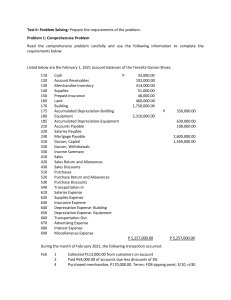

Cost Accounting and Cost Management Accounting is. . . 1.) 2.) 3.) 4.) 5.) Basic Accounting Cycle ABSantos, CPA, RCA A service activity. It’s function is to provide quantitative information, Primarily financial in nature About economic entity That is intended to be useful in making economic decisions. Accounting is also defined as. . . An “ART” of: 1.) RECORDING a. Journalizing – Books of Original Entry Journals • General Journals • Cash Receipt Journals • Sales Journals • Cash Disbursements Journal • Purchase Journal 2.) CLASSIFYING b. Posting – Books of Final Entry General Ledger • Subsidiary Ledgers 3.) SUMMARIZING c. Preparation of the Unadjusted Trial Balance – Contains both Real / Permanent and Nominal / Temporary Accounts Preparation of the Adjusting Journal Entries Preparation of the Adjusted Trial Balance – Contains both Real / Permanent and Nominal / Temporary Accounts Preparation of the Financial Statements d. e. f. ` Statement of Financial Position or Balance Sheet - (Real / Permanent Accounts) • Statement of Changes in Capital / Stockholder’s Equity / Retained Earnings • Cash Flow Statement Statement of Income or Income Statement - (Nominal / Temporary Accounts) Notes to Financial Statements g. Preparation of Closing Entries – Clearing Entries - Close All Income and Expenses to Income Summary Account - Credit / Debit Balances will be closed directly to Capital or Retained Earnings Account which signifies the Net Income / Loss respectively. h. Preparation of the Post Closing Trial Balance - Ends the Accounting Cycle. - Contains the Permanent Accounts balances only. i. Preparation of the Reversing Entries - Accrued Income / Expenses - Prepaid Expenses (Expense Method) - Deferred or Unearned Income (Income Method) 4.) INTERPRETING - 1|Page Financial Statement Analysis Cost Accounting and Cost Management Basic Accounting Cycle ABSantos, CPA, RCA FUNDAMENTALS OF ACCOUNTING Listed below are the February 1, 2007 account balances of the Alexander D’ Great Company: (110) Cash Php33,000; (120) Accounts Receivable Php192,000; (130) Merchandise Inventory Php413,000; (140) Supplies Php51,000; (150) Prepaid Insurance Php48,000; (160) Land Php460,000; (170) Building Php1,750,000; (175) Accumulated Depreciation-Building Php350,000; (180) Equipment Php2,310,000; (185) Accumulated Depreciation-Equipment Php630,000; (210) Accounts Payable Php108,000; (230) Mortgage Payable Php2,600,000; (310) Gibson, Capital Php1,569,000. Other accounts in addition to the accounts with remaining balances are: (220) Salaries Payable; (320) Gibson, Withdrawal; (330) Income Summary; (410) Sales; (420) Sales Return and Allowances; (430) Sales Discounts; (510) Purchases; (520) Purchase Returns and Allowances; (530) Purchase Discounts; (540) Transportation-In; (610) Salaries Expenses; (620) Supplies Expense; (630) Insurance Expense; (640) Depreciation Expense-Building; (650) Depreciation Expense-Equipment; (660) Transportation-Out; (670) Advertising Expense; (680) Interest Expense; (690) Miscellaneous Expense. During the month of February, the following transaction occurred: Feb. 1 2 4 5 7 7 8 9 10 12 14 15 16 18 19 20 22 23 24 24 25 26 28 28 Collected P113,000 from customers on account Paid P64,000 of accounts due less discounts of 3% Purchased merchandise, P170,000. Terms: FOB Shipping point; 3/10, n/30 Sold merchandise on account to Gonzales Company, P270,000. Terms: FOB shipping point; 2/10, n/30. Paid for advertising for the month of February, P6000 Sold merchandise for cash, P250,000 Paid the amount due from the February 4 transaction Paid Iloilo Freight P4,000 for delivering merchandise last February 4 Received returns from the Gonzales Company, P70,000 Received payment from the Gonzales Company less returns and discounts Paid P26,000 interest on the Mortgage Payable Paid salaries, P51,000 Sold merchandise on account to Ronzales Company, P392,000. Terms: FOB Destination, 2/10, n/30 Paid P4,000 freight charges on the sale of February 2016 Acquired supplies for cash, P21,000 Purchased P125,000 of merchandise from Lozada Company on account. Terms: FOB Destination; 3/10, n/30 Paid P7,000 miscellaneous expenses Received payment from Ronzales Company less discounts Purchased P373,000 of merchandise on account from Agustin Company. Terms: FOB Shipping Point; 3/10, n/30 Paid La Paz Express P9,000 freight for delivering merchandise acquired from Agustin. Sold merchandise to Ronzales Company on account, P420,000. Terms: FOB shipping point, 2/10, n/30 Received returns from Ronzales Company, P71,000 Gibson withdrew P400,000 from the business Returned merchandise purchased from Agustin on February 24, P25,000 Required: 1. Post the February account balances to the ledger accounts 2|Page