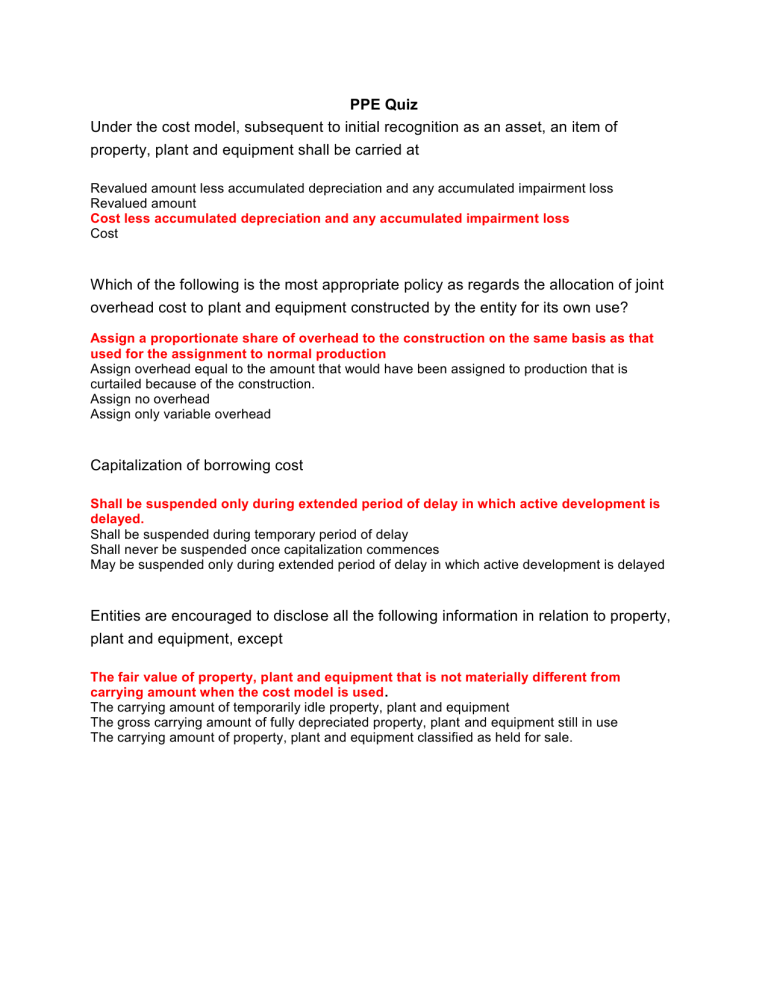

PPE Quiz Under the cost model, subsequent to initial recognition as an asset, an item of property, plant and equipment shall be carried at Revalued amount less accumulated depreciation and any accumulated impairment loss Revalued amount Cost less accumulated depreciation and any accumulated impairment loss Cost Which of the following is the most appropriate policy as regards the allocation of joint overhead cost to plant and equipment constructed by the entity for its own use? Assign a proportionate share of overhead to the construction on the same basis as that used for the assignment to normal production Assign overhead equal to the amount that would have been assigned to production that is curtailed because of the construction. Assign no overhead Assign only variable overhead Capitalization of borrowing cost Shall be suspended only during extended period of delay in which active development is delayed. Shall be suspended during temporary period of delay Shall never be suspended once capitalization commences May be suspended only during extended period of delay in which active development is delayed Entities are encouraged to disclose all the following information in relation to property, plant and equipment, except The fair value of property, plant and equipment that is not materially different from carrying amount when the cost model is used. The carrying amount of temporarily idle property, plant and equipment The gross carrying amount of fully depreciated property, plant and equipment still in use The carrying amount of property, plant and equipment classified as held for sale. When an item of property, plant and equipment is acquired by issuing equity shares, which of the following is the best basis for establishing the historical cost of the acquired asset? Historical cost of the asset is zero since noncash is paid in the acquisition Fair value of the asset received or the fair value of the shares issued, whichever is more readily determinable Historical cost of a similar asset acquired in another transaction by the buyer Historical cost of the asset to the seller In an exchange of assets, an entity received equipment with a fair value equal to the carrying amount of equipment given up. The entity also contributed cash. As a result of the exchange, the entity shall recognize A loss determined by the proportion of cash paid to the total transaction value A gain determined by the proportion of cash paid to the total transaction value Neither gain nor loss A loss equal to the cash given up The cost of an item of property, plant, and equipment acquired in a nonmonetary exchange is measured at the Carrying amount of the asset received Carrying amount of the asset given up Fair value of the asset given up Fair value of the asset received The cost of the land shall include all the following except Property tax after date of acquisition assumed by the purchaser Commission related to acquisition Property tax to date of acquisition assumed by the purchaser Cost of survey Which of the following terms best describes the removal of an asset from an entity's statement of financial position? Derecognition Depreciation Writeoff Impairment If the qualifying asset is financed by specific borrowing, the capitalizable borrowing cost is equal to Actual borrowing cost incurred up to completion of asset minus any investment income from the temporary investment of the borrowing Actual borrowing cost incurred Actual borrowing cost incurred up to completion of asset Zero If the present value of a note issued in exchange for a plant asset is less than its face amount, the difference shall be Amortized as interest expense over the life of the note Amortized as interest expense over the life of the asset Included in the cost of the asset Included in interest expense in the year of issuance Grants related to depreciable assets are usually recognized as income Over the useful life of the assets and in proportion to the depreciation of the assets Over the useful life of the assets using sum of years' digits Immediately Over the useful life of the assets using straight line Which disclosure is not required by PAS 20? The nature and extent of government grant recognized in the financial statements and an indication of other form of government assistance from which the entity has directly benefited. Unfulfilled conditions and other contingencies attaching to government assistance. The name of the government agency that gave the grant along with the date of sanction of the grant by the government agency and the date when cash was received in case of monetary grant. The accounting policy adopted for government grant including method of presentation adopted in the financial statements. When an entity purchases land with a building on it and immediately tears down the building so that the land can be used for the construction of a plant, the cost incurred to tear down the building shall be Added to the cost of the plant Added to the cost of the land Expensed as incurred Amortized over the estimated time period between the tearing down of the building and the completion of the plant Grants in recognition of specific costs are recognized as income Over a maximum of 5 years using sum of years digits Immediately Over a maximum of 5 years using straight line Over the same period as the relevant expense A government grant that becomes receivable as compensation for expenses or losses already incurred or for the purpose of giving immediate financial support to the entity with no future related costs should be recognized as income Over a maximum of 5 years using straight line When received Of the period in which it becomes receivable Over a maximum of 10 years using straight line Costs directly attributable to bringing the asset to the location and condition for its intended use include all of the following, except Cost of employee benefit not arising directly from the construction and acquisition of property, plant and equipment Installation and assembly cost Delivery and handling cost Cost of site preparation Major spare parts and standby equipment which are expected to be used over a period of more than one year shall be classified as Expense Property, plant and equipment Noncurrent investment Inventory Which type of expenditure occurs when an entity installs a higher capacity boiler to heat its plant? Addition Ordinary repair and maintenance Rearrangement Betterment For purposes of capitalization of borrowing cost, which of the following is not a qualifying asset? Investment property Asset ready for its intended use Power generation facility Manufacturing plant