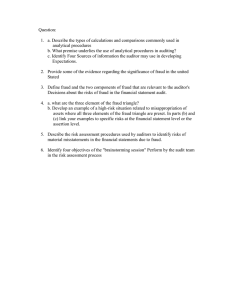

Judicial Accounting (Forensic Accounting) Fourth Year- English Section Recap of Previous points covered in part 1 In the previous lecture we covered the following points: 1234567- The Difference between Financial Auditing and Forensic/Judicial Accounting. The distinctive features of forensic accountants The need for forensic accounting. The Difference between Fraud Auditing and Forensic/Judicial Accounting. Fraud Fraudulent financial reporting and Misappropriation of assets Conditions for fraud. Conditions for fraud Three conditions for fraud are referred to as the fraud triangle: 1- Incentives/Pressures: Management or other employees have incentives or pressures to commit fraud. لدى اإلدارة أو الموظفين اآلخرين حوافز أو ضغوط الرتكاب االحتيال 2- Opportunities: Circumstances provide opportunities for management or employees to commit fraud. صا لإلدارة أو الموظفين الرتكاب االحتيال ً توفر الظروف فر. 3- Attitudes/Rationalization: An attitude, character, or set of ethical values exists that allows management or employees to commit a dishonest act, or they are in an environment that imposes sufficient pressure that causes them to rationalize committing a dishonest act. أو، يوجد موقف أو شخصية أو مجموعة من القيم األخالقية التي تسمح لإلدارة أو الموظفين بارتكاب فعل غير أمين ً أنهم في بيئة تفرض ضغ. طا كافيًا يدفعهم إلى تبرير ارتكاب فعل غير أمين Risk Factors for Fraudulent Financial Reporting: An essential consideration by the auditor in uncovering fraud is identifying factors that increase the risk of fraud. .من االعتبارات األساسية للمدقق في الكشف عن االحتيال تحديد العوامل التي تزيد من مخاطر االحتيال The next slide provides examples of these fraud risk factors for each of the three conditions of fraud for fraudulent financial reporting. In the fraud triangle, fraudulent financial reporting and misappropriation of assets share the same three conditions, but the risk factors differ. Remember Ineffective BOD or audit committee means they lack: 1- Independence in fact or in appearance (meaning they are biased) or 2- Competence (meaning that they lack the needed qualifications to perform their job) Risk Factors for Misappropriation of Assets The same three conditions apply to misappropriation of assets. However, in assessing risk factors, greater emphasis is placed on individual incentives and opportunities for theft. - Effective Anti-fraud strategy An effective anti-fraud strategy in fact has four main components: 1234- Prevention Detection Response. Deterrence الردع The four elements are all closely interlinked and each plays a significant role in combating fraud. First: Corporate Governance Oversight to Reduce Fraud Risks Management is responsible for implementing corporate governance and control procedures to minimize the risk of fraud, through a combination of prevention, deterrence, and detection measures. من خالل مجموعة من، اإلدارة مسؤولة عن تنفيذ إجراءات حوكمة الشركات والرقابة لتقليل مخاطر االحتيال .إجراءات المنع والردع والكشف The AICPA identifies three elements to prevent, deter, and detect fraud: 1- Culture of honesty and high ethics 2- Management’s responsibility to evaluate risks of fraud 3- Audit committee oversight First: Culture of Honesty and High Ethics The most effective way to prevent and deter fraud is to implement antifraud programs and controls that are based on core values embraced by the company. الطريقة األكثر فعالية لمنع االحتيال وردعه هي تنفيذ برامج وضوابط مكافحة االحتيال التي تستند إلى القيم األساسية التي تتبناها الشركة. Such values create an environment that reinforces acceptable behavior and expectations that employees can use to guide their actions. تخلق هذه القيم بيئة تعزز السلوك المقبول والتوقعات التي يمكن للموظفين استخدامها لتوجيه أفعالهم. Creating a culture of honesty and high ethics خلق ثقافة الصدق واألخالق الرفيعة 1- Setting the Tone at the Top: Honesty and integrity by management reinforces honesty and integrity by employees, meaning that: Management cannot act one way and expect others in the company to behave differently. Through its actions and communications, management can show that dishonest and unethical behaviors are not tolerated, even if the results benefit the company. من خالل.ال يمكن لإلدارة أن تتصرف بطريقة واحدة وتتوقع أن يتصرف اآلخرون في الشركة بشكل مختلف ، يمكن لإلدارة أن تظهر أنه ال يتم التسامح مع السلوكيات غير النزيهة وغير األخالقية،أفعالها واتصاالتها حتى لو كانت النتائج مفيدة للشركة. 2- Creating a Positive Workplace Environment: Wrongdoing occurs less frequently when employees have positive feelings about their employer than when they feel abused, threatened, or ignored. تحدث المخالفات بشكل أقل بكثير عندما يكون لدى الموظفين مشاعر إيجابية تجاه صاحب العمل مما يحدث عندما يشعرون باإلساءة أو التهديد أو التجاهل. A positive workplace can generate improved employee morale, which may reduce employees’ likelihood of committing fraud against the company. 3- Hiring and Promoting Appropriate Employees: To prevent fraud, companies implement screening policies and promote employees who are trustworthy to reduce the likelihood of hiring and promoting individuals with low levels of honesty, especially those who hold positions of trust. تنفذ الشركات سياسات الفرز وترقية الموظفين الجديرين بالثقة لتقليل احتمالية توظيف وترقية، لمنع االحتيال وخاصة أولئك الذين يشغلون مناصب ثقة، األفراد بمستويات منخفضة من الصدق. Such policies may include background checks on individuals being considered for employment or for promotion to positions of trust. Background checks verify a candidate’s education, employment history, and personal references, including references about character and integrity. بما في ذلك،تتحقق عمليات التحقق من الخلفية من تعليم المرشح وتاريخه الوظيفي والمراجع الشخصية المراجع المتعلقة بالشخصية والنزاهة. After an employee is hired, continuous evaluation of employee compliance with the company’s values and code of conduct also reduces the likelihood of fraud. ضا من ً فإن التقييم المستمر المتثال الموظف لقيم الشركة ومدونة قواعد السلوك يقلل أي،بعد تعيين الموظف .احتمالية االحتيال 4- Training: New employees should be trained about the company’s expectations of employees’ ethical behavior. Fraud awareness training should also be included. ضا تضمين التدريب ً يجب أي.يجب تدريب الموظفين الجدد على توقعات الشركة للسلوك األخالقي للموظفين للتوعية باالحتيال. Employees should be told of their duty to communicate actual or suspected fraud and the appropriate way to do so. In addition, fraud awareness training should be tailored to employees’ specific job responsibilities with, for example, different training for purchasing agents and sales agents. .يجب إخبار الموظفين بواجبهم في اإلبالغ عن احتيال فعلي أو مشتبه به والطريقة المناسبة للقيام بذلك صا للمسؤوليات الوظيفية ً يجب أن يكون التدريب على الوعي باالحتيال مصم ًما خصي،باإلضافة إلى ذلك . تدريب مختلف لوكالء الشراء ووكالء المبيعات، على سبيل المثال،المحددة للموظفين مع 5- Confirmation: Employees should periodically confirm their responsibilities for complying with the code of conduct. .يجب على الموظفين تأكيد مسؤولياتهم بشكل دوري لالمتثال لقواعد السلوك 6- Discipline: Employees must know that they will be held accountable for failure to follow the code of conduct. Enforcement of violations of the code sends the message that compliance with the code is expected. يؤدي إنفاذ انتهاكات القانون إلى.يجب أن يعرف الموظفون أنهم سيحاسبون على عدم اتباع مدونة السلوك إرسال رسالة مفادها أن االمتثال للمدونة أمر متوقع. Enforcement of violations of the code, regardless of the level of the employee committing the act, sends clear messages to all employees that compliance with the code of conduct and other ethical standards is important and expected. يرسل رسائل واضحة إلى جميع الموظفين،تنفيذ االنتهاكات بغض النظر عن مستوى ارتكاب الموظف للفعل .بأن االمتثال لقواعد السلوك والمعايير األخالقية األخرى أمر مهم ومتوقع Thorough investigation of all violations and appropriate and consistent responses can be effective deterrents to fraud. Second: Management’s Responsibility to Evaluate Risks of Fraud 1- Identifying and Measuring Fraud Risks: Effective fraud oversight begins with management recognition that fraud is possible and almost any employee is capable of it. .تبدأ الرقابة الفعالة على االحتيال بإدراك اإلدارة أن االحتيال ممكن وأن أي موظف قادر عليه تقريبًا 2- Mitigating Fraud Risks: Management is responsible for implementing controls to mitigate fraud risks,and it can change business activities and processes prone to fraud to reduce incentives and opportunities for fraud. ويمكنه تغيير األنشطة والعمليات.اإلدارة مسؤولة عن تنفيذ الضوابط للتخفيف من مخاطر االحتيال .التجارية المعرضة لالحتيال لتقليل الحوافز وفرص االحتيال For example, management can outsource certain operations, such as transferring cash collections from company personnel to a bank lockbox system. 3- Monitoring Fraud Prevention Programs and Controls: Management should periodically evaluate antifraud programs and ensure controls are effective. .يجب على اإلدارة تقييم برامج مكافحة االحتيال بشكل دوري والتأكد من فعالية الضوابط For example, management’s review and evaluation of results for operating units or subsidiaries increases the likelihood that manipulated results will be detected. تزيد مراجعة اإلدارة وتقييم النتائج لوحدات التشغيل أو الشركات التابعة من احتمالية اكتشاف النتائج التي تم .التالعب بها Internal audit plays a key role in monitoring. .دورا رئيسيًا في المراقبة ً يلعب التدقيق الداخلي Third: Audit Committee Oversight As mandated by the Sarbanes-Oxley Act of 2002, the US Securities and Exchange Commission (SEC) adopted rules and requirements that a company needs to fulfill to get its securities listed on a national exchange. اعتمدت هيئة األوراق المالية والبورصات، 2002 لعامSarbanes-Oxley وفقًا لما ينص عليه قانون ) القواعد والمتطلبات التي يجب على الشركة الوفاء بها إلدراج أوراقها المالية في البورصةSEC( األمريكية .الوطنية The requirements include the following: 1. The audit committee must consist of independent members. 2. The audit committee is given the responsibility of selecting and overseeing the company’s independent auditor. 3. Compensation is provided to any outside auditors or independent auditor engaged by the audit committee. 4. The audit committee is given the authority to engage advisors. organizational chart Board of Audit Directors committee Head of Eco Internal audit Consumer business head Chief operating officer CFO CLO Commercial business head Accordingly, the audit committee has primary responsibility to oversee the organization’s financial reporting and internal control process. In fulfilling this responsibility, the audit committee considers the potential for management override of internal controls and oversees management’s fraud risk assessment process, as well as antifraud programs and controls. The audit committee also assists in creating an effective “tone at the top” about the importance of honesty and ethical behavior by reinforcing management’s zero tolerance for fraud. Therefore, as a subcommittee of the board of directors, the audit committee is ultimately accountable for mitigating the risk of fraud. Audit Committee Oversight The audit committee is a deterrent to fraud by senior management by: a) Direct reporting of key findings by internal auditors to the audit committee b) Periodic reports by ethics officers about whistleblowing c) Other reports about lack of ethical behavior or suspected fraud Because the audit committee plays an important role in establishing a proper tone at the top and in overseeing the actions of management, PCAOB auditing standards require the auditor of a public company to evaluate the effectiveness of the board and audit committee as part of the auditor’s evaluation of the operating effectiveness of internal control over financial reporting. فإن معايير،دورا مه ًما في الرقابة األعلى وفي اإلشراف على إجراءات اإلدارة ً نظرا ألن لجنة المراجعة تلعب ً تتطلب من مدقق شركة عامة تقييم فعالية مجلس اإلدارة ولجنة التدقيق كجزء من تقييم المدققPCAOB تدقيق .للفعالية التشغيلية للرقابة الداخلية على التقارير المالية Second: Internal Control Systems An internal control system comprises all those policies and procedures that taken together support an organization's effective and efficient operation. . وتدعم عملية المنظمة الفعالة والفعالة،يشمل كل تلك السياسات واإلجراءات التي تم جمعها معًا Internal controls typically deal with factors such as: a) approval and authorization processes, b) access restrictions and transaction controls, account reconciliations, and c) Physical security. These procedures often include the division of responsibilities and checks and balances to reduce risk. Segregation of duties is not always possible though, and it may be necessary to introduce additional management examination and control, including some form of internal audit as a regular feature. وقد يكون من الضروري تقديم فحص ومراقبة إضافية، فإن الفصل بين المهام ليس ممكنًا دائ ًما،ومع ذلك . بما في ذلك بعض أشكال التدقيق الداخلي كميزة منتظمة، لإلدارة The number and type of internal controls that an organization can introduce will again depend on the nature and size of the organizations. .سيعتمد عدد ونوع الضوابط الداخلية التي يمكن للمؤسسة إدخالها مرة أخرى على طبيعة المؤسسات وحجمها Examples of the variety of such controls include: A) Requiring multiple signatories on high value transactions (e.g. within a finance or procurement department) B) Enforcing employees to take holiday (e.g. many employees in the banking sector must take a minimum of two weeks holiday in a given period) C) Restricting belongings that can be brought into the office environment (e.g. many call center employees are not allowed to take in pens, paper or mobile phones, and some organizations have restricted the use of USB sticks) D) Conducting random searches of staff (e.g. in factories, distribution centers or retail outlets). Questions 1) Which of the following are elements of the fraud triangle? A) Attitudes/rationalization Risk Factors Yes No Opportunities Yes B) Attitudes/rationalization No Risk Factors Yes Opportunities Yes C) Attitudes/rationalization Yes Risk Factors No Opportunities No D) Attitudes/rationalization No Risk Factors Yes Opportunities No 2) Although the financial statements of all companies are potentially subject to Answer: A manipulation, the risk is greater for companies that A) are heavily regulated. B) have low amounts of debt. C) have to make significant judgments for accounting estimates. D) operate in stable economic environments. Answer: C 3) Which of the following is not a factor that relates to opportunities to commit fraudulent financial reporting? A) lack of controls related to the calculation and approval of accounting estimates B) ineffective oversight of financial reporting by the board of directors C) management's set of ethical values D) high turnover of accounting, internal audit, and information technology staff Answer: C 4) Fraud is more prevalent in smaller businesses and not-for-profit organizations because it is more difficult for them to maintain A) adequate separation of duties. B) adequate compensation. C) adequate financial reporting standards. D) adequate supervisory boards. Answer: A 5) Which of the following is a factor that relates to incentives or pressures to commit fraudulent financial reporting? A) significant accounting estimates involving subjective judgments B) excessive pressure for management to meet debt repayment requirements C) management's practice of making overly aggressive forecasts D) high turnover of accounting, internal audit, and information technology staff Answer: B 6) Which of the following is a factor that relates to attitudes or rationalization to misappropriate assets? A) significant accounting estimates involving subjective judgments B) excessive pressure for management to meet debt repayment requirements C) a sense of superiority by executives D) high turnover of accounting, internal audit and information technology staff Answer: C True or False: 1) A common incentive for companies to manipulate financial statements is a decline in the company's financial prospects. Answer: TRUE 2) The pressure to do "whatever it takes" to meet goals is one of the main reasons why financial statement fraud occurs. Answer: TRUE 3) In the fraud triangle, fraudulent financial reporting and misappropriation of assets share the same conditions and risk factors. Answer: FALSE End of chapter.