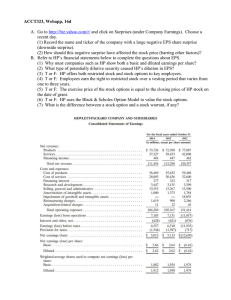

Tutorial Questions Q1) Price earning ratio = market price per share/ earning per share = $95/$1 = 95x As, Eps dropped to 50 and 30% dropped in EPS, ($1*70%) x 50 = $0.70 x 50 = $35 $35/$95 = 0.3684 1-0.3684 = 0.6315 (63.15%) Thus, 63.15% dropped. 10% dropped from $35, $35 x 90% = $31.50 PER = Market price per share/ EPS 50 = $31.50/ EPS Thus, EPS = $0.63/ share. Q2) Preferred stock is many times referred to as a hybrid security. This is because preferred stock has many characteristics of both common stock and bonds. It has characteristics of common stock: no fixed maturity date, the non-payment of dividends does not force bankruptcy, and the non-deductibility of dividends for tax purposes. But it is like bonds because the dividends are fixed in amount like interest payments. From the point of view of the preferred stock shareholder, this is not the most delightful combination. On one hand, the dividends are limited as with bonds, but the security of forced payment by the threat of bankruptcy is not there. Thus, from the point of view of the investor, the worst features of common stock and bonds are combined. Q3) a) growth rate = ROE x retention rate =0.115 x 0.55 =0.0633 (6.33%) b) expected return = ( dividend/ market price ) + growth rate = ($3.25 / $40) + 0.0633 = 0.1496 (14.96%) c) Since the expected return is 14.96% which is greater than your required return rate of 13%, Yes, you should invest. Q4) The intrinsic value = $12 /(7%-6%) =$ 1200 The cost of capital : Stock price = 0.20(1.06)/ (0.07-0.06) = $ 21.20