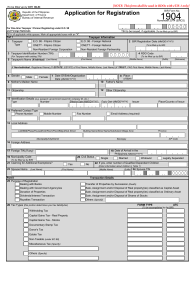

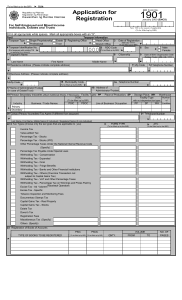

For BIR Use Only: Republic of the Philippines Department of Finance Bureau of Internal Revenue BCS/ Item: BIR Form No. VGS&Co. Donor’s Tax Return 1800 January 2018 (ENCS) Page 1 1 Date of Donation (MM/DD/YY) Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an “X”. Two copies MUST be filed with the BIR and one held by the taxpayer. 0 1 1 4 2 0 2 Amended Return? x Yes No 1800 01/18ENCS P1 3 No. of Sheet/s Attached 4 Alphanumeric Tax Code (ATC) 0 0 DN 010 Part I – Taxpayer Information 5 Donor’s Taxpayer Identification Number (TIN) 0 0 9 - 1 1 2 - 0 6 7 - 0 0 0 0 0 6 RDO Code 0 8 0 7 Donor’s Name (Last Name, First Name, Middle Name for Individuals ORRegistered Namefor Non-Individuals) S A N T O S B A R T O L O M E G O M E Z ndicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) 8 Registered Address B A R A N G A Y P U S O K L A P U - L A P U C I T Y 8A ZIP Code 6 0 1 5 9A ZIP Code 5 9 Residence Address (Indicate complete address) B A R A N G A Y P U S O K 10 Contact Number 2 5 6 - 8 1 L A P U - L A P U C I 6 0 1 11 Email Address b a r 2 0 t s a n t o s @ g m a i Donee’s Name (Attach additional sheet/s, if necessary) 12 T Y (Last Name, First Name, Middle Namefor Individuals OR Registered Namefor Non-Individuals) A RODRIGUEZ, BIENVENIDO CAMACHO B C D E 13 Are you availing of tax relief under a Special Law/International Tax Treaty? l . c o m Donee’s Taxpayer Identification Number 009-456-789-000 Yes x 13A If yes, No specify Part II – Computation of Tax 14 Total Net Gifts Subject to Tax (From Part IV Item 38) 1 1 7 16 Total Donor’s Tax Due (Item 14 x Item 15) . 0 0 6 . 0% . 0 0 0 5 0 0 15 Applicable Donors Tax Rate 7 0 5 17 Less: Tax Credit Payments 17A Payments for Prior Gifts During the Calendar Year 17B Foreign Donor’s Tax Paid (Subject to limitation under Section 101 of the NIRC) 17C Tax Paid in Previously Filed Return, if this is an Amended Return 17D Total Tax Credits/Payments (Sum of Items 17A to 17C) 18 Tax Payable/(Overpayment) (Item 16 Less Item 17D) 7 0 5 0 . . . . . 0 0 . . . . . 0 0 19 Add: Penalties 19A Surcharge 19B Interest 19C Compromise 19D Total Penalties (Sum of Items 19A to 19C) 20 TOTAL AMOUNT PAYABLE/(Overpayment) (Sum of Items 18 and 19D) 7 0 5 0 In case of overpayment, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds) I/We declare under the penalties of perjury that this return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach Special Power of Attorney) For Individual: For Non-Individual: Engr. Bartolome Gomez Santos 009-112-067-000 Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent (Indicate title/designation and TIN) Tax Agent Accreditation No. / Attorney’s Roll No. (If applicable) Signature over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent (Indicate title/designation and TIN) Date of Issue (MM/DD/YYYY) Date of Expiry (MM/DD/YYYY) Part III – Details of Payment Details of Payment Drawee Bank/ Agency Number 21 Cash/Bank Debit Memo 22 Check 23 Tax Debit Memo Date (MM/DD/YYYY) Amount 0 1 1 4 2 0 2 0 7 0 5 0 . . . 0 24 Others (Specify below) . Machine Validation *NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph) Stamp of Authorized Agent Bank and Date of Receipt (Bank Teller’s Initial) 0 Donor’s Tax Return BIR Form No. 1800 January 2018 (ENCS) Page 2 1800 01/18ENCS P2 TIN 0 Donor’s Name 0 9 1 1 2 0 6 7 0 0 0 0 0 S A N T O S , B A R T O L O M E G . Part IV – Computation of Tax 25 Personal Properties (From Part V Schedule A) 26 Real Properties (From Part V Schedule B) 27 Total Gifts in this Return (Sum of Items 25 and 26) 6 7 5 0 0 0 6 7 5 0 0 0 . . . 0 0 0 0 Less: Deductions 28 U N P A I D . 0 0 . . . . 3 0 7 5 0 0 . 0 0 3 6 7 5 0 0 . 0 0 . 3 6 7 5 0 0 . 0 0 2 5 0 0 0 0 . 0 0 1 1 7 5 0 0 . 0 0 M O R T G A G E 3 0 7 5 0 0 29 30 31 32 33 Total Deductions Allowed (Sum of Items 28 to 32) 34 Total Net Gifts in this Return (Items 27 Less Item 33) 35 Add: Total Prior Net Gifts During the Calendar Year (Item 36 of Return Previously Filed within the year) 36 Total Net Gifts (Sum of Items 34 and 35) 37 Less: Exempt Gift 38 Total Net Gifts Subject to Tax (Item 36 Less Item 37) Part V – Schedules Schedule A – Description of Donated Personal Property (Attach additional sheet/s, if necessary) PARTICULARS FAIR MARKET VALUE 1 2 3 4 5 6 7 8 9 10 TOTAL (To Part IV Item 25) Schedule B – Description of Donated Real Property (Attach additional sheet/s, if necessary) OCT/TCT/CCT NO. 1 2 3 4 5 6 7 8 9 10 LOCATION TAX DECLARATION NO. (TD) 56712 LOT/IMPROVEMENT *CLASSIFICATION RR BANILAD, CEBU CITY Schedule B – Continuation of the Description of Donated Real Property AREA 1 2 3 4 5 6 7 8 9 10 FAIR MARKET VALUE (FMV) PER TD 100 sq. m. FAIR MARKET VALUE FMV PER BIR (ZONAL VALUE) 1, 350, 000. 00 (whichever is higher) 1, 200, 000. 00 1, 350, 000.00/2 TOTAL (To Part IV Item 26) * RR-Residential Regular 675, 000.00 CR-Condominium Regular CL-Cemetery Lot GL-Government Lot RC-Residential Condominium CC-Commercial Condominium PS-Parking Slot A-Agricultural X-Institutional GP-General Purpose I-Industrial APD-Area for Priority Development For BIR Use Only: Republic of the Philippines Department of Finance Bureau of Internal Revenue BCS/ Item: BIR Form No. Donor’s Tax Return 1800 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an “X”. Two copies MUST be filed with the BIR and one held by the taxpayer. January 2018 (ENCS) Page 1 1 Date of Donation (MM/DD/YY) 0 1 1 4 2 0 2 Amended Return? x Yes No 1800 01/18ENCS P1 3 No. of Sheet/s Attached 00 4 Alphanumeric Tax Code (ATC) DN 010 6 RDO Code 0 8 0 Part I – Taxpayer Information 5 Donor’s Taxpayer Identification Number (TIN) 4 5 1 - 3 2 2 - 6 2 6 - 0 0 0 0 0 7 Donor’s Name (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals) S A N T O S M A R G A R I T A Y N E Z 8 Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) B A R A N G A Y P U S O K L A P U - L C I A P U T Y 8A ZIP Code 6 0 1 5 9A ZIP Code 5 9 Residence Address (Indicate complete address) B A R A N G A Y P U S O K L A P U - L 12 C I T Y 6 0 1 11 Email Address 10 Contact Number 2 5 6 - 8 1 A P U m a r 2 0 g a s a n t o s 1 7 @ g m a i Donee’s Name (Attach additional sheet/s, if necessary) Special Law/International Tax Treaty? . c o m Donee’s Taxpayer Identification Number (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals) A RODRIGUEZ, BIENVENIDO CAMACHO B C D E 13 Are you availing of tax relief under a l 123-456-789-000 Yes x No 13A If yes, specify Part II – Computation of Tax 14 Total Net Gifts Subject to Tax (From Part IV Item 38) 1 1 7 5 7 0 15 Applicable Donors Tax Rate 16 Total Donor’s Tax Due (Item 14 x Item 15) . 0 0 6 . 0% 5 0 . 0 0 0 0 17 Less: Tax Credit Payments 5 0 . . . . . 0 0 5 0 . . . . . 0 0 17A Payments for Prior Gifts During the Calendar Year 17B Foreign Donor’s Tax Paid (Subject to limitation under Section 101 of the NIRC) 17C Tax Paid in Previously Filed Return, if this is an Amended Return 17D Total Tax Credits/Payments (Sum of Items 17A to 17C) 18 Tax Payable/(Overpayment) (Item 16 Less Item 17D) 7 0 19 Add: Penalties 19A Surcharge 19B Interest 19C Compromise 19D Total Penalties (Sum of Items 19A to 19C) 20 TOTAL AMOUNT PAYABLE/(Overpayment) (Sum of Items 18 and 19D) 7 0 In case of overpayment, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds) I/We declare under the penalties of perjury that this return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach Special Power of Attorney) For Individual: For Non-Individual: Dr. Margarita Ynez Santos 451-322-626-000 Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent Signature over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent (Indicate title/designation and TIN) (Indicate title/designationand TIN) Tax Agent Accreditation No. / Date of Issue Date of Expiry Attorney’s Roll No. (If applicable) (MM/DD/YYYY) (MM/DD/YYYY) Part III – Details of Payment Details of Payment Drawee Bank/ Agency Number 21 Cash/Bank Debit Memo 22 Check 23 Tax Debit Memo Date (MM/DD/YYYY) 0 1 1 4 2 0 2 0 Amount 7 0 5 0 . . . 0 0 24 Others (Specify below) . Machine Validation *NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph) Stamp of Authorized Agent Bank and Date of Receipt (Bank Teller’s Initial) Donor’s Tax Return BIR Form No. 1800 January 2018 (ENCS) Page 2 1800 01/18ENCS P2 TIN Donor’s Name 4 5 1 3 2 2 6 2 6 0 0 0 0 0 S A N T O S M A R G A R I T A Y N E Z Part IV – Computation of Tax 25 Personal Properties (From Part V Schedule A) 26 Real Properties (From Part V Schedule B) 6 7 5 0 0 0 27 Total Gifts in this Return (Sum of Items 25 and 26) 6 7 5 0 0 0 . . . 0 0 0 0 Less: Deductions 28 U N P A I D M O R T G A G E . 0 . . . . 3 0 7 5 0 0 . 0 3 6 7 5 0 0 . 0 . 3 6 7 5 0 0 . 0 250000.00 1 1 7 5 0 0 . 0 3 0 7 5 0 0 29 30 31 32 33 Total Deductions Allowed (Sum of Items 28 to 32) 34 Total Net Gifts in this Return (Items 27 Less Item 33) 35 Add: Total Prior Net Gifts During the Calendar Year (Item 36 of Return Previously Filed within the year) 36 Total Net Gifts (Sum of Items 34 and 35) 37 Less: Exempt Gift 38 Total Net Gifts Subject to Tax (Item 36 Less Item 37) 0 0 0 0 0 Part V – Schedules Schedule A – Description of Donated Personal Property (Attach additional sheet/s, if necessary) PARTICULARS FAIR MARKET VALUE 1 2 3 4 5 6 7 8 9 10 TOTAL (To Part IV Item 25) Schedule B – Description of Donated Real Property (Attach additional sheet/s, if necessary) OCT/TCT/CCT NO. 1 2 3 4 5 6 7 8 9 10 LOCATION TAX DECLARATION NO. (TD) 56712 LOT/IMPROVEMENT *CLASSIFICATION RR BANILAD, CEBU CITY Schedule B – Continuation of the Description of Donated Real Property AREA 1 2 3 4 5 6 7 8 9 10 FAIR MARKET VALUE (FMV) PER TD 100 sq. m. 1, 350 ,000.00 TOTAL (To Part IV Item 26) * RR-Residential Regular CR-Condominium Regular RC-Residential Condominium CC-Commercial Condominium FMV PER BIR (ZONAL VALUE) 1, 200, 000.00 FAIR MARKET VALUE (whichever is higher) 1, 350, 000.00/2 675,000.00 CL-Cemetery Lot GL-Government Lot A-Agricultural X-Institutional PS-Parking Slot GP-General Purpose I-Industrial APD-Area for Priority Development For BIR Use Only: Republic of the Philippines Department of Finance Bureau of Internal Revenue BCS/ Item: BIR Form No. Donor’s Tax Return 1800 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an “X”. Two copies MUST be filed with the BIR and one held by the taxpayer. January 2018 (ENCS) Page 1 1 Date of Donation (MM/DD/YY) 0 6 2 1 2 0 2 Amended Return? x Yes 1800 01/18ENCS P1 3 No. of Sheet/s Attached No 0 0 4 Alphanumeric Tax Code (ATC) DN 010 6 RDO Code 0 8 0 Part I – Taxpayer Information 5 Donor’s Taxpayer Identification Number (TIN) 0 0 9 - 1 1 2 - 0 6 7 - 0 0 0 0 0 7 Donor’s Name (Last Name, First Name, Middle Name for Individuals ORRegistered Namefor Non-Individuals) S A N T O S B A R T O L O M E G O M E Z 8 Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) B A R A N G A Y P U S O K L A P U - L A P U C I T Y 8A ZIP Code 6 0 1 5 9A ZIP Code 5 9 Residence Address (Indicate complete address) B A R A N G A Y P U S O K L A P U - L 10 Contact Number 2 5 6 A P U C I 6 0 1 11 Email Address - 8 1 2 0 b a r t s a n t o s @ g m a i Donee’s Name (Attach additional sheet/s, if necessary) 12 T Y Special Law/International Tax Treaty? . c o m Donee’s Taxpayer Identification Number (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals) A SANTOS, BART ANDREW YNEZ B C D E 13 Are you availing of tax relief under a l 967-400-220-000 Yes x 13A If yes, No specify Part II – Computation of Tax 14 Total Net Gifts Subject to Tax (From Part IV Item 38) 6 16 Total Donor’s Tax Due (Item 14 x Item 15) . 0 0 6 . 0% 0 . 0 0 1 7 5 0 0 3 7 0 5 7 0 5 0 7 0 5 0 0 0 0 0 . . . . . 0 . . . . . 15 Applicable Donors Tax Rate 17 Less: Tax Credit Payments 17A Payments for Prior Gifts During the Calendar Year 17B Foreign Donor’s Tax Paid (Subject to limitation under Section 101 of the NIRC) 17C Tax Paid in Previously Filed Return, if this is an Amended Return 17D Total Tax Credits/Payments (Sum of Items 17A to 17C) 18 Tax Payable/(Overpayment) (Item 16 Less Item 17D) 3 0 0 0 0 0 0 19 Add: Penalties 19A Surcharge 19B Interest 19C Compromise 19D Total Penalties (Sum of Items 19A to 19C) 20 TOTAL AMOUNT PAYABLE/(Overpayment) (Sum of Items 18 and 19D) 3 0 0 0 0 0 In case of overpayment, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds) I/We declare under the penalties of perjury that this return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach Special Power of Attorney) For Individual: For Non-Individual: Engr. Bartolome Gomez Santos 009-112-067-000 Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent (Indicate title/designation and TIN) Tax Agent Accreditation No. / Attorney’s Roll No. (If applicable) Signature over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent (Indicate title/designation and TIN) Date of Issue (MM/DD/YYYY) Date of Expiry (MM/DD/YYYY) Part III – Details of Payment Details of Payment Drawee Bank/ Agency Number 21 Cash/Bank Debit Memo 22 Check 23 Tax Debit Memo Date (MM/DD/YYYY) 0 6 2 1 2 0 2 0 Amount 3 0 0 0 0 . . . 0 24 Others (Specify below) . Machine Validation *NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph) Stamp of Authorized Agent Bank and Date of Receipt (Bank Teller’s Initial) 0 Donor’s Tax Return BIR Form No. 1800 January 2018 (ENCS) Page 2 1800 01/18ENCS P2 TIN 0 0 Donor’s Name 9 1 1 2 0 6 7 0 0 0 0 0 S A N T O S B A R T O L O M E G . Part IV – Computation of Tax 25 Personal Properties (From Part V Schedule A) 5 0 0 0 0 0 5 0 0 0 0 0 26 Real Properties (From Part V Schedule B) 27 Total Gifts in this Return (Sum of Items 25 and 26) . . . 0 0 0 0 Less: Deductions 28 29 30 31 32 33 Total Deductions Allowed (Sum of Items 28 to 32) 34 Total Net Gifts in this Return (Items 27 Less Item 33) 35 Add: Total Prior Net Gifts During the Calendar Year (Item 36 of Return Previously Filed within the year) 36 Total Net Gifts (Sum of Items 34 and 35) 37 Less: Exempt Gift 38 Total Net Gifts Subject to Tax (Item 36 Less Item 37) . . . . . . 5 0 0 0 0 0 . 0 0 3 6 7 5 0 0 . 0 0 8 6 7 5 0 0 . 0 0 2 5 0 0 0 0 . 0 0 6 1 7 5 0 0 . 0 0 Part V – Schedules Schedule A – Description of Donated Personal Property (Attach additional sheet/s, if necessary) PARTICULARS 1 2 3 4 5 6 7 8 9 10 FAIR MARKET VALUE BRAND NEW SUZUKI MOTORCYCLE 500, 000.00 TOTAL (To Part IV Item 25) 500, 000.00 Schedule B – Description of Donated Real Property (Attach additional sheet/s, if necessary) OCT/TCT/CCT NO. LOCATION TAX DECLARATION NO. (TD) LOT/IMPROVEMENT *CLASSIFICATION 1 2 3 4 5 6 7 8 9 10 Schedule B – Continuation of the Description of Donated Real Property AREA FAIR MARKET VALUE (FMV) PER TD FMV PER BIR (ZONAL VALUE) FAIR MARKET VALUE (whichever is higher) 1 2 3 4 5 6 7 8 9 10 TOTAL (To Part IV Item 26) * RR-Residential Regular CR-Condominium Regular RC-Residential Condominium CC-Commercial Condominium CL-Cemetery Lot GL-Government Lot A-Agricultural X-Institutional PS-Parking Slot GP-General Purpose I-Industrial APD-Area for Priority Development For BIR Use Only: Republic of the Philippines Department of Finance Bureau of Internal Revenue BCS/ Item: BIR Form No. Donor’s Tax Return 1800 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark applicable boxes with an “X”. Two copies MUST be filed with the BIR and one held by the taxpayer. January 2018 (ENCS) Page 1 1 Date of Donation (MM/DD/YY) 0 9 1 4 2 0 2 Amended Return? x Yes No 1800 01/18ENCS P1 3 No. of Sheet/s Attached 0 0 4 Alphanumeric Tax Code (ATC) DN 010 6 RDO Code 0 8 0 Part I – Taxpayer Information TIN) 5 Donor’s Taxpayer Identification Number 4 5 1 - 3 2 2 - 6 2 6 - 0 0 0 0 0 7 Donor’s Name (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals) S A N T O S M A R G A R I T A Y N E Z 8 Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905) B A R A N G A Y L A P U - L P U S O K A P U C I T Y 8A ZIP Code 6 0 1 5 9A ZIP Code 5 9 Residence Address (Indicate complete address) B A R A N G A Y P U S O K L A P U - L 10 Contact Number 2 5 6 - 8 1 C I T Y 6 0 1 11 Email Address 2 0 m a r g a Donee’s Name (Attach additional sheet/s, if necessary) 12 A P U s a n t o s 1 7 @ g m a i (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individuals) A SANTOS, BRIENNE YNEZ B C D E 13 Are you availing of tax relief under a Special Law/International Tax Treaty? l . c o m Donee’s Taxpayer Identification Number 455-123-123-000 Yes x 13A If yes, No specify Part II – Computation of Tax 14 Total Net Gifts Subject to Tax (From Part IV Item 38) 7 4 2 16 Total Donor’s Tax Due (Item 14 x Item 15) . 0 0 6 . 0% 0 . 0 0 5 0 0 15 Applicable Donors Tax Rate 4 4 5 5 17 Less: Tax Credit Payments 17A Payments for Prior Gifts During the Calendar Year 7 0 5 0 7 0 5 0 7 5 0 0 . . . . . 5 0 0 . . . . . 17B Foreign Donor’s Tax Paid (Subject to limitation under Section 101 of the NIRC) 17C Tax Paid in Previously Filed Return, if this is an Amended Return 17D Total Tax Credits/Payments (Sum of Items 17A to 17C) 18 Tax Payable/(Overpayment) (Item 16 Less Item 17D) 3 0 0 0 0 0 0 19 Add: Penalties 19A Surcharge 19B Interest 19C Compromise 19D Total Penalties (Sum of Items 19A to 19C) 20 TOTAL AMOUNT PAYABLE/(Overpayment) (Sum of Items 18 and 19D) 3 7 0 0 In case of overpayment, apply for tax refund using BIR Form No. 1914 (Application for Tax Credits / Refunds) I/We declare under the penalties of perjury that this return, and all its attachments, have been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach Special Power of Attorney) For Individual: For Non-Individual: Dr. Margarita Ynez Santos 451-322-626-000 Signature over Printed Name of Taxpayer/Authorized Representative/Tax Agent (Indicate title/designation and TIN) Tax Agent Accreditation No. / Attorney’s Roll No. (If applicable) Signature over Printed Name of President/Vice President/Authorized Officer or Representative/Tax Agent (Indicate title/designation and TIN) Date of Issue (MM/DD/YYYY) Date of Expiry (MM/DD/YYYY) Part III – Details of Payment Details of Payment Drawee Bank/ Agency Number 21 Cash/Bank Debit Memo 22 Check 23 Tax Debit Memo Date (MM/DD/YYYY) 0 9 1 4 2 0 2 0 Amount 3 7 5 0 0 . . . 0 24 Others (Specify below) . Machine Validation *NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph) Stamp of Authorized Agent Bank and Date of Receipt (Bank Teller’s Initial) 0 Donor’s Tax Return BIR Form No. 1800 January 2018 (ENCS) Page 2 1800 01/18ENCS P2 TIN Donor’s Name 4 5 1 3 2 2 6 2 6 0 0 0 0 0 S A N T O S , M A R G A R I T A Y . Part IV – Computation of Tax 25 Personal Properties (From Part V Schedule A) 6 2 5 0 0 0 26 Real Properties (From Part V Schedule B) 27 Total Gifts in this Return (Sum of Items 25 and 26) 6 2 5 0 0 0 . . . 0 0 0 0 Less: Deductions 28 29 30 31 32 33 Total Deductions Allowed (Sum of Items 28 to 32) 34 Total Net Gifts in this Return (Items 27 Less Item 33) 35 Add: Total Prior Net Gifts During the Calendar Year (Item 36 of Return Previously Filed within the year) 36 Total Net Gifts (Sum of Items 34 and 35) 37 Less: Exempt Gift 38 Total Net Gifts Subject to Tax (Item 36 Less Item 37) . . . . . . 6 2 5 0 0 0 . 0 0 3 6 7 5 0 0 . 0 0 9 9 2 5 0 0 . 0 0 250000.00 7 4 2 5 0 0 . 0 0 Part V – Schedules Schedule A – Description of Donated Personal Property (Attach additional sheet/s, if necessary) 1 2 3 4 5 6 7 8 9 10 PARTICULARS UNLISTED ORDINARY SHARES- DELA VEGA DISTILLERIES, INC FAIR MARKET VALUE 625, 000.00 TOTAL (To Part IV Item 25) 625, 000.00 Schedule B – Description of Donated Real Property (Attach additional sheet/s, if necessary) OCT/TCT/CCT NO. LOCATION TAX DECLARATION NO. (TD) LOT/IMPROVEMENT *CLASSIFICATION 1 2 3 4 5 6 7 8 9 10 Schedule B – Continuation of the Description of Donated Real Property AREA FAIR MARKET VALUE (FMV) PER TD FMV PER BIR (ZONAL VALUE) FAIR MARKET VALUE (whichever is higher) 1 2 3 4 5 6 7 8 9 10 TOTAL (To Part IV Item 26) * RR-Residential Regular CR-Condominium Regular RC-Residential Condominium CC-Commercial Condominium CL-Cemetery Lot GL-Government Lot A-Agricultural X-Institutional PS-Parking Slot GP-General Purpose I-Industrial APD-Area for Priority Development