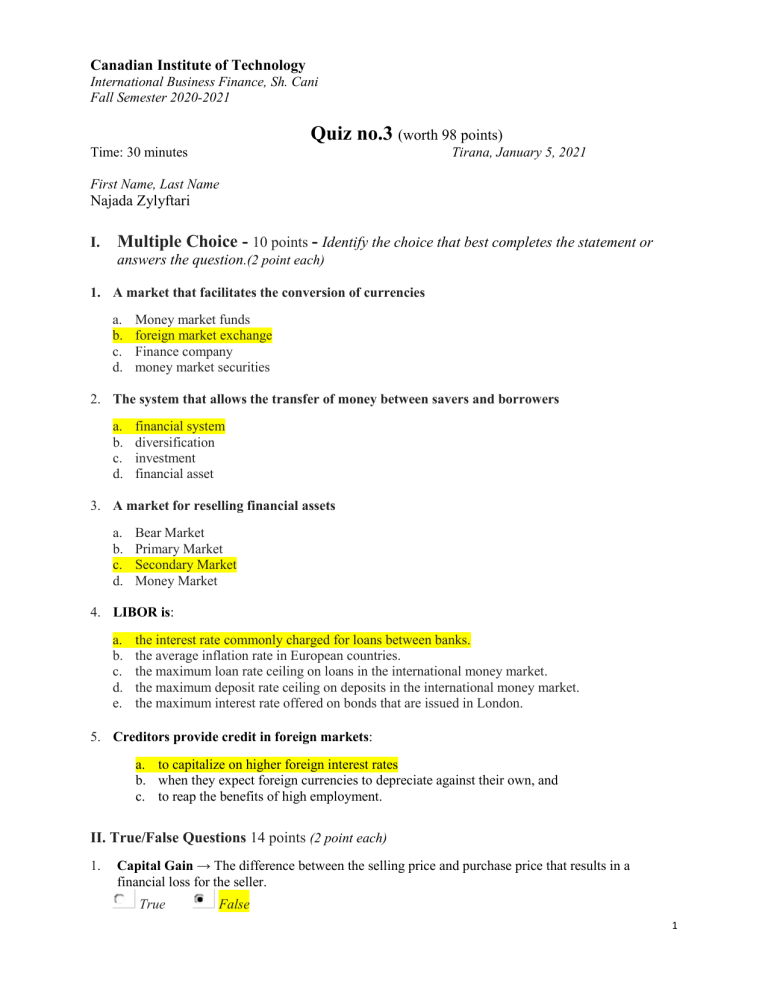

Canadian Institute of Technology International Business Finance, Sh. Cani Fall Semester 2020-2021 Quiz no.3 (worth 98 points) Time: 30 minutes Tirana, January 5, 2021 First Name, Last Name Najada Zylyftari I. Multiple Choice - 10 points - Identify the choice that best completes the statement or answers the question.(2 point each) 1. A market that facilitates the conversion of currencies a. b. c. d. Money market funds foreign market exchange Finance company money market securities 2. The system that allows the transfer of money between savers and borrowers a. b. c. d. financial system diversification investment financial asset 3. A market for reselling financial assets a. b. c. d. Bear Market Primary Market Secondary Market Money Market 4. LIBOR is: a. b. c. d. e. the interest rate commonly charged for loans between banks. the average inflation rate in European countries. the maximum loan rate ceiling on loans in the international money market. the maximum deposit rate ceiling on deposits in the international money market. the maximum interest rate offered on bonds that are issued in London. 5. Creditors provide credit in foreign markets: a. to capitalize on higher foreign interest rates b. when they expect foreign currencies to depreciate against their own, and c. to reap the benefits of high employment. II. True/False Questions 14 points (2 point each) 1. Capital Gain → The difference between the selling price and purchase price that results in a financial loss for the seller. True False 1 2. Financial Intermediary → An institution that helps channel funds from savers to borrowers. True 3. False Distinction between direct and indirect finance is: → Who owns the underlying asset? True 4. Euro money market → dollar deposits in banks in Europe and other continents called Eurodollars or Eurocurrency True 5. False The largest stock exchange in the world → London’s Stock Exchange True 7. False What is a foreign exchange indirect quotation for the U.S.? → The number of units of a foreign currency per dollar. 1/direct quotation True 6. False False Treasury bills → represent government short-term borrowing in the money market True False III. Short Answer Question 50 points (6 points each) 1. Why the international financial system does exist? The financial market exists because it allows a broader exchange of contracts and financial instruments. And it is designed in that form that it gives every investor the opportunity to be part of it. 2. Which are three main functions of a Financial System? Financial markets allow the flow of fund between savers and borrowers. So it makes it possible for funds to go from people who save them to people or investors who need them. It allows a diversity for its investors because there are so many financial instruments that you can choose the level of return, the risk you want to overtake and other aspects related to an investement. 3. What is Indirect Finance? Indirect finance is when a business borrows money but with an intermediary and not directly from its investors. For example when a bank finds money for a business and gets an interest for that service. 4. What is LIBOR? LIBOR is a benchmark interest rate that serves for banks that indicated the cost of borrowing between banks, for the short term loans. 2 5. Which are five Advantages of indirect financial flow markets? The economies of scale allow investors to profit from the volume of the business, and reap operational and financial benefits. Indirect financial markets offer a variety of financial instruments from which the investors can choose, and these instruments can also be different from the interest rates that they offer, their maturity, liquidity of even the risk which the investors face. 6. Which kind of stocks is called “Yankee stock offerings”? Yankee stock offering are bonds which are issued from a foreign bank but in the us and in us dollars. So basically the bonds is traded in the US but is issued in a foreign country. 7. Which kind of bonds is called Eurobonds? A Eurobond is a financial instrument (debt instrument) which is issued in different currency from that of the home country where it is actually issued. These bonds are usually issued by the European government and companies to raise funds in a foreign country. 8. Why interest rates are crucial for MNC’s? When there is a change in the interest rates it means that there will be changes in the cost of financing. Since MNC borrow money for investing in their operations this means that the cost of financing these operations will change, if there will be fluctuations. 9. Why borrowers borrow in foreign markets? To create profits from the lower foreign interest rates or to profit when they think that the foreign currency to depreciate in value against their home currency. 10. Why creditors provide credit in foreign markets? To capitalize or to create profit from the movements of the exchange rates in foregin markets, because they expects that the foreign currency to increase in value against their home currency or to create profits from the opportunities that allow the diversification. IV. Exercises –24 points (each worth 8 points). Please display all calculations in your answer sheet in order to receive full credit. 1. Suppose that an umbrella costs USD 20 in Michigan, and the USD/CAD exchange rate is 0.84. How many USD do you need to buy the umbrella in Atlanta? 3 2. Assume the Canadian dollar is equal to £0.51 and the Peruvian Sol is equal to £0.16. The value of the Peruvian Sol in Canadian dollars is: a. about 0.3621 Canadian dollars. c. about 2.36 Canadian dollars. b. about 0.3137 Canadian dollars. d. about 2.51 Canadian dollars. 3. Assume that a bank's bid rate on Swiss francs is £0.25 and its ask rate is £0.26. Its bidask percentage spread is : 4