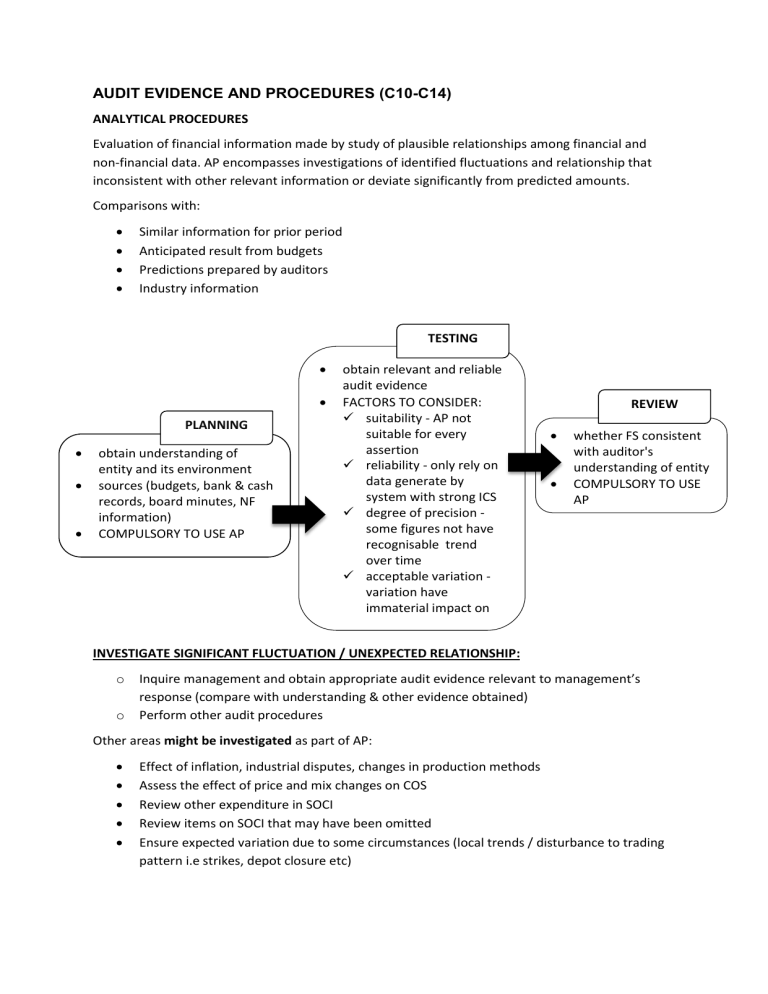

AUDIT EVIDENCE AND PROCEDURES (C10-C14) ANALYTICAL PROCEDURES Evaluation of financial information made by study of plausible relationships among financial and non-financial data. AP encompasses investigations of identified fluctuations and relationship that inconsistent with other relevant information or deviate significantly from predicted amounts. Comparisons with: Similar information for prior period Anticipated result from budgets Predictions prepared by auditors Industry information TESTING PLANNING obtain understanding of entity and its environment sources (budgets, bank & cash records, board minutes, NF information) COMPULSORY TO USE AP obtain relevant and reliable audit evidence FACTORS TO CONSIDER: suitability - AP not suitable for every assertion reliability - only rely on data generate by system with strong ICS degree of precision some figures not have recognisable trend over time acceptable variation variation have immaterial impact on FS REVIEW whether FS consistent with auditor's understanding of entity COMPULSORY TO USE AP INVESTIGATE SIGNIFICANT FLUCTUATION / UNEXPECTED RELATIONSHIP: o o Inquire management and obtain appropriate audit evidence relevant to management’s response (compare with understanding & other evidence obtained) Perform other audit procedures Other areas might be investigated as part of AP: Effect of inflation, industrial disputes, changes in production methods Assess the effect of price and mix changes on COS Review other expenditure in SOCI Review items on SOCI that may have been omitted Ensure expected variation due to some circumstances (local trends / disturbance to trading pattern i.e strikes, depot closure etc) FINANCIAL RATIO PROFITABILITY/RETURN GROSS MARGIN 𝐺𝑃 × 100% 𝑅𝐸𝑉 NET MARGIN 𝑁𝑃 × 100% 𝑅𝐸𝑉 ROCE 𝑃𝐵𝑇 𝑇𝐴 − 𝐶𝐿 LIQUIDITY/EFFICIENCY RECEIVABLE COLLECTION DAYS 𝑇 𝑅𝐸𝐶 × 365 𝐶 𝑆𝐴𝐿𝐸𝑆 GEARING GEARING RATIO 𝐿𝑂𝐴𝑁𝑆 × 100% 𝑂𝑆𝐶 + 𝑅𝐸𝑆𝐸𝑅𝑉𝐸𝑆 INVENTORY TURNOVER 𝐶𝑂𝑆 𝐼𝑁𝑉 CURRENT RATIO 𝐶𝐴 𝐶𝐿 QUICK RATIO 𝐶𝐴 − 𝐼𝑁𝑉 𝐶𝐿 Working paper must contain complete AP result INCLUDING: - Outline programme Summary of significant figures Result of investigations Audit conclusion Information considered necessary ACCOUNTING ESTIMATES (ESTIMATES INVOLVED, RMM ↑) Approximation of monetary amount by management of entity for an item in the absence of precise measurement Examples : o o o o o Allowances against inventory/receivables Depreciation allowances Accrued revenue Provision for loss on lawsuit Provision of warranty claims Auditor shall determine : Whether management appropriately applied requirement to accounting estimate Whether methods to make accounting estimates are appropriate and applied consistently Test estimates by : Determine whether events occurring up to the date of auditor’s report provide audit evidence Test how management made accounting estimate Test the operating effectiveness of controls Develop a point estimate/independent estimate Auditors will carry out : Consider whether data accurate, complete and reliable Seek appropriate audit evidence from outside client Evaluate whether base used is appropriate Consider use of expert Test calculation (consider complexity, methods used and materiality) Differences between estimate supported by evidence and management’s estimate - If unreasonable – adjust If management refuse to revise – consider misstatement INVENTORIES Why audit of inventory is area of high inherent risk? Completeness – Closing inventory not normally part of double entry Existence – Verified only by attending inventory count & follow up procedure Valuation – IAS2 allow variety of methods / made up of large number of different items Cut off – May be necessary to move inventory during count Right & obligation – Not all inventories belongs to client Presentation & disclosure – Classified incorrectly PHYSICAL COUNT at year end •Best method from auditor's viewpoint before or after year end •Varying reliability depends on : •Length of time between count and year end •ICS of business •Quality of inventory movement records continuous (perpetual) •Used by larger company •Have independent count team to carry out counting at regular interval If perpetual method is used, auditor will ensure that management : Have a system to maintain accurate and up to date inventory record Every item is counted at least once a year Counting is well organised and controlled Counts are documented and reviewed by management All differences are investigated Why do a physical count? Gives valuable evidence that inventory actually exists Check accuracy of inventory records Discrepancies help to point out control deficiencies See condition of inventory Why auditor should attend the count? o o o o Evaluate management’s instructions and procedures Observe performance of count procedures Inspect inventory Perform test counts How inventory count instruction considered complete and accurate? o o o o o Independent person supervise and deal with queries Inventory tidies and laid out in orderly manner Pre-numbered inventory sheets should be issue to counters Each area subject to recount All inventory should be marked after being counted as evidence CUT OFF TESTING Importance of cut off : - Point of purchase and receipt of goods and services o Invoices record as liability ONLY IF goods received prior inventory count Requisition of raw material for production Transfer WIP to FG Sale and despatch of FG o Invoices for goods despatched after inventory count EXCLUDED as revenue Management’s arrangement before inventory count so cut off properly applied : Appropriate system of recording receipts and despatches – GRN and GDN sequentially pre-numbered Final GRN / GDN / material requisition numbers are noted INVENTORY VALUATION (Cost vs NRV – WIL) Cost – All cost purchase and other cost incurred in bringing inventory to present location and condition NRV – Estimated selling price LESS estimated cost of completion and cost necessary to make sale PHYSICAL INVENTORY COUNT SP PLANNING REVIEW INSTRUCTION DURING COUNT Gain understanding - Review previous year’s arrangement - Perform AP Organising - Supervision by senior staff - Tidy and mark inventory - - - Plan procedure Sufficient attention to high value item Consider expert Recording Serial numbering, control and return of inventory sheets Inventory sheets being completed in ink and signed Observe whether client’s staff follow instruction Re-perform test count to ensure procedure and ICS worked properly Confirm inventory held on behalf of third party is separately identified and accounted Ensure procedure for damaged, obsolete, slow moving item operate properly Consider any amendment necessary Trace item that were test counted to final inventory sheet (completeness & accuracy) Verify all count records have been included (completeness) Verify final inventory sheets supported by count records (existence) Confirm client’s final valuation of inventory (accuracy) Follow up queries and notify management any problems - AFTER COUNT - Asses key factor Identify high value item Nature and volume of inventory Counting Systematic counting Team of two independent counters - - CUT OFF SP MANAGEMENT INSTRUCTION - GRN / GDN / material requisition recorded by pre-numbered documentation Final numbers of GRN / GDN / material requisition should be noted Cut off arrangement with 3rd party should be satisfactory DURING COUNT - Record all movement notes related to period Observe whether correct procedure being followed Discuss procedure with staff who perform to ensure they understood AFTER COUNT - Match GRN with invoices ensure liability recorded in correct period Match GDN with invoices ensure income recorded in correct period Match requisition notes to WIP figures for receiving department ensure correctly recorded INVENTORY VALUATION SP Cost to be included Audit test Raw materials / Goods for resale Actual cost (invoices) Delivery cost o WIP & FG Cost of purchase Cost of conversion (attributable/POH/other OH) NRV NRV < cost when; Increase in cost Fall in selling price Physical deterioration Obsolescence of products Marketing decision to sell at loss Confirm which valuation method used o Agree valuation of raw materials to invoices (accuracy) Materials : o Confirm which valuation method used o Agree valuation of raw materials to invoices (accuracy) Labour : o Agree labour cost to wage record o Agree labour hours to time summaries POH : o Ensure only POH (exclude admin & selling) o OH absorption rate based on normal output WIP : o Check stage of completion for materials, labour & OH o Review and test client’s system to identify slow moving o Examine inventory records to identify slow moving item o Review quantities of goods sold after YE o Review procedure to compare cost and NRV o Ensure estimated cost to complete are correct NON CURRENT ASSETS What are the inherent risks on audit of NCA? Completeness – Assets owned but not included in FS Existence – Assets on FS do not actually exist (sold / scrap) Valuation – Incorrect valuation, recording and depreciation calculation Right & obligation – Asset in FS not actually controlled by entity Presentation & disclosure – Incorrect disclosures TANGIBLE NCA How auditors proceed to audit NCA if client does not maintain NCA register? - Ask client for a schedule listing the major items of NCA (show original cost, depreciation, additions, disposals) Reconcile schedule to draft FS Verify additions to supported document and inspect asset Review previous year schedule listing Inspect board minutes for any reference to disposal Completeness (understatement) Existence (overstatement) Valuation Rights & obligation Depreciation Additions Self-constructed asset Disposals o o o o o o o o o o o o o o o o o o o o o o o o Match sample of assets which physically exist to register Compare NCA in register to NCA in general ledger Reconcile schedule of NCA to general ledger Physically inspect a sample from register Check sample of asset in use Investigate any asset not be found Verify valuation to valuation certificate Consider reasonableness of valuation Recalculate revaluation surplus Obtain certificate from solicitors/bankers Confirm all assets used for business Inspect registration document to verify ownership Confirm depreciation has been charged on all assets Confirm depreciation based on revalued amount (revalued assets) Re-perform calculation of depreciation rates Inspect relevant certification to verify Verify capitalisation of expenditure is correct Inspect board minutes to confirm that purchase authorised by directors Inspect relevant documents to verify cost Confirm expenditure has been analysed and charged properly Verify no profit element included in cost Recalculate to verify calculation of profit/loss Inspect board minutes to confirm that disposal authorised by directors Consider whether proceeds are reasonable INTANGIBLE NCA (GOODWILL) & INVESTMENT Goodwill Completeness Ownership Valuation Presentation Additions Disposals Recalculate goodwill Check amount paid for business acquired Reconcile schedule of investment with general ledger Match sample of investment held to investment register Agree investment on register to appropriate legal documents Inspect investment document Verify market value for securities Investment in portfolio held at fair value in accordance to accounting standard Inspect FS to verify investment properly described and classified Inspect SOCI to confirm that any gain or loss on portfolio has been properly classified Inspect a sample of purchases to verify it has been properly allocated to NCA Verify disposal to supporting document Recalculate gain or loss from sale of securities ACCOUNTS RECEIVABLES CONFIRMATION/CIRCULARISATION Problems : Not all customers reply Customer reply, but not check properly Key things : Auditor decide what needs to be confirmed Auditor select which customer to get asked (not client)\ Auditor states that reply comes to her directly Auditor sends out request personally Results : Any doubts over reliability – perform alternative test Not reliable for sure – consider effect on risk assessment & perform alternative test No response – perform alternative test Confirm different amount – timing difference / problem with controls / fraud Process : 1. Planning Decide TWO things : - When? (timing) Include who? (sample) 2. Decide +ve/-ve circularisation positive Ask customer whether he agree or not with the balances Methods : 1. Give him figure and confirm 2. Ask him to provide by himself Risks : 1. Confirm without checking 2. Lower response rate negative Reply only if he disagrees with the balance (less reliable) Used if : 1. RMM is low 2. Client has good ICS 3. Very low exception rate is expected 3. Sample selection Procedure : May include : - - Sample representative of population - Get aged receivable listing - Check listing is accurate Overdue balances Negative balances Nil balances All materials balances 4. Procedure when getting reply: Check : Balances not agree : - - Ask client to reconcile and check - Control/timing? If timing, no further work Signed by responsible official Replies filed in current audit file No reply – carry out further work - Balances agree – no further work Check cash received Check signed PO Check sales invoice exist 5. Summarise & conclude - Summarise balances not verified Conclude likelihood and materiality of misstatement Bad debts Cut off Prepayment - Examine customer files on overdue receivables, asses allowance Review calculation of bad debt Review company procedure for identifying them Inspect goods despatch and return inwards Reconcile entries in receivable ledger control account to daily batch invoice Review receivable ledger control account for unusual item - Refer to cashbook, expense invoices, etc (existence) Recalculate sample of prepayment Review detail SOPL (completeness) CASH AND BANK What is inherent risk of cash and bank? Completeness – Material cash balances are omitted Existence – Bank balances not actually owned by the client Valuation – Reconciliation differences incorrectly dealt with Right & obligation – Bank balances not actually owned by the client CONFIRMATION / BANK LETTER Client must give permission to the bank to reply Should be in a standard format acceptable to the bank The authorisation could be a standing authority - this must be referred to in the letter The letter is sent from the auditor (and the reply back to auditor) Methods : 1. The auditor gives the balances from the client’s accounting records and asks the bank to confirm 2. The auditor asks for the balance (not giving the bank the balance first) What is in the bank letter? balances on all bank accounts any unpaid bank charges any liens (charges) over clients assets any client assets held as security any other bank accounts known but not listed Bank balances o o o o o Verify arithmetic of bank reconciliation (accuracy) Compare CB to BS for last month, trace outstanding items Get bank reconciliation Check bank letter against balance used in bank record Review letter for any other information Cash count o o o o o o o o All cash/petty cash book should be written up to date in ink All balances counted at same time No time auditors left alone with cash All cash counted must be recorded in working paper Reconciliation should be prepared if applicable Certificates of cash in hand obtained as appropriate IOUs and cheques cashed by employee have been reimbursed The balances as counted are reflected in the account Follow up procedures CURRENT LIABILITIES What are the main risks on payables? Not all recorded Cut off incorrect Some included are not obligation of client Not properly disclosed “Positive” replies for supplier’s confirmation letter will be required if: Supplier’s statement unavailable or incomplete ICS is weak – possible MM of liabilities Client deliberately understate trade account payables Accounts appear to be irregular/abnormal PURCHASES & EXPENSES: - Completeness (understatement) Occurrence (overstatement) - CUT OFF: - Completeness - ACCRUALS: - Completeness - WAGES & SALARIES: - Occurrence Accuracy Completeness - Compare supplier’s statement with year-end purchase ledger balances (include NIL and –ve balances) Reconcile the balance statement to purchase ledger account on monthly basis Match sample of PO/GRN to invoices Review unprocessed invoices and obtain explanations Agree purchases & expenses in ledger/cash book to supporting document Consider reasonableness of deductions (refer to subsequent event) Verify whether valid debt recorded in purchase ledger (review credit note) Review GRN before period end - invoices (posted to ledger / included in accruals schedule) Review accruals schedule – goods received after period end exc Reconcile daily batch invoice totals to payable control ledger – post in correct period Verify accruals are fairly calculated and refer to subsequent payment and document to verify it Test transactions around YE to determine whether amount recognised at correct period Ensure disclosure relevant to liabilities have been made in FS Agree individual remuneration per payroll to personnel records/record of hours worked/agreement Meet employees (attend wages pay out/confirm with manager) to confirm existence Agree benefits to document Verify accuracy calculation of payroll Reperform calculation on statutory deduction Confirm validity of other deduction Select sample from personnel records ensure they are included in payroll records Perform casts of payroll records Obtain details of new joiners ensure recorded in correct period AP is IMPORTANT in purchases & expenses, auditor should consider: o o o o o Level of purchase and expenses (month-by-month with previous period) Effect on purchase value due to changes in quantity purchased Effect on purchase value due to changes in product purchased (ingredient/price) Ratio trade account to purchases with previous figure Ratio trade account to inventory with previous figure AP is IMPORTANT in wages & salaries, auditor should consider: o o o o o Level of wages & salaries (month-by-month with previous period) Effect on wages & salaries due to changes in rate Average wage per month over the year Sales/profit per employee Payroll proof in total NON CURRENT LIABILITIES (authorised by board & well documented) Completeness Accuracy - Presentation - Review board minutes and cash book – all loans have been recorded Compare balances to general ledger and investigate differences Compare opening balances to previous years paper (carried forward accurately) Obtain direct confirmation from lenders Trace addition and repayment to entries in cashbook (closing balance) Review draft of FS – disclosure correct in accordance to standard PROVISIONS & CONTINGENCIES V. certain (≥90%) Probable (>50%) Possible (≥5%) PROVISIONS & CONTINGENT LIABILITIES Provision+disclosure Provision+disclosure Disclosure Provision – Uncertain timing / amount Contingent – Possible obligation from past events only will be confirmed by occurrence of ≥future events not within entity’s control Recognised as assets Not report as contingent Remote (<5%) Ignore Present obligation from past events not recognised : - Outflow economic benefit not probable - Cannot measure amount CONTINGENT ASSETS Disclosure Ignore Ignore Contingent – Possible EXAMPLES OF CONTINGENCIES : asset from past events - guarantees only will be confirmed - discounted bills of exchange by occurrence of - lawsuits ≥future events not - uncalled liabilities within entity’s control Obligating event – Event that creates legal/constructive obligation resulting entity having no realistic alternative to settle obligation Legal obligation – Contract/legislation/operation of law Constructive obligation – Pattern of past practices/published policies/sufficiently current statement, indicate other that it will accept certain responsibilities AND create valid expectation What to be disclosed for contingent liabilities & assets? A brief description of the contingent liability/asset An estimate of its financial effect An indication of the uncertainties For contingent liabilities, the possibility of any reimbursement General vs Specific inquiry? General - Specific - Provisions Contingencies - Inform auditor any claims/litigation they aware, assessment & estimates Legal adviser unlikely to reply appropriately Include list of claims, management’s assessment & estimates and confirmed reasonableness of assessments by entity if incorrect - Get a list of provisions ensure all have been disclosed - Confirm in line with IAS 37 (obligation, probable, reliable measure) - Review changes in the provisions - Review the valuation and think of using an expert - Understand the management approach to identifying contingencies - Review board minutes - Review legal correspondence and possible direct confirmation from them (letter from management but reply direct to auditor)