Accountancy Assignment: Budgeting & Variance Analysis

advertisement

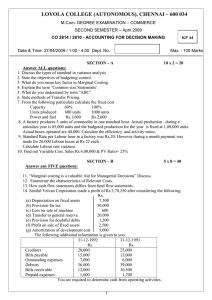

SCHOOL OF MANAGEMENT SCIENCES DEPARTMENT OF ACCOUNTANCY ACC 1244/1644 Main Group Assignment DUE DATE: JANUARY 5th 2021 Email: Mpho.Tshiololi@univen.ac.za TIME: Before 17H00 This assignment must be typed. Handwritten assignments will not be accepted Late submission will not be accepted No assignment should be submitted via WhatsApp Question 1 The Chief Operating Officer of Play-date Manufacturers is concerned with the operating results for September 2020. They are producers and sellers of various types of toys. As part of the company’s employee’s development projects, you have recently attended a course on budgeting and decide to use your experience by applying the principles of flexible budgeting to one of the company’s less profitable type of toy called Transformers. The following information is made available: Statement of Profit or Loss and Other Comprehensive Income For The Period September 2020 Units Sales Less: Variable expenses Direct material Direct labour Variable overheads Selling and administrative Budget 45 000 R1 800 000 R810 000 R360 000 R270 000 R135 000 R45 000 Actual 40 000 R1 600 000 R760 400 R357 000 R253 000 R110 400 R40 000 Contribution Less: Fixed expenses Manufacturing overheads Selling and administrative Net profit R990 000 R750 000 R405 000 R345 000 R240 000 R839 600 R753 200 R408 200 R345 000 R86 400 Required: a) Compile a flexible budget at actual activity level Question 2 The summary of Premiership Ltd’s transactions for January, February and March 2020 and its expected transactions for April 2020 are as follows: Sales (20% Cash and 80% Credit) Purchases (30% Cash and 70% Credit) Salaries and wages Rental General expenses Payment made on loan January R110 000 R27 000 February R90 000 R24 000 March R75 000 R18 000 April R60 000 R15 000 R42 000 R600 R9 000 R33 000 R600 R8 000 R30 000 R650 R9 000 R5 000 R12 000 R600 R7 000 Additional Information: 1. The bank overdraft at 1 March amounted to R9 600 2. Interest on a R6 000 investment at 10% per annum is received every six month in October and April. 3. Credit sales are collected as follows: 40% in the month of sale 30% in the first month after sale 28% in the second month after sale 2% irrecoverable 4. Credit purchases are paid for within the month of purchase in order to obtain a discount of 2%. 5. All other expenses are paid in cash. Required: a) Prepare the cash budget for March and April 2020. Question 3 Unique Boutique Ltd is a company specializing in custom-made evening dresses. The company usually cater for each individual customer’s needs by tailor-making a dress according to the specification. The following is a budgeted contribution format income statement for Unique Boutique Ltd: R Sales Less: Variable cost Direct materials A (@R10 per kg) Direct materials B (@R4 per litre) Direct labour (@R16 per hour) Variable factory overheads (@R4 per hour) Contribution margin Less: Fixed costs Net income Additional Information 360 000 (246 000) 120 000 36 000 72 000 18 000 114 000 80 000 34 000 1. The company manufactures and sells a single product. The budgeted units produced and sold (on which the statement was based) was 6 000 units. 2. The standard usage per unit is as follows: Direct materials A 8 kg Direct material B 6 litres Direct labour 3 hours Variable overheads 3 hours 3. Actual results for the period were as follows: a. Units produced and sold 6 300 units b. Material A 25 000 kg at a total cost of R124 500 c. Material B 20 160 litres at a total cost of R41 328 d. Direct labour 9 600 hours at R17 per hour e. Variable overheads R21 600 Required: Calculate the following variances and state the possible causes for the variances: a. b. c. d. e. f. g. h. Material price variance for material A Material price variance for material B Material usage variance for material A Material usage variance for material B Total material variance Labour rate variance Labour efficiency variance Total labour variance i. j. Variable overheads efficiency Variable overheads spending Question 4 The present market for golf balls is estimated at 80 000 balls per month and market research indicates that with a selling price of R3 per golf ball, a market penetration of one third to a half can be achieved within 12 month. Your company has devised a process which will produce golf balls with a fixed cost of R97 500 per month and a variable cost of R1,50 per ball. Required: a. b. c. d. e. Calculate the contribution margin (CM) ratio. Calculate the breakeven point in units and in rands. Calculate the number of golf balls that must be sold in order to earn a target profit of R52 500. Calculate the margin of safety as a percentage. (Round off to the nearest whole number) Further market research reveals that at a selling price of R2,80 the company could reach sales of 135 000 balls. a. Calculate the profit to be made, if the company sells 135 000 golf balls per month. (Draft a marginal costing income statement.) b. Calculate the new breakeven point in units. c. Should the company reduce the selling price? Give a reason for your answer.