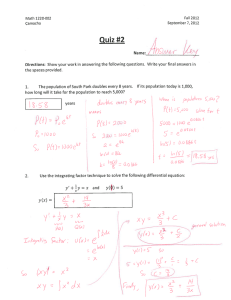

Suppose a product can be produced using virgin ore at a marginal cost

given by MC1 = 0.5q1 and with recycled materials at a marginal cost

of MC2 = 5+0.1q2.

a. If the inverse demand curve were given by P = 10 − 0.5(q1 + q2), how

many units of the product would be produced with virgin ore and how

many with recycled units?

b. How would this allocation change if the inverse demand function

were P = 20−0.5(q1 + q2) instead?

c. Discuss why the allocation in part (a) and (b) is different?

ANS

As per given data,

Marginal cost of virgin ore MC1 = 0.5q1

Marginal cost recycled material MC2 = 5+0.1q2

a. If the inverse demand curve were given by P = 10 − 0.5(q1 +q2), how

many units of the product would be produced with virgin ore and how many

with recycled units?

→ Inverse demand curve P = 10 − 0.5(q1 +q2)

To find the no. of units produced, we equate the condition P = MC for each

product.

For the virgin ore

0.5q1 = 10 − 0.5(q1 +q2)

→ 0.5q1 = 10 - 0.5q1 - 0.5q2

→ q1 = 10 - 0.5q2 .... (i)

For the recycled ore

5 + 0.1q2 = 10 − 0.5(q1 +q2)

→ 5 + 0.1q2 = 10 - 0.5q1 - 0.5q2

→ 0.6q2 = 5 - 0.5q1 .... (ii)

Equating the value of q1 from eq(i) into eq(ii), we get:

→ 0.6q2 = 5 - 0.5(10 - 0.5q2)

→ 0.6q2 = 5 - 5 + 0.25q2

→ 0.35q2 = 0

→ q2 = 0 units

Hence q1 = 10 - 0.5q2 = 10 - 0 = 10 units

Price P = 10 − 0.5(q1 +q2) = 10 - 0.5*10 = $5

Ans a) The firm will produce 10 units of virgin ore at a price of $5/unit and

zero units of recycled material will be produced.

b. How would this allocation change if the inverse demand function

were P = 20−0.5(q1 +q2) instead?

→ If Inverse demand curve P = 20 − 0.5(q1 +q2)

To find the no. of units produced, we equate the condition P = MC for each

product.

For the virgin ore

0.5q1 = 20 − 0.5(q1 +q2)

→ 0.5q1 = 20 - 0.5q1 - 0.5q2

→ q1 = 20 - 0.5q2 .... (i)

For the recycled ore

5 + 0.1q2 = 20 − 0.5(q1 +q2)

→ 5 + 0.1q2 = 20 - 0.5q1 - 0.5q2

→ 0.6q2 = 15 - 0.5q1 .... (ii)

Equating the value of q1 from eq(i) into eq(ii), we get:

→ 0.6q2 = 15 - 0.5(20 - 0.5q2)

→ 0.6q2 = 15 - 10 + 0.25q2

→ 0.35q2 = 5

→ q2 = 0.355 = 14.28 units

→ Hence q1 = 20 - 0.5q2 = 20 - 0.5*0.355= 12.857 ~ 12.86 units

Price P = 20 − 0.5(14.28 +12.86) = $6.43

Ans b) The firm will produce 12.86 units of virgin ore and 14.28 units of

recycled material will be produced at a price of $6.43/unit .

c. Discuss why the allocation in part (a) and (b) is different?

→ As we can see, the firm chose to produce only using virgin ore in case(a)

as the marginal cost for recycled material was quite high (because of the

+5 in its equation MC2 = 5+0.1q2). Since P =$5, a MC of over $5 makes the

recycled material products a bad choice.

7) Hyperinflation refers to ____ which results from _______ .

the occurrence of extremely high inflation rates; the rapid expansion of the money

supply by the government

Explanation: Hyperinflation occurs due to a significant increase in money supply in a

short time while economic growth is less as compared to it. It causes prices to sky-rocket

leading to extremely high inflation rates.

10) Workers who want to work full-time but are only able to find part-time work are

classified as

underemployed.

Explanation: Part time workers are considered "employed" so we can remove the other

three options. As per the question, these workers want full-time work but are forced to

work part-time for economic reasons. Such workers are thus "underemployed".

14) When large numbers of unemployed workers leave the labor force, the labor

force will decline at a _____ rate than total unemployment, causing the

unemployment rate to____.

slower; fall

Explanation: We know, Labor Force = Employed + Unemployed

Let us assume values of Emp. = 100, Unemployed = 20. Thus we get the Labor Force

LF = 120 and Unemployment Rate UR = \frac{20}{120}*10012020∗100 = 16.67%

Suppose 15 Unemployed workers quit the labor force, thus bringing it down to 105. Thus

percent change in LF = \frac{105-120}{120}*100120105−120∗100 = -12.5%.

While the percent Change in Total unemployment = \frac{5-20}{20}205−20 = -75%

New Unemployment Rate UR = \frac{5}{105}*1001055∗100 = 4.76%.

From this, we can see that LF falls at a slower rate than total unemployment and that the

Unemployment Rate falls.