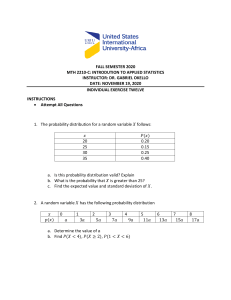

Chapter five Pricing and Business strategy April 2020 Yordanos G. (Mulungushi Univ.) Pricing strategies • What is a price strategy? Price strategy refers to the firm’s plan or discretion of price fixation in a manner such that it may successfully adjust to attain the objective profit maximization. • Pricing is key to managerial decision making. • If the price doesn’t fit what customers are willing to pay, then the product may not be profitable. April 2020 Yordanos G. (Mulungushi Univ.) • Price directly relates to firm’s profitability. • Firm’s profitability can be affected by internal and external factors (1) Competitive advantage (internal factors) (2) Market conditions (external factors) April 2020 Yordanos G. (Mulungushi Univ.) 5.1 Mark-up pricing • Most businesses set prices in ‘relation to costs’, but not demand. Two steps • The firm estimates the cost per unit of output of the product , usually marginal cost (average cost). • The firm adds a mark-up to the estimated average cost. April 2020 Yordanos G. (Mulungushi Univ.) Mark-up on cost/cost plus pricing = ( − Where the numerator, price – cost, is the profit margin. If the cost of a book is $4 and its price is $6 (6 − 4) = = 0.50 4 Or 50 percent. April 2020 Yordanos G. (Mulungushi Univ.) ) • If we solve the above equation for price, the result is = 1+ Which is the pricing formula for the firm. − = 4 1 + 0.5 = 6 April 2020 Yordanos G. (Mulungushi Univ.) Mark-up on price • It is a measure of profit margin that is expressed as a percentage of price. ( − ) = • The mark-up on cost and mark-up on price formulas are simply alternative means for expressing the relative size of profit margins. April 2020 Yordanos G. (Mulungushi Univ.) • • April 2020 = = Yordanos G. (Mulungushi Univ.) Example • Sam is a project coordinator at Sam & Associates Ltd. Sam has asked you to complete an analysis of profit margins earned on a number of recent projects. Unfortunately, your predecessor on this project was abruptly transferred, leaving you with only sketchy information on the firm’s pricing practices. • Use the available data to complete the following table: April 2020 Yordanos G. (Mulungushi Univ.) Price ($) 100 240 680 750 2,800 Marginal cost ($) 25 72 272 Markup on cost (%) 300 Markup on price (%) 75 150 100 60 40 2,700 3,360 5,800 6,250 33.3 20 10 5.3 1,000 April 2020 0 Yordanos G. (Mulungushi Univ.) 5.2 Price discrimination • In some situations it is possible to charge different prices for different units of the output: - Price discrimination Examples of price discrimination - suppliers offer quantity discount - Airlines charge different prices - Price of Phone/electricity consumption vary in time April 2020 Yordanos G. (Mulungushi Univ.) • Price discrimination is a device to increase profit. Charging different prices for different clients allows for an increase in profit. April 2020 Yordanos G. (Mulungushi Univ.) When is price discrimination possible? • Existence of monopoly power • Separate market - there must be two or more separate markets. - Transferring a commodity from low-priced market to highpriced market should be expensive. • Difference in the elasticity of demand - elasticity of demand should be different in different markets. April 2020 Yordanos G. (Mulungushi Univ.) Price discrimination and profits Example: suppose a firm sell its product in two markets and has constant marginal costs of production equal to $2 per unit. The demand equations for the two markets are as follows: Market 1 Market 2 = 14 − 2 = 10 − What are the profit maximizing prices and quantities in each market? Show that profit from price discrimination is greater than a uniform price. April 2020 Yordanos G. (Mulungushi Univ.) Solution: With price discrimination, the condition for profit maximization is = = = 3; = 4; = 8; = 34 April 2020 Yordanos G. (Mulungushi Univ.) =6 • To compute profits in the absence of price discrimination, the combined demand and marginal revenue equations must be computed. • The first step is to express the demand equations in terms of quantities. Thus, =7− April 2020 2 = 10 − Yordanos G. (Mulungushi Univ.) Note that the subscript has been dropped from price because the same price is to be charged in each market. Adding to two demand curves gives 3 = 17 − 2 The corresponding marginal revenue equation is calculated by solving for P and using the principle that marginal revenue function for a linear demand curve has the same intercept and twice the slope. Thus, April 2020 Yordanos G. (Mulungushi Univ.) 1 2 = 11 − 3 3 and 1 4 = 11 − 3 3 Equating marginal revenue to marginal cost =7 April 2020 2 =6 3 2 = 32 3 Yordanos G. (Mulungushi Univ.) Degrees of Price Discrimination • Under first-degree price discrimination, the firm extracts the maximum amount each customer is willing to pay for its products. Such pricing precision is rare because it requires that sellers know the maximum price each buyer is willing to pay for each unit of output. April 2020 Yordanos G. (Mulungushi Univ.) • Second-degree price discrimination, a more frequently employed type of price discrimination, involves setting prices on the basis of the quantity purchased. April 2020 Yordanos G. (Mulungushi Univ.) • The most commonly observed form of price discrimination, thirddegree price discrimination, results when a firm separates its customers into several classes and sets a different price for each customer class. April 2020 Yordanos G. (Mulungushi Univ.) 5.3 Peak-load Pricing Peak-load pricing is the practice of charging a higher price for a service when demand is high and capacity is fully utilized and a lower price when demand is low and capacity is underutilized. • The demand for airline travel is greater during holiday seasons than at other times. • The demand for electric power, for example, is higher during the day than at night Peak-load pricing rule: Charge a higher price during peak times than is charged during off-peak times so that MR=MC during each period. April 2020 Yordanos G. (Mulungushi Univ.) Peak-load pricing may be suitable only if three conditions are met in producing a product. 1. The product cannot be storable. Eg. Electricity 2. The same facilities must be used to provide the service during different periods of time. 3. There must be variation in demand characteristics of consumers at different periods of time. April 2020 Yordanos G. (Mulungushi Univ.) Example of peak-load pricing • The Gotham Bridge and Tunnel Authority (GBTA) has estimated the following demand equations for peak and off-peak automobile users of the Frog’s Neck Bridge: = − = 10 − 0.02 = = 5 − 0.05 Where T is the toll charged for a one-minute trip (Q) across the bridge. April 2020 Yordanos G. (Mulungushi Univ.) • The marginal cost of operating the bridge has been estimated at $2 per automobile bridge crossing. The peak capacity of the Frog’s Neck Bridge has been estimated at 50 automobiles per minute. What toll should the GBTA charge peak and off-peak users of the bridge? April 2020 Yordanos G. (Mulungushi Univ.) • With assume that the firm wants to maximize profit • = = 5 − 0.05 =5 The marginal revenue equation is = 5 − 0.1 . Then, 5 − 0.1 =2 = 30 April 2020 Yordanos G. (Mulungushi Univ.) − 0.05 Substituting this result into the off-peak demand equation yields the toll charged to off-peak automobile users of the bridge: = 5 − 0.05 = 5 − 0.05 30 = $3.50 At a bridge capacity of 50 automobiles per minute, the marginal cost curve is vertical. Substituting bridge capacity into the peak demand equation yields the toll that should be charged to peak automobile users of the bridge: = 10 − 0.02 50 = $9 Peak users of the bridge should be charged $9 per crossing. April 2020 Yordanos G. (Mulungushi Univ.)