Accounting Basics: Objectives, Functions, and Limitations

advertisement

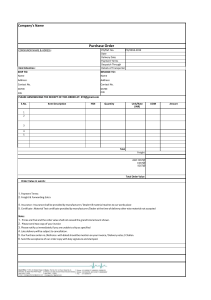

NameAbhishek Singh Roll no -04 Class –Xi F Summited To Mr. Labh Singh Accounting What Is Accounting? Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing and reporting these transactions to oversight agencies, regulators and tax collection entities. The financial statements used in accounting are a concise summary of financial transactions over an accounting period, summarizing a company's operations, financial position and cash flows. Objectives of Accounting: The following are the main objectives of accounting : 1. To maintain full and systematic records of business transactions: Accounting is the language of business transactions. Given the limitations of human memory, the main objective of accounting is to maintain ‘a full and systematic record of all business transactions. 2. To ascertain profit or loss of the business: Business is run to earn profits. Whether the business earned profit or incurred loss is ascertained by accounting by preparing Profit & Loss Account or Income Statement. A comparison of income and expenditure gives either profit or loss. 3. To depict financial position of the business: A businessman is also interested in ascertaining his financial position at the end of a given period. For this purpose, a position statement called Balance Sheet is prepared in which assets and liabilities are shown. Just as a doctor will feel the pulse of his patient and know whether he is enjoying good health or not, in the same way by looking at the Balance Sheet one will know the financial health of an enterprise. If the assets exceed liabilities, it is financially healthy, i.e., solvent. In the other case, it would be insolvent, i.e., financially weak. 4. To provide accounting information to the interested parties: Apart from owner of the business enterprise, there are various parties who are interested in accounting information. These are bankers, creditors, tax authorities, prospective investors, researchers, etc. Hence, one of the objectives of accounting is to make the accounting information available to these interested parties to enable them to take sound and realistic decisions. The accounting information is made available to them in the form of annual report. What are the Functions of Accounting? Functions of accounting All companies use accounting to report, track, execute and predict financial transactions. The main functions of accounting are to store and analyze financial information and oversee monetary transactions. Accounting is used to prepare financial statements for a company's employees, leaders, and investors. Accounting also functions to ensure payment of funds into and out of a company. Accounting creates a fiscal history for any company. It is used to track expenditures from business operations as well as a company's profits. It can also be utilized to predict financial success and the future needs of a company to create budgets and take advantage of new growth opportunities. Accountants use this information to prepare financial statements used by business professionals and government officials. The functions of announting in a business include the following: Business Costs and Revenue An important function of accounting is to track business spending in relation to income. Just like managing your personal finances, accountants record expenses and payments to keep an accurate and up to date record of the company's funds. Accounts Receivable Proper accounting ensures the company receives any payment they are due. An accountant tracks the profits of a business to ensure that revenue is continually flowing into their bank account. Accounts Payable Accounts payable functions to pay the company's bills. They ensure the business pays for any money they owe and check that it is a legitimate charge. They also help set the due dates for payments so a company can best manage their own funds based on when money is coming in. Payroll Accountants deduct employee wages from company funds for paychecks. They are also in charge of managing employee benefits if they are paid out of an employee's income. Accounting may help decide how employees are compensated for their work based on how wages effect the company's profits. Financial Reporting Accountants use digital systems to store and calculate data. If a company is publicly owned, they must also prepare both quarterly and yearly reports for shareholders detailing the assets, profits and losses of the business. Privately owned companies also utilize fiscal reports like these to understand the financial resources of their firm. Financial Analysis Companies use accounting to perform regular analysis of how well the business is performing. Either an outside consultant or internal personnel will look at the business as a whole to determine what functions can be made more efficient based on financial outcomes. They may suggest changes to employee departments or streamlined costs for production to reduce waste. Taxes and Compliance A business must comply with government laws and standards from the Internal Revenue Service and the Securities and Exchange Commission, among other regulations. States also enforce monetary guidelines for businesses. Accounting is responsible for reporting the financial workings of the company and making sure they conform to all local and national laws and guidelines. Budgeting Accounting is in charge of setting a company's budget. They use financial data from the past as well as projections for future income to compose annual budgets. Accountants also prepare budgets for individual departments and special projects within the company Limitations of Accounting There are some misconceptions about accounting. Like the fact that a Profit & Loss Statement shows the true profit or loss earned in a year, or that a balance sheet perfectly depicts the financial position of a firm. Whereas the truth is that accounting is not a perfect science or art or language yet. It has been evolving for so many years and continues to evolve. The limitations of accounting must be studied to understand it better. Measurability One of the biggest limitations of accounting is that it cannot measure things/events that do not have a monetary value. If a certain factor, no matter how important, cannot be expressed in money it finds no place in accounting. Some very important qualities like management, loyalty, reputation, etc find no place on the balance sheet or the income statement. No Future Assesment The financial statements show the financial position of the firm on the date of preparation. The users of the statement are more interested in the future of the company in the short term and long term. However, accounting does not make any such estimates. And due to the dynamic nature of the business environment, a lot can change between such dates. Auditors sometimes do disclose the important events occurring after the balance sheet date to rectify these limitations of accounting. Historical Costs Accounting often uses historical costs to measure the values. This fails to take into consideration factors such as inflation, price changes, etc. This skews the relevance of such accounting records and information. This is one of the major limitations of accounting. Accounting Policies There is no global standard in accounting policies. In India, we follow the Accounting Standards. Americans follow the GAAP and then there are the international standards, namely the IFRS. And if a global company operates in more than one country, there may be confusion. Not all accounting policies follow the same line of thinking, and conflicts may arise due to this. It has long been said that the whole world must agree on uniform accounting policies but this has not happened yet. Estimates Sometimes in accounting estimation may be required as it is not possible to establish exact amounts. But these estimates will depend on the personal judgment of the accountant. And estimates are extremely subjective in nature. They are basically a person’s guess of future events. in accounting, there are many cases where such estimates need to be made like provision of doubtful debt, methods of depreciation, etc. Verifiability An audit of the financial statements does not guarantee the correctness of such statements. The auditor can only assure that the statements are free from error to the best of his judgment. Errors and Frauds Accounting is done by humans, so there will always be the scope of human errors. There is also the fear of possible manipulation of accounts to cover up a fraud. Since fraud is deliberate, it is that much harder to spot. This is one of the most dreaded limitations of accounting. BASIC ACCOUNTING TERMS Understanding Basic Accounting Terms Business Transaction, Account, Capital, Drawings, Liabilities and Assets Business Transaction: Transaction: It is an event which involves transfer of money, goods and services and can be classified into cash or credit transactions. Cash transaction is the one where cash receipt or payment is involved and a credit transaction is one where cash is not involved immediately but will be paid or received later. Types of Transactions Based on Relationshi p with Accounting Unit Internal Transactions External Transactions Based on Mode of Settlement Cash Transactions Credit Transactions Business Transaction: It is a financial transaction or an economic event expressed in terms of money which brings in a change in the financial position of an enterprise. It involves transfer and exchange of goods or services such as purchase/sale of goods and services, wages paid to workers, rent paid, dividend received, lending and borrowing money. Characteristics: Following are the characteristics of a Business Transaction: i. money or money’s worth: it is basically concerned with money or money’s worth received from of sale of goods or provision of services. ii. Exchange of goods or services: It arises out of exchange of goods or services. iii. Change in financial position: It affects the financial statements of an enterprise and therefore, is responsible for change in its financial position. iv. Accounting equation: It affects the accounting equation of any business firm. v. Dual Aspects: Every business transaction has 2 sides, one is receiving side and the other is giving side and therefore, it is said to have a dual aspect for every transaction. vi. Equality of Balance Sheet: Since, every transaction has dual aspect affecting the two sides namely, Receiving and Giving simultaneously, it helps in maintaining the equality of Balance Sheet Accounting Principles What are Accounting Principles? Accounting principles are the rules and guidelines that companies must follow when reporting financial data. The Financial Accounting Standards Board (FASB) issues a standardized set of accounting principles in the U.S. referred to as generally accepted accounting principles (GAAP). Accrual principle Conservatism principle Consistency principle Cost principle Economic entity principle Full disclosure principle Going concern principle Matching principle Materiality principle Monetary unit principle Reliability principle Revenue recognition principle Time period principle Accounting Concepts and Conventions Accounting Conventions The most commonly encountered convention is the "historical cost convention". This requires transactions to be recorded at the price ruling at the time, and for assets to be valued at their original cost. Under the "historical cost convention", therefore, no account is taken of changing prices in the economy. The other conventions you will encounter in a set of accounts can be summarised as follows: Monetary measurement Accountants do not account for items unless they can be quantified in monetary terms. Items that are not accounted for (unless someone is prepared to pay something for them) include things like workforce skill, morale, market leadership, brand recognition, quality of management etc. Separate Entity This convention seeks to ensure that private transactions and matters relating to the owners of a business are segregated from transactions that relate to the business. Realisation With this convention, accounts recognise transactions (and any profits arising from them) at the point of sale or transfer of legal ownership - rather than just when cash actually changes hands. For example, a company that makes a sale to a customer can recognise that sale when the transaction is legal - at the point of contract. The actual payment due from the customer may not arise until several weeks (or months) later - if the customer has been granted some credit terms. Materiality An important convention. As we can see from the application of accounting standards and accounting policies, the preparation of accounts involves a high degree of judgement. Where decisions are required about the appropriateness of a particular accounting judgement, the "materiality" convention suggests that this should only be an issue if the judgement is "significant" or "material" to a user of the accounts. The concept of "materiality" is an important issue for auditors of financial accounts. Accounting Concepts Four important accounting concepts underpin the preparation of any set of accounts: Going Concern Accountants assume, unless there is evidence to the contrary, that a company is not going broke. This has important implications for the valuation of assets and liabilities. Consistency Transactions and valuation methods are treated the same way from year to year, or period to period. Users of accounts can, therefore, make more meaningful comparisons of financial performance from year to year. Where accounting policies are changed, companies are required to disclose this fact and explain the impact of any change. Prudence Profits are not recognised until a sale has been completed. In addition, a cautious view is taken for future problems and costs of the business (the are "provided for" in the accounts" as soon as their is a reasonable chance that such costs will be incurred in the future. GST GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. ... Under the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are charged. Question 1:Pass entries in the books of Mukerjee & Sons. assuming all transactions have taken place within the state of Uttar Pradesh. Assume CGST @9% and SGST @ 9%. 2018 March 1 Purchased goods for ₹ 5,00,000 from Mehta Bros. March Sold goods for ₹ 8,00,000 to Munjal & Co. 10 March Paid for advertisement ₹ 40,000 by cheque. 15 March Purchased furniture for office use ₹ 50,000 and payment made 18 by cheque. March Paid for printing and stationery ₹ 8,000. 25 March Payment made of balance amount of GST. 31 Journal Date 2018 Mar 04 Particulars L.F. Debit Amount (₹) Purchases A/c Dr. 5,00,000 Input CGST A/c Dr. 45,000 Input SGST A/c Dr. 45,000 To Mehta Bros. A/c (Purchase d from Mehta Bros.) Credit Amount (₹) 5,90,000 Mar 10 Munjal & Co. A/c Dr. 9,44,000 To Sales A/c 8,00,000 To Output CGST A/c 72,000 To Output SGST A/c 72,000 (Sold goods to Munjal & Co.) Mar 15 Advertisement A/c Input CGST A/c Dr. 40,000 Dr. 3,600 Input SGST A/c Dr. 3,600 To Bank A/c (Paid for advertisement) 47,200 Mar 18 Furniture A/c Dr. 50,000 Input CGST A/c Dr. 4,500 Input SGST A/c Dr. 4,500 To Bank A/c (Purchase d office furniture) 59,000 Mar 25 Printing & Stationery A/c Dr. 8,000 Input CGST A/c Dr. 720 Input SGST A/c Dr. 720 To Cash A/c (Paid for printing and stationery) 9,440 Mar 31 Output CGST A/c Dr. 53,820 Output SGST A/c Dr. 53,820 To Input CGST A/c 53,820 To Input SGST A/c 53,820 (Input tax credit availed) Mar 31 Output CGST A/c Dr. 18,180 Output SGST A./c Dr. 18,180 To Bank A/c 36,360 (Balance tax paid to governme nt) 17,93,640 17,93,640 Thanks For watching Summited By Abhishek Singh Roll no -4 Class XI -f