Textile & Garment

Industry in Vietnam

Research on Garment Producers in Vietnam

International Business Research Vietnam 2008

Ms. L. Buisman

Ms. G.J. Wielenga

Groningen

August 15th, 2008

University of Groningen, Faculty of Economics and Business

International Business Research Vietnam 2008 – Bandolera

1

Executive Summary

Vietnam is known to have an impressive and quickly developing textile and garment industry and low

labor costs. These factors make it a possible interesting and attractive market for Dutch garment and

fashion brands such as Bandolera. Bandolera is a Dutch fashion brand for women of 25‐60 years. Her

collections are designed with special care, made out of high‐quality fabrics and use many details and

accessories to provide women with trendy clothing. For her production she is already settled in China

and India and now looking for extra sourcing possibilities in Vietnam. The goal of this report is to give

an answer to the main question whether it is interesting for Bandolera to produce their garment in

Vietnam.

From February till August 2008, the International Business Research Project of the University of

Groningen contained market research in Vietnam by order of Bandolera. The research was executed

by 2 selected business students of the Faculty of Economics and Business and supported by two

assistant‐professors. To get detailed information on all important aspects, both desk‐ and field

research was executed, of which the later took place in Vietnam (May – June 2008).

To decide whether it is interesting for Bandolera to let their garment be produced in Vietnam, three

requirements are of main importance. First of all, the fabrics Bandolera wants to use should be

available in Vietnam and of good quality. Secondly, the local garment producers have to be capable of

producing fashionable garment with many details, for low order quantities ranging from 300 – 3.000

pieces and deliver everything within 90 days in the depot in The Netherlands. Third and last of all,

Vietnamese legislations should not restrain the export of garment and good logistic services of should

well represented for both shipment and airmail.

The fabrics available in Vietnam are mainly cotton, followed by polyester and silk. The garment sector

needs up to 200.000 tonnes of cotton for its export plans. The current production does not meet

more than 2% of this demand. Despite big investments by the government, the production of cotton

is decreasing in the last couple of years due to low economic efficiency. The production of polyester

only meets 4% of the national demand. Recently, big investments have been made in the polyester

plants which should be able provide in 50% of the national demand by 2012. The silk production in

Vietnam is small and still in a traditional way. Compared to Japanese silk the quality is low. It turns out

that Vietnam does not have the machinery and capacity to produce silk for the industry to export.

Overall, different sources confirm that the Vietnamese production of fabrics is insufficient to provide

in the sector’s demand, making it dependent on import. In terms of quality, Vietnam can provide in

low‐to‐mid level quality, but high quality fabrics still need to be imported from China, Taiwan, etc. It

has to be noted that Vietnam is heavily investing in its fabric production capacity, but the focus is first

of all on quantities and these plans also cope with many difficulties.

In general, most garment companies (70%) are located in the south of Vietnam, near the harbor and

airport of Ho Chi Minh City. In total we visited 17 garment companies in Vietnam. These company

visits clarified that the focus of the sector is on massive quantities of low to mid‐level quality. These

massive quantities are needed because the main reason for customers to go to Vietnam for

production of garment is its low pricing. There are a lot of big quantities orders of low quality fabrics

available for low prices, which has the interest of huge corporations mostly from the US. Although the

machinery in Vietnamese factories is new and advanced, there is little market for the production of

small, fashionable orders. Often Vietnamese garment producers will not accept low order quantities,

because they need to keep their machines running and do not have the time to instruct the sewers on

different production lines how to create many details. They realize high turnovers by producing large,

simple orders for low prices. None of the companies we visited could meet all requirements of

Bandolera.

The Vietnamese government is promoting the export of garment and therefore there is no restriction

on the export of garment and very little legislation influences the delivery times of garment orders.

Next to that, logistic services in Vietnam are well represented and accommodated. However, there

International Business Research Vietnam 2008 – Bandolera

2

are some setbacks concerning the pricing methods. Bandolera prefers pricing on Cost & Freight (C&F),

in which the producer takes care of all logistic matters until the delivery in the customers’ depot. One

step down is pricing on Freight on Board (FOB), in which the producer takes care of the goods until

they are on board of the ship. Pricing on FOB is becoming more common in Vietnam, but is still

considered as a risky business. We have not found any producer willing to deliver orders on C&F base.

Other barriers exist in the more informal aspects such as language and communication problems.

These barriers make it necessary for a company such as Bandolera to, when producing in Vietnam,

keep a close eye on the production to prevent mistakes and misunderstandings.

Based on the requirements of Bandolera it is difficult to find a fitting garment producer in Vietnam.

Vietnamese fabric plants are not able to produce middle‐to‐high quality fabrics, and often the quality

is not stable. Next to supplying fabrics from other foreign countries buttons, sewing threads,

interlining, shoulder pads, and other embroidery are imported as well. Due to the fact that most must

be sourced from other Asian countries, the lead/delivery time of garment as well as the cost price of

garment increases. Furthermore, Vietnamese garment companies are not specialized in the

production of detailed, fashionable garment and also do not prefer this kind of orders. At this

moment there is much competition in the textile and garment industry and there are many big

quantity orders available, guaranteeing salary and employment. Because of the bad fit on two of the

three investigated aspects, we can answer our main question negatively. All together, Vietnam does

not appear as an interesting market for Bandolera to invest her time and energy in.

International Business Research Vietnam 2008 – Bandolera

3

Preface

There is no doubt about it, Vietnam is booming. Since the adoption of the doi moi (“renewal”) policy

in the late 1980s, Vietnam’s economy has shown remarkable growth. Numerous economic

progressions have transformed the centrally planned economy into a market‐based one. Over the last

five years Vietnam reached a steady average economic growth of 8 percent. When Vietnam joined the

World Trade Organization in 2007, the international borders were officially opened and in that same

year the amount of foreign investments doubled to 7.8 billion US dollars.

Vietnam has become a great potential for foreign investors because of its crude oil production, its

richness in natural gas reserves and its hardworking workforce with low labor costs. All together,

Vietnam has become one of Asia’s best economic performers and is often described as the “new

China.” This makes it an interesting business opportunity for Dutch companies.

From February till August 2008, the International Business Research Project of the University of

Groningen contained market research in Vietnam for 11 Dutch companies. The report in front of you

is the result of the research for one of those companies: Bandolera, a Dutch fashionable garment

brand for women. The research was executed by 2 selected business students of the Faculty of

Economics and Business and supported by two assistant‐professors.

Goal of this report is to give an answer to the question whether it is interesting for Bandolera to

produce their garment in Vietnam. To do this, we looked at three aspects: (1) the availability of fabrics

in Vietnam, (2) visiting and evaluating local garment producers on capability, and (3) the influence of

legislations and the availability of logistic services. To get detailed information on all three aspects,

both desk‐ and field research was executed, of which the later took place in Vietnam (May – June

2008). During our stay in Vietnam we visited both state‐owned and private companies and held

interviews with different experts and agents. The results of our research are represented in this

report.

For all the help we received during the research and the writing of the report, we would like to thank

our assistant‐professors Mr. dr. K.J. Alsem and Mr. dr. T.W. de Boer. They have guided us through

many difficulties during our research and supported us with the writing of the report. In Vietnam we

had many help when communicating with Vietnamese companies from our interpreters, Ms. Nguyen

Thuy Vy and Ms. Nguyen Hong Chinh. Many thanks for all their help, without them we could not have

gathered as much information as we have. Finally we would like to thank Mrs. Nghiem Lien Huong

and Mr. Jos Langens for their help and hospitality during our stay in HCMC. From them we received

many important additional information, we otherwise would not have been able to find.

A last word to all readers of this report; we have put much effort in writing this report as clear and

pleasant as possible. We hope you will find the information you are looking for. Enjoy!

August 2008, Groningen.

Lisette Buisman and Gerda Wielenga

International Business Research Vietnam 2008 – Bandolera

4

Content

Executive Summary............................................................................................................................... 2

Preface

4

Content

5

Chapter 1

Introduction..................................................................................................................... 7

1.1

Bandolera............................................................................................................................. 7

1.2

Purpose of research and research questions........................................................................ 8

1.3

Conceptual Model................................................................................................................ 9

1.4

Report set up ..................................................................................................................... 10

Chapter 2

Methodology ................................................................................................................. 11

2.1

General methodology ........................................................................................................ 11

2.2

Criteria for selection of new garment producers................................................................ 11

2.3

Decision Tree ..................................................................................................................... 14

Chapter 3

The Vietnamese Fabric Market ...................................................................................... 16

3.1

Current situation and trends in the Vietnamese fabric market .......................................... 16

3.2

Overview main domestic production of fabrics.................................................................. 17

3.3

Conclusion ......................................................................................................................... 18

Chapter 4

The Vietnamese Garment Industry ................................................................................ 20

4.1

Economy ............................................................................................................................ 20

4.2

Export of textile and garment ............................................................................................ 21

4.3

Overview of companies...................................................................................................... 21

4.4

The Vietnam Textile and Apparel Association .................................................................... 22

4.5

Future plans ...................................................................................................................... 22

Chapter 5

Evaluation of Garment Producers .................................................................................. 24

5.1

Description of visited garment companies and factories.................................................... 24

5.2

Final evaluation of garment producers............................................................................... 32

5.3

Comparisons to current producers of Bandolera................................................................ 35

5.4

Excluded garment producers ............................................................................................. 35

5.5

Experts and agents............................................................................................................. 36

5.6

Conclusion ......................................................................................................................... 37

Chapter 6

Logistics and Legislation............................................................................................... 391

6.1

Legislation and rules about exporting garment to the EU ................................................ 391

6.2

Pricing and payment ........................................................................................................ 391

6.3

Logistic service companies Vietnam – The Netherlands ..................................................... 40

6.4

Informal trade barriers in the Vietnamese garment industry ............................................. 41

International Business Research Vietnam 2008 – Bandolera

5

6.5

Conclusion ......................................................................................................................... 42

Chapter 7

Conclusion and Recommendation ................................................................................. 43

7.1

Conclusion ......................................................................................................................... 43

7.2

Recommendation............................................................................................................... 44

References

...................................................................................................................................... 46

Overview of Appendixes ..................................................................................................................... 47

Appendix 1 Abbreviation List............................................................................................................ 48

Appendix 2 Process of Fabric Production.......................................................................................... 49

Appendix 3 Process of Garment Production ..................................................................................... 51

Appendix 4 Maps of Vietnam ......................................................................................................... 526

Appendix 4.1......................................................................................................Provinces of Vietnam

52

Appendix 4.2 ........................................................................................... Industrial zones of Vietnam

53

Appendix 5 Agenda in Vietnam and Contact Details......................................................................... 54

Appendix 5.1 ........................................................................................................ Agenda in Vietnam

54

Appendix 5.2 .............................................................................................................. Contact Details

55

Appendix 6 List of Rejected Garment Companies ............................................................................. 59

Appendix 7 Checklist ........................................................................................................................ 62

International Business Research Vietnam 2008 – Bandolera

6

Chapter 1

Introduction

Bandolera is a Dutch fashion brand for women of 25 – 60 years. The company is searching for new

attractive sourcing places to improve her production process, possibly in Vietnam. In this first chapter

we will give more information about the company and what she is precisely looking for. We will

continue with clarifying the purpose of the research and its research questions. This is further

illustrated with a conceptual model. We conclude the chapter with an outline of the set up of the

report.

1.1

Bandolera

Bandolera was established in 1985 as an original wholesaler. Over the last 20 years, Bandolera has

grown to an international ladies fashion brand. Their main market lies in Europe, but Bandolera also

has selling points in the United States (US) and Canada. The brand Bandolera is sold in 40 different

countries and Not The Same (NTS; an independent coordinated casual line of Bandolera) is available

in 30 countries. With 40%, the Netherlands still takes care of the biggest part of the turnover,

followed by Belgium and Norway.

Bandolera sells over 1.5 million garments annually, representing a yearly turnover over € 50 million

(year 2007). Worldwide Bandolera has more than 2,400 points of sale, including several Bandolera

stand‐alone or franchised shops and several shops incorporated within department stores. In total,

Bandolera has 51 mono‐brand Bandolera stores and NTS shops. The company started with

establishing its own stores three years ago. Of the total turnover of 2007, more than 60% is exported

to 25 countries. Over 2007, the turnover rate growth was 30%.

Quality management is very important for the company. The designing, buying of materials, making of

patterns, planning and supervision of production all takes place at the head office in Rotterdam, The

Netherlands. All materials are tested for quality, shrinkage and wear ability. To keep the ability of

bringing out 16 collections per year, the need for precise delivery dates and quick supply re‐orders is

very high. Bandolera therefore needs to retain control over the whole process from designing to

1

logistics .

Philosophy and market positioning

Bandolera focuses on the young dynamic woman who leads an active life. Bandolera’s collection aims

to create a distinctive image which is trend following, while offering the possibility of multiple

combinations, but still providing an elegant and feminine feeling.

To keep close track on fashion trends, Bandolera has its own trend watchers who are following the

international fashion scene. Next to that, Bandolera offers 16 collections a year, which is a flexible

way for the styling department to keep close track of the trends and share them with Bandolera’s

customers. In short, Bandolera tries to combine high quality and service with a strong, trend following

image.

Sourcing: suppliers in Turkey, India and China

Bandolera is already working with garment producers in Turkey, China and India. They have the

longest and strongest relationship with the factory in Ünlu, Turkey. Bandolera has worked with them

since they started. Of the whole Bandolera collection, 50% is produced in Turkey. Bandolera is co‐

owner of this factory, 20% of the production of this factory is for Bandolera. The relationship with this

factory is strong; they do not just produce the garment, but also take care of small problems at the

scene when these occur (for instance local logistic problems). The factory in Ünlu (Turkey) has 800

sewers. For Bandolera they mainly produce suits (blazers, pants, confection). The production of these

is still cheaper and better in Turkey then in Asia. Bandolera’s head of purchase (Mrs. P. Punt‐

Oldenhof) visits this factory together with a stylist every two weeks. This is mainly to check the

processes and to fit the fitting samples.

For the NTS brand, all garments are produced in Asia. Bandolera is cooperating with India and China

for about 3½ years. In relationship terms this is still short. One of the difficulties with finding a new

1

www.bandolera.com, 4 March 2008

International Business Research Vietnam 2008 – Bandolera

7

garment producer in Asian countries is the difference in language and culture. The Asian way of doing

business is not always as straight forward as the Western way of doing business. Samples that are

shown by producers, for example, could be models that they do not make anymore, or even have not

produced in their own factory. It has taken Bandolera 2 years to establish a real open, trustful

relationship with their current producers in China and India. They visit the companies in China 2 to 3

times per year. First Bandolera visits the factory, after that the factory will send the samples to the

Netherlands where they will be checked on fit size. The factories in China are in Hongzou, ShangHai,

Beijng and Hong Kong. They have the fastest delivery times and have the most and newest materials.

The factories in China and India usually have about 50/100 sewers. A lot of jackets are produced in

Asia. For the fitting of the garment from Asia, the samples are flown in by air. Fitting ladies in the

Netherlands will check if the sizes are correct. After that the samples are sent back to the factory. The

usual process is that samples from Asia are sent forth and back by air, while the real production order

is shipped over sea. This is necessary to catch the deadline of total delivery time of 90 days, but also

results in € 400.000 ‐ 500.000 UPS costs per year. The total delivery time of 90 days is very tight and

important for Bandolera to be able to bring out 16 collections per year. These 16 collections per year

mean that they offer a new collection every 2/3 weeks. Therefore the first delivery time is usually the

tightest and is sometimes send by air.

In general, orders are placed per size and per color. Sizes range from 36 – 46. The average quantity

per model of an order from Bandolera is 1.500 pieces (with ranges between 300 – 3.000 pieces, with

pikes to 200 or 5.000 pieces). This order size does not differ over the different product groups (pants,

blouses, etc.). Patterns are designed by Bandolera and send to the producer digitally.

Future plans

In the first half year of 2008, 20 new mono brand stores are opened in the Netherlands, Belgium,

Germany, Poland and Turkey. The brand has also announced a new start in the United States.

Bandolera hopes that the development of activities in the US will lead to an important contribution to

a quick growth of the company worldwide. In the second half of this year another 20 stores are

planned to open. As every company, Bandolera is looking for new ways to improve its production

process. Because of the great development of the textile industry and the low labor costs in Vietnam,

Bandolera is hoping for a new sourcing place to support its future plans.

1.2

Purpose of research and research questions

The purpose of this research is to provide Bandolera a solid report on base of which Bandolera will

make a well‐considered decision whether to produce garment in Vietnam. At the same time the

report will provide practical information about doing business in Vietnam (i.e. governmental laws and

policy with regard to production and export of garment), which is relevant for Bandolera when she

decides to enter the Vietnamese fabrics and garment market.

We are looking for the opportunities for Bandolera to produce middle‐to‐high quality garment in

Vietnam. Main aspects are whether fabrics are available in Vietnam (homemade), investigating which

producers are able to produce the required garment of Bandolera, and also enquire practical things

which are concerned with entering the Vietnamese market. The above mentioned leads to the

following problem statement:

Is it interesting for Bandolera to produce their garment in Vietnam?

To answer this question, we divided the subject in 3 main research questions (RQ). Each of them is

divided in several sub questions (SQ) which we will try to answer in this investigation. The research

questions are also summarized in a conceptual model at the end of this paragraph.

RQ1

What is the availability of fabrics in Vietnam?

This research question provides insight in the different kinds of fabrics (yarns, fabrics, accessory,

embroidery) used for production of garment products of Bandolera. Bandolera has provided the

research time information about the characteristics of the different kinds of yarns and fabrics which

are used in their production/fashion line. Also an overview is given about the fabrics that are available

in Vietnam, which of these are homemade and which of these are imported.

International Business Research Vietnam 2008 – Bandolera

8

SQ1.1

SQ1.2

SQ1.3

SQ1.4

What kind of fabrics does Bandolera in general use for the production of her collections?

What kinds of fabrics are available in Vietnam (divided by homemade fabrics and imported

fabrics)?

What is the delivery time of the homemade and imported fabrics?

How can fabrics in Vietnam be characterized in terms of quality compared to surrounding

exporting Asian countries?

RQ2

Can Vietnamese garment producers meet the selection criteria provided by Bandolera?

This research question provides insight in the Vietnamese market of fabrics and garment producers.

An extensive list of Vietnamese textile and garment producers will be put together. A checklist is used

to evaluate each producer whether it is an interesting company for Bandolera to do business with.

This checklist uses grades to assess for example the capacity, quality, references and the level of

English of the local producer. The companies with the most potential are visited in Vietnam and again

evaluated with a checklist of criteria. Contact information of the visited companies is included in

Appendix 5.2 of this report.

SQ2.1

SQ2.2

SQ2.3

SQ2.4

SQ2.5

SQ2.6

Which local producers are advised to us by our contact persons?

Do Vietnamese garment producers have the capacity, machinery, experience and certificates

to produce for Bandolera?

Are Vietnamese garment producers able to produce fashionable garment products similar to

the current Bandolera collection?

Are additional items and accessories (such as buttons and YKK‐zippers) available in Vietnam?

What is the production time and estimated price of counter and fitting samples?

With which lead times and payment terms for complete orders do Vietnamese garment

producers in general work?

RQ3

Which Vietnamese legislations and logistic services influence the export of garment to The

Netherlands?

This research question provides insight into the practical execution of the research in the case that

Bandolera wants to do business with a Vietnamese producer.

SQ3.1

SQ3.2

SQ3.4

1.3

What do Vietnamese legislations specify about the export of different kinds of Vietnamese

garment products to the EU?

Which local producers are available to facilitate in matters of logistics? For example, are

Western companies such as UPS/DHL represented in Vietnam?

What are the costs and delivery times of logistic services from Vietnam to the Netherlands?

(Airmail and shipping?)

Conceptual Model

To mark the boundaries of our research, we created a conceptual model (see figure 1.1 below) in

which we simplify the Vietnamese textile and garment market. The conceptual model represents the

main concepts and their relationships which are of significance to Bandolera and about which we

collected information. The model can be read from left to right, divided in three parts. Starting at the

left side of the model, we begin our research with the availability of fabrics, yarn and accessories

(RQ1). The second ‘column’ focuses on the Vietnamese production lines (RQ2). The third column

represents the subject of RQ3 where the influence of legislations and the availability of logistic

services are attended.

International Business Research Vietnam 2008 – Bandolera

9

Figure 1.1

Conceptual model

Fabric

Sample(s)

Yarn

Airmail

Production

lines

Bandolera

Order

Shipment

Accessories

Legislation

Government

1.4

Report set up

The report is divided in 7 chapters, of which the first gives an introduction of the purpose of the

research. In chapter 2 the general methodology and the specific manner of data collection is

described. The 3rd chapter describes the availability and quality of fabrics and fabric production in

Vietnam. In chapter 4 we give a description of the general Vietnamese garment industry with current

statistics and future plans. Chapter 5 gives an overview of the relevant company visits, compared with

Bandolera’s current suppliers and some main conclusions about the availability of potential garment

producers in Vietnam. In the 6th chapter we give more information about logistics and legislation

concerning the export of garment from Vietnam to The Netherlands. We end the report with

conclusions and recommendations for Bandolera in chapter 7.

International Business Research Vietnam 2008 – Bandolera

10

Chapter 2

2.1

Methodology

General methodology

The research was conducted in two phases; the desk research in the Netherlands and the field

research in Vietnam. The desk research was executed from February 2008 till May 2008. In this part of

the research information about the Vietnamese textile and garment industry was collected on the

internet. A first selection of garment producers was made through the use of 5 different lists2 of

garment producers. These producers were e‐mailed and if no response was received, a telephone call

was made to get in contact with the companies. Through this way we reached out to 80 companies, of

which 20 responded and 17 appointments were made. A different way to get more knowledge about

the Vietnamese textile and garment industry was to build relationships with useful contact persons

and experts. In the Netherlands, we received information from Mr. Westland and Mr. Vrieswijk about

their experience with export and logistic matters from Vietnam to The Netherlands. We also received

information from Mr. Marsman about his experience with importing garment from Vietnam.

Furthermore we found two theses, though which we reached two old PhD‐students, one in HCMC and

one in Hanoi. With both contact persons we made appointments in Vietnam. We also got in contact

with the University of HCMC and a Dutch garment producer that has been active in the Vietnamese

garment industry since 1986. In desk research phase of the research we were able to get in touch with

5 contact persons and experts in Vietnam and 3 in The Netherlands.

From the 5th of May 2008 till the 06th of June 2008 field research was executed in Ho Chi Minh City (3

weeks) and Hanoi (2 weeks). In this part of the research data was collected through interviews with

garment producers and experts, and through company and factory visits of selected garment

producers. The focus was on the areas in or nearby the centers of both cities, at least within 2 hours

driving. In HCMC this contains the provinces Ho Chi Minh, Binh Duong (and Long An). In Hanoi this

contained the province Hanoi and some surrounding provinces.

In total we were able to build relationships with 11 contact persons and experts who lead us to 17

possibly interesting companies. Of these we were able to contact 11 companies. In total we visited 17

companies and interviewed 7 contact persons or experts.

2.2

Criteria for selection of new garment producers

Bandolera provided the research team with criteria selections to search for potential suppliers. These

criteria are demands Bandolera sets for all her producers and which producers should be able to

fulfill. General criteria such as the capacity, machinery, export experience and certificates (ISO) of the

company will give details about the company’s business. These are usually displayed in the company’s

profile. Based on the information in these profiles, companies were selected for a company and

factory visit. During these visits the criteria discussed below were checked. Below, the criteria and

how these are evaluated during a company visit are discussed.

Company profile

Capacity: The maximum capacity of a producer is not very important, it is more important whether

they can make 10.000 pieces per month (minimum requirement). Because the quantity of Bandolera

orders lie within the range of 300 – 3.000 pieces, it is important that producers are able to produce

these small orders. The average per model is 1.500 pieces, which can be used to make price

comparisons.

Data collection: During the interview questions are asked about the capacity per model, the capacity

per month or year of the factories, the size of current orders, the number of workers in the factories

and the number of production lines.

Machinery: The kind of machinery that is used in the factory shows what skills the company has inside

and which kind of activities they have to outsource. For example, the presence of spinning lines,

weaving looms, knitting machines, dyeing machines, sewing machines and embroidery machines

show which kind of fabric and garment can be made.

2

See references Chapter 8

International Business Research Vietnam 2008 – Bandolera

11

Data collection: When visiting the factory, machines are checked whether they are fully used and if

not, what explanation this has. It is a bad signal if there is, for example, a layer of dust on the

machinery. Next to that it is important to check what kind of machinery they have and use. The

brands of these machines are written down.

Export experience: The experience of Vietnamese companies with exporting to western countries

(preferably they export to the EU, but if not they should at least export to the US). Producers that do

not already export are not potential, because then they are not familiar with the process of exporting

and dealing with English speaking customers.

Data collection: In the interview, questions are asked for which customers they produce and to which

countries they export. While walking around in the factory and looking at samples in the showroom,

labels of garment are checked for familiar brands. The ability to work with foreign countries also

becomes clear in how well the communication is going during the interview. We check this by judging

the grade of English of the contact person and whether or not it is necessary to use a linguist

ISO norms: The ISO 9001 certificate is a standard to check the organization of the company, but the

use of it should not be overestimated. ISO 9001 is one of the standards in the ISO 9000 family of

standards for quality management systems. ISO 9000 is maintained by the International Organization

for Standardization and is administered by accreditation and certification bodies. Some of the

requirements in ISO 9001 include (1) a set of procedures that cover all key processes in the business,

(2) monitoring processes to ensure they are effective, (3) keeping adequate records, (4) checking

output for defects, with appropriate and corrective action where necessary, (5) regularly reviewing

individual processes and the quality system itself for effectiveness, and (6) facilitating continual

improvement. ISO 9001 certification does not guarantee that the company delivers products of

superior (or even decent) quality. It just certifies that the company engages internally in paperwork

prescribed by the standard. Some companies use the ISO 9001 certification as a marketing tool.

Data collection: During the interview, questions are asked about the presence of ISO 9000, ISO 9001

and SA 8000 certificates. Usually certificates like ISO are publicly displayed.

Fabrics

In the research we search for all kind of fabrics and garment. Strong requirement is that producers

work with middle‐to‐high quality fabrics and can supply these fabrics. The focus thus lies on good

quality fabrics, not cheap ones. The processing of good fabrics is more complex. To have short

delivery times, fabrics should be produced in Vietnam and not imported from China. Because delivery

times are short, fabrics should be available in just a few days. If fabric has to be imported, it takes at

least a few days to cross the border. Because Bandolera works with a tight schedule, they stress on

precise delivery dates and quick supply re‐orders. Bandolera starts her process of designing a new

collection with the fabric. The fabric is the first input and with this fabric they design a new model.

Therefore Bandolera is searching for special fabrics of good to, preferably, high quality. Next to that, it

is also very important that the quality of the fabrics is stable. The quality Bandolera is looking for is

middle price level, not at the budget‐end and also not at the high‐end price level. The producers have

to be able to show with what kind of fabric they are working with and can find. They almost never

have fabrics in stock. Bandolera mostly uses its own colors, therefore fabrics have to be dyed specially

for Bandolera´s production.

Data collection: When visiting the companies, questions will be asked about which kind of fabrics the

companies work with and where they get there fabrics from. When asking about the delivery times of

the fabrics, the focus lies on fabric from scratch (before the dyeing takes place), because Bandolera

often uses her own dyeing colors. Another important aspect of fabrics is the quality, this is difficult to

check. Therefore we ask questions, take pieces of fabric and we also ask if quality of the fabrics is

stable. In a later stadium, these fabrics can be re‐checked for quality by Bandolera.

Garment

Bandolera is looking for the production of all kinds of product groups; t‐shirts, jeans, blouses, etc. The

only garment product group Bandolera is not interested in is underwear. Every factory is usually

specialized in one product group, for example they are only specialized in making jeans. But if they

can make blazers, they usually also are able to produce blouses. If factories make many different

product groups, then these will be separate divisions with a different manager you have to deal with.

International Business Research Vietnam 2008 – Bandolera

12

Bandolera collections are not simple, but mainly have detailed and complex designs. Some

embroidery has to be done by hand. Therefore the products are very labor intense. Interesting is

whether Vietnamese garment producers are specialized in one specific garment group and if this fits

with the Bandolera style. Producers have to already be familiar with the kind of garment products

that Bandolera is looking for, they should not have to develop it.

Data collection: As mentioned most companies specialize in one kind of product group. Important is

what kind of garment the company is specialized in, which they can produce and which they produce

at the moment. Furthermore questions are asked about which brands of yarn, interlining and

shoulder pads they work with. A good brand for yarn is COATS. A good tool to judge a company is to

check whether they understand the product specifications of Bandolera, if they have their own

laundry and also if they are able to print digitally sent patterns. When visiting the factory and judging

samples from the showroom a better insight can be given of the quality of lining, shoulder pads and

workmanship.

Accessories

Not only the fabrics should be available, but also the zippers and the buttons. It is a prior requirement

that they work with YKK zippers. These are the only zippers which can be guaranteed to work

correctly. The buttons Bandolera is working with varies with the season.

Data collection: During the interview questions are asked with what kind of accessories the company

is working. Zippers have to be from the brand YKK. Furthermore it is important to ask for a sample

book of the buttons the company is working with. Usually every producer has its own brand and there

is no well known brand of buttons. Best would be to get a sample book of buttons, but this can also

be copied. With blazers it is important to ask what kind of shoulder pads they use. Producers should

be able to show what kind of buttons, shoulder pads interlining they work with. For embroidery and

prints we ask whether the company can make them in their own factories or if they have to outsource

them. During the visiting of the factory, we check with what kind of machines the embroidery and

prints are made.

Samples

For fitting of the garment from Asia, the samples are delivered/send by air. The experience of

Bandolera with Asian suppliers is that they usually do not charge costs for the first sample. The

making of the first sample (proto‐type) usually takes 21 days. Before a whole order is placed,

Bandolera asks for 50 salesroom samples. After this the proto‐sales take place in about 2 months.

Data collection: When visiting the factory, it should be possible to ask whether a B‐choice (a rejected

product) can be given to us. The making of the first sample (the proto‐type) usually takes about 21

days. This sample should be without costs. Before a whole order is placed, Bandolera asks for 50

salesroom samples. Usually the costs of these samples should be about 150% of the production price.

Furthermore we ask if they have a separate sample room and if yes, what is the capacity and the

number of employees working there. When looking at samples in the showroom it is important to ask

whether they made a production order of these samples and if this took place recently. The samples

of Bandolera will be demonstrated at the end of the interview. We will use these to ask them if they

can make similar garment and if yes, we also ask for an estimation of the production price.

Delivery times

The lead time of Bandolera’s production order has a maximum of 90 days, within which the garment

should be delivered in stock in Rotterdam. On average it takes 2 weeks (14 days) to produce the fabric

and 4 weeks (28 days) to ship the garment. That leaves 48 days to finish the garment. If the delivery

time cannot be handled, the products can be flown in by air but the question is if this is affordable.

There are different prices in which deals and contracts can be made. Pricing on CMPT base only

includes the price of total product, inclusive fabric, sewing thread, buttons and sewing of the

garment. Pricing on FOB base means free on board, this means that the producer will deliver until the

Vietnamese border. Bandolera requires C&F pricing, this includes freight until Bandolera’s stock in

Rotterdam. Therefore all logistics from producer until the Netherlands should be arranged by the

supplier. In the Netherlands, Bandolera works with the logistics company Unique Logistics. They

arrange all distribution within the Netherlands. Data collection: Different questions are asked about

the delivery times during the interview. Important delivery times are the delivery times of the fabric,

International Business Research Vietnam 2008 – Bandolera

13

of the proto‐type and also that of the total production order. Furthermore we ask questions about the

manner of logistics, pricing and exporting. These usually are expressed in CMPT, FOB and C&F prices.

2.3

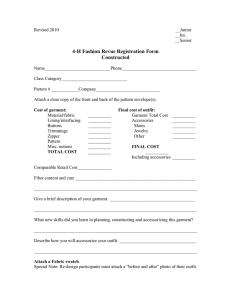

Decision Tree

To give an answer to the main question whether it is interesting for Bandolera to produce their

garment in Vietnam, we created a ‘decision tree’ (see below). The tree is divided in 3 hierarchies,

depicted with 3 different colors. To give a positive answer on the main question, all questions in the

pink boxes below should be answered with a ‘yes’. From left to right these pink boxes relatively

represent the research questions 1‐3. The answers given on these questions depend on the

information found about the questions in the green boxes in the lowest level of the tree.

International Business Research Vietnam 2008 – Bandolera

14

Figure 2.1

Decision tree research Bandolera – ‘Is it interesting for Bandolera to produce their garment in Vietnam?’

International Business Research Vietnam 2008 – Bandolera

15

Chapter 3

The Vietnamese Fabric Market

As mentioned in chapter 1, Bandolera is looking for all kinds of high‐quality fabrics. In this chapter we

give insight in the availability of fabrics in Vietnam. In paragraph 3.1 we start with an overview of the

current situation and trends in the Vietnamese fabric market. In paragraph 3.2 we will discuss the

fabric production of three main fabrics in Vietnam. We end the chapter with a conclusion in which we

give answer to research question 1.

3.1

Current situation and trends in the Vietnamese fabric market

The Vietnamese textile and garment industry has long time been under influence of the communistic

system. Its current situation and the trends in the industry are influenced by their relatively late

international start. As explained more clearly by Mr. Toan (owner of Yen Bien Company in Hanoi),

“Vietnam did not export garment until there was an open policy in 1986. Therefore the production of

fabrics at the beginning was poor. After the open policy, the production started to increase bit by bit.

But the production is mainly for massive quantities, which are needed because the main reason for

customers to go to Vietnam for production of garment is its low pricing”. These massive quantities and

the economic growth in general have helped the Vietnamese garment industry to expand (and keep

expanding) rapidly.

Currently Vietnam still relies on substantial imports of fibers, yarns, fabrics and garment accessories.

In 2004 the value of imports of fibers, yarns, fabrics and garment accessories reached 4,601 million

U.S. dollars (USD), which is more than double the 2,284 million USD worth of these imports in 2000.

Compared to the 1,089 million USD worth of imports in 2000, the imports of cotton, yarn and fabrics

tripled to 3,722 million USD in 2006. The most important import item is fabric, upon which Vietnam's

garment industry is heavily dependent. In 2006 fabric imports were worth 2.954 million USD,

compared with only 761,3 million USD in 2000. Fabric imports rose in value by 288 percent over the

six‐year period. The Vietnamese government has a clear strategy of increasing the supply of

domestically produced inputs such as raw cotton, yarns, fabrics and garment accessories. Vietnam’s

3

overall aim is to reduce the import content to less than 25 percent by 2010 .

Table 3.1 Import value per year (US dollars x 1.000)

Import/Year

Fibers, Yarn, Fabric and accessories

Cotton, yarn and fabrics

Fabrics

2000

2.284

2004

4.601

2006

1.089

761.300

3.722

2.954.000

Machinery investments – Investment in modern machinery has increased in recent years. During 2006

the industry added 171.720 new spindles and 5.840 open‐end rotors. This followed an extended

period of expansion during the ten‐year period of 1997‐2006, when 840.132 spindles and 19.784

open‐end rotors were obtained. In the weaving sector the industry added 6.012 shuttle less looms

during 1997‐2006, of which 1.357 alone were added to the industry's capacity in 2006 following the

addition of 476 looms in 2005. These figures are summarized in table 3.2 which shows that Vietnam is

moving towards more modern manufacturing technology.

Table 3.2 Machinery investments per year (US dollars)

Investments / Year

1997 ‐ 2006

Spindles

840.132

Open‐end Rotors

19.784

Shuttle less Looms

6.012

2005

2006

171.720

5.840

1.357

476

The textile and clothing industry has also managed to attract a substantial amount of foreign

investment. The largest foreign investor in the Vietnamese textile and clothing industry is Taiwan,

followed by South Korea and Hong Kong. However, looking at the total foreign direct investment (FDI)

3

th

http://www.just‐style.com, 9 June 2008

International Business Research Vietnam 2008 – Bandolera

16

in Vietnam, the textile and clothing industry only gets a very small piece of it. Most of the foreign

investments are made in Vietnam’s crude oil fields and the Vietnamese finance and banking industry4.

3.2

Overview main domestic production of fabrics

The Vietnamese export of textiles and garment continues to grow. The Trade Information Center

estimates a 1.7 billion U.S. dollars export of Vietnamese textile and garment during the first 4 months

of 2008. This is a year‐on‐year rise of almost 39 percent5. In the meantime, the garment sector copes

with a chronic shortage of materials for its production. Garment experts say that to earn 7.7 billion

U.S. dollars from exports in 2007, the sector spent 5.3 billion U.S. dollars importing raw materials6.

On the question where to find fabrics in Vietnam, we received the answer from Mr. Manning, owner

of apparel agency/supplier Indo Pride International in HCMC. He informed us that “all fabrics can be

found within 2 hours drive from HCMC. At macro scale, most fabric is to be found in South Vietnam.”

Different sources have independently informed us that “the fabrics available in Vietnam are mainly

cotton, followed by polyester and silk” (Mr. Toan, owner of Yen Bien Company in Hanoi). Below we

will discuss the production and availability of these three types of fabrics in Vietnam separately.

Cotton

Three out of the four agents and experts we interviewed, informed us that cotton is the main fabric

available in Vietnam. Due to the rapid development of the Vietnamese garment sector, the demand

for cotton has increased drastically. However, according to the report of the Voice of Vietnam (VOV),

Vietnam’s cotton acreage has been reduced in 2008 to 6,000 ha and only produces 2,600 tonnes7. The

garment sector’s demand is about 160,000 tonnes of cotton and needs up to 200.000 tonnes for its

export plans. The current production of 2,600 tonnes therefore doesn’t even meet more than 2

percent of the garment sector’s demand. The 2001‐2010 cotton development program has been set

up to expand the cotton acreage to 150,000ha, which should produce approximately 80,000 tonnes.

These plans have great difficulty reaching their goal. The cotton acreage has been shrinking year on

year. The Dak Lak province for example, has a large acreage under cotton cultivation in the Central

Highlands. However, the acreage has downsized from 16.000ha in 2002 to 9.000ha in 2003, 4.000ha

in 2004 and still decreased after 2004. The main cause of the continuing shrinkage in the cotton

acreage is its low economic efficiency. Farmers are selecting other short‐term cash crops of higher

economic values to grow, such as maize and soybeans rather than cotton. On average, cotton growers

need 3.5‐4 million Vietnamese Dong (VND) to invest in 1ha of cotton to yield a ton of seeds and earn

just 3 million VND. Meanwhile, when they grow maize, which yields 5 tonnes/ha, they can earn up to

10 million VND. In 2004 the Vietnam Cotton Company even proposed that the government should

stop cultivating cotton in the flood‐prone Mekong River delta and adjust the cotton acreage from

80.000ha to 50.000ha by 2010. Despite these difficulties, the Vietnamese Textile and Garment Group

(VINATEX) set its mind to create 45.000‐50.000 new hectares of cotton growing area by 2010. To

realize this goal, they developed cotton plantations in Ninh Thuan, Binh Thuan, Dak Lak, Quang Ngai

and Dong Nai provinces8.

Polyester/synthetic fibers

According to different news articles, the polyester production in Vietnam is increasing and big

investments are made. At present (2008), the supply of polyester fiber produced by foreign‐invested

and private factories nationwide only meets around 4 percent of the Vietnamese demand. The

VINATEX and the Vietnam National Oil and Gas Group (PetroVietnam) recently have jointly poured

over 125 million USD into the development of facilities for producing polyester fiber from

petrochemical products at the Hai Phong‐based Dinh Vu Industrial Park. They plan to meet 15‐20

percent of the national demand for polyester fiber by 2009 and 50 percent by 2012. The VINATEX and

4

th

http://www.vietpartners.com, 10 June 2008

th

http://english.peopledaily.com.cn, 10 June 2008

6

th

http://english.vietnamnet.vn, 19 May 2008

7

th

http://english.vietnamnet.vn, 19 May 2008

8

th

www.vinatex.com, 19 May 2008

5

International Business Research Vietnam 2008 – Bandolera

17

PetroVietnam have called for foreign investors to build three polyester fiber factories in southern

Dong Nai and Binh Duong provinces.

We received more information about the production of polyester from Mr. Toan, owner of Yen Bien

Company in Hanoi. He told us that “Taiwanese and Malaysian manufacturers produce polyester in

Vietnam but only for reason of export. Thai Tuan is a well known fabric producer in Vietnam (mainly

for polyester), but their fabric is expensive in local terms.” We visited the Thai Tuan Textile and

Garment Corporation at the 9th of May 2008. In Vietnam the company is well known for its production

of polyester fabrics. They specialize in producing jacquard, plain from polyester, spandex and viscose,

using technologies transferred from Japan and the EU. Thai Tuan supplies a variety of fabrics, of which

most is exported to surrounding Asian countries. Their capacity is 15 million meters fabric per year

with 1.500 workers employed. The delivery time of their fabrics is 50‐60 days by ship. In high peaks in

the business the delivery can take about 70 days. We took different samples with us to give Bandolera

insight in the Vietnamese level of quality.

Silk

The Vietnamese silk production has a long history in which Vietnamese silk was produced locally for

royal families or people of rank. Vietnam’s province Ha Tay, was known as the biggest and oldest silk

production centre in Vietnam. The most popular and biggest village was and still is Van Phuc, 10 km

south of the centre of Hanoi. Van Phuc Village, now has 730 households with 1.600 people earning a

living by weaving silk. The village stocks a wide variety of silk products, and ships goods all over

Vietnam, as well as exported overseas. Fabric made of 50% silk, 75% silk or 100% silk is priced

depending on the quality of pattern and fabric thickness. Statistics show that 785 of all 1.343

households in Van Phuc commune take part in the craft. Silk sales generate about 1.6 million USD and

make up 63% of the commune's economy each year. Given that each power‐loom generates one

weaving job, the craft village can create more than 1.000 jobs each year9.

We visited Van Phuc on the 3rd of June. In the village we visited 2 homes where we were showed the

process of making silk and the silk market. Many shops sell garment, ties, and other accessories.

‘White yarn/silk’ costs about 150.000 VND (9 USD) per meter. Their product capacity is not high, they

can i.e. make 4,5 meters (is 9 roles of yarn) per day. This concerns the thicker silk, which is more

expensive because more cocoons and more labor are needed for production. Plus it’s more difficult to

put on a role. Silk from the Van Phuc village is not exported for commercial ends. Cocoons are sourced

from the Ha Dong province: Dan Phuong (Hoai Duc). There is a small silk production in Vietnam, but

still in a traditional way and of low quality. Japanese silk has higher quality because they have thinner

yarn and better machines. Vietnam does not have the machinery and capacity to produce silk for the

industry to export. These findings were in line with what we already heard during our interview with

Mr. Manning (owner of apparel agency/supplier Indo Pride International in HCMC). He told us that, in

Vietnam you can find “…some silk, but this market is very narrow. The average Vietnamese does not

buy silk (to expensive) and the silk is not as fine as that from Japan or even as that from china.

3.3

Conclusion

The first research question considers the availability of fabrics in Vietnam. In this conclusion we try to

answer this question and its sub questions. Sub question 1.1 (What kind of fabrics does Bandolera in

general use for the production of her collections?) has been discussed in chapter 2. Bandolera design

process starts with special fabrics of preferably high quality. Furthermore, it is important that the

quality of the fabrics is stable.

The sub question 1.2 discussed the availability of fabrics in Vietnam. The question is “What kind of

fabrics are available in Vietnam? Which are produced domestically and which have to be imported?”

Concluding from the information as described in this chapter we can conclude that most common

fabric found in Vietnam is cotton. There is some production of polyester and silk, but there is not

much and the quality is worse than that of competing, surrounding Asian countries. All fabrics that

can’t be bought from the local market are imported. This certainly counts for high quality fabrics

9

th

http://english.vietnamnet.vn, 27 May 2008

International Business Research Vietnam 2008 – Bandolera

18

which still need to be imported from countries like Thailand, Taiwan, etc. Although the government

plans to expand the production of fabrics with incentives the production of cotton is decreasing due

to low economic efficiency. Furthermore, the demand for low quality, high quantity fabrics is much

bigger than the request for special fabrics of good quality.

Sub question 1.3 discussed the delivery times of the fabrics. Information about delivery times were

received during company visits. In general the delivery time of fabrics imported from China, Taiwan,

Korea, etc is 4‐10 days if the fabric is available. When companies also produce their own fabrics, the

time to produce them is on average 21‐28 days. We have little information about the delivery time of

domestically produced fabric, but the best estimation is about 2‐5 days if the fabric is available. The

last sub question focuses on the comparison of the quality of fabrics produced in Vietnam, compared

to the surrounding exporting Asian countries. The information we conducted during our literature

study as well as the information we received in Vietnam self points to a low‐to‐mid level quality

fabrics. Compared to surrounding Asian countries, Vietnamese fabrics are of lesser quality. In terms of

quality, Vietnam cannot compete with countries such as China, Taiwan or Japan. Although Vietnam is

heavily investing in its fabric production capacity, these still face many difficulties and the market is

unstable.

International Business Research Vietnam 2008 – Bandolera

19

Chapter 4

The Vietnamese Garment Industry

With a good insight in the Vietnamese fabrics industry, this chapter focuses on the Vietnamese

garment industry. In 4.1 we give a general overview of the Vietnamese economy. This paragraph is

followed by a focus on the export of the textile and garment industry in 4.2. In paragraph 4.3 we give

a rough overview of the textile and garment enterprises settled in Vietnam. Many enterprises are

member of the VITAS: a non‐governmental umbrella association working in the field of textile and

garment industry in Vietnam. Their roles and future plans will be described in paragraphs 4.4 and 4.5.

In 4.6 a short conclusion will be given about the Vietnamese garment industry.

4.1

Economy

Over the last many years, Vietnam textile and garment industry has witnessed strong development.

Products made in Vietnam have penetrated to the world market, thus it was contributing to the

economic development of the country. The export values increased rapidly, and this sector is one of

the industries that is for many consecutive years ranked very high in terms of key export products.

The industry counts near 2.000 companies who have in total more than 2 million workers. Over many

years, the industry continuously invested and changed equipment and technology to meet the market

demand and to improve its competiveness.

In general there are two major factors which contribute to Vietnam’s remarkable performance. The

first is the transition of central planning to an open‐market system and the second is the increasing

integration between regions and countries by becoming a member of the Association of Southeast

Asian Nations (ASEAN), ASEAN Free Trade Area (AFTA) and the World Trade Organization (WTO).

These 2 factors are strongly related to each other. The Vietnamese textile and garment industry made

significant achievements, thanks to the above mentioned factors and the political stability. The

industry employs a large labor force, with low labor cost. Thanks to the open door policy, the

government of Vietnam took bold reform measures to promote the economic development of the

country.

In 1995, Vietnam became a member of the Association of Southeast Asian Nations (ASEAN). Vietnam

actively participated in all activities of this organization and step by step integrated into the regional

and global economy for the benefit of the country (and region). On 1 January 1996 Vietnam officially

joined the Commonly Effective Preferential Tariff (CEPT) and implemented the AFTA with the

roadmap of ten years (1996 – 2006). In that period all tariff on textile and garment products is down

to 0 – 5% only.

Given the current trend of economic globalization and integration of countries around the world, the

competition is hard in gaining market share. Vietnam (and other developing countries) has to cope

with many difficulties: it is currently less developed in terms of machinery and equipment,

technology, and labor skills. Other difficulty is the high inflation (2007: 16%10) and economic growth

(2007: 8,5%11). Besides this, labor costs are becoming more competitive. There are many workers in

this sector, so companies compete with each other to get (the best) workers. On the other side, it

could be possible that in future labor costs are getting less important when there is more demand for

technical skills. However, nowadays economies of scale play an important role in all of these activities.

Vietnam’s accession to the WTO on 11 January 2007 brings significant opportunities to the garment

exporters. They are not restricted anymore by export quota’s (quantity restriction). However the WTO

brings opportunities to enter markets of all countries, and therefore competition among the

exporters is becoming tougher.

10

11

th

www.iht.com, 5 June 2008

th

www.english.vietnamnet.vn/biz, 5 June 2008

International Business Research Vietnam 2008 – Bandolera

20

4.2

Export of textile and garment

In short, the textile and garment sector has made a remarkable contribution to the economic

development of Vietnam. With nearly 2 million people involved, the industry contributes 8,2% to

Vietnam’s industrial value, 5 billion USD or 16,5% to the country’s export turnover for the year of

2006. In table 4.1 an overview of the total textile and garment export of Vietnam is given.

Table 4.1 Total Textile and Garment Export 1997 – 200612

Value (USD million)

Growth rate (%)

1997

1.349

17,3

1998

1.351

0,1

1999

1.747

29,3

2000

1.892

8,3

2001

1.962

3,7

2002

2.752

40,3

2003

3.654

32,8

2004

4.386

20,0

2005

4.838

10,3

2006

5.834

20,6

Export growth since 2001 has been steep. It was particularly strong in 2003 at 33% and in 2002 at

40%, but growth slowed in 2005 to just 10%. This was due mainly to the fact that quotas restricting

imports from other Asian countries were eliminated at the beginning of the year, but imports from

Vietnam into the USA ‐ Vietnam's largest export market ‐ were still subject to quotas. US retail buyers

therefore turned to countries such as China and India for their clothing. In 2006, however, the USA

implemented safeguard quotas on several categories of Chinese textiles and clothing, with the result

that buyers returned to Vietnam. As a result, Vietnamese exports soared by 20,6% to USD 5.834

million.

As mentioned before Vietnam joined the WTO in 2007, and the USA was obliged to remove all quotas

on textile and clothing imports from the country. The removal of quotas boosted US demand for

Vietnamese clothing, especially for lower‐end products.

In Table 4.2 an overview is given of the export divided to several markets: EU, US, Japan, or other

countries.

Table 4.2 Textile and Garment Export (by market)13

2006

2005

2004

2003

2002

EU

21%

16%

18%

18%

US

52%

56%

57%

55%

Japan

11%

13%

13%

14%

Others

16%

15%

12%

13%

Total USD (million)

5.834

4.838

4.836

3.654

2.752

Vietnam plans to double the value of its textile and garment exports from USD 4.8 billion in 2005 to

USD 10 billion, according to a new report by Textiles Intelligence. At the same time it hopes to double

the number of people working in the industry from 2 million to 4 million workers. Vietnam’s textile

and garment industry plans to achieve these targets by streamlining production and thereby reducing

unit costs to boost international competitiveness. On the way towards achieving its 2010 objective,

the industry has set an export target for 2007 of USD 7 billion14.

4.3

Overview of companies

As mentioned before there are on average 2.000 textile and garment companies in Vietnam. In table

4.3 an overview is given of the companies split up by locations or by product categories. Especially in

the South of Vietnam (near HCMC) most enterprises (70%) are established. In the North are (near

Hanoi) 10% of the companies located, and in the rest and Central Vietnam the other 20% are

established. In Appendix 4 a map of the provinces of Vietnam is attached. In Vietnam are 50 state‐

owned companies, the others are limited liability companies, joint stock companies, and private

companies (on average 1.500). The remaining enterprises are (foreign) investment projects and joint

ventures.

12

Vietnam Textile and Apparel Association, Directory 2006, p.9

Vietnam Textile and Apparel Association, Quality – Credibility, 2007

14

th

th

www.just‐style.com, 4 June 2008 (article of 8 August 2007)

13

International Business Research Vietnam 2008 – Bandolera

21

Table 4.3 Number of enterprises (updated 2006)15

By location

Ho Chi Minh City

1090

Hanoi City

157

Dong Nai province

142

Binh Duong province

116

Long An province

27

Da Nang city and surroundings

55

Others

364

By product categories

Materials and spinning

Woven

Non‐woven

Garment

Accessories

Services

96

382

6

1446

35

265

The main difference between state‐owned companies and private companies is the decision‐making

process and the size of the company. In state‐owned companies the decision‐making is rather slow.

This is because these companies are really big, and that there is much more hierarchy than in private

companies. In these enterprises there is more decentralization, like less hierarchy, faster decision‐

making process, and having the possibility to decide on your own.

Many garment factories cooperate with another factory. They have ‘subcontracts’. Most factories

cannot do every activity to finish a garment product. That is a main reason why companies have

subcontracts and why they are more dependent of each other.

4.4

The Vietnam Textile and Apparel Association

The Vietnam Textile and Apparel Association (VITAS) is a non‐governmental umbrella association

working in the field of textile and garment industry in Vietnam. They have 15 branches in Vietnam and

in total 635 members. These members account for 70% of the total capacity of the industry.

The role of VITAS is to promote business and investment cooperation as well as exchanging

information among members, between members, and the outside. Furthermore, VITAS represents its

members and consults the State and Government bodies that are relevant and comforting policies

and mechanisms relating to the development of the Textile and Garment industry in Vietnam. The

VITAS is representing the Vietnam textile and garment industry in international organizations and

tries to be a bridge of cooperation between the domestic industry and the outside world. The VITAS

also supports foreign companies in looking for Vietnamese textile and garment producers.

One of the biggest members of VITAS is The Vietnam Textile and Garment Group (VINATEX), which is

the biggest group of companies in the field of textile and garment in Vietnam. It has over 90 member

companies in Vietnam which together cover activities from spinning, knitting, weaving, and dyeing to

finishing. The total labor force of the VINATEX is nearly 100.000 employees and another 35.000

employees work in joint‐ventures with foreign and local partners. The production capacity of the

VINATEX is 100.000 tons of spun yarn, 250 million square meters of fabrics, 350 million pieces of

woven garment, 80 million pieces of knitting, 200 million pieces of garment, and 15.000 tons of raw

cotton (data from 200616).

The VITAS gives advice to the government, and together with the big stakeholders they set some

plans for future to increase development, competition, and export. In the next paragraph those plans

are described.

4.5

Future plans

The industry needs government support to accelerate its development to shorten the gap to other

large exporters in the world. Together with the VITAS the government made investment plans to

increase exports. To achieve those goals the government came up with two main policy objectives: (1)

shift the focus in garment manufacturing from CMT (cut, make and trim) to FOB (free on board)

production, and (2) increase the domestic content of garment production by investing in cotton

production, and in spinning and weaving facilities. The government has also identified three other

aims for the industry:

15

16

Vietnam Textile and Apparel Association, Quality – Credibility, 2007

Vietnam Textile and Apparel Association, Quality – Credibility, 2007

International Business Research Vietnam 2008 – Bandolera

22

1.

2.

3.

The industry must build on its existing reputation for high quality by moving from the lower

end of the market to the mid‐range and the high end of the market.

The industry must become more efficient in the sourcing of materials. This should be

achieved by:

‐ increasing Vietnamese fabrics production;

‐ implementing more efficient import sourcing methods;

‐ achieving further vertical integration by adding upstream capacity.

The competency and productivity of the industry must be increased by enhancing research,

training and development.

The government is planning to invest around USD 3 billion in developing the textile and garment

sector during the run‐up to 2010. It is envisaged that USD 180 million will be spent on projects to

expand raw material supplies, USD 2.27 billion on textile and dyeing projects, USD 443 million on

garment projects, and USD 200 million on trade centers and personnel training.

Meanwhile, state‐owned VINATEX plans to invest over USD 1 billion in 24 key expansion projects from

2006 to 2010. According to VINATEX, these projects aim to develop production and distribution

systems, fashion design and infrastructure.

One sector targeted for expansion is raw cotton production. To process the additional cotton

produced, VINATEX plans to invest USD 26,7 million in the construction of five new cotton processing

mills during the next two years in a bid to satisfy demand for raw materials from the country's textile

producers. Further down the supply chain, VINATEX expects to produce over 400 million square

meters of fabric per annum by 2010, including 270 million square meters for export.

There are also projects of the industry with the goal to invest in upgrading the productivity. These

special programs are in line with the industrial strategies and the WTO‐framework. These programs

include:

‐ Investment in raw material development;

‐ Investment in fiber production;

‐ Investment in cloth weaving;

‐ Investment in knitting development;

‐ Investment in developing color printing, dyeing and finishing;

‐ Investment in producing synthetic cloth;

‐ Investment in producing industrial textiles;

‐ Investment in mechanical industry for textile and garment;

‐ Investment in environment protection and social responsibility;

‐ Investment in producing garment accessories.

The Vietnamese textile and garment sector is rapidly catching up with surrounding countries such as

China and Taiwan. The investments of the government and the low labor costs attract many foreign

investors and customers. However, earlier investment plans of the Vietnamese government have

often shown to go wrong or get mixed up at the implementation phase due to lack of funds or

planning and communication problems. At the moment high inflations and economic growth are

affecting the Vietnamese industries negatively. Another problem is that many industries in Vietnam

are developing faster than the infrastructure, causing logistic difficulties.

International Business Research Vietnam 2008 – Bandolera

23

Chapter 5

Evaluation of Garment Producers

In this chapter we will give an overview of the visited garment producers in Vietnam. As mentioned

before we visited 17 companies both state‐owned and private companies. In general state‐owned

companies have a very large production capacity and most of the times they only produce basic