merch

advertisement

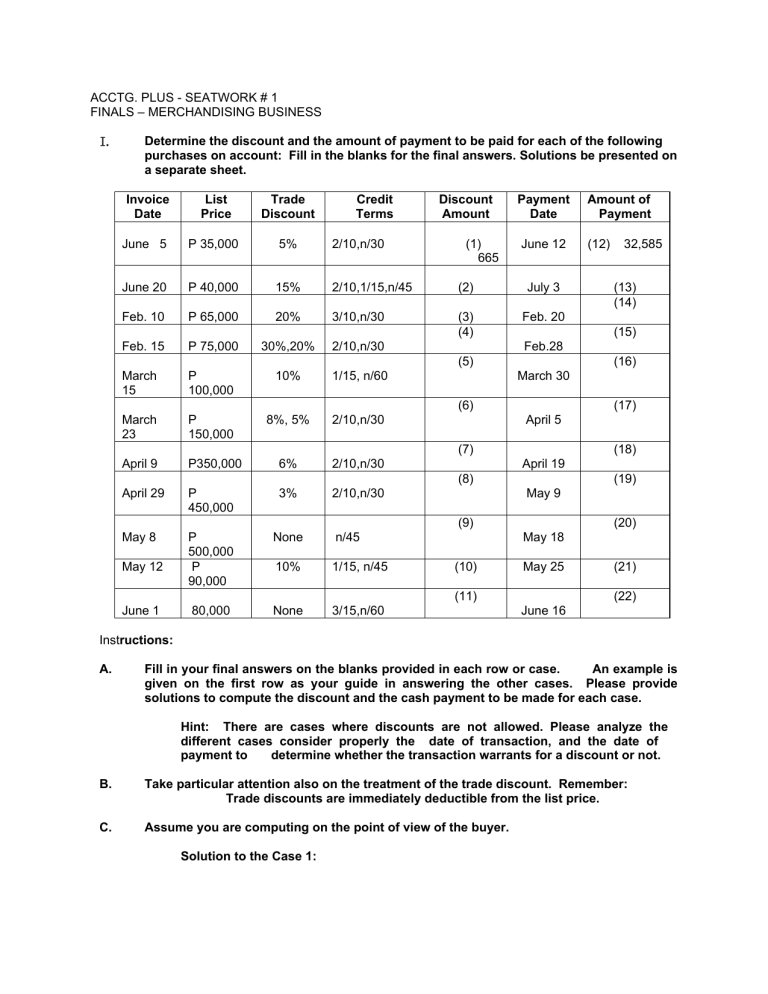

ACCTG. PLUS - SEATWORK # 1 FINALS – MERCHANDISING BUSINESS I. Determine the discount and the amount of payment to be paid for each of the following purchases on account: Fill in the blanks for the final answers. Solutions be presented on a separate sheet. Invoice Date List Price Trade Discount Credit Terms Discount Amount June 5 P 35,000 5% 2/10,n/30 June 20 P 40,000 15% 2/10,1/15,n/45 (2) July 3 Feb. 10 P 65,000 20% 3/10,n/30 (3) (4) Feb. 20 Feb. 15 P 75,000 30%,20% 2/10,n/30 March 15 P 100,000 10% 1/15, n/60 March 23 P 150,000 8%, 5% 2/10,n/30 April 9 P350,000 6% 2/10,n/30 April 29 P 450,000 3% 2/10,n/30 May 8 P 500,000 P 90,000 None n/45 10% 1/15, n/45 80,000 None 3/15,n/60 (1) 665 Payment Date June 12 32,585 (13) (14) (15) (16) March 30 (6) (17) April 5 (7) (18) April 19 (8) (19) May 9 (9) (20) May 18 (10) May 25 (11) June 1 (12) Feb.28 (5) May 12 Amount of Payment (21) (22) June 16 Instructions: A. Fill in your final answers on the blanks provided in each row or case. An example is given on the first row as your guide in answering the other cases. Please provide solutions to compute the discount and the cash payment to be made for each case. Hint: There are cases where discounts are not allowed. Please analyze the different cases consider properly the date of transaction, and the date of payment to determine whether the transaction warrants for a discount or not. B. Take particular attention also on the treatment of the trade discount. Remember: Trade discounts are immediately deductible from the list price. C. Assume you are computing on the point of view of the buyer. Solution to the Case 1: 2 Date of Transaction = June 5 List Price P 35,000, Terms: 5%, 2/10,n/30. of Payment June 12. The discount is computed in such a way that, the term 5%,2/10,n/30, means that the buyer is entitled to a credit term of 30 days. He is given further a 5% trade discount, and 2% cash discount. The trade discount is immediately deducted from the list price of P 35,000. Hence the net amount to be used as a basis for the cash discount is P 33,250, that is, ( 35,000 x .95). Then, since the purchase was paid within the discount period ( June 5 - June 15 is 7 seven days, hence, 33,250 x .02 = P 665 = discount). The net cash to be paid is therefore = P 32,585 ( 33,250 - 665) Date