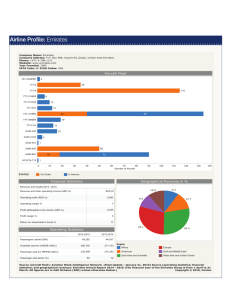

Case Study Of Analysis of Luxury Airlines Emirates Airways and competitors Under Supervision of Prof. Riccaboni Massimo Author Abedelazez Safi May 2011 1 Electronic Electronic copy copyavailable available availableat: at: at:https://ssrn.com/abstract=2045661 http://ssrn.com/abstract=2045661 Electronic copy https://ssrn.com/abstract=2045661 Abstract During the last decade travel and tourism has assisted the Emirates Group in spreading its wings into every aspect of travel, tourism and business to become the fastest growing corporation in its field. Emirates airlines and Middle East aviation system will face strong challenges with global aviation during the coming years. In the mean while,“the overall growth aspiration of the region demands a high-performing aviation system including airlines, airports, and air traffic control (ATC) that in 20 years must successfully serve more than four times the passengers it serves today. However, international benchmarks illustrate that even today’s aviation system does not fulfill current demand. In many Middle East countries, aviation systems’ quality and efficiency levels are well below international levels (e.g., compared to Europe and Asia). Heavy regulation also has resulted in limited service in terms of route frequency and destinations, high customer prices, and a need for high government subsidies to maintain the system.”1 Middle East aviation markets especially United Arab Emirates have set the level for reforming their aviation systems and have started encouraging trading and deregulation of airlines rules. In addition, the Middle airline sector plays a smart role in developing a world-class, such as Qatar Airways (which has a five-star Skytrax ranking) and Emirates Group (which has above-average profitability). “Aviation and transport infrastructure is the fundamental catalyst for the creation of global cities. The UAE’s open skies policy is the cornerstone upon which Dubai built its dynamic air transport hub, which in turn supports the growth of other industry sectors. The growth of Emirates embodies the spirit of competition and free enterprise, which will continue to guide their policies for the benefit of the UAE and of the global community in which they operate.”2 Finally, analyzing Emirates airline challenges through SWOT analysis and comparing it with Lufthansa Group a prove of being very active with Cargo and shipment services and passenger cater through developing there technology and advertise there 40 brands and looking to the needs of the customers. It was very obvious of the strengthen of innovation and creativity of Emirates is much stronger then the weakness and keep in going to hire new employees and buying new plans even during Dubai crisis. After compering Emirates with Lufthansa Group the largest airlines in terms of passenger and second largest airline of fleet aircraft. We will prove that Emirates is the most innovative and the fastest airlines growing in the world since they are 25 years old and Lufthansa 86 years old. 1 2 Ringbeck. J, Majdalani. F, Ismail. A, Mastering the Challenges of the Middle East Aviation System, 28 July 2006, Booz Allen Hamilton GmbH, p.1. Al Maktoum. M, Emirates Group Annual Reprot 2009-2010, http://www.theemiratesgroup.com/english/facts-figures/annual-report.aspx, p.3. 2 Electronic Electronic copy copyavailable available availableat: at: at:https://ssrn.com/abstract=2045661 http://ssrn.com/abstract=2045661 Electronic copy https://ssrn.com/abstract=2045661 Contents Abstract…………………….………………………….……………………….…..……………………..2 Emirates Airways Overview……………………..…….………………………….…………………..…5 Leadership Team and Style……………………………..………………...……………………..............6 Emirates Airline Alliance……………………………………..…………………...…………………….6 Aviation Industry Scenario.………………………………………..………………………..…………..6 Emirates Strategy………………………………………………………..…….…………………..……..7 Emirates Operational Excellence Highlights & Fleet Information……….……………………..……8 Fleet Acquisition and Financing…….…………………………….……………….…………………....9 Overcoming Recent Aviation Challenges..…………………………………………….……….….……9 Operational Strategies………………………………………………………………………....…….…..9 New Markets and Payment Schemes Technology…………………………….………….……….…..10 Customer Satisfaction Objectives…………………………………………………….…….……….…11 Knowledge Excellence of the Organization.………………………………………………..………….13 Emirates Financial Highlights.…………………………………………………….……….………......13 Profitability………………………………………………………………………….……..…………....14 Revenue……………………………………………………………………………….....……………....14 Geographical Revenue………………………………………………………………..…………...……16 Expenditure…………………………………………………………………….…….………………….16 Currency and Interest Rate Risk…………………………………………………..…………………..17 SWOT Analysis for Emirates Airways.…………………………………………….………………….20 Lufthansa vs. Emirates…..…………………………………………………….….………………...….22 Lufthansa Airlines overview……………..……………..……………..………….…..……………...…22 Airline subsidiaries wholly owned by Lufthansa…………………………………………..………….22 Alliances and Partner Airlines……………………………………………………………..……...…...23 Lufthansa and Group Fleet ..………………………………..…………...……………………….……24 Lufthansa Group Financial Highlights……………………………….…………….……….…….......25 Lufthansa Group in Comparison with Competitors…………………….…………..…………...…...28 Emirates Airline in Comparison with Lufthansa Group………………………..……………...….…28 Conclusion…………………………………………………………………….…….…………….……..30 Glossary………………………………………………………………………..…………….………..…31 Bibliography………………...…………………………………………………………………………...33 Tables 3 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Table 1: Fleet Information of Emirates Airline………………………………………………9 Table 2: Financial Highlights of Emirates Airline US$ million………………....………….14 Table 3: Revenue of Emirates Airline in US$ Million………………………….………..….16 Table 4: Geographical Revenue in US$ Million…………………………………...……..….17 Table 5: Operating costs………………………………………………………….....…….….18 Table 6 Group fleet – Number of commercial aircraft and fleet orders…………………...24 Table 7: Fleet Order Of Lufthansa Group……………………...……………………….......25 Table 8: Lufthansa Group Financial highlights…………………….....………………….....27 Table 9: Comparing Lufthansa Group with Emirates Airline………………….....…..…...28 Table 10: GDP Development Forecast 2010 to 2013…..………………………………………...29 Figures Figure 1: Aircraft Departure….……………………………………………………………....12 Figure 2: Operating Profit in United Arab Emirates Currency............…….………..……15 Figure 3: Revenue of Emirates Airline in United Arab Emirates currency…………….…15 Figure 4: Jet fuel Costs in % during last 5 years ……………...……………………………18 Figure 5: Revenue & Operating profit in EUR……….………………………………….…25 Figure 6: Lufthansa Group with competitors British Airways and Air FranceKLM……………………...……………………………………………………………...……..28 4 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Emirates Airways Overview During the mid-1980s, Gulf Air began to cut back its services to Dubai as it was concerned it was providing regional feeder flights for other carriers. As a result Emirates was conceived in March 1985 with backing from Dubai's royal family, and was required to operate independent of government subsidies, apart from US$10 million in start-up capital. Emirates Airline first flight on October 25, 1985 by the government of Dubai. The airline industry has started its operations with flights to Mumbai and Karachi and then followed by Delhi in September. Today the industry is considered to be a subsidiary of the Emirates Group which is headquartered in Dubai, UAE.3 The Emirates Group is composed of Emirates Airlines, airport services provider the Dubai National Air Transport Association (DNATA), other transportation-related activities, and a hotel group. Owned by the government of Dubai.4 Emirates have flourished under the sheikdom's "wide open skies" policy, which has brought more than 100 foreign airlines to Dubai's efficient airport, the busiest in the Middle East. The airline, simply known as Emirates, is renowned for luxurious in-flight service as well as consistently profitable growth. It is the largest airline in the Middle East, operating over 2,400 passenger flights per week,5 and it is unique among long-haul airlines in its resistance to joining a global alliance such as the Star Alliance or Oneworld. Emirates do, however, participate in code-sharing arrangements with several carriers and has a minority holding in Sri Lankan Airlines.6 The company has been provided with different recognitions and in 2010 Emirates was noted to be the sixth-largest airline in the global market in terms of international passengers being carried and largest in the world in terms of scheduled international passenger-kilometers flown. Emirates are also known for being one of the only five airline industries that operates in the entire wide-body aircraft feel. (7)(8) With a fleet of 152 aircraft,9 they are currently fly to over 103 destinations in 65 countries around the world, and their network is expanding constantly.10 Nearly 700 Emirates flights depart Dubai each week on their way to destinations on six continents. In fact, Emirates' flights account for nearly 40 per cent of all flight movements in and out of Dubai International Airport, while in 2010 they increase their market-share to 70 per cent.11 Propelled forward by their united strength, the two have evolved at a phenomenal rate to establish the Emirates Group as an immense organization, spanning a portfolio of more than 50 brands and employing over 50,000 people. 3 "Out History". Emirates group. http://www.theemiratesgroup.com/english/our-­‐company/our-­‐history.aspx. Retrieved 2 March 2011. Benham, J. "Dubai moves ownership of Emirates, Dnata to ICD – Transportation". http://www.arabianbusiness.com/dubai-moves-ownership-of-emirates-dnata-icd41385.html. Published 2008-12-31. 5 "Emirates to hire 700 pilots over next 18 months". Gulf News. http://gulfnews.com/business/aviation/emirates-­‐to-­‐hire-­‐700-­‐pilots-­‐over-­‐next-­‐18-­‐months-­‐1.636488. Retrieved 5 March 2011. 6 "Frequently Asked Questions". Emirates website. http://www.emirates.com/english/help/faqs/FAQDetails.aspx?faqCategory=193393. Retrieved 2011-­‐03-­‐05. 7 "Scheduled Passenger – Kilometers Flown". http://www.iata.org/ps/publications/Pages/wats-­‐passenger-­‐km.aspx. Retrieved 2011-­‐03-­‐05. 8 Ibid. 9 "Emirates – Details and Fleet History." http://www.planespotters.net/Airline/Emirates?show=all. Retrieved 2011-­‐03-­‐5. 10 Emirates launches first direct flight from Middle East to South America (2 October 2007). http://gulfnews.com/business/aviation/emirates-­‐launches-­‐first-­‐direct-­‐flight-­‐from-­‐middle-­‐east-­‐to-­‐ south-­‐america-­‐1.205006. Retrieved on 2 October 2007. 4 11 Emirates Group Annual Report 2009-2010, http://www.theemiratesgroup.com/english/facts-figures/annual-report.aspx, p.45. 5 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 It can be sent that since Emirates started its business operations, they are able to gain competitive position and advantage in the market place. Today’s leaders of Emirates are considered to be the most influential and essential people in the company as they are the one who make everything possible for the industry. Sheik and other leaders of the company have been able to show their innate ability to lead the company efficiently and effectively. Leadership Team and Style The Emirates Group (Emirates Airline and DNATA) success has been the continuity of its management team, many of whom have been with the airline since its start of the company. The leadership team has 23 years of experience inside the company. HH Sheikh Ahmed bin Saeed Al Maktoum (Chairman and Chief Executive, Emirates Airline & Group), Maurice Flanagan CBE Executive Vice Chairman (Emirates Airline & Group), and Tim Clark (President Emirates Airline).12 In the case of Emirates leader, they can be considered as an influential and democratic kind of leader. It is known the leadership composes the aptitude and skills to inspire as well as influence the behaviour and the thinking of the people or the subordinates. It is a process of social influence in which an individual can able to provide the support and assistance for others to achieve common goal. It can be said that the decision of Emirates Group leaders to requisite an extraordinary board meeting to deal with the issue and other leaders like Flanagan suggests that he is possess the democratic type of leadership. It can be perceived in the given case study that Emirates leader looked for final decisions made by the other members of the corporation especially the shareholders.13 Alliance Emirates are currently not a member of any of the three global airline alliances Oneworld, SkyTeam and Star Alliance. In 2000, however, the carrier briefly considered joining the latter, but opted to remain independent of the three alliances. The reason for this was later revealed by senior vice-president of the airline's commercial operations worldwide that, "Your ability to react in the marketplace is hindered because you need a consensus from your alliance partners."14 Codeshare agreements as of January 2011, Emirates has codeshare agreements with the following airlines:15 • Air Malta • • • • Air Mauritius Continental Airlines (Star Alliance) Japan Airlines (Oneworld) Jet Airways 12 .Emirates Group Annual Report 2009-2010, Leadership Team Ibid. p.10. Leadership. Emirates Group. http://www.theemiratesgroup.com/english/our-­‐company/leadership/leadership.aspx. Retrieved 2011-­‐03-­‐6 Heasley, Andrew (1/11/10). "Lone Emirates still flying high on luxury". http://www.theage.com.au/business/lone-­‐emirates-­‐still-­‐flying-­‐high-­‐on-­‐luxury-­‐20101031-­‐178u5.html. Retrieved 6 March 2011. 15 "Frequently Asked Questions". Emirates website. http://www.emirates.com/english/help/faqs/FAQDetails.aspx?faqCategory=193393. Retrieved 2011-­‐03-­‐05. 13 14 6 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 • • • • • • • Korean Air (SkyTeam) Oman Air Philippine Airlines Royal Air Maroc South African Airways (Star Alliance) Thai Airways International (Star Alliance) V Australia AVIATION INDUSTRY SCENARIO The global aviation industry suffered a disastrous during the crises, with more than a score of airline bankruptcies, shrinkage in airline networks and service levels and IATA adjusted its estimates for 2009 net losses from US$11 billion to US$9.4 billion. In the all Aviation sectors the airlines suffered contraction, fierce price-cutting and firing the employees.16 While the oil prices had dominated the first half of 2008, global recession characterized the second half and presented a grim picture for those planning the 2009-2010 fiscal years. Falling demand, shattered consumer confidence and collapsing yields confronted the airlines. A 15% contraction in world trade saw changed business patterns which in turn meant that travel budgets were slashed. According to Emirates Airline, the global aviation industry, faced with a need to invest a collective US$ 1 trillion in new, more fuel-efficient aircraft, was confronted with a banking industry reluctant to lend after the near collapse of the finance sector.17 EMIRATES AIRLINE STRATEGY The challenges faced by Emirates Airline same as any other aviation industry it was lucky to be operating in the Middle East where there was still positive growth in air travel, truism and aviation industry. According to the International Air Transport Association (IATA), "Middle Eastern carriers saw demand grow 14.3 percent, the highest among the regions. The region’s carriers continue to add capacity, increasing 15.3 percent in October and outpacing the growth in demand".18 Emirates airline was able to generate a net profit of US$ 964 million, an increase of US$ 777 million on revenues of US$ 11.8 billion, that is clear sign of efficient response to the design took in every area of the business.19 Emirates was also able to catch up with new ideas and challenges from their experience in the international environment and leaving the old traditional practices behind from being beside the customer and understand their needs through innovations and new ideas. This aim was very 16 Publisher: Island Territory of Curaçao. CURAÇAO ECONOMIC OUTLOOK 2010. http://www.spocnet.net/Bestanden/curacao_economic_outlook_2010__1281031646.pdf. P.80. Retrieved 2011-­‐03-­‐05. Emirates Group Annual Report 2009-2010, Ibid p.10. 18 Yahoo, Maktoob. Business news. “Mideast air passenger traffic jumps 14 pct”. http://en.news.maktoob.com/20090000402170/Mideast_air_passenger_traffic_jumps_14_pct/Article.htm. Retrieved 2011/03/06. 19 Emirates Group Annual Report 2009-2010, Ibid, p.38. 17 7 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 important for the company to make thing easier for customer safety and entertainment. Two examples which illustrate this philosophy:20 • When the crisis hit the world and Dubai specifically the financial institutions had almost stopped lending the money, Emirates continued to have requirements for new financing to support its growth program. Also they create new financial instrument that generated considerable excitement in the aviation and financial sectors and was recognized by an industry award. • From advance technology and a new level of safety customer sides, Emirates will be the first airline in the world to introduce the Smart-Landing and Smart-Runway safety solutions to reduce the risk of runway incursions and excursions. Which will be the level of safety to landing an aircraft. Customer service the heart of the company for Emirates and any other airlines in the world, so Emirates was able to resolve and keep developing in this sector through increasing the network, frequencies and rising service standards and add more value to the customer experience. Emirates airline Said “There was no temptation shown by the company to compromise standards or adopt a “holding operation” until the world economy recovered.” And keep challenging to improve their product and pioneering new ideas with their own. All that growth and continue facing the risk of the recession and not get heart because of they maintain their growth strategy. Emirates Operational Excellence Highlights and Fleet Information Every months and year they have surprise news about their fleet but they keep developing this important asset and put it in track. During 2009-2010 the company took delivery of 15 new aircraft, 4 Airbus A380s and 11 Boeing 777s. This brought their fleet to 152 aircraft and 194 aircraft on order up to date21, 50 Airbus A380s, 21 Boeing 777s, 5 Boeing 747s and 70 Airbus A350 XWBs plus 50 options on the type. The company plan to take delivery of new aircraft at an average of one per month, it also continues to be in negotiations with the manufacturers for additional aircraft. [Table 1] illustrates Fleet information of Emirates Airline for 2009-2010 with fleet of 142 aircraft and 146 on order22 Airbus A380 is the ultimate symbol of Emirates pioneering spirit they call it “superjumbo”. A380 continue to be the headline on any new airport in the world, including Bangkok, Toronto, Paris, Seoul and Jeddah, the first regional airport to take the aircraft. These destinations were added to an A380 network that already included Heathrow (a second superjumbo service a day will be added during 2010), Sydney and Auckland.23 20 Emirates Group Annual Report 2009-2010.Ibid, p.16-20. "Emirates – Details and Fleet History – Planespotters.net Just Aviation". http://www.planespotters.net/Airline/Emirates?show=all. Retrieved 2011-­‐03-­‐08. “Our fleet” http://www.emirates.com/english/flying/our_fleet/our_fleet.aspx. Retrieved 2011/03/08. 23 “Emirates A380 News & Events.” http://www.emirates.com/english/flying/our_fleet/emirates_a380/news_and_events/news_and_events.aspx. Retrieved 2011/3/08. 21 22 8 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Table 1: Fleet information of Emirates Airlines, Resources: Emirates Groups Annual Report 2009-10) Fleet Acquisition and Financing24 During the financial year (2009-2010), Emirates raised a total of US$ 2,389 million in aircraft financing including aircraft operating leases over the period under review, and have already received offers of finance covering all deliveries due in the forthcoming financial year. Eight B777-300ER aircraft were funded through finance leases, (with the option to refinance in the capital markets); two through sale and lease back transactions while the freighter was financed as a pure operating lease. According to Emirates airline, the financial highlight of the year was the first ever financing of Boeing aircraft through capital markets guaranteed by the US Export-Import bank on finance lease. This allowed the transaction to raise US$ 413 million to finance three Boeing 777300ERs. And this is the type of new financial instruments which Emirates created. This new structure reached a much deeper and broader investor base than the conventional bank market, which hitherto had been the traditional source of investors for Ex-Im Bank guaranteed export finance. The result was a more durable financing solution that is less vulnerable to the financial stress that constricted the banking institutions starting in the fourth quarter of 2008. The transaction was also recognized by the industry as ground-breaking and earned accolades from the financing community. Emirates have gone on to refinance two more 777-300ER aircrafts in the capital markets through this innovative structure. The four Airbus A380 units delivered, two were financed as finance leases and two through sale and lease back transactions using the German KG market. During the year, also they successfully closed two sale and lease back transactions for eight spare engines and two B777200 classic aircraft. 24 Emirates Group Annual Report 2009-2010, Ibid, p.18-21. 9 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Overcoming Recent Aviation Challenges Operational Strategies The global Aviation industry face strong challenges through the recession, while Emirate face the same challenges they used their experience in this field in very clear way and continue to take delivery of new aircraft, also invest in their brand, expend network, that was surprise to all other airlines competitor because it went opposite prevailing industry theory on increasing contraction. Cost containment strategy used to maintain organizational costs within a specified budget and to restraining expenditures to meet organizational or project financial targets. To face all this challenges it was a prior and initiatives were launched at all levels to deliver savings. Internal auditing initiatives designed to underpin cost containment included the introduction of the concept of Control Self Assessment at all outstations. This strategy was balanced against the need to safeguard jobs and keep staff costs at significantly lower levels than many of their competitors.25 New Markets and Payment Schemes Technology New markets were added to Emirates operation this year inside and outside Dubai. By creating global account manager they added value to existing customers. The new markets target, including the increasingly important cruise segment operating out of Dubai. New agreements were signed with Costa Cruises and Royal Caribbean International. A lot’s of packages were delivered during the major events, including the 2010 FIFA World Cup26, the Dubai World Cup and the Dubai Rugby 7s. 27They made them by innovative payment schemes for those booking online. Cardholders were offered the chance with zero percent interest to pay for tickets in three monthly installments. This system made an incentive way to most customers to move online to use their business transactions. This system available in 59 countries and in 13 languages, it is growing rapidly. Revenue via emirates.com continues to grow at 45% a year and in some markets contributes more than 20% of total revenue. Using this new innovative technology and the swings of consumer behavior, to shape the price policy was sophisticated. They take time when the highly sophisticated software systems that routinely track the business and set the price which compete the competitor all that price setting majored by the team member experience. They also took critical decisions on pricing that ran counter to the prevailing conventions that then informed the airline industry. Maintained fares while managing healthy yields supported by excellent load factors. While the competitors continued to discount airfares to loss levels. This was not a paradox, they made this because to sustained investment in the brand and make it powerful loyalty among customers. All this stability made the customer willing to pay a premium for that. Emirates didn’t just protect it is route network, but also they expanding it each year. Up to March 2011 they continue increasing there network routes until they reach 103 destination, so they add new destination to there network and that is one of main 25 26 27 Emirates Group Annual Report 2009-2010, Ibid p.18. "Emirates". http://www.fifa.com/aboutfifa/marketing/partners/emirates.html. Retrieved 2011-­‐03-­‐20. Emirates Group Annual Report 2009-2010 Ibid p.14, p.18-­‐24 10 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 strategy to become global airline to join any two points on the earth through Dubai airport. Some of the new route was Dubai-Tokyo, after long waited service and a year negotiation. Considering Emirates as global business they were lobbying on behalf of globalization and against the stirrings of protectionism that have resulted from the recession. They made major success of deployment the most efficient Boeing 777-300ER to the West Coast of the United States through the operational procedures and the use of new flight paths. It brands the company in very fast way through using the showcased in Bahamas of new flight paths. That was one operation to transport FIFA delegates to the Nassau destination. This smart strategy of using the assets was evident on the airfreight side, which tends to be “first in, first out” in bad economic times. According to Emirates annual report, “during 2009-2010 the global industry declined by 10%, registering a 23% fall in one month alone.” So the Emirates Sky Cargo used a strategy of protecting and securing cargo market share, and they success of doing it through resistant on fast responding to downturn and rightsizing their fleets. That made big achievement in business though double-digit growing in the volumes transported. They started the 2009 with 8 aircrafts, and ended it with seven freighters, 5 Boeing 747Fs and two Boeing 777Fs. After on they brand new aircraft and benefits were gain a lot from their efficiency and by using the strategy of economies of scale as they took their place in a large fleet of that type. Despite of the crisis and due to economic situation, advertising spend was redirected from corporate to tactical advertising campaigns to support there specific markets. They are also known to be in sport sponsorship, so they continued with a US$ 81.6 million deal to back Italian football, AC Milan. And in cricket, became the sponsor of the high profile Twenty 20 World Cup held in England. 28 The Emirates Airline marks its 25th anniversary, which is great tactic to remind people of long-term survive Brand.29 New technological progress was also made in digital communications, with their website traffic to emirates.com increasing while other airline web traffic worldwide is in decline comparing to Emirates. Their website traffic reached the highest peak in the first quarter of 2010. In the recession time of global aviation, Emirates was able to show up in every famous event and be attractive brand for the customers. That make the communication channels of the company to continue for long term marketing strategy and showing the excellent way of knowing who and where to use their business with low costs expenses. Customer Satisfaction Objectives Continue building their new strategy every where in the world for each year in 2009-2010 they opened an additional six Emirates lounges including those at Hamburg, Manchester and Mumbai airports, the latter being the first lounge in India. Around US$ 72.5 million worldwide investments dedicated for this new lounges, for first and business class customers and top-tier Skywards. The lounges are a distinctive feature of Emirates and were giving attraction for their customers. With the 6 new Emirates lounges in total they have 26 airport lounges world wide.30 28 29 30 Emirates Group Annual Report 2009-2010, Ibid p.23 “Open Sky, The public affairs journal of Emirates.” http://www.emirates.com/english/images/Issue%208%20-­‐%20OpenSky%20October_tcm233-­‐612121.pdf. Retrieved 2011/03/20. Emirates Group Annual Reprot 2009-2010, Ibid p.20-21. 11 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Aircraft Departures Every Each year we find significant change in Emirates Airlines If we look at the Aircraft departures in Figure 1 we will see the increased by 12.4% to 123,055 in comparison with 109,477 in 2008-2009.31 the eremitical increase in traffic came principally from: Figure 1: Aircraft Departure (Source: Emirates Groups Annual Report 2009-2010) Introducing new services to Durban, Luanda and Tokyo. Also increase frequencies to several existing destinations, mainly Jakarta, Rome, Doha, Bangkok, Kolkata and Kozhikode. Increase capacity to several existing destinations with bigger aircraft, mainly Dusseldorf, Munich, Paris, Seoul and Hong Kong.32 More new investment in their product, they raised baggage allowances by ten kilograms extra per person across all seating classes. This was one of the most competitive tools with all their competitors. Also they gave new improvement in bag handling at Dubai International Airport. Around US$ 78 million has been invested in adding cabin interiors and the in-flight entertainment system, like ice as part of the emphasis on continuous improvement to the fleet. The refresh cabin was completed on 26 Airbus aircraft and on four aircraft in the B777 fleet. As more passengers migrate to online check-in, they redeployed more stuff from routine checkin duties to personal passenger help which will increase their services level. Even getting in touch with Emirates became easier during the coming years with the upgrading Emirates Contact Centers under a contract with British Telecom Global Connect.33 31 Dubai International on course to become fastest growing major international airport. http://www.dubaiairport.com/DubaiAirports/English/Media+Center/Press+Release/DANews13Jan10.htm. Retrieved 2011-­‐03-­‐20. Emirates Group Annual Reprot 2009-2010, Ibid p.41. 33 Ibid p.20. 32 12 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Knowledge Excellence of the Organization Emirates Group as an immense organization are spanning a portfolio of more than 50 brands and employing over 50,000 employees for over 150 countries. The commitment to continuous improvement in product and service is completed by the ongoing drive to implement the greater efficiencies in all technical areas. The efficiencies translate into cost savings and more environmentally friendly operations it proof the excellence of the company. For support the growing Emirates fleet, they planned to open a Technical Facility for maintenance in 2010 at a cost in excess of US$ 545 million. Also it includes a paint shop that will be used to repaint the aircraft using advanced technology paints capable of reducing in-flight drag. New indictor received has been seen during the year that 1,000th GE90 engine for the Boeing 777 fleet, and the 6,000th Airbus production aircraft – an A380. This support form Emirate to their own platform for securing their future in an efficient way from the partnership such as Boeing, Airbus and Rolls Royce, it describe the key excellent of the company for the coming challenges. Also, the new Plan for opening of terminal 3 in the third quarter of 2012 for Dubai International Airport is another new levels of excellence.34 EMIRATES FINANCIAL HIGHLIGHTS In this part of the paper we will try to explain the most important subjects of the financial Emirates airline annual report of the company of 2009-2010. As we can see from table 2 Emirates was able to return a net profit of US$ 964 million, an increase of US$ 777 million on revenues of US$ 11.8 billion despite the increasing capacity in the Airport and the aircraft industry while the change in percentage in comparison with the last year was 56.4% which is a testament to the superb response to the situation made by every area of the business chosen by the company.35 In the coming pages will see the comparison between Emirates airline and Lufthansa airline with it subsidiaries and showing how this excellence testament of the company in generating 56.4% of net profit. The 17.1% of increasing with Emirates total assets is a significant from the company of show non-stop in growing strategy, which is proof the increasing number of the aircraft up to 142 during the year 2009-2010 whilst the aircraft number reach 152 up to date.36 34 35 36 Emirates Group Annual Report 2009-2010, Ibid p.20. Ibid p.4. "Emirates – Details and Fleet History – Planespotters.net Just Aviation". http://www.planespotters.net/Airline/Emirates?show=all. Retrieved 2011-­‐03-­‐20. 13 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Table 2: Financial Highlights of Emirates Airlines US$ million37 2009-10 2008-09 Change Revenue and results US$ m US$ m % Revenue and other operating income 11,834 11,782 0.4 Operating profit million $ 964 620 56.5 Operating margin % 8.2 5.3 2.9 Profit attribute to the Owner million $ 963 186 41.5 Profit margin % 8.1 1.6 6.5 Return on shareholder's funds % 21.6 4.4 17.2 Total assets million $ 15,127 12,921 17.1 Cash assets million $ 2,862 2,006 42.7 Net debt (including aircraft operating lease) equity ratio % EBITDAR million $ 158.5 167 8.5 2,897 2,256 28.4 EBITDAR margin % 24.5 19.2 5.3 Passengers carried number ‘000 27,454 22,731 20.8 Cargo carried tonnes’000 1,580 1,408 12.2 Passenger seat factor % 78.1 75.8 2.3 Overall capacity ATKM million 28,526 24,597 16.9 Available seat kilometers ASKM million 161,756 134,180 20.6 142 127 12 36,652 35,812 2.3 Financial position and cash flow Airline operating statistics Aircraft Number Employee data Average employee strength number Profitability Emirates ended the financial year with an operating profit of AED 3,565 million (US$ 964 million) which is AED 1,287 million (US$ 350.4 million) or 56.5% better than the previous year and a healthy operating margin of 8.2% or 2.9 percentage points higher than last year. The 37 Emirates Group Annual Report 2009-2010, Ibid p.4. 14 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 profit margin also recovered to 8.1% from 1.6%, as significant achievement in a difficult year which indicated in Figure 2 using the operating Profit in United Arab Emirates currency (AED).38 Figure 2: Operating Profit in United Arab Emirates Currency, (Source: Emirates Groups Annual Report 2009-2010). Revenue Figure 3 Showing the Revenue of Emirates Airline for the last five years in United Arab Emirates Currency (AED) in billion remained stable in the last two years. In 2009-10 AED 42,477 million (US$ 11,567 million) in comparison with 2008-09 AED 42,459 million (US$ 11,562 million) they are very close. The reason behind the stability of the last two years came from stability of the passenger revenue and the decline in the cargo revenue because of the decrease of the freight yield per FTKM39 during the Dubai crisis at the end of 2009. We will see that in details at table 3 showing the revenue of Emirates Airline.40 Figure 3: Revenue of Emirates Airline in United Arab Emirates Currency, (Source: Emirates Groups Annual Report 2009-2010). In Table 3 we introduced the Revenue of Emirates Airline in US$ Million. Passenger revenue at US$ 8,985 million was marginally higher by US$ 79.7 million While Cargo revenue at US$ 38 39 40 Emirates Group Annual Report 2009-2010, Ibid p.38-39. FTKM : Cargo tonnage uplifted multiplied by the distance carried. Emirates Group Annual Report 2009-2010, Ibid p.38-39. 15 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 1,719 million is 8.1% lower than last year (2008-09: US$ 1,871 million), also the result of declining yields. While cargo tonnage increased by 12.2% over the previous year mainly in the second half of the year, freight yield per FTKM declined by 18.9%. Revenue from cargo, mail and courier continues to constitute an important 17.2% (2008-09: 18.2%) of Emirates transport revenue.41 Table 3: Revenue of Emirates Airline in US$ Million42 2009-2010 2008-2009 Change US$ million US$ million % Passenger 8,985 8,904 0.9 Cargo 1,719 1,871 (8.1) Courier 116 95 22.6 Excess baggage 75 95 (20.3) Mail 42 34 23.8 10,940 11,000 (0.6) Sale of goods 470 425 10.5 Destination and leisure 42 52 (19.6) Other 114 83 37.5 Total 11,567 11,562 _ Transport Revenue 41 42 Emirates Group Annual Report 2009-2010,Ibid p.38-­‐40 Ibid p.38. 16 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Geographical Revenue There was an increase and decrease in geographical area this change came for the shift in transport revenues if we check table 4 we will see Americas continent 8.1% is the highest in comparison with other this surprise impact came from opening new routes while the West Asia and Indian Ocean region experienced stronger revenue growth over other regions, but in revenue East Asia and Australasia in the highest during the year 2009-2010 that is confirm the operation of emirates are very high in this region because the have most of there network destinations in this regions. Europe coming the second in revenue even though have less destination than Asia region they are also sponsor of famous sport teams and very high promotion in their brand name.43 Table 4: Geographical Revenue in US$ Million44 Year Europe Americas 2009-10 Gulf, Middle east and Iran 1,345 3,162 1,090 3,225 1,449 1,295 11567761410 2008-09 1,318 3,318 1,008 3,294 1,344 1,278 11562859470 2.00% (4.70)% 8.10% (2.10)% 7.80% 1.30% %Change East Asia and Australasia West Asia and Indian Ocean Africa Total Expenditure If we check table 5 we can see the total operating cost of the 2009-10 year at US$ 10,863 million were US$ 299 million or 2.7% less than the previous year the main reason was behind the reduction in the jet fuel bill which is lower by US$ 690.3 million or 17.6%. More than that the Employee cost increase by 8.3% which compares with 15.9% growth in capacity, reflecting an impressive productivity gain per airline employee, and employee numbers also increased by 2.3% to reach the total number of 50 thousand employees. 43 44 Emirates Group Annual Report 2009-2010, Ibid p.39. Ibid p.39. 17 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Table 5: Operating costs45 2009-10 Jet fuel Employee Aircraft operating leases Sales and marketing Depereciation Handling In-flight catering and other operating costs Overflying Landing and parking Aircraft maintenance Cost of good solds Amortisation Corporate overheads Total operating costs 08-09 %Change 09-10% of operating costs 3,242 1,727 1,119 822 787 764 593 3,933 1,596 1,034 904 585 689 523 (17.6) 8.3 8.3 (9.1) 34.6 10.8 13.4 29.9 15.9 10.3 7.6 7.2 7 5.5 391 238 230 229 18 695 10,863 348 200 185 223 16 920 11,162 12.3 18.9 24.2 2.7 13.1 (24.4) -2.7 3.6 2.2 2.1 2.1 0.2 6.4 100 For the last five years Emirates was trying to reduce the jet fuel cost to improve their efficient and be environmental friendly which they already awarded this more than once, so during 200910 they made and improvement in their aircraft engines also buy new engines for some old plane. If we look at figure 4, we can see the Jet fuel costs at US$ 3,242 million or 29.9% during 2009-10 while US$ 3,933 million or 35.2% during 2008-09. This change is not just environmental friendly or increasing the efficiency it is also very profitable for the organization to prove their excellence in follow the right strategy.46 Figure 4: Jet fuel Costs in % during last 5 years (Source, Emirates Group Annual Report 2009-10) 45 46 Emirates Group Annual Report 2009-2010, Ibid p.40. Ibid p.40. 18 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Currency and Interest Rate Risk Any efficient organization hedge against currency risk exposures and interest rate and that is what Emirates Airline did to take an advantage from the market movement and currency swaps, so they continue to target a balanced portfolio approach to gain this advantage. For hedging was around half of its interest rate and currency risk exposures, using prudent hedging solutions including swaps and options tools. The borrowings and lease liabilities (net of cash) also aircraft operating leases, at 31 March 2010, comprised 83% on a fixed interest rate basis with the balance 17% on floating interest rates, while 2008-09 the fixed interest rate was comprised of 61% basis with the balance 39% on floating interest rates. Increasing one percentage point in interest rates would increase the interest charges and the operating lease charges (net of interest income) during the next financial year by US$ 20.1 million (2008-09: US$ 29,6 million). At 31 March 2010, Emirates borrowings and lease liabilities carried an effective interest rate of 2.5% and (2008- 09: 3.5%). They managed their productivity in currency exposure by using prudent hedging solutions and currency swaps, options and natural hedges through outflows denominated in Pound sterling, Euro, Australian dollars, New Zealand dollars and Japanese yen. For the year ended 31 March 2010, hedging coverage for Pound sterling, Euro, Australian dollars, New Zealand dollars and Japanese yen were 14%, 24%, 29%, 81% and 91% respectively.47 47 Emirates Group Annual Report 2009-2010, Ibid p.44. 19 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 SWOT Analysis for Emirates Airways This part of the paper will analyse the strategic position of Emirates Airline through the use of SWOT analysis. Based on the given case, the strategic position of the Emirates Airline specifies their airline and aviation position has been challenged because of the changing situations of the airline market. Rival industries of the company has been able to announced the establishment of their business approach in the global market which offers diversity of airline industries to cater the needs of the passengers, cargo and shipment services. The announcement of this company affects the strategic position of the entire Emirates Airline. In order to make sure that the company will not be left behind, Emirates Airline has been able to involve themselves into the expansion to technological developments. Through the use of SWOT analysis, the strategic position of Emirates Airline in 2011 will be analyzed. Strengths As a competitive and globally recognised airline industry, Emirates Airline has been able to have strategic position in the global market. In fact, when Emirates Airline streamlined their business, it already had the advantage of size. With several consecutive years of multibillion profits, the company has outshined its major rival companies to become a model firm. Emirates Airline’s decision to focus on diversified market and by considering and extended the cargo shipping and their customer service was a courageous one, and it has led to its current position as one of the top global brands. Even upgrading the system to Emirates Contact Centers under a contract with British Telecom Global Connect make the company more branded. The firm has likewise been characterized by many analysts to have an ability to adapt to changing market conditions in order to maximize profit. Listening to and identifying with consumers has allowed Emirates Airline to construct a corporate culture that bears little resemblance to the Emirates Airline of the past. The ability to continuously renew and improve their service in the airline and aviation while effectively managing the needs of their target audience is the key to maintaining Emirates Airline’s leader status and the key for succeeding in having strategic position. Weaknesses Not all of diversification and approach have been successful and this can be considered as one of the flaws or weaknesses of the company. Analysts have accused the company of focusing too much on their high-end acquisitions and diversification in spite of the risky effects of such decisions. 20 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Opportunities The basis for long-term competitiveness is the ability to develop continuously new generations of more advanced airline and aviation services. Therefore one of the company’s opportunities is to tap into more markets as a result of the innovations being introduced in the aviation. Localized capabilities enabling or even enhancing such co-operationwill always make a difference when it comes to first-mover advantages. The opportunity to penetrate new growth markets where internet adoption still has room to go, Leveraging Emirates Airline’s infrastructure business to get first choice and stronger position against rivals is also an opportunity. They also have the opportunity to get ahead of their rival companies, and this should be the case, since the said market is a potential sizeable source of income. The trend of considering the internet market also shows cases new opportunities for the company. Threats Rival companies are major threats to the business (Gulf Air Company GSC, British Airways Plc, Air France-KLM S.A. Deutsche Lufthansa AG, Qatar Airways Group). Emirates Airline, in contrast, started out in other lines of business and entered and airline capabilities of the company. The firm’s inability to keep up with innovations, or recognize its demand, creates a threat for them, a risk that they could be displaced by other industry leaders. The legal and political environment in the countries where they operate in could potentially affect the business negatively. Their apparent complacence could be used by their rival companies to their advantage, and take Emirates Airline by surprise, with the latter realizing too late that they are not the industry leader anymore. 21 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Lufthansa vs. Emirates The European airline industry is a competitive and dynamic industry whose fortune is closely linked to the performance of the overall European economy. It is impossible to conceive of the European Union (“EU”) economy being able to achieve sustained growth in the future without an improvement in the performance of an integrated transport system and air travel is an increasingly important component within that. After examines the structure of the Emirates airline industry and analyze the financial issues of Emirates Airlines now I will shortly describe Lufthansa financial industry and their group overview. Which is consider one of the strongest Emirates Airline Competitor Lufthansa Airline Overview Deutsche Lufthansa AG was founded in 1926 (as Deutsche Luft Hansa Aktiengesellschaft), and re-founded in 1954. 48 It is the flag carrier of Germany and the largest airline in Europe in terms of overall passengers carried. It also considers the fifth largest airline in worldwide in terms of overall passengers carried. The airlines are operating services to 18 domestic destinations and 183 international destinations in 78 countries across four continents Europe, America, Asia and Africa. Together with its partners Lufthansa services around 410 destinations.49 Airline subsidiaries wholly owned by Lufthansa50 • • • • • • • • Air Dolomiti (Italy) Austrian Airlines (Austria). British Midland International(UK). Edelweiss Air(Swiss). Germanwings, low-cost subsidiary of Eurowings (Germany). Lufthansa Cargo, an air cargo company (Germany). Lufthansa CityLine, a regional carrier (Germany). Swiss International Air Lines (Basel). 48 “History” Lufthansa Group website. http://konzern.lufthansa.com/en/history/twenties.html. Retrieved 2011/03/06. “World Airlines.” Flight International. Weekly News 2007/04/03 : p. 107. 50 “Lufthansa Annual Report 2009.” Major Subsidiaries. p. 216-­‐221. 49 22 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Other Airline subsidiaries51 • • • • • • • Brussels Airlines, Lufthansa acquired a 45% stake in the Belgian airline with an option to acquire the remaining 55% in 2011. Eurowings a regional carrier, 49% owned by Lufthansa. Jade Cargo International. Lufthansa Cargo owns 25% of the company, remainder is held by Shenzhen Airlines, which has a 51% stake, and DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbH, a subsidiary of the German state-owned KfW bank – with 24%. It started operations in March 2005 with intra-Asian services. It is the first cargo airline in China with foreign ownership. JetBlue Airways, an airline headquartered in New York, 19% owned by Lufthansa. Lufthansa Italia, a subsidiary which operates flights from Milan Malpensa to destinations across Europe, with a fleet of nine Airbus A319 aircraft. It is intended to capture a large slice of the Milan market following major cutbacks by Alitalia as a result of its hub change to Rome Fiumicino Airport. Luxair – Lufthansa holds a 13% stake. SunExpress, airline based in Antalya, Turkey; 50% owned by Lufthansa (The remainder is owned by Turkish Airlines). Alliances and Partner Airlines Alliances are fundamental to Lufthansa’s success. As a founding member of Star Alliance, Lufthansa offers innumerable advantages in the world’s biggest global network. Its regional strategy under the Lufthansa Regional brand connects Europe’s regions with one another and with the world beyond. Bilateral partnerships augment and enhance the services portfolio.52 Star Alliance On May 18, 1997 Lufthansa, Air Canada, Scandinavian Airlines, Thai Airways and United Airlines formed the Star Alliance, the world's first unilateral airline alliance. The global alliance groups together 28 leading airlines, which offer flights to well nigh any point in the globe.53 Lufthansa Regional Under the Lufthansa Regional brand, carriers of the likes of Air Dolomiti, Augsburg Airways, Lufthansa CityLine, Contact Air and Eurowings operate point-to-point flights across Europa as well as connecting flights to onward international destinations on Lufthansa’s behalf.54 51 “Lufthansa Annual Report 2009.” Ibid. p. 216-­‐221. Ibid, p.6. “Star Alliance.” Lufthansa Group. http://konzern.lufthansa.com/en/alliances/star-­‐alliance.html. Retrieved 2011/03/06 54 “Lufthansa Regional.” Lufthansa Group. http://konzern.lufthansa.com/en/alliances/lufthansa-­‐regional.html. Retrieved 2011/03/06. 52 53 23 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Codeshare Agreements Lufthansa has bilateral cooperation accords with a host of quality airlines. The partner airlines include Air India, Air Malta, Air Moldova, JetBlue Airways Jat Airways. Cimber Sterling, Cirrus Airlines, Ethiopean Airlines, Luxair, Mexicana, Qatar Airways and TACA.55 Lufthansa and Group Fleet With over 722 aircraft it has the third-largest passenger airline fleet in the world when combined with its subsidiaries (look at table 6 and 7). Group’s fleet is a core operating resource and the largest asset in the consolidated balance sheet. It stands at the centre of the value creation process. The fleet includes aircraft from different manufacturers, principally Boeing and Airbus. The Canadian manufacturer Bombardier and Embraer from Brazil are also represented with larger numbers of aircraft that are deployed mainly in the Lufthansa regional companies.56 Table 6 Group fleet – Number of commercial aircraft and fleet orders Manufacturer/type LH Airbus A300 Airbus A310 Airbus A319 Airbus A320 Airbus A321 Airbus A330 Airbus A340 Airbus A380 Boeing 737 Boeing 747 Boeing 767 Boeing 777 Boeing MD11F Bombardier CRJ Bombardier C-Series Bombardier Q-Series ATR Avro RJ BAe 146 Embraer Fokker F70 Fokker F100 Cessna Citation Total aircraft 6 3) 3 26 38 42 15 52 LX 7 23 6 11 13 63 30 OS bmi 7 8 6 3) 1 2) 2 11 10 9 3 11 17 4U CLH EN EW LCAG 26 6 4 19 18 1) 10 52 10 20 5 1) 14 20 5 18 8 15 1) 4 3) 3) 3 9 15 17 102 67 2) 4 317 84 26 Note Lufthansa AG (LH), SWISS (LX), Austrian Airlines (OS), British Midland (bmi), Germanwings (4U), 70 14 23 19 56 6 3 77 79 63 30 67 0 91 30 6 4 19 90 0 20 24 38 8 39 9 15 4 722 Lufthansa CityLine (CLH), Air Dolomiti (EN), Eurowings (EW) and Lufthansa Cargo (LCAG) as of 31.12.2009 1) Let to Lufthansa regional airlines. 2) Let to SWISS. 3) Leased to company outside the Group. 55 Group fleet Ibid “Corporate Facts.” Lufthansa Investor Relations. http://investor-­‐relations.lufthansa.com/en/fakten-­‐zum-­‐unternehmen/fleet.html. Retrieved 2011/03/06. 24 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Table 7: Fleet Order Of Lufthansa Group57 Lufthansa Group Financial Highlights Deutsche Lufthansa AG is a global aviation group. The Group operates in five business segments, each dedicated to high quality standards. The five units – the passenger airline business, logistics, MRO, catering and IT services – all play a leading role in the industry in which they operate. The Lufthansa Group includes a total of more than 400 subsidiaries and associated companies.58 In the year 2009 Lufthansa ended the financial year see (Figure 5) with an operating profit of EUR 130 million (US$168 million), and achieved total operating revenue of EUR 22.3 billion (US$28.8 billion) for the year. The five business segments play a leading role in operating revenue and profit and they employed some 118,000 personnel at the end of 2009. Figure 5: Revenue & Operating profit in EUR million (Recourse: Lufthansa annual report 2009. P.2.) 57 58 “Lufthansa Annual Report 2009.” Ibid, p. 70. Ibid. p.1-­‐6. 25 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Passenger Airline Group falls in passenger numbers and prices affected the traffic figures for all the airlines in the Passenger Airline Group while Logistics Lufthansa Cargo was hit very hard by the collapse in the airfreight market. In the main while MRO, IT Services and Catering continued its courses of profitable growth. Despite a sharp decline in demand in Catering. It was able to generate profit the reason was LSG Sky Chefs is the global market leader in airline catering and also via partnerships grows in innovations and environmental awareness. Lufthansa Passenger Airlines responded swiftly to the crisis, cutting costs and imposing a hiring freeze. With Climb 2011 they also address structural shifts in demand patterns and aim at improving earnings by EUR 1bn by the end of 2011. Strong financial profile with its established financial strategy Lufthansa promotes corporate performance and safeguards it against fluctuations in demand and on financial markets look at (Table 8: Lufthansa Group Financial highlights). 26 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 59 Table 8: Lufthansa Group Financial highlights Revenue and result 2009 2008 Change in % 28,811 32,120 – 10.3 22,761 25,821 – 11.8 Operating result 168 1,655 – 89.8 EBIT 124 1,166 – 89.4 EBITDA 2,253 3,034 – 25.7 Net profit/loss -144 700 Total assets 34,124 28,973 17.8 Equity ratio 23.5 28.4 – 5.9 pts Net indebtedness 2,838 -161 Cash flow from operating activities 2,574 3,197 – 19.5 Capital expenditure (gross) 3,109 2,785 11.7 Total revenue of which traffic revenue Key balance sheet and cash flow statement figures Traffic figures Passengers thousands 76,543 70,543 8.5 Freight and mail thousand tonnes 1,712 1,915 – 10.6 77.9 78.9 – 1.0 pts 60.3 62.8 – 2.5 pts 893,235 830,832 7.5 112,320 108,123 3.9 117,521 107,800 9.0 Passenger load factor Cargo load factor Flights % % number Employees Average number of employees Employees as of 31.12. number number Note: Lufthansa Group: meaning Lufthansa airline and all Lufthansa subsidiaries and the sum of all five segments operation (Passenger Airline Group, logistics, MRO, IT Services and Catering) 59 “Lufthansa Annual Report 2009.” Ibid p.144-­‐146. 27 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Lufthansa Group in Comparison with Competitors With an operating profit of US$ 168m (EUR 130m), the Lufthansa Group (look at figure 6) again takes a leading position among its competitors in 2009. Figure 6: Lufthansa Group with competitors British Airways and Air France-­‐KLM (Sources: Lufthansa Annual report 2009) In comparison with competitors, Lufthansa’s greater earnings stability is clearly visible. Even in the crisis year 2009, which many airlines are closing with heavy losses, Lufthansa was able to generate an operating profit.60 Emirates Airline in Comparison with Lufthansa Group Emirates Airline in comparison with Lufthansa special for the last year 2009 is very clear that Emirates is the fastest growing airline in the world. Both airlines hit with the crisis from worldwide crisis to Dubai crisis. Comparing both companies for the financial year of 2009 (Table 9): Table 9: Comparing Lufthansa Group with Emirates Airline Companies comparison of 2009 Lufthansa Group Emirates Airline Revenue US$28.8 billion US$ 11.8 billion Operating profit US$168 million US$ 964 million 60 “Lufthansa Annual Report 2009.” Ibid, p.19-­‐20. 28 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 After looking at table 9 we can see Emirates was able to return a net profit of US$ 964 million which is five times higher than Lufthansa while Lufthansa revenue is twice higher than Emirates airlines this is a testament to the superb response to the situation made by every area of the business by Emirates airlines. The important factor between both of them Lufthansa is Global aviation and it operates in 183 international destinations except the regional destinations while Emirates is international airline and it operate in 102 international destinations without regional destinations and no alliance. The key success for Emirates they have very modern fleet which Lufthansa Airline and Lufthansa group didn’t have yet. Emirates owning 8 aircraft of A380 and 50 on order while Lufthansa ordering new 15 aircraft of A380. Boeing aircraft 777 300ER which reach the other side of cost Emirates owning 52 and 19 in order, but Lufthansa doesn’t have much of this Family they just has 4 of 777 with their subsidiaries and 30 of Boeing 747 while 20 on order.61 One of the most important factors between both airlines Middle East and Asia/Pacific GDP (look at table 10) and airlines traffic estimation is growing very fast according to IATA Emirates Airlines took that in consideration and they are very developed in Middle East Area and they are opening two new destinations Asia/Pacific.62 Emirates have very innovative strategy to respond to the markets and invest in each creative market special of being sponsors for famous event that promoting the brand worldwide. Table 10: GDP Development Forecast 2010 to 2013. 61 62 “Eimrates Group Annual Report 2009-­‐2010.” Ibid.45. “Lufthansa Annual Report 2009.” Ibid. P.51-­‐53. 29 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Conclusion In this case study about Analysis of Luxury Airlines Emirates Airways important subjects such as company overview, leadership team and style, alliance, aviation industry scenario, Emirates strategy, emirates operational excellence highlights and fleet information and fleet acquisition and financing were introduced and highlighted. In addition, overcoming recent aviation challenges such as operational strategies, new markets and payment schemes technology, customer satisfaction objectives and knowledge excellence of the organization were included and illustrated. Furthermore, financial highlights, profitability, revenue, expenditure, currency and interest rate risk of Emirates Airlines and geographical revenue in US$ Million were shown. SWOT Analysis such as Strengths, Weaknesses, Opportunities and Threats were introduced and analyzing lufthansa group with Emirates airlines. In this paper I went through a short overview about the Emirates Airline describing that company has got one of the youngest fleet in the world and one of the most developed aviation. Looking to the awards which Emirates groups got more than 400 international awards are making it clear to understand they are luxury aviation and very modern airline. One of the main reason which was behind making of the Emirates Groups very success was behind the leadership team which they had more than 23 years of experience with the company it self after all this experience make Emirates Airlines to be proud of not having alliance comparing to other companies. Looking back to the aviation industry in the worldwide it was so strange to make Emirates Airlines to keep in operation and continue of buying new fleet and developing the company infrastructure. After all when I analyzed the SWOT analysis and looked at the challenge of the company of being very active with Cargo and shipment services and passenger cater through developing their technology and advertise their 40 brands and looking to the needs of the customers. It was very obvious of the strengthen of the company is much stronger then the weakness of keep in going to hire new employees and buying new plans even during Dubai crisis. Compering Emirates with Lufthansa Group the largest airlines in terms of passenger and second largest airline of fleet aircraft. I could say Emirates is the most innovative and the fastest airlines growing in the world since they are 25 years old and Lufthansa 86 years old. 30 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Glossary AED (Arab Emirates Dirham): United Arab Currency. ASKM (Available Seat Kilometer): Passenger seat capacity measured in seats available multiplied by the distance flown. ATKM (Available Tone Kilometer): Overall capacity measured in tones available for carriage of passengers and cargo load multiplied by the distance flown. Codeshare Agreement: sometimes simply codeshare is an aviation business arrangement where two airlines share the same flight. A seat can be purchased on one airline but is actually operated by a cooperating airline under a different flight number or code. The term "code" refers to the identifier used in flight schedule, generally the 2character IATA (International Air Transport Association) airline designator code and flight number. Currency Swap: A swap that involves the exchange of principal and interest in one currency for the same in another currency. It is considered to be a foreign exchange transaction and is not required by law to be shown on a company's balance sheet. EBITDAR: Operating profit before depreciation, amortization and aircraft operating lease rentals. EBITDAR Margin: EBITDAR expressed as a percentage of the sum of revenue and other operating income. FTKM: Cargo tonnage uplifted multiplied by the distance carried. Hub: In air traffic a hub refers to an airline’s transfer airport, a central connecting point for different routes. Passengers and goods are transported from the original starting point to the airport’s hub. From there they are carried to their destination by a second flight alongside passengers and goods from other departure points. IATA: International Air Transport Association – the international trade association for the airline industry. MRO: Short for maintenance, repair and overhaul of aircraft. Passenger-kilometer/tone-kilometer: Standard output units for air transport. A revenue passenger-kilometer (RPK) denotes one fare-paying passenger transported one kilometer. A revenue tone-kilometer (RTK) denotes one tone of load (passengers and/or cargo) transported one kilometer. 31 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 EBIT: Financial indicator denoting earnings before interest and taxes. EBITDA: Financial indicator denoting earnings before interest, taxes, depreciation and amortization. Depreciation relates to items of property, plant and equipment and amortization to intangible assets – both terms apply equally to non-current and current assets. The figure also includes impairment losses on equity investments accounted for under the equity method and on assets held for sale. Operating result: Measure of profitability denoting the operating result calculated as the result of operating activities, adjusted for book gains and losses, write-backs of provisions, exchange rate gains and losses on the measurement of non-current borrowing as of the reporting date and income and expenses relating to other periods, Traffic revenue: Revenue generated solely from flight operations. It comprises revenue from transporting passengers and cargo as well as related ancillary services. Group of consolidated companies: Group of subsidiaries included in a company’s consolidated financial statements. 32 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 Bibliography • Al Maktoum. M, Emirates Group www.theemiratesgroup.com. • Benham, J. "Dubai moves ownership of Emirates, Dnata to ICD – Transportation". www.arabianbusiness.com. • “Corporate Facts.” Lufthansa Investor Relations. http://investor-­‐relations.lufthansa.com. • Dubai International on course to become fastest growing major international airport. http://www.dubaiairport.com. • "Emirates – Details and Fleet History." http://www.planespotters.net. • "Emirates to hire 700 pilots over next 18 months". Gulf News. http://gulfnews.com. • Emirates launches first direct flight from Middle East to South America (2 October 2007). http://gulfnews.com. • Emirates Group Annual Report 2009-2010, http://www.theemiratesgroup.com. • Emirates A380 News & Events.” http://www.emirates.com. • "Emirates". http://www.fifa.com. • "Emirates, Details and Fleet History. Planespotters.net Just Aviation. • "Frequently Asked Questions". Emirates website. http://www.emirates.com. • Heasley, Andrew (1/11/10). "Lone Emirates still flying high on luxury". http://www.theage.com. • “History” Lufthansa Group website. http://konzern.lufthansa.com. • • Island Territory of Curaçao. CURAÇAO ECONOMIC OUTLOOK 2010. http://www.spocnet.net. Leadership. Emirates Group. http://www.theemiratesgroup.com. • “Lufthansa Annual Report 2009.” • “Mideast air passenger traffic jumps 14 pct” Yahoo, Maktoob. Business news. http://en.news.maktoob.com. • “ Open Sky, The public affairs journal of Emirates.” http://www.emirates.com. • “Our fleet” http://www.emirates.com. • "Our History". Emirates group. http://www.theemiratesgroup.com/english/our-­‐company/our-­‐history.aspx. • Ringbeck. J, Majdalani. F, Ismail. A, Mastering the Challenges of the Middle East Aviation System, 28 July 2006, Booz Allen Hamilton GmbH. • "Scheduled Passenger – Kilometers Flown". http://www.iata.org. • • “Star Alliance.”, “Lufthansa Regional.” Lufthansa Group. http://konzern.lufthansa.com. “World Airlines.” Flight International. Weekly News 2007/04/03. 33 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661 “All rights reserved. No reproduction, copy or transmission of this publication may be made without written permission.” Safi, Abedelazez, “Analysis of Luxury Airlines Emirates Airways and Competitors” (25 May, 2011) Contact Information: Name: Abedelazez Surname: Safi Skype: abed_Safi Email: abedelazez.safi@gmail.com Linkedin webpage: http://www.linkedin.com/in/abedelazezsafi 34 Electroniccopy copyavailable available at: at: https://ssrn.com/abstract=2045661 Electronic https://ssrn.com/abstract=2045661