Aircraft Cost Estimation Error Risk Analysis Thesis

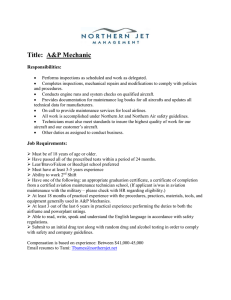

advertisement