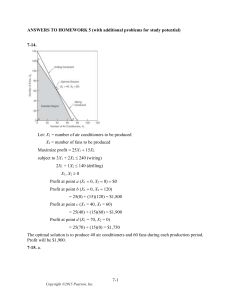

ANSWERS TO HOMEWORK 5 (with additional problems for study potential) 7-14. Let: X1 = number of air conditioners to be produced X2 = number of fans to be produced Maximize profit 25X1 15X2 subject to 3X1 + 2X2 240 (wiring) 2X1 + 1X2 140 (drilling) X1, X2 0 Profit at point a (X1 0, X2 0) $0 Profit at point b (X1 0, X2 120) = 25(0) + (15)(120) = $1,800 Profit at point c (X1 = 40, X2 = 60) =25(40) + (15)(60) = $1,900 Profit at point d (X1 = 70, X2 = 0) =25(70) + (15)(0) = $1,750 The optimal solution is to produce 40 air conditioners and 60 fans during each production period. Profit will be $1,900. 7-15. a. Copyright ©2015 Pearson, Inc. 7-1 Maximize profit 25X1 15X2 subject to 3X1 + 2X2 240 2X1 + 1X2 140 X1 20 X2 80 X1, X2 0 The feasible region for this problem is the combination of all of the shaded areas in Figure 7.15 above, Profit at point a (X1 20, X2 0) = 25(20) + (15)(0) = $500 Profit at point b (X1 20, X2 80) = 25(20) + (15)(80) = $1,700 Profit at point c (X1 = 40, X2 = 60) =25(40) + (15)(60) = $1,900 – Optimal solution. Profit at point d (X1 = 70, X2 = 0) =25(70) + (15)(0) = $1,750 Profit at point e (X1 = 26.67, X2 = 80) =25(26.67) + (15)(80) = $1,867 Hence, even though the shape of the feasible region changed from Problem 7-14, the optimal solution remains the same. The calculations for the slack available at each of the four constraints at the optimal solution (40, 60) are shown below. The first two have zero slack and hence are binding constraints. The third constraint of X1 ≥ 20 has a surplus (this is called a surplus instead of slack because the constraint is “>“) of 20 while the fourth constraint of X2 ≤ 80 has a slack of 20. Copyright ©2015 Pearson, Inc. 7-2 3X1 + 2X2 + S1 = 240 so S1 = 240 - 3X1 - 2X2 = 240 – 3(40) - 2(60) = 0 2X1 + 1X2 + S2 = 140 so S2 = 140 - 2X1 - 1X2 = 140 - 2(40) – 1(60) = 0 X1 – S3 = 20 so S3 = -20 + X1 = -20 + 40 = 20 X2 S4 80 so S4 80 - X2 b. Maximize profit = 25X1 + 15X2 subject to 3X1 + 2X2 240 2X1 + 1X2 140 X1 30 X2 50 X1, X2 0 The feasible region for this problem is only the darker shaded area in Figure 7.15 above, It is significantly smaller and only has four corners denoted by a’, b’, c’ and d. Profit at point a’ (X1 30, X2 0) = 25(30) + (15)(0) = $750 Profit at point b’ (X1 30, X2 50) = 25(30) + (15)(50) = $1,500 Profit at point c’ (X1 = 45, X2 = 50) = $1,875 – Optimal solution. =25(45) + (15)(50) Profit at point d (X1 = 70, X2 = 0) =25(70) + (15)(0) = $1,750 Here, the shape and size of the feasible region changed and the optimal solution changed. The calculations for the slack available at each of the four constraints at the optimal solution (45, 50) are shown below. The second and the fourth constraints have zero slack and hence are are binding constraints. The third constraint of X1 ≥ 30 has a surplus of 15 while the first constraint of 3X1 + 2X2 240 has a slack of 5. 3X1 + 2X2 + S1 = 240 so S1 = 240 - 3X1 - 2X2 = 240 – 3(45) - 2(50) = 5 2X1 + 1X2 + S2 = 140 so S2 = 140 - 2X1 - 1X2 = 140 - 2(45) – 1(50) = 0 Copyright ©2015 Pearson, Inc. 7-3 X1 – S3 = 30 so S3 = -30 + X1 = -30 + 45 = 15 X2 S4 50 so S4 50 - X2 7-16. Let R = number of radio ads; T = number of TV ads. Maximize exposure = 3,000R + 7,000T Subject to: 200R + 500T 40,000 (budget) R 10 T 10 RT R, T 0 Optimal corner point R = 175, T = 10, Audience = 3,000(175) + 7,000(10) = 595,000 people 7-17. X1 = number of benches produced X2 = number of tables produced Maximize profit $9X1 $20X2 subject to 4X1 + 6X2 1,200 hours 10X1 + 35X2 3,500 feet X1, X2 0 Profit at point a (X1 = 0, X2 = 100) = $2,000 Profit at point b (X1 = 262.5, X2 = 25) = $2,862.50 Profit at point c (X1 = 300, X2 = 0) = $2,700 Copyright ©2015 Pearson, Inc. 7-4 7-18. X1 = number of undergraduate courses X2 = number of graduate courses Minimize cost $2,500X1 $3,000X2 subject to X1 30 X2 20 X1 + X2 60 Total cost at point a (X1 40, X2 20) = 2,500(40) + (3,000)(20) = $160,000 Total cost at point b (X1 30, X2 30) Copyright ©2015 Pearson, Inc. 7-5 = 2,500(30) + (3,000)(30) = $165,000 Point a is optimal. 7-19. X1 = number of Alpha 4 computers X2 = number of Beta 5 computers Maximize profit $1,200X1 $1,800X2 subject to 20X1 25X2 800 hours (total hours 5 workers 160 hours each) X1 10 X2 15 Corner points: a(X1 = 10, X2 = 24), profit = $55,200 b(X1 = 21 1 , X2 = 15), profit = $52,500 4 Point a is optimal. 7-20. Let P = dollars invested in petrochemical; U = dollars invested in utility Maximize return = 0.12P + 0.06U Subject to: P + U = 50,000 total investment is $50,000 9P + 4U 6(50,000) average risk must be 6 [or total 6(50,000)] P, U 0 Copyright ©2015 Pearson, Inc. 7-6 Corner points Return = P U 0.12P + 0.06U 0 50,000 3,000 20,000 30,000 4,200 The maximum return is $4,200. The total risk is 9(20,000) + 4(30,000) = 300,000, so average risk = 300,000/(50,000) = 6 7-21. Let P = dollars invested in petrochemical; U = dollars invested in utility Minimize risk = 9P + 4U Subject to: P + U = 50,000 total investment is $50,000 0.12P + 0.06U 0.08(50,000) return must be at least 8% P, U 0 Corner points Risk = P Copyright ©2015 Pearson, Inc. 9P + 4U U 7-7 50,000 0 450,000 16,666.67 33,333.33 283,333.3 The minimum risk is 283,333.33 on $50,000 so the average risk is 283,333.33/50,000 = 5.67. The return would be 0.12(16,666.67) + 0.06(33,333.33) = $4,000 (or 8% of $50,000) 7-22. Note that this problem has one constraint with a negative sign. This may cause the beginning student some confusion in plotting the line. As for the slack of each of the constraints, the first and third constraints are binding and, hence, have zero slack. The second constraint of X – 2Y ≤ 10 has a slack of 28.75. Copyright ©2015 Pearson, Inc. 7-8 7-23. Point a lies at intersection of constraints (see figure below): 3X + 2Y = 120 X + 3Y = 90 Multiply the second equation by 3 and add it to the first (the method of simultaneous equations): 3X 2Y 120 3X 9Y 270 7Y 150 Y 21.43 and X 25.71 Cost = $1X + $2Y = $1(25.71) + ($2)(21.43) $68.57 7-24. X1 = $ invested in Louisiana Gas and Power X2 = $ invested in Trimex Insulation Co. Minimize total investment X1 X2 subject to $0.36X1 $0.24X2 $720 $1.67X1 $1.50X2 $5,000 0.04X1 0.08X2 $200 Investment at a is $3,333. Investment at b is $3,179. optimal solution Investment at c is $5,000. Short-term growth is $926.09. Copyright ©2015 Pearson, Inc. 7-9 Intermediate-term growth is $5,000. Dividends are $200. See graph. Copyright ©2015 Pearson, Inc. 7-10