Motsepe’s TymeBank hits 800K customers, eyes 1m ITWeb

advertisement

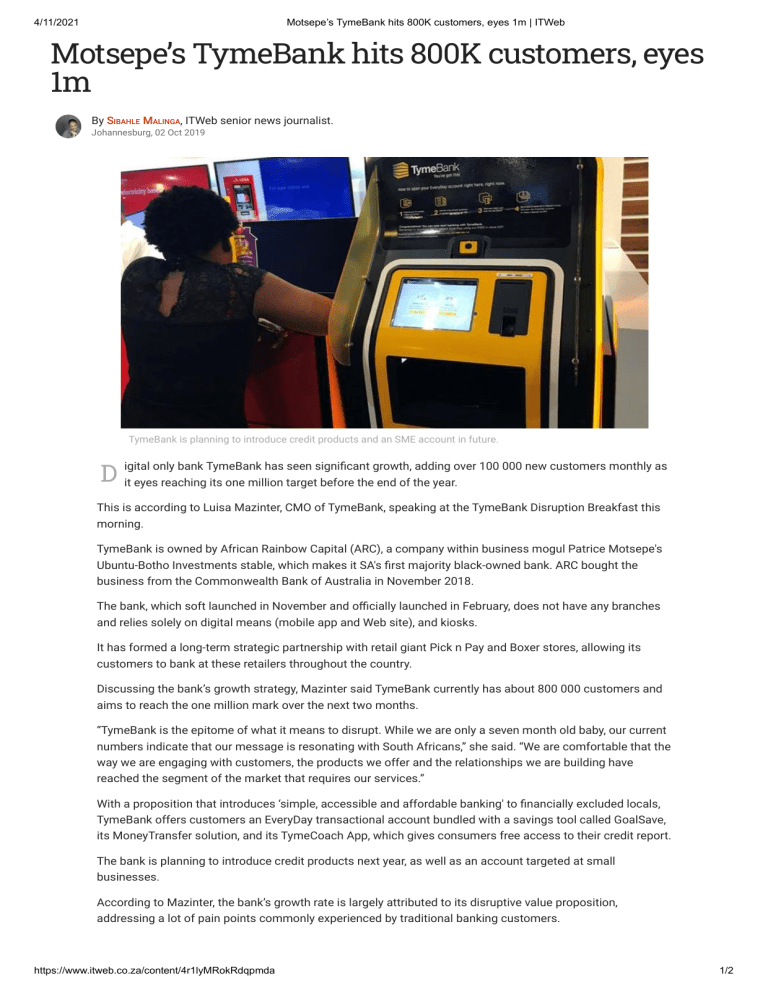

4/11/2021 Motsepe’s TymeBank hits 800K customers, eyes 1m | ITWeb Motsepe’s TymeBank hits 800K customers, eyes 1m By SIBAHLE MALINGA, ITWeb senior news journalist. Johannesburg, 02 Oct 2019 TymeBank is planning to introduce credit products and an SME account in future. only bank TymeBank has seen signi cant growth, adding over 100 000 new customers monthly as D igital it eyes reaching its one million target before the end of the year. This is according to Luisa Mazinter, CMO of TymeBank, speaking at the TymeBank Disruption Breakfast this morning. TymeBank is owned by African Rainbow Capital (ARC), a company within business mogul Patrice Motsepe's Ubuntu-Botho Investments stable, which makes it SA's rst majority black-owned bank. ARC bought the business from the Commonwealth Bank of Australia in November 2018. The bank, which soft launched in November and o cially launched in February, does not have any branches and relies solely on digital means (mobile app and Web site), and kiosks. It has formed a long-term strategic partnership with retail giant Pick n Pay and Boxer stores, allowing its customers to bank at these retailers throughout the country. Discussing the bank’s growth strategy, Mazinter said TymeBank currently has about 800 000 customers and aims to reach the one million mark over the next two months. “TymeBank is the epitome of what it means to disrupt. While we are only a seven month old baby, our current numbers indicate that our message is resonating with South Africans,” she said. “We are comfortable that the way we are engaging with customers, the products we offer and the relationships we are building have reached the segment of the market that requires our services.” With a proposition that introduces ‘simple, accessible and affordable banking' to nancially excluded locals, TymeBank offers customers an EveryDay transactional account bundled with a savings tool called GoalSave, its MoneyTransfer solution, and its TymeCoach App, which gives consumers free access to their credit report. The bank is planning to introduce credit products next year, as well as an account targeted at small businesses. According to Mazinter, the bank’s growth rate is largely attributed to its disruptive value proposition, addressing a lot of pain points commonly experienced by traditional banking customers. https://www.itweb.co.za/content/4r1lyMRokRdqpmda 1/2 4/11/2021 Motsepe’s TymeBank hits 800K customers, eyes 1m | ITWeb “From our research we knew that our customers were experiencing many complexities when signing up with a new bank and we have always had a clear vision of making our on-boarding process and all other services as simple as possible from inception.” Establishing an entirely new business model in the local market last year, the bank needed to have very clear vision about how credibility is earned as it depends on a high level of trust from its customers, said Mazinter. “Customers had to be con dent that they can trust us with their money, and that was a challenge for a business with no bank branches. We also don’t have the media advertising budgets that most of our competitors have, so we had to rely on innovative ways to communicate with customers and market our brand.” TymeBank’s steady growth journey has not been without its fair share of growing pains, Mazinter noted. “Our business was registered as Tyme Digital by Commonwealth Bank SA when we rst started. However, as we were about to go to market, we were told by The Commonwealth Bank of Australia that we had to change our name. This meant that we had to completely re-brand, only two months before we went live. We also had some technology glitches shortly after launching, which is nothing new in this industry. But we have found a sweet spot and we are expecting higher numbers as we look towards the new year,” she concluded. https://www.itweb.co.za/content/4r1lyMRokRdqpmda 2/2