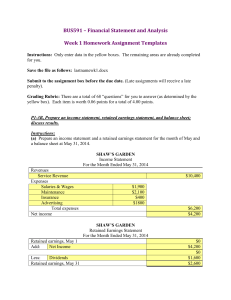

CHAPTER 11 - UNDERSTANDING FINANCIAL STATEMENTS LEARNING OBJECTIVES After studying Chapter 11, you should be able to: 1. Understand how business activities are reported through financial statements. 2. Appreciate the general objectives of financial statements. 3. Enumerate and identify the needs of various users that demand financial accounting information. 4. Enumerate the sources of information about a business enterprise. 5. Understand the benefits and costs of supplying accounting information. 6. Identify the required financial statements and know how they are interconnected. 7. Know the nature and significance of the a. Balance Sheet Statement b. Statement of Comprehensive Income c. Statement of Stockholders’ Equity, and d. Statement of Cash Flows INTRODUCTION This chapter provides a framework and several tools to help us analyze companies and value their securities. At this point, it is helpful to imagine yourself as a specific user of financial statements. For example, assume that you are a manager deciding whether to acquire another company or divest of a current division? Or imagine yourself as an equity or credit analyst - how do you assess and communicate an investment appraisal or credit risk report? This focused perspective will enhance one’s learning process and makes it relevant. HOW BUSINESS ACTIVITIES ARE REPORTED To be able to analyze a company effectively or infer its value, it is important that one must understand the company’s business activities. This can be accomplished through the financial statements. Financial statements report on a company’s performance and financial condition and reveal executive management’s privileged information and insights. Financial statements serve the needs of different users. The operation of the accounting information system involves application of accounting standards to produce financial statements that provide the insight on the business activities of the company under analysis. Accounting information should be used in the business context in which the information is created. All companies without exception, plan business activities, finance those activities, invest in those activities and then, engage in operating activities. Business firms conduct all these activities while confronting business forces, including market constraints and competitive pressures. Financial statements also provide crucial input for strategic planning, as well as, information about the relative success of those plans which can be used to corrective action and make new operating, investing, and financing decisions. GENERAL OBJECTIVES OF FINANCIAL STATEMENTS The important objectives of financial statements are: 1. Providing Information for Economic Decisions The economic decisions that are taken by the users of financial statements require an evaluation of the ability of an enterprise to generate cash and cash equivalents, and the timing and certainty of their generation. This ability ultimately determined the capacity of an enterprise to pay its employees and suppliers, meet interest payments, repay loans, and make distributions to its owners. 2. Providing Information about Financial Position The financial position of an enterprise is affected by the economic resources such as: a. Information about the economic resources controlled by the enterprise and its capacity in the past to modify these resources is useful in predicting the ability of the enterprise to generate cash and cash equivalents in the future. b. Information about financial structure is useful in predicting future borrowing needs and how future profits and cash flows will be distributed among those with an interest in the enterprise. c. Information is useful in predicting how successful the enterprise is likely to be in raising further finance. d. Information about liquidity and solvency is useful in predicting the ability of the enterprise to meet the financial commitments as fall due. Liquidity refers to the availability of cash in the near future after taking account of financial commitments and solvency refers to the availability of cash over the longer term to meet the financial commitments as they fall due. 3. Providing Information about Performance of an Enterprise Another important objective of the financial statements is that, it provides information about the performance and in particular its profitability, which is required in order to assess potential changes in the economic resources that are likely to control in future. Information about variability of performance is important and useful in predicting the capacity of the enterprise to generate cash flows from its existing resource base, and in forming judgement about the effectiveness with which the enterprise might employ additional resources. 4. Providing Information about Changes in Financial Position The financial statements provide information concerning changes in the financial position of an enterprise, which is useful in order to assess its investing, financing and operating activities during the reporting period. This information is useful in providing the user with a basis to assess the ability of the enterprise to generate cash and cash equivalents, and the needs of the enterprise to utilize those cash flows. DEMAND FOR FINANCIAL ACCOUNTING INFORMATION Decision makers and other stakeholders demand information on the company’s past and prospective returns and risks to facilitate efficient contracting and risk-sharing. The broad classes of users that demand financial accounting information include the following: 1. Managers and Employees For their own well-being and prospective earnings, potential managers and employees need accounting information on the financial condition, profitability and prospects of their companies as well as comparative financial information on competing companies and business opportunities. Management uses financial statements to raise financing for the company, to meet disclosure requirements and to serve as a basis for executive remuneration and bonuses, for wage negotiations and to meet disclosure requirements. 2. Investors and Analysts Financial statements are used by these parties to decide whether to buy or sell equity shares. Expectations about future profitability and the ability to generate cash influence the price of securities and a company’s ability to borrow money at favorable terms. Other information intermediaries such as, financial press writers and investment analysts are interested in predicting companies’ future performance. 3. Creditors and Suppliers Banks and other lenders need financial accounting information to help determine loan terms, loan amounts, interest rates and required collateral. Suppliers demand financial data to establish credit terms and to determine their long-term commitment to supply-chain relations. Both creditors and suppliers use information to monitor and adjust their contractual requirements and environment with a business firm. 4. Shareholders and Directors Financial accounting information is needed by owners and directors of the company to assess its profitability and risks, to evaluate managerial performance and to help make leadership decisions. 5. Regulatory and Tax Agencies The SEC, BIR, BSP and other legal institutions demand financial accounting information to monitor the business firms’ compliance with laws, for public protection, price setting and for setting tax and other regulatory policies. 6. Customers and Potential Strategic Partners Customers both current and potential, need accounting information to evaluate a company’s ability to provide products and services as agreed and to assess the company’s reliability and staying power. Potential strategic partners would wish to estimate the firm’s profitability to assess the fairness of returns on mutual transactions and strategic alliances. 7. Other decision makers Financial accounting information is required for varied purposes by other parties from assessing damages for environmental abuses to making policy and decisions involving economic, social, taxation and other initiatives. SOURCES OF INFORMATION ABOUT BUSINESS ENTERPRISE In general, the quantity and quality of accounting information that companies supply are determined by the manager's assessment of the benefits and costs of disclosure. In the Philippines, publicly listed companies must file financial accounting information with the Securities and Exchange Commission (SEC). These are; 1. The audited annual report that includes the four financial statements (Statement of Financial Position [traditionally known as the Balance Sheet Statement], Statement of Comprehensive Income, Statement of Stockholders’ Equity, and Statement of Cash Flow) with explanatory notes and the management’s discussion and analysis of financial results. 2. The unaudited quarterly or interim reports that include summary versions of the four financial statements and limited additional disclosure. All other registered corporations and partnerships are likewise required to file annually audited financial statements with accompanying explanatory notes with the SEC. BENEFITS OF DISCLOSURE The advantages of supplying accounting information extend to a company’s capital, labor, input and output markets. Companies compete in these markets. For instance, debt and equity financing are sourced from capital markets and the better a company’s prospects, the lower will be its cost of capital as reflected in higher stock prices or lower interest rate. The same is true for a company’s recruitment efforts in labor markets and its ability to establish and maintain superior supplier-customer relations in the input and output markets. The company’s ability to disclose reliable (audited) accounting information about its products, processes and other business activities enable them to better compete in capital, labor, input and output markets. COSTS OF DISCLOSURE The preparation and dissemination costs of supplying accounting information can be substantial, and the possibility for information to produce competitive disadvantages is high. Companies are apprehensive that disclosure of their activities such as product or segment successes or failures, strategic initiatives, technological or systems innovations could harm their competitive advantages. Companies also face possible lawsuits when disclosures create expectations that eventually are not met. Disclosure costs including political costs are high for highly visible companies such as large telecommunication conglomerate (e.g. PLDT and Digitel), oil companies and software companies because they are favorite targets of public scrutiny. CONSTRAINTS ON RELEVANT AND RELIABLE INFORMATION 1. Timeliness If there is undue delay in the reporting of information, it may lose its relevance. Management may need to balance the relative merits of timely reporting and the provision of reliable information. To provide information on a timely basis, it may often be necessary to report before all aspects of a transaction or other event are known, conversely if thus impairing reliability. Conversely, if reporting is delayed until all aspects are known, the information may be highly reliable but of little use to users who have had to make decisions in the interim. In achieving a balance between relevance and reliability, the overriding consideration is how best to satisfy the economic decisionmaking needs of users. 2. Balance Between Benefit and Cost The balance between benefit and cost is a pervasive constraint rather than a qualitative characteristic. The benefits derived from information should exceed the cost of providing it. The evaluation of benefits and costs is, however, substantially a judgmental process. 3. Balance Between Qualitative Characteristics In practice, a balancing or trade-off between qualitative characteristics is often necessary. Generally, the aim is to achieve an appropriate balance among the characteristics in order to meet the objective of financial statements. The relative importance of the characteristics in different cases is a matter of professional judgment. 4. True Fair View or Fair Presentation Financial statements are frequently described as showing a true and fair view of the financial position, performance and changes in financial position of an enterprise. Although, this framework does not deal directly with such concepts, the applications of the principal qualitative characteristics and of appropriate accounting standards, normally results in financial statements that convey what is generally understood as a true and fair view of such information. FINANCIAL STATEMENTS Business activities are periodically reported by companies using four financial statements: the Statement of Financial Position, Statement of Comprehensive Income, Statement of Stockholders' equity and the Statement of Cash Flows. Figure 11-1 shows how these statements are interconnected across time. A Statement of Financial Position reports on a company's financial position at a point in time. The Statement of Comprehensive Income, Statement of Stockholders' Equity and the Statement of Cash Flows report on performance over a period of time. The three statements in the middle of Figure 11-1 link the statement of financial position from the beginning to the end of the period. Figure 11-1. Financial Statement Links across Time LINKAGE OF FINANCIAL STATEMENTS The four financial statements are linked with each other and linked across time. This linkage is also known as articulation. The succeeding section demonstrates the articulation of financial statements using Orange Inc. The statement of financial position and statement of comprehensive income are linked via retained earnings. Retained earnings are updated each period and reflect cumulative income that has not yet been distributed to shareholders. Figure 11-2 shows Orange Inc. retained earnings reconciliation for 2014. ORANGE INC. Retained Earnings Reconciliation For Year Ended September 30, 2014 (pesos in millions) Retained earnings, September 30, 2013 Add: Net Income P5.607 3.496 Less: Dividends Other adjustments Retained earnings, September 30, 2014 (0) (.002) P9.101 Figure 11-2. Retained Earnings Reconciliation In the absence of transactions with stockholders (e.g., stock issuances, repurchase and dividend payments), the change in stockholders’ equity equals income or loss for the period. The income statement, thus, measures the change in company value as measured in accordance with financial reporting standards. This is not necessarily company value as measured by the market. Of course, all value-relevant items eventually find their way into the income statement. So, from a long term perspective, the income statement does measure change in company value. This is why stock prices react to reported income and to analysts’ expectations about future income. Orange lnc. begins the fiscal year 2013-2014 with assets of P17.205 million, consisting of cash for P6.392 million and noncash assets for P10.813 million. These investments are financed with P7.221 million from nonowners and P9.984 million from shareholders. The owner financing consists of contributed capital of P4.355 million, retained earnings of P5.607 million and other stockholders’ equity of P22 million. Figure 11-3 shows statement of financial position at the beginning and end of Orange Inc. The statement of cash flows explains how operating, investing and financing activities increase the cash balance by P2.960 million from P6.392 million at the beginning of the year to P9.352 million at year-end. Orange Inc.'s P3.496 million net income reported on the income statement is also carried over to the statement of shareholders' equity. The net income explains nearly all of the change in retained earnings reported in the statement of shareholders equity because Orange Inc. paid no dividends in that year (other adjustments reduced retained earnings by P.002 million). There is an order to financial statement preparation. First, a company prepares its income statement using the statement of comprehensive income accounts. It then uses the net income number and dividend information to update the retained earnings account. Second, it prepares the statement of financial position using the updated retained earnings account along with the remaining statement of financial position accounts from the trial balance. Third, it prepares the statement of stockholders' equity. Fourth, it prepares the statement of cash flows using information from the cash accounts and other sources. Figure 11-3. Articulation of Orange Inc. Financial Statements STATEMENT OF FINANCIAL POSITION A Statement of Financial Position reports a company’s financial position at a point in time, the company’s resources (assets) namely, what the company owns and also the sources of asset financing. There are two ways a company can finance its assets: 1. Owner financing. It can raise money from shareholders. 2. Nonowner financing. It can also raise money from banks or other creditors and suppliers. This means that both owners and nonowners hold claims on the company assets. Owner claims on assets are referred to as Equity, and nonowner claims are referred to as Liabilities (or debt). Since all financing must be invested in something, we obtain the following basic relation: (investing = financing). This equality is called the accounting equation which follows: (assets = liabilities + owner’s equity). * Financial statement titles sometimes begin with word consolidated. This means that the financial statement includes a parent company and one or more subsidiaries, companies that the parent company owns. For Blue Company, other equity includes accumulated other comprehensive income and minority interests. Investing Activities Statement of financial position is organized like the accounting equation. Investing activities are represented by the company's assets. These assets are financed by a combination of nonowner financing (liabilities) and owner financing (equity). Financing Activities Assets must be paid for, and funding is provided by a combination of owner and nonowner financing. Owner (or equity) financing includes resources contributed to the company by its owners along with any profit retained by the company. Nonowner (creditor or debi) financing is borrowed money. We distinguish between these two financing sources for a reason: borrowed money entails a legal obligation to repay amounts owed, and failure to do so can result in severe consequences for the borrower. Equity financing entails no such obligation for repayment. Some questions that a reader of the Statement of Financial Position of Blue Company might have at this early stage are: ● Blue Company reports P88.658 million of cash on its 2014 statement of financial position, which is 16% of total assets. Many investment-type companies such as Blue Company and high-tech companies such as Cisco Systems carry high levels of cash. Why is that? Is there a cost to holding too much cash? Is it costly to carry too little cash? ● The relative proportion of short-term and long-term assets is largely dictated by companies' business models. Why is this the case? Why is the composition of assets on statement of financial position for companies in the same industry similar? By what degree can a company's asset composition safely deviate from industry norms? ● What are the trade-offs in financing a company by owner versus nonowner financing? If nonowner financing is less costly, why don't we see companies financed entirely with borrowed money? ● How do shareholders influence the strategic direction of a company? How can long-term creditors influence strategic direction? ● Most assets and liabilities are reported on the statement of financial position at their acquisition price, called historical cost. Would reporting assets and liabilities at fair values be more informative? What problems might fair-value reporting cause? Review the Blue Company Statement of Financial Position summarized in Figure 11-4 and think about these questions. Working Capital Current assets are often called working capital because these assets “turn over” that is, they are used and then replaced throughout the year Net working capital is the difference between current assets minus liabilities while net operating working capital is the difference between current assets and non-interest bearing current liabilities. STATEMENT OF COMPREHENSIVE INCOME The statement of comprehensive income reports on a company' s performance over a period of time and lists amounts for revenues (also called sales), expenses and other comprehensive income. Revenues less expenses yield the bottom-line net income amount. Figure 11-5 shows the Blue Company Statement of Comprehensive Income. Refer to its income statement to verify the following: revenues = P236.490 million; expenses = P210.064 million; and net income = P26.426 million. Net income reflects the profit (also called earnings) to owners for that specific period. Figure 11-5. Statement of Comprehensive Income Manufacturing and merchandising companies typically include an additional expense account, called cost of goods sold (or cost of sales), in the statement of comprehensive income following revenues. It is also common to report a subtotal called gross profit (or gross margin), which is revenues less cost of goods sold. The company’s remaining expenses are then reported below gross profit. This income statement layout follows: Operating Activities Operating activities use company resources to produce, promote and sell its products and services. These activities extend from input markets involving suppliers of materials and labor to a company’s output markets involving customers of products and services. Input markets generate most expenses (or costs) such as inventory, salaries, materials and logistics. Output markets generate revenues (or sales) to customers. Output markets also generate some expenses such as marketing and distributing products and services to customers. Net income arises when revenues exceed expenses. A loss occurs when expenses exceed revenues. Differences exist in the relative profitability of companies across industries. Although effective management can increase the profitability of a company, business models play a large part in determining company profitability. The following questions might be considered regarding the Statement of Comprehensive Income. ● Assume that a company sells a product to a customer who promises to pay in 30 days. Should the seller recognize the sale when it is made or when the cash is collected? ● When a company purchases a long-term asset such as a building, its cost is reported on the statement of financial position as an asset. Should a company, instead record the cost of that building as an expense when it is acquired? If not, how should a company report the cost of that asset over the course of its useful life? ● Manufacturers and merchandisers report the cost of a product as an expense when the product sale is recorded. How might we measure the costs of a product that is sold by a merchandiser? By a manufacturer? ● If an asset, such as a building, increases in value that increase is not reported as income until the building is sold, if ever. What concerns arise if we record increases in asset values as part of income, when measurement of that increase is based on appraised values? ● Employees commonly earn wages that are yet to be paid at the end of a particular period. Should their wages be recognized as an expense in the period that the work is performed, or when the wages are paid? ● Companies are not allowed to report profit on transactions relating to their own stock. That is, they do not report income when stock is sold, nor do they report and expense when dividends are paid to shareholders. Why is this the case? Review the Blue Company Statement of Comprehensive Income summarized in Figure 11-5 and think about these questions. STATEMENT OF STOCKHOLDERS’ EQUITY The statement of stockholders’ equity reports on changes in key types of equity over a period of time. For each type of equity, the statement reports the beginning balance, a summary of the activity in the account during the year and the ending balance. Figure 11-6. Statement of Stockholders’ Equity Contributed capital represents the cash that the company received from the sale of stock to stockholders (also called shareholders), less any funds expended for the repurchase of stock. Retained earnings (also called earned capital or reinvested capital) represent the cumulative total amount of income that the company has earned and that has been retained in the business and not distributed to shareholders in the form of dividends. The change in retained earnings links consecutive statement of financial position via the income statement: Ending retained earnings = Beginning retained earnings + Net income – Dividends. For Blue Company, its recent year’s retained earnings increases from P117.824 million to P144.306 million. This increase of P26.482 million is explained by net income of P26.426 million, no payment of dividends and P0.056million related to a mandated accounting change. STATEMENT OF CASH FLOWS The statement of cash flows reports the change (either an increase or decrease) in company’s cash balance over a period of time. The statement reports on cash inflows and outflows from operating, investing and financing activities over a period of time. Blue Company Statement of Cash Flows For Year Ended December 31, 2014 (pesos in millions) Operating Cash Flows P12,550 Investing Cash Flows (13,428) Financing Cash Flows 1,464 Net Increase in cash 586 Cash, December 31, 2013 43,743 Cash, December 31, 2014 P44,329 Figure 11-7. Statement of Cash Flows Consider the following questions regarding the Statement of Cash Flows: ● What is the usefulness of the statement of cash flows? Do the statement of financial position and income statement provide sufficient cash flow information? ● What types of information are disclosed in the statement of cash flows and why are they important? ● What kinds of activities are reported in each of the operating, investing and financing sections of the statement of cash flows? How is this information useful? ● Is it important for a company to report net cash inflows (positive amounts) relating to operating activities over the longer term? What are the implications if operating cash flows are negative for an extended period of time? ● Why is it important to know the composition of a company’s investment activities? What kind of information might we look for? Are positive investing cash flows favorable? ● Is it important to know the source of a company’s financing activities? What questions might that information help us answer? ● How might the composition of operating, investing and financing cash flows change over a company’s life cycle? ● Is the bottom line increase in cash flow the key number? Why or why not?