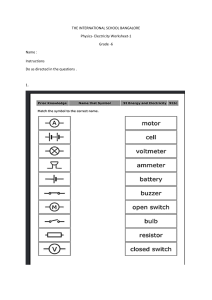

Welcome to Energy Markets and Policy ECON 433/633 1 Course Logistics It’s a stacked course – students from different academic disciplines will enhance discussion Prerequisites Comfortable with or willing to teach yourself: Basic intermediate microeconomic theory Ability to read regression results & understand how to interpret Course readings No textbook. Only a reader available at Notes N Quotes Read material before each lecture 2 Course Logistics (contd) Tell me about yourself by filling out notecards Class discussion My cold-calling policy My testing style TA: Jose Castillo (jgcastillo@tamu.edu) Office hours are reserved for you. Come! Grading is described on syllabus Any logistical questions? 3 In case you hiked to class today… 4 Energy Club Upcoming Events: Networking events Sept. 8 and 11 5 Examples of Important Questions for the future of the energy industry Impacts of dramatic increase in U.S. shale gas? What should the “smart grid” look like? Smart meters, smart appliances, plug-in electric vehicles Development of renewable energy sources Pipeline infrastructure, exporting LNG, carbon implications Impact of abundant cheap natural gas on coal? Wind, solar intermittency New markets and trading Wholesale & retail power, green power, natural gas trading 6 Our Lens to Analyze These Questions Economics toolkit Is the outcome in a particular energy market a “good outcome”? “Good” ≡ efficient When do markets work well to yield “good” outcome? When do markets fail & what’s the role for policy? Also, can we convincingly say that one factor causes another? We’ll focus on this from an economics perspective, but other lenses (e.g. technological, engineering, policy implementation) are equally important, just not the focus of this class. 7 Overview of Course Questions Topic #1: Is the price right? 8 Gasoline Prices in College Station: 2006-yesterday Is there anything economically “bad” about these prices? 9 Source: gasbuddy.com Motivation: Natural Gas Prices 1997-2014 Is there anything economically “bad” about these prices? Is there anything economically “bad” about these prices? 10 Motivation: Electricity Wholesale Prices Is there anything economically “bad” about these prices? 11 Overview of Course Questions Topic #1: Is the price right? Do price controls in energy markets make good economic sense? Answer: It depends on ……. Case 1: Natural gas wellheads Case 2: Electricity markets 12 Overview of Course Questions Topic #1: Is the price right? Do price controls in energy markets make good economic sense? Answer: It depends on ……. Case 1: Natural gas wellheads Case 2: Electricity markets What is the “right” price (from an economics point of view)? Does the market yield that price? 13 Overview of Course Questions (contd) Change hats… Study of energy trading Topic #2: What are profit-maximizing bidding strategies and arbitrage strategies? Future careers? Arbitrage in electricity markets 14 Arbitrage in Electricity Markets Can you make money by buying electricity one day & selling it the next? Price of buying on same day Price of buying 1 day before Source: Borenstein, Bushnell, Knittel & Wolfram (2008) 15 Overview of Course Questions (contd) Study of energy trading Future careers? Arbitraging Electricity Bidding into electricity markets “You be the bidder” – real bid data from Texas electricity auctions “Electricity Strategy Game” Possible field trip 16 Overview of Course Questions (contd) Study of energy trading Future careers? Arbitraging Electricity Bidding into electricity markets “You be the bidder” – real bid data from Texas electricity auctions “Electricity Strategy Game” Possible field trip 17 Electricity Strategy Game Simulate the trading of electricity in real-world markets Understand the strategic behavior in electricity markets and how profit-maximization works Work in teams collaboratively Bid for a set of powerplants for your team to own Then you compete to sell your plants’ power into electricity auctions Winning will matter… 18 Overview of Course Questions (contd) Study of energy trading Future careers? Arbitraging Electricity Bidding into electricity markets “You be the bidder” – real bid data from Texas electricity auctions “Electricity Strategy Game” Possible field trip 19 Next Topic: Implications of the Shale Boom Combination of two key technological developments has caused a large increase in drilling and production of both natural gas & oil Implications we need to understand: Locally: economic activity, wealth, property values, crime Globally: emissions from electricity sector, exporting of natural gas & coal 20 Wells in Shale Plays Across U.S. 21 Wells in Shale Play Around Ft. Worth 22 Wells in Shale Play In Southeast Texas 23 More Natural Gas Rigs… …and more Natural Gas Production Where Will the Natural Gas Go? 26 Will natural gas be exported? Next Topic: Implications of the Shale Boom Combination of two key technological developments has caused a large increase in drilling and production of both natural gas & oil Implications we need to understand: Locally: economic activity, wealth, property values, crime Globally: emissions from electricity sector, exporting of natural gas & coal 28 Overview of Course Questions (contd) Next topic: Energy in the transportation sector Determinants of retail gasoline prices 29 Hurricanes & Gasoline Prices “Rockets and feathers” phenomenon 30 Source: Lewis (2006) Overview of Course Questions (contd) Energy in the transportation sector Determinants of retail gasoline prices Is there “market power”? Sufficiently competitive? 31 Overview of Course Questions (contd) Energy in the transportation sector Determinants of retail gasoline prices Is there “market power”? Sufficiently competitive? Does environmental regulation create market power? 32 33 Overview of Course Questions (contd) Energy in the transportation sector Should govt policy target gasoline consumption and driving? Unpriced externalities? Smog? CO2? Congestion? Accidents? Merits of fuel efficiency standards vs. gasoline tax Gasoline tax – reduce “bad” taxes and increase “good” taxes? 34 Overview of Course Questions (contd) Next topic: Energy and climate policy Optimal means to reduce CO2 emissions by X%? Shale gas as a “bridge to a low carbon future”? Development of renewables 35 If policy needs to consider worldwide energy consumption, looks beyond the U.S. 36 Final Topic: Should Policies Target Consumer Use of Energy? Energy is the “life blood” of economic activity Households spend: $325 billion / year on gasoline $245 billion / year on electricity, natural gas, fuel oil $361 billion spent on durables goods that use energy such as cars or household appliances in 2011 Do energy consumers leave “money on the table”? 37 Motivation #1: Money on the Table? 38 Motivation #1: Money on the Table? Avg. $/kwh for 1000kwh .07 .08 .09 .1 .11 .12 .13 .14 .15 .16 TNMP Territory: Avg Rates Over Time Jan 2002 Jan 2003 Jan 2004 Incumbent Green CREP 3 Jan 2005 Jan 2006 CREP 1 CREP 2 CREP 4 39 Motivation #1: Money on the Table? Incumbent 0 Share of Monthly Residential Load .2 .4 .6 .8 1 Evolution of Market Shares: TNMP Jan 2002 Jan 2003 Jan 2004 Jan 2005 Jan 2006 40 Motivation #2: Money on the Table? Adding insulation to home or installing a programmable thermostat. Will it make households better off? Size of energy bill today? Size of energy bill “tomorrow” capitalized into home value? Other factors that affect “utility function”? Is there an “energy efficiency gap”? gap 41 Should Policies Target Consumer Use of Energy? Energy is the “life blood” of economic activity Households spend: $325 billion / year on gasoline $245 billion / year on electricity, natural gas, fuel oil $361 billion spent on durables goods that use energy such as cars or household appliances in 2011 Are consumers myopic? Are there externalities? If inefficiencies exist, will “well-meaning” policy fix the problem? 42 Next Up… Make sure we all have the same theoretical toolkit Next 2 lectures: Perfect competition Monopoly Oligopoly Externalities Coase Theorem For next time: Read Notes & Quotes pages 2-12 Following lecture: Read N&Q pages 13-33 43