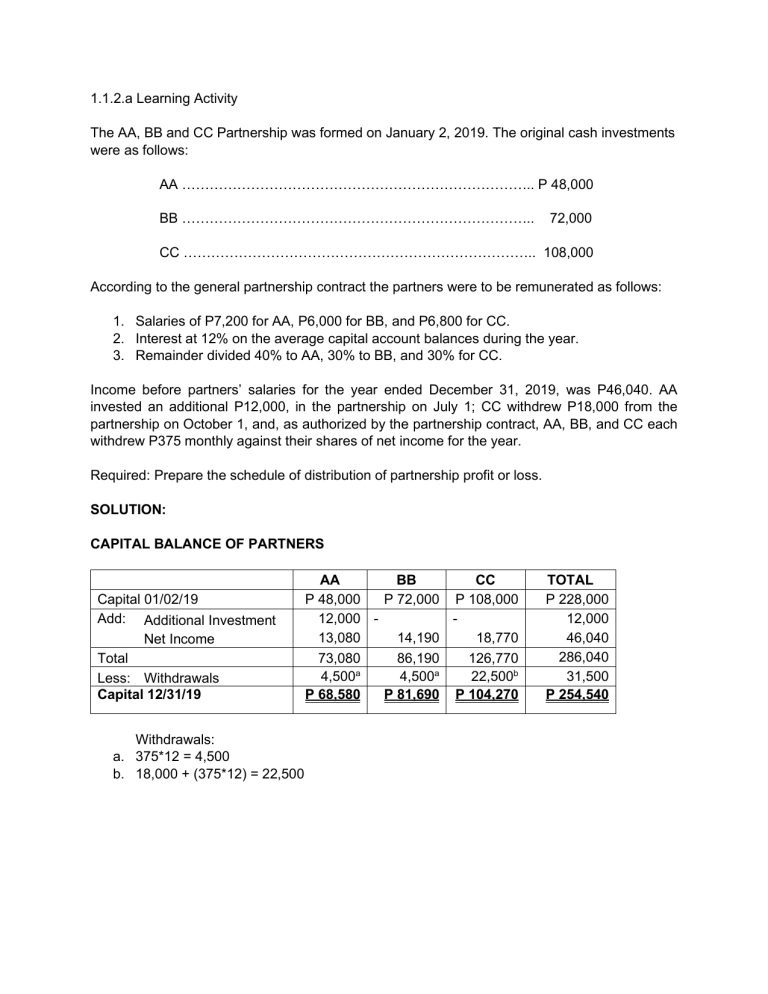

1.1.2.a Learning Activity The AA, BB and CC Partnership was formed on January 2, 2019. The original cash investments were as follows: AA ………………………………………………………………….. P 48,000 BB ………………………………………………………………….. 72,000 CC ………………………………………………………………….. 108,000 According to the general partnership contract the partners were to be remunerated as follows: 1. Salaries of P7,200 for AA, P6,000 for BB, and P6,800 for CC. 2. Interest at 12% on the average capital account balances during the year. 3. Remainder divided 40% to AA, 30% to BB, and 30% for CC. Income before partners’ salaries for the year ended December 31, 2019, was P46,040. AA invested an additional P12,000, in the partnership on July 1; CC withdrew P18,000 from the partnership on October 1, and, as authorized by the partnership contract, AA, BB, and CC each withdrew P375 monthly against their shares of net income for the year. Required: Prepare the schedule of distribution of partnership profit or loss. SOLUTION: CAPITAL BALANCE OF PARTNERS Capital 01/02/19 Add: Additional Investment Net Income Total Less: Withdrawals Capital 12/31/19 Withdrawals: a. 375*12 = 4,500 b. 18,000 + (375*12) = 22,500 AA BB CC P 48,000 P 72,000 P 108,000 12,000 13,080 14,190 18,770 73,080 4,500a P 68,580 86,190 4,500a P 81,690 126,770 22,500b P 104,270 TOTAL P 228,000 12,000 46,040 286,040 31,500 P 254,540 DISTRIBUTION OF PROFIT/LOSS Salaries Interest on Average Capital AA (54000*12%) BB (72000*12%) CC (103500*12%) Balance Net Income(Loss) AA 7,200 BB 6,000 CC 6,800 TOTAL 20,000 (450) 14,190 12,420 (450) 18,770 6,480 8,640 12,420 (1,500) 46,040 48,000 12/12 48,000 12,000 6/12 6,000 54,000 72,000 12/12 72,000 108,000 12/12 108,000 (18,000) 3/12 (4,500) 103,500 6,480 8,640 (600) 13,080 COMPUTATION AVERAGE CAPITAL: AA 01-Jan19 Beginning Balance 01-Jul- Additional 19 investment BB 01-Jan19 Beginning Balance CC 01-Jan19 Beginning Balance 01-Oct19 Withdrawal