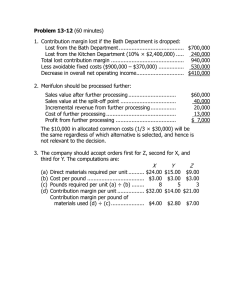

UNIT 7 - RELEVANT COSTING - Problem Solutions Problem 7-2 Savings Salary of gardeners Plant materials Fertilizer Fuel Sale of old equip Total Cost of Highline Benefit of Outsourcing in yr 1 182000 75000 6000 7500 30000 300500 275000 25500 In Second year Total Savings Less Sale of old equip Savings in 2nd yr Higlline Net Benefit in 2nd yr 300500 -30000 270500 275000 -4500 From second yr, there will be a loss of 4500, so outsourcing in this case is not profitable. Problem 7-3 Savings Payroll clerk Software Updates HR Manager Seminar Total Saving Cost of ABC Net Benefit 9000 1000 20000 1200 31200 18000 13200 The Company only saves money on outsourcing payroll. Also the computers can be used efficiently for othe Problem 7-4 Don’t Buy Materials Labour to form ductwork Labour to install ductwork Misc Variable costs Allocated fixed costs Buy 35000 3000 9000 1500 3000 40000 0 9000 1500 3000 Difference -5000 3000 0 0 0 Penalty for delay Total 6000 57500 0 53500 6000 4000 Bradley should buy the pre-fabricated ductwork, since it gives a incremental revenue of 4000. Problem 7-6 Cost Savings Cost of purchasing containers 10% on Direct materials 20% on Direct Labor 15% on Variable Overhead Supervisor Salary Rent Savings Total Savings Net Benefit of purchasing 175000 65000 70000 15000 70000 15000 235000 Fixed Overhead is 200000, so for 1 packag 60000 Company should purchase containers since it yields a profit of 60000. Problem 7-7 Revenue Variable Cost incurred Fixed Cost incurred Recoloring cost Total Recolour and sell Sell Difference 10000 7000 3000 5000 5000 0 3000 3000 0 2000 0 2000 0 -1000 1000 The company should repeat the coloring process—the net incremental benefit of this action is $1,000 comp Problem 7-8 Zylex A Costs Selling Price Material Labor Overhead Total Costs Contribution margin Time to Produce CM/min 9 2 2.5 2.25 6.75 2.25 25 0.09 Zylex B Incremental Selling Price Material Labor 6 1.75 0.5 Overhead Total Costs Contribution margin Incremental Time to Produce CM/min 1.1 3.35 2.65 10 0.265 There is no question that ZylexA has to be produced, because the company cannot make ZylexB without starting with ZylexA. The question is, “If you have a unit of ZylexA, should you take up production time converting it into ZylexB or should you just make more ZylexA?” The analysis indicates that production of ZylexB actually yields profit at a rate of $.265 per minute. Thus, ZylexB should be produced. Problem 7-9 When you drop/stop a product you lose the CM. Loss of CM Savings on Direct Salaries Net Effect -310000 65000 Other fixed costs will remain the same only - Assumed -245000 By dropping Accelerators the company will be worse off by 245000. So it is better to keep them, though the Problem 7-10 Fescue CM per sq. yard 1.45 Bermuda 1.7 15000 Planting bermuda in additional 60000 yards will yield an incremental profit of [(1.7-1.45)*60000], 15000. T Problem 7-11 Cost Savings Dropping Model 599 Lost revenue Materials Direct Labor Direct Fixed Cost Total Savings Net Benefit -6500000 3000000 2000000 500000 5500000 -1000000 Droppin Model 599 only worsens the profit by 1000000, so contuining with it is a rather good idea. Problem 7-12 The Economy grade is dropped Standard Yards of Carpet Deluxe Total 45000 75000 120000 Sales Variable Costs Fixed Costs Net Profit 675000 405000 303750 -33750 1500000 900000 506250 93750 2175000 1305000 810000 60000 Since Standard is generating a loss, that is also dropped Deluxe Yards of Carpet Sales Variable Costs Fixed Costs Net Profit 75000 1500000 900000 810000 -210000 In many if not most cases, common costs will not be reduced when aproduct or product line is dropped. Th blem Solutions profitable. can be used efficiently for other useful purposes. revenue of 4000. head is 200000, so for 1 package it is 200000/100000 = 2, Total overhead is 3, 3-fixed = 3-2 = 1) it of this action is $1,000 compared to selling the carpet to United Home Discount Store for $7 per square yard. main the same only - Assumed etter to keep them, though the profit from them is comparatively low. f [(1.7-1.45)*60000], 15000. The opportunity cost of sticking to an equal mix is 15000. t is a rather good idea. or product line is dropped. The costs are simply “passed on” to theremaining products, which may in turn appear unprofitable! turn appear unprofitable!