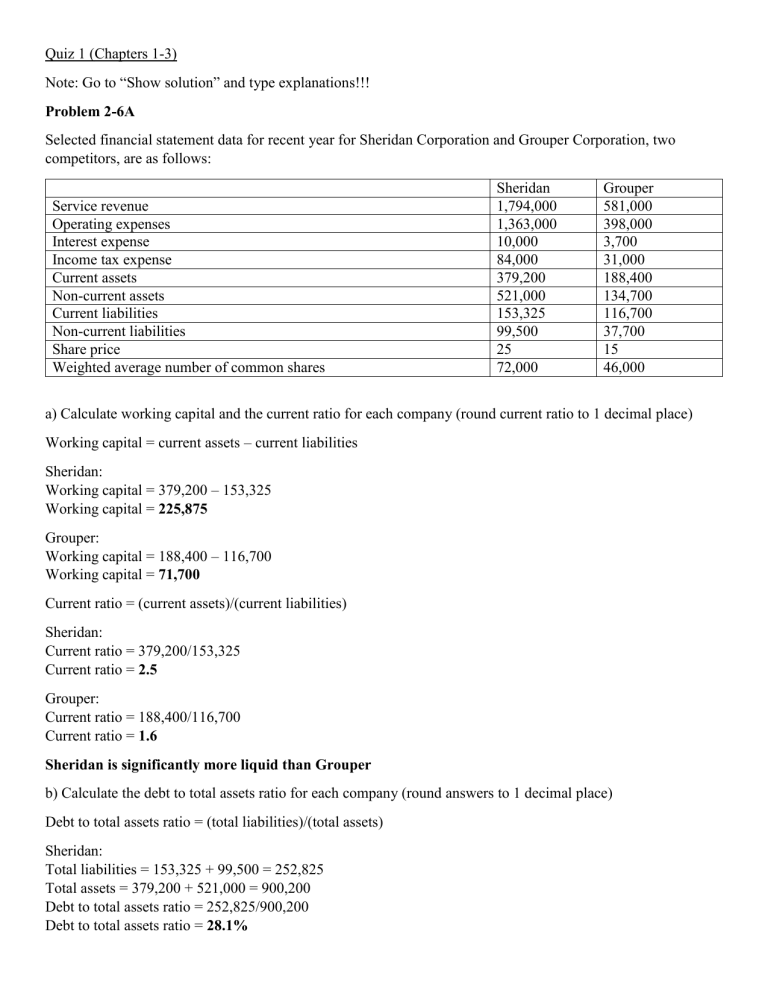

Quiz 1 (Chapters 1-3) Note: Go to “Show solution” and type explanations!!! Problem 2-6A Selected financial statement data for recent year for Sheridan Corporation and Grouper Corporation, two competitors, are as follows: Service revenue Operating expenses Interest expense Income tax expense Current assets Non-current assets Current liabilities Non-current liabilities Share price Weighted average number of common shares Sheridan 1,794,000 1,363,000 10,000 84,000 379,200 521,000 153,325 99,500 25 72,000 Grouper 581,000 398,000 3,700 31,000 188,400 134,700 116,700 37,700 15 46,000 a) Calculate working capital and the current ratio for each company (round current ratio to 1 decimal place) Working capital = current assets – current liabilities Sheridan: Working capital = 379,200 – 153,325 Working capital = 225,875 Grouper: Working capital = 188,400 – 116,700 Working capital = 71,700 Current ratio = (current assets)/(current liabilities) Sheridan: Current ratio = 379,200/153,325 Current ratio = 2.5 Grouper: Current ratio = 188,400/116,700 Current ratio = 1.6 Sheridan is significantly more liquid than Grouper b) Calculate the debt to total assets ratio for each company (round answers to 1 decimal place) Debt to total assets ratio = (total liabilities)/(total assets) Sheridan: Total liabilities = 153,325 + 99,500 = 252,825 Total assets = 379,200 + 521,000 = 900,200 Debt to total assets ratio = 252,825/900,200 Debt to total assets ratio = 28.1% Grouper: Total liabilities = 116,700 + 37,700 = 154,400 Total assets = 188,400 + 134,700 = 323,100 Debt to total assets ratio = 154,400/323,100 Debt to total assets ratio = 47.8% Grouper is considerably less solvent than Sheridan c) Calculate the net income, basic earnings per share, and price-earnings ratio for each company. Assume that the net income you calculate equals the income available to common shareholders. (Round basic earnings per share to 2 decimal places and price-earnings ratio to 1 decimal place) Net income = revenues – expenses Sheridan: Net income = (1,794,000) – (1,363,000 + 10,000 + 84,000) Net income = 337,000 Grouper: Net income = (581,000) – (398,000 + 3,700 + 31,000) Net income = 148,300 Basic earnings per share = (income available to common shareholders)/(weighted average number of commonshares) Sheridan: Basic earnings per share = 337,000/72,000 Basic earnings per share = 4.68 Grouper: Basic earnings per share = 148,300/46,000 Basic earnings per share = 3.22 Price-earnings ratio = (price per share)/(earnings per share) Sheridan: Price-earnings ratio = 25/4.68 Price-earnings ratio = 5.3 Grouper: Price-earnings ratio = 15/3.22 Price-earnings ratio = 4.7 Investors believe that Sheridan will be more profitable than Grouper in the future Practice, Question 18 Joe Refreh Ltd. Began with retained earnings of $400,000. The company earned $150,000 during the year, and paid a dividend of $100,000. The ending retained earnings balance is: a) $150,000 b) $425,000 c) $450,000 d) $650,000 Retained earnings = beginning retained earnings + net income – dividends declared Retained earnings = $400,000 + $150,000 - $100,000 Retained earnings = $450,000 Practice, Question 04 Which of the following should be classified as current assets? a) accounts payable, income tax payable, and accounts receivable b) prepaid expenses, equipment, and long-term investments c) cash, prepaid expenses, and income tax payable d) accounts receivable, cash, and prepaid expenses Practice, Question 07 Which of the following statements about the statement of changes in equity is incorrect? a) In the statement of changes in equity, profits for the period are added to the opening balance of retained earnings - True b) The statement of changes in equity describes the changes in each component of shareholders’ equity that took place during the period - True c) In the statement of changes in equity, dividends are shown as expenses - False d) The closing balance of the statement of changes in equity is reported in the shareholders’ equity section of the statement of financial position – True Practice, Question 09 The following balances and amounts were taken from the financial statements of Frisbee, Inc. The items are presented in alphabetical order. Accounts payable Accounts receivable Cash Common shares Gross profit Market price per share Net sales Other current liabilities Net income Salaries payable Sheridan 35,000 47,500 180,000 8,000 shares 185,000 8 500,000 22,000 64,000 10,000 The price-earnings ratio is: a) 2. b) 1.5. c) 12. d) 1. Price-earnings ratio = (market price per share)/(basic earnings per share) Basic earnings per share = (income available to common shareholders)/(weighted average number of commonshares) Basic earnings per share = 64,000/8,000 Basic earnings per share = 8 Price-earnings ratio = 8/8 Price-earnings ratio = 1.0 Practice, Question 05 Volcano Inc. received $1,000 cash in advance for work to be performed. How will this transaction affect the accounts? a) Cash will increase by $1,000 and Service Revenue will increase by $1,000 b) Cash will decrease by $1,000 and Service Revenue will increase by $1,000 c) Unearned Revenue will increase by $1,000 and Cash will increase by $1,000 d) Service Revenue will increase by $1,000 and Unearned Revenue will decrease by $1,000 Practice, Question 07 Western Manufacturer bought two new machines at a cost of $20,000 each for use in its new plant extension. Western made a $10,000 down payment and agreed to pay the balance owing within the next month. At the time of purchase, the effect of this transaction on the accounts would be: a) There is no effect on the accounting records at the time of purchase. The machines will be recorded when the full amount is paid b) A credit to Cash of $10,000, a debit to Machinery of $40,000 and a credit to Accounts Payable of $30,000 c) A debit to Machinery of $40,000 and a debit to Cash of $40,000 d) A debit to Machinery of $40,000 and a credit to Accounts Payable of $40,000 Assets + Expenses + Dividends = Liabilities + Share Capital + Revenue Cash is an asset that decreases by $10,000 – credit Accounts payable is a liability that increases by $30,000 – credit Equipment is an asset that increases by $40,000 – debit Practice, Question 20 Which of the following statements about posting is true? a) Posting accumulates the effects of journalized transactions in the individual accounts - Transferring from general journal to general ledger accounts b) Posting should be only at the end of a year - It should be done at least monthly c) Posting is performed before journalizing can be performed - After journalizing d) Posting is the only procedure where the debit and credit for a transaction are recorded together - Journalizing not posting Brief Exercise 1-3 Classify each item by type of business activity – operating, investing, or financing. Also indicate whether it results in an inflow or outflow of cash. Loan taken out from a bank Cash received from customers Sale of office equipment that company is done using Dividends paid to shareholders Common shares issued to investors Loan repayment Payment to supplier for inventory Purchase of an office building Salaries paid Business Activity Financing Operating Investing Financing Financing Financing Operating Investing Operating Inflow/Outflow Inflow Inflow Inflow Outflow Inflow Outflow Outflow Outflow Outflow Exercise 1-2 Consider the following statements and indicate if each of the statements listen in the left-hand column of the table is normally true or false for each of the types of business organization: proprietorship, partnership, public corporation, and private corporation. Proprietorship Partnership F T Public Corporation T F Private Corporation T F 1. No personal liability 2. Owner(s) pay(s) personal income tax on company income 3. Generally easiest form of organization to raise capital F T F F T 4. Ownership indicated by shares 5. Required to issue quarterly financial statements 6. Owned by one person 7. Limited life 8. Usually easiest form of organization to set up F F F F T T T – False True but not “easiest” T F T T T F F F F F F 9. Required to use IFRS as its accounting standards 10. Shares are closely held F F T T – False True but not “easiest” F T F F F F T Exercise 1-7 Summaries of selected data from the financial statements of two corporations follow. Both companies have just completed their first year of operations. Determine the missing amounts for [1] to [12]. Note that you may not be able to solve the items in numerical order. Income statement Total revenues Total expenses Net income Statement of changes in equity Total shareholders’ equity, beginning of year Cullumber Inc. Bramble Inc. 950,000 820,000 130,000 325,000 280,000 45,000 0 0 Common shares, beginning of year Issue of shares Common shares, end of year Retained earnings, beginning of year Net income Dividends declared Retained earnings, end of year Total shareholders’ equity, end of year Statement of financial position Total assets Total liabilities Total shareholders’ equity 0 110,000 110,000 0 130,000 40,000 90,000 200,000 0 20,000 20,000 0 45,000 10,000 35,000 55,000 1,100,000 900,000 200,000 200,000 145,000 55,000 1) Total expenses = total revenues – net income = 950,000 – 130,000 = 820,000 2) Common shares, end of year = common shares, beginning of year + issues of shares = 0 + 110,000 3) Net income given in income statement 4) Retained earnings = revenues – expenses – dividends declared 90,000 = 950,000 – 820,000 – dividends declared Dividends declared = 40,000 5) Total shareholders’ equity, end of year = common shares, end of year + retained earnings, end of year = 110,000 + 90,000 = 200,000 6) Total shareholders’ equity = total assets – total liabilities = 1,100,000 – 900,000 = 200,000 7) Total revenues = total expenses + net income = 280,000 + 45,000 = 325,000 8) Issue of shares = common shares, end of year – common shares, beginning of year = 20,000 – 0 = 20,000 9) Net income given in income statement 10) Total shareholders’ equity, end of year = common shares, end of year + retained earnings, end of year = 20,000 + 35,000 = 55,000 11) Total assets = total liabilities + total shareholders’ equity = 145,000 + 55,000 = 200,000 12) Calculated in 10) Practice Exercise 1-3 Consider the following business activities and classify each of the items by type of business activity: operating, investing or financing. Type of Activity Operating Investing Investing - Operating 4. Receipt of funds from the bank to finance the purchase of the additional Investing snow-making equipment - Financing 5. Issue of shares to raise funds for a planned expansion Financing 6. Repayment of a portion of the loan from the bank Financing 7. Payment of interest on the bank loan Financing - Operating 8. Payment of salaries to the employees who operate the ski lifts Operating 9. Receipt of a grant from the government for training a group of disabled skiers Financing - Operating 10. Payment of dividend to shareholders Financing 1. Cash receipts from customers paying for daily ski passes 2. Payments made to purchase additional snow-making equipment 3. Payments made to repair the grooming machines Practice Exercise 1-4 Sandhill Corporation, a private corporation, was formed on July 1 2018. Only July 31, Guy Gelinas, the company’s president, prepared the following statement of financial position: Assets Cash Accounts receivable Inventory Boat Sandhill Corporation Statement of Financial Position July 31,2018 Liabilities and Shareholders’ Equity 25,000 Accounts payable 50,000 53,000 Boat loan payable 42,000 38,000 Common shares 46,000 27,000 Retained earnings 5,000 $143,000 $143,000 Guy admits that his knowledge of accounting is somewhat limited and is concerned that his statement of financial position might not be correct. He gives you the following additional information: 1. The boat actually belongs to Guy Gelinas, not to Sandhill Corporation. However, because Guy thinks he might take customers out on the boat occasionally, he decided to list it as an asset of the company. To be consistent, he also included as a liability of the company the personal bank loan that he took out on the boat. 2. Included in the accounts receivable balance is $10,000 that Guy personally loaned to his brother 5 years ago, Guy included this in the receivables of Sandhill Corporation so that he wouldn’t forget that his brother owes him money. 3. Guy’s statements didn’t balance. To make them balance, he adjusted the Common Shares account until assets equalled liabilities and shareholders’ equity. Prepare a correct statement of financial position. (Hint: To get the balance sheet to balance, adjust Common Shares and list Assets in order of liquidity). Cash Accounts Receivable Inventory Total Assets Sandhill Corporation Statement of Financial Position For the Month Ended July 31 2018 Corrected: July 31 2018 Assets 25,000 43,000 38,000 106,000 Liabilities and Shareholders’ Equity Liabilities Accounts Payable Total Liabilities Shareholders’ Equity Common Shares Retained Earnings Total Shareholders’ Equity Total Liabilities and Shareholders’ Equity 50,000 50,000 51,000 5,000 56,000 106,000 Problem 1-9A Incomplete financial statements for Wildhorse, Inc. follow. a) Calculate the missing amounts for [1] to [13] Service revenue Operating expenses Income before income tax Income tax expense Net income Wildhorse, Inc. Income Statement Year Ended November 30, 2018 291,000 [1] 250,000 41,000 9,000 [2] 32,000 1) Operating expenses = service revenue – income before income tax = 291,000 – 41,000 = 250,000 2) Net income = income before income tax – income tax expense = 41,000 – 9,000 = 32,000 Balance, December 1 2017 Issued common shares Net income Dividends declared Balance, November 30 2018 Wildhorse, Inc. Statement of Changes in Equity Year Ended November 30, 2018 Common Shares Retained Earnings 0 0 230,000 [3] 32,000 - 10,000 230,000 [4] 22,000 Total Equity 0 [5] 230,000 [6] 32,000 - 10,000 [7] 252,000 3) Solved in 2) 4) Balance (retained earnings) = net income – dividends declared = 32,000 – 10,000 = 22,000 5) Issues common shares given 6) Solved in 2) 7) Total equity = common shares + retained earnings = 230,000 + 22,000 = 252,000 Wildhorse, Inc. Statement of Financial Position November 30, 2018 Assets Liabilities and Shareholders’ Equity Cash 24,000 Liabilities Accounts Receivable 35,000 Accounts Payable [10] 92,000 Land [8] 280,000 Bank loan payable 600,000 Buildings 390,000 Total liabilities 692,000 Equipment 215,000 Shareholders’ equity Total assets [9] 944,000 Common shares [11] 230,000 Retained earnings [12] 22,000 Total shareholders’ equity [13] 252,000 Total liabilities and shareholders’ equity 944,000 9) Total assets = total liabilities and shareholders’ equity = 944,000 10) Accounts payable = total liabilities – bank loan payable = 692,000 – 600,000 = 92,000 11-13) Solved in Statement of Changes in Equity 8) Land = total assets – cash – accounts receivable – buildings – equipment = 944,000 – 24,000 – 35,000 – 390,000 – 215,000 = 280,000 WileyPLUS Problem 1-7 Businesses can be organized in different ways. From the list provided, choose the answer that best fits for each of the three most common forms of business organizations. Is the business private or public? Does the business have a limited life? What is the owner’s personal liability for the business? What do we call the owner or owners? Who pays income tax on the net income? How many owners for the business? Proprietorship Private Limited Unlimited Proprietor Paid by the owner One Partnership Usually private Limited Limited or Unlimited - Unlimited Partners Paid by the partners Two or more Corporation Private or public Indefinite Limited Shareholders Paid by the corporation Two or more - One or more WileyPLUS Problem 1-8 Match the items below by entering the appropriate code letter. A. Internal users B. Proprietorship C. Expenses D. Investing Activities E. Financing Activities F. Assets G. Liabilities H. Private corporation I. Dividends J. Public corporation 1. Consumed assets or services: C 2. Ownership is limited to one person: B 3. Officers and others who manage the business: A 4. Creditor claims against the assets of the company: G 5. A separate legal entity under provincial or federal laws that is listed on a Canadian, or other, stock exchange, and is required to distribute their financial statements to the general public: J 6. Provides future economic benefits to the company: F 7. An activity that involves acquiring the resources necessary to run the business: D 8. An activity in which companies borrow money and sell shares: E 9. Payment to shareholders: I 10. A separate legal entity under provincial or federal laws where the shares are often said to be “closely held”: H Brief Exercise 2-4 Pharaoh Inc. reports the following current and non-current liabilities: accounts payable $24,000; salaries payable $3,900; interest payable $5,600; unearned revenue $900; income tax payable $6,700; mortgage payable (due within the year) $4,700; mortgage payable (due in more than one year) $47,000. Prepare the current liabilities section of the statement of financial position. Pharaoh Inc. Statement of Financial Position (Partial) Current Liabilities Accounts payable Salaries payable Interest payable Unearned revenue Income tax payable Mortgage payable (due within the year) - Current portion of mortgage payable Total Current Liabilities 24,00 3,900 5,600 900 6,700 4,700 45,800 Note: Mortgage payable (due in more than one year) is a non-current liability Brief Exercise 2-9 Match the listed qualitative characteristics of useful financial information discussed in this chapter to each of the following statements below. a) Information that has predictive value, confirmatory value, and is material is said to have this fundamental characteristic: relevance b) Information that is complete, neutral, and free of error is said to have this fundamental characteristic: faithful representation c) Public accountants perform audits to determine this enhancing qualitative characteristic: verifiability d) This quality requires that information cannot be selected to favour one position over another: neutrality e) This enhancing qualitative characteristic describes information that a reasonably informed user can interpret and comprehend: understandability f) When information provides a basis for forecasting income for future periods, it is said to have this quality: predictive value g) This enhancing qualitative characteristic requires that similar companies should apply the same accounting principles to similar events for successive accounting periods: comparability h) This quality results in information that has nothing important omitted: completeness i) This restriction requires that the value of the information presented should be greater than the cost of providing it: cost constraint j) This quality describes information that confirms or corrects users’ prior expectations: confirmatory value k) This enhancing qualitative characteristic requires that information be available to decision makers before it loses its ability to influence their decisions: timeliness l) Faithful representation means that information is complete, neutral and this third quality: freedom from error or bias m) This quality allows items of insignificance that would not likely influence a decision not to be disclosed: materiality Exercise 2-2 The assets (in thousands) that follow were taken from the December 31, 2015, balance sheet for Big Rock Brewery Inc.: Accounts receivable Accumulated depreciation – buildings Accumulated depreciation – machinery and equipment Accumulated depreciation – mobile equipment Accumulated depreciation – office furniture and equipment Buildings Cash 2,221 1,817 10,122 434 516 Intangible assets Inventories Land Machinery and equipment Mobile equipment 456 4,935 8,377 24,860 1,054 17,692 540 Office furniture and equipment Prepaid expenses and other 1,286 1,573 Prepare the assets section of the statement of financial position. (List current assets in order of liquidity. List Property, Plant, and Equipment in Land, Buildings, Machinery and Equipment, and Office Furniture. Show all amounts in thousands of dollars). Big Rock Brewery Inc. Statement of Financial Position (Partial) December 31, 2015 (in thousands) Assets Current Assets Cash Accounts receivable Inventories Prepaid expenses and other Total Current Assets Property, Plant and Equipment Land Buildings Less accumulated depreciation Machinery and Equipment Less accumulated depreciation Mobile equipment Less accumulated depreciation Office furniture and equipment Less accumulated depreciation Total Property, Plant and Equipment Intangible Assets Total Assets 540 2,221 4,935 1573 9,269 8,377 17,692 1,817 24,860 10,122 1,054 434 1,286 516 15,875 14,738 620 770 40,380 456 50,105 Exercise 2-3 The liabilities and shareholders’ equity items (in millions) that follow were taken from the March 31, 2016, balance sheet for Saputo Inc.: Accounts payable and accrued liabilities 896.6 Bank loans payable (current) Common shares Deferred income taxes payable (non-current) Income taxes payable Long-term debt Other long-term liabilities Retained earnings 423.1 821 475.6 37.1 1,208.3 61.8 3,180,8 Prepare the liabilities and shareholders’ equity sections of the statement of financial position (round answers to 1 decimal place) Saputo Inc. Statement of Financial Position (Partial) March 31, 2016 (in millions) Liabilities and Shareholders’ Equity Current Liabilities Accounts payable and accrued liabilities Bank loans payable (current) Income taxes payable Total Current Liabilities Non-Current Liabilities Deferred income taxes payable (non-current) Long-term debt Other long-term liabilities Total Non-Current Liabilities Total Liabilities Shareholders’ Equity Common shares Retained earnings Total Shareholders’ Equity Total Liabilities and Shareholders’ Equity 896.6 423.1 37.1 1356.8 475.6 1,208.3 61.8 1,745.7 3,102.5 821.0 3,180.8 4001.8 7,104.3 WileyPLUS Problem 2-10 Select from the following list the qualitative characteristic of useful information that best describes each of the following items: predictive value, confirmatory value, materiality, completeness, neutrality, freedom from error, verifiability, comparability 1. In order to keep the financial statements simple, Carlaw Consulting shows three items on its income statement: Revenue, Expenses and Net income: completeness 2. The financial statements of Belbach Industries are audited on an annual basis by public accountants: verifiability 3. Rydell Corporation is contemplating an investment in Fryan Ltd. Rydell has requested a copy of the company’s year-end financial statements to assist them in their investment decision: predictive value 4. Chemical Reaction Inc. operates in both the US and Canada and restates its US financial statements according to Canadian GAAP for its Canadian investors: comparability 5. The Controller for Location Inc. emphasizes that factual and unbiased information prevails in the preparation of the company financial statements: neutrality WileyPLUS Problem 2-8 Use the ratios below and statement of financial position to fill in the missing information. (Round debt to total assets ratio to 1 decimal place). Ayayai Corporation had the following comparative statements of financial position: Ayayai Corporation Statement of Financial Position Dec. 31, 2018 Dec. 31, 2017 Assets Current assets Cash Held for trading investments Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment (net) Total assets Liabilities and Shareholders’ Equity Current liabilities Accounts payable Salaries payable Income tax payable Total current liabilities Mortgage payable Total liabilities Shareholders’ equity Common shares Retained earnings Total liabilities and shareholders’ equity 85,000 114,000 140,000 232,000 94,000 665,000 197,000 862,000 90,000 162,000 135,500 207,000 61,000 655,500 200,000 855,500 315,385 108,750 50,865 475,000 60,578 535,578 308,000 87,000 41,000 436,000 75,795 511,795 275,000 51,422 862,000 275,000 68,705 855,500 Additional information: Current ratio Working capital Debt to total assets 2018 1.4 : 1 $ 190,000 62.1% 2017 1.5 : 1 $ 219,500 59.8 % Current ratio = (current assets)/(current liabilities) 2018: 1.4 = 665,000/current liabilities current liabilities = 475,000 Salaries payable = current liabilities – accounts payable – income tax payable = 475,000 – 315,385 – 50,865 = 108,750 Total liabilities = current liabilities + mortgage payable = 475,000 + 60,578 = 535,578 Working capital = current assets – current liabilities = 665,000 – 475,000 = 190,000 2017: Salaries payable = total liabilities – mortgage payable – income tax payable – accounts payable = 511,795 – 75,795 – 41,000 – 308,000 = 87,000 Current liabilities = accounts payable + salaries payable + income tax payable = 308,000 + 87,000 + 41,000 = 436,000 Total assets = total liabilities and shareholders’ equity = 855,500 Current assets = total assets – property, plant, and equipment (net) = 855,500 – 200,000 = 655,500 Held for trading investments = current assets – cash – accounts receivable – inventory – prepaid expenses = 655,500 – 90,000 – 135,500 – 207,000 – 61,000 = 162,000 Debt to total assets ratio = (total liabilities)/(total assets) = 511,795/855,500 = 59.8% Brief Exercise 3-10 June 1 4 7 18 25 27 28 29 General Journal Account Titles Cash Common Shares Supplies Accounts Payable Accounts Receivable Service Revenue Cash Accounts Receivable No Entry No Entry Cash Unearned Revenue Accounts Payable Cash Income Tax Expense Cash Debit 2,710 Credit 2,710 231 231 318 318 212 212 0 0 201 201 231 231 95 95 Using T accounts, post the above journal entries to the general ledger. (Post entries in the order presented in the problem). June 1 June 18 June 27 Bal. June 7 Bal. June 4 June 28 Cash 2,710 June 28 212 June 29 201 2,797 Accounts Receivable 318 June 18 106 Supplies 231 Accounts Payable 231 June 4 Bal. 231 95 212 231 0? Unearned Revenue June 27 Common Shares June 1 Service Revenue June 7 Income Tax Expense June 29 201 2,710 318 95 Brief Exercise 3-3 For each of the following accounts, indicate (a) whether it is an asset, liability, or shareholders’ equity account; (b) the normal balance of the account; (c) whether a debit will increase or decrease the account; and (d) whether a credit will increase or decrease the account. 1. Accounts Payable 2. Accounts Receivable 3. Cash 4. Common Shares 5. Dividends Declared 6. Equipment 7. Income Tax Expense 8. Retained Earnings 9. Service Revenue 10. Unearned Revenue (a) Basic Type Liability Asset Asset Shareholders’ Equity Shareholders’ Equity Asset Liability - Shareholders’ Equity Shareholders’ Equity Asset - Shareholders’ Equity Liability (b) Normal Balance Credit Debit Debit Credit Debit Debit Credit - Debit Credit Debit - Credit Credit (c) Debit Effect Decrease Increase Increase Decrease Increase Increase Decrease - Increase Decrease Increase - Decrease Decrease (d) Credit Effect Increase Decrease Decrease Increase Decrease Decrease Increase - Decrease Increase Decrease - Increase Increase Assets + Expenses + Dividends = Liabilities + Share Capital + Revenues Brief Exercise 3-6 Presented below are a number of economic events. 1. Purchased supplies on account, $240 2. Provided a service on account, $450 3. Paid salaries expense, $330 4. Issued common shares in exchange for cash, $5,230 5. Declared and paid $90 of dividends to shareholders 6. Received cash from a customer who had previously been billed for services provided, $450 (see item 2) 7. Paid account owed to supplier on account, $240 (see item 1) 8. Paid for insurance in advance, $100 9. Received cash in advance from a customer for services to be performed in the future, $280 10. Performed the service that the customer previously paid for (see item 9) Journalize the transactions given above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select “No Entry” for the account titles and enter 0 for the amounts.) No. Account Titles and Explanation 1. Supplies Accounts Payable 2. Accounts Payable - Accounts Receivable Unearned Revenue - Service Revenue 3. Salaries Expense Cash 4. Cash Common Shares 5. Dividends Declared Cash 6. Unearned Revenue - Cash Accounts Receivable 7. Accounts Payable Cash 8. Prepaid insurance Cash 9. Cash Unearned Revenue 10. Unearned Revenue Service Revenue Debit 240 240 450 450 330 330 5230 5230 90 90 450 450 240 240 100 100 280 550 450 Assets + Expenses + Dividends = Liabilities + Share Capital + Revenues 1. Performed the service that the customer previously paid for (see item 9) Brief Exercise 3-9 Fill in the missing amounts from the following T accounts Accounts Receivable Aug. 10 15 18,400 6,300 Aug 23 Bal. Sept. 5 (a) 16,000 8,700 (b) 4,300 Sept. 15 7,800 Bal. 5,300 Accounts Payable Aug. 5 (c) 5,500 18 3,300 Aug. 29 Sept. 23 Credit 5,400 Bal. Sept. 12 3,400 7,300 Bal. (d) 4,200 6,500 280 450 550 Sales Aug. 10 Aug. 12 15 Sept. 25 48,900 400 Bal. Sept. 12 47,300 (e) 95,800 (f) 5,100 Bal. 100,400 500