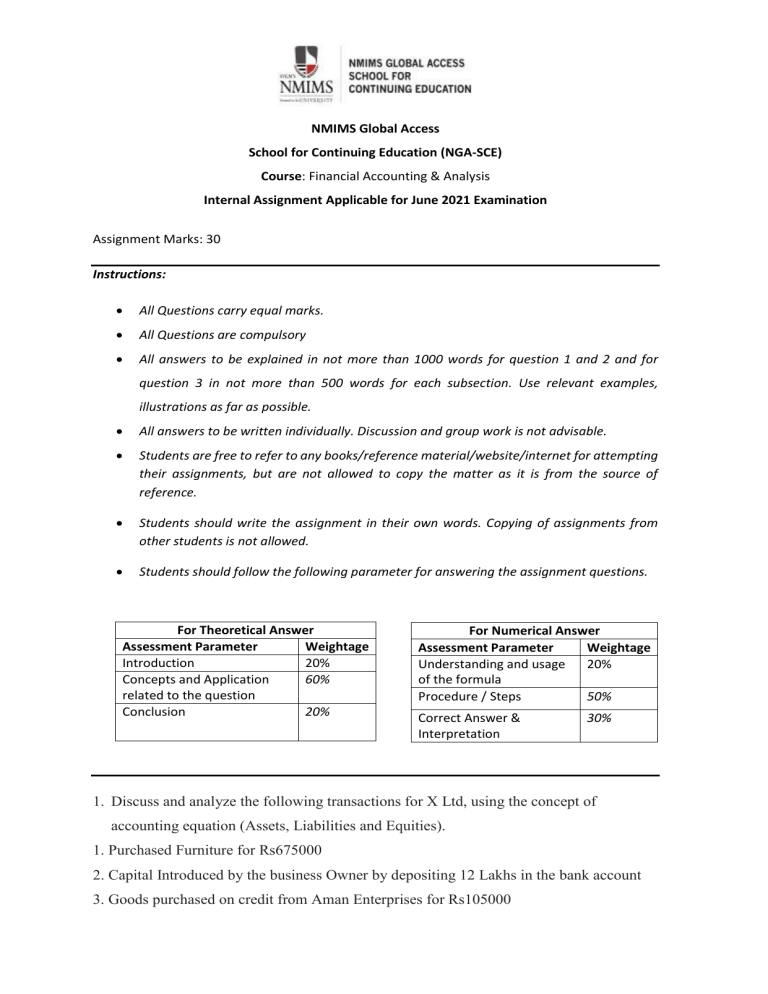

NMIMS Global Access School for Continuing Education (NGA-SCE) Course: Financial Accounting & Analysis Internal Assignment Applicable for June 2021 Examination Assignment Marks: 30 Instructions: All Questions carry equal marks. All Questions are compulsory All answers to be explained in not more than 1000 words for question 1 and 2 and for question 3 in not more than 500 words for each subsection. Use relevant examples, illustrations as far as possible. All answers to be written individually. Discussion and group work is not advisable. Students are free to refer to any books/reference material/website/internet for attempting their assignments, but are not allowed to copy the matter as it is from the source of reference. Students should write the assignment in their own words. Copying of assignments from other students is not allowed. Students should follow the following parameter for answering the assignment questions. For Theoretical Answer Assessment Parameter Weightage Introduction 20% Concepts and Application 60% related to the question Conclusion 20% For Numerical Answer Assessment Parameter Weightage Understanding and usage 20% of the formula Procedure / Steps 50% Correct Answer & Interpretation 30% 1. Discuss and analyze the following transactions for X Ltd, using the concept of accounting equation (Assets, Liabilities and Equities). 1. Purchased Furniture for Rs675000 2. Capital Introduced by the business Owner by depositing 12 Lakhs in the bank account 3. Goods purchased on credit from Aman Enterprises for Rs105000 NMIMS Global Access School for Continuing Education (NGA-SCE) Course: Financial Accounting & Analysis Internal Assignment Applicable for June 2021 Examination 4. Goods sold on credit for Rs 400000. The cost of the goods sold was Rs 300000 5. Purchased goods from Sneha Enterprises for Rs 600000 and made the payment from the business's bank account (5*2 = 10 Marks) 2. Love Doddle is a gifting enterprise of Ms. Dorati. The enterprise generates inflows by arranging gift hampers for the customer's loved ones. The inflows arises from the sale of gift hampers Rs 505000 and from bank interest, dividend receipt Rs4200. Ms. Dorati is confused on how to record these inflows. She would like to understand from you about the concepts Revenue from operation and other income, so that she can record the information so as to prepare the profit and loss statement of the enterprise. Define, share examples, and elaborate on your understanding towards the terms Revenue from Operation and Other Income (10 Marks) 3. The following information is given with respect to the ratio's of two companies Current ratio Quick Ratio Return on investment Debt Equity Ratio Aman Ltd Roger Ltd 2:01 1.35:1 15% 2.5:1 1.60:1 1:01 13% 1:01 a. Define the concepts of Current and Quick ratio’s and also, reflect on your understanding towards the financial performance of the companies by looking to the above information (2marks for defining and 3 marks for interpretation and reasoning) (5 Marks) NMIMS Global Access School for Continuing Education (NGA-SCE) Course: Financial Accounting & Analysis Internal Assignment Applicable for June 2021 Examination b. Define the terms- Return on Investment and Debt equity ratio and also, reflect on your understanding towards the financial performance of the companies (2marks for defining and 3 marks for interpretation and reasoning) ********** (5 Marks)