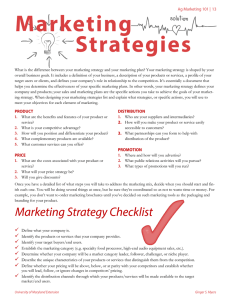

DONE BY: ADITYA SHIRODKAR T.Y IMCOM IMCOM18-34 Q1. Statement of minimum price which the company can afford to quote for the new customer (based on relevant cost) (figures in ₹) Particulars Cost to be incurred to bring the equipment in its original condition Opportunity cost of the direct material Direct Wages: Dept A (15 days x ₹120) Dept B (25 Days x ₹ 100) Opportunity cost of Contribution lost by Dept B (₹ 2500 x ₹3.20) Variable Overheads [25% x (₹1800 + ₹2500)] Delivery Costs Supervisory overtime payable for Modification Control Device to be used in another job (WN- 1) Net Loss on material cost savings in the original equipment (WN-2) Opportunity cost of remaining materials which can be sold as scrap Opportunity cost of sale of drawings Total Minimum price which may be quoted Amount 29,700 2,250 1800 2500 8000 1075 1350 1050 (10,350) 11,700 11,400 1,500 ₹ 61,975 Working Notes: WN- 1 Cost of Control device to be used in another job Cost of controlling device Less: Dismantling & Removal cost of control mechanism (1day x ₹ 120) Less: Variable Cost (25% x ₹120) Balance Cost of Control Device WN-2 Net loss on material cost saving of equipment Loss on material cost saving equipment Less: Conversion costs (2 days x ₹120) Less: Variable Overheads (25% x 240) Net Loss on material cost saving of equipment (figures in ₹) 10,500 120 30 10,350 (figures in ₹) 12,000 240 60 11,700 Q2. (a) Price skimming is a product pricing strategy by which a firm charges the highest initial price that customers will pay and then lowers it over time. As the demand of the first customers is satisfied and competition enters the market, the firm lowers the price to attract another, more price-sensitive segment of the population. Situations in which Skimming Pricing can be adopted: If a limited supply exists, the company may follow a skimming approach to match demand and supply. Where a company wants to maximize its revenue. When initial cost of production is very high which has to be recovered as early as possible. Where the products are of specialty goods such as fashion-oriented goods. Where the segment of the market is willing to pay a premium price for the value received. Where the price and quality relationships are viewed favourably. High prices imply high quality for quality conscious customers. Advantages of Price Skimming Strategy are as follows: To boom the profit: - The company will try to increase the profit as much as possible during the initial product release as they know that competitors will introduce new products with the same or better feature, and their sale quantity will decrease over time. Moreover, after some time the sales quantity will decrease, so the company must decrease some price to maintain the selling quantity. They will suffer from low margins, but it much better than allowing the customer to go and buy competitor products. The company may have heavily invested in the production equipment, so they have to take a lower profit rather than dealing with substantial fixed costs. They will keep doing this until the new product arrives. To maximize profit from different market segment: - The company understands that some customers willing to pay more to become the first to own the products while others may wait until price decrease and pay for the best value. By using price skimming, the company will be able to maximize profit from both types of customers. For example, PlayStation 3 was sold $ 599 and then decrease to $ 200. The loyal customers will be happy to pay premium during the initial release. To protect the brand value: - High prices can convince the customers that our product has high quality and features. It also differentiates ourselves from the other competitors too. For example, Apple, Supreme, Lamborghini is the brand that considers as the luxury brand due to its high price. Massive demand in the market with low supplier: - The company can take this opportunity to increase the price as they know their products will be the market leader as it is new and unique. It doesn’t matter if we charge a higher rate; customers are willing to pay for it. Short life product: - Some products life span is concise, and the demand will drop very quickly. So, the company needs to act fast. For example, in the fashion industry, the price of new clothes are very high due to the original design and customers willing to pay for them. But after several months, the company needs to decrease price as the market moving forward to new trending. Disadvantages of Skimming Pricing are as follows: Encourage the competitor to join the market: - When we set a high price for the product, it means there is a huge profit for them. The competitor sees the opportunity and will try their best to enter the market. For example, after Apple introduced the iPhone in 2007, the gross margin was around 50%-58% based on the experts. It such a high-profit business while another company charge below 40% of gross margin. As a result, many companies join the race and push the market up to now. In the top 10 smartphone companies, more than half of them introduce their smartphones later than in 2010. Slow down the product growth: - In each product life cycle, the initial release is the time that the company needs to boost sales by increasing marketing expenses. However, the high price seems a barrier for customers to purchase our product. It will limit the potential growth of the product as well as reduce the peak of its life cycle. Damage reputation: - The way that the company keeps charging high prices will alert to customers sooner or later. Customers will start to compare the product from one company to another. If we can’t differentiate our features, it will ruin our reputation due to the high price. For example, Apple is known as the company with a high price tag. Some even use the word “Apple Tax” to represent Apple margin due to its high price compare to other suppliers. A huge problem if the demand is elastic: - Different product in a different market at different times has different elastic level. If we are setting price skimming without critical market analysis, we will face the issue as the demand is very elastic due to the high price. Customers will be looking for a similar substitute product at a lower price. It is mostly happening in a market recession when people try to save money. It also occurs when there are too many products available in the market at different prices. It will not last for long: - We may have a plan to reduce prices within a period of time. However, competitors may come up with their product earlier than our expectations, and it will put pressure on us to decrease the price sooner or loss the sale volume. It will ruin our business plan. Q2. (b) Penetration pricing is a marketing strategy used by businesses to attract customers to a new product or service by offering a lower price during its initial offering. The lower price helps a new product or service penetrate the market and attract customers away from competitors. Market penetration pricing relies on the strategy of using low prices initially to make a wide number of customers aware of a new product. Situations in which penetration pricing can be adopted: Elastic Demand: When demand of the product is elastic to price. In other words, the demand of the product increases when the price is low. Mass Production: When there are substantial savings on large scale production. Here increase in demand is sustained by adoption of low pricing strategy. Frighten Competition: When there is threat of competition the prices fixed at a low- level act as an entry barrier to the prospective competitors. Advantages of Penetration Pricing High adoption and diffusion: Penetration pricing enables a company to get its product or service quickly accepted and adopted by customers. Marketplace dominance: Competitors are typically caught off guard by a penetration pricing strategy and are afforded little time to react. The company is able to utilize the opportunity to switch over as many customers as possible. Economies of scale: The pricing strategy generates a high sales quantity that enables a firm to realize economies of scale and lower its marginal cost. Increased goodwill: Customers that are able to find a bargain in a product or service are likely to return to the firm in the future. In addition, this increased goodwill creates positive word of mouth. High inventory turnover: Penetration pricing results in an increased inventory turnover rate, making vertical supply chain partners, such as retailers and distributors, happy. Disadvantages of Penetration Pricing Pricing expectation: When a firm uses a penetration pricing strategy, customers often expect permanently low prices. If prices gradually increase, customers may become dissatisfied and may stop purchasing the product or service. Low customer loyalty: Penetration pricing typically attracts bargain hunters or those with low customer loyalty. Said customers are likely to switch to competitors if they find a better deal. Price cutting, while effective for making some immediate sales, rarely engenders customer loyalty. Damage brand image: Low prices may affect the brand image, causing customers to perceive the brand as cheap or poor quality. Price war: A price penetration strategy may trigger a price war. This decreases overall profitability in the market, and the only companies strong enough to survive a protracted price war are usually not the new entrant who triggered the war. Inefficient long-term strategy: Price penetration is not a viable long-term pricing strategy. It is usually a better idea to approach the marketplace with a pricing strategy that your company can live with, long-term. While it may then take longer to acquire a sizeable market share, such a patient, long-term strategy is more likely to serve your company better overall, and less likely to expose you to severe financial risks. Q3. Decision Making based on Relevant Cost (i) Buy from External Company A: Relevant Cost= ₹ 33,200 (ii)Buy from External Company B: Cash Paid to B Cash Received from B Purchase of Parts Relevant Cost of RS: (125% x own costs) + 7500 = 13,000 Therefore, own costs = 5,500/1.25 = 4,400 Therefore, Variable costs to group = 4,400 x 70% = Relevant Cost (35,000) 13,000 (7,500) 3,080 (32,580) (iii) Buying Internally From RS Opportunity cost of external sales foregone by RR (Production costs incurred away) 8,000 + 11,000 Relevant Costs Of RT Total Costs= 30,000/120% 25,000 Less: Transferred Costs from RR (11,000) Therefore, own costs 14,000 Therefore, Variable Costs to group (14,000 x 65%) Relevant Costs of RS Own costs=42,000 – (30,000 + 8,000) 4,000 Therefore, Variable Costs to group = 70% x 4,000 Relevant Costs (19,000) (9,100) (2,800) ( 30,900) Decision: Since the relevant costs are low when buying internally from RS so we should place the order with them.