ACCTG 211 Course Outline: Accounting Standards & Financial Statements

advertisement

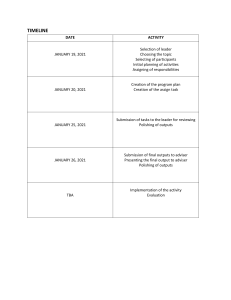

Learning is not a spectator sport. This is a 15 point course and requires a commitment of 150 hours. There are 43 hours of contact hours so . . . Accounting 211 Semester 1 2021 1 My name is Chris Clarke. My roles in ACCTG 211: -the Course Coordinator -the lecturer for Topics 1, 2, 4, 5 and 6 -taking three, of the five, tutorial streams Dr Lina Li is the lecturer for Topic 3 and takes the two remaining tutorial streams Extended Course Outline – available on Canvas/Modules/Extended Course Outline It is in your best interests to know what is expected of you in ACCTG 211 so please read this document in detail. Enrol yourself onto Piazza. Check that you can access PeerWise. Assignment 1 document is available on Canvas/Modules/Assignments 1 to 5. This assignment must be ‘successfully submitted’ before 6 pm on Friday, the 5 March 2021. Reduce the level of stress in your life by submitting your assignments online a few hours earlier. Late submissions, in any form, cannot be marked. Why? Tutorial 1 and Tutorial 2 document is available on Canvas/Modules/Tutorial materials. Tutorials start in Week 2. Accounting 211 Semester 1 2021 2 Part of Assignment 1 NZ IAS 1 Presentation of Financial Statements Topic 3 (three weeks) NZ IFRS 16 Leases Topic 2 (two weeks) NZ IAS 7 Statement of Cash Flows Set of Financial Statements/Annual Report*/GPFS: SFP SCI A, L, E SCE SCF Notes Income, Exps Topic 4 (one week) NZ IAS 16 PPE NZ IAS 36 Impairment of Assets NZ IAS 38 Intangible Assets Topic 6 NZ IAS 10 (one week) Events after the reporting period Topic 5 (four weeks) NZ IFRS 3 Business Combinations NZ IFRS 10 Consolidated Financial Statements NZ IAS 28 Investments in Associates and Joint Ventures * You will be referring to the 2020 Auckland Airport Annual Report and Air NZ Annual Report for each topic. Accounting 211 Semester 1 2021 3 ACCTG 211 SELF-STUDY PLAN Total contact hours plus total self-study hours = 150 hours Assignment/PW successfully submitted by 6 pm Lecture Attendance Tutorial Attendance Total Contact hours 1 3 hours - 3 Assign 1 due 05 March 4 2 3 hours 1 hour 1/10 4 PW 1 due 12 March 2 3 3 hours 1 hour 2/10 4 Assign 2 due 19 March 4 4 3 hours 1 hour 3/10 4 PW 2 due 29 March 2 5 3 hours 1 hour 4/10 4 PW 3 due 02 April 2 Week % Completion of Assignment/PW Note (b) Feedback review of assignment Note (c) Total self-study hours (a) + (b) + (c) - Break from classes 6 3 hours 1 hour 5/10 4 Assign 3 due 23 April 4 7 - - - Test on xx April 25 8 3 hours 1 hour 6/10 4 - - 9 3 hours 1 hour 7/10 4 PW 4 due 14 May 2 10 3 hours 1 hour 8/10 4 PW 5 due 21 May 2 11 3 hours 1 hour 9/10 4 Assign 4 due 28 May 4 12 3 hours 1 hour 10/10 4 Assign 5 due 04 June 4 Exam Study - - - Exam date TBD 33 Review of topic materials Note (a) 10 Total 43 45 100% Total 107 Accounting 211 Semester 1 2021 4 Accounting cycle Debit and credit rules T-account format for GL accounts Effect on financial statements if an expenditure is expensed v. capitalised. Effect on financial statements if receipts of income are recognised as received v. recognised on a SL basis Splitting assets/liabilities into current and non-current Accounting 211 Semester 1 2021 5 Accounting cycle: ACCTG 102 1 Transaction/event occurs 2 Analyse (residual analysis) 3 Prepare journal entries 4 Post journal entries to GL (Running balance GL account format emphasis) 5 Prepare a TB 6 Prepare adjusting journal entries at year end 7 Prepare an adjusted TB 8 9 10 ACCTG 211 Prepare a SFP and SCI Prepare closing journal entries at year end Prepare a closing TB (consisting of asset, liability and permanent equity GL account balances ) Accounting 211 Semester 1 2021 6 Accounting equation: A = L + E Normal balance To increase To decrease (same as normal balance) (opposite of normal balance) A = Assets L = Liabilities E = Equity (meaning Total Equity) Total Equity is made up of: Share capital Retained earnings (RE)/Retained profits (RP) Asset revaluation surplus (ARS) Various other individual equity accounts Income accounts – temporary equity a/c’s Expense accounts – temporary equity a/c’s Dividends declared – temporary equity a/c Accounting 211 Semester 1 2021 7 Cookie Jar = Asset Left side = Debit side Right side = Credit side Dr side Mon morning Starting quantity of cookies During Monday Cookies eaten During Mon Cookies bought Mon evening Closing quantity Tues morning Day 2 starting quantity of cookies Accounting 211 Semester 1 2021 Cr side 8 Entity B: Expensed Entity A: Capitalised $ SFP as at 31/03/2021 $ SFP as at 31/03/2021 PPE Less AD SCI for the year ended 31/03/2021 SCI for the year ended 31/03/2021 Office expense Depn expense SCF for the year ended 31/03/2021 SCF for the year ended 31/03/2021 Office expense paid Purchase of PPE Next four years: No effect on Next four years: Will have an effect on (say 5 year life) . No effect of the Accounting 211 Semester 1 2021 . and 9 Entity B: Recognise as received Entity A:Recognise on a SL basis $ SFP as at 31/03/2021 $ SFP as at 31/03/2021 Liability: SCI for the year ended 31/03/2021 SCI for the year ended 31/03/2021 Income Income SCF for the year ended 31/03/2021 SCF for the year ended 31/03/2021 Income received Income received Next year the dollar amount of $ and . will both show a Next year: There will be no in the SFP. The will again recognise $430 income. The will show a dollar amount of $360. Accounting 211 Semester 1 2021 10 SFP as at: 31/03/20 31/03/21 31/03/22 31/03/23 31/03/24 31/03/20 31/03/21 31/03/22 31/03/23 31/03/24 Current liabilities: Loan payable Non-current liabilities: Loan payable SCF for the year ended: Receipt of loan Loan repayment Accounting 211 Semester 1 2021 11 Assignment 1 contains additional revision type questions. Now to Topic 2 SCF Accounting 211 Semester 1 2021 12