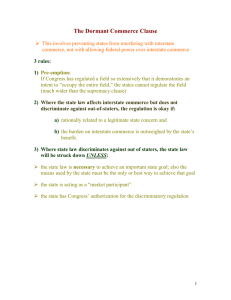

Attack Sheet for Issue Spotters – Con law 1 Break the facts down to rules set out by the state and by the fed. gov., See exactly where the requirements don’t meet up Start with Standing: Is there a constitutional issue here? 1. Injury - there must be an 1)actual and 2)immediate injury present? 2. Causation - the P must show that there is a direct link inter their injury and the D 3. Remedy - there must be a way for the injury to be remediable by a favorable decision in the case Standing and Taxes: *general rule is that a taxpayer's connection to such government action does not give her any more stake in the government's action than any other citizen-taxpayer and whatever injury exists is thus not sufficiently particularized to count as an injury-in-fact for purposes of standing. In the Frothingham case, the case on which this problem was based, the Court held that the taxpayer's alleged injury was too "remote" and "speculative." See Frothingham v. Mellon, 262 U.S. 447, 487 (1923). Even if the federal government spends money under the Maternity Act, there is no assurance that a given taxpayer's taxes will increase. Moreover, Frothingham held that a federal taxpayer's interest in the federal treasury is too minute and indeterminable to show injury for standing. See id. Finally, Frothingham expressed concern that, if individuals like Frothingham could establish standing, then virtually any taxpayer would have standing to challenge virtually any federal spending program. See id. The Court was unwilling to go that far Move on to: 1. Ripeness - P must have an injury that is real, present, and legitimate (or on the horns of a dilemma: an ultimatum, either do this thing or suffer consequences) 1. Mootness - the P must bring a claim that where relief can be granted (mootness focuses on whether the controversy has subsided to the point that judicial intervention is no longer necessary. Example: supposed issue has gone on so long without issue that it no longer Is necessary to argue over) (case: On the other hand, this case is quite different than the abortion issues involved in Roe v. Wade . A pregnancy only lasts for nine months, and it is very difficult for an abortion case to make it to a higher level court in that amount of time. As a result, there is a much stronger case for arguing that the abortion issues are "capable of repetition but evading review." 1. Political Question(14th amend) - those issues, which have already been assigned to specific political powers, must be addressed by said specific political powers. Federal courts should not hear cases which deal directly with issues that the Constitution makes the sole responsibility of the Executive Branch and/or the Legislative Branch. (Baker v. Carr) Examples of political questions: a. The president’s conduct of foreign policy b. Challenges to the impeachment process c. The apportionment of votes in a state 6 Tests for non-justiciable political questions (1) a textually demonstrable constitutional commitment of that issue to another political branch (best description on an exam) (2) lack of judicially discoverable and manageable standards for resolving the issue (3) an impossibility of deciding the issue without making an initial policy determination of a kind not suitable for judicial discretion (4) a lack of respect for the other branches of government in undertaking independent resolution of the case (5) an unusual need for unquestioning adherence to a political decision already made (6) potential for embarrassment for differing pronouncements of the issue by different branches of government Guaranty Clause Article 4 section 4 of the constitution The Guarantee Clause requires the United States to guarantee to the states a republican form of government, and provide protection from foreign invasion and domestic violence. Necessary and Proper clause? ⁃ Congress cannot mandate individuals, only those expand upon those powers which it already possesses. If a cause that congress is trying to gain federal regulation (control) over is in no way related to any of congress’ powers listed in the constitution (stemming from the powers to lay and collect taxes, to borrow money, to regulate commerce, to raise and support armies and navies, etc.) then they cannot use the nec and prop. Clause to argue authority/regulation Within the limits of the 10th amendment? (Congress does not have the right to regulate states) (Reno) The Tenth Amendment limitations on federal power extend only to attempts by the Federal Government to compel legislative or executive action on the part of the States in the regulation of their citizens as part of administering a federal program. In Reno v. Condon, the Supreme Court of the United States illustrates two basic concepts: (i) the supremacy of federal law (Congress may pass laws that affect state action) and (ii) the sovereignty of the individual States (Congress may not pass laws that require the states to expend resources enforcing federal policy). *The Tenth Amendment does not prevent the Federal Government from regulating the States as individual entities if it does not ask the States to enforce a federal program. Commerce Clause? Article 1 section 8 clause 3: To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes; Within Congress’ commerce power? (Commerce clause and Dormant commerce clause) Channel of Interstate Commerce: <Subject to federal regulation A channel of interstate commerce is a route of interstate commerce--anything upon which or through which interstate commerce is conducted and thus facilitates interstate commerce. (Ex: railroad, highway, shipping route, Rivers, the internet) If congress wants to enact a program over major highways in an effort to make them more safe, then that can fall under the commerce clause as the highways are a channel of interstate commerce Thus under the Commerce Clause, Congress can regulate channels of interstate commerce directly and, under Pierce County v. Guillen, indirectly, so long as it could reasonably believe that its regulation would affect channels of interstate commerce. Instrumentality of Commerce <subject to federal regulation An instrumentality of interstate commerce is a vehicle of interstate commerce-anything in which interstate commerce is conducted and thus facilitates interstate commerce. (Ex: airplanes, cars, cell phones, the internet,) Electronic communications, aircraft, and shipping vehicles are all vehicles of interstate commerce and thus facilitate interstate commerce. They are therefore instrumentalities of interstate commerce. Guns, courts (and judicial remedies), and assaults are not vehicles of interstate commerce, and they do not directly facilitate interstate commerce. Substantial Effects on Interstate Commerce: <subject to federal regulation The Supreme Court has ruled that Congress can regulate under its Commerce Clause authority in a third area: where the regulated activity "substantially affects" interstate commerce. 4 elements to consider: 1. Whether the regulated activity is commercial in nature; (Commercial activity is activity that involves trade--usually goods or services for money or something of value. (Restaurant service, loan-sharking, mining) (cases: US v. Morrison, US v. Lopez) 2. Whether the congressional statute contains a jurisdictional element; (a simple phrase added to a statute that requires that the regulated activity substantially affect interstate commerce) (ex: Because the jurisdictional element, by definition, limits the application of the act to those instances within congressional authority, i.e., those that substantially affect interstate commerce) (The jurisdictional element requires the plaintiff or the prosecution to show a substantial effect on interstate commerce as an element of the underlying cause of action or crime) 3. Whether Congress reasonably found that the regulated activity substantially affects interstate commerce; (ex: Testimony before a Senate subcommittee, and reflected in subcommittee findings, that firearms move freely in interstate commerce and are found in increasing numbers near schools) (But the existence of congressional findings is not sufficient, by itself, to sustain the constitutionality of Commerce Clause legislation. As we stated in Lopez, "[S]imply because Congress may conclude that a particular activity substantially affects interstate commerce does not necessarily make it so." US v Morrison) 4. Whether the link between the regulated activity and interstate commerce is too attenuated. Dormant Commerce Clause? Is there conflict inter the state and federal regulation? = dormant commerce clause (Basically we are trying to make sure states are not giving themselves advantages AND that they are not placing a burden on interstate commerce) Under the Dormant Commerce Clause cases, if a state law discriminates against out-ofstate goods or nonresident economic actors, the law can be sustained only on a showing that it is narrowly tailored to advance a legitimate local purpose. Where the statute regulates evenhandedly to effectuate a legitimate local public interest, and its effects on interstate commerce are only incidental, it will be upheld unless the burden imposed on such commerce is clearly excessive in relation to the putative local benefits. (City of Philly v. NJ) ^Rule: If a state law discriminates intentionally against out of state interests, the law must serve an important interest and there must be no reasonable alternatives. If a state law is not intentional discrimination, then its benefits need only outweigh the burdens on interstate commerce. *A commerce restriction can be upheld if it is a valid environmental protection method. (Minnesota v. Clover Leaf Creamery Co) Tax and Spending Clause? Gives congress the power to pass laws and to lay and collect taxes. Key case: Sebelius Does the medicaid expansion violate the spending clause? ⁃ Ct says it was violated quia the act was forcing states to comply with federal rule ⁃ Especially quia the fed. Rule said it was going to defund states which were not complying with the medicaid expansion Conclusion? ⁃ The individual mandate and the affordable care act is constitutional under the tax clause, but the medicaid expansion is not constitutional 4 Main Limitations on Spending Power: 1. the expenditure must be for the general welfare 2. the condition must be clear and unambiguous 3. condition must be reasonably related to the purpose of the expenditure 4. the legislation must not violate any independent constitutional provisions Congress may tax and apportion for the general welfare, but Congress may not use taxation as a means to exercise powers retained by the States. (Butler) The power of congress to authorize expenditures is not limited to specific enumerated powers of the constitution ⁃ IE: the spending powers could be used to incentivize nearly any behavior The spending clause provides for federal crime prohibiting anyone under federal funding from taking a bribe (Sabri) Non-coercive financial incentives by Congress are a constitutional exercise of the taxing and spending power. (SD v. Dole) Congress can withhold federal funding from the states if they do not comply, but not a “coercive” amount ⁃ They have to give the states a choice as well according to the 10th amend. either ⁃ just regulate yourselves voluntarily by their own standards or according to fed. Standards; or ⁃ state law pre-empted by federal regulation <(fed. Gov must pay for the regulation in this case) Preemption A doctrine under which certain federal laws preempt, or take precedence over, conflicting state or local laws. The preemption doctrine refers to the idea that a higher authority of law will displace the law of a lower authority of law when the two authorities come into conflict. Types of Preemption 1. Express 2. Implied 3. Field - congress completely dominates the field 4. conflict (Fl. Lime) - conflict inter federal and state *When a state and federal statute exist with different standards, as long as both statutes can coexist, the Supreme Court of the United States will not decide whether or which one preempts the other. (FL Lime) *States don't have the power to regulate immigration. State law must give way to federal law in at least two circumstances. (Arizona) 1. First, the States are precluded from regulating conduct in a field that Congress, acting within its proper authority, has determined must be regulated by its exclusive governance. 2. Second, state laws are preempted when they conflict with federal law. This includes cases where compliance with both federal and state regulations is a physical impossibility, and those instances where the challenged state law stands as an obstacle to the accomplishment and execution of the full purposes and objectives of Congress. Executive Privilege Presidential executive privilege (PEP): The purpose of the PEP is to improve the quality of presidential advice and decision making. The PEP does this by ensuring that the President and his advisers will feel free to speak candidly about policy issues, and that they will feel comfortable advancing unorthodox, tentative, or "off the wall" ideas for the President's consideration. (US v Nixon) Protection of communications The PEP protects the content of deliberative discussions between the President and his advisers ⁃ It does not protect ALL of a presd’ communications or all comm. inter pres. And his advisors Staff Communications: In order for the privilege to apply to staff deliberations, three things must be shown. 1. First, the President's staff must be involved in the deliberative discussions. See Paul F. Rothstein & Susan W. Crump, Federal Testimonial Privileges § 6:2 (2d ed. 2007). 2. Second, the deliberations must be made as part of a process designed to render advice to the President. Id. 3. Finally, the staff's job duties must extend to the issues in question. Id. In other words, it is incorrect to suggest that it is not necessary that the officials be able to show that their job duties extended to the issues in question When to assert PEP The PEP may be asserted either by a sitting president or by a former president. And it can protect both sitting and former presidents. In addition, in an appropriate case, the President's staff may assert the privilege on his behalf until he has the chance to decide whether to assert it To invoke the PEP, the President must submit an affidavit invoking the privilege. See Paul F. Rothstein & Susan W. Crump, Federal Testimonial Privileges § 6.3 (2d ed. 2007). In addition, the President must segregate and produce non-privileged information found in privileged documents PEP is a qualified privilege. As a leading commentator on the privilege suggests, courts consider a variety of factors in deciding whether to uphold the PEP or to require disclosure. These factors include the relevance of the documents to the civil litigation, the availability of other (nonprivileged) documents that might be available to plaintiffs, the seriousness of the litigation and the nature of the issues, the role of the government in the litigation, and the potential impact of disclosure on the willingness of presidential advisers to speak candidly. In other words, it is incorrect to suggest that the mere "relevance" of the documents is a determinative consideration. While it is a factor, it is not determinative.