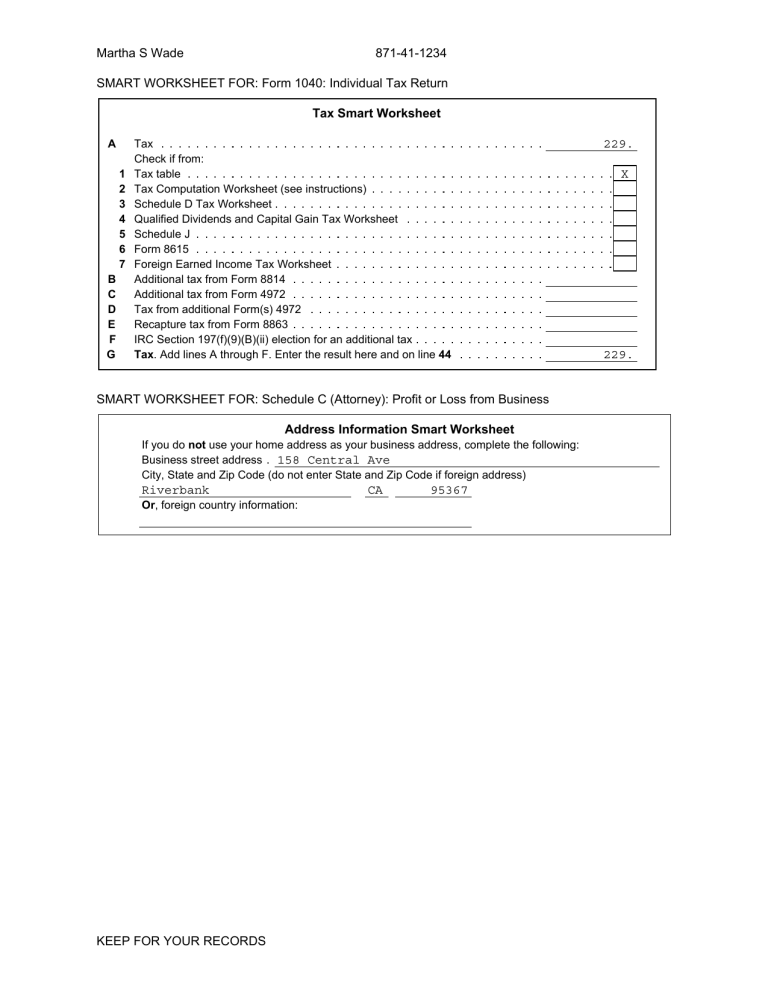

Martha S Wade 871-41-1234 SMART WORKSHEET FOR: Form 1040: Individual Tax Return Tax Smart Worksheet A 1 2 3 4 5 6 7 B C D E F G Tax Check if from: Tax table Tax Computation Worksheet (see instructions) Schedule D Tax Worksheet Qualified Dividends and Capital Gain Tax Worksheet Schedule J Form 8615 Foreign Earned Income Tax Worksheet Additional tax from Form 8814 Additional tax from Form 4972 Tax from additional Form(s) 4972 Recapture tax from Form 8863 IRC Section 197(f)(9)(B)(ii) election for an additional tax Tax. Add lines A through F. Enter the result here and on line 44 SMART WORKSHEET FOR: Schedule C (Attorney): Profit or Loss from Business Address Information Smart Worksheet If you do not use your home address as your business address, complete the following: Business street address 158 Central Ave City, State and Zip Code (do not enter State and Zip Code if foreign address) Riverbank Or, foreign country information: KEEP FOR YOUR RECORDS CA 95367 229. X 229. Martha S Wade 871-41-1234 SMART WORKSHEET FOR: Schedule C (Attorney): Profit or Loss from Business Domestic Production Activities Smart Worksheet ? Amounts have been gathered from the Schedule C as a starting point for the Domestic Production Activities deduction calculation. Make adjustments as necessary, taking care not to duplicate amounts on lines B, C and D. Be sure the amount on line E is also included on line(s) B, C and D, as appropriate. ? If you qualify for the deduction, complete the Domestic Production column and the Oil-Related Production column (if applicable). For the small business simplified overall method, enter gross receipts. For the simplified deduction method, enter gross receipts and cost of goods sold. For the Section 861 method, enter all amounts. Total A B C D E Gross receipts Cost of goods sold Directly allocable deductions, expenses, or losses Indirectly allocable deductions, expenses, or losses W-2 wages (adjust for wages from COGS, if necessary) Domestic Production Oil-Related Production 24,395. 5,043. QuickZoom to Form 8903, Domestic Production Activities Deduction SMART WORKSHEET FOR: Schedule C (Attorney): Profit or Loss from Business Activity Summary Smart Worksheet Supporting information provided by program. NO ENTRIES ARE NEEDED. Regular Tax A B C D E F G H I J K L M N Ownership At risk status Passive status Schedule C Tentative profit (loss) Other preferences and adjustments At risk disallowed loss Passive carryover loss Passive disallowed loss Net profit (loss) allowed Related Dispositions Tentative profit (loss) At risk disallowed loss Passive carryover loss Passive disallowed loss Net profit (loss) allowed KEEP FOR YOUR RECORDS Alternative Minimum Tax Taxpayer All Nonpassive 19,352. 19,352. 19,352. 19,352.