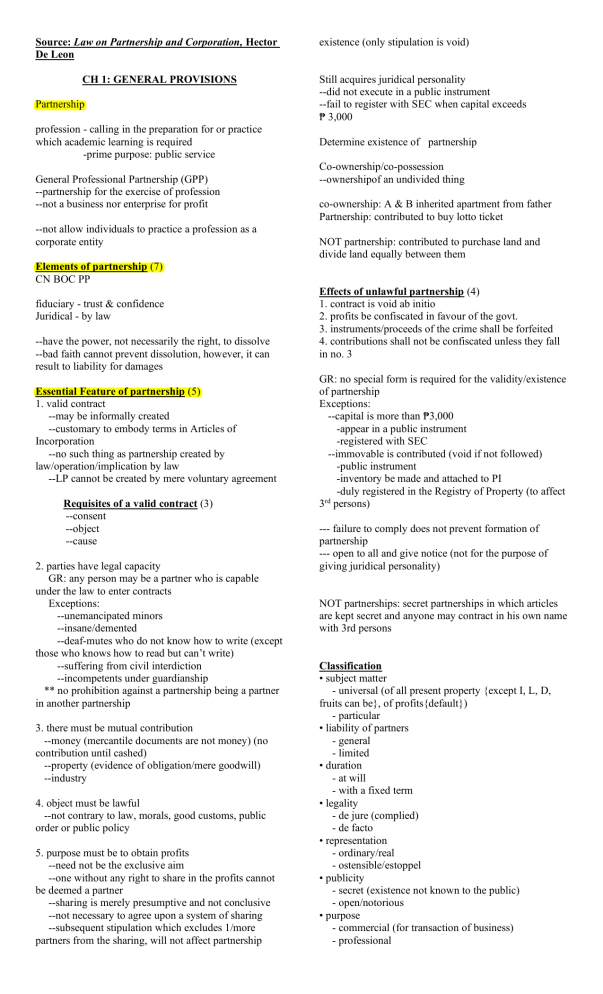

Source: Law on Partnership and Corporation, Hector

De Leon

CH 1: GENERAL PROVISIONS

Partnership

profession - calling in the preparation for or practice

which academic learning is required

-prime purpose: public service

General Professional Partnership (GPP)

--partnership for the exercise of profession

--not a business nor enterprise for profit

--not allow individuals to practice a profession as a

corporate entity

existence (only stipulation is void)

Still acquires juridical personality

--did not execute in a public instrument

--fail to register with SEC when capital exceeds

₱ 3,000

Determine existence of partnership

Co-ownership/co-possession

--ownershipof an undivided thing

co-ownership: A & B inherited apartment from father

Partnership: contributed to buy lotto ticket

NOT partnership: contributed to purchase land and

divide land equally between them

Elements of partnership (7)

CN BOC PP

fiduciary - trust & confidence

Juridical - by law

--have the power, not necessarily the right, to dissolve

--bad faith cannot prevent dissolution, however, it can

result to liability for damages

Essential Feature of partnership (5)

1. valid contract

--may be informally created

--customary to embody terms in Articles of

Incorporation

--no such thing as partnership created by

law/operation/implication by law

--LP cannot be created by mere voluntary agreement

Requisites of a valid contract (3)

--consent

--object

--cause

2. parties have legal capacity

GR: any person may be a partner who is capable

under the law to enter contracts

Exceptions:

--unemancipated minors

--insane/demented

--deaf-mutes who do not know how to write (except

those who knows how to read but can’t write)

--suffering from civil interdiction

--incompetents under guardianship

** no prohibition against a partnership being a partner

in another partnership

3. there must be mutual contribution

--money (mercantile documents are not money) (no

contribution until cashed)

--property (evidence of obligation/mere goodwill)

--industry

4. object must be lawful

--not contrary to law, morals, good customs, public

order or public policy

5. purpose must be to obtain profits

--need not be the exclusive aim

--one without any right to share in the profits cannot

be deemed a partner

--sharing is merely presumptive and not conclusive

--not necessary to agree upon a system of sharing

--subsequent stipulation which excludes 1/more

partners from the sharing, will not affect partnership

Effects of unlawful partnership (4)

1. contract is void ab initio

2. profits be confiscated in favour of the govt.

3. instruments/proceeds of the crime shall be forfeited

4. contributions shall not be confiscated unless they fall

in no. 3

GR: no special form is required for the validity/existence

of partnership

Exceptions:

--capital is more than ₱3,000

-appear in a public instrument

-registered with SEC

--immovable is contributed (void if not followed)

-public instrument

-inventory be made and attached to PI

-duly registered in the Registry of Property (to affect

3rd persons)

--- failure to comply does not prevent formation of

partnership

--- open to all and give notice (not for the purpose of

giving juridical personality)

NOT partnerships: secret partnerships in which articles

are kept secret and anyone may contract in his own name

with 3rd persons

Classification

• subject matter

- universal (of all present property {except I, L, D,

fruits can be}, of profits{default})

- particular

• liability of partners

- general

- limited

• duration

- at will

- with a fixed term

• legality

- de jure (complied)

- de facto

• representation

- ordinary/real

- ostensible/estoppel

• publicity

- secret (existence not known to the public)

- open/notorious

• purpose

- commercial (for transaction of business)

- professional

Kinds of partners

• civil code

--Capitalist

-- Liquidating

--Industrialist

-- Partner by estoppel

--General

--Continuing

--Limited

--Surving

--Managing

--Subpartner

•other

--Ostensible (active, known)

--Secret (active, not known)

--Silent (not active, known) (must give notice when

withdraws)

--Dormant (not active, not known) (may retire w/o

giving notice)

--Original

--Incoming

--Retiring

Universal Partnership of all present property

--contribute all properties which actually belong to them

--become common property (property, profit from

property)

GR: future properties cannot be contributed

Any stipulation including the ff. shall be void:

--inheritance

--legacy

--donation

Except the fruits

Profits from other sources (not from contributed

property) is valid as long as there is stipulation

Universal Partnership of profits

--comprises all that the partners may acquire by their

industry or usufruct (right to enjoy the property of

another with the obligation to preserve its form and

substance)

--partners retain ownership

--what passes are the profits and usufruct

--returned upon dissolution

--not included:

- profits acquired through chance (lottery)

-fruits of property subsequently acquired (can be

when there is stipulation)

--persons prohibited to give donations cannot enter into a

UP

Void donations:

--made between persons guilty of adultery

--made between those found guilty of the same criminal

offense

--made to a public officer by reason of his office

Particular Partnership – purpose of carrying out a

specific purpose

CH 2: OBLIGATIONS OF THE PARTNERS

Sec 1 Obligations of P among themselves

Juridical relations: (4)

P, P-P, P-3rd, P-3rd

Oblig with respect to contributions of property (5)

1.contribute at the beg./stipulated time

2.answer for eviction

3.answer to the partnership for the fruits

4.preserve pending delivery

5. indemnify the partnersgip for any damage

Fails to contribute, liable for interest and damages

Oblig with respect to contribution of money &

conversion for personal use

1. contribute on the due date

2. reimburse

3.pay the agreed/legal interest

4. indemnify

Prohibition against engaging in buisness:

• Industrial - absolute (same kind/any kind)

--engages without sxpress permission,

-CP exclude him from firm

-CP avail benefits

-CP and IP have right to damages

• Capitalist - same kind

GR: CP not bound to contribute more than what he

agreed to contribute

Exceptions:

- imminent loss

- majority CP, addtl would save

- CP refuses

- no agreement

*IP is exempted from additional contribution

Debtor pays to MP in MP's name

- applied to personal and partnership credits

Debtor pays to MP for partnership account

- applied wholly to partnership credit

Requisites:

- 2 debts (collecting partner, partnership)

- both are demandable

- one who collects is authorized to manage

GR: damages caused by a partner to the partnership

cannot be offset by the profits which he may have earned

Exception:

--unusual profits are realized through extraordinary

efforts of partner in fault (courts may lessen liability)

Risk of loss of things contributed:

(delivered to the partnership)

(1) S, D, not F, usufruct contributed = partner

(2) S, D, ownership to Partnership = partnership

(3) F (only for use) = partnership

(4) to be sold = partnership

(5) brought and appraised in the inventory =

partnership

Fungible things – goods of which any unit is treated as

equivalent of any other unit

CP - prohibited: same line (may be stipulated to be

allowed)

Partnership obligation to partners:

- refund advances made by partners

- answer for obligations contracted in good faith

- answer for risks

Distribution of profits

1. agreement

2. n/a: -- CP, proportion to CC

-- IP, first, just and equitable (also shares in the

profit after giving to IP if he has CC)

Distribution of losses

1. agreement

2. n/a: -- profit-sharing ratio (except IP)

3. no p-s ratio: proportion to CC (except purely IP)

May assign 3rd person for the designation of share in

P/L (by common consent)

--impugne when manifestly inequitable

--cannot complain:

- begun to execute decision

- fails to impugn within 3 months

Exclusion from losses:

-express stipulation: no partnership

-excludes IP: valid stipulation

GR: not entitled to formal account

Exceptions:

- wrongfully excluded from partnership

Sec 2 Property Rights of a Partner

Principal Rights (3)

PP, I, M

Related Rights (5)

- reimbursement

- access & inspection of books

- true & full info

- formal account

- partnership dissolved

Partner acquired in own name using partnership funds =

partnership property

Partner acquired in own name using partnership funds

after dissolution, before winding up = own property

(liable to the partnership for the funds used)

Carried in the partnership books = partnership property

Income generated by property is received by partnership/

taxes paid by partnership = partnership property

Appointment of MP in the articles:

- revocable: - just and lawful cause

- vote of partners representing

controlling interest

Appointment of MP after constitution of the partnership:

- revocable: - any time, any cause

- vote of CI

2/more MP:

-- duties unspecified

• oppose: -decision of majority of MP

- tie: CI partners

-- specified

• decision of partner concerned

Requisites:

- 2/more MP

- unspecified

- no stipulation that 1 shall not act w/o consent of all the

others

Stipulated that consent of all MP is required

- exception: -- imminent danger to the partnership

-- routine transactions

No manner of management

• opposition: -- majority vote of MP

-- tie: CI of all partners

Alteration of immovable

- unanimous consent of all partners

- need not be express

Except: alteration is necessary for its preservation, not

merely useful

Subpartner (assignee) - w/o consent

To be a partner - w/ consent of all

Partnership funds used to repair property of partner

bought by own funds = partner

Incidents of co-ownership:

- equal right of possession

- cannot assign his right (except retiring)

- not subject to attachment/execution except on a claim

against the partnership (interest is)

- not subject to legal support (interest is subject)

Partner's interest:

- profit (net income)

- surplus (assets-liabilities/equity)

Rights withheld from assignee:

- management

- require any info

- inspect books

Rights of assignee

- receive profits

- usual remedies in the event of fraud

- receive interest upon dissolution

- require an account of partnership affairs upon

dissolution

(purchaser of interest may apply to the court for the

dissolution)

Sec 3 Obligation with regard to 3rd Persons

Firm name

- facilitate business transactions

- must be registered with the Bureau of Commerce (not

DTI)

- may be that of an individual partners, surnames with

the addition of "and Company"

- cannot continue to use in its firm name the names of

deceased partners

- the continued use of the name of a deceased partner is

permissible provided that the firm indicates in all its

communications that said partner is deceased

Persons who, not partners, include their names in the

firm name

- do not acquire the rights of a partner

- subject to the liability of a partner insofar as 3rd

persons w/o notice are concerned

GR: partner has the right to make all partners liable for

contracts he makes in the name and for the account of

the partnership

Personally liable: partner may assume a separate

undertaking in his name with a 3rd party

Partners, including IP, are liable to creditors for the

obligations contracted in the name and for the account of

the partnership

Pro-rata - equally/jointly (cannot increase the liability of

other partners)

Subsidiary - become personally liable only after all the

partnership assets have been exhausted

*acts in contravention of a restriction

-not liable to 3rd persons having actual/presumptive

knowledge of the restrictions, whether or not the acts are

for the usual way of business

-persons not having such notice have right to assume

that authority is co-extensive with the business

-always presumed when there is no evidence

GR: partner who undertakes to bind his co-partners

without authority is personally liable

Real Properties

1. Title: partnership conveyance: partnership

-passes title

-unless: --not in the usual way

--3rd person had knowledge on lack of

authority

--recovery of property & ownership

-cannot be recovered when conveyed to a holder for

value and without notice

2. Title: partnership conveyance: partner’s name

-passes equitable interest only (EI: not duly recognized

by law but in equity alone; right/interest in property

which is imperfect and unenforceable by law)

IP can recover the amount he paid from CP

The inability of the partnership to pay a debt to 3rd party

does not mean that partnership operated at a loss.

The exemption of IP to pay losses relates exclusively to

the settlement of partnership affairs among the partners

themselves

A stipulation among partners contrary to the pro rata and

subsidiary liability shall be VOID

-valid and enforceable only as among partners

Except when authorized, no authority to:

1.Assign PP in trust for creditors

2.Dispose of the goodwill

3.Do any other act that would make it impossible to

carry on the ordinary business

4.Confess a judgement

5.Enter into a compromise concerning partnership

liability

6.Submit a partnership claim to arbitration

7.Renounce a claim

Agreement is silent, each partner has the implied

authority to do all things necessary to carry out ordinary

business

Apparent authority – based on doctrine of estoppels

Third persons – doctrine of mutual agency

-right to assume that every GP has the power to bind the

partnership

-not bound to ascertain acting partner’s authority;

knowledge is enough

-gen. presumption: each partner is an agent and has

authority to bind the firm

-should not assume that a partner has unlimited authority

--when 3rd party deals with a partner with no authority,

partnership is not liable unless the other partners ratify

his acts/are stopped

*carrying on the usual way of business

-2 requisites in order to make partnership liable:

--partner has no authority

--3rd person knows he have no authority

*acts of strict dominion/ownership

-not on the usual way, partnership is not bound, unless

--authorized by all other P

--abandoned the business

3. Title: 1/more partners conveyance: partner

- passes title

-unless: -- not in the usual way

--3rd person had knowledge on lack of

authority

4. Title:1/more for a trust conveyance: partner’s name

-passes equitable interest only

-unless: ---- not in the usual way

--3rd person had knowledge on lack of

authority

5. Title: all partners

conveyance: all partners

- passes title

-cannot be recovered by the partnership

GR: a person is not bound by the act of another of which

he has no knowledge or to which he has not given his

consent, except:

--by virtue of a particular relationship between them

Declaration made by partner acting for the partnership

-admissible

-not admissible: made by a partner who is no longer a

partner

Declaration made in the presence of a partner

-admissible

--notice/knowledge of any partner of any matter relating

to partnership affairs operates as notice/knowledge of the

partnership

--3rd person desiring to give notice need not

communicate with all the partners

3 cases of knowledge:

1.Knowledge of acting partner (AP) while a partner

2.Knowledge of AP then present to his mind

3.Knowledge of any other partner who reasonably could

and should have communicated it to the AP

Liability arising from partner’s wrongful act/omission

-solidary

Requisite for liability:

1.partner must be guilty of a wrongful act

2.acting in the ordinary course of business/with authority

Loss:

-partner acting within the scope of his authority receives

money/property of a 3rd person and misapplies it

-partnership receives money/property of a 3rd person and

the money/property is misapplied by any partner while it

is the custody of partnership

--dissolution must not be understood as its

extinguishment

--no new partnership should be undertaken

--affairs should be liquidated and distributed

--partnership continues until the winding up is

completed

--not the actual cessation

Estoppel – precludes a person from denying/asserting

anything in contrary to that which has been established

as the truth by his own deed, either express/implied

--directly represents himself as a partner

--indirectly represents himself by consenting to another

representing him as partner

Statutory causes of dissolution

1. Without violation of the agreement

-termination of the definite term

-express will of any

-express will of all

-expulsion of any

Partnership liability

-all the actual partners consented

2. Voluntary: will of any partner

Liability pro-rata

-no existing partnership

-all those represented consented

-or not all partners of an existing partnership consented

Liability separate (represented,consented)

-no existing partnership

-not all but some of those represented consented

- none of the partners in existing partnership consented

--liability is created only in favour of persons who gave

credit to the actual/apparent partnership

Incoming partner

-liable for all obligations existing at the time of

admission (limited to his share)

-obligations subsequent to his admission (liable up to

his/her separate properties)

Existing and subsequent creditors

-against partnership property and

-separate property of previously existing partners

Subsequent creditors

-partnership property and

-separate property of existing and newly admitted

partner

Partnership creditors

-entitled to priority of payment

Personal creditors

-may ask for the attachment and public sale of the share

of the partner in the partnership assets

Involuntary: operation of law

-any event which makes in unlawful for the business

to continue

-specific thing perishes before delivery

-death of any partner

-insolvency of any partner

-civil interdiction of any partner

-decree of court

3. Extrajudicially

-without violation

-in contravention of agreement

- any event which makes in unlawful for the business

to continue

-specific thing perishes before delivery

-death of any partner

-insolvency of any partner

-civil interdiction of any partner

Judicially

--application by a partner

-declared insane

-becomes incapable of performing his part

-guilty of such conduct

-willfully/persistently commits a breach of

partnership agreement

-business can only be carried on at a loss

-other circumstances render a dissolution equitable

(abandonment of business, fraud in the management,

refusal to render accounting of partnership affairs

without justifiable cause)

--application by a purchaser of partner’s interes

-termination of a specific term

-any time if partnership was a partnership at will

when the interest was assigned

4. Automatic dissolution

---purchaser in a public sale does not become a partner

--expiration of the term, partners continue without

making a new agreement (partnership at will)

--each partner have the power and right to terminate

without the consent of his co-partners

--dissolve before the termination of term, must be

unanimous

CH 3: DISSOLUTION AND WINDING UP

Dissolution – change in the relation of the partners/any

partner ceasing to be associated

--represents demise of a partnership

Doctrine of delectus personae – have the power to

dissolve the partnership

--withdrawing partner is liable for damages for

unjustified dissolution

Winding up – settling the business

Termination – completely wound up and finally settled

--signifies end of partnership

Specific things

• Loss before delivery

-partnership is dissolved

•

•

Loss after delivery

-not dissolved

-assumes the loss

Loss where only use/enjoyment contributed

-dissolves the partnership

-partner bears the loss

--agreement may provide that death, withdrawal or

admission of new partner will not effect dissolution

--in such a case, estate of deceased is not liable for

obligations after dissolution beyond the extent of his

capital remaining in the business

Insolvency of partner

-subjects his interest in the partnership to the right of his

creditors

-no authority to act for the partnership nor the other

partners act for him

Insolvency of partnership

-partnership property is liable for the satisfaction of

partnership obligations

Civil Interdiction – deprives the offender during the time

of hi sentence of the right to manage his property and

dispose of such property

Dissolution, partner’s power of representation is

confined only to acts incident to winding up/completing

transactions begun but not completed

--terminates the actual authority of a partner to undertake

new business

--partnership is bound by the new contract (innocent

parties can always recover from AP)

Authority of a partner is not terminated:

1.cause of the dissolution is the ac of the partner and AP

had knowledge of the dissolution

2.cause of the dissolution is the death/insolvency of a

partner and AP had knowledge/notice

Knowledge of a fact – actual knowledge

--have knowledge of such other

facts as in the circumstances show bad faith

Notice of a fact – states the fact

--delivers through mail a written

statement of the fact

Power of partner to bind dissolved partnership:

1.act for winding up/completing unfinished transactions

2.any transaction which would bind partnership if

dissolution had not taken place

*extended credit to the partnership prior to

dissolution (had no knowledge/notice)

-notice must be actual (mere mailing is insufficient)

*known of the partnership prior to dissolution and

the fact of dissolution had not been advertised (had no

knowledge/notice)

Partnership not bound after dissolution

1.dissolved because it is unlawful

2.partner has become insolvent

3.partner had no authority to wind up affairs; except by a

transaction with one who:

--extended credit to the partnership prior to

dissolution (had no knowledge/notice)

--known of the partnership prior to dissolution and

the fact of dissolution had not been advertised (had no

knowledge/notice)

Between themselves

-power of agency is terminated

To relieve partnership from liability:

*prior dealers – extended credit through confidence in

the solvency and probity of the firm (dealing on a cash

basis/purchases goods is NOT a prior dealer)

-notice must be actual (mere mailing is insufficient)

*as to all others (who knew of the partnership before)

-notice through advertisement in a local newspaper

-actual notification is not necessary

--dormant partner (unknown & inactive) need not give

notice

--dissolution does not discharge the existing liability of

a partner

--relived only by an agreement between himself,

partnership creditor and other partners (consent of

creditor and partners may be implied)

--individual property of deceased partner shall be liable

for all partnership obligations incurred when he was a

partner

--individual creditors are preferred with respect to

individual property

Manner of winding up:

Judicially – under control and direction of proper court

Extrajudicially – partners themselves

Authorized to wind up:

-partners designated

-absence of agreement, all partners who have not

wrongfully dissolved the partnership

-legal representative of last surviving partner, not

insolvent

--surviving partners are charged with winding up

--estate of the decease is not liable for subsequent

debts/losses of the surviving partners without the

consent of the state

Rights where dissolution is without violation

-have partnership property (PP) applied to discharge

partnership liabilities

-to have surplus owing to partners

*bona fide expulsion of a partner: expelled partner

may be discharged from all PL (receive only cash)

Rights where dissolution is in violation

* not caused dissolution

- have PP applied to discharge partnership liabilities

and receive in cash for the share in surplus

-indemnified for damages

-continue the business

-posses PP if they continue

* wrongfully caused dissolution

--business not continued

- have PP applied to discharge partnership liabilities

and receive in cash for the share in surplus less damages

--business is continued

-ascertain value of his interest and paid in

cash/secured by bond approved by the court

-released from all existing and future liabilities

Voidable/annulable

-induced by fraud/misrepresentation to become a partner

-if annulled, injured is entitled to restitution

-until annulled, partnership relations exists

LP – limited liability is the key characteristic of limited

partnership

-same type of liability as a stockholder of corporation

--no prohibition to engage in business for himself

Rights of injured partner where contract rescinded on the

ground of fraud/misrepresentation:

-right of a lien on the surplus of PP after PL

-right to subrogation after payment of PL

-right of indemnification by the guilty partner

General Partner

personal

No agreement,

equal right

Money, property,

industry

✓

Limited Partner

Up to CC

None

Assignee does

not become a

partner

Freely assignable

with assignee

acquiring all

rights

x

Order of application of assets

1.partnnership creditors

2.loan/advances of partners t the partnership

3.return of capital

4.share of the profits

Assets are insufficient

-deficit is a capital loss which requires contribution

-have the right to enforce contribution

-if partners does not pay his share of the loss, remaining

partners can sue him/her or indemnification

Liability of deceased partner’s individual property (IP):

-liable for his share of the contributions

Distribution of insolvent person’s IP:

1.separate creditors

2.partnership creditors

3.owing to partners

Rights of creditors (old & new) to PP

--dissolved by a change in membership (6)

--business is continued

--without liquidation

-liability of new partner to the creditors of the dissolved

partnership shall be satisfied out of PP only unless there

is a stipulation

Rights of retiring/legal representative of deceased

partner when business is continued without settlement:

-ascertain the value of his interest at date of dissolution

(retirement/death)

-receive an amount equal to the value of his share with

interest

GR: when partnership is dissolved, partner/legal

representative is entitled to the payment of what may be

due after a liquidation

-no liquidation is necessary when there is already an

agreement as to what he shall receive

Liability

Management

Contribution

Party to

proceedings

Assignment of

interest

Use of name in

firm name

Engaging in

business

Causes of

dissolution

Creation

Composition

Operation

✓

Cash, property

x

Prohibited from

all kinds of

business

Retirement,

death,

insolvency,

insanity

No prohibition

General

Partnership

In any form

Only GP

Limited

Partnershi

After compliance

GP and LP

Firm name

followed by the

word “Limited”

Dissolution and

winding up

Statutory requirements:

1.certificate/articles must be signed and sworn to

2.such certificate must be filed for record on the Office

of the SEC

--to give actual/constructive notice to potential

creditors of the limited liability

--strict compliance is not necessary

*partnership transacting business is prima facie a general

partnership

--avail protection under LP, must show due compliance

with statutory requirements

--failure of LP to extend its term when it expired, and to

register it anew with SEC (law considers it as GP)

CH 4: LIMITED PARTNERSIP

Limited Partnership – composed of 1/more general

partners (GP) and 1/more limited partners (LP)

Characteristics

1.compliance with statutory requirements

2.1/more GP control the business and personally liable

3.1.more LP contribute to the capital and share in the

profits but do not participate in the management and are

not personally liable beyond their capital contribution

4.LP may ask for the return of their capital contribution

(CC)

5.PL are paid out of common fund and IP of GP

--if LP contributes services, shall be considered an

industrial and general partner

--a partner may be a GP and LP in the same partnership

at the same time provided it is stated in the certificate

--LP may not be an industrial partner without being a GP

Surname of a LP shall not appear in partnership name

unless:

--also a surname of GP

--prior when LP became such, business had been carried

on under such name

---a LP whose surname appears in the firm name is liable

as GP (without the rights of GP)to partnership creditors

who extended credit without actual knowledge that he is

not a GP

Allowable transactions of LP

-granting loans to the partnership

-transacting other business with it

-receiving a pro rata share of PA with general creditors

Liability for false statement in certificate

--knew false statement at the time he signed, or,

having sufficient time to cancel/amend, fails to do so

--person seeking to enforce liability has relied upon

false statement

--person suffered a loss as a result of reliance

---LP is liable as GP if he becomes involved in the

management of the firm’s business (active participation)

--bare grant of apparent control is not sufficient to make

him liable as GP where he has not actually participated

--not participating: always in the GM’s office and gives

advice

--additional partners may be admitted after formation

--law requires that there is proper amendment to the

certificate which must be signed and sworn to and filed

in SEC

GP have no authority to (acts of strict dominion):

1.do any act in contravention

2.do any act which would make it impossible to carry on

the ordinary business

3.confess a judgement against partnership

4.possess PP, assign their rights

5.admit a person as GP

6.admit a person as LP, unless the right is in the

certificate

7.continue the partnership with PP on the death,

retirement, insanity, civil interdiction or insolvency of

GP, unless the right is in the certificate

Other limitations:

--no power to bind LP beyond the latter’s investment

--change the nature of the business without consent of

the LP

Same rights of LP as to GP:

1.have partnership books kept at principal place of

business

2.have on demand true and full info of all things

affecting partnership, and a formal account of

partnership affairs

3.have dissolution and winding up by decree of court

Specific rights of LP:

1.require that partnership books kept at principal place of

business

2.inspect & copy PB at reasonable hour

3. demand true and full info

4.demand formal account of partnership affairs

5. ask for dissolution and winding up by decree of court

6.receive a share of profits by way of income

7.receive the return of his contribution (PA > PL)

Exemption from liability as GP

-contributed capital

-believing that he has become a LP

-name appears on the certificate as GP

--he promptly renounces his interest in the profits (sell to

GP) (renounce his interest before partnership has

become liable to 3rd persons)

--surname does not appear in the partnership name

--does not participate in the management

Prohibited transactions of LP

-holding as collateral security any PP

-receiving any payment if PA are not sufficient to

discharge PL

*preference may be given to some LP as to the:

-return of their contribution

-compensation by way of income

-any other matter

LP shall not receive until:

1.All assets have been paid (except those owed to GP

and LP on account for their contribution: return of

contributions, loan extended, indemnity)

2.consent of all (GP & LP) have been obtained

3.certificate is cancelled/amended as to set forth the

withdrawal/reduction in the contribution

LP may rightfully demand the return of his contribution:

1.on the dissolution

2.date specified in the certificate has arrived

3.after he has given 6 months notice in writing to all

other members , if no time is specified

LP have right to demand and receive cash, except:

-stipulated

-all partners (GP and LP) consents to the return other

than cash

LP may have partnership dissolved when:

1.rightfully but unsuccessfully demands the return of his

contribution

2.PP is insufficient for the payment and the LP is

entitled to the return of his contribution

LP is liable to the partnership:

--difference between his contribution as actually made

and that stated in the certificate

--unpaid contribution which he agreed in the certificate

to make in the future

--LP’s liability is to the partnership, not creditors

--GP cannot waive any liability to the prejudice of

creditors

Liability as trustee

--specific property not contributed

-- specific property which has been wrongfully returned

to him

--money wrongfully paid to him

--other property wrongfully paid to im

Liabilities of LP may be waived:

--waiver is made with the consent of all the partners

--waiver does not prejudice partnership creditors

assignee

-- is only entitled to receive the share of the profits by

way of income/return of contribution

--no right to require any info/account of partnership

affairs

--acquires all the rights of LP only when he becomes a

substituted LP

Requisites to become substituted LP:

-all the members must consent or

LP must give the assignee the right to become LP

-certificate must be amended

-certificate must be registered in SEC

Substituted LP: liable for all liabilities of assignor

Assignee: not released from liability to persons who

suffered damage by reliance on false statement and to

creditors who extended credit before substitution

Change in the relation of limited partners

-does not necessarily dissolve

Change in the relation of general partners

-dissolves the partnership unless

---agreed upon at the beginning

---agreed after the time

On the death of LP:

-executor/administrator shall acquire all the rights of LP

for the purpose of settling the affairs of LP

Creditor of LP:

-apply to the proper court for an order charging the LP’s

interest in the partnership for the payment of any

unsatisfied claim

---the interest charged may be redeemed with the

separate property of any GP but not PP

---redeemed with PP with the consent of all partners

whose interest is not so charged

Priority in the distribution of assets after dissolution:

1. due to creditors (including LP loans extended)

2. LP in their share of profit

3. LP for the return of capital

4. GP for their advances/loans

5. GP in respect to profits

6. GP for the return of their capital

General partnership: claims of GP in respect to capital

enjoy preference over in respect to profits

ART 1864. Certificate shall be amended

Certificate shall be cancelled:

--dissolved other than by expiration of term

--all LP ceases to be such

** in writing, signed by all and filed with SEC

---approval by the Commission of the

amendment/cancellation is not required

LP – no right of action against 3rd persons

LP a proper party:

--the object of the proceeding is to enforce his individual

rights against the partnership and to recover damages for

violation of such right

--action by law against LP to account for and restore

sums withdrawn by him from the capital of the firm with

outstanding debts on a voluntary dissolution