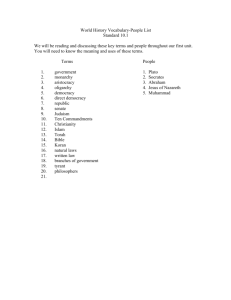

The Effect of Oil Reserves Volume on Economic Growth Selected countries from the perspective of resource curse (With emphasis on democracy) Ali Emadi Aemasi10@gmail.com Abstract In this study, we examine the effect of oil reserves volume on economic growth in three high-income income groups (Australia, US, UK, Denmark, Norway and Canada) and low income (Egypt, India, Indonesia, and Syria) for the period. 1960-2012, with emphasis on democracy. For this purpose, we use the dynamic panel data model and the GMM method.The dependent variable uses GDP 2005 at the constant price of the dollar and the independent variables are the model, the volume of oil reserves, the size (costs) of government, democracy or public participation, trade freedom, and the consumer price index. The resource curse phenomenon is common in middle-income countries, but it is rejected in highincome and low-income countries. Keywords Curse of Democrat, Resource Holders in Rashad Oilfield Reserves, Economical growth 1. Introduction The richness of natural resources has caused similar disasters in different forms and times. Throughout history, numerous examples can be seen showing that countries with abundant natural resources had a worse fate than poor nations in terms of resources. In the seventeenth century the Netherlands outperformed rich resource-rich Spain, even though the Spanish treasuries were rich in gold and silver obtained from the America.In recent years in Angola, as one of the most important African oil countries, $ 4.2 billion has been cut from the state treasury. In Venezuela, poverty has more than doubled since the late 1970s, and the share of national income given to shareholders and infidels has increased from 50% to 80%. As a result, ordinary workers now earn only 20% of economic income. (birdsall and subramanian, 2004). One can honestly say that Nigeria's most dramatic oil experience has been through. Subsequent military rule and successive coups, widespread internal strife, corruption and high inflation have been Nigeria's share of oil sales. And 83.5 in 2000. Per capita oil revenue rose from $ 33 in 1965 to $ 325 in 2000.Between 1970 and 2000, the population living on less than a dollar a day in Nigeria has gone from 26 percent to almost 70 percent. Consecutive military dictatorships have plundered huge oil wealth and Niger has been spreading stories about the transfer of large amounts of wealth. Not known in other countries. Oil revenues have fundamentally altered Nigeria's politics and government (ibrahim, sala.i.martin, auty, 2003). Therefore, oil wealth and its impact on the economic growth of countries is an important issue that needs to be addressed. In this study, we examine the effect of reserves volume on economic growth in oil-rich countries with emphasis on democracy, the first part of which deals with the theoretical foundations of the research. The second section is devoted to a review of the research performed. In the next section, the model is refined and the results analyzed, and the final section concludes. 2. Theoretical Foundations 1-2. Oil reserves and the curse phenomenon of resources The resource curse hypothesis has been favored by countries with abundant natural resources, which have less economic growth than countries with limited natural resources. It provides the fastest source of foreign exchange and attracts foreign investment and capital, as well as increasing access to raw materials, production and demand for industrial products. However, over the past 50 years, countries rich in natural resources such as Russia, Nigeria and Venezuela have experienced much less economic growth than other countries with less natural resources (Auty, 2001).A person who has a big windfall is better off winning or drawing treasure, but for many developing countries, finding valuable natural resources can have strange and sometimes harmful political implications. To have. In oil-rich countries, less democracy, less economic stability, and civil wars are more common than countries without oil. Since the 1980s, the developing world has become richer, more democratic, and more peaceful. However, this is only true for countries without oil. Oil-rich states scattered in the Middle East, Africa, Latin America and Asia, They are not more democratic and more peaceful than they were three decades ago; some are even worse. From 1980 to 2006, per capita incomes in Venezuela dropped by 6 percent, 45 percent in Gabon, and 85 percent in Iraq. Many oil producers Like Algeria, Angola, Nigeria, Sudan and again Iraq have been frightened by decades of civil war.These chronic political and economic ailments create what is called a resource disaster. True, it is a mineral disaster, since these diseases and disasters are caused by other types of natural resources such as forests, clean water. Or no fertile land. Among the minerals, oil, which accounts for more than 90 percent of the world's mineral trade, poses the biggest problems for most countries. The resource disaster is the oil disaster. 2-2. public participation Public participation in the process of adapting people's abilities and talents to development needs and goals relies on the quantity and quality of political and social institutions and cultural currents and practices of that community without causing severe disruption to people's personal, family, and social spaces. Permanently provides new products, methods, jobs, criteria and goals for people and society and provides space for its implementation. Expansion of these institutions and processes and lifestyles is not an easy task, it is impossible in the short term and requires a long and sustained planning based on community structures.All efforts in this direction, with the aim of achieving a proper development process, should be regarded as a key infrastructure investment, as long as there is no suitable space and early incentives, investments Physical and economic cannot be the source of lasting effect. Therefore, for underdeveloped societies that seek to design endogenous and sustained growth patterns, these investments have a key role and priority to play in the process of their development, priority, quantity and quality.The presence of people in the development process is essential. This is so essential that without this participation, comprehensive, sustained and sustainable development research is impossible. The presence and participation of people in decision-making means effective exchange and The interplay of science and information is the continuous monitoring and control of the state. The direct role of the people as long as the goals and resources of government and society are not in harmony with one another, possible development means their awareness of the social, political and economic situation. , The culture and security of a country and the world, as well as the knowledge, knowledge of its past, present, future, present and future, and other It has been and without this presence may have tasted a country for short periods of time, but development is not possible because development is with people and for people. The economic and social problems of underdeveloped societies are the result of the historical backwardness of the social, cultural and economic systems of these countries, and teach us that a way to reach a society that meets today's needs of development is to use and use it seriously. There are no human, economic, and cultural potentialities. There is no way to achieve such a goal except to engage people in matters of democracy and practice, with judiciary security, freedom of the press, pen and speech and party freedom. Development takes place in the context of partnership, not in the field War and strife. The dominant aspect of wars and conflicts throughout history has been and will be the inability of societies to find forms of public participation. Not much involved in development campaigns, they feel a gap between themselves and the government, which is the biggest factor leading to despotism. Tyrannical methods, instead of allowing development and modernization, are a major obstacle to the solution. The new economy, with more freedom of expression and better feedback between rulers and government officials, encourages greater participation of people in decision-making. Freedom is one of the essential human rights and an essential component of democracy (Sattarifar, 1995). 3. Research Background Akani et al. (2003) examined the impact of oil rent on economic growth in a study. They used theoretical and empirical data to examine the curse of resources in 47 oil-exporting countries, including Africa, during the 1970-2000 period, using panel data. They concluded that the resource curse in these countries was not due to Dutch diseases and the effects of the exchange rate; rather, the lack of democracy in these countries created oil rents, thereby slowing economic growth in these countries. Given this relationship of variables such as per capita income, investment to GDP ratio, oil wealth, quality Eddie, real per capita income, population growth and the exchange rate used. Vantchegon (2004) has also examined the impact of natural resources on economic growth in democratic governments. In his research he used Gini coefficients, the ratio of exports to GDP and the degree of government concentration. To increase democracy, but if the increase in income from wealth causes democracy to disappear. Economists such as Romer (1970) and Lewis (1989) emphasize the positive relationship between abundance of natural resources and economic growth. Papyrakis and Grloff (2004) examined the direct and indirect effects of natural resource abundance on economic growth and concluded that When natural resources are considered as an explanatory variable alone, it has a positive effect on growth, but when other explanatory variables such as corruption, investment, degree of openness of the economy, exchange relationship and education are included in the model, the effects are negative. Is. Elusi and Elagunjo (2005), for Nigeria during the period 20032008, showed that the production and export of the country's agricultural sector has stagnated with oil boom and rising oil prices. Bronzchweiler (2006) found a positive and significant relationship between economic growth and abundance of natural resources. In this way resources reduce investment, years of education, commercial openness, and research and development costs and corruption in society. Oomes and Calcheva (2007), by examining the Dutch disease hypothesis in Russia using real exchange rate indices, declining industry growth and increasing services, showed that rising oil prices led to declining industry And the employment growth growth in this sector. Jim and Adland (2010) examined the phenomenon of resource curse in the United States and concluded that an increase in natural resources in these different states would reduce economic growth.Boyce and Herbert Amery (2011) also found a negative relationship between natural resources and economic growth. In general, countries whose economies rely on natural resources have experienced examples of development failures, in contrast, countries with less abundant natural resources (such as Japan, Hong Kong, Korea and Ireland) have lower rates. It has experienced higher economic growth, and the third group includes countries that, despite their dependence on primary resources, have good economic growth performance (such as Norway and Botsvana). For many developing countries, finding valuable natural resources can have strange consequences, And sometimes have harmful politics. In countries rich in oil, less democracy, less economic stability, and civil wars are more common than countries without oil. Since the 1980s, the developing world has become richer, more democratic, and more peaceful. However, this is only true for countries without oil. Oil-rich states scattered in the Middle East, Africa, Latin America and Asia, They are not more democratic and more peaceful than they were three decades ago; some are even worse. From 1980 to 2006, per capita incomes in Venezuela dropped by 6 percent, 45 percent in Gabon, and 85 percent in Iraq. Many oil producers Like Algeria, Angola, Nigeria, Sudan and again Iraq have been frightened by decades of civil war.These chronic political and economic ailments create what is called a resource disaster. True, it is a mineral disaster, since these diseases and disasters are caused by other types of natural resources such as forests, clean water. Or no fertile land. Among the minerals, oil, which accounts for more than 90 percent of the world's mineral trade, poses the biggest problems for most countries. The resource disaster is the oil disaster. This study differs from previous studies both in terms of time period and countries under study. In this study we used the variables of democracy, size of government, inflation of trade freedom and volume of oil reserves to investigate the curse phenomenon of resources. We have used volumes instead of oil revenues, while most studies have examined the impact of oil revenues on economic growth. This choice allows us to obtain different results and the effect of these resources. On democracy and thus on economic growth. The countries studied in this study b The three income groups (high, middle and low income) are divided by the World Bank as follows: Table1. chosen countries period countries group 1960-2012 Australia, america, England, Denmark, Norway and canada High income 1960-2012 Colombia, Malaysia, iran, gabon, ecuador, algeria Middle income 1960-2012 Egypt, india, Indonesia, Syria Low income Source: global bank 4. Research pattern and method of estimation 4-1. Explain the pattern In this study, we used the model of Alumwa et al. (2003) as follows: LGDP = C (1)*LGDP (-1) + C (2)*LGOV + C (3)*LOIL + C (4)*DEM + C (5)*INF + C (6)*LOPE Where variables are defined in Table 2: Table2. Introducing variables and source of intel Source of intel Explanation Variable GDP logarithm at constant 2005 dollar prices LGDP OPEC(2013) & BP(2013) The logarithm of the volume of oil reserves in a thousand million barrels LOIL World Bank(2013) Logarithm of government size (costs) at constant 2005 dollars Democracy or People's Participation (Democracy includes numbers between negative 10 and positive 10, which also includes the numbers themselves). LGOV World Bank(2013) The logarithm of trade freedom is derived from the sum of exports and imports on GDP. LOPE World Bank(2013) Consumer Price Index World Bank(2013) Center of Global Polity George mason university(2013) DEM INF 2-4. The static test of variables Given that the long time period of this study, we examine their static using the Levine-Levine Chow Test (LLC). Since all variables are static, there is no need to perform a convergence test. Table 3. Low income Middle income High income Variable Static Prob. Static Prob. Static Prob. LGDP 3.2 0.0007 3.08 0.0010 6.0 0.0000 LGOV 18.86 0.0156 3.2 0.0007 7.89 0.0000 LOIL 3.53 0.0002 6.0 0.0003 5.3 0.0000 DEM 80.68 0.0000 12.11 0.0000 4.5 0.0000 INF 4.68 0.0000 3.2 0.0005 3.4 0.0002 LOPE 2.52 0.0058 6.0 0.0395 8.5 0.0000 RESID 3.82 0.0001 10.0 0.0000 11.06 0.0000 Source: Software Output 1-2-4. Generalized Torque Method (GMM) One of the suitable econometric methods for solving or reducing endogenous problem and correlation between variables is estimating the model using Generalized Moments (GMM). Kasley et al. (1996) (quoted by Nadiri & Mohammadi, 2011) for the first time The GMM approach used dynamic panel data to estimate economic growth models. According to Sachs (2003) (cited by Nadiri and Mohammadi 2011), per capita income should be determined using dynamic models. (2001) (cited by Nadiri and Mohammadi 2011), have elaborated on the use of this method in estimating growth models. The GMM method is a robust estimator that, unlike the maximum likelihood method, does not require accurate distortion statement distribution information. Fixed or random effects models, where the error term may be correlated with delay variables, can lead to inconsistent or biased estimators. When the dependent variable model appears to the right of the model, The OLS estimates will no longer be consistent. 2-2-4. Sagan test The compatibility of GMM estimators depends on the validity of the tools used. To test this, we use the statistics proposed by Arlando Bond, Blaemann and Bond, and Arnulo and Believe. This test, called asymptotes, validates the tools used. Oleaster. The Sargan test statistic, which has a distribution with degrees of freedom equal to the number of exceedingly specified constraints. Rejects the null hypothesis that the residuals are correlated with the instrumental variables. Based on the results of this test, the instrumental variables used in the model estimation are: They are valid (there is no relationship between the error components and the tools used). We present the results of the Sagan test in each model. Table4. Sagan test results Low income Medium income High income J-statistic Prob. J-static Prob. J-static Prob. 5.6 0.41 1.96 0.135 1.96 0.57 Another test is the autocorrelation of regression residuals. The lack of autocorrelation indicates that all delayed explanatory variables can be used as instrumental variables. The results of the autocorrelation analysis of the difference disordered sentences are presented in the following estimation of each model. Table5. Arlanduband test results Low income Medium income High income Explanation Prob. Prob. Prob. AR(1) 0.0003 0.0219 0.0032 AR(2) 0.7177 0.3386 0.9733 According to the results of Table 3, it can be stated that the order of autocorrelation between the disorder statements is first order, therefore, the Arlanduband method is an appropriate method to eliminate the fixed effects of the model. In other words, the degree of autocorrelation in the first-order difference equation of the disorder is first order, therefore, the model estimated with the first-order end-of-phase difference is an appropriate method for estimating the model and does not have a model bias. 5. Experimental data and results The results are presented in Tables 2, 3, and 4 for low-, medium- and highincome groups using the Generalized Momentum Method (GMM). Table6. Experimental data and results Model Estimation Results in Low-Income Countries Using the GMM Method Variable Low income countries LGDP(-1) R-squared 0.93 [51] (0.0000) -0.082 [3.82] (0.0002) 0.02 [1.68] (0.0838) 0.003 [5.78] (0.0000) 0.003 [2.80] (0.0056) 0.018 [3.62] (0.0004) 0.99 J-statistic 5.16 Prob J-statistic 0.415 LGOV LOIL DEM INF LOPE Table7. Experimental data and results Model Estimation Results in medium-Income Countries Using the GMM Method variable Medium income countries LGDP(-1) R-squared 1.01 [0.04] (0.0000) -0.01 [1.62] (0.0956) -0.004 [1.67] (0.0945) 0.0001 [1.48] (0.1374) 0.0006 [3.13] (0.0019) 0.0002 [0.040] (0.9680) 0.99 J-statistic 1.96 Prob J-statistic 0.135 LGOV LOIL DEM INF LOPE Table8. Experimental data and results Model Estimation Results in high-Income Countries Using the GMM Method variable high income countries LGDP(-1) R-squared 0.96 [62] (0.0000) 0.026 [1.75] (0.0799) 0.05 [2.94] (0.0035) 0.039 [5.6] (0.0001) -0.004 [3.98] (0.0001) 0.07 [3.55] (0.0005) 0.99 J-statistic 8.6 Prob J-statistic 0.572 LGOV LOIL DEM INF LOPE According to Tables 2, 3 and 4, the results for the low, medium and high income groups using the GMM method are as follows: LGOV: The government log (cost) logarithm of the constant price of US $ 2000 has a negative and significant effect on both middle and low income groups, but on high income countries has a positive and significant effect on economic growth. LOIL: The logarithm of oil reserves is thousands of barrels. The volume of oil reserves in the low income and high income groups has a positive and significant effect on economic growth, but in the middle income countries has a negative and significant effect on economic growth. DEM: It's democracy or people's participation. Democracy in high income group and low income group has positive and significant effect on economic growth and in middle income group has no significant effect on economic growth. INF: Consumer price index. Inflation also has a positive and significant effect in the low income group and has no significant effect in the middle income group. In the high income group, it does not have a negative effect on economic growth. LOPE: The logarithm of trade freedom is derived from the sum of exports and imports on GDP. Commercial freedom in all three income groups has a positive and significant effect on economic growth. 6-Conclusion Economic institutions are very important in the rapid economic growth because they shape the motivations of important economic actors in society. In particular, their impact is on physical and human investment, technology and production organization. The difference in economic institutions is the main reason for the differences in economic growth in countries. Economic institutions not only determine the potential for economic growth but also distribute resources in the future. It is assumed that the dominant economic entity is political power, which Determine the distribution of available resources. Democracy, despotism, or dictatorship - political institutions - can be described as an example of the political system. Political institutions have political power by law, but a group of individuals may, even if they do not have power through institutions, may They have real political power. They use any means, including the military, to impose their demands on society. This powerful group has great ability to exploit basic institutions by accessing the community's economic resources. Directly and indirectly to liberal democracy, non-liberal democracy, despotism or dictatorship Are divided. The worst consequences of the disaster are found in the Middle East, which holds more than half of the world's proven oil reserves. It is moving away from democracy, gender equality and economic reform after other parts of the world (Asthma Oglu, 2004). In this study, we examine the effect of oil reserves volume on economic growth in three income groups (high income, middle income and low income) for the period 1960-2012. GDP with a lag has a positive and significant effect on all three income groups. Therefore, with the increase in GDP this year, GDP will increase in the coming year. Government spending (government size) has a significant and negative effect on both middle and low income groups, but on high income countries it has a positive effect on economic growth (as shown in the tables for both middle and high income groups). The effect of government size on economic growth is significant with a 90% confidence interval). The size of government can have a positive or negative effect on economic growth. Clare et al. (1999) state that costs such as education and government development costs increase economic growth, but costs such as security and welfare costs do not affect economic growth. Barrow et al. (1999) and Gartney et al. (1998), as well as Barrow in 1989, indicate that large government impedes economic growth, or that Sala Martin (1997) showed a weak relationship between economic growth and government size. The volume of oil reserves in the low-income and highincome groups had a positive and significant effect on economic growth, but in middle-income countries, it had a negative effect on economic growth. We can honestly say that there is a curse of resources in the middle income group, with most countries relying on petroleum income and being mostly single-product. Countries with lower oil revenues are preventing them from addressing other sectors of the economy, leading to slower economic growth. Commercial freedom has a positive and significant effect on economic growth in all three income groups. It can be said that in the first group inflation is the engine of economic growth and without inflation there is no economic growth in these countries, but in the third group, high income, inflation decreases economic growth. There is a negative relationship with economic growth rates. Some also believe that inflation is associated with a positive economic growth rate. At higher threshold rates, the relationship between these two variables is negative (Soheili et al., 2012). Democracy has a positive and significant effect on economic growth in the high income and low income groups and has no significant effect on economic growth in the middle income group. In these countries, because of the size of the government, people's participation in economic activity is not very noticeable, so it does not have a significant effect on economic growth in these countries, but in the other two groups income will increase economic growth. References: Abounoori A., Mohammadi T., & Jahangard, F. (2013).The relationship between reserves of oil endowment and economic growth from the resource curse viewpoint: a case study of Iran and selected oil countries. European Journal of Scientific Research ISSN: Vol.106, No. 3. Acemoglu, D., Johnson, S., Robinson, J.A., & Yared, P., (2004), From education to democracy? American Economic Review, 98, 808-842. Akanni, O.P. (2007). Oil wealth and economic growth in oil exporting African countries (Vol. 170). Kenya, Nairobi: African Economic Research Consortium. Aşici, A.A. (2013). Economic growth and its impact on environment: A panel data analysis. Ecological indicators, 24, 324-333. Auty, R.M. (2001). Resource Abundance and Economic Development. Oxford University Press. Barro, R.J. (1991). Economic growth in a cross section of countries, Quarterly Journal of Economics, No 106, mayo. Barro, R.J. (1996). Democracy and Growth. Journal of economic growth, 1(1), 1-27. Birdsall, N., & Subramanian, A. (2004). Saving Iraq from its oil. Foreign Affairs, 83(4), 77-89. Boyce, J.R., & Emery, J.H. (2011). Is a negative correlation between resource abundance and growth sufficient evidence that there is a “resource curse”? Resources Policy, 36(1), 1-13. Brunnschweiler, C.N. (2006). Cursing the blessings? Natural resource abundance, institutions, and economic growth. Working Paper 06/51 May 2006. Bond, S.R., Hoeffler, A., & Temple, J.R. (2001). GMM estimation of empirical growth models. CEPR Discussion paper Series NO.3048. Clare, J., White, J., Edwards, H., & Van Loon, A. (2002). Curriculum, clinical education, recruitment, transition and retention in nursing. AUTC Phase One Final Report, Flinders University, Adelaide, Australia. Caselli, F., Esquivel, G., & Lefort, F. (1996). Reopening the convergence debate: a new look at cross-country growth empirics. Journal of economic growth, 1(3), 363-389. Gwartney, J.D., Lawson, R., & Holcombe, R. G. (1998). The size and functions of government and economic growth (pp. 1-32). Washington, DC: Joint Economic Committee. Ibrahim, I. (1985). Energy forecasting and energy data in the Arab countries. OPEC Review, 9(2), 125-140. James, A., & Aadland, D. (2011). The curse of natural resources: An empirical investigation of US counties. Resource and Energy Economics, 33(2), 440-453. Jensen, N., & Wantchekon, L. (2004). Resource wealth and political regimes in Africa. Comparative political studies, 37(7), 816-841. Lewis, A. (1989). Oil spill dispersant: efficacy and effects. International oil spill conference (IOSC) Proceeding, Washington, D.C. Starrifar Muhammad. T (1995). Income on Capital and Development, Allameh Tabataba'i University Press. Soheili, Kiomars; Diamond, Mojtaba & Safaei, Maryam (2012). Assessing the Impact of Expected Inflation, Liquidity Growth, Import Inflation, Production Gap, and Exchange Rate on Inflation Rate in Iran, Macroeconomic Journal, 13-39-60. Nadiri, Mohammad ؛Mohammadi, Timoz. (2011). Investigating the Impact of Institutional Structures on Economic Growth Using GMM Dynamic Panel Data, Economic Modeling, No. 15, 1-24.