ACFrOgCldCwAuC4DAykyh5NZS6j2szkF7j2ghKtl3fD6g2tPVK34Da7vN3gx5golOW3xMALMZPbFr1o-0YY0zHvOuc1Y1DNr0paoIlFLKxxxZJ-Kfgk0Fm9SFxRnufem56sW2YU8picgs6X7SBwq

advertisement

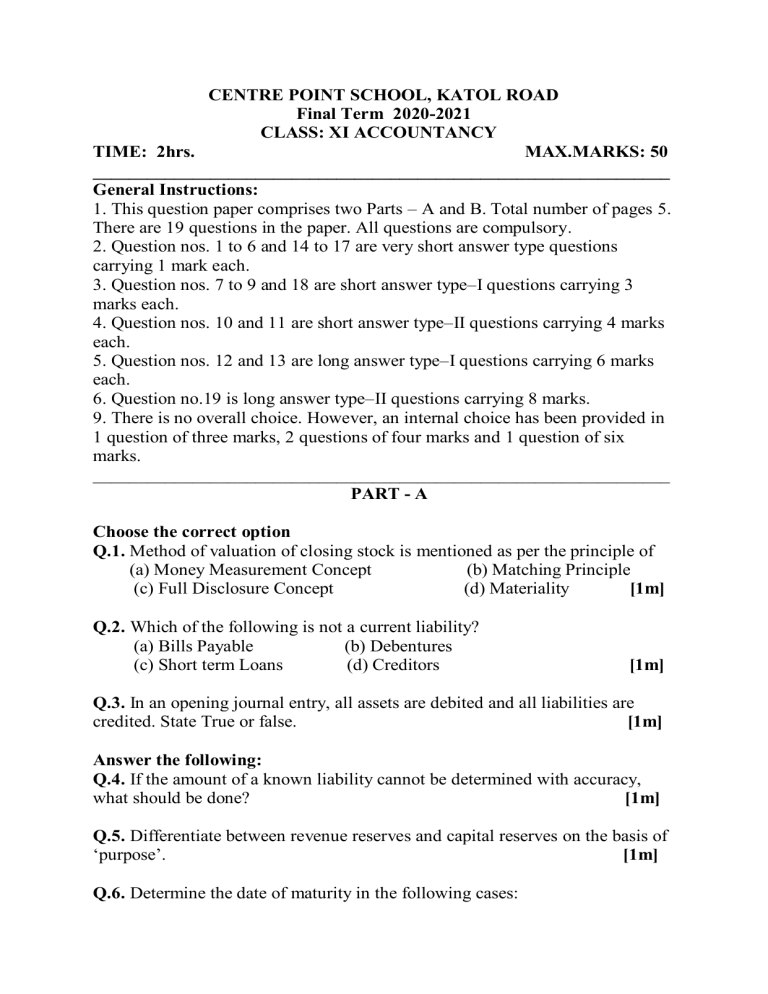

CENTRE POINT SCHOOL, KATOL ROAD Final Term 2020-2021 CLASS: XI ACCOUNTANCY TIME: 2hrs. MAX.MARKS: 50 ________________________________________________________________ General Instructions: 1. This question paper comprises two Parts – A and B. Total number of pages 5. There are 19 questions in the paper. All questions are compulsory. 2. Question nos. 1 to 6 and 14 to 17 are very short answer type questions carrying 1 mark each. 3. Question nos. 7 to 9 and 18 are short answer type–I questions carrying 3 marks each. 4. Question nos. 10 and 11 are short answer type–II questions carrying 4 marks each. 5. Question nos. 12 and 13 are long answer type–I questions carrying 6 marks each. 6. Question no.19 is long answer type–II questions carrying 8 marks. 9. There is no overall choice. However, an internal choice has been provided in 1 question of three marks, 2 questions of four marks and 1 question of six marks. ________________________________________________________________ PART - A Choose the correct option Q.1. Method of valuation of closing stock is mentioned as per the principle of (a) Money Measurement Concept (b) Matching Principle (c) Full Disclosure Concept (d) Materiality [1m] Q.2. Which of the following is not a current liability? (a) Bills Payable (b) Debentures (c) Short term Loans (d) Creditors [1m] Q.3. In an opening journal entry, all assets are debited and all liabilities are credited. State True or false. [1m] Answer the following: Q.4. If the amount of a known liability cannot be determined with accuracy, what should be done? [1m] Q.5. Differentiate between revenue reserves and capital reserves on the basis of ‘purpose’. [1m] Q.6. Determine the date of maturity in the following cases: (a) A bill drawn on 15th July,2017 for 30 days. (b) A bill drawn on 27th October, 2017 for 4 months. [1m] Q.7. Journalize the following transactions: i) Sold goods to Raman of list price Rs.60,000 at 10% trade discount and 5% cash discount. Half of the amount received by cheque. ii) Overhauling expenses incurred on a second-hand machinery purchased Rs.1,200 iii) Samar who owed us Rs.9,600 is declared insolvent and only 30paise in a rupee could be recovered. [3m] Q.8. On 31st December, 2017 cash book of a businessman showed a bank overdraft of Rs.7,700. On scrutiny it was found that: i) Cheques amounting to Rs.3,500 were paid into bank but only cheques of Rs.1,000 were credited. ii) Issued cheques of Rs.6,500 out of which cheques of Rs.2,650 were presented for payment. iii) Pass Book was debited with Rs.65 for bank charges and Rs.35 for interest. iv) Rs.2,400 directly deposited in the bank by a customer. Prepare Bank Reconciliation Statement as on 31st December, 2017. [3m] OR On 31 March, 2018 Pass Book of Mr. Tejas is showing a debit balance of Rs.5,000. On comparing with the cash book, following differences were found: i)Cheques issued before 31st March, 2018 for Rs.1,900 were presented for payment on 4th April, 2018. ii) Cheques for Rs.8,200 deposited in bank but cleared on April 2, 2018. iii) Dividend of Rs.6,000 collected by bank, not shown in cash book. iv) Insurance premium of Rs.1,000 paid by bank on standing instructions by him. st Q.9. Rectify the following errors and prepare suspense account to ascertain the difference in trial balance. i) Total of Sales Return Book was overcast by Rs.1,900. ii) Wages paid for installation of machinery Rs.500 was posted to wages account as Rs.50. iii) Credit purchases from Akash for Rs.6,000 were recorded in Sales Book. However, Akash’s account was correctly credited. iv) Depreciation provided on computers Rs.800 was not posted. [3m] Q.10. Pass journal entries for the following transactions assuming CGST and SGST @6% each: i) Sold goods to Payal & Co. of list price Rs.4,000 at 10% trade discount. ii) Purchased goods from Mehta & Co. worth Rs.2,400. iii) Sold goods for Rs.2,500. Balance GST. [4m] OR Pass journal entries for the following, assuming CGST and SGST @6% each: i) Received commission Rs.1,000. ii) Cash collected for goods sold and deposited in bank Rs.1,500 (IGST). iii) Purchased furniture by cheque Rs.1,200. iv) Paid rent by cheque Rs.3,000. Q.11. Anil drew upon Sunil three bills of exchange for Rs.25,000 for one month, Rs.20,000 for two months and Rs.40,000 for three months. He endorsed the first bill in favour of his creditor Manoj in settlement of his debt of Rs.26,200. Anil retained the second bill. The third bill was discounted with the bank at 10% p.a. The first bill was met on maturity. The second and third bill dishonoured and noting charges paid were Rs.150 for each bill. Record these transactions in the books of Anil. [4m] OR On 1 January, 2016 X sold goods to Y for Rs.20,000. Y paid 50% immediately at 2% discount. X drew a bill on Y for two months for the balance amount. Y accepted the bill. The bill was dishonoured on the due date and X paid noting charges of Rs.100. Y paid the amount due to X by cheque after 10 days. Pass entries in the books Y. st Q.12. Prepare a double column cash book from the following transactions: 2019 March: 1. Cash in hand Rs.31,200; Bank Overdraft Rs.14,800. 4.An amount of Rs.5,000 due from Raunak & Sons written off as bad debts previously, now recovered. 8. Received a cheque from Kunal and deposited it in the bank Rs.4,000. 10. Sold goods Rs.2,500. 12. Received a cheque from Ravi Rs.3,000. 14. Paid electricity expenses through cheque Rs.1,000. 18. Purchased goods for Rs.3,000. 20. Ravi’s cheque dishonoured. 31. Interest on bank overdraft Rs.1,300. 31. Deposited in bank, entire balance after retaining Rs.10,000 at office. [6m] Q.13. A firm purchased on 1st April, 2016 a second-hand machinery for Rs.36,000 and spent Rs.4,000 on its installation. On 1 st October in the same year, another machinery costing Rs.20,000 was purchased. On 1 st October, 2018 machinery bought on 1st April, 2016 was sold for Rs.12,000. Depreciation is provided annually on 31 st March @ 10%p.a. on Written Down Value method. Show Machinery Account from 2016-2019. [6m] OR The following balances appear in the books of Crazy Ltd., on 1st April, 2018 Machinery Account Rs.15,00,000 Provision for Depreciation Account Rs.5,50,000 st On 1 July, 2018 a machinery which was purchased on 1 st April, 2015 for Rs.2,00,000 was sold for Rs.75,000. A new machine was purchased on 1 st October, 2018 for Rs.6,00,000. Depreciation is provided on machinery at 20% p.a. on Straight Line Method on 31 st March every year. Prepare Machinery account and Provision for Depreciation account for the year ending 31 st March, 2019. PART – B Q.14. State the meaning of operating profit. [1m] Q.15. Which of the following is not a revenue receipt? a) Discount Received b) Sales c) Sale of Plant d) Commission Received [1m] Q.16. From incomplete records, it is not always possible to prepare: a) Ledger b) Trial Balance c) Balance Sheet d) All of the above [1m] Q.17. Identify the type of expenditure in the following cases: i) Registration fees paid at the time of purchase of building. ii) Heavy advertisement expenditure. [1m] Q.18. Mr. Sarvesh started a business with a capital of Rs.2,00,000. At the end of the year his total assets were Rs.5,00,000 and external liabilities were Rs.2,25,000. He further informs you that during the year he withdrew Rs.25,000 for household use. During the year he sold his personal investments of Rs.25,000 at 20% profit and brought that money into the business as additional capital. You are required to prepare a statement of Profit or Loss under accounts from incomplete records. [3m] Q.19. From the following Trial Balance of M/s Armaan & Sons as at 31st March, 2017, prepare Trading and Profit & Loss Account and Balance Sheet: Particulars Dr. (Rs.) Cr. (Rs.) Drawings and Capital 9,000 40,000 Purchase and Sales 41,300 77,500 st Stock(1 April, 2016) 21,000 -------Return Outward ------800 Carriage Inward 600 -----Wages 2,000 -----Power & Fuel 3,000 -----Machinery 25,000 -----Furniture 7,000 ------Rent 11,000 -------Salary 7,500 -----Insurance 1,800 ------8% Bank Loan ------12,500 Debtors 10,300 ------Creditors -------9,450 Cash in hand 750 -------Total 1,40,250 1,40,250 Adjustments: I) Closing Stock Rs.32,000. ii) Bad debts Rs.300 and Provision for bad and doubtful debts to be 5% on debtors. iii) Rent is paid for 11 months. iv) Loan from the bank was taken on 1 st October, 2016. v) Provide manager’s commission at 10% on Net Profit after charging such commission. [8m] ***CPS***