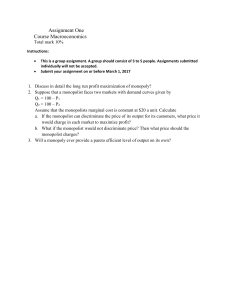

EC370 Midterm I Practice Questions 1. If the inverse demand curve a monopoly faces is p = 100 - 2Q, and MC is constant at 16, then profit maximization a. b. c. d. 2. is achieved when 21 units are produced. is achieved by setting price equal to 21. is achieved only by shutting down in the short run. cannot be determined solely from the information provided. If the inverse demand curve a monopoly faces is p = 100 - 2Q, and MC is constant at 16, then the firm’s Lerner index equals a. b. c. d. 58/16. 16/42. 58/42. 42/58. 3. Figure above shows the demand and cost curves facing a monopoly. The monopoly maximizes profit by selling a. b. c. d. 4. 0 units. 25 units. 50 units. 75 units. A profit-maximizing monopolist faces the demand curve q = 100 – 3p. It produces at a constant marginal cost of $20 per unit. A quantity tax of $10 per unit is imposed on the monopolist’s product. The price of the monopolist’s product. a. b. c. d. e. rises by $5 rises by $10 rises by $12 rises by $20 remains unchanged 5. A monopolist has the total cost function c(q) = 800 + 8q. The inverse demand function is p(q) = 80 – 6q, where prices and costs are measured in dollars. If the firm is required by law to meet demand at a price equal to its marginal costs, a. the firm will earn zero profit b. the firm will make positive profit smaller than it would have made if it were free to choose its own price c. the firm will lose $400 d. the firm will lose $480 e. the firm will lose $800 6. A monopolist faces a downward-sloping demand curve and has fixed costs so large that when she maximizes profits with a positive amount of output, she earns exactly zero profits. At this positive, profit-maximizing output, a. b. c. d. e. 7. average cost is greater than marginal cost there are decreasing returns to scale demand is price inelastic marginal revenue exceeds marginal cost price equals marginal cost A monopolist produces at a point where the price elasticity of demand is –0.7 and the marginal cost is $2. If you were hired to advise this monopolist on how to increase his profits, you would find that the way to increase his profits is to a. b. c. d. lower the price produce the output quantity at which price equals marginal cost increase his output decrease his output 8. A monopolist faces a constant marginal cost of $1 per unit and has no fixed costs. If the price elasticity of demand for this product is constant and equal to –4, then a. b. c. d. 9. to maximize profit, he should charge a price of $4 he is not maximizing profits to maximize profit, he should charge a price of $1.33 to maximize profit, he should charge a price of $1.25 The demand for Professor Swinnen’s new book is given by the function Q = 2,000 – 100p. To sell the book, it must be typeset (a fixed cost), and copies must be printed. If the cost of having the book typeset is $7,000, if the marginal cost of printing an extra copy is $4, and if he has no other costs, then he would maximize his profits by a. b. c. d. e. having it typeset and selling 400 copies having it typeset and selling 800 copies having it typeset and selling 1,000 copies having it typeset and selling 1,600 copies not having it typeset (selling zero copies) 10. A monopolist is able to practice third-degree price discrimination between two markets. The demand function in the first market is q = 500 – 2p and the demand function in the second market is q = 1,500 – 6p. To maximize his profits, he should a. b. c. d. Sell in only one of the two markets charge the same price in both markets charge a higher price in the second market than in the first charge a higher price in the first market than in the second 11. A monopolist sells in two markets. The demand curve for her product is given by P1 = 122 – 2Q1 in the first market and P2 = 306 – 5Q2 in the second market, where Qi is the quantity sold in market i and Pi is the price charged in market i. She has a constant marginal cost of production, c = 6, and no fixed costs. She can charge different prices in the two markets. What is the profit-maximizing combination of quantities for this monopolist? a. b. c. d. e. Q1 = 29 and Q2 Q1 = 39 and Q2 Q1 = 49 and Q2 Q1 = 58 and Q2 Q1 = 59 and Q2 = 30 = 28 = 40 = 32 = 29 12. A price-discriminating monopolist sells in two separate markets such that goods sold in one market are never resold in the other. It charges p1 = $4 in one market and p2 = $8 in the other market. At these prices, the price elasticity of demand in the first market is –1.90 and the price elasticity of demand in the second market is –0.80. Which of the following actions is sure to raise the monopolist’s profits? a. b. c. d. e. Lower p2, leave p1 unchanged Raise p1 and lower p2 Raise p2, leave p1 unchanged Raise both p1 and p2 Raise p2 and lower p1 13. A monopolist has a constant marginal cost of $2 per unit and no fixed costs. He faces separate markets in Alberta and Saskatchewan. He can set one price, p A , for buyers in Alberta and a different price, pS , for buyers in Saskatchewan. If demand in Alberta is given by q A p A 7,000 700 p A , and demand in Saskatchewan is given by q S p S 3,200 400 p S , then, at the profit-maximizing prices pAM , pSM a. pAM pSM 3 b. p AM pSM 3 c. pAM pSM 0 d. pAM pSM 1 e. p AM pSM 1 14. A multimarket price-discriminator sells its products in Florida for three times the price it sets in New York. Assuming the firm faces the same constant marginal cost in each market and the price elasticity of demand in New York is -2.0, the demand in Florida has priceelasticity of: a. b. c. d. e. -6.0 -2.0 -1.2 -1.0 -0.667 15. Roach Motors has a monopoly on used cars in Enigma, Ohio. By installing secret microphones in the showroom, the friendly salespersons at Roach are able to learn each customer’s willingness to pay and can therefore practice firstdegree price discrimination, extracting from each customer his entire consumer’s surplus. The inverse demand function for cars in Enigma is p = 2,000 – 10q. Roach Motors purchases its stock of used cars at an auction in Cleveland for $600 each. Roach motors will a. b. c. d. e. Sell 70 cars for a total profit of $49,000 Sell 140 cars for a total profit of $98,000 Sell 140 cars at a price of $600/car. Sell 168 cars for a total profit of $156,800 Discontinue operations (shut down) because its revenue does not cover variable costs. 16. A monopoly firm has two types of customers, but cannot identify customer type before a purchase is made. One customer type has inverse demand p1 q1 80 q1 , while the other customer type has inverse demand p2 q2 120 4q2 . The cost of production is c(q) = 40q (there are no fixed costs). Which of the following pricing schemes will provide the firm with the highest profit? a. b. c. d. Charge $60 per unit for any quantity, or $40 per unit if buying 40 or more units Charge $80 per unit for any quantity, or $60 per unit if buying 10 or more units Charge $60 per unit for any quantity, or $50 per unit if buying 30 or more units Charge $80 per unit for any quantity, or $60 per unit if buying 20 or more units 17. An industry has two firms. The inverse demand function for this industry is p = 263 – 6q. Both firms produce at a constant unit cost of $29 per unit. What is the Cournot equilibrium price for this industry? a. b. c. d. e. 18. $26 $29 $39 $53.50 $107 A duopoly faces the inverse demand p = 160 – 2q. Both firms in the industry have constant costs of $10 per unit of output. In a Cournot equilibrium how much output will each duopolist sell? a. b. c. d. e. 19. 25 35 48 54 75 There are two major producers of corncob pipes in the world, both located in Herman, Missouri. The inverse demand function for corncob pipes is described by p(q) = 160 – 3×q, where q is total industry output. Marginal costs are zero. What is the Cournot reaction function (Best Response function) of Firm 1 to the output, q 2 , of Firm 2? a. q1BR q2 160 3 q 2 b. q1BR q2 160 3 q 22 c. q1BR q2 26 .67 0.5 q2 d. q1BR q2 53 .33 3 q2 e. q1BR q2 163 6 q2 20. A duopoly faces the inverse demand p = 110 – 0.5×q. Both firms in the industry have constant costs of $10 per unit of output. If the industry consists of Stackelberg Leader (Firm 1) and Stackelberg Follower (Firm 2), then, in equilibrium, the amount produced by Firm 2 (Follower) is a. b. c. d. e. 21. 15 units 20 units 30 units 40 units 50 units The inverse demand function for fuzzy dice is p = 20 – q. There are constant returns to scale in this industry with unit costs of $8. Which of the following sets of statements is completely true? a. Monopoly output is 6. Cournot duopoly total output is 8. A Stackelberg leader’s output is 8. b. Monopoly output is 8. Cournot duopoly total output is 8. A Stackelberg leader’s output is 8 c. Monopoly output is 6. Cournot duopoly total output is 8. A Stackelberg follower’s output is 3. d. Monopoly output is 6. Cournot duopoly total output is 6. A Stackelberg follower’s output is 3. e. Monopoly output is 6. Cournot duopoly total output is 8. A Stackelberg follower’s output is 4. 22. The duopolists Carl and Simon face a demand function for pumpkins of Q = 2,200 – 400P, where Q is the total number of pumpkins that reach the market and P is the price of pumpkins. Suppose further that each farmer has a constant marginal cost of $1.50 for each pumpkin produced. If Carl believes that Simon is going to produce Qs pumpkins this year, then the reaction function tells us how many pumpkins Carl should produce in order to maximize his profits. Carl’s reaction function is a. RC QS 400 QS 2 b. RC QS 2,200 800 QS c. RC QS 800 QS 2 d. RC QS 2,200 400 QS e. RC QS 400 QS 23. The duopolists Grinch and Grubb go into the wine business in a small country where wine grapes are difficult to grow. The demand for wine is given by p = $480 – .2Q, where p is the price and Q is the total quantity sold. The industry consists of just the two Cournot duopolists, Grinch and Grubb. Imports are prohibited. Grinch has constant marginal costs of $30 and Grubb has marginal costs of $60. How much is Grinch’s output in equilibrium? a. b. c. d. e. 400 units 800 units 1,200 units 1,600 units 2,400 units 24. Suppose that two airlines are Cournot duopolists serving the Peoria-Dubuque route, and the demand curve for tickets per day is Q = 220 – 2p (so p 110 Q 2 ). Total costs of running a flight on this route are 1,400 + 20q, where q is the number of passengers on the flight. Each flight has a capacity of 80 passengers. In Cournot equilibrium, each duopolist will run one flight per day and will make a daily profit of a. b. c. d. e. 25. $400. $800. $220. $700. $3,000. The market demand curve for bean sprouts is given by P = 820 – 2Q, where P is the price and Q is the total industry output. Suppose that the industry has two firms, a Stackelberg leader and a follower. Each firm has a constant marginal cost of $20 per unit of output. In equilibrium, total output by the two firms will be a. b. c. d. e. 50 units 100 units 200 units 300 units 400 units 26. A city has two major league baseball teams, A and B. The number of tickets sold by either team depends on the price of the team’s own tickets and the price of the other team’s tickets. If team A charges Pa for its tickets and team B charges Pb for its tickets, then ticket sales, measured in hundreds of thousands per season, are 10 – 2Pa + Pb for team A and 5 + Pa – 2Pb for team B. The marginal cost of an extra spectator is zero for both teams. Each team believes the other’s price is independent of its own choice of price, and each team sets its own price so as to maximize its revenue. What price do they charge per ticket? a. b. c. d. 27. Team A charges 3 and team B charges 2. Team A charges 3 and team B charges 4. Team A charges 4 and team B charges 4. Team A charges 5 and team B charges 1. A game has two players. Each player has two possible strategies. One strategy is Cooperate, the other is Defect. Each player writes on a piece of paper either a C for cooperate or a D for defect. If both players write C, they each get a payoff of $100. If both players write D, they each get a payoff of 0. If one player writes C and the other player writes D, the cooperating player gets a payoff of S and the defecting player gets a payoff of T. To defect will be a dominant strategy for both players if a. b. c. d. e. S + T > 100. T > 2S. S < 0 and T > 100. S < T and T > 100. S and T are any positive numbers. 28. Frank and Nancy met at a sorority party. They agreed to meet for a date at a local bar the next week. Regrettably, they were so fraught with passion that they forgot to agree on which bar would be the site of their rendezvous. Luckily, the town has only two bars, Rizotti’s and the Oasis. Having discussed their tastes in bars at the party, both are aware that Frank prefers Rizotti’s to the Oasis and Nancy prefer the Oasis to Rizotti’s. In fact, the payoffs are as follows. If both go to the Oasis, Nancy’s payoff is 3 and Frank’s payoff is 2. If both go to Rizotti’s, Frank’s payoff is 3 and Nancy’s payoff is 2. If they don’t both go to the same bar, each has a payoff of 0. a. b. c. d. e. 29. This game has no Nash equilibrium in pure strategies. This game has a dominant strategy equilibrium. There are two Nash equilibrium in pure strategies and a Nash equilibrium in mixed strategies where the probability that Frank and Nancy go to the same bar is 12 25 . This game has two Nash equilibria in pure strategies and a Nash equilibrium in mixed strategies where each person has a probability of 1 2 of going to each bar. This game has exactly one Nash equilibrium. Two players are engaged in a game of Chicken. There are two possible strategies, Swerve and Drive Straight. A player who chooses to Swerve is called Chicken and gets a payoff of zero, regardless of what the other player does. A player who chooses to Drive Straight gets a payoff of 32 if the other player swerves and a payoff of –48 if the other player also chooses to Drive Straight. This game has two pure strategy equilibria and a. a mixed strategy equilibrium in which each player swerves with probability .60 and drives straight with probability .40. b. two mixed strategies in which players alternate between swerving and driving straight. c. a mixed strategy equilibrium in which one player swerves with probability .60 and the other swerves with probability .40. d. a mixed strategy in which each player swerves with probability .30 and drives straight with probability .70. e. no mixed strategies. 30. Big Pig and Little Pig have two possible strategies, Push the Button or Wait at the Trough. If both pigs choose Wait at the Trough, both have a payoff of 3. If both pigs choose Push the Button, then Big Pig has 8 and Little Pig has 2. If Little Pig chooses Push the Button and Big Pig chooses Wait at the Trough, then Big Pig has 10 and Little Pig has 0. If Big Pig chooses Push the Button and Little Pig chooses Wait at the Trough, then Big Pig has 2 and Little Pig has 1. In Nash equilibrium: a. b. c. d. e. both pigs wait at the trough. Little Pig has a payoff of 1 and Big Pig has a payoff of 2. Little Pig has a payoff of 0. Little Pig has a payoff of 2 and Big Pig has a payoff of 8. Both pigs must be using mixed strategies.