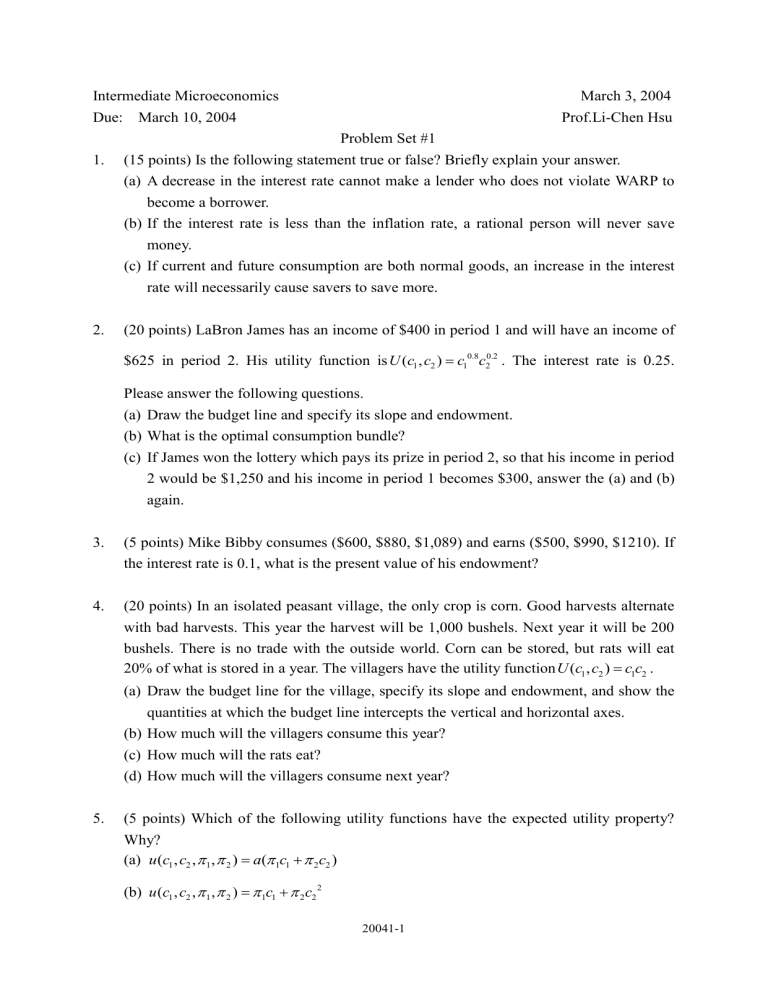

Intermediate Microeconomics Due: 1. 2. March 3, 2004 March 10, 2004 Prof.Li-Chen Hsu Problem Set #1 (15 points) Is the following statement true or false? Briefly explain your answer. (a) A decrease in the interest rate cannot make a lender who does not violate WARP to become a borrower. (b) If the interest rate is less than the inflation rate, a rational person will never save money. (c) If current and future consumption are both normal goods, an increase in the interest rate will necessarily cause savers to save more. (20 points) LaBron James has an income of $400 in period 1 and will have an income of $625 in period 2. His utility function is U (c1 , c2 ) c10.8c20.2 . The interest rate is 0.25. Please answer the following questions. (a) Draw the budget line and specify its slope and endowment. (b) What is the optimal consumption bundle? (c) If James won the lottery which pays its prize in period 2, so that his income in period 2 would be $1,250 and his income in period 1 becomes $300, answer the (a) and (b) again. 3. (5 points) Mike Bibby consumes ($600, $880, $1,089) and earns ($500, $990, $1210). If the interest rate is 0.1, what is the present value of his endowment? 4. (20 points) In an isolated peasant village, the only crop is corn. Good harvests alternate with bad harvests. This year the harvest will be 1,000 bushels. Next year it will be 200 bushels. There is no trade with the outside world. Corn can be stored, but rats will eat 20% of what is stored in a year. The villagers have the utility function U (c1 , c2 ) c1c2 . (a) Draw the budget line for the village, specify its slope and endowment, and show the quantities at which the budget line intercepts the vertical and horizontal axes. (b) How much will the villagers consume this year? (c) How much will the rats eat? (d) How much will the villagers consume next year? 5. (5 points) Which of the following utility functions have the expected utility property? Why? (a) u(c1 , c2 , 1 , 2 ) a( 1c1 2c2 ) (b) u (c1 , c2 , 1 , 2 ) 1c1 2 c2 2 20041-1 (c) u(c1 , c2 , 1 , 2 ) 1 ln c1 2 ln c2 17 (d) u(c1 , c2 , 1 , 2 ) b( 1c1 ) d ( 2c2 ) 3 (e) u (c1 , c2 , 1 , 2 ) a( 1c1 2 c2 ) 2 6. (5 points) A risk-averse individual is offered a choice between a gamble that pays $1000 with a probability of 25% and $100 with a probability of 75%, or a payment of $325. (a) Which would he choose? (b) What if the payment was $320? 7. (10 points) Andy is thinking of starting a pinball palace. Andy is an expected utility maximizer with a von Neuman-Morgenstern utility function, U (W ) 1 (2000 / W ) , where W is his wealth. Andy’s total wealth is $8000. With probability 0.2 he’ll lose $6000, so that his wealth will be just $2000. With probability 0.8 his wealth will grow to $x. What is the smallest value of x that would be sufficient to make Andy want to invest in the pinball palace rather than have a wealth of $8000 with certainty? 8. (5 points) Tom has a von Neuman-Morgenstern utility function U (c) c1/ 2 . If Tom is not injured this season, he will receive an income of $36 million. If he is injured, his income will be only $10000. The probability that he will be injured is 0.1 and the probability that he will not be injured is 0.9. What is his expected utility? 9. (7 points) Oskar’s preference over gambles in which the probability of events 1 and 2 are both 1/2 can be represented by the von Neuman-Morgenstern utility function 0.5 y10.5 0.5 y20.5 , where y1 is his consumption if event 1 happens and y 2 is his consumption if event 2 happens. A gamble that allows him a consumption of $16 if event 1 happens and $25 if event 2 happens is exactly as good for Oskar as being sure to have an income of_____. (Show the calculations!) 10. (8 points) Mary owns just one ship. The ship is worth $200 million dollars. If the ship sinks, Mary loses $200 million. The probability that it will sink is 0.02. Mary’s total wealth, including the value of the ship is $225 million. She is an expected utility maximizer with von Neuman-Morgenstern utility function U (W ) W 1/ 2 . What is the maximum amount that Mary would be willing to pay in order to be fully insured against the risk of losing her ship? 20041-2