation of § 83(a) and the regulations thereunder o Holding: agreed – nothing in statute or regulations addressed the matter and held that the holder of an unvested capital interest in a partnership does not recognize as income the undistributed profit allocations attributable to such interest A service provider’s interest in the undistributed profits remains subject to the same risk of forfeiture that applies to the underlying capital interest The undistributed income would be included in the value of the partnership interest to be included in gross income if and when the interest vested until that point the undistributed profits would be taxed to the remaining owners of the entity as part of their distributive shares of income under § 702 Practical Considerations Issuance of a capital interest in a partnership to a service provider carries significant practical drawbacks o The partners in the partnership naturally will be reluctant to currently part with an interest in the partnership’s capital for the future services of a new partner Tax issues – in any transfer of a capital interest the value of the pro-rata interest in partnership property deemed transferred to the partner under Step 1 of the McDougal analysis must be determined and then must be included in income by the service provider when the interest is granted or if the interest is subject to a substantial risk of forfeiture and no § 83(b) election is made then when interest vests o Service partner must have sufficient liquidity to pay the resulting tax liability or the partnership must couple the grant of the capital interest with a cash payment to finance the tax payments o Result: partnership capital interests are rarely issued as part of equity compensation packages Receipt of a Profits Interest for Services If manager receives only an interest in the future profits of the partnership then he is nonetheless being compensated for his services and has realized ordinary income 30 Issue: what is the value of his interest, which measures the amount of his income? Should the income be considered realized at the time the interest is received when the amount is speculative or only when the profits are actually earned by the partnership? Hale v. Commissioner – Hale received partnership interest in joint venture of company for future services but sold right of interest before receiving any income. Hale tried to argue that the gain received from the sale is a capital gain Holding: Hale realized ordinary income on the transaction as if it had received such income directly from Walnut Co. Diamond v. Commissioner – Diamond acquired for $25,000 the buyer’s rights in a contract for the sale of an office building. Diamond was asked to obtain a mortgage loan for the full $1,100,000 purchase price of the building and they agreed that Diamond would receive a 60% share of profits or loss of the venture if he arranged the financing. After closing, it was proposed that Diamond sell his interest and substituted by Liederman on a 50-50 basis. Holding: taxpayer’s services had all been rendered and the prospect of earnings from the real estate was very good – general principle that a valuable property interest received in return for services is compensation and income o Each partner determines his income tax by taking into account his distributive share of the taxable income of the partnership Here: taxpayer was entitled to defer income taxation on the compensation for his services except as partnership earnings were realized o If partner taxed on the determinable market value of a profit-share at the time it is created in his favor and is also taxed on his full share of earnings as realized, then there will be double taxable that is avoidable by permitting him to amortize the value which was originally treated as income Scope of Diamond Although decision can be read to apply whenever a service partner receives a profits interest that is readily susceptible of valuation – the facts of case suggest a narrower holding 7th Circuit assumed Diamond received an interest in future partnership profits – Diamond received his interest for past services rendered (not future services to be performed for the partnership) Subsequent Developments § 83 applies to any transfer of “property” in connection with the performance of services o Regulations define “property” to include all real and personal property (excluding only money or an unfunded and unsecured promise to pay money or property in the future) § 83 regulations make no reference to partnership interests or to property received in a partner capacity o But it seemed theoretically correct and unwise to treat a profits interest as § 83 “property” Service then stated it would not follow Diamond to the extent that it held that the receipt of an interest in future partnership profits as compensation was a taxable event o Cases After – generally held that a profits interest received for services had no value for tax purposes because the taxpayer would not be entitled to any interest in partnership capital on liquidation and the future profits of the partnership were speculative Campbell v. Commissioner – tax court held that the receipt of profits interests in real estate limited partnership by a taxpayer who had performed services for the syndicator of the ventures was taxable even though the taxpayer would not have been entitled to receive anything of value on an immediate liquidation of his interest o Court valued the interests by looking to the present value of the projected future tax benefits and cash contributions of the partnerships o 8th Circuit: reversed – held that the profits interests had no value because the projected future benefits were wholly speculative but left open the possibility that a profits interest received by a service partner acting in a partner capacity would be taxable if it were susceptible of valuation o Suggested that the receipt of a profits interest by a partner might not be taxable as a matter of law because sections 61 and 83 were preempted by other provisions of Subchapter K that govern the taxation of compensatory payments to partners for services rendered in their partner and nonpartner capacities Revenue Procedure 93-27 – guidance on the treatment of the receipt of a partnership profits interest for services provided to or for the benefit of the partnership If a person receives a profits interest for the provision of services to or for the benefit of a partnership in a partner capacity or in anticipation of being a partner – IRS will not treat the receipt of such an interest as a taxable event for the partner or the partnership Does not apply to: 31 o o o (1) if the profits interest relates to a substantially certain and predictable stream of income from partnership assets; (2) if within 2 years of receipt the partner disposes of the profits interest; or (3) if the profits interest is a limited partnership interest in a publicly traded partnership within the meaning of § 7704(b) Notes: Where a partner with managerial or technical expertise receives a share of future profits upon joining a partnership receipt of the profits interest will not be a taxable event as long as the 3 exceptions in Revenue Procedure 93-27 area avoided o Rev. Procedure 93-27 did not address whether a profits interest constitutes “property” under section 83 or is capable of reasonable valuation – becomes important if a grant of a profits interest falls outside of the procedure’s safe harbor The Service’s tolerant policy toward the grant of a profits interest applies only if the services are performed for the partnership in a partner capacity or in anticipation of being a partner o Thus if a profits interest is received for services performed in a nonpartner capacity the service provider presumably is taxable upon receipt of the interest As for partnership – the tax issues resulting from taxing the transfer of a profits interest are numerous and conceptually challenging – consider: o (1) should partnership obtain deduction for transfer of the profits interest to the services partner? o (2) is the transfer of the interest a taxable event for the partnership? o (3) if the service partner is taxable on receipt of the profits interest, what should happen when the profits are actually realized? Important to remember that they only arise when a partner is taxable on the receipt of a profits interest Nonvested Profits Interests Rev. Procedure 2001-43 – issued to clarify the application of Rev. Procedure 93-27 in the context of the grant of a profits interest that is subject to a substantial risk of forfeiture o 1.) provides whether an interest granted to a service provider is a profits interest is tested at the time the interest is granted, even if that interest is not substantially vested under § 83 Clarification critical because allocations of distributive shares of income or loss during the period the profits interest remains unvested could create a capital account balance that would render the interest a capital interest when it vests o 2.) Service will not treat the grant of a nontaxable profits interest, or the event that causes the interest to be substantially vested under § 83, as a taxable event Thus a § 83(b) election is not required if a partnership profits interest is not substantially vested at the time it is granted Rev. Proc. 2001-43 requires: o (1) service provider must be treated as the owner of the interest from the date of its grant and must take into account the distributive share of all items associated with the interest for the entire period during which it has the profits interest; o (2) neither the partnership nor any partner may deduct any amount for the FMV of the interest either upon the grant of the interest or when it becomes substantially vested; and o (3) all the other requirements of Rev. Procedure 93-27 must be satisfied Taxation of “Carried Interests” Post Diamond – a partner generally may receive a profits interest as compensation for services and avoid being immediately taxed on the value of the interest Generally a service partner will receive a guaranteed payment, a distributive share of partnership profits, or a combination of both, in exchange for the work performed for the partnership, and the Service has the authority to recharacterize some partnership allocations and treat them as payments for services Hedge funds, private equity and venture capital funds, and other types of investment pools have raised large amounts of capital from institutional investors and wealthy individuals while protecting their privacy and avoiding most government regulation o Almost all structured as partnerships or LLCs – investment manager or affiliate act as the general partner or manager member and the investors as limited partners or non-manager members 32 Profit share may be payable in all events or only after the fund has returned a specific return (hurdle rate) to investors profit allocation (carried interest) usually flows through to general partners as tax-preferred capital gains because it represents a portion of the gains realized when the fund sells its investment assets o The manager-general partner is not taxed on receipt of the carried interest thus income from the carried interest is deferred until assets are sold and then it is taxable at capital gains rates Recharacterization of Gain – § 1061 Tax years before December 31, 2017 – § 1061 simply recharacterizes a partner’s distributive share of long-term capital gain with respect to an “applicable partnership interest” as short-term capital gain unless the gain is attributable to property held for more than 3 years o Converts to short-term capital gain the excess of: (1) the taxpayer’s distributive share of long-term capital gain with respect to the applicable partnership interest over (2) the taxpayer’ distributive share of long-term capital gain with respect to the interest determined by imposing a 3 year holding period for long-term treatment Allocations of long-term capital gain with respect to assets held for less than 3 years therefore will be taxed at the higher ordinary income rates o Because these allocations are treated as short-term capital gains still may be offset by capital losses and are not subject to self-employment tax Score of Application § 1061 is limited to long-term capital gain with respect to an “applicable partnership interest” – generally is a partnership interest transferred to or held in connection with the performance of substantial services by the taxpayer in any applicable trade or business Applicable trade/business – any activity conducted on a regular, continuous and substantial basis that consists of: o (1) raising or returning capital; and o (2) investing in or developing “specific assets” consisting of a broad range of financial investments (securities, commodities, options, derivatives, and cash equivalents) Definition extends to most hedge funds & private equity, venture capital, and real estate partnerships Exceptions: two important exceptions to the scope of the partnership interests covered by the statute: o (1) an applicable partnership interest does not include an interest held by a corporation o (2) an applicable partnership interest does not include a capital interest in a partnership that provides the taxpayer with the right to share in partnership capital in a manner commensurate with either (a) the amount contributed to the entity or (b) the value of the interest included in the taxpayer’s gross income under § 83 at the time of receipt or vesting Thus § 1061 does not apply to a partnership interest received in exchange for contributed capital or a capital interest effectively purchased for tax purposes through inclusion of its value in the taxpayer’s gross income at the time it was received or vested Exclusion from Recharacterization for Gains from Non-Portfolio Investments Statute provides Service with authority to exclude from § 1061 income or gain attributable to any asset not held by the partnership for portfolio investment on behalf of third party investors o Purpose – permit the exclusion of gain attributable to a partner’s share of the enterprise value of a business (i.e., an investment management company’s goodwill) Context of Private Equity or Venture Capital Fund – provision appears to have little application Relevance of Section 83 Section 1061 provides that the statute’s conversion of certain long-term capital gains to short-term capital gains applies notwithstanding § 83 or any election in effect under § 83(b) o Means – § 83 cannot be interpreted as somehow overriding or negating application of § 1061 Application to a Transfer of an Applicable Partnership Interest to a Related Person If § 1061 were to apply only to allocations of long-term capital gain with respect to an applicable partnership interest then taxpayers might be tempted to circumvent the statute through transfers of partnership interests to related parties § 1061 appears to foreclose this avoidance opportunity by providing that the transferring partner must include in gross income as short-term capital gain the excess of: o (1) so much of the taxpayer’s long-term capital gains with respect to the interest for the taxable year attributable to the sale or exchange of any asset held for not more 3 years as is allocable to such interest, over o (2) any amount treated as short-term capital gain under § 1061(a) with respect to the transfer of such interest 33 “Related Person”: a member of the taxpayer’s family or a person who performed a service in the current calendar year or preceding 3 calendar years in the applicable trade or business in which or for which the taxpayer performed a service Reporting Requirements and IRS Regulatory Authority § 1061 directs Secretary to require reporting by taxpayers to provide information necessary to carry out the purpose of the section o Also directs the Secretary to promulgate regulations or to issue guidance under § 1061 as may be necessary or appropriate to carry out the purposes of the section Chapter 8 – Property Transactions Between Partners & Partnerships Payments for the Use of Property Code divides partner partnership transactions for services in 3 broad categories: o (1) those between a partnership and a partner who is not acting as a partner that are treated under § 707(a)(1) as occurring between the partnership and an unrelated 3rd party o (2) guaranteed payments under § 707(c) that are made to the partner in their capacity as a partner but determined without regard to partnership income o (3) other payments made to the partner in their capacity as a partner that are based on partnership profits and therefore are part of the partner’s distributive share Transactions in which a partner provides the partnership with the use of capital (i.e., property) generally are categorized and taxed under the same framework Section 707(a)(1) § 707(a)(1): a partner engages in a property transaction with a partnership other than in his capacity as a partner is taxed as if they were an unrelated third party o Therefore Subchapter K does not apply o Example: if a partner leases property to their partnership, a lease payment made by the partnership normally would result in gross income for the partner and produce a deduction for the partnership. The arrangement would not be treated as a contribution of property by the partner under § 721, followed by subsequent distributions by the partnership under § 731 Loans or property and sales and purchases of property between partners and partnerships are considered § 707(a)(1) transactions o If partner retains ownership of property but allows partnership to use the property to obtain credit or as security in a guaranty, pledge or other agreement, then the transaction is also treated as between a partnership and an unrelated party Timing of income to partner determined under the partner’s tax accounting method o Any partnership deduction for a § 707(a)(1) payment may be restricted in an accrual method partnership under § 267 provides that an accrual method partnership may not take a deduction prior to the year in which the amount is includible in the gross income of a payee-partner Disguised Payments for the Use of Property § 707(a)(2)(A): authorizes the Service to treat a related direct or indirect allocation and distribution as a § 707(a)(1) transaction in situations where the allocation and distribution are properly characterized as a transaction occurring between the partnership and unrelated third party o Provides factors to determine whether payment to be received is subject to significant entrepreneurial risk – partners extract profits of partnership with reference to the business success, while third parties generally receive payments which are not subject to this risk Other relevant factors to transactions are: o (1) transitory partner status – limits the duration of the joint undertaking and suggests the payment of a fee for the property; and o (2) whether the allocation and distribution are close in time to the transfer of property – indicates they are related to the use of property Congress did not intent § 707(a)(2)(A) to repeal the general rule that contributions of property may be made by a partner tax free under § 721 and partners may receive an allocation or an increased allocation of partnership income for extended periods of time attributable to property contributed as a partner Section 707(c) Guaranteed Payments for Property 34 Guaranteed payments may be made by a partnership to a partner for the use of property o Typically the payment would be a preferred return on a partner’s equity investment that is payable in all events before any allocation of income or losses among the partners Guaranteed payments for use of property – taxable to partner as ordinary income and deductible by the partnership under § 162 (subject to the capitalization requirement of § 263) Timing of inclusion of guaranteed payment by partner focuses on partnership’s method of accounting o A guaranteed payment is included by the partner in the taxable year which ends in the partnership taxable year in which the partnership deducts or capitalizes the payment Tax Consequences under Section 199A § 199A does not directly address whether a partner’s income from a § 707(a) property transaction may be qualified business income eligible for the § 199A deduction o However tax treatment of the payment for § 199A should depend on the nature of the partner’s activities as a nonpartner and the character of the income to the partner from the transaction Based on the partner’s activities outside the partnership that generated the income – question is whether the income satisfies the requirements and limitations in § 199A § 707(c): the proposed § 199A regulations provide that a guaranteed payment for the use of capital is not considered to be attributable to a trade or business so is not taken into account for purposes of computing qualified business income o Reasoning: a guaranteed payment for capital is not attributable to the trade or business because it is determined without regard to the income of the partnership o However any allowable partnership deduction associate with the guaranteed payment will be taken into account for purposes of computing qualified business income if the deduction is properly allocable to the trade or business Sales and Exchanges of Property Between Partners & Partnerships Generally a bona fide sale or exchange of property by a partner to a partnership (or vice versa) is treaded as a § 707(a) (1) transaction between unrelated parties § 267(a)(1): disallows losses with respect to many transaction between related parties but does not apply to partnerpartnership sales or exchanges o § 707(b)(1) fills the gap by disallowing losses on sales or exchanges of property between partnerships and partners who own (directly or indirectly) more than a 50% interest in partnership capital or profits § 707(b)(2) and § 1239(a) – characterize gain on sales and exchanges of property between partners and controlled partnerships (more than 50%) as ordinary income § 453(g): disallows installment sale treatment on such sales if the property is depreciable to the transferee unless the seller can establish that the sale did not have tax avoidance as a principal purpose Disguised Sales § 707(a)(2)(B): provides that if a partner transfers money or other property to a partnership and the partnership makes a related transfer of money or other property to that partner or another partner, then the two transfers shall be treated as a sale or exchange of property between the partnership and the partner acting in a nonpartner capacity, or between two partners acting as outsiders o Temporal proximity of the contribution and distribution is a significant factor for a disguised sale Guiding Principle – a contribution and related distribution should be recast as a sale only when their combined effect is to allow a partner to withdraw all or part of their equity in the transferred property o Simultaneous Transfers: transactions likely to be viewed as a sale Transfer will not be treated as a disguised sale if the transferring partner is converting equity in the property into an interest in partnership capital and the transfer is subject to the entrepreneurial risks of the enterprise Nonsimultaneous Transfers: if between a partnership and a partner and made within 2 years of each other, then presumed to be a sale (transfers made more than 2 years apart are presumed not to be a sale) o Both presumptions are rebuttable and regulations provide a list of factors that may prove the existence of a disguised sale Partial Sales Generally if the consideration treated as transferred to a partner in a sale is less than the FMV of the property transferred to the partnership, then the transaction is treated as a part-sale and part-contribution o The transferring partner must pro rate their basis in the property between the sale and contribution portions 35 Precontribution Leveraging of Property Issue – situations where a partner or partnership borrows against property in connection with a transfer and related distribution o When borrowed funds end up in the transferring partner’s pocket then the overall transaction may be equivalent to a sale (at least to the extent that the other partners assume primary responsibility for repayment of the loan) Generally if a liability incurred by a partner in anticipation of a transfer is assumed by a partnership, then the partnership is treated as transferring consideration to the partner to the extent that responsibility for repayment of the transferred liability is shifted to the other parties o Liabilities incurred within 2 years of a transfer are presumed to be in anticipation of the transfer and if incurred more than 2 years before a transfer then they are called qualified liabilities o Are treated as consideration paid in a sale only to the extent that the transferring partner is otherwise treated as having sold a portion of the property Reporting Requirements Regulations require disclosure on a prescribed form when a partnership transfers money or property to a partner within 2 years of a transfer of property by the partner to the partnership and the partner has treated the transfer as other than a sale for tax purposes Debt-Financed Distributions § 707(a)(2)(B): generally provides that if a partner transfers property to a partnership and the partnership incurs a liability the proceeds of which are allocable to a distribution to the partner within 90 days of the liability being incurred, then the transfer of money to the contributing partner is taken into account for purposes of § 707(a)(2)(B) only to the extent the amount of money exceeds the contributing partner’s allocable share of the liability o Rationale: because the proceeds of a loan incurred by the partnership may be distributed to the partners on a tax-free basis provided each partner receives their allocable share of the liability under § 752, the same transaction should not be treated differently merely because a partner has recently contributed appreciated property to the partnership o Debt-financing technique is designed to benefit from the exemption by structuring what otherwise would be proceeds of the sale of property as a distribution of the partner’s § 752 share of an entity-level liability Canal Corp. v. Commissioner – Chesapeake corp. wanted to sell its sub Wisconsin Tissue Mills (WISCO) to Georgia Pacific (GP) and avoid recognition of gain on the sale. Chesapeake contributed WISCO to an LLC with GP and the LLC borrowed $750 million from a bank, which was roughly the FMV of WISCO’s business, then distributed that amount to WISCO. GP guaranteed the loan, but in order to preserve good tax consequences, WISCO agreed to indemnify GP if it paid off all or any part of the loan. Chesapeake and GP relied on an accounting firm’s opinion that this indemnification agreement kept WISCO at risk for the value of the property. For financial accounting purposes and trading on public exchanges, Chesapeake treated the transaction as a sale. Held: this was a disguised sale on which WISCO realized gain. The distribution of cash to WISCO did not fit the debt-financed transfer exception to the disguised sale rules. Notes: The debt-financed distribution transaction depends on the partnership liability being allocated to the “selling” partner for purposes of § 752(a) – as the proceeds of the liability often represent the selling price in substance, the liability generally represents the obligation of the “purchasing” partner o Therefore indemnity or reimbursement agreements are used to allocate the ultimate risk of loss for the liability to the “selling” partner o Impact: the potential success of the strategy depends on the taxpayers being able to argue that the “selling” partner retains risk of loss for the liability under § 752 Transfers of Property & Related Allocations A contribution of property to a partnership is not likely to be accompanied by an allocation of partnership income to the contributing partner [at least where capital accounts are maintained in accordance with § 704(b)] 36 o o Since regulations require that a partner’s capital account must be increased by the FMV of contributed property – allocation of additional income to the contributing partner would result in double capital account credit for the contribution Impact: would alter the partners’ economic business deal and is not likely to be accepted by the other partners Chapter 9 – Sales and Exchanges of Partnership Interests Consequences to the Selling Partner Transaction might be fragmented into sales of the partner’s undivided fractional interest in each asset of the partnership but also can be viewed as the disposition of a capital asset without regard to the character of the underlying partnership assets o Debate settled when Congress enacted a statutory hybrid a modified entity approach § 741: provides that gain or loss from the sale or exchange of an interest in a partnership shall be considered as gain or loss from the sale of a capital asset o But unqualified capital gain treatment on the sale of a partnership interest historically led to abuse if the partnership held assets (i.e., inventory and accounts receivable) that gave rise to ordinary income if sold by the partnership § 741 yields to § 751(a) to the extent that the amount received by a selling partner is attributable to “unrealized receivables” or “inventory items” o Both provisions apply whether the selling partner disposes of their entire interest or only some portion of it o Interaction of both provisions resembles the relationship of the depreciation recapture provisions to § 1221 and § 1231 § 751(a): overrides § 741 and converts what otherwise would be capital gain or loss into ordinary gain or loss and has priority (first carving out an appropriate amount as ordinary gain or loss and then leaving § 741 to characterize the balance) Overall Gain or Loss on Sale Applied to Partnership Interest – the selling partner first must apply the general rules of § 1001(a) and compute the total realized gain or loss on the sale o This requires a determination of the difference between the amount realized by the partner on the sale and the adjusted basis of the partnership interest sold o Thus § 752(d) incorporates the teachings of Crane by including in the amount realized the selling partner’s share of all partnership liabilities along with the cash and FMV of other property received by the seller The adjusted basis of the seller’s interest is their outside basis under § 705(a) adjusted to reflect the seller’s pro-rata share of partnership income or loss from the beginning of the current taxable year up to the date of sale Partner’s Distributive Share of Gain or Loss in Year of Sale Although a partnership’s taxable year generally does not close when a partner sells an interest – it closes with respect to a partner immediately upon the sale or exchange of their entire interest in the partnership o The income or loss arising from that short taxable period then passes through to the partner and is reflected in their outside basis In the case of partner who sells only a portion of their interest partnership’s year does not close and the selling partner’s distributive share of income or loss is included at the end of the partnership’s year In the case of a partner selling a portion of an interest regulations require an appropriate adjustment to the outside basis of the portion sold to reflect the partner’s distributive share as of the date of the sale or exchange In any sale or exchange of a partnership interest – the distributive shares of the partners are determined by taking into account the varying interests of the partners in the partnership during the taxable year Determination of Ordinary Income – § 751(a) Next Step: determine what portion (if any) of the seller’s total realized gain or loss is characterized as ordinary income under § 751(a) § 751(a) Assets: include “unrealized receivables” and “inventory items” as defined in § 751(c), (d) o Unrealized receivables generally include rights to payments for goods & services which have not previously been included in come provided that the sales proceeds would be treated as received from the sale or exchange or non-capital assets [in the case of goods] o Unrealized receivables include certain short-term debt obligations and an array of assets to the extent that their disposition at FMV would trigger recapture of cost recovery and certain other prior deductions 37 Since the recapture portion would be characterized as ordinary income on a sale or other disposition of these assets, they are appropriately included in § 751 Inventory Items: broadly defined to include non-capital assets in § 1221(a)(1) and any property which would not be considered a capital asset or § 1231 asset o Result: an asset may constitute both an unrealized receivable and an inventory item o If an asset falls within both § 751(a)(1) and (a)(2) then taxed only once If part of the amount realized is attributable to § 751 assets then tax consequences of the sale must be bifurcated by determining the amount of income or loss from § 751 property that would have bene allocated to the selling partner if the partnership had sold all of its property in a fully taxable transaction for cash in an amount equal to the FMV of such property o The selling partner’s share of income or loss from § 751 property takes into account special allocations and allocations required under § 704(c) o The gain or loss attributable to § 751 property will be ordinary gain or loss Final Step: determine the difference between the selling partner’s total gain or loss and the ordinary gain or loss determined under § 751(a) o That difference is the selling partner’s § 741 capital gain or loss on the sale of the partnership interest it is possible that the seller has a gain under § 751(a) and a loss under § 741 o The long or short-term character of the § 741 capital gain or loss depends on the partner’s holding period for the partnership interest (not partnership’s holding period for its assets) Anti-Avoidance Rule for Tiered Partnerships Can’t use a multi-tiered partnerships to avoid § 751(a) gain by adopting an aggregate theory in § 751(f) § 751(f): provides that in determining a partnership’s § 751 assets, the partnership shall be treated as owning its proportionate share of the property of any other partnership in which it is a partner o Rule applies regardless of number of tiers between selling partner and ordinary income property Glazer v. Commissioner – illustrates that the reach of § 751 is understood by, including the courts, to extend to ordinary income from partnership assets, no matter how those assets are characterized Issue: whether the gain to the petitioners arising from the sale of their interests in a partnership is to be treated as ordinary income or capital gain Holding: court found that the entire value of all the partnership interests were attributable to the house sale contracts Ledoux v. Commissioner – illustrates key points about (a) finding portion of amount realized attributable to § 751 property – namely allocation by agreement is possible only if there is non-§751 property in the partnership’s hands; (b) court may disregard what purports to be § 751 agreement; and (c) unrealized receivables include things that look like goodwill or leases or franchises in some setting Issue: whether any portion of the amount received by petitioner pursuant to an agreement for the sale of a partnership interest was attributable to an unrealized receivable of the partnership and thus required to be characterized as ordinary income under § 751 Capital Gains Look-Through Rule Regulations apply a look-through rule for sales or exchanges of interests in a partnership, an S Corporation, or a trust o Result: a partner who sells a partnership interest held for more than 1 year may recognize § 751 ordinary income and up to 3 different types of long-term capital gains: (1) collectibles gain (2) unrecaptured § 1250 gain (3) residual capital gain § 1(h)(5)(B): any gain from the sale of a partnership interest held for more than 1 year that is attributable to unrealized appreciation in the value of the partnership’s collectibles is treated as gain from the sale or exchange of a collectible o Regulations provide that the selling partner’s share of collectibles gain is the amount of the net collectibles gain (but not net loss) that would be allocated to that partner if the partnership transferred all of its collectibles for cash equal to the FMV of such assets in a fully taxable transaction immediately before the transfer of the partnership interest Same approach used to determine a selling partner’s share of unrecaptured § 1250 capital gain o Selling partner’s residual capital gain is the amount of the § 741 long-term capital gain or loss minus the partner’s shares of collectibles and unrecaptured § 1250 gains 38 o Thus approach of the look-through rule for capital gains is similar to the method used to identify the amount of a selling partner’s § 751(a) gain and § 741 gain Collateral Issues – Holding Period A partner may have a divided holding period in a partnership interest Example: assume a partner has held his partnership interest more than 1 year and the partner makes a cash contribution to the partnership. For the next year the partner will have a short-term holding period in the portion of the partnership interest attributable to the cash contribution o Thus if the partner sells all or a part of the partnership interest within 1 year of the cash contribution, any capital gain or loss has to be divided between long-term and short-term capital gain or loss in the same proportion as the long-term and short-term holding periods for the partnership interest Regulations integrate the holding period rule and the look-through rule for capital gains by first identifying the portions of the selling partner’s § 741 capital gain or loss that are long-term or short-term capital gain or loss o Then a proportionate amount of any collectibles or unrecaptured § 1250 gain is deemed to be part of the longterm capital gain or loss Regulations contain a few special rules for determining the holding period of a partner selling a partnership interest o One allows a partner’s cash contributions within 1 year prior to the sale or exchange to be offset by cash distributions during that period o Another rule disregards contributions within 1 year before the sale or exchange of unrealized receivables and inventory items if the partner recognizes ordinary income on those assets in a fully taxable transactions Revenue Ruling 89-108 – if property of a partnership includes inventory, to what extent may the installment method of reporting income under § 453 be used to report income on the sale of an interest in that partnership? Holding: under § 453, the income from the sale of a partnership interest may not be reported under the installment method to the extent it represents income attributable to the partnership’s inventory which would not be eligible for the installment sale treatment if sold directly Notes: The relationship of the installment sales provisions of § 453 to the sale of a partnership interest raises a number of questions o Whether an entity or aggregate approach, or blend of the two, should be adopted in determining whether deferral of gain is permissible Only statutory answer found in § 453(i)(2) – denies installment sale treatment to § 1245 and § 1250 recapture income “Recapture Income” definition makes it clear that § 751 gain on the sale of a partnership interest that is attributable to depreciation recapture must be recognized in the year of sale Consequences to the Buying Partner § 742: provides that a partner takes a cost basis for a partnership interest acquired by purchase o Cost includes the partner’s share of any partnership liabilities o Involves only the partner’s outside basis § 743(a): generally provides that the basis of partnership property shall not be adjusted as the result of a transfer of an interest in a partnership by sale or exchange o Example: Buyer purchases 1/3 interest in a cash method, calendar year service partnership which has its primary asset of $90,000 of accounts receivable with a 0 basis and $30,000 of other assets. Buyer then pays $40,000 for the interest and thus has an outside basis of $40,000. In effect, he has paid $30,000 for his 1/3 interest in the receivable and $10,000 for his 1/3 interest in other assets. On January 1 of following year all the receivables are collected by the partnership. Result – the partnership has $90,000 of ordinary income when the receivables are collected and each partner (including buyer) is taxed on their 1/3 distributes share or $30,000 of ordinary income To avoid taxing the buying partner on the appreciation of their proportionate share of partnership assets prior to the date of purchase partnership may elect under § 754 to adjust the basis of its assets under section 743(a) § 754 election – also may require a downward adjustment to the bases of partnership assets which have declined in value as of the time of the sale or exchange of the partnership interest 39 § 743(b)(2): requires that the partnership must decrease the adjusted bases of its assets with respect to any partner if that partner’s proportionate share of the partnership’s total inside basis in its assets exceeds the buying partner’s outside basis o The amount of the downward adjustment is the excess of that partner’s proportionate share of the partnership’s inside bases over the partner’s outside basis in their partnership interest o The buying partner’s distributive share thus will not reflect any increase or decline in value of partnership assets occurring prior to their purchase of an interest in the firm § 743(d): a partnership has a substantial built-in loss with respect to a transfer of an interest in the partnership if: o (A) the partnership’s adjusted basis in the partnership property exceeds by more than $250,000 of the FMV of such property; or o (B) the transferee partner would be allocated a loss of more than $250,000 if the partnership assets were sold for cash equal to their FMV immediately after such transfer Concerns a foreseeable loss o The Secretary shall prescribe such regulations to carry out the purposes above, including regulations aggregating related partnerships and disregarding property acquired by the partnership in an attempt to avoid such purposes Mandatory Inside Basis Adjustment for Partnership with Substantial Built-In Loss Section 754 election may provide a buying partner with a beneficial tax avoidance strategy o If partnership’s assets have appreciated and have built-in gains then election will eliminate the potentially disadvantageous distortions in the timing and characterization of partnership income o But if partnership’s assets have depreciated in value and would produce losses then a savvy buyer would prefer the partnership not to make the election in order to reap the tax benefit of deducting those losses Section 743 requires an adjustment to the basis of partnership property on the transfer of a partnership interest if the partnership has a substantial built-in loss immediately after the transfer o Partnership has a substantial built-in loss if the adjusted basis in its property exceeds the property’s FMV by more than $250,000 Even if aggregate value of partnership property has not declined this much substantial built-in loss under § 743 also exists if the sale of all partnership property in a fully taxable transaction would cause the transferee partner to be allocated loss in excess of $250,000 o The mandatory basis step-down rule under § 743 cannot be avoided through special allocations of significant loss items to the transferee partner o Service has the authority to aggregate related partnerships or disregard acquisitions of property designed to avoid the limit Special rule for an electing investment partnership (i.e., venture capital & buyout funds formed to raise capital from investors pursuant to a private offering and to make and hold investments for capital appreciation) these types of investment partnerships incur administrative difficulties if they were required to make partnership-level basis adjustments when their interests were transferred o An electing investment partnership is allowed to use a partner-level loss limitation instead of making basis adjustments to its assets Under Limit – a transferee partner’s share of losses (without regard to gains) from the sale or exchange of partnership property is not allowed except to the extent it is established that such losses exceed any loss recognized by the transferor on the transfer of the partnership interest Calculating the Section 743(b) Adjustment Purpose of § 743(b) adjustment – designed to give new partners a special inside basis in their share of partnership assets to place them in same position as if they had purchased those assets directly Mechanics of Computing & Allocating Adjustment: o 1.) new partner must first determine the amount of the overall basis adjustment (the difference between the partner’s outside basis or the partner’s cost plus his share of partnership liabilities) and his share of the partnership’s inside basis in its assets o 2.) partner then shuttled to § 755 (multi-step process for allocating the adjustment among the various partnership assets) The amount of the overall § 743(b) adjustment normally should be the difference between the new partner’s outside basis and his proportionate share of the partnership’s inside basis 40 Regulations provide complex formula for determining the transferee partner’s share of the partnership’s inside basis of its assets o A transferee partner’s share of the adjusted basis to the partnership of its property is equal to the sum of the transferee’s interest in the partnership’s previously taxed capital + transferee’s share of partnership liabilities o Transferee’s interest in the partnership’s previously taxed capital is determined by considering a hypothetical disposition by the partnership of all of its assets in a fully taxable transaction for cash equal to the FMV of the assets Transferee’s interest in the partnership’s previously taxed capital generally is equal to the cash the transferee would receive on a liquidation following the hypothetical transaction and increased by the amount of tax loss and decreased by the amount of tax gain that would be allocated to the transferee from the transaction If partnership has a § 754 election in effect § 743(b) adjustment is equal to difference between buyer’s outside basis and buyer’s share of the adjusted basis to the partnership of its property If partner contributes appreciated or depreciated property to the partnership and later transfers his partnership interest then built-in gain or loss is allocated to the transferee partner as it would have been allocated to the transferor partner Allocation of the Adjustment under § 755 Once the total § 743(b) adjustment is determined that adjustment must be allocated among the partnership’s assets under § 755 § 755: provides that the partnership must first determine the value of its assets o Then partnership’s assets are first divided into 2 classes: (1) capital assets and § 1231(b) property (capital gain property); and (2) any other property (ordinary income property o The basis adjustment is then allocated between those classes of property and within each class based on the allocations of income, gain, or loss that the transferee partner would receive if all of the partnership’s assets were disposed of in a fully taxable transaction for FMV Regulations permit an increase to be made to 1 class or 1 property while a decrease is made to the other class or a different property within the class o (1) basis first allocated to the class of ordinary income property o (2) then to the class of capital gain property A decrease in basis allocated to capital gain property may not produce a negative basis in any asset o Thus if entire decrease allocated to capital gain property reduces the basis of those assets to 0 then any excess reduces the basis of the class of ordinary income property The adjustment to each item of property within a class of property is designed to produce the equivalent of a cost basis for the transferee partner via the § 743(b) adjustment Complication: valuation of partnership assets that is required in the process of allocating a basis adjustment under § 755 o If assets of partnership constitute a trade or business then regulations provide that the valuation generally is done in accordance with rules under § 1060 for applicable asset acquisitions o (1) the value of the partnership’s assets other than § 197 intangibles is first determined under an “all facts and circumstances” test o (2) partnership then determines the gross value of all its assets – generally with reference to the basis of the transferee partner If partnership’s gross value is greater than aggregate value of the partnership property other than § 197 intangibles – the excess is: o (1) first allocated to § 197 intangibles other than goodwill and going concern value; and o (2) then to goodwill and going concern value Effect of Section 743(b) Adjustment A basis adjustment under § 743(b) is personal to the transferee partner o No adjustment is made to the common basis of the partnership property and § 743(b) adjustment has no effect on the partnership’s computation of any § 703 item o (1) partnership first computes all partnership items at the partnership level and each partner is allocated those items under § 704 o (2) partnership then adjusts the transferee’s distributive share of partnership income, gain, loss or deduction to reflect the § 743(b) basis adjustment These basis adjustments do not affect the transferee’s capital account 41 If depreciable or amortizable property acquires an upward basis adjustment under § 743(b) – property generally is treated as two separate assets for depreciation or amortization purposes o First asset retains the original depreciation remaining in the depreciable or amortizable property prior to the adjustment The amount of the adjustment is treated as being attributable to a newly purchased asset for depreciation or amortization purposes Relationship to Section 704(c) Goal of Regulations – to coordinate § 704(c) and § 743 o Generally provides that a transferee’s income, gain, or loss from the sale or exchange of a partnership asset in which the transferee has a basis adjustment is equal to the transferee’s share of the partnership’s gain or loss from the sale of the asset minus (–) amount of any positive section 743(b) basis adjustment or plus (+) the amount of any negative section 743(b) adjustment § 704(c) may also come into play in connection with the transfer of a partnership interest § 704(c)(1)(C): in the case of property that was contributed to a partnership with a built-in loss – no other partner may be allocated that pre-contribution loss o Thus purchaser of a partnership interest may not obtain the benefit of a built-in loss contributed by the seller of the interest Chapter 10 – Operating Distributions Introduction Under aggregate approach to partnership taxation – a partner is taxed on his distributive share of partnership income whether or not it is distributed o Partner’s outside basis includes their share of those previously taxed profits in addition to their capital contribution to the firm To the extent of that outside basis – a partner should not be required to recognize gain on a current distributions of cash o But if a cash distribution exceeds the partner’s outside basis they have received something more than their investment in the partnership and share of previously taxed income Thus should be required to recognize gain to the extent of the excess If a distribution consists of property other than cash a transferred basis mechanism can be used to preserve any unrecognized gain for reckoning at a later time Another Goal – prevent taxpayers from converting ordinary income into capital gain o To forestall that type of potential tax avoidance in the partnership distribution setting it is necessary to preserve the ordinary income character of certain assets in the hands of the distribute partner § 735: implements this policy for distributed property in a manner mirroring the treatment of contributed property under § 724 In Operating Distributions – the failure to adjust the basis of partnership assets after the sale of a partnership interest may distort the tax treatment for all the remaining partners Issue: taxpayers attempted to exploit the rule to achieve favorable results indirectly that could not be reached in a more straightforward manner § 704(c)(1)(B) and § 737: override the general nonrecognition rules in order to combat the mixing bowl transaction – a strategy where a partner transfers appreciated property to a partnership and within a 7 year period the partnership either distributes the contributed property to another partner or distributes other property to the contributing partner o Both cases – the agenda is to shift or defer the recognition of the contributing partner’s pre-contribution gain Purpose of § 751(b): to curb the potential shifting of the character of income that may result from distributions that alter the partners’ interests in partnership property o Also overrides the general nonrecognition rules Because an operating distribution results in the withdrawal of part of a partner’s equity in the partnership – the value of that partner’s interest is reduced o If an operating distribution is not in accordance with the partners’ respective interests in the partnership – it will alter their future economic relationship o Therefore the partnership allocation regulations require that the partner’s capital account must be decreased by the amount of money and the FMV of any property distributed to the partner o If the partnership distributes property with a FMV that differs from the book value then other adjustments also may be necessary to reflect accurately the respective economic interests of the partners after the distribution 42 Consequences to Distributee Partner – Nonrecognition Rules on Distribution § 731(a): generally a partner will recognize neither gain nor loss on a current distribution of cash § 733: the partner’s outside basis will be reduced (not below 0) by the amount of the distribution o The partner’s outside basis represents his original investment in the partnership and will be adjusted upwards/downwards for the partner’s share of profits/losses o Impact – to the extent of the partner’s outside basis – an operating distribution represents earnings previously taxed to the partner or a return of capital appropriate to confer nonrecognition of gain to the distribute partner and to require a corresponding downward adjustment to basis o On the Loss Side – an operating distribution does not represent a closed transaction so it is a premature occasion for determining whether a loss has been sustained by the distribute partner If cash distributions exceed a partner’s outside basis partner is receiving something more than previously taxed income or a return of capital § 731(a)(1): the excess of cash received over the distribute partner’s outside basis is treated as gain from the sale or exchange of a partnership interest (usually a capital gain unless § 751 applies) o Avoids the tax taboo of a negative basis and ensures partner’s gain will not escape tax Rules embrace (1) actual cash distributions and (2) transactions that are treated as cash distributions o Example: any reduction of a partner’s share of partnership liabilities is treated as a distribution of cash to the partner Such reductions occur as partnership liabilities are paid off and on other types of transactions (i.e., abandonment of property, reconveyance or foreclosure, a condemnation or another partners assumption of a share of liability on property) Operating distribution rules do not apply if cash received from a partnership is not in fact a distribution o Example: if the cash is received as a loan then transaction governed by § 707(a)(1) but a discharge of the obligation to repay the loan is treated as a distribution of cash o Example: if the cash is an advance or draw against a partner’s distributive share of income then same as a loan and not treated as a distribution until the last day of the partner’s year Distributions of Property The partnership and the distribute partner do not recognize gain/loss on an operating distribution of property unless § 704(c)(1)(B), § 737, or § 751(b) applies or the distribution is of marketable securities o Rationale – a distribution of property (unlike a cash distribution) provides an opportunity for the deferral of gain o Any gain inherent in the distributed property is preserved by assigning the distribute a transferred basis under § 732(a) o Any gain inherent in the partner’s interest in the partnership is preserved by § 733 – reduces the partner’s outside basis by his transferred basis in the distributed property This ensures that the sum of the partner’s basis in the distributed property and their outside basis remains constant But if partnership’s basis in the distributed assets exceeds the partner’s outside basis—less any cash distributed in the same transaction—the partner could not maintain his total basis unless he emerged from the distribution with a negative outside basis § 732(a): if the partner’s share of the inside basis in the distributed property exceeds his outside basis—reduced by any cash distributed in the same transaction—the transferred basis is limited to that outside basis which is then reduced to 0 under § 733 Allocation of Basis to Distributed Properties If the special basis limitation rule in § 732(a)(2) applies and several assets are distributed basis to be allocated must be allocated among the distributed properties under § 732(c) § 732(c): multi-step process o (1) first – any distributed unrealized receivables and inventory items are tentatively assigned a basis equal to the partnership’s basis in each of those assets If sum of the partnership’s bases in the unrealized receivables and inventory items exceeds the basis in those properties must be decreased by the amount of the excess Reduction achieved by first allocating basis decreases among the properties with built-in loss in proportion to the amounts of such loss and only to the extent of each property’s built-in loss Also additional decreases are allocated (if needed) in proportion to the remaining adjusted basis of the unrealized receivables and inventory items 43 (2) if basis to be allocated exceeds partnership’s basis in the distributed unrealized receivables and inventory items then each other distributed property is tentatively assigned a basis equal to the partnership’s basis in that asset Partnership’s bases in those properties then must be reduced so that the sum of their basis is equal to the remaining basis to be allocated Allocation method designed to preserve partnership’s basis for unrealized receivables & inventory items o Thus ensures the partner will recognize at least the same amount of gain upon the disposition of those assets as the partnership would have recognized had they been sold at the partnership level o Section 732(d) § 732(d): exception to the foregoing basis rules – permits certain distribute partners to elect to treat any distributed properties as though the partnership had a § 754 election in effect when the partner purchased or inherited his interest o Result – assets distributed to the new partner are eligible for a § 743(b) adjustment and a special inside basis then may be used to determine the partner’s basis in the distributed assets under sections 732(a) and (c) o Only applies for purposes of determining the bases of distributed assets and does not apply for purposes of partnership depreciation, depletion, or gain/loss on disposition Election only available if the distribution is made within 2 years of the distribute partner’s acquisition of their interest by purchase, exchange or inheritance and the partnership had no § 754 election in effect when interest was acquired o § 732(d) election is partner’s last chance to avoid some of the distortions that could result from the partnership’s failure to make a § 754 election § 732 adjustment can be required if the FMV of the partnership property/money at the time the partner acquired his interest exceeds 110% of its adjusted basis to the partnership o Limited to cases where lack of a § 732(d) election would cause a shift in basis from non-depreciable property Distributions of Marketable Securities § 732(c): generally treats marketable securities as money for purposes of both § 731(a)(1) and § 737 to the extent of the FMV of the securities on date of the distribution Marketable Securities – financial instruments like stocks, bonds, options, and foreign currencies which are actively traded—including interests in mutual funds and instruments that are convertible into money or marketable securities Any gain recognized by the distribute partner normally will be capital gain o If a partner recognizes gain on the distribution of a marketable security then partner’s basis in the security is partner’s basis under § 732 increased by the amount of gain recognized by the partner Limitation permits a distribute partner to reduce the amount of a distribution of marketable securities by the excess of: o (1) partner’s distributive share of the net fain if all the partnership’s marketable securities had been sold immediately before the distribution for their FMV, over o (2) partner’s distributive share of the net gain attributable to the partnership’s marketable securities immediately after the distribution o Means partner may reduce the cash deemed received by the amount of the decrease in the partner’s share of the net unrealized appreciation in the partnership’s marketable securities Other specialized exceptions: o 1.) Distributions of marketable securities from an investment partnership to a partner who did not contribute any money or property to the partnership (other than money or securities) will not be treated as money Investment Partnership – partnership (like a venture capital fund) that has never engaged in a trade or business and the assets of which consist substantially of stocks, bonds, cash, currencies, and other investment-type properties o 2.) Distributions of a security to a partner who contributed that security to the partnership Both Exceptions – the prospect of a distribution of marketable securities being used to avoid recognition of gain under § 731 is minimized Treatment of Debt Relief and Assumption on Distributions Distributions can alter a partner’s share of partnership liabilities for purposes of § 752 o Example: a reduction in a partner’s share of partnership liabilities will be treated as a cash distribution pursuant to § 752(b) – could trigger the recognition of gain under § 731(a)(1) 44 Revenue Ruling 94-4 – if a deemed distribution of money under § 752(b) occurs as a result of a decrease in a partner’s share of the liabilities of a partnership, is the deemed distribution taken into account at the time of the distribution or at the end of the partnership taxable year? A deemed distribution of money under § 752(b) resulting from a decrease in a partner’s share of the liabilities of a partnership is treated as an advance or drawing of money under § 1.731-1(a)(1)(ii) to the extent of the partner’s distributive share of income for the partnership taxable year A deemed distribution of money resulting from a cancellation of debt may qualify for advance or drawing treatment under this ruling and Rev. Ruling 92-97 Revenue Ruling 79-205 – when a partnership makes a nonliquidating distribution of property, (1) is a partner permitted to offset the increase in the partner’s liabilities against the decrease in the partner’s liabilities in determining the extent of recognition of gain or loss, and (2) is partnership basis adjusted before or after the property distribution? Generally partnership distributions are taxable under § 731(a)(1) only to the extent that the amount of money distributed exceeds the distribute partner’s basis for the partner’s partnership interest In a distribution of encumbered property, the resulting liability adjustments will be treated as occurring simultaneously (not occurring in a particular order) o Therefore, the amount of money considered distributed to a partner for purposes of § 731(a)(1) is the amount by which the decrease in the partner’s share of the liabilities of the partnership under § 752(b) exceeds the increase in the partner’s individual liabilities under § 752(a) o The amount of money considered contributed by a partner under § 722 is the amount by which the increase in the partner’s individual liabilities under § 752(a) exceeds the decrease in the partner’s share of the liabilities of the partnership under § 752(b) Consequences on Subsequent Sales of Distributed Property The characterization of gain or loss on the disposition of property is generally determined by the character of the asset in the hands of the taxpayer who disposes of the property o But property acquired via a nonrecognition transaction is often subject to special rules that govern its basis, holding period, and the tax character of the asset o Same with property received by a partner in a distribution from a partnership § 735: to prevent the conversion of partnership ordinary income into partner capital gain additional rules are provided to govern the character of gain or loss on the disposition of ordinary income property received by the partner in a distribution o Similar to § 724 – provides the tacking of partnership’s holding period in the distributed property Characterization § 735(a): gains or losses recognized by a distribute partner on the disposition of unrealized receivables received in a distribution are treated as ordinary income or loss and gains or losses on the sale or exchange of distributed inventory items suffer a similar character taint if they are sold or exchanged by the partner within 5 years from the date of their distribution Unrealized Receivables – the character taint remains with the assets as long as they are held by the distributee partner Inventory – taint is not permanent a patient partner who holds these items as capital assets may avoid ordinary income characterization on the sale or exchange of the inventory by delaying any disposition until the expiration of 5 years from the date of distribution Both Unrealized Receivable & Inventory – more stringent rules are applicable and the § 735 taint cannot be removed in a nonrecognition transaction or a series of such transactions o Taint carries over to the exchanged basis property received in the transaction (except in the case of C Corporation stock received in a § 351 corporate formation) The § 735 taint does not apply to recapture property o But the recapture gain which the partnership would have recognized on a sale of the property carries over to the distributee partner that recognizes ordinary income on a subsequent sale or exchange accomplished via definitions of “recomputed basis” and “additional depreciation” in the applicable recapture provisions Tacking Holding Periods § 735(b): allows the distributee partner to tack the partnership’s holding period with respect to property with a transferred basis from the partnership and any distribute property which has some specially determined basis Tacking is not permitted in measuring the 5 year taint applicable to distributed “inventory items” 45 Consequences to the Distributing Partnership § 735(b): nonrecognition rule – provides that no gain or loss is recognized by a partnership on the distribution of money or property to a partner § 734(a): impact on inside basis – sets forth general rule that distributions of property do not affect the inside basis of property retained by the partnership o No adjustment rule applies even though the distributee partner recognizes gain on the distribution or is required to take a basis in the distributed property which differs from its basis to the partnership o These situations – the no adjustment rule may create distortions resembling those which occur on the sale of a partnership interest Appreciated Partnership Assets – a § 754 election allows the partnership to make a basis adjustment under § 743(b) and provide relief for the buying partner Operating & Liquidating Distributions – a § 754 election triggers a similar inside basis adjustment under § 743(b) which benefits all the remaining partners and corrects the imbalance o § 743 may require a downward adjustment in the partnership’s basis in its assets in order to prevent inappropriate deferral of taxes by partners following a liquidating distribution § 743(b): determines the overall adjustment and the action then shifts to § 755 § 755: governs the allocation of the adjustment among the partnership assets o 1.) first value the partnership’s assets o 2.) then the assets of the partnership are divided into two classes: (a) capital gain property [capital assets and § 1231(b) property]; and (b) other property § 743(b) adjustments benefit all continuing partners unless a special allocation to the contrary is made o Permits an adjustment when the basis of the distributed property is limited under § 732(a)(2) to the distributee partner’s outside basis o Permits the partnership to increase its bases in the remaining assets by an amount equal to the difference between the partnership’s basis in the distributed property and the basis taken by the distributee partner in that property The adjustment is made to property in the same class as the distributed property whose basis was changed as a result of the distribution o If there is an increase in basis allocated within a class of property first allocated to properties with unrealized appreciation in proportion to their appreciation Any remaining increase is allocated in proportion to the FMV of the properties o A decrease basis allocated within a class of property is first allocated to properties based upon their respective amounts of unrealized depreciation before the decrease and then in proportion to the adjusted bases of the property [after adjustment for unrealized depreciation] Basis of the property can never be below 0 If a partnership does not have property of the character to be adjusted or if the basis of all property of like character has been reduced to 0 adjustment is held in abeyance until the partnership acquires property in the class to be adjusted Under Cost Recovery of § 168 – if basis of a partnership’s recovery property is increased under § 734 as a result of a distribution then the increased portion of the basis is treated as newly purchased recovery property placed in service when the distribution occurs o Thus any applicable recovery period and method may be used with respect to the increased portion of the basis o No change made in determining the cost recovery allowance for the portion of the basis for which there is no increase If a distribution triggers a decrease in the basis of a partnership’s cost recovery property then the decrease is accounted for over the property’s remaining recovery period (beginning with the recovery period in which the basis is decreased) Impact on Capital Accounts Tax treatment of partnership allocations an agreed allocation is not respected unless the partnership agreement requires capital accounts to be maintained throughout the life of the partnership o Nonliquidating distributions are an example of a partnership transaction that necessitate capital account adjustments Because a distribution reduces the distributee partner’s equity in the partnership and because the function of a capital account is to measure a partner’s interest in the firm at any given point – a partner’s capital account must be reduced by an money distributed to the partner and by the FMV of any distributed property 46 But partnership does not recognize gain or loss on distributions of property Thus the reduction of a distributee partner’s capital account by the FMV of the distributed property would distort the partnership’s financial balance sheet unless an additional adjustment is made to reflect the unrealized appreciation or decline in value of the property Regulations fix problem by providing that the capital accounts of all partners must be adjusted by their respective shares of the gain or loss that the partnership would have recognized if it had sold the distributed property for its FMV on the date of distribution If a distribution is more than a de minimis amount and is in exchange for any portion of a partners’ interest in the partnership then the partnership may elect to restate on its books all remaining assets at their current FMV and restate the partners’ capital accounts o o Mixing Bowl Transactions § 704(c)(1)(B) and § 737: both aimed at mixing bowl transactions and is an income-shifting strategy were a partner transfers appreciated property to a partnership and the partnership later either distributes the contributed property to another partner or distributes substitute property to the contributing partner o Tax Planning Goal – shift or defer recognition of contributing partner’s precontribution gain by exploiting the nonrecognition rules that apply to contributions to and distributions by partnership Distributions of Contributed Property to Another Partner § 704(c)(1)(A): a partner contributing property with a built-in gain or loss to a partnership is generally allocated that gain or loss when the partnership subsequently disposes of the property § 704(c): limited to partnership sales of contributed property thus a contributing partner could avoid an allocation of precontribution gain if the partnership distributed the contributed property to another partner rather than selling it o Since partnership usually does not recognize gain or loss on distribution of property – the contributing partner was not taxed on the distribution and any built-in gain was shifted to the distributee partner through a transferred basis mechanism § 704(c)(1)(B): precludes this type of mixing bowl transaction by providing that if property contributed by one partner is distributed to another partner within 7 years of its contribution to the partnership then the contributing partner (or their successor) is treated as recognizing its FMV at time of distribution o Character of gain/loss is the same as if the partnership had sold the contributed property to the distributee partner o The contributing partner’s outside basis is increased/decreased by the amount of gain/loss recognized as a result of the distribution To avoid double recognition of that gain/loss partnership’s inside basis in the property is increased or decreased prior to the distribution to reflect the gain/loss recognized by the contributing partner 2 Exceptions to § 704(c)(1)(B): o (1) it does not apply if the contributed property is distributed back to the contributing partner or their successor No abuse here because the precontribution gain continues to lurk in the contributing partner’s transferred basis in the distributed property o (2) § 704(c)(2) provides relief to a contributing partner who receives a distribution of like-kind property within 180 days after the contributed property is distributed to another partner The contributing partner is allowed to reduce the amount of gain or loss recognized under § 704(c)(1) (B) by the amount of built-in gain or loss in the distributed like-kind property o Policy: the contributing partner should not have to recognize gain under § 704(c)(1)(B) if they would have qualified for nonrecognition if the transaction occurred outside the partnership Anti-Abuse Rule under § 704(c)(1)(B): statute and regulations must be applied in a manner consistent with the purpose of the section and the Service can recast a transaction for federal tax purposes to achieve appropriate tax results Distributions of Other Property to the Contributing Partner Another issue was that a transaction where a partner contributes appreciated property to a partnership and later receives a distribution of other property while the partnership retains the contributed property o If the normal contribution and distribution rules applied – contributing partner would be able to exchange the contributed property in a nonrecognition transaction where a similar swap outside the partnership would not have qualified for nonrecognition 47 § 737: prevents this type of mixing bowl transaction by requiring a contributing partner to recognize gain if they contribute appreciated property to a partnership and within 7 years of the contribution receives property other than money as a distribution from the partnership Amount of gain is the lesser of: o 1.) the FMV of the distributed property (other than money) less the partner’s outside basis immediately before the distribution (reduced by the amount of money received in the distribution but not below 0); or o 2.) the “net precontribution gain” of the partner – the net gain that would have been recognized by the distributee partner under § 704(c)(1)(B) if all of the property contributed by that partner within 7 years of the current distribution had been distributed to another partner at the time of the distribution to the contributing partner The character of the gain is determined by reference to the contributed property § 704(c)(1)(B): appropriate concurrent basis adjustments are triggered when § 737 applies o The contributing (now distributee) partner may increase their outside basis by the amount of gain recognized under § 737 o Adjustment is made after measurement of the amount of § 737(a) gain but before the distribution of the property o Partnership increases its inside basis in the contributed property by the amount of any § 737 gain The § 737(a) general rule is subject to 2 statutory exceptions: o 1.) if any portion of the distributed property consists of property that was contributed by the distributee partner then property is not taken into account in determining gain under § 737(a)(1) or measuring the net precontribution gain under § 737(b) o 2.) § 737 does not apply to the extent that § 751(b) applies Anti-Abuse Rule under § 737: requires the rules of § 737 and the regulations to be applied in a manner consistent with the purpose of the section and Service is empower to recast a transaction for federal tax purposes as appropriate to achieve tax results consistent with the purpose of § 737 Challenge with § 737: its relationship with parts of Subchapter K o Both § 704(c)(1)(B) and § 737 can apply to different contributing partners when there is a single distribution of contributed property o If either § 707(a)(2)(B) or § 704(c)(2) applies to a transaction also covered by § 737 then those sections take precedence o Also § 737 does not apply to the extent that § 751(b) overrides it Distributions that Alter the Partners’ Interests in Ordinary Income Property Issue: taxpayers searched for opportunities to shift ordinary income into a lower bracket or convert ordinary income into capital gain § 751(b): overrides the nonrecognition and substituted basis rules of § 731 and § 732 – occurs when a distribution has the effect of altering the partners’ interests in § 751 property o Applies to both operating & liquidating distributions o Inventory – treated as § 751 property only if they have appreciated substantially in value Substantially Appreciated Inventory Items Inventory items are not treated as § 751 property for purposes of § 751(b) unless they are substantially appreciated i.e., unless their aggregate FMV exceeds 120% of the adjusted basis of the inventory items in the hands of the partnership o Purpose of Test: limit the application of § 751(b) to cases where there is a significant potential conversion of ordinary income to capital gain thus in measuring appreciation any inventory acquired for the principal purpose of avoiding the 120% test is excluded from consideration Definition of inventory includes § 1221(a)(1) “dealer” property and any property which upon sale by the partnership or the distributee partner would not be considered a capital asset or a § 1231 asset o Definition Result – an asset may constitute both an unrealized receivable & an inventory item and inclusion of receivables in inventory category is significant because they are then combined with other inventory items in determining whether those items are substantially appreciated If the aggregate inventory items are substantially appreciated then they are all treated as § 751 assets If asset falls within both § 751(b)(1)(A)(i) and (b)(1)(A)(ii) then it will be taxed only once 48 But if inventory items are not substantially appreciated then only the unrealized receivables are treated as § 751 assets under § 751(b)(1)(A) Anti-Stuffing Rule – any inventory acquired for a principal purpose of avoiding the 120% test is excluded in measuring appreciation o Operation of Section 751(b) If a current or liquidating distribution to a partner has the effect of altering the interests of the partners in § 751 property then § 751(b) comes into play to make things right Distributions of both § 751 and § 741 property present challenge because it usually is more difficult to determine the extent to which a distribution is disproportionate if it is an operating distribution (rather than a liquidating distribution) o Determination is made by comparing the distributee partner’s interest in either the § 741 or § 751 assets both before and after the distribution Policy Considerations Purpose of § 751(b) – to prevent the conversion of ordinary income into capital gains and the shifting of the character of gain or loss among partners o The section constructs hypothetical exchanges of capital and noncapital assets where no exchanges actually occurred § 751(b) has no defenders and detractors break down into 2 categories o 1.) those who favor outright repeal o 2.) those who favor a different approach to achieve the section’s goals Main Problem of § 751(b) – they focus on shifts in the value of § 751 assets rather than shifts in ordinary income potential among the partners o Thus § 751(b) is triggered when the partners’ shares of value in § 751 assets change even though there is no shift in ordinary income among the partners Also § 751(b) will not apply when there are shifts in ordinary income among the partners if there are no changes in each partner’s share of the values of § 751 property Modified Approach Under Proposed Regulations In 2014 – Service issued proposed regulations under § 751(b) that altered the determination of when the statute is implicated o If § 751(b) applies parties provided more flexibility in determining the tax consequences that flow from the mandatory ordinary income recognition to one or more of the partners Most significant change – test for determining when § 751(b) applies compares each partner’s share of unrealized income or loss in § 751(b) property before and after the distribution at issue o Now utilizes gross values in determining whether a partner’s interest in § 751(b) property has been altered through a distribution Proposed regulations also employ a hypothetical sale approach to determine if a distribution alters the partners’ interests in § 751(b) property o They apply the rules of § 704(c) to any contributed property held by the partnership o Partner’s pre-distribution interest in § 751(b) property is determined by calculating the amount of ordinary income or loss that would be allocated to the partner if the partnership sold all of its assets for FMV taking into account any remedial allocations of § 704(c) gain and special basis adjustments under § 743 Amount represents the partner’s pre-distribution “net § 751 unrealized gain or loss” A partner’s post-distribution “net § 751 unrealized gain or loss’ is determined in the same way but the post-distribution figure includes any ordinary income or loss that would be realized by the distribute partner upon the hypothetical sale of the distributed property Section 751(b) Amount If the net § 751 unrealized gain or loss for a partner before the distribution differs from that following the distribution then the difference gives rise to a § 751(b) amount o § 751(b) Amount – arises when a partner’s net § 751 unrealized gain decreases or a net § 751 loss increases as a result of the distribution or combination of the two A § 751(b) amount for a partner triggers the application of the statute will require the affected partner to recognize ordinary income equal to the § 751(b) amount 49 Collateral Tax Consequences Hallmark of proposed regulations under § 751(b) – flexibility afforded to the partnership in determining the tax consequences resulting from the application of the statute o Current Regulation: change in partner’s interest in § 751(b) property requires a hypothetical distribution of property to the partner followed by a sale back to partnership can accelerate the recognition of capital gain for partners whose interests in § 751(b) property have not changed Hypothetical sale approach remains available under the proposed regulations but not required o Proposed regulations only state that the partnership must choose a reasonable approach that is consistent with the purpose of § 751(b) and once an approach is selected then the partnership must continue to apply that approach in all circumstances implicating § 751(b) Deemed Gain Approach – proposed regulations say a partner who has recognized ordinary income under § 751(b) increases his or her outside basis by such amount and the partnership increases its inside basis in the partnership property that implicated the § 751(b) inclusion to the same extent o Adjustments would take place right before analyzing the distribution under generally applicable tax principles Capital Gain Recognition Proposed regulations appear to simplify application of the statute in most cases but the regime creates its own complications resulting from basis adjustments to partnership property o Example: if a distribution would trigger a basis reduction under § 734(b) that would reduce other partners’ shares of net unrealized § 751 gain or loss then the regulation requires the distributee partner to recognize capital gain to avoid that result o Example: if distribution would cause reduction in basis of distributed § 751(b) under § 732(a)(2) or (b) then the proposed regulations allow the distributee partner to elect to recognize capital gain to avoid this result Chapter 11 – Liquidating Distributions Liquidation of Partner’s Interest: the termination of a partner’s entire interest in a partnership by means of a distribution or a series of distributions to the partner by the partnership Retiring Partner: one who ceases to be a partner under local law so § 736 applies to payments to any withdrawing partner and not just those active in the operations of the business as the common meaning of “retiring” may suggests Tax consequences of partnership terminations and other events that cause the partnership to cease to exist for tax purposes – are the subject of Chapter 12 Situation: consider the choices faced by Retiring Partner who desires to terminate their interest in a partnership that will continue to operate after the retiring partner’s withdrawal o One option – RP to sell its interest to the remaining partners or to a 3 rd party Tax consequences of sale of a partnership interest are governed by § 741 and § 751 and RP generally will recognize capital gain/loss except to extent of their share of § 751 assets o Second option – RP could liquidate its interest in the partnership (a transaction resembling a corporation’s redemption of a shareholder’s stock) and in exchange, RP might receive payments for a variety of items Tax consequences to RP and the remaining partners may differ depending on how the parties structure RP’s withdrawal from the partnership § 736: classifies payments in liquidation of a retiring partner’s interest in a continuing partnership by dividing them into 2 categories o 1.) payments for the partner’s interest in partnership property o 2.) all other payments § 736(b): treats payments for the partner’s interest in partnership property as distributions in liquidation of the retiring partner’s interest o Tax consequences of these payments governed by the distribution provisions and § 751(b) o All other payments fall into a second category and are characterized by § 736(a) as either (1) a distributive share of partnership income if based on profits of the firm or (2) as guaranteed payments under § 707(c) if determined without reference to partnership income § 736 only classifies payments Parties may have flexibility to shape the tax consequences of a partner’s withdrawal from a partnership by selecting the form of the transaction and classifying the payments in an arm’s length agreement o Example: there may be significant differences in tax treatment with respect to payments for goodwill depending on whether or not the partnership agreement specifically provides for such payments and to 50 “premium” payments if the transaction is structured as a liquidation rather than a sale or if the payments in either type of transaction are made in installments Liquidations are linked to the capital account concept capital accounts determine the amounts partners are entitled to receive on a liquidation of their interests in the partnership o The capital accounts must be adjusted to reflect the book gain/loss inherent in any property distributed in liquidation of a partner’s interest in a manner similar to that used in the case of operating distributions Liquidation of a Partner’s Interest First step in sorting out the tax treatment of payments to a retiring partner – determine whether the payments are being made to the partner in respect of their interest in partnership property o Dividing line between § 736(a) and § 736(b) payments Valuations are not precise and this is amplified by the fact that the retiring partner’s interest in partnership property includes partnership goodwill (usually valued on a residual basis) and whether the parties agree to pay the retiring partner a “premium” beyond the agreed value of the partnership’s assets o Thus the dividing line between a retiring partner’s interest in partnership goodwill [generally falling under § 736(b)] and a premium payment made to the exiting partner separate from their interest in partnership property [governed by § 736(a)] is not always easy to decipher Sometimes the statute excludes from § 736(b) certain payments to a retiring partner for that partner’s interest in 2 types of partnership property: o 1.) unrealized receivables; and o 2.) partnership goodwill – if the partnership agreement does not expressly provide for such payments (unstated goodwill) o In both cases – payments are removed from § 736(b) only if the retiring partner is a general partner of a partnership in which capital is not a material income producing factor The scope of partnership property that may be removed from § 736(b) is limited o (1) the definition of unrealized receivables for this purpose does not include recapture gain o (2) the regulations provide that even when the § 736(b)(2) exclusions apply they only extend to payments in excess of the retiring partner’s inside basis in that partner’s share of unrealized receivables and unstated goodwill The tax treatment of the resulting payments is determined under other provisions of Subchapter K o Focuses first on § 736(b) payments – their tax consequences are governed by the same statutory scheme applicable to operating distributions Tax Consequences to the Retiring Partner As with Operating Distributions – a retiring partner recognizes gain on a liquidating distribution only to the extent that the cash received exceeds the partner’s outside basis o If both cash & other property are distributed then § 731 and § 732 work together to treat the distribution as a nonrecognition transaction: (1) the partner reduces his outside basis by the cash received (2) then partner exchanges his remaining partnership interest for the other assets received in the distribution § 731: provides nonrecognition treatment to the partner and the partnership on the distribution § 732(b): provides the partner with an aggregate basis in the distributed property equal to his pre-distribution outside basis less an cash received in the liquidation Exchanged basis mechanism preserves any gain/loss inherent in the partner’s interest for recognition when the partner disposes of the distributed assets If more than 1 asset is distributed – § 732(c) prescribes a multi-step process for allocating the aggregate exchanged basis to the distribute partner § 735(b): the distribute partner may tack the partnership’s holding period § 735(a): preserves the ordinary income character in the hands of the partner indefinitely for any unrealized receivables and 5 years for inventory items Recognition of Loss If partner receives only cash, unrealized receivables and inventory items in a liquidating distribution then (unlike operating distributions) – § 731(a)(2) provides that the partner recognizes a loss to the extent that his outside basis exceeds the sum of the cash distributed plus the partner’s § 732 transferred basis in the receivables and inventory items 51 The loss is considered as incurred on the sale or exchange of a partnership interest thus is a capital loss under § 741 Where partner receives only cash – any realized gain or loss must be recognized because the partner may not defer recognition by way of an exchanged basis o If partner also receives ordinary income assets then immediate recognition of loss is required to prevent the partner from converting a capital loss into an ordinary loss on the sale of the distributed assets o Tax Consequences to the Partnership A partnership generally recognizes neither gain nor loss on a liquidating distribution on property § 734(a): the basis of partnership property generally is not adjusted as a result of the distribution o But as with operating distributions – a partnership with a § 754 election in effect may adjust the basis of its assets to prevent the distortions that result from a liquidating distribution In certain liquidating distributions – a partner may recognize gain or loss o If gain is recognized partnership may increase the basis of capital assets or § 1231 property it retains by the amount of the gain o If retiring partner recognizes a loss while a § 754 election is in effect § 734(b) requires the partnership to decrease the inside basis of its retained capital assets and § 1231 property by the amount of the loss o If the liquidating partner’s exchanged basis in distributed capital assets of § 1231 property exceeds the partnership’s inside basis in those assets and a § 754 election is in effect partnership must decrease its basis in retained assets of a similar class in an amount equal to the increase in the basis of the distributed assets in the hands of the retiring partner Partnership also must decrease its basis in retained assets even if a § 754 election has not been made whenever a liquidating distribution results in a substantial basis reduction Substantial Basis Reduction – occurs if the downward basis adjustment that would have been made to the partnership’s assets if a § 754 election had been made exceeds $250,000 o Example: if a liquidated partner recognizes a loss on the distribution that is greater than $250,000 then partnership is required to decrease the basis in its retained assets even if it has never made a § 754 election Also basis reduction in partnership’s retained assets is required if the basis of capital assets or § 1231 property that are distributed in a liquidating distribution is increased by more than $250,000 above the partnership’s basis in those assets Section 751(b) The disproportionate distribution rules in § 751(b) overrides the general rules of § 731 and § 732 on a partnership’s operating distributions In general § 751(b) plays an identical role with respect to liquidating distribution but payments received by a retiring general partner for their interest in unrealized receivables or unstated goodwill of a services partnership are governed by § 736(a) o In these cases – partner’s share of unrealized receivables is disregarded in determining the partner’s predistribution share of § 751 assets and the partner’s pre-distribution share of unstated goodwill is disregarded in determining their share of § 741 assets o Any payments received by the partner in exchange for their share of partnership unrealized receivables or unstated goodwill or any “premium” payments received are governed by § 736(a) Thus they are disregarded in determining the partner’s post-distribution share of § 751 or § 741 assets Section 736(a) Payments § 736(b) embraces payments for a retiring partner’s interest in partnership property with some limited exceptions If § 736(b) does not apply then § 736(a) takes control o If the amount received by the retiring partner is determined with respect to the income of the partnership then payment is treated as a part of the partner’s distributive share Otherwise that amount constitutes a guaranteed payment under § 707(c) o In both cases – the payment generally results in ordinary income to the retiring partner and a current partnership deduction that benefits the remaining partners Most payments made in liquidation of a partner’s interest fall within § 736(b) thus scope of § 736(a) is very limited and only applies to payments received by a general partner in a partnership in which capital is not a material incomeproducing factor for: o (1) the partner’s share of unrealized receivables (not including recapture or similar gain); and o (2) partnership goodwill if partnership agreement does not expressly provide for such payments 52 Capital is not a material income-producing factor where substantially all of the gross income of the business consists of fees, commissions, or other compensation for personal services o Thus a legal, medical, dentistry, accounting, architectural or other service partnership falls within this classification even though there is a substantial investment in office plant or equipment if that investment is merely incidental to the rendering of services Payments for Unrealized Receivables § 736(a) only embraces payments to compensate a liquidated general partner in a services partnership for his interest in the partnership’s receivables that have not been included in income o Regulations provide that only payments in excess of the partner’s basis in the unrealized receivables are encompassed by § 736(a) o To extent of Partner’s Share of the Inside Basis – receivables are considered as already realized and thus covered by § 736(b) § 736(a) only applies to payments for unrealized receivables o To extent that Receivables are Distributed In Kind – there is no payment and the partner’s receipt of the receivables is taxed under § 736(b) o Payment – term does not require a cash transfer so a distribution of other assets in exchange for a general partner’s interest in unrealized receivables in a services partnership also is governed by § 736(a) Scope of unrealized receivables under § 736(a) treatment is further limited by § 751(c) § 751(c): eliminates recapture gain (i.e., gain treated as ordinary recapture of depreciation income under § 1245) and similar property held by any services or capital partnership from the definition of an unrealized receivables for purposes of § 736 o Thus payments for recapture gain automatically fall within § 736(b) Payments for Goodwill § 736(b) generally applies to payments for the retiring partner’s share of goodwill o But § 736(a) assumes jurisdiction over such payments if they are made to a retiring general partner in a services partnership to the extent that the payments exceed partner’s inside basis in the goodwill and liquidation agreement does not state that the payment is for goodwill o Thus the parties in this situation have flexibility to remove goodwill from § 736(a) and send it back to § 736(b) by including a specific provision in the agreement governing the liquidation To fall within § 736(b) – payments allocated to goodwill must be reasonable but a valuation normally will be accepted by the Service if it is the product of an arm’s length agreement between parties Premium Payments § 736(a) also applies to classify the tax treatment of any premium payments to a retiring partner in excess of payments for that partner’s interest in partnership property Whether there is a “premium” – must first determine the amount of the partner’s share of the partnership’s property o Any payments in excess of that amount in cash or other property are governed by § 736(a) Premium payment could result from bargaining power the continuing partners may be willing to pay a premium to the retiring partner to consolidate control or to simply remove the partner from the firm o This type of payment would not be made in respect of retiring partner’s interest in partnership property so would fall within § 736(a) Tax Stakes Retiring partners historically sought to avoid as much ordinary income as possible but the current statutes impedes that planning agenda in many situations o Example: a retiring partner is likely to be indifferent to whether cash payments attributable to his share of the partnership’s unrealized receivables are classified under § 736(a) or § 736(b) If payments fall under § 736(b) then distribution implicates § 751(b) – triggers hypothetical distribution of the retiring partner’s share of the receivables that would be sold back to the partnership at FMV After § 751(b) – retiring partner recognizes ordinary income on the portion of the distribution attributable to his share of unrealized receivables o If the payment to the retiring partner of a fixed amount for his share of the same receivables falls within § 736(a) then the retiring partner recognizes ordinary income on this amount as a guaranteed payment under § 707(c) 53 o Either way – the retiring partner ends up with ordinary income Under hypothetical exchange required by § 751(b) in connection with a § 736(b) distribution – the partnership takes a cost basis in the retiring partner’s share of the partnership’s unrealized receivables o If payment to the retiring partner fell under § 736(a) so was treated as a guaranteed payment under § 707(c) then partnership would be entitled to a corresponding current deduction that is not subject to the capitalization requirement o Thus treating payments to a retiring partner for unrealized receivables as § 736(a) payments entitles the continuing partners to a current deduction when the receivables are liquidated The disposition of goodwill typically gives rise to capital gain for the seller o If the parties provide for the payment of goodwill in an agreement then the payments are not excluded from § 736(b)(1) – therefore treated as distributions Because goodwill does not constitute § 751(b) property payments would give rise to capital gain to the extent they exceed the retiring partner’s outside basis in the partnership interest o But if amounts paid to the retiring partner for unstated goodwill are not dependent on partnership profits then retiring partner will recognize ordinary income on these payments under § 707(c) Issue: why would the retiring general partner of a services partnership not insist that the agreement state that a payment is being made in respect of goodwill to avoid ordinary income treatment? o If a payment falls under § 736(a) then partnership is entitled to current deductions for what will be classified as § 707(c) guaranteed payment to the retiring partner (even if payment represents a capital expenditure) o Thus the continuing partners obtain an immediate deduction for the purchase of the retiring partner’s share of the partnership goodwill This additional basis would arise only if the retiring partner recognized capital gain on the distribution and the partnership had a § 754 election in place and even then only to the extent such basis increase is allocated to goodwill under § 755 o Therefore when the choice is available the parties generally should opt for § 736(a) treatment of the payments for goodwill because the overall tax treatment to the retiring partner and the continuing partners will yield a net tax benefit o In that case – one would expect the continuing partners to share the tax savings from their deduction by compensating the retiring partner for being taxed on the goodwill payments at ordinary income rates Also payments that the parties designate as not made in respect of partnership property present the same planning opportunities relating to the distinction between payments for stated or unstated goodwill with one critical distinction – payments falling under § 736(a) because they are not made in respect of partnership property are available to any type of partner in any type of partnership o These payments likely will give rise to ordinary income to the retiring partner while effectively entitling the continuing partners to a current deduction for the amount of payments If the payments instead had been designated as made in return for the retiring partner’s share of goodwill then the payment would give rise to capital gain to the recipient partner and (at most) an inside basis increase for the continuing partners in capital assets o Thus barring extreme abuses, the literal election for payments made to retiring general partners in a services partnership between classifying payments under § 736(b) as opposed to § 736(a) also may exist in the characterization of payments as being made in respect of the retiring partner’s interest in partnership property [§ 736(b)] or something else [§ 736(a)] Smith v. Commissioner – Commissioner v. Jackson Investment Co. – Chapter 13 – The Death of a Partner When a partner dies there is no repose for their partnership interest At a partner’s death – their interest in the partnership can: o (1) survive and be acquired by their successor in interest; o (2) be sold pursuant to a buy-sell agreement taking effect at the partner’s death; or o (3) be liquidated under a pre-existing agreement Treatment of Income in Year of Partner’s Death 54 Generally a partnership’s taxable year does not close on the death of a partner o But for a deceased partner the partnership year closes at the date of the decedent’s death under each of the three scenarios stated above Therefore a partner’s distributive share of income or loss for all or part of any partnership year is included on the decedent’s final income tax return and a partner’s distributive share of partnership income or loss from a partnership year ending prior to their death & within the decedent’s final taxable year is included on the decedent’s final return o Example: assume Partner (calendar-year taxpayer) has an interest in a partnership with a fiscal year ending April 30. Partner dies on October 31 of year one. The distributive share of partnership income or loss for the fiscal year ending April 30 of year one must be included on partner’s final income tax return, which will cover the period from the beginning of the calendar year through the date of death. Partner’s year also terminates on October 31 of year one, with the result that income for both years is bunched on partner’s final income tax return The rules apply even if the decedent was a member of a two-person partnership as long as the partner’s successor continues to share in the profits and losses of the firm Estate Taxation of Partnership Interests – Treatment of “IRD” Items & Basis Consequences The FMV of a decedent’s interest in a partnership (including partner’s distributive share of income earned prior to death) is included in the decedent’s gross estate for federal estate tax purposes o In theory – the FMV is what a willing buying would pay to a willing seller and both having reasonable knowledge of the relevant facts More certainty if the decedent enters into a bona fide, arm’s length buy-sell or liquidation agreement that is binding both during the decedent’s life and at death o In that event – the sale or liquidation price may determine the value of the partnership interest for estate tax purposes Many FLPs and FLLCs are created and structured primarily to obtain substantial valuation discounts for minority interests and illiquidity causing value to disappear from the transfer tax base Congress took steps to ensure that valuation discounts obtained in the estate tax arena are binding upon the decedent’s beneficiaries for income tax purposes § 1014(f): limits the basis in property acquired by reason of death to the value of the property as finally determined for estate tax purposes o Thus while valuation discounts achieved through the use of FLPs and FLLCs may generate considerable estate tax savings – those savings will be mitigated somewhat by increased future income tax liabilities for a deceased partner’s estate or other successors in interest Generally property owned at death is included in the decedent’s gross estate and takes a “date-of-death” basis in the hands of the successor in interest equal to its FMV on the date of the decedent’s death o The date-of-death basis rule creates special problems in connection with items that have been earned but yet taxed as of the date of death Congress devised the present “neutralization” approach under which several sections of the Code combine to require the decedent’s successor in interest eventually both to report the amount and to retain the character of income which previously escaped tax in the hands of the decedent o 1.) § 451(a) provides that amounts included in income on the decedent’s final return are determined by his regular accounting method Therefore a cash method taxpayer who dies holding a $3,000 account receivable for services would not include the $3,000 on his final income tax return o 2.) to preserve income for later recognition by decedent’s successor in interest – § 1014(c) denies a date-ofdeath basis to IRD items and instead requires the successor to take a transferred basis o 3.) § 691(a)(1) provides that the IRD item will be taxable when it is actually received or collected by the decedent’s estate or distributes and § 691(a)(3) characterizes the IRD items to the recipient in the same manner as if they had been received by the decedent IRD typically includes income items that already have been earned by (but not yet taxed to) the decedent prior to death (i.e., cash method receivables and § 453 obligations) o While mere asset appreciation generally is not subject to the IRD regime Outside Basis Consequences 55 Determining tax consequences of the death of a partner and the planning opportunities that arise – the fundamental starting point is to determine the outside basis of the partnership interest in the hands of the deceased partner’s estate or other successor in interest o Generally the basis of a partnership interest in the hands of the successor is the FMV of the interest as of the date of death – increased by the successor’s share of partnership liabilities and decreased by any IRD items Consequences vary depending on whether the partnership interest continues in the hands of the decedent’s successor, is sold, or is liquidated Treatment of IRD Items § 753: if decedent’s interest is liquidated pursuant to agreement effective as of the date of death then amounts classified under § 736(a) are considered IRD under § 691 o Role: limited to characterizing § 736(a) payments received by a deceased partner’s successor in interest as IRD does not apply if the partner’s interest continues in the hands of a successor or is sold pursuant to a preexisting buy-sell agreement o Both situations – decedent may have an interest in partnership’s zero basis accounts receivable These receivables would constitute IRD if the decedent held them directly Service has contended that § 753 is not the exclusive means of classifying the decedent’s interest in partnership assets as IRD o Applying an Aggregate Theory – courts have created an additional category of IRD that is not specially contemplated by § 753 extended to other types of partnership assets and to zero basis accounts receivable of a liquidated partnership interest within § 736(b) Quick’s Trust v. Commissioner – Woodhall v. Commissioner – Revenue Ruling 66-325 – whether sections 754 and 743 may be applied so as to give the estate of a deceased member of a personal service partnership the benefit of an adjustment to the basis of the partnership’s accounts receivable existing at the date of the decedent’s death Where collection of accounts receivable represents income in respect of a decedent – § 743 not applied so as to give the estate of a deceased member of a personal service partnership the benefit of an adjustment to the basis of partnership’s accounts receivable existing at the date of the decedent’s death Inside Basis Consequences The death of a partner also may affect the inside bases of partnership assets o Since decedent’s successor in interest takes a date-of-death outside basis (except for IRD items) the successor’s outside basis likely will differ from his share of the inside basis To correct the imbalance – § 743(b) may apply to allow an adjustment to the inside bases of partnership assets if there is a § 754 election in effect or if one is made for the year of the deceased partner’s death o If a § 754 election if not in place then there remains the prospect of an inside basis adjustment in any property distributed to the deceased partner’s successor in interest within 2 years of the decedent’s death if the successor makes a § 732(d) election o An inside basis adjustment can never be made to property that constitutes an item of IRD If partnership property has declined in value and the share of inside basis attributable to the deceased partner’s interest exceeds its FMV as of the decedent’s death then any resulting § 743(b) adjustments will generate a net reduction in basis o Avoid a § 754 election § 743 nonetheless requires a downward adjustment to the inside basis of partnership assets if the partnership has a substantial built-in loss immediately after the deceased partner’s death A substantial built-in loss exists if the total adjusted basis of the partnership’s assets exceeds their FMV by more than $250,000 Property Contributed by the Decedent with a Built-In Loss If deceased partner had contributed property to the partnership with a built-in loss then § 704(c)(1)(C) provides that: o (1) the built-in loss can only be allocated to the contributing partner; and 56 (2) the property’s basis is deemed to be its FMV at the time of contribution for purposes of making allocations to other partners o Thus the built-in loss is eliminated when the partnership interest passes from the decedent The resulting decrease in the partnership’s inside basis in contributed loss property occurs even in the absence of a § 754 election o Consequences of a Sale or Liquidation of a Deceased Partner’s Interest at Death The death of a partner and the increase in outside basis from this event can change the tax consequences to the estate or successor in interest of a partner o Example: when payments made in respect of deceased partner’s interest in partnership goodwill If the decedent was a general partnership in a services partnership then any payments for unstated goodwill will be characterized under § 736(a) as guaranteed payments under § 707(c) o Therefore the payments will give rise to ordinary income with no basis offset and similar tax treatment occurs if the parties characterized the payments as premium payments not made for the successor’s interest in partnership property But such payments may be classified as distributions under § 736(b) when: o (1) partnership is one in which capital is a material income producing factor; o (2) partnership is a services partnership but the decedent was not a general partner of the partnership; or o (3) partnership is a services partnership of which the decedent was a general partner but the partnership agreement specifies that the payments are being made in respect of goodwill When not involving death of a partner – usually classifying payments for goodwill as distributions under § 7369b) will lead to capital gain treatment to the withdrawing partners for such payments o But payments for goodwill to a successor in interest to a deceased partner often will generate no income at all therefore the downside of classifying liquidating payments for goodwill as § 736(a) payments is more disadvantageous to the withdrawing partner here Chapter 12 Partnership Terminations and Mergers § 708(a): provides that an existing partnership is considered as continuing unless it is terminated § 708(b)(1): provides that a partnership is terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership A liquidation is the most basic form of partnership termination o Incorporation of a partnership is another example In liquidation – partnership simply distributes its net assets to its partners and then goes out of existence o But a liquidation of a partnership must be distinguished from the liquidation of any particular partner’s interest in a continuing partnership If a partner withdraws from a partnership and receives a distribution for her interest transaction is governed by § 736 If partner receives a series of payment and then the partnership liquidates when the payments terminate § 736(a) would apply to the first partner on liquidation of his interest but not to the remaining partners on liquidation of the partnership o Services applies § 736(a) to the first partner even if it is a two-person partnership o § 736 does not apply when there is a single distribution of assets to the parties in dissolution of the partnership If a liquidation of a partnership results in a pro rata or at least a nondisproportionate distribution of all the partnership assets to the partners § 751(b) does not apply and the tax consequences are determined under the general distribution rules of sections 731, 732, and 735 o But if a complete liquidation of a partnership includes a disproportionate distribution section 751(b) cannot be avoided A liquidation or a termination also must be distinguished from a conversion of a partnership into another form of statelaw entity taxed as a “partnership” o Example: a general partnership could be converted under state law into a limited liability company classified as a partnership for federal tax purposes Service’s pro-taxpayer position is that the conversion is not a termination of the general partnership because its business continues after the conversion Revenue Ruling 77-412 – addressed application of § 751(b) in the complete liquidation of a two-person partnership, but its principles also apply to larger partnership 57 To the extent that a partner either receives § 751 property in exchange for relinquishing any part of such partner’s interest in other property or receives other property in exchange for relinquishing any part of the interest in § 751 property the distribution is treated as a sale or exchange of such properties between the distribute partner and the partnership (even though after the distribution the partnership consists of a single individual) Revenue Ruling 99-6 – what are the federal income tax consequences if one person purchases all of the ownership interests in a domestic LLC that is classified as a partnership under § 301.7701-3 causing the LLC’s status as a partnership to terminate under § 708(b)(1)(A) Revenue Ruling 95-37 – (1) do the federal income tax consequences described in Rev. Ruling 84-52 apply to the conversion of an interest in a domestic partnership into an interest in a domestic LLC that is classified as a partnership for federal tax purposes? They apply to the conversion of an interest in a domestic partnership in an interest in a domestic LLC that is classified as a partnership for federal tax purposes The consequences are the same whether the resulting LLC is formed in the same state or in a different state than the converting domestic partnership (2) does the taxable year of the converting domestic partnership close with respect to all the partners or with respect to any partner? The taxable year of the converting domestic partnership does not close with respect to all the partners or with respect to any partner (3) does the resulting domestic LLC need to obtain a new taxpayer identification number? The resulting domestic LLC does not need to obtain a new taxpayer identification number Notes: The service has extended the principles of Revenue Ruling 95-37 to the conversion of a general partnership into a limited liability partnership Rev. Ruling 95-55 holds that: o (1) a New York general partnership registered as a New York limited liability partnership is a partnership for federal tax purposes; and o (2) the registration does not terminate the partnership under § 708(b) Incorporation of a Partnership Revenue Ruling 84-111 announces that for tax purposes Service will respect the form adopted to incorporate a partnership Revenue Ruling 2004-59 Service analogized an incorporation under a state conversion statute to the situation where a partnership elects to be classified as a corporation for federal tax purposes o Thus the transaction is taxed like when a partnership is deemed to contribute all of its assets and liabilities to the corporation for stock and then partnership liquidates by distributing the stock to its partners Partnership Merges & Divisions § 708(b)(2)(A): if two or more partnerships merge or consolidate into one partnership then the resulting partnership is considered the continuation of the merging or consolidating partnership whose members own an interest of more than 50% in the capital and profits of the resulting partnership When partnerships merge or combine – transaction may take one of three forms: o (1) the terminated partnership may transfer its assets and liabilities to the resulting partnership in exchange for a partnership interest which is distributed to the partners of the terminated partnership (assets-over form); o (2) the terminating partnership may liquidate by distributing its assets and liabilities to its partners who then contribute the assets and liabilities to the resulting partnership; or o (3) the partners in the terminating partnership may transfer their partnership interests to the resulting partnership in exchange for interests in that partnership and the terminating partnership liquidates into the resulting partnership Tax results of a merger of partnerships vary o Example: the adjusted basis of assets contribute dot the resulting partnership may vary depending upon the form of transaction selected when the partners’ aggregate outside bases do not equal the terminating partnership’s inside basis 58 Assets-Over Transaction – the resulting partnership’s basis in the assets will be the same as the terminating partnership’s basis under § 723 Assets-Up Transaction – the adjusted basis of the assets will first be determined under § 732 on the liquidation of the terminating partnership and then under § 723 on the contribution to the resulting partnership § 708: provides partners with a great deal of flexibility when they merge partnership the form of the merger will be respected if the partners select the assets-over or assets-up form for the transaction o If the merger is accomplished without undertaking a form or takes an interests-over form then the merger is treated as undertaking the assets-over form for tax purposes Special rules for mergers of partnerships increases and decreases in partnership liabilities associated with a merger or consolidation are netted by the partners in the terminating partnership and the resulting partnership to determine the effect of the merger under § 752 o Prevents the terminating partnership from recognizing gain under § 752 when it becomes a momentary partner in the resulting partnership in an assets-over transaction Issue: if a partner in the terminating partnership does not want to become a partner in the resulting partnership and wishes to receive money or property instead of partnership interest o If resulting partnership transfers money or other consideration in addition to the resulting partnership interests in an assets-over transaction terminating partnership could be treated as selling part of its property under § 707(a)(2)(B) o But regulations provide that the partner’s sale of the interest will be respected as a sale if the merger agreements specifies: (1) that the resulting partnership is purchasing an interest from a particular partner in the merger partnership; and (2) the consideration that is transferred for each interest sold § 708(b)(2)(B): if a partnership divides into two or more partnership then a resulting partnership shall be considered a continuation of the prior partnership if members of the resulting partnership had a more than 50% interest in the capital and profits of the prior partnership Partnership Divisions – can be accomplished using an assets-over or assets-up form o If divisions take place without a form or does not employ the assets-up form characterized under the assetsover form for tax purposes Application of the Mixing-Bowl Rules Revenue Ruling 2004-43 expresses the Service’s view on how the mixing bowl rules apply to a partnership merger following the assets-over form A partnership division also can raise issues under § 704(c)(1)(B) and § 737 o In division following the assets-up form distribution of partnership assets to the partners could trigger either of the sections o In an assets-over division partnership interest in the resulting partnership is treated as § 704(c) property to the extent that the interest is received in exchange for § 704(c) property o Thus distribution of interests in resulting partnership will trigger § 704(b)(1)(B) to extent that interests are received by partners other than the partner who contributed the § 704(c) property § 373 also may be triggered if a partner who contributed § 704(c) property receives an interest in the resulting partnership that is not attributable to § 704(c) property Revenue Ruling 2004-43 – (1) does § 704(c)(1)(B) apply to § 704(c) gain or loss that is crated in an assets-over partnership merger?; (2) for purposes of § 737(b), does net pre-contribution gain include § 704(c) gain or loss that is crated in an assets-over partnership merger? Holding #1 – § 704(c)(1)(B) applies to newly created § 704(c) gain or loss in property contributed by the transferor partnership to the continuing partnership in an assets-over partnership merger, but does not apply to newly created reverse § 704(c) gain or loss resulting from a revaluation of property in the continuing partnership Holding #2 – for purposes of § 737(b), net pre-contribution gain includes newly created § 704(c) gain or loss in property contributed by the transferor partnership to the continuing partnership in an assets-over partnership merger, but does not include newly created reverse § 704(c) gain or loss resulting from a revaluation of property in the continuing partnership 59