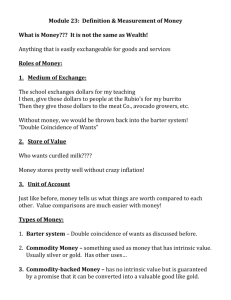

Essay “Money and its functions” For modern economies money is supposed to be the main component, as they primarily help consumers to satisfy their longings and needs. Money is a commodity, which built economic relationships in society. Money is equivalent to the cost of other goods and services. It is a complex phenomenon invented by people for people. Market relations began to be formed in VII-VIII Millennium BC. At that time primitive men exchanged with each other superfluous products, and the proportions were established depending on the circumstances. With the development of the social division of labor barter gradually became inconvenient, and our ancestors began to improve the monetary system. Nowadays money fulfills certain functions: 1. The Medium of Exchange Money, the medium of exchange, is used in one-half of almost all exchange. Workers exchange labour services for money. People buy and sell goods in exchange for money. We accept money not to consume it directly but because it can subsequently be used to buy things we do wish to consume. Money is the medium through, which people exchange goods and services. Money gives an opportunity to choose on what can we spent it, whereas, for instance, barter system did nor provide consumers with this chance. There is no choice, only a fact that this particular commodity will be exchanged for another particular commodity. So consumers had to spend their time on searching for a favourable product to exchange, thereby it was extremely wasteful. 2. Measure of Value. Money is also a measure of value. Society uses the monetary unit for measuring the relative worth of heterogeneous goods and resources. With a money system, we need not state the price of each product in terms of all other products for which it can be exchanged; In Russia prices are quoted in rubles; in Britain, in pounds sterling; in the USA, in US dollars; in France, in French francs. It is usually convenient to use the units in which the medium of exchange is measured as the unit of account as well. However there are exceptions. During the rapid German inflation of 1922 – 1923 when prices in marks were changing very quickly, German shopkeepers found it more convenient to use dollars as the unit of account. Prices were quoted in dollars even though payment was made in marks, the German medium of exchange. The situation in Russia nowadays reminds of that of in Germany. 3. Money is a store of value, for it can be used to make purchases in future. For money to be accepted in exchange, it has to be a store of value. Unless suitable for buying goods with tomorrow, money will not be accepted as payments for the goods supplied today. But money neither the only nor necessarily the best store of value. Houses, stamp collections, and interest-bearing bank accounts all serve as stores of value. 4. Money serves as a standard of deferred payment or a unit of account over time. This means that when money are borrowed, the amount to be repaid next year is measured in units of national currency, rubles of Russian Federation, for example. All in all, the main function is considered to be a The Medium of Exchange, though other functions also play an important role in commodity and money relations.