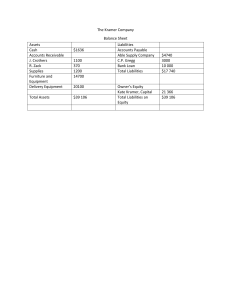

Balance sheet A statement of the assets, liabilities, and equity if a business or other organization at a particular point in time. A balance sheet can also be described as a snapshot of a company’s financial condition. A balance sheet is broken up into three sections, assets, liabilities. The difference between the assets and the liabilities is the equity of the company, also known as net assets, net worth, or capital. So, you’ll start a business, you go to a bank and you get a loan. On your balance sheet, this loan shows in the liabilities as it has to be paid to the bank, it also shows in the assets. Thus, the balance sheet is balanced. You need to buy a computer for your new business, the cash in your assets decreases, but you new computer asset helps balance this. As you sale to your customers, your profits are recorded as retained earnings in the equity. The cash from these profits are recorded in the assets section, and the sheet keeps balanced. Every month you make a loan payment to the bank. The liabilities are reduced and the cash are reduced by the same amount. What’s your profits are the net worth.