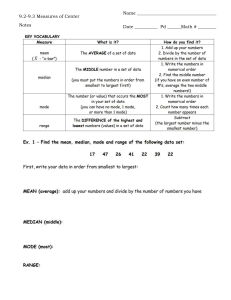

FORT WORTH, TEXAS Retail Market Analysis Presented by Sanil Paul Acquisitions Associate www.qthos.com 10th December 2020 Agenda Access Demand Generators Demographics Macro Economic Variables Market Trends 2 Ranked among ten best downtowns to live in the US Where the West Begins #1 fastest growing MSA in the US #13 most populous city in the US #14 in FORBES’ 25 best cities for young professionals Source: www.livability.com, US Census Bureau, Forbes 3 Fort Worth is a fastgrowing suburban destination, but the retail prospects are limited due to demographic and macroeconomic challenges 4 Fort Worth cities have the longest commute time in Texas Limited public transportation options and most places are accessible only by car Fort Worth commuters have a journey of 28.3 minutes to the office Source: www.walkscore.com / US News Rankings 5 Economy dependent on Transportation, Aerospace and Energy Sectors Top employers operate in high risky sectors and no major Universities present Company Employment American Airlines 25,000 Lockheed Martin 13,690 Fort Worth ISD 12,000 Drivers Logistics & Transport Manufacturing Challenges Oil Price Volatility Airline Industry Job loses No major Universities 6 Only One Third Population above 25 Have Some College Education Less educated workforce an impediment for businesses to shift base to Fort Worth Source: US Census Bureau, Survey 1-year estimates. 7 Low Household Income and Unfavorable Demographics Median Age Median Property Value 33.2 $189,300 US Median: US Median: 38.2 $229,700 Median Household Income Poverty Rate $58,448 16% US Median: US Median: $61,937 13.1% Uneducated youth presents a challenge along with 6% lesser household income 8 40% 35% Spending Patterns Unfavorable for Retail Growth Housing expenditure share significantly higher and budget spent on food and apparel lower than US average 30% 25% 20% 15% 10% 5% 0% US Source: US Census Bureau Fort Worth 9 High Vacancy Forecast and Low Net Absorption Vacancy is projected to reach 7.7% by 2024 and Net Absorption will be down 147% from peak Source: Costar 10 Low Probability of Immediate Leasing 50% probability for a retail project to wait six months before being able to lease Source: Costar 11 Asking Rent Expected to Fall Asking rent per sf estimated to decrease 2.6% in 2021 Source: Costar 12 High Expected Property Prices Cap Rate has not increased significantly even during the pandemic and expected to reduce further, increasing the property prices Source: Costar 13 Recommendation Fort Worth does not present a good return on investment as the risks far outweigh the benefits High quality housing Chaotic traffic conditions Low cost of living Less educated workforce High dependen ce on risky sectors High quality amenities Low price to benefit ratio of assets 14 Question & Answer www.qthos.com