Int Microeconomics Thry Midterm 2 Chapter 25

Study online at quizlet.com/_6u3wp8

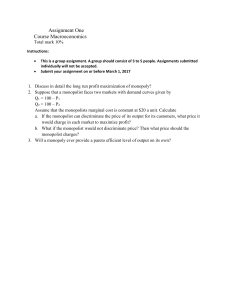

1.

$1

In a market with the inverse demand curve P = 10 − Q,

Brand X is a monopolist with no fixed costs and with

a marginal cost of $2. If marginal cost rises to $4, by

how much will the price of Brand X rise?

2.

$3,200

A monopolist faces the demand curve q = 90 − p/2,

where q is the number of units sold and p is the price

in dollars. He has quasi-fixed costs, C, and constant

marginal costs of $20 per unit of output. Therefore his

total costs are C + 20q if q > 0 and 0 if q = 0. What is

the largest value of C for which he would be willing

to produce positive output?

3.

$3,200

A monopolist faces the demand curve q = 90 − p/2,

where q is the number of units sold and p is the price

in dollars. She has quasi-fixed costs, C, and constant

marginal costs of $20 per unit of output. Therefore

her total costs are C + 20q if q > 0 and 0 if q = 0.

What is the largest value of C for which she would

be willing to produce positive output?

9.

$160

An airline has exclusive landing rights at the local

airport. The airline flies one flight per day to New

York with a plane that has a seating capacity of 100.

The cost of flying the plane per day is $4,000 + 10q,

where q is the number of passengers. The number of

flights to New York demanded is q = 165 − .5p. If the

airline maximizes its monopoly profits, the difference

between the marginal cost of flying an extra

passenger and the amount the marginal passenger is

willing to pay to fly to New York is

10.

-1.20

The demand for a monopolist's output is 6,000/(p +

2)2, where p is the price it charges. At a price of $3,

the elasticity of demand for the monopolist's output

is

11.

-1.60

The demand for a monopolist's output is 3,000/(p +

2)2, where p is the price it charges. At a price of $3,

the elasticity of demand for the monopolist's output

is

4.

$8

A profit-maximizing monopolist faces a downwardsloping demand curve that has a constant elasticity

of −3. The firm finds it optimal to charge a price of

$12 for its output. What is its marginal cost at this

level of output?

12.

2

dollars

The demand for a monopolist's output is 7,000

divided by the square of the price in dollars that it

charges per unit. The firm has constant marginal

costs equal to 1 dollar per unit. To maximize its

profits, it should charge a price of

5.

$15

The demand for a monopolist's output is 6,000/(p +

3)2, where p is its price. It has constant marginal

costs equal to $6 per unit. What price will it charge

to maximize its profits?

13.

5

6.

$17

The demand for a monopolist's output is 6,000/(p +

7)2, where p is its price. It has constant marginal

costs equal to $5 per unit. What price will it charge

to maximize its profits?

The demand curve facing a monopolist is D(p) =

100/p if p is 20 or smaller and D(p) = 0 if p > 20. The

monopolist has a constant marginal cost of $1 per

unit produced. What is the profit-maximizing quantity

of output for this monopolist?

14.

10

A monopolist faces the inverse demand curve p =

120 − 6q. At what level of output is his total revenue

maximized?

15.

16

A monopolist faces the inverse demand curve p =

64 − 2q. At what level of output is his total revenue

maximized?

16.

18

Charlie can work as many hours as he wishes at a

local fast-food restaurant for a wage of $4 per hour.

Charlie also does standup comedy. Since Charlie

lives in a quiet, rather solemn Midwestern town, he is

the town's only comedian and has a local monopoly

for standup comedy. The demand for comedy is Q =

40 − P, where Q is the number of hours of comedy

performed per week and P is the price charged per

hour of comedy. When Charlie maximizes his utility,

he spends at least 1 hour per week working at the

restaurant and he gets at least 1 hour of leisure time.

His utility depends only on income and leisure. How

many hours per week does he perform standup

comedy?

7.

8.

$18

$20

A profit-maximizing monopolist faces a downwardsloping demand curve that has a constant elasticity

of −4. The firm finds it optimal to charge a price of

$24 for its output. What is its marginal cost at this

level of output?

The demand for a monopolist's output is 10,000

divided by the square of the price it charges. The

monopolist produces at a constant marginal cost of

$5. If the government imposes a sales tax of $10 per

unit on the monopolist's output, the monopolist price

will rise by

17.

20

A monopolist has constant marginal costs of $1 per

unit. The demand for her output is 1,000/p if p is less

than or equal to 50. The demand is 0 if p > 50. What

is her profit maximizing level of output?

18.

23 10q

A monopolist faces the inverse demand function

described by p = 23 − 5q, where q is output. The

monopolist has no fixed cost and his marginal cost

is $6 at all levels of output. Which of the following

expresses the monopolist's profits as a function of

his output?

19.

20.

21.

22.

25,000

26

38

45q 4q^2

A computer software firm has developed a new and

better spreadsheet program. The program is

protected by copyrights, so the firm can act as a

monopolist for this product. The demand function

for the spreadsheet is q = 50,000 − 100p. Any single

consumer will want only one copy. The marginal

cost of producing and distributing another copy and

its documentation is just $10 per copy. If the

company sells this software at the profit-maximizing

monopoly price, the number of consumers who

would not buy the software at the monopoly price

but would be willing to pay at least the marginal

cost is

An industry has two firms, a leader and a follower.

The demand curve for the industry's output is given

by p = 208 − 4q, where q is total industry output.

Each firm has zero marginal cost. The leader

chooses his quantity first, knowing that the follower

will observe the leader's choice and choose his

quantity to maximize profits, given the quantity

produced by the leader. The leader will choose an

output of

An industry has two firms, a leader and a follower.

The demand curve for the industry's output is given

by p = 456 − 6q, where q is total industry output.

Each firm has zero marginal cost. The leader

chooses his quantity first, knowing that the follower

will observe the leader's choice and choose his

quantity to maximize profits, given the quantity

produced by the leader. The leader will choose an

output of

23.

99

gallons

In some parts of the world, Red Lizzard Wine is

alleged to increase one's longevity. It is produced

by the process Q = min{(1/3)L, R}, where L is the

number of spotted red lizards and R is gallons of

rice wine. PL = PR = $1. Demand for Red Lizzard

Wine in the United States is Q = 576P−2 A1/2. If the

advertising budget is $121, the quantity of wine

which should be imported into the United States is

24.

100%

A major software developer has estimated the

demand for its new personal finance software

package to be Q = 1,000,000P−2 while the total

cost of the package is C = 100,000 + 25Q. If this

firm wishes to maximize profit, what percentage

markup should it place on this product?

25.

100%

The demand for copies of the software package

Macrosoft Doors is given by Q = 10,000P−2. The

cost to produce Doors is C = 100,000 + 5Q. If

Macrosoft practices cost plus pricing, what would

be the profit-maximizing markup?

26.

108

gallons

In some parts of the world, Red Lizzard Wine is

alleged to increase one's longevity. It is produced

by the process Q = min{(1/4)L, R}, where L is the

number of spotted red lizards and R is gallons of

rice wine. PL = PR = $1. Demand for Red Lizzard

Wine in the United States is Q = 900P−2 A1/2. If the

advertising budget is $144, the quantity of wine

which should be imported into the United States is

27.

144

An obscure inventor in Strasburg, North Dakota, has

a monopoly on a new beverage called Bubbles,

which produces an unexplained craving for

Lawrence Welk music. Bubbles is produced by the

following process: Q = min{R/2, W}, where R is

pulverized Lawrence Welk records and W is gallons

of North Dakota well water. PR = PW = $1. Demand

for Bubbles is Q = 576P−2A0.5. If the advertising

budget for Bubbles is $81, the profit-maximizing

quantity of Bubbles is

28.

160

An obscure inventor in Strasburg, North Dakota, has

a monopoly on a new beverage called Bubbles,

which produces an unexplained craving for

Lawrence Welk music. Bubbles is produced by the

following process: Q = min{R/3, W}, where R is

pulverized Lawrence Welk records and W is gallons

of North Dakota well water. PR = PW = $1. Demand

for Bubbles is Q = 1,024P−2A0.5. If the advertising

budget for Bubbles is $100, the profit-maximizing

quantity of Bubbles is

29.

225

Peter Morgan sells pigeon pies from his pushcart in

Central Park. Due to the abundant supplies of raw

materials, his costs are zero. The demand schedule

for his pigeon pies is p(y) = 150 − y/3. What level of

output will maximize Peter's profits?

A monopolist faces the inverse demand function

described by p = 50 − 4q, where q is output. The

monopolist has no fixed cost and his marginal cost

is $5 at all levels of output. Which of the following

expresses the monopolist's profits as a function of

his output?

30.

250%

A major software developer has estimated the

demand for its new personal finance software

package to be Q = 1,000,000P−1.40 while the total

cost of the package is C = 100,000 + 20Q. If this

firm wishes to maximize profit, what percentage

markup should it place on this product?

31.

average

total

cost is

greater

than

marginal

cost

A monopolist faces a downward-sloping demand

curve and has fixed costs so large that when she

maximizes profits with a positive amount of

output, she earns exactly zero profits. At this

positive, profit-maximizing output,

decrease

her price

by $5

A profit-maximizing monopolist faces a demand

function given by q = 1000 − 20p, where p is the

price of her output in dollars. She has a constant

marginal cost of 20 dollars per unit of output. In

an effort to induce her to increase her output, the

government agrees to pay her a subsidy of $10

for every unit that she produces. She will

32.

33.

34.

decrease

her price

by $20

A profit-maximizing monopolist has the cost

schedule c(y) = 20y. The demand for her product

is given by y = 600/p4, where p is her price.

Suppose that the government tries to get her to

increase her output by giving her a subsidy of $15

for every unit that she sells. Giving her the

subsidy would make her

decrease

her price

by $28

A profit-maximizing monopolist has the cost

schedule c(y) = 40y. The demand for her product

is given by y = 600/p4, where p is her price.

Suppose that the government tries to get her to

increase her output by giving her a subsidy of $21

for every unit that she sells. Giving her the

subsidy would make her

35.

decrease

his

output

A monopolist produces at a point where the price

elasticity of demand is −0.7 and the marginal cost

is $2. If you were hired to advise this monopolist

on how to increase his profits, you would find that

the way to increase his profits is to

36.

the firm

could

produce

either 5

units or

35 units

A natural monopolist has the total cost function

c(q) = 350 + 20q, where q is its output. The inverse

demand function for the monopolist's product is p

= 100 − 2q. Government regulations require this

firm to produce a positive amount and to set

price equal to average costs. To comply with

these requirements

37.

The firm

produce

zwiffle only

if F is less

than or equal

to 36

A firm has discovered a new kind of

nonfattening, non-habit-forming dessert

called zwiffle. It doesn't taste very good, but

some people like it and it can be produced

from old newspapers at zero marginal cost.

Before any zwiffle could be produced, the

firm would have to spend a fixed cost of $F.

Demand for zwiffle is given by the equation

q = 12 − p. The firm has a patent on zwiffle, so

it can have a monopoly in this market.

38.

the firm will

lose $750

A monopolist has the total cost function c(q)

= 750 + 5q. The inverse demand function is

140 − 7q, where prices and costs are

measured in dollars. If the firm is required by

law to meet demand at a price equal to its

marginal costs,

39.

the firm will

lose $800

A monopolist has the total cost function c(q)

= 800 + 8q. The inverse demand function is

80 − 6q, where prices and costs are

measured in dollars. If the firm is required by

law to meet demand at a price equal to its

marginal costs,

40.

The firm will

produce

zwiffle only

if F is less

than or equal

to 100

A firm has discovered a new kind of

nonfattening, non-habit-forming dessert

called zwiffle. It doesn't taste very good, but

some people like it and it can be produced

from old newspapers at zero marginal cost.

Before any zwiffle could be produced, the

firm would have to spend a fixed cost of $F.

Demand for zwiffle is given by the equation

q = 20 − p. The firm has a patent on zwiffle,

so it can have a monopoly in this market.

41.

goes down

and its

demand for

gravel may

go up, down

or remain the

same,

depending

on the

demand

function for

the concrete.

The Hard Times Concrete Company is a

monopolist in the concrete market. It uses

two inputs, cement and gravel, which it buys

in competitive markets. The company's

production function is q = c1/2g1/2, where q

is its output, c is the amount of cement it

uses, and g is the amount of gravel it uses. If

the price of cement goes up, the firm's

demand for cement

42.

having it

typeset and

selling 2,300

copies

The demand for Professor Bongmore's new

book is given by the function Q = 5,000 −

100p. If the cost of having the book typeset is

$9,000, if the marginal cost of printing an

extra copy is $4, and if he has no other costs,

then he would maximize his profits by

43.

If he sells at a

positive price,

demand must

be inelastic at

that price

A monopolist receives a subsidy from the

government for every unit of output that is

consumed. He has constant marginal costs

and the subsidy that he gets per unit of

output is greater than his marginal cost of

production. But to get the subsidy on a

unit of output, somebody has to consume

it.

44.

if the industry is

competitive,

output will be

exactly twice as

great as it

would be if the

industry were

monopolized

The demand curve for the output of a

certain industry is linear; q = A − Bp. There

are constant marginal costs of C. For all

values of A, B, and C such that A > 0, B >

0, and 0 < C < A/B,

increase its

price by 1

dollars

A profit-maximizing monopoly faces an

inverse demand function described by the

equation p(y) = 30 − y and its total costs

are c(y) = 5y, where prices and costs are

measured in dollars. In the past it was not

taxed, but now it must pay a tax of 2

dollars per unit of output. After the tax, the

monopoly will

45.

46.

increase its

price by 3

dollars

A profit-maximizing monopoly faces an

inverse demand function described by the

equation p(y) = 40 − y and its total costs

are c(y) = 7y, where prices and costs are

measured in dollars. In the past it was not

taxed, but now it must pay a tax of 6

dollars per unit of output. After the tax, the

monopoly will

47.

marginal

revenue equal

to marginal cost

A profit-maximizing monopolist sets

48.

the monopolist

cannot be

maximizing

profits.

A monopolist faces a constant marginal

cost of $1 per unit. If at the price he is

charging, the price elasticity of demand

for the monopolist's output is −0.5, then

49.

The

monopolist

keep his

price

constant and

his sales

double

A monopolist enjoys a monopoly over the

right to sell automobiles on a certain island.

He imports automobiles from abroad at a

cost of $10,000 each and sells them at the

price that maximizes profits. One day, the

island's government annexes a neighboring

island and extends the monopolist's

monopoly rights to this island. People on the

annexed island have the same tastes and

incomes and there are just as many people as

on the first.

50.

None of the

above

Peter Morgan sells pigeon pies from his

pushcart in Central Park. Due to the abundant

supplies of raw materials, his costs are zero.

The demand schedule for his pigeon pies is

p(y) = 80 − y/4. What level of output will

maximize Peter's profits?

51.

not change

its price or

the quantity

it sells.

A monopoly has the demand curve q =

10,000 − 100p. Its total cost function is c(q) =

1,000 + 10q. The government plans to tax the

monopoly's profits at a rate of 50%. If it does

so, the monopoly will

52.

not having it

typeset and

not selling

any copies

The demand for Professor Bongmore's new

book is given by the function Q = 2,000 −

100p. If the cost of having the book typeset is

$7,000, if the marginal cost of printing an

extra copy is $4, and if he has no other costs,

then he would maximize his profits by

53.

p/2 - 3/2

A monopolist faces the demand function Q =

7,000/(p + 3)−2. If she charges a price of p,

her marginal revenue will be

54.

p/2 - 6/2

A monopolist faces the demand function Q =

4,000/(p + 6)−2. If she charges a price of p,

her marginal revenue will be

55.

A Pareto

improvement

could be

achieved by

having

government

pay for the

firm a

subsidy of

$59 and

insisting that

the firm

offer Slops

at zero price

A firm has invented a new beverage called

Slops. It doesn't taste very good, but it gives

people a craving for Lawrence Welk's music

and Professor Johnson's jokes. Some people

are willing to pay money for this effect, so

the demand for Slops is given by the

equation q = 14 − p. Slops can be made at

zero marginal cost from old-fashioned

macroeconomics books dissolved in

bathwater. But before any Slops can be

produced, the firm must undertake a fixed

cost of $54. Since the inventor has a patent

on Slops, it can be a monopolist in this new

industry.

A Pareto

improvement

could be

achieved by

having the

government

pay the firm

a subsidy of

$35 and

insisting that

the firm

offer Slops

at zero price

A firm has invented a new beverage called

Slops. It doesn't taste very good, but it gives

people a craving for Lawrence Welk's music

and Professor Johnson's jokes. Some people

are willing to pay money for this effect, so

the demand for Slops is given by the

equation q = 10 − p. Slops can be made at

zero marginal cost from old-fashioned

macroeconomics books dissolved in

bathwater. But before any Slops can be

produced, the firm must undertake a fixed

cost of $30. Since the inventor has a patent

on Slops, it can be a monopolist in this new

industry.

57.

produces

more output

than it would

if it were

maximizing

profits

A certain monopolist has a positive marginal

cost of production. Despite this fact, the

monopolist decides to produce a quantity of

output that maximizes total revenues. Assume

that the marginal revenue curve for this

monopolist always has a negative slope.

Then the monopolist

58.

produce too

little output

from the

standpoint

of efficiency

A monopolist has decreasing average costs

as output increases. If the monopolist sets

price equal to average cost, it will

Q = 101 and

P = 49.83

The Fabulous 50s Decor Company is the only

producer of pink flamingo lawn statues.

While business is not as good as it used to

be, in recent times the annual demand has

been Q = 400 − 6P. Flamingo lawn statues are

handcrafted by artisans using the process Q =

min{L, P/2} where L is hours of labor and P is

pounds of pink plastic. PL = 15 and PP = 3.

What would be the profit-maximizing output

and price?

56.

59.

60.

Q = 265 and

P = 87

The Fabulous 50s Decor Company is the only

producer of pink flamingo lawn statues.

While business is not as good as it used to

be, in recent times the annual demand has

been Q = 700 − 5P. Flamingo lawn statues are

handcrafted by artisans using the process Q =

min{L, P/7} where L is hours of labor and P is

pounds of pink plastic. PL = 20 and PP = 2.

What would be the profit-maximizing output

and price?

61.

raise prices

The Cleveland Visitors Bureau is the exclusive

national marketer of weekend getaway

vacations in Cleveland, Ohio. At current

market prices, the price elasticity of demand

is −1. To maximize profits, the bureau should

62.

raise prices

The Cleveland Visitors Bureau is the exclusive

national marketer of weekend getaway

vacations in Cleveland, Ohio. At current market

prices, the price elasticity of demand is −.50. To

maximize profits, the bureau should

63.

rises by $5

A profit-maximizing monopolist faces the

demand curve q = 100 − 3p. It produces at a

constant marginal cost of $20 per unit. A

quantity tax of $10 per unit is imposed on the

monopolist's product. The price of the

monopolist's product

64.

there is no

price at

which ticket

revenues

still cover

costs but

total

number

surplus

from the

rink

exceeds

costs

The town council of Frostbite, Ontario, is trying

to decide whether to build an outdoor skating

rink which would cost $1 million and last for

only one season. Operating costs would be

zero. Yearly passes would be sold to anyone

who wanted to use the rink. If p is the price of

the pass in dollars, the number demanded

would be q = 1200 − .6p. The council has asked

you to advise them on building the rink. You

should tell them that

65.

to

maximize

profits, he

should

charge a

price of

$1.33

A monopolist faces a constant marginal cost of

$1 per unit and has no fixed costs. If the price

elasticity of demand for this product is

constant and equal to −4, then

66.

to

maximize

profits, he

should

charge a

price of

$1.50

A monopolist faces a constant marginal cost of

$1 per unit and has no fixed costs. If the price

elasticity of demand for this product is

constant and equal to −3, then