NANYANG

TECHNOLO6ICAIUNIVERSITY

Nanyang Business SchooI

SKA

J1\Nffi-trS

THE ASIAN BUSINESS CASE CENTRE

5l$'*GAPfrftC

EATIGO: CONNECTING EMPTY DINING TABLES

WITH EMPTY STOMACHS

HBSP No.: NTU152

Ref No.: ABCC-2017-024

Date: 12 September 2017

Khoo Hong Meng and Kong Yoon Kee

A meeting with one prospective investor in Q3 2015 left Judy and Sid, two of the four co-founders of Eatigo,

feeling exhausted and a little ovenryhelmed. They were drained after staying up late for numerous nights

collating copious amounts of information and addressing issues raised by various investors.

As Judy stepped out of the car with Sid, they both knew that they had to have a serious discussion with the

other two co-founders, Michael and Pumin, about the future funding direction of Eatigo. They needed to

reach a decision quickly: a substantial amount of their own savings had been pumped into the venture,

which was on the verge of running out of cash. They planned to call Michael and Pumin the next day so

that they could decide on their next course of action. But before doing so, Judy and Sid themselves first

had to seriously consider their options...

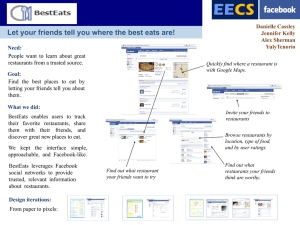

EATIGO: BACKGROUND INFORMATION

Headquartered in Bangkok, Eatigo is a restaurant reservation application (or "app" for short) founded in

2013 by Michael Cluzel, Judy Tan, Siddhanta Kothari and Pumin Yuvacharuskul. Eatigo offered an

alternative way of connecting diners to restaurants. Through its website, iPhone and Android applications,

Eatigo aimed to improve restaurants' profitability by filling up empty restaurant seats during off-peak hours,

by offering time-based discounts which could range from 1 0 to 50 percent (see Exhibit 1).

ln2O14, Eatigo was named one of the Top 8 Tech Influencers at Echelon Thailand. In 2015, Eatigo won

the Global Brain Award at the Tech in Asia Conference in Singapore, and placed second in the "Best

Startups in the Region" category. In less than four years, Eatigo had managed to shape diners' behaviour

and disrupt the modus operandi of the industry to become a leading restaurant reservation app with

presence in Singapore, Thailand, Malaysia, Hong Kong, India and the Philippines (see Exhibit 2).

Dr Khoo Hong Meng and Dr Kong Yoon Kee prepared this case based on interviews with

Eatigo Ihls case is intended

for c/ass discussion and learning, and not intended as source of research material or as illustration of effective or

m an agement

COPYRIGHT @ 2018 Nanyang Technological University, Singapore All rights reserved No part of this publication may

be copied, stored, transmitted, altered, reproduced or distributed in any form or medium whatsoever without the written

consent of Nanyang Technological University

The Asian Business Case Centre, Nanyang Business School, Nanyang Technological University, Nanyang Avenue,

Singapore 639798. Phone: +65-6790-4864/6552, E-mail: asiacasecentre@ntu edu sg

ineffective

Page 2

ABCC-2017424

Agani-.qs$r.fisfld

CNE

AsIn

THE

N BUSINESS

CENTRE

THE FOUNDING OF EATIGO

Eatigo was a multinational start-up from the very beginning. The founders were of diverse nationalities Michael was from France, Judy was from Singapore, Siddhanta was from India and Pumin was from

Thailand.

Michael, Siddhanta and Judy knew each other whilst they were colleagues working for Millicom International

Cellular SA, an international telecommunications and media company which marketed a wide range of

digital services through the Tigo brand to more than 63 million customers in fourteen markets in Africa and

Lalin America. The divestment of its Asia operation in 2011 led to Michael and Siddhanta heading the

regional office for the new owners. Later, they left this company to join another telecommunications MNC

based in the Caribbean.

Judy left Millicom following its divestment in Asia and started a second career as an adjunct lecturer in one

of the national universities in Singapore. The trio met up again after two years when Michael and Siddhanta

approached Judy with a compelling business idea which they could nurture and build based on their shared

vision, values and skills honed from years of working in MNCs. They also roped Pumin into the venture.

Pumin was a mutual friend of both Michael and Siddhanta and, at 29, was already a well-known

entrepreneur in Thailand with a successful water business which utilized nanotechnology. After a couple of

meetings and several rounds of heavy dinners in Bangkok, the business concept of Eatigo was crystallized

- a platform where empty dining tables meet empty stomachs.

THE BUSINESS IDEA

The idea of Eatigo was inspired by yield management practices in travel and hospitality. Time-based price

differentiation had been applied successfully for years in the airline and hotel industries. In this model of

differential pricing, lower prices are charged during periods of low demand while higher prices prevail during

peak periods. This differential pricing significantly reduces capacity under-utilization during lull periods and

helps even out demand patterns.

At the 1me of Eatigo's conception, the demand for restaurant services typically followed the shape of an Mcurve (see Exhibit 3). Most restaurants' businesses peaked during lunch and dinner, though seating

capacity remained very much constant throughout the day. During peak periods, popular restaurants would

experience long queues and might have to turn down customers who either did not want or could not afford

the time to wait. Outside peak periods, all restaurants had to manage the issue of excess capacity. Underutilized seats could range from 20 to 80 percent depending on the popularity of the restaurants. The empty

seats were effectively deadweight loss, they did not contribute positively to offsetting fixed costs like rental,

air-conditioning and utilities. And, the capacity utilization of restaurants was significantly lower than the

capacity utilization of mid 70-percent in airlines and hotels.

By 2015, the global dine-in market was estimated by Eatigo to be valued at around USD 2.1 trillion, with

only an average of 35 percent restaurant capacity utilization (see Exhibit 4). Application of effective yield

management practices could lead to a more even spread of diners over the day, resulting in fewer lost

business opportunities and increased capacity utilization, an improvement of '1 0 percent in utilization could

lead to USD 590 billion in extra revenue for the industry

The idea of offering time-based dining discounts was aimed at making restaurants more profitable by filling

othenruise empty tables during off-peak hours (see Exhibit 4). This could bring benefits to popular

restaurants too, as it could spread the peak-hour dining crowds over periods just before or just after peak

hours, thereby reducing queues and increasing total diners served. Diners could choose to dine at various

times in a restaurant and enjoy discounts which could range from 10 percent during peak hours to 50

percent during off-peak hours. The discount amount depended on the number of unfilled seats in a

soecific

,qsgA.{::"EHA:.cs

THF

ASIA\

BUS]NESS CASE CENTRT

restaurant. For example, one could enjoy a high 50 percent discount in a certain restaurant in the central

business district (CBD) area at 6pm during weekdays as the CBD often empties out after work hours. The

same restaurant may give a mere 10 percent discount during lunchtime on weekdays, as they would already

have good crowds during that time. Weekends were generally quiet for such restaurants, and as such,

prices could be reduced by 50 percent for weekend lunches. Restaurants in other areas had different

patterns. For example, in the heartlands, weekday dinners and weekends were generally peak periods with

weekday lunches being quieter and where restaurants would have empty tables to fill.

DYNAMICS OF THE DINING INDUSTRY

With restaurant capacity utilization at only 35 percent, the market for restaurant apps had much potential

to grow, and there might be room for a few major market players even in the near future. Initially their

concept was new and there were hardly any direct competitors. There were also typically no government

policies that barred entry into the restaurant reservation app business.

Mindful that their pioneering time-based discount bookings could be replicated later, Eatigo sought to

establish and entrench clear market leadership by carefully tailoring their marketing to both restaurants and

diners, with initial focus on Bangkok and Singapore. Establishing clear market leadership would mean that

new competitors would need deep pockets and extremely good connections to build up sutficient restaurant

partners and patron bases in a short time. Eatigo did not consider online food delivery platforms like

Foodpanda and UberEats as offering a substitute service, as they catered to the dine-in segment while

Eatigo focused on the dine-out segment. Similarly, social buying platforms would not offer a direct substitute

as Eatigo's high 50 percent off-peak discount evened out the M-curve effectively, while these other

platforms could not

Diners were a diverse group, and there was no single diner or group of diners which the dine-out industry

and Eatigo were dependent on. Users were not locked-in to using Eatigo's app and could vote with their

feet. Hence, Eatigo aimed to make its app very user-friendly and introduced many attractive features to

retain users such as simple terms and conditions for enjoying the discounts.

Similarly, restaurants, the industry suppliers' base, were very diversified by cuisine and location To attract

and retain restaurant partners, Eatigo's unique business model sought to improve their profitability by

sending diners to them during their off-peak hours, when they had underutilized capacity. Eatigo sought to

retain their restaurant partners' loyalty by ensuring that their profits were sustainable despite Eatigo's

discounts. Eatigo aims to be the go-to platform for off-peak reservations, by striving to attain and maintain

pole position as the leading off-peak reservation app

EATIGO'S DIFFERENCE

Conventional restaurant booking required calling the restaurant physically or making a reservation through

email or at the restaurant's own online portal. Restaurants were required to have available manpower and

an existing system to manage reservations done in this manner This may be a stretch on resources,

especially during busy periods lt may also be inconvenient for diners, who may wish to make or edit

reservations before or after the restaurants' opening times, and who would have to track their reservations

themselves.

Restaurant reservation platforms such as OpenTable and Chope offered diners and restaurants greater

convenience by allowing users to reserve seats at restaurants through online web portals or mobile apps.

Diners could make or change reseruations as they wish at any time, and were reminded of their reservations

by these portals through email and/or SMS, and thus did not have to manually make a note of them by

themselves. Such restaurant reservation platforms provided marketing services for restaurants as well as

Asa.r{{:fq.%ffi"cs

THE As]nN BUSINESS CNE CENTRE

an online platform to capture reservations, negating the need for restaurants to dedicate manpower and

have their own system for accepting and managing reservations. However, diners who made reservations

at restaurants via these platforms tended to follow regular dining times, which did not help restaurants solve

the problem of excess capacity in the form of unfilled tables during off-peak hours

Social buying platforms such as Groupon/Fave were promotional tools. They attempted to improve

restaurant patronage by giving discounts for a given period of time, with these discounts being fixed and

without any intra-day variation. These deals tended to exacerbate the intra-day peak period constraints

faced by restaurants. Another potential problem was that these sites collected payment upfront from their

customers upon online purchase of dining vouchers, and paid the restaurants after that. Hence, restaurants

were exposed to credit risk due to this time lag in receiving monies payable to them by these platforms.

Similar to the case of a conventional restaurant reservation system, they did not help with the problem of

excess capacity during the off-peak periods as most diners used the dining vouchers during peak hours.

Eatigo aimed to improve capacity utilization by bringing diners to restaurants when they needed them most.

Through a time-based discount system, Eatigo encouraged higher restaurant patronage during off-peak

hours. The idea was to make restaurants more profitable by filling othenarise empty tables during the offpeak. This could benefit popular restaurants too, as it could spread the peak-hour dining crowds over

periods just before or just after peak hours, thereby reducing queues and increasing total diners served.

SOLVING DINERS' PAIN POINTS

ln many parts of the world and especially in Asia, consumers are value conscious. They are motivated by

good deals such as discounts. Social buying platforms understood this well and worked towards customer

acquisition through offering discounts However, indiscriminate discounting harms the profitability of

restaurants, and as such, is not sustainable. Also, the deals are often accompanied with a number of terms

and conditions which may make it difficult for diners to enjoy their meals with total peace of mind, resulting

in frustration and sometimes disagreements with restaurant staff. As such, a number of popular restaurants

may not want to work with these platforms.

Eatigo's challenge was to find a way to bring to consumers what they want without hurting the profitability

of their restaurant partners. They designed a system to ensure that the best discounts were for diners who

patronized the restaurants at times that the specrfic restaurant would otherwise have empty tables.

Whilst consumers were value driven, not all looked for low prices. In addition to providing usage gains,

Eatigo had to solve diners' pain points. Eatigo's app and website helped diners to access and evaluate

discounts available in restaurants in their vicinity. The app and website were simple and easy to use, and

diners could book restaurants up to a maximum of 30 days in advance. There was no downloading of

coupons and pre-payment required Diners simply made a reservation via the app or website, obtained a

confirmation via the app or email, turned up at the restaurant at the expected time, and dined to their hearts'

content. The stipulated discount for that time period would automatically be applied to their bills after

showing the reservation confirmation to the restaurant staff.

To relieve diners' pain point of having to remember, examine and compare the terms and conditions under

which discounts offered by various restaurants would apply, such as payment methods (e.9., which credit

card to use), offer period, timing of the day, percentage discounts, minimum amount spent, and so on,

Eatigo decided to standardize its offerings to very simple rules: its discounts are applicable to all food items

on the menu with only drinks being excluded, its discounts cannot be combined with other discounts or

promotions, and discounts are time-based. With only these simple terms to remember, it became very easy

for diners to use Eatigo on a regular basis and they enjoy a minimum discount of 10 percent, with at least

two dining slots of 50 percent discount every day, as long as the restaurant was open. In addition, restaurant

menus could be easily obtained from the app with their pricing (before and after the time-specific

discounts,

AstAil..\'#Fi"€*

THE AsIAN BUSINESS CASE CENTRE

Page 5

ABCC-2017-024

saving consumers the hassle of making these calculations themselves). Cross-country bookings could be

made, and there were also halal-certified options offered.

Customers could leave feedback in the form of restaurant ratings and comments; potential customers could

view them to make a more informed decision, and restaurant managers could also take them into

consideration to improve their service. Live chats were made available during office hours, and links to

maps to locate participating restaurants were provided to maximlze convenience for diners.

GOING LIVE IN BANGKOK AND TEETHING PROBLEMS

ln June 2O14,the founders launched Eatigo in Bangkok. Bangkok had sufficiently high Internet and mobile

telephone penetration rates. In addition, its dine-out culture, openness to dining innovation, and diners'

willingness to make lifestyle changes for discounts were favourable factors. Besides, Eatigo's founders

were familiar with the Thai market and culture. They decided to use Bangkok instead of Singapore as a

testbed as Thai restaurants and diners were relatively more forgiving and any mistakes made would be

less costly due to the overall lower cost of doing business.

When Eatigo first entered the market, the F&B industry seemed conservative and hesitant to take up this

new idea. Industry players preferred the status quo, and to remain in control. And so, the enrolment of the

first 40 restaurants was difficult. Many could not understand the concept of using cloud-based technology

and algorithms to shape traffic. Most restaurants were hesitant and adopted a wait-and-see attitude. They

did not want to be the first to try out new products and services, and potentially the first to fail. Popular

restaurants felt that they did not have the capacity as they already had long, snaking queues of customers,

and Eatigo did not want to work with non-popular restaurants as they would not have the necessary

underlying economic elasticities necessary for effective yield management. Fine-dining restaurants were

concerned that the 50 percent discount might tarnish their image, and Eatigo had to convince them that

whilst cut throat promotions could tarnish their brand, yield management would not. The founders cited the

case of Singapore Airlines, a world-renowned international airline, which practises yield management by

having different prices on different days of the week but still maintains its premium branding.

Despite being cautious, many restaurants did not want to be left behind by the competition. When they

learned that others had gained significant sales volume increases of more than 15 percent by using Eatigo,

they began to sign up. Suki-Ya, Outback Steakhouse, Wine Connection, Coffee Club, and Manhattan Fish

Market were some of the better-known restaurant chains that came onboard Eatigo's panel of restaurants.

Eatigo also attracted a lot of hotels: they understood yield management easily, since they do that with room

capacities too - popular hotel restaurants such as Novotel, Swissotel, Hilton, Renaissance, Westin, The

Peninsula, Siam Kempinski, Grand Hyatt, and SO Sofitel joined the platform as well.

EATIGO'S REVENUE MODEL

The founders were mindful, even before the launch of the business, of the types of revenue models they

would not adopt at the outset. They decided against a subscription based revenue model which charged

companies a flat fee per month, as that restricted upsides for the company They also decided against

charging a one-off setup fee for restaurants since Eatigo was new and unknown to many restaurants, and

this might impede achieving a critical mass of restaurant partners to come onboard.

As such, the founders faced a chicken-and-egg situation. lf insufficient diners signed up for the Eatigo app

or website, restaurants would be less inclined to use it. On the other hand, a limited list of restaurants

available in Eatigo would deter diners from signing up. After much contemplation, they decided to prioritize

restaurants over diners. They believed that enrolling reputable and good restaurants was important, and

that diners could be persuaded by providing attractive deals.

l\s5A;l4sFCreE.c*p.4

THE AS]AN BUSINESS

CENTRE

Eatigo's revenue was mainly derived from charging restaurants a fixed fee for every successful referral.

Eatilo segmented restaurants into three tiers - low-end, mid-end and high-end restaurants. The fee

charleable for each restaurant tier increased accordingly from low to high. Eatigo would not charge for nosnows, and diners could download and use Eatigo's app for free. Eatigo used this simple transactional fee

model to encourage restaurants and diners to use its platform actively. The start-up funds for the business

came from the four founding partners. However, with Eatigo's rapid expansion, funding became increasingly

challenging.

THE DILEMMA: WHIGH FUNDING OPTION?

A series of meetings in Q3 2015 where Judy and Sid pitched to different investor groups left them drained.

Cash was running out soon, especially after the launch of Eatigo's app in Singapore in Feb 2015. They

explored the various options that were available to a small-medium enterprise operating in Singapore and

Bangkok, in preparation for their call to Michael and Pumin to decide on the next course of action. Debt in

the f-orm of small business loans were not readily available and rather prohibitive because Eatigo lacked a

track record and physical assets to pledge as collateral. Credit cards were plausible more for the shortterm, but the amounts they could obtain on credit would be too small for the company and interest rates

were just too high. They could try to buy some time by getting smaller amounts from friends and family or

even iry for one of the grants offered to start-ups in Singapore. They had found some information about the

requirements of these grants and needed to check if the company could fulfil these requirements. The grant

amounts were not likeiy to be sufficient for the aggressive business plan they were pursuing but it would

not involve too much being given away in terms of equity or control. lt would still make sense to obtain such

smaller interim funding to scale up and gain more traction, so that Eatigo could further boost its sales and

gain more market share. This would help to justify a higher valuation later, and the consequential dilution

would be less for the founders.

On the other hand, to obtain more immediate substantial funding, should they continue their discussion with

the various venture capital firms that they had met so far, and if so, how would they evaluate Eatigo? Other

than the provision of funds, it was clear that certain firms had connections and resources that would be

extremely helpful especially in the countries where they planned to launch next. However, it was also clear

that the venture capital companies had firm ideas on how the business should be scaled up, and this might

mean that the founders lose the ability to control the direction of the company. There were also a lot of

terms such as pre-money valuation, post-money valuation, parlicipating versus non-participating liquidity

oreference, anti-dilution, ratchet clauses and so on that were discussed - the implications of these would

need to be fully understood as it could have significant impact on the founders. Last but not least was the

question of valuation - how should they determine this and what data could they provide to support their

estimates? Initial numbers indicated by a couple of venture capital firms seemed too low and would mean

heavy dilution for the founders.

Eatigo had had a number of discussions with other investors such as family offices as well as strategic

investors in related spaces such as F&B consultancy, media, and technology development. These investors

seemed more than happy to continue to "let the founders run the show" but wanted to see strategic

cooperation in the areas where they operated. Would that limit options for the company, for instance, by

forcing Eatigo to work with only one media company? Also, they needed more time to conduct due diligence

processes, and funding from these investors would likely take more time to procure.

Eatigo had to decide whether it should seek smaller interim financing to buy time for higher valuation, or

seek a bigger funding quantum from venture capitalist immediately with the founders risking loss of control,

or source funds from family offices and/or strategic investors which involved longer processing time but

retained more control for its founders. Cash was burning up fast because of the huge pickup in expansion,

and the clock was ticking.

As[A

Page 7

f"q"sffi,.cstu{

ABCC-2017-024

THE ASIAN BUSINESS CASE CENTRE

EXHIBIT

1

EATIGO'S TIME-BASED DISCOUNT

Korean Fusion BBQ

@

DunloP

Food Capital G Grand

Coothorne Waterfroni Hotel

Escape

@

One Faner Hotel &

spa

nit?

Swensen's

Suki-Ya@112Katong

@

ION Orchard

Crystal Jade Kitchen G Great

World City

*1''

Source: Eatigo (n.d.) Eatigo Singapore. Retrieved from https://eatigo com/home/sg/en/singapore/

Ptg 1zjf \

.

t!,

Page

r:',lis=""CsM

AslA.{'

BUSINLSS CASE

I

TH E ASI^ N

ABCC-2017424

EXHIBIT 2

EATIGO, A LEADING RESTAURANT RESERVATION APP

@trip;rtJvi:;r.:r

n*f . off p*ak

reservetion platform

for restaurants. n *n

Singap,:re, Th*i1*nrl,

N{alaysl*" Hot"lg Kon g^

lnciia artd Philippir:es

Source: Eatigo

CF

N

.

RL

Page 9

ASLE Affiffi,CSM

ABCC-2017-O24

THE ASIAN BUSINESS CASE CENl RL

EXHIBIT 3

TyPtcAL DEMAND VARIABILITY lN THE RESTAURANT BUSINESS (M-CURVE)

W

,(?li

il:il{:

i\,s"4

';"?t':

1.;i/J

l:{Ri

:\,

91"4

iil;i

PM

1-ir:ll

Source: Dealici (n.d

)

t::ri..Ei

i]fl

i{r,l.'(:'t'llt

Restauranls Retrieved from www dealtci com

ffi

; t.lal

'1,1

l:}""'ir-

:r'i.".:

r,:,,,1

$:r}] tllrilil 1l-:l-1(i

i:'i...** f)fo,{ fr,!1

As$A#,q.'&'#"."*"*?&

CNE CENIRE

THE AS]AN BUSINESS

EXHIBIT 4

SMOOTHENING THE M.CURVE

Capacity utilisation of restaurants LHSS TI{AN half of those of airlines or hotels

*

seals are under utillsed durlng off peak hours

t

potentialto increase revenue by filling those seats

Eatigo shapes diner's traffic with 90% of its diners eating at off-peak hours, increasing restaurant profit and

capacity utilization.

Source: Eatigo