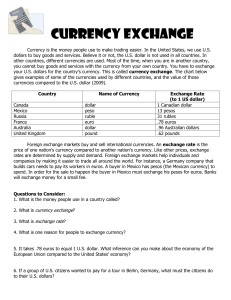

1: Chapter Managing Finance in Foreign Subsidiaries 1. Motives of an MNC. Describe constraints that interfere with a MNCs objective. ANSWER: The constraints faced by financial managers attempting to maximize shareholder wealth are: a. Environmental constraints - countries impose environmental regulations such as building codes and pollution controls, which increase costs of production. b. Regulatory constraints - host governments can impose taxes, restrictions on earnings remittances, and restrictions on currency convertibility, which may reduce cash flows to be received by the parent. c. Ethical constraints - U. S.-based MNCs may beat a competitive disadvantage if they follow a worldwide code of ethics, because other firms may use tactics that are allowed in some foreign countries but considered illegal by U. S. standards. 2. International Opportunities. a. How does access to international opportunities affect the size of corporations? ANSWER: Additional opportunities will often cause a firm to grow more than if it did not have access to such opportunities. Thus, a firm that considers international opportunities has greater potential for growth. b. Describe a scenario in which the size of a corporation is not affected by access to international opportunities. ANSWER: Some firms may avoid opportunities because they lack knowledge about foreign markets or expect that the risks are excessive. Thus, the size of these firms is not affected by the opportunities. c. Explain why MNCs such as Coca Cola and Pepsi Co, Inc., still have numerous opportunities for international expansion. ANSWER: Coca Cola and Pepsi Co still have new international opportunities because countries are at various stages of development. Some countries have just recently opened their borders to MNCs. Many of these countries do not offer sufficient food or drink products to their consumers. 3. Impact of the Euro on U.S. Subsidiaries. McCanna Corp. has a French subsidiary that produces wine and exports to various European countries. Explain how the subsidiary’s business may have been affected since the conversion of many European currencies into a single European currency (the euro) in 1999. ANSWER: The subsidiary and its customers based in countries that now use the euro as their currency would no longer be exposed to exchange rate risk. 4. Agency Problems of MNCs. Explain the agency problem of MNCs. ANSWER: The agency problem reflects a conflict of interests between decision-making managers and the owners of the MNC. Agency costs occur in an effort to assure that managers act in the best interest of the owners. b. Why might agency costs be larger for an MNC than for a purely domestic firm? ANSWER: The agency costs are normally larger for MNCs than purely domestic firms for the following reasons. First, MNCs incur larger agency costs in monitoring managers of distant foreign subsidiaries. Second, foreign subsidiary managers raised in different cultures may not follow uniform goals. Third, the sheer size of the larger MNCs would also create large agency problems. 5. International Business Methods. Snyder Golf Co., a U.S. firm that sells high-quality golf clubs in the U.S., wants to expand internationally by selling the same golf clubs in Brazil. a. Describe the tradeoffs that are involved for each method (such as exporting, direct foreign investment, etc.) that Snyder could use to achieve its goal. ANSWER: Snyder can export the clubs, but the transportation expenses may be high. If could establish a subsidiary in Brazil to produce and sell the clubs, but this may require a large investment of funds. It could use licensing, in which it specifies to a Brazilian firm how to produce the clubs. In this way, it does not have to establish its own subsidiary there. b. Which method would you recommend for this firm? Justify your recommendation. ANSWER: If the amount of golf clubs to be sold in Brazil is small, it may decide to export. However, if the expected sales level is high, it may benefit from licensing. If it is confident that the expected sales level will remain high, it may be willing to establish a subsidiary. The wages are lower in Brazil, and the large investment needed to establish a subsidiary may be worthwhile. 6. Impact of Eastern European Growth. The managers of Loyola Corp. recently had a meeting to discuss new opportunities in Europe as a result of the recent integration among Eastern European countries. They decided not to penetrate new markets because of their present focus on expanding market share in the United States. Loyola’s financial managers have developed forecasts for earnings based on the 12 percent market share (defined here as its percentage of total European sales) that Loyola currently has in Eastern Europe. Is 12 percent an appropriate estimate for next year’s Eastern European market share? If not, does it likely overestimate or underestimate the actual Eastern European market share next year? ANSWER: It would likely overestimate its market share because the competition should increase as competitors penetrate the European countries. 1 8. Comparative Advantage. a. Explain how the theory of comparative advantage relates to the need for international business. ANSWER: The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. Consequently, there is a need for international business. b. Explain how the product cycle theory relates to the growth of an MNC. ANSWER: The product cycle theory suggests that at some point in time, the firm will attempt to capitalize on its perceived advantages in markets other than where it was initially established. 9. Impact of Political Risk. Explain why political risk may discourage international business. ANSWER: Political risk increases the rate of return required to invest in foreign projects. Some foreign projects would have been feasible if there was no political risk, but will not be feasible because of political risk. 10. Valuation of Wall-Marts International Business. In addition to all of its stores in the U.S., Wal-Mart has 11 stores in Argentina, 24 stores in Brazil, 214 stores in Canada, 29 stores in China, 92 stores in Germany, 15 stores in South Korea, 611 stores in Mexico, and 261 stores in the U.K. Consider the value of Wal-Mart as being composed of two parts, aU.S. part (due to business in the U.S.) and a non-U.S. part (due to business in other countries). Explain how to determine the present value (in dollars) of the non-U.S. part assuming that you had access to all the details of Wal-Mart businesses outside the U.S. ANSWER: The non-U.S. part can be measured as the present value of future dollar cash flows resulting from the non-U.S. businesses. Based on recent earnings data for each store and applying an expected growth rate, you can estimate the remitted earnings that will come from each country in each year in the future. You can convert those cash flows to dollars using a forecasted exchange rate per year. Determine the present value of cash flows of all stores within one country. Then repeat the process for other countries. Then add up all the present values that you estimated to derive a consolidated present value of all non-U.S. subsidiaries. 11. Valuation of an MNC. Birm Co., based in Alabama, considers several international opportunities in Europe that could affect the value of its firm. The valuation of its firm is dependent on four factors: (1) Expected cash flows in dollars, (2) Expected cash flows in euros that are ultimately converted into dollars, (3) The rate at which it can convert euros to dollars, and (4) Birms weighted average cost of capital. For each opportunity, identify the factors that would be affected. a. Birm plans a licensing deal in which it will sell technology to a firm in Germany for $3,000,000; the payment is invoiced in dollars, and this project has the same risk level as its existing businesses. b. Birm plans to acquire a large firm in Portugal that is riskier than its existing businesses. c. Birm plans to discontinue its relationship with a U.S. supplier so that can import a small amount of supplies (denominated in euros) at a lower cost from a Belgian supplier. d. Birm plans to export a small amount of materials to Ireland that are denominated in euros. ANSWER: Opportunity Dollar CF a. joint venture b. acquisition c. imported supplies d. exports to Ireland X Euro CF X Exchange rate at which Birm Co. converts euros to dollars Birmingham’s weighted average cost of capital X X X 12. Centralization and Agency Costs. Would the agency problem be more pronounced for Berkley Corp., which has its parent company make most major decisions for its foreign subsidiaries, or Oakland Corp., which uses a decentralized approach? ANSWER: The agency problem would be more pronounced for Oakland because of a higher probability that subsidiary decisions would conflict with the parent. Assuming that the parent attempts to maximize shareholder wealth, decisions by the parent should be compatible with shareholder objectives. If the subsidiaries made their own decisions, the agency costs would be higher since the parent would need to monitor the subsidiaries to assure that their decisions were intended to maximize shareholder wealth. 2 13. International Opportunities Due to the Internet. a. What factors cause some firms to become more internationalized than others? ANSWER: The operating characteristics of the firm (what it produces or sells) and the risk perception of international business will influence the degree to which a firm becomes internationalized. Several other factors such as access to capital could also be relevant here. Firms that are labor-intensive could more easily capitalize on low-wage countries while firms that rely on technological advances could not. b. Offer your opinion on why the Internet may result in more international business. ANSWER: The Internet allows for easy and low-cost communication between countries, so that firms could now develop contacts with potential customers overseas by having a website. Many firms use their website to identify the products that they sell, along with the prices for each product. This allows them to easily advertise their products to potential importers anywhere in the world without mailing brochures to various countries. In addition, they can add to their product line and change prices by simply revising their website, so importers are kept abreast of the exporter’s product information by monitoring the exporter’s website periodically. Firms can also use their websites to accept orders online. Some firms with an international reputation use their brand name to advertise products over the internet. They may use manufacturers in some foreign countries to produce some of their products subject to their specification. 14. Imperfect Markets. a. Explain how the existence of imperfect markets has led to the establishment of subsidiaries in foreign markets. ANSWER: Because of imperfect markets, resources cannot be easily and freely retrieved by the MNC. Consequently, the MNC must sometimes go to their sources rather than retrieve resources (such as land, labor, etc.). b. If perfect markets existed, would wages, prices, and interest rates among countries be more similar or less similar than under conditions of imperfect markets? Why? ANSWER: If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. As this occurred, shortages of resources in any particular country would be alleviated and the costs of such resources would be similar across countries. 15. International Joint Venture. Anheuser-Busch, the producer of Budweiser and other beers, has recently expanded into Japan by engaging in a joint venture with Kirin Brewery, the largest brewery in Japan. The joint venture enables Anheuser-Busch to have its beer distributed through Kirin’s distribution channels in Japan. In addition, it can utilize Kirin’s facilities to produce beer that will be sold locally. In return, Anheuser-Busch provides information about the American beer market to Kirin. a. Explain how the joint venture can enable Anheuser-Busch to achieve its objective of maximizing shareholder wealth. ANSWER: The joint venture creates away for Anheuser-Busch to distribute Budweiser throughout Japan. It enables Anheuser-Busch to penetrate the Japanese market without requiring a substantial investment in Japan. b. Explain how the joint venture can limit the risk of the international business. ANSWER: The joint venture has limited risk because Anheuser-Busch does not need to establish its own distribution network in Japan. Thus, Anheuser-Busch may be able to use a smaller investment for the international business, and there is a higher probability that the international business will be successful. c. Many international joint ventures are intended to circumvent barriers that normally prevent foreign competition. What barrier in Japan is Anheuser-Busch circumventing as a result of the joint venture? What barrier in the United States is Kirin circumventing as a result of the joint venture? ANSWER: Anheuser-Busch is able to benefit from Kirin distribution system in Japan, which would not normally be so accessible. Kirin is able to learn more about how Anheuser-Busch expanded its product across numerous countries, and therefore breaks through an information barrier. d. Explain how Anheuser-Busch could lose some of its market share in countries outside Japan as result of this particular joint venture. ANSWER: Anheuser-Busch could lose some of its market share to Kirin as a result of explaining its worldwide expansion strategies to Kirin. However, it appears that Anheuser-Busch expects the potential benefits of the joint venture to outweigh any potential adverse effects. 18. Impact of International Business on Cash Flows and Risk. Nantucket Travel Agency specializes in tours for American tourists. Until recently, all of its business was in the U.S. It just established a subsidiary in Athens, Greece, which provides tour services in the Greek islands for American tourists. It rented a shop near the port of Athens. It also hired residents of Athens, who could speak English and provide tours of the Greek islands. The subsidiary’s main costs are rent and salaries for its employees and the lease of a few large boats in Athens that it uses for tours. American tourists pay for the entire tour in dollars at Nantucket’s mainU.S. office before they depart for Greece. a. Explain why Nantucket may be able to effectively capitalize on international opportunities such as the Greek island tours. 3 ANSWER: It already has established credibility with American tourists, but could penetrate a new market with some of the same customers that it has served on tours in the U.S. b. Nantucket is privately-owned by owners who reside in the U.S. and work in the main office. Explain possible agency problems associated with the creation of a subsidiary in Athens, Greece. How can Nantucket attempt to reduce these agency costs? ANSWER: The employees of the subsidiary in Athens are not owners, and may have no incentive to manage in a manner that maximizes the wealth of the owners. Thus; they may manage the tours inefficiently. Nantucket could attempt to allow the employees a portion of the ownership of the company so that they benefit more directly from good performance. Alternatively, Nantucket may consider having one of its owners transfer to Athens to oversee the subsidiary’s operations. c. Greece’s cost of labor and rent are relatively low. Explain why this information is relevant to Nantucket’s decision to establish a tour business in Greece. ANSWER: The low cost of rent and labor will be beneficial to Nantucket, because it enables Nantucket to create the subsidiary at a low cost. d. Explain how the cash flow situation of the Greek tour business exposes Nantucket to exchange rate risk. Is Nantucket favorably or unfavorably affected when the euro (Greece’s currency) appreciates against the dollar? Explain. ANSWER: Nantucket’s tour business in Greece results in dollar cash inflows and euro cash outflows. It will be adversely affected by the appreciation of the euro because it will require more dollars to cover the costs in Athens if the euros value rises. e. Nantucket plans to finance its Greek tour business. Its subsidiary could obtain loans in euros from a bank in Greece to cover its rent, and its main office could pay off the loans over time. Alternatively, its main office could borrow dollars and would periodically convert dollar sto euros to pay the expenses in Greece. Does either type of loan reduce the exposure of Nantucket to exchange rate risk? Explain. ANSWER: No. The euro loans would be used to cover euro expenses, but Nantucket would need dollars to pay off the loans. Alternatively, the U.S. dollar loans would still require conversion of dollars to euros. With either type of loan, Nantucket is still adversely affected by the appreciation of the euro against the dollar. f. Explain how the Greek island tour business could expose Nantucket to country risk. ANSWER: The subsidiary could be subject to government restrictions or taxes in Greece that would place it at a disadvantage relative to other Greek tour companies based in Athens. 19. Benefits and Risks of International Business. As an overall review of this chapter, identify possible reasons for growth in international business. Then, list the various disadvantages that may discourage international business. ANSWER: Growth in international business can be stimulated by: (1) Access to foreign resources which can reduce costs, or (2) Access to foreign markets which boost revenues. Yet, international business is subject to risks of exchange rate fluctuations, foreign exchange restrictions, a host government takeover, tax regulations, etc. 20. Methods Used to Conduct International Business. Duve, Inc., desires to penetrate a foreign market with either a licensing agreement with a foreign firm or by acquiring a foreign firm. Explain the differences in potential risk and return between a licensing agreement with a foreign firm, and the acquisition of a foreign firm. ANSWER: A licensing agreement has limited potential for return, because the foreign firm will receive much of the benefits as a result of the licensing agreement. Yet, the MNC has limited risk, because it did not need to invest substantial funds in the foreign country. An acquisition by the MNC requires a substantial investment. If this investment is not a success, the MNC may have trouble selling the firm it acquired for a reasonable price. Thus, there is more risk. However, if this investment is successful, all of the benefits accrue to the MNC. 21. Impact of the Euro. Explain how the adoption of the euro as the single currency by European countries could be beneficial to MNCs based in Europe and to MNCs based in the U.S. ANSWER: There is now no exchange rate risk between the countries participating in the euro. This makes it easier to compare prices across countries and to compete for MNCs based in Europe. The advantages are the same for MNCs based in the U.S. 22. Impact of September 11. Following the terrorist attack on the U.S., the valuations of many MNCs declined by more than 10 percent. Explain why the expected cash flows of MNCs were reduced, even if they were not directly hit by the terrorist attacks. ANSWER: A MNCs cash flows could be reduced in the following ways. First, a decline in travel would affect any MNCs that have business in travel-related industries. The airline, hotel, and tourist-related industries were expected to experience a decline in business. Layoffs were announced immediately by many of these MNCs. Second, these effects on travel-related industries can carry over to 4 other industries, and weaken economies. Third, the cost of international trade increased as a result of tighter restrictions on some products. Fourth, some MNCs incurred expenses as a result of increasing security to protect their employees. 23. Assessing Motives for International Business. Fort Worth Inc. specializes in manufacturing some basic parts for sports utility vehicles that are produced and sold in the U.S. Its main advantage in the U.S. is that its production is efficient, and less costly than that of some other unionized manufacturers. It has a substantial market share in the U.S. Its manufacturing process is labor-intensive. It pays relatively low wages compared to U.S. competitors, but has guaranteed the local workers that their job positions will not be eliminated for the next 30 years. It hired a consultant to determine whether it should set up a subsidiary in Mexico, where the parts would be produced. The consultant suggested that Forth Worth should expand for the following reasons. Offer your opinion on whether the consultants’ reasons are logical: a. Theory of Competitive Advantage: There are not many SUVs sold in Mexico, so Fort Worth Inc. would not have to face much competition there. b. Imperfect Markets Theory: Fort Worth Inc. cannot easily transfer workers to Mexico, but it can establish a subsidiary there in order to penetrate a new market. c. Product Cycle Theory: Fort Worth Inc. has been successful in the U.S. It has limited growth opportunities because it already controls much of the U.S. market for the parts it produces. Thus, the natural next step is to conduct the same business in a foreign country. d. Exchange Rate Risk. The exchange rate of the peso has weakened recently, so this would allow Fort Worth Inc. to build a plant at a very low cost (by exchanging dollars for the cheap pesos to build the plant). e. Political Risk. The political conditions in Mexico have stabilized in the last few months, so Fort Worth should attempt to penetrate the Mexican market now. ANSWER: None of the arguments by the consultant are logical. If SUVs are not sold in the Mexican market, there is no need for these parts in Mexico. Fort Worth Inc. should only attempt to penetrate a new market if there is demand. Just because it has limited growth potential in the U.S., this does not mean that there will be demand for its product in Mexico. Even if the exchange rate is low relative to recent periods, it could decline further, which would adversely affect any the dollar amount of future remitted earnings. Stable political conditions in Mexico are not a sufficient reason to pursue direct foreign investment there. 24. Global Competition. Explain why more standardized product specifications across countries can increase global competition. ANSWER: Standardized product specifications allow firms to more easily expand their business across other countries, which increases global competition. Solution to Continuing Case Problem: Blades, Inc. 1. What are the advantages Blades could gain from importing from and/or exporting to foreign country such as Thailand? ANSWER: The advantages Blades, Inc. could gain from importing from Thailand include potentially lowering Blades cost of goods sold. If the inputs (rubber and plastic) are cheaper when imported from a foreign country such as Thailand, this would increase Blades net income. Since numerous competitors of Blades are already importing components from Thailand, importing would increase Blades competitiveness in the U.S., especially since its prices are among the highest in the roller blade industry. Furthermore, since Blades is considering longer range plans in Thailand, importing from and exporting to Thailand may present it with an opportunity to establish initial relationships with some Thai suppliers. As far as exporting is concerned, Blades, Inc. could be one of the first firms to sell roller blades in Thailand. Considering that Blades is contemplating to eventually shift its sales to Thailand, this could be a major competitive advantage. 2. What are some of the disadvantages Blades could face as a result of foreign trade in the short run? In the long run? ANSWER: There are several potential disadvantages Blades, Inc. should consider. First of all, Blades would be exposed to currency fluctuations in the Thai baht. For example, the dollar cost of imported inputs may become more expensive over time if the baht appreciates even if Thai suppliers do not adjust their prices. However, Blades sales in Thailand would also increase in dollar terms if the baht appreciates, even if Blades does not increase its prices. Blades, Inc. would also be exposed to the economic conditions in Thailand. For example, if there is a recession, Blades would suffer from decreased sales to Thailand. In the long run, Blades should be aware of any regulatory and environmental constraints the Thai government may impose on it (such as pollution controls). Furthermore, the company should be aware of the political risk involved in operating in Thailand. For example, the likelihood of expropriation by the Thai government should be assessed. Another important issue involved in Blades long-run plans is how the foreign subsidiary would be monitored. Geographical distance may make monitoring very difficult. This is an especially important point since Thai managers may conform to goals other than the maximization of shareholder wealth. 3. Which theories of international business described in this chapter apply to Blades, Inc. in the short run? In the long run? ANSWER: There are at least three theories of international business: the theory of comparative advantage, the imperfect markets theory, and the product cycle theory. In the short run, Blades would like to import from Thailand because inputs such as rubber and plastic are cheaper in Thailand. Also, it would like to export to Thailand to take advantage of the fact that few roller blades are currently sold in Thailand. Both of these factors suggest that the imperfect markets theory applies to Blades in the short run. In the long run, the goal is to possibly establish a subsidiary in Thailand and to be one of the first roller blade manufacturers in Thailand. 5 Chapter 2: International Fund Flows 1. IMF. a. What are some of the major objectives of the IMF? ANSWER: Major IMF objectives are to (1) Promote cooperation among countries on international monetary issues, (2) Promote stability in exchange rates, (3) Provide temporary funds to member countries attempting to correct imbalances of international payments, (4) Promote free mobility of capital funds across countries, and (5) Promote free trade. b. How is the IMF involved in international trade? ANSWER: The IMF in involved in international trade because it attempts to stabilize international payments, and trade represents a significant portion of the international payments. 3. Balance of Payments. a. What is the current account generally composed of? ANSWER: The current account balance is composed of: (1) The balance of trade, (2) The net amount of payments of interest to foreign investors and from foreign investment, (3) Payments from international tourism, and (4) Private gifts and grants. b. What is the capital account generally composed of? ANSWER: The capital account is composed of all capital investments made between countries, including both direct foreign investment and purchases of securities with maturities exceeding one year. 4. Free Trade. There has been considerable momentum to reduce or remove trade barriers in an effort to achieve free trade. Yet, one disgruntled executive of an exporting firm stated, “Free trade is not conceivable; we are always at the mercy of the exchange rate. Any country can use this mechanism to impose trade barriers”. What does this statement mean? ANSWER: This statement implies that even if there were no explicit barriers, a government could attempt to manipulate exchange rates to a level that would effectively reduce foreign competition. For example, a U.S. firm may be discouraged from attempting to export to Japan if the value of the dollar is very high against the yen. The prices of the U.S. goods from the Japanese perspective are too high because of the strong dollar. The reverse situation could also be possible in which a Japanese exporting firm is priced out of the U.S. market because of a strong yen (weak dollar).[Answer is based on opinion.] 5. Government Restrictions. How can government restrictions affect international payments among countries? ANSWER: Governments can place tariffs or quotas on imports to restrict imports. They can also place taxes on income from foreign securities, thereby discouraging investors from purchasing. If they loosen restrictions, they can encourage international payments among countries. 7. Inflation Effect on Trade. a. How would a relatively high home inflation rate affect the home country’s current account, other things being equal? ANSWER: A high inflation rate tends to increase imports and decrease exports, thereby increasing the current account deficit, other things equal. b. Is anegative current account harmful to a country? Discuss. ANSWER: This question is intended to encourage opinions and does not have a perfect solution. A negative current account is thought to reflect lost jobs in a country, which is unfavorable. Yet, the foreign importing reflects strong competition from foreign producers, which may keep prices (inflation) low. 8. International Investments. In recent years many U.S.-based MNCs have increased their investments in foreign securities, which are not a ssusceptible to negative shocks in the U.S. market. Also, when MNCs believe that U.S.securities is overvalued, they can pursue non-U.S. securities that are driven by adifferent market. Moreover, in periods of low U.S. interest rates, U.S. corporations tend to seek investments in foreign securities. In general, the flow of funds into foreign countries tends to decline when U.S. investors anticipate a strong dollar. a. Explain how expectations of a strong dollar can affect the tendency of U.S. investors to invest abroad. ANSWER: A weak dollar would discourage U.S. investors from investing abroad. It can cause the investors to purchase foreign currency (when investing) at a higher exchange rate than the exchange rate at which they would sell the currency (when the investment is liquidated). 6 b. Explain how low U.S. interest rates can affect the tendency of U.S.-based MNCs to invest abroad. ANSWER: Low U.S. interest rates can encourage U.S.-based MNCs to invest abroad, as investors seek higher returns on their investment than they can earn in the U.S. c. In general terms, what is the attraction of foreign investments to U.S. investors? ANSWER: The main attraction is potentially higher returns. The international stocks can outperform U.S. stocks, and international bonds can outperform U.S. bonds. However, there is no guarantee that the returns on international investments will be so favorable. Some investors may also pursue international investments to diversify their investment portfolio, which can possibly reduce risk. 9. Exchange Rate Effect on Trade Balance. Would the U.S. balance of trade deficit be larger or smaller if the dollar depreciates against all currencies, versus depreciating against some currencies but appreciated against others? Explain. ANSWER: If the dollar weakens against all currencies, the U.S. balance of trade deficit will likely be smaller. Some U.S. importers would have more seriously considered purchasing their goods in the U.S. if most or all currencies simultaneously strengthened against the dollar. Conversely, if some currencies weaken against the dollar, the U.S. importers may have simply shifted their importing from one foreign country to another. 10. Exchange Rate Effects on Trade. a. Explain why a stronger dollar could enlarge the U.S. balance of trade deficit. Explain why a weaker dollar could affect the U.S. balance of trade deficit. ANSWER: A stronger dollar makes U.S. exports more expensive and may decrease demand. On another hand, it makes U.S. imports cheap and may increase U.S.imports. A weaker home currency increases the prices of imports purchased by the home country and reduces the prices paid by foreign businesses for the home countrys exports. This should cause a decrease in the home country’s demand for imports and an increase in the foreign demand for the home countrys exports, and therefore increase the current account. However, this relationship can be distorted by other factors. b. It is sometimes suggested that a floating exchange rate will adjust to reduce or eliminate any current account deficit. Explain why this adjustment would occur. ANSWER: A current account deficit reflects a net sale of the home currency in exchange for other currencies. This places downward pressure on that home currencys value. If the currency weakens, it will reduce the home demand for foreign goods (since goods will now be more expensive), and will increase the home export volume (since exports will appear cheaper to foreign countries). c. Why does the exchange rate not always adjust to a current account deficit? ANSWER: In some cases, the home currency will remain strong even though a current account deficit exists, since other factors (such as international capital flows) can offset the forces placed on the currency by the currentaccount. 11. Currency Effects. When South Koreas export growth stalled, some South Korean firms suggested that South Koreas primary export problem was the weakness in the Japanese yen. How would you interpret this statement? ANSWER: One of South Koreas primary competitors in exporting is Japan, which produces and exports many of the same types of products to the same countries. When the Japanese yen is weak, some importers switch to Japanese products in place of South Korean products. For this reason, it is often suggested that South Koreas primary export problem is weakness in the Japanese yen. 12. Effects of the Euro. Explain how the existence of the euro may affect U.S. international trade. ANSWER: The euro allowed for a single currency among many European countries. It could encourage firms in those countries to trade among each other since there is no exchange rate risk. This would possibly cause them to trade less with theU.S. The euro can increase trade within Europe because it eliminates the need for several European countries to exchange currencies when trading with each other. 13. Effects of Tariffs. Assume a simple world in which the U.S. exports soft drinks and beer to France and imports wine from France. If the U.S. imposes large tariffs on the French wine, explain the likely impact on the values of the U.S. beverage firms, U.S. wine producers, the French beverage firms, and the French wine producers. ANSWER: TheU.S. wine producers benefit from the U.S. tariffs, while the French wine producers are adversely affected. The French government would likely retaliate by imposing tariffs on the U.S. beverage firms, which would adversely affect their value. The French beverage firms would benefit. 15. Demand for Exports. A relatively small U.S.balance of trade deficit is commonly attributed to a strong demand for U.S. exports.What do you think is the underlying reason for the strong demand for U.S. exports? ANSWER: The strong demand for U.S. exports is commonly attributed to strong foreign economies or to a weak dollar. Solution to Continuing Case Problem: Blades, Inc. 7 1. How could a higher level of inflation in Thailand affect Blades (assume U.S. inflation remains constant)? ANSWER: A high level of inflation in Thailand relative to the United States could affect Blades favorably. Generally, if a country’s inflation rate increases relative to the countries with which it trades, consumers and corporations within the country will most likely purchase more goods overseas, as local goods become more expensive. Consequently, Blades sales to Thailand may increase. 2. How could competition from firms in Thailand and from U.S. firms conducting business in Thailand affect Blades? ANSWER: Blades would be favorably affected relative to Thai roller blade manufacturers and relative to other U.S. roller blade manufacturers with operations in Thailand. Both groups of firms will likely be forced to raise their prices if they want to maintain the same profit margin should inflation in Thailand increase. This is especially true if both groups of firms source their supplies directly from Thailand, sothat the prices of these supplies are subject to the higher inflation in Thailand.Conversely, Blades cost of goods sold incurred in Thailand is relatively small. Chapter 3: International Financial Markets 1. Euro. Explain the foreign exchange situation for countries that use the euro when they engage in international trade among themselves. ANSWER: There is no foreign exchange. Euros are used as the medium of exchange. 2. Eurocredit Loans. a. With regard to Eurocredit loans, who are the borrowers? b. Why would a bank desire to participate in syndicated Eurocredit loans? c. What is LIBOR and how is it used in the Eurocredit market? ANSWER: a. Large corporations and some government agencies commonly request Eurocredit loans. b. With a Eurocredit loan, no single bank would be totally exposed to the risk that the borrower may fail to repay theloan. The risk is spread among all lending banks within the syndicate. c. LIBOR (London interbank offer rate) is the rate of interest at which banks in Europe lend to each other. It is used as a base from which loan rates on other loans are determined in the Eurocredit market. 3. Bid/Ask Spread. Compute the bid/ask percentage spread for Mexican peso retail transactions in which the ask rate is $.11 and the bid rate is $.10. ANSWER: [($.11 - $.10) /$.11] = .091, or 9.1%. 4. Bid/Ask Spread. Utah Banks bid price for Canadian dollars is $.7938 and its ask price is $.81. What is the bid/ask percentage spread? ANSWER: ($.81 - $.7938)/$.81 = .02 or 2% 5. International Financial Markets. Recently, Wal-Mart established two retail outlets in the city of Shanzen, China, which has a population of 3.7 million. These outlets are massive and contain products purchased locally as well as imports. As Wal-Mart generates earnings beyond what it needs in Shanzen, it may remit those earnings back to the United States. Wal-Mart is likely to build additional outlets in Shanzen or in other Chinese cities in the future. a. Explain how the Wal-Mart outlets in China would use the spot market in foreign exchange. ANSWER: The Wal-Mart stores in China need other currencies to buy products from other countries, and must convert the Chinese currency (yuan) into the other currencies in the spot market to purchase these products. They also could use the spot market to convert excess earnings denominated in yuan into dollars, which would be remitted to the U.S. parent. b. Explain how Wal-Mart might utilize the international money market when it is establishing other Wal-Mart stores in Asia. ANSWER: Wal-Mart may need to maintain some deposits in the Euro currency market that can be used (when needed) to support the growth of Wal-Mart stores in various foreign markets. When some Wal-Mart stores in foreign markets need funds, they borrow from banks in the Eurocurrency market. Thus, the Eurocurrency market serves as a deposit or lending source for Wal-Mart and other MNCs on a short-term basis. c. Explain how Wal-Mart could use the international bond market to finance the establishment of new outlets in foreign markets. ANSWER: Wal-Mart could issue bonds in the Eurobond market to generate funds needed to establish new outlets. The bonds may be denominated in the currency that is needed; then, once the stores are established, some of the cash flows generated by those stores could be used to pay interest on the bonds. 6. International Markets. What is the function of the international money market? Briefly describe the reasons for the development and growth of the European money market. Explain how the international money, credit, and bond markets differ from one another. 8 ANSWER: The function of the international money market is to efficiently facilitate the flow of international funds from firms or governments with excess funds to those in need of funds. Growth of the European money market was largely due to (1) regulations in the U.S. that limited foreign lending by U.S. banks; and (2) regulated ceilings placed on interest rates of dollar deposits in the U.S. that encouraged deposits to be placed in the Euro currency market where ceilings were non existent. The international money market focuses on short-term deposits and loans, while the international credit market is used to tap medium-term loans, and the international bond market is used to obtain long-term funds (by issuing long-term bonds). 7. International Diversification. Explain how the Asian crisis would have affected the returns to a U.S. firm investing in the Asian stock markets as a means of international diversification. ANSWER: The returns to the U.S. firm would have been reduced substantially as a result of the Asian crisis because of both declines in the Asian stock markets and because of currency depreciation. For example, the Indonesian stock market declined by about 27% from June 1997 to June 1998. Furthermore, the Indonesian rupiah declined again the U.S.dollar by 84%. 8. Stock Market Integration. Bullet, Inc., a U.S. firm, is planning to issue new stock in the United States during this month. The only decision still to be made is the specific day on which the stock will be issued. Why do you think Bullet monitors results of the Tokyo stock market every morning? ANSWER: The U.S. stock market prices sometimes follow Japanese market prices. Thus, the firm would possibly be able to issue its stock at a lower price in the U.S. if it can use the Japanese market as an indicator of what will happen in the U.S. market. However, these indicators will not always be accurate. 9. Foreign Stock Markets. Explain why firms may issue stock in foreign markets. Why might U.S. firms issue more stock in Europe since the conversion to a single currency in 1999? ANSWER: Firms may issue stock in foreign markets when they are concerned that their home market may be unable to absorb the entire issue. In addition, these firms may have foreign currency inflows in the foreign country that can be used to pay dividends on foreign-issued stock. They may also desire to enhance their global image. Since the euro can be used in several countries, firms may need a large amount of euros if they are expanding across Europe. 11. Foreign Exchange. You just came back from Canada, where the Canadian dollar was worth $.70. You still have C$200 from your trip and could exchange them for dollars at the airport, but the airport foreign exchange desk will only buy them for $.60.Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for $.10 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1300 pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain. ANSWER: Exchange with the tourist. If you exchange the C$ for pesos at theforeign exchange desk, the cross-rate is $.60/$10 = 6. Thus, the C$200 would be exchanged for 1200 pesos (computed as 200*6). If you exchange Canadian dollars for pesos with the tourist, you will receive 1300 pesos. 12. Indirect Exchange Rate. If the direct exchange rate of the euro is worth $1.25, what is the indirect rate of the euro? That is, what is the value of a dollar in euros? ANSWER: 1/1.25 = .8 euros. 13. Cross Exchange Rate. Assume Poland’s currency (the zloty) is worth $.17 and the Japanese yen is worth $.008. What is the cross rate of the zloty with respect to yen? That is, how many yen equal a zloty? ANSWER: $.17/$.008 = 21.25 1 zloty = 21.25 yen 14. Exchange Rate Effects on Investing. Explain how the appreciation of the Australian dollar against the U.S. dollar would affect the return to a U.S. firm that invested in an Australian money market security. ANSWER: If the Australian dollar appreciates over the investment period, this implies that the U.S. firm purchased the Australian dollars to make its investment at a lower exchange rate than the rate at which it will convert A$ to U.S.dollars when the investment period is over. Thus, it benefits from the appreciation. Its return will be higher as a result of this appreciation. 15. Exchange Rate Effects on Borrowing. Explain how the appreciation of the Japanese yen against the U.S. dollar would affect the return to a U.S. firm that borrowed Japanese yen and used the proceeds for a U.S. project. ANSWER: If the Japanese yen appreciates over the borrowing period, this implies that the U.S. firm converted yen to U.S. dollars at a lower exchange rate than the rate at which it paid for yen at the time it would repay the loan. Thus, it is adversely affected by the appreciation. Its cost of borrowing will be higher as a result of this appreciation. 16. Bank Services. List some of the important characteristics of bank foreign exchange services that MNCs should consider. ANSWER: The important characteristics are (1) competitiveness of the quote, (2) the firms’ relationship with the bank, (3) speed of execution, (4) advice about current market conditions, and (5) forecasting advice. 9 10 17. Syndicated Loans. Explain how syndicated loans are used in international markets. ANSWER: A large MNC may want to obtain a large loan that no single bank wants to accommodate by itself. Thus, a bank may create a syndicate whereby several other banks also participate in the loan. 18. Loan Rates. Explain the process used by banks in the Eurocredit market to determine the rate to charge on loans. ANSWER: Banks set the loan rate based on the prevailing LIBOR, and allow the loan rate to float (change every 6 months) in accordance with changes in LIBOR. 19. Evolution of Floating Rates. Briefly describe the historical developments thatled to floating exchange rates as of 1973. ANSWER: Country governments had difficulty in maintaining fixed exchange rates. In 1971, the bands were widened. Yet, the difficulty of controlling exchange rates even within these wider bands continued. As of 1973, the bands were eliminated so that rates could respond to market forces without limits (although governments still did intervene periodically). 20. Interest Rates. Why do interest rates vary among countries? Why are interest rates normally similar for those European countries that use the euro as their currency? Offer a reason why the government interest rate of one country could be slightly higher than that of the government interest rate of another country, even though the euro is the currency used in both countries. ANSWER: Interest rates in each country are based on the supply of funds and demand for funds for a given currency. However, the supply and demandconditions for the euros are dictated by all participating countries in aggregate, and do not vary among participating countries. Yet, the government interest rate in one country that uses the euro could be slightly higher than others that use the euro if it is subject to default risk. The higher interest rate would reflect a risk premium. 21. Forward Contract. The Wolfpack Corporation is a U.S. exporter that invoices its exports to the United Kingdomin British pounds. If it expects that the pound will appreciate against the dollar in thefuture, should it hedge its exports with a forward contract? Explain. ANSWER: The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. Yet, in this case, the Wolfpack Corporation should not hedge because it would benefit from appreciation of the pound when it converts the pounds to dollars. 22. Motives for Investing in Foreign Money Markets. Explain why an MNC may invest funds in a financial market outside its own country. ANSWER: The MNC may be able to earn a higher interest rate on funds invested in a financial market outside of its own country. In addition, the exchange rate of the currency involved may be expected to appreciate. Overall, investors invest in foreign markets from one or more of the following motives: economic conditions, exchange rate expectations, international diversification. 23. Motives for Providing Credit in Foreign Markets. Explain why some financial institutions prefer to provide credit infinancial markets outside their own country. ANSWER: Financial institutions may believe that they can earn a higher return by providing credit in foreign financial markets if interest rate levels are higher and if the economic conditions are strong so that the risk of default on credit provided is low. Creditors may consider supplying capital to countries whose currencies are expected to appreciate against their own, therefore because of exchange rate expectations. The institutions may also want to diversify their credit so that they are not too exposed to the economic conditions in any single country. 24. Effects of September 11. Why do you think the terrorist attack on the U.S. was expected to cause a decline in U.S. interest rates? Given the expectations for a potential decline in U.S. interest rates and stock prices, how were capital flows between the U.S. and other countries likely affected? ANSWER: The attack was expected to cause a weaker economy, which would result in lower U.S. interest rates. Given the lower interest rates, and the weak stock prices, the amount of funds invested by foreign investors in U.S. securities would be reduced. Solution to Continuing Case Problem: Blades, Inc. 1. One point of concern for you is that there is a tradeoff between the higher interest rates in Thailand and the delayed conversion of baht into dollars. Explain what this means. ANSWER: If the net baht-denominated cash flows are converted into dollars today, Blades is not subject to any future depreciation of the baht that would result in less dollar cash flows. 2. If the net baht received from the Thailand operation are invested in Thailand, how will U.S. operations be affected? (Assume that Blades is currently paying 10 percent on dollars borrowed, and needs more financing for its firm.) 11 Chapter 4: Determining Exchange Rates 1. Speculative Effects on Exchange Rates. Explain why a public forecast by a respected economist about future interest rates could affect the value of the dollar today. Why do some forecasts by well-respected economists have no impact on today’s value of the dollar? ANSWER: If the valued opinion (the forecast) of future high interest rates were acted upon, it could have an immediate effect on the dollar. Investors may decide to invest their dollars in foreign securities that are expected not to fluctuate. Consumers might decide to purchase now rather than later because the dollar wouldn’t be as valuable in the future. This would cause supply and demand levels to move. Forecasts may have a larger impact on emerging markets, however.Some forecasts have no impact because of the daily changing value moves so quickly, and there isn’t time to respond. Banks and firms that have large purchasing / borrowing capacities would have a greater impact. Foreign exchange rates are very volatile and a poor forecast could result in huge losses, so investors have hopefully learned not to place as much emphasis on an ‘expert forecast’. 2. Income Effects on Exchange Rates. Assume that the U.S. income level rises at a much higher rate than does the Canadian income level. Other things being equal, how should this affect the (a) U.S. demand for Canadian dollars, (b) Supply of Canadian dollars for sale, and (c) Equilibrium value of the Canadian dollar? ANSWER: The demand for Canadian dollars should increase, supply of Canadian dollars for sale may not be affected, and the Canadian dollars value should increase. 3. Inflation Effects on Exchange Rates. Assume that the U.S. inflation rate becomes high relative to Canadian inflation. Other things being equal, how should this affect the (a) U.S. demand for Canadian dollars, (b) supply of Canadian dollars for sale, and (c) equilibrium value of the Canadian dollar? ANSWER: Demand for Canadian dollars should increase, supply of Canadian dollars for sale should decrease, and the Canadian dollars value should increase. 4. Interest Rate Effects on Exchange Rates. Assume U.S. interest rates fall relative to British interest rates. Other things being equal, how should this affect the (a) U.S. demand for British pounds, (b) supply of pounds for sale, and (c) equilibrium value of the pound? ANSWER: Demand for pounds should increase, supply of pounds for sale should decrease, and the pounds value should increase. 5. Factors Affecting Exchange Rates. What factors affect the future movements in the value of the euro against the dollar? ANSWER: Either trade or financial flows will affect the exchange rates or the interaction of these two will cause a shift in the value of the currency. All relevant factors must be considered simultaneously to assess the likely movements on the euro or the dollar. Supply and demand are the most determining factors. As demand for the euro rises, the demand for the dollar should decrease. 6. Trade Restriction Effects on Exchange Rates. Assume that the Japanese government relaxes its controls on imports by Japanese companies. Other things being equal, how should this affect the (a) U.S. demand for Japanese yen, (b) supply of yen for sale, and (c) equilibrium value of the yen? ANSWER: Given that there would be relaxed controls on imports it’s should cause an increase in the US demand for Japanese yen. The supply of yen for sale should decrease, and the equilibrium value of the yen should increase. 7. Trade Deficit Effects on Exchange Rates. Every month, the U.S. trade deficit figures are announced. Foreign exchange traders often react to this announcement and even attempt to forecast the figures before they are announced. a. Why do you think the trade deficit announcement sometimes has such an impact on foreign exchange trading? ANSWER: The trade deficit announcement may provide a reasonable forecast of future trade deficits and therefore has implications about supply and demand conditions in the foreign exchange market. For example, if the trade deficit was larger than anticipated, and is expected to continue, this implies that the U.S. demand for foreign currencies may be larger than initially anticipated. Thus, the dollar would be expected to weaken. Some speculators may take a position in foreign currencies immediately and could cause an immediate decline in the dollar. b. In some periods, foreign exchange traders do not respond to a trade deficit announcement, even when the announced deficit is very large. Offer an explanation for such a lack of response. ANSWER: If the market correctly anticipated the trade deficit figure, then any news contained in the announcement has already been accounted for in the market. The market should only respond to an announcement about the trade deficit if the announcement contains new information. 8. Factors Affecting Exchange Rates. In the 1990s, Russia was attempting to import more goods but had little to offer other countries in terms of potential exports. In addition, Russia’s inflation rate was high. Explain the type of pressure that these factors placed on the Russian currency. 12 ANSWER: The large amount of Russian imports and lack of Russian exports placed downward pressure on the Russian currency. The high inflation rate in Russia also placed downward pressure on theRussian currency. 9. Factors Affecting Exchange Rates. If the Asian countries experience a decline in economic growth (and experience a decline in inflation and interest rates as a result), how will their currency values (relative to the U.S. dollar) be affected? ANSWER: A relative decline in Asian economic growth will reduce Asian demand for U.S. products, which places upward pressure on Asian currencies. However, given the change in interest rates, Asian corporations with excess cash may now invest in the U.S. or other countries, thereby increasing the demand for U.S.dollars. Thus, a decline in Asian interest rates will place downward pressure on the value of the Asian currencies. The overall impact depends on the magnitude of the forces just described. 10. Comovements of Exchange Rates. Explain why the value of the British pound against the dollar will not always move in tandem with the value of the euro against the dollar. ANSWER: The euros value changes in response to the flow of funds between the U.S. and the countries using the euro or their currency. The pounds value changes in response to the flow of funds between the U.S. and the U.K. [Answer is based on intuition, is not directly from the text.] 11. Measuring Effects on Exchange Rates. Tarheel Co. plans to determine how changes in U.S. and Mexican real interest rates will affect the value of the U.S. dollar. (See Appendix C.) a. Describe a regression model that could be used to achieve this purpose. Also explain the expected sign of the regression coefficient. ANSWER: Various models are possible. One model would be: %Change = a0 + a1 (rU.S. rM) + u in peso Where rU.S. rM a0 a1 u = real interest rate in the U.S. real interest rate in Mexico intercept regression coefficient measuring the relationship between the real interest rate differential and the percentage change in the pesos value error term = Based on the model above, the regression coefficient is expected to have a negative sign. A relatively high real interest rate differential would likely cause a weaker peso value, other things being equal. An appropriate model would also include other independent variables that may influence the percentage change in the pesos value. b. If Tarheel Co. thinks that the existence of a quota in particular historical periods may have affected exchange rates, how might this be accounted for in the regression model? ANSWER: A dummy variable could be included in the model, assigned a value of one for periods when a quota existed and a value of zero when it did not exist. This answer requires some creative thinking, as it is not drawn directly from the text. 12. Factors Affecting Exchange Rates. Mexico tends to have much higher inflation than the United States and also much higher interest rates than the UnitedStates. Inflation and interest rates are much more volatile in Mexico than in industrialized countries. The value of the Mexican peso is typically more volatile than the currencies of industrialized countries from a U.S. perspective; it has typically depreciated from one year to the next, but the degree of depreciation has varied substantially. The bid/ask spread tends to be wider for the peso than for currencies of industrialized countries. Identify the most obvious economic reason for the persistent depreciation of the peso. ANSWER: The high inflation in Mexico places continual downward pressure on the value of the peso. b. High interest rates are commonly expected to strengthen acountrys currency because they can encourage foreign investment in securities in that country, which results in the exchange of other currencies for that currency. Yet, the pesos value has declined against the dollar over most years even though Mexican interest rates are typically much higher than U.S. interest rates. Thus, it appears that the high Mexican interest rates do not attract substantial U.S. investment in Mexico’s securities. Why do you think U.S. investors do not try to capitalize on the high interest rates in Mexico? ANSWER: The high interest rates in Mexico result from expectations of high inflation. That is, the real interest rate in Mexico may not be any higher than the U.S. real interest rate. Given the high inflationary expectations, U.S. investors recognize the potential weakness of the peso, which could more than offset the high interest rate (when they convert the pesos back to dollars at the end of the investment period). Therefore, the high Mexican interest rates do not encourage U.S. investment in Mexican securities, and do not help to strengthen the value of the peso. c. Why do you think the bid/ask spread is higher for pesos than for currencies of industrialized countries? How does this affect a U.S. firm that does substantial business in Mexico? ANSWER: The bid/ask spread is wider because the banks that provide foreign exchange services are subject to more risk when they maintain currencies such as the peso that could decline abruptly at any time. A wider bid/ask spread adversely affects the U.S. firm that does business in Mexico because it increases the transactions costs associated with conversion of dollars to pesos, or pesos to dollars. 13. Interaction of Exchange Rates. Assume that there are substantial capital flows among Canada, the U.S., and Japan. If interest rates in Canada decline to a level below the U.S. interest rate, and inflationary expectations remain unchanged, how could this affect the value of the Canadian dollar against the U.S. dollar? How might this decline in Canada’s interest rates possibly affect the value of the Canadian dollar against the Japanese yen? 13 ANSWER: If interest rates decline in Canada, then US and Japanese investors will increase their flow of capital into Canada, thus increasing the supply of Canadian dollars. If the supply of a lower valued Canadian dollar increases, demand will then decrease over time. The US dollar should experience growth during this time as it invests capital in a market where it is appreciating. The Japanese yen should be the most influenced by the interest rates because of Japan’s assumed heavy capital flow transactions with the Canadians as well as the US. 14. Aggregate Effects on Exchange Rates. Assume that the United States invests heavily in government and corporate securities of Country K. In addition, residents of Country K invest heavily in the United States. Approximately $10 billion worth of investment transactions occur between these two countries each year. The total dollar value of trade transactions per year is about $8 million. This information is expected to also hold in the future. Because your firm exports goods to Country K, your job as international cash manager requires you to forecast the value of Country K’s currency (the krank) with respect to the dollar. Explain how each of the following conditions will affect the value of the krank, holding other things equal. Then, aggregate all of these impacts to develop an overall forecast of the kranks movement against the dollar. a. U.S. inflation has suddenly increased substantially, while Country Ks inflation remains low. ANSWER: Increased U.S. demand for the krank. Decreased supply of kranks for sale. Upward pressure in the kranks value. b. U.S. interest rates have increased substantially, while Country K’s interest rates remain low. Investors of both countries are attracted to high interest rates. ANSWER: Decreased U.S. demand for the krank. Increased supply of kranks for sale. Downward pressure on the kranks value. c. The U.S. income level increased substantially, while Country K’s income level has remained unchanged. ANSWER: Increased U.S. demand for the krank. Upward pressure on the kranks value. d. TheU.S. is expected to impose a small tariff on goods imported from Country K. ANSWER: The tariff will cause a decrease in the United States desire for Country K’s goods, and will therefore reduce the demand for kranks for sale. Downward pressure on the kranks value. e. Combine all expected impacts to develop an overall forecast. ANSWER: Two of the scenarios described above place upward pressure on the value of the krank. However, these scenarios are related to trade, and trade flows are relatively minor between the U.S. and Country K. The interest rate scenario places downward pressure on the kranks value. Since the interest rates affect capital flows and capital flows dominate trade flows between the U.S. and Country K, the interest rate scenario should over whelm all other scenarios. Thus, when considering the importance of implications of all scenarios, the krank is expected to depreciate. 16. National Income Effects. Analysts commonly attribute theappreciation of a currency to expectations that economic conditions will strengthen. Yet, this chapter suggests that when other factors are held constant, increased national income could increase imports and cause the local currency to weaken. In reality, other factors are not constant. What other factor is likely to be affected by increased economic growth and could place upward pressure on the value of the local currency? ANSWER: Interest rates tend to rise in response to a stronger economy, and higher interest rates can place upward pressure on the local currency (as long as there is not offsetting pressure by higher expected inflation). 17. Percentage Depreciation. Assume the spot rate of the British pound is $1.73. The expected spot rate one year from now is assumed to be $1.66. What percentage depreciation does this reflect? ANSWER: ($1.66- $1.73)/$1.73= 4.05% Expected depreciation of 4.05% percent 18. Effects of Real Interest Rates.What are the expected relationship between the relative real interest rates of two countries and the exchange rate of their currencies? ANSWER: A high interest rate may attract foreign inflows (to invest in securities offering high yields), causing an expectation of high inflation. High inflation can place downward pressure on the local currency, so some foreign investors may be discouraged from investing in securities denominated in that country’s currency. The REAL INTEREST RATE adjusts the nominal interest for inflation. This is known as the Fisher effect. 20. Impact of September 11. The terrorist attacks on the U.S. on September 11, 2001 were expected to weaken U.S. economic conditions, and reduce U.S. interest rates. How do you think the weaker U.S. economic conditions would affect trade flows? How would this have affected the value of the dollar (holding other factors constant)? How do you think the lower U.S. interest rates would have affected the value of the U.S. dollar (holding other factors constant)? ANSWER: The weak U.S. economy would result in a reduced demand for foreign products, which results in a decline in the demand for foreign currencies, and therefore places downward pressure on currencies relative to the dollar (upward pressure on the dollars value). The lower U.S. interest rates should reduce the capital flows to the U.S., which place downward pressure on the value of the dollar. 14 21. Impact of Crises. Why do you think most crises in countries (such as the Asian crisis) cause the local currency to weaken abruptly? Is it because of trade or capital flows? ANSWER: Capital flows have a larger influence. In general, crises tend to cause investors to expect that there will be less investment in the country in the future and also cause concern that any existing investments will generate poor returns (because of defaults on loans or reduced valuations of stocks). Thus, as investors liquidate their investments and convert the local currency into other currencies to invest elsewhere, downward pressure is placed on the local currency. 22. Speculation. Blue Demon Bank expects that the Mexican peso will depreciate against the dollar from its spot rate of $.15 to $.14 in 10 days. The following interbank lending and borrowing rates exist: Currency Lending Rate Borrowing Rate U.S. dollar 8.0% 8.3% Mexican peso 8.5% 8.7% Assume that Blue Demon Bank has a borrowing capacity of either $10 million or 70 million pesos in the interbank market, depending on which currency it wants to borrow. a. How could Blue Demon Bank attempt to capitalize on its expectations without using deposited funds? Estimate the profits that could be generated from this strategy. ANSWER: Blue Demon Bank can capitalize on its expectations about pesos (MXP) as follows: 1. Borrow MXP 70 million 2. Convert the MXP 70 million to dollars: MXP 70,000,000*$.15 = $10,500,000 3. Lend the dollars through the interbank market at 8.0% annualized over a 10-day period. The amount accumulated in 10 days is: $10,500,000 [1 + (8%* 10/360)] = $10,500,000*[1.002222] = $10,523,333 4. Repay the peso loan. The repayment amount on the peso loan is: MXP 70,000,000* [1 + (8.7%*10/360)] = 70,000,000 [1.002417] = MXP 70,169,167 5. Based on the expected spot rate of $.14, the amount of dollars needed to repay the peso loan is: MXP 70,169,167* $.14 = $9,823,683 6. After repaying the loan, Blue Demon Bank will have a speculative profit (if its forecasted exchange rate is accurate) of: $10,523,333 - $9,823,683 = $699,650 b. Assume all the preceding information with this exception: Blue Demon Bank expects the peso to appreciate from its present spot rate of $.15 to $.17 in 30 days. How could it attempt to capitalize on its expectations without using deposited funds? Estimate the profits that could be generated from this strategy. ANSWER: Blue Demon Bank can capitalize on its expectations as follows: 1. Borrow $10 million 2. Convert the $10 million to pesos (MXP): $10,000,000/$.15 =MXP 66,666,667. 3. Lend the pesos through the interbank market at 8.5% annualized over a 30-day period. The amount accumulated in 30 days is: MXP 66,666,667* [1 + (8.5%* 30/360)] = 66,666,667* [1.007083] = MXP 67,138,889 4. Repay the dollar loan. The repayment amount on the dollar loan is: $10,000,000* [1 + (8.3%* 30/360)] = $10,000,000 *[1.006917] = $10,069,170 5. Convert the pesos to dollars to repay the loan. The amount of dollars to be received in 30 days (based on the expected spot rate of $.17) is: MXP 67,138,889*$.17 = $11,413,611 6. The profits are determined by estimating the dollars available after repaying the loan: $11,413,611 - $10,069,170 = $1,344,441 23. Speculation. Diamond Bank expects that the Singapore dollar will depreciate against the dollar from its spot rate of $.43 to $.42 in 60 days. The following interbank lending and borrowing rates exist: Currency Lending Rate Borrowing Rate U.S. dollar 7.0% 7.2% Singapore 22.0% 24.0% dollar Diamond Bank considers borrowing 10 million Singapore dollars in the interbank market and investing the funds in dollars for 60 days. Estimate the profits (or losses) that could be earned from this strategy. Should Diamond Bank pursue this strategy? ANSWER: 1. Borrow S$10,000,000 2. Convert to U.S. $: S$10,000,000* $.43 =$4,300,000 3. Invest funds for 60 days. The rate earned in the U.S. for 60 days is: 7%*(60/360) = 1.17% Total amount accumulated in 60 days: $4,300,000* (1 + .0117) =$4,350,310 4. Convert U.S. $ back to S$ in 60 days: $4,350,310/$.42 = S$10,357,881 5. The rate to be paid on loan is: .24*(60/360) = .04 Amount owed on S$ loan is: S$10,000,000*(1 + .04) = S$10,400,000 15 6. This strategy results in a loss: S$10,357,881- S$10,400,000 = -S$42,119. Diamond Bank should not pursue this strategy. Chapter 5: Exchange Rate Derivatives 5 1. Forward versus Future contracts. Compare and contrast forward and future contracts. ANSWER: Currency futures contracts are similar to forward contrast in that they allow a customer to lock in the exchange rate at which a specific currency is purchased or sold for a specific date in the future. Neverthless, there are some differences between currency futures contracts and forward contracts, which are summarized in exhibit below. Currency futures contracts are sold on an exchange, while each forward contract is negotiated between a firm and a commercial bank over a telecommunications network. Thus, forward contracts can be tailored to the needs of the firm, while currency futures contracts are standardized. Corporations that have established relationships with large banks tend to use forward contracts rather than futures because forward contracts are tailored to the precise amount of currency to be purchased or sold in the future and the precise forward date that they prefer. Conversely, small firms and individuals who do not have established relationships with large banks or prefer to trade in smaller amounts tend to use currency futures contracts. 2. Advantages and disadvantages of forward and future contracts. ANSWER: Forward Contracts: Advantages: Can be written for any amount and term, Offers a complete hedge. Disadvantages: Difficult to find a counterparty (no liquidity), requires tying up capital, subject to default risk. Futures Contracts: Advantages: Lots of liquidity, Position can be reversed easily, doesn’t tie up much capital Disadvantages: Written for fixed amounts and terms, Offers only a partial hedge, Subject to basis risk (bond issuer can default). 3. Using Currency Futures. a. How can currency futures be used by corporations? ANSWER: U.S. corporations that desire to lock in a price at which they can sell a foreign currency would sell currency futures. U.S. corporations that desire to lock in a price at which they can purchase a foreign currency would purchase currency futures. b. How can currency futures be used by speculators? ANSWER: Speculators who expect a currency to appreciate could purchase currency futures contracts for that currency. Speculators who expect a currency to depreciate could sell currency futures contracts for that currency. 16 4. Currency options. Differentiate between a currency call option and a currency put option. ANSWER: Currency call option - right to buy ccy; Currency put option – right to sell ccy; Currency options provide the right but not the obligation to purchase or sell currencies at specified prices within a specified period of time. A currency put option provides the right but not the obligation to sell a specified currency for a specified price within a specified period of time. A currency call option is said to be: - IN THE MONEY when the present exchange rate exceeds the strike price. - AT THE MONEY when the present exchange rate equals the strike price. - OUT OF THE MONEY when the present exchange rate is less than the strike price. A currency put option is said to be: - IN THE MONEY when the present exchange rate is less the strike price. - AT THE MONEY when the present exchange rate equals the strike price. - OUT OF THE MONEY when the present exchange rate exceeds the strike price. 5. Forward premium. Compute the forward discount or premium for the Mexican peso whose 90-day forward rate is £0.05 and the spot rate is £0.051. State whether your answer is discount or premium. ANSWER: = (F-S) / S * 360 / no of days; = (0.05- 0.051) / 0.051 * 360/90 = -0.078 or -7.8% (discount). 6. Effects of a forward contract. How can a forward contract backfire? ANSWER: If the spot rate of the foreign currency at the time of the transaction is worth less than the forward rate that was negotiated, or is worth more than the forward rate that was negotiated, the forward contract has backfired. 7. Hedging with currency options. When would a U.S. firm consider purchasing a call option on euros for hedging? When would a U.S. firm consider purchasing a put option on euros for hedging? ANSWER: A call option can hedge a firm s future payables denominated in euros. It effectively locks in the maximum price to be paid for euros. A put option on euros can hedge a U.S. firm’s future receivables denominated in euros. It effectively locks in the minimum price at which it can exchange euros received. 8. Currency calls option premiums. List the factors that affect currency call option premiums and briefly explain the relationship that exists for each. Do you think an at-the-money call option in euros has a higher or lower premium than an at-the-money call option in British pounds (assuming the expiration date and the total dollar value represented by each option are the same for both options)? ANSWER: These factors are listed below: The higher the existing spot rate relative to the strike price, the greater is the call option value, other things equal. The longer the period prior to the expiration date, the greater is the call option value, other things equal. The greater the variability of the currency, the greater is the call option value, other things equal. The at-the-money call option in euros should have a lower premium because the euro should have less volatility than the pound. 9. Currency put option premiums. List the factors that affect currencies put options and briefly explain the relationship that exists for each. ANSWER: These factors are listed below: The lower the existing spot rate relative to the strike price, the greater is the put option value, other things equal. The longer the period prior to the expiration date, the greater is the put option value, other things equal. The greater the variability of the currency, the greater is the put option value, other things equal. 10. Speculating with currency call options. Randy Rudecki purchased a call option on British pounds for $.02 per unit. The strike price was $1.45 and the spot rate at the time the option was exercised was $1.46. Assume there are 31,250 units in a British pound option. What was Randy s net profit on this option? ANSWER: Profit per unit on exercising the option = $0.01 (kada se oduzme $1.46 - $1.45) Premium paid per unit = $0.02 Net profit per unit = -$0.01 ($0.01-$02 = -$01) Net profit per option = 31,250 * -$0.01 = -$312.50 *** Recalling the 4th question… A currency call option is said to be OUT OF THE MONEY when the present exchange rate is less than the strike price, as it is in this case. 17 11. Speculating with put currency options. Alice Duever purchased a put option on British pounds for $.04 per unit. The strike price was $1.80 and the spot rate at the time the pound option was exercised was $1.59. Assume there are 31,250 units in a British pound option. What was Alice s net profit on the option? ANSWER: Profit per unit on exercising the option = $1.80-$1.59 = $0.21 Premium paid per unit = $0.04 Net profit per unit = $0.21- $0.04 = $0.17 Net profit per option = 31,250 * $0.17 = $5,321.50 12. Selling currency call options. Mike sold a call option on Canadian dollars for £0.01 per unit. The strike price was £0.42, and the spot rate at the time the option was exercised was £0.46. Assume Mike did not obtain Canadian dollars until the option was exercised. Also assume that there are 50,000 units in a Canadian dollar option. What was Mike’s net profit on the call option? ANSWER: Premium received per unit = £0.01 Amount per unit received from selling C$ at strike = £0.42 Amount per unit paid when purchasing C$ = £0.46 Net profit per unit = -£0.03 (dobija se: £0.42-£0.46-£0.01) Profit on call option = -£1,500 (dobija se: 50,000 units * -£0.03) 13. Selling currency put options. Brian sold a put option on Canadian dollars for £0.02 per unit. The strike price was £0.42, and the spot rate at the time option was exercised was £0.40. Assume Brian immediately sold off the Canadian dollars received when the option was exercised. Also assume that there are 50,000 units in a Canadian dollar option. What was Brian’s net profit on the put option? ANSWER: Premium received per unit = £0.02 Amount per unit received from selling C$ at spot = £0.40 Amount per unit paid for C$ = £0.42 Net profit per unit = £0.00 14. Forward versus Currency Option Contracts. What are the advantages and disadvantages to a MNC that uses currency options on euros rather than a forward contract on euros to hedge its exposurein euros? Explain why a MNC use forward contracts to hedge committed transactions and use currency options to hedge contracts that are anticipated but not committed. Why might forward contracts be advantageous for committed transactions, and currency options be advantageous for anticipated transactions? ANSWER: A currency option on euros allows more flexibility since it does not commit one to purchase or sell euros (as is the case with a euro futures or forward contract). Yet, it does allow the option holder to purchase or sell euros at a locked-in price. The disadvantage of a euro option is that the option itself is not free. One must pay a premium for the call option, which is above and beyond the exercise price specified in the contract at which the euro could be purchased. A MNC may use forward contracts to hedge committed transactions because it would be cheaper to use a forward contract (a premium would be paid on an option contract that has an exercise price equal to the forward rate). The MNC may use currency options contracts to hedge anticipated transactions because it has more flexibility to let the contract go unexercised if the transaction does not occur. 15. Speculating with currency futures. Assume that euro’s spot rate has moved in cycles over time. How might you try to use futures contracts on euros to capitalize on this tendency? How could yo determine whether such a strategy would have been profitable in previous periods? ANSWER: Use recent movements in the euro to forecast future movements. If the euro has been strengthening, purchase futures on euros. If the euro has been weakening, sell futures on euros. A strategy’s profitability can be determined by comparing the amount paid for each contract to the amount for which each contract was sold. 16. Hedging with currency derivates. Assume that the transactions listed in the first column of the following table are anticipated by UK firms that have no other foreign transactions. Place an ‘X’ in the table wherever you see possible ways to hedge each of the transactions. a. George ltd plans to purchase Japanese goods denominated in yen. b. Harvard ltd sold goods to Jaan, denominated in yen. c. Yale plc has a subsidiary in Australia that will be remitting funds to the US parent. d. Brown ltd needs to pay off existing loans that are denominated in Canadian dollars. e. Princeton ltd may purchase a company in Japan in the near future (but the deal may not go through). 18 ANSWER: a. George ltd plans to purchase Japanese goods denominated in yen. b. Harvard ltd sold goods to Jaan, denominated in yen. c. Yale plc has a subsidiary in Australia that will be remitting funds to the US parent. d. Brown ltd needs to pay off existing loans that are denominated in Canadian dollars. e. Princeton ltd may purchase a company in Japan in the near future (but the deal may not go through). FORWARD CONTRACTS FWD Purchase FWD Sale FUTURE CONTRACTS Buy futures Sell futures OPTIONS CONTRACTS Purchase call Purchase put X X X X X X X X X X X X X 17. Price Movements of Currency Futures. Assume that on November 1, the spot rate of the British pound was $1.58 and the price on a December futures contract was $1.59. Assume that the pound depreciated during November so that by November 30 it was worth $1.51. a. What do you think happened to the futures price over the month of November? Why? ANSWER: The December futures price would have decreased, because it reflects expectations of the future spot rate as of the settlement date. If the existing spot rate is $1.51, the spot rate expected on the December futures settlement date is likely to be near $1.51 as well. b. If you had known that this would occur, would you have purchased or sold a December futures contract in pounds on November 1? Explain. ANSWER: You would have sold futures at the existing futures price of $1.59. Then as the spot rate of the pound declined, the futures price would decline and you could close out your futures position by purchasing a futures contract at a lower price. Alternatively, you could wait until the settlement date, purchase the pounds in the spot market, and fulfill the futures obligation by delivering pounds at the price of $1.59 per pound. 18. Speculating with Currency Futures. Assume that a March futures contract on Mexican pesos was available in January for $.09 per unit. Also assume that forward contracts were available for the same settlement date at a price of $.092 per peso. How could speculators capitalize on this situation, assuming zero transaction costs? How would such speculative activity affect the difference between the forward contract price and the futures price? ANSWER: Speculators could purchase peso futures for $.09 per unit, and simultaneously sell pesos forward at $.092 per unit. When the pesos are received (as a result of the futures position) on the settlement date, the speculators would sell the pesos to fulfill their forward contract obligation. This strategy results in a $.002 per unit profit. As many speculators capitalize on the strategy described above, they would place upward pressure on futures prices and downward pressure on forward prices. Thus, the difference between the forward contract price and futures price would be reduced or eliminated. 19. Speculating with Currency Call Options. LSU Corp. purchased Canadian dollar call options for speculative purposes. If these options are exercised, LSU will immediately sell the Canadian dollars in the spot market. Each option was purchased for a premium of $.03 per unit, with an exercise price of $.75. LSU plans to wait until the expiration date before deciding whether to exercise the options. Of course, LSU will exercise the options at that time only if it is feasible to do so. In the following table, fill in the net profit (or loss) per unit to LSU Corp. based on the listed possible spot rates of the Canadian dollar on the expiration date. ANSWER: Possible spot rate of C$ on Net profit / loss per unit to expiration date LSU corporation if spot rate occurs -$0.02 or $0.76-$0.75-$0.03 $0.76 19 $0.78 $0.80 $0.82 $0.85 $0.87 $0.00 $0.02 $0.04 $0.07 $0.09 20. Speculating with Currency Put Options. Auburn Co. has purchased Canadian dollar put options for speculative purposes. Each option was purchased for a premium of £.02 per unit, with an exercise price of £0.48 per unit. Auburn Co. will purchase the Canadian dollars just before it exercises the options (if it is feasible to exercise the options). It plans to wait until the expiration date before deciding whether to exercise the options. In the following table, fillin the net profit (or loss) per unit to Auburn Co. based on the listed possible spot rates of the Canadian dollar on the expiration date. ANSWER: Possible spot rate of C$ on Net profit / loss per unit to expiration date Auburn ltd £0.04 or (£0.48-£0.42-£0.02) £0.42 £0.02 £0.44 £0.00 £0.46 -£0.02 £0.48 -£0.02 £0.50 -£0.02 £0.52 21. Speculating with Currency Call Options. Bama Corp. has sold dollar call options for speculative purposes.The option premium was £0.04 per unit, and the exercise price was £0.54. Bama will purchase the dollars on the day the options are exercised (if the options are exercised) in order to fulfill its obligation. In the following table, fill in the net profit (or loss) to BamaCorp. if the listed spot rate exists at the time the purchaser of the call options considers exercising them. ANSWER: Possible spot rate at the time the Net profit / loss per unit to Bama purchaser of the call option considers plc exercising them £0.48 £0.04 (premia) £0.50 £0.04 (premia) £0.52 £0.04 (premia) £0.54 £0.04 (premia) £0.56 £0.02 (0.54-0.56+0.04) £0.58 £0.00 (0.54-0.58+0.04) £0.60 -£0.02 (0.54-0.60+0.04) 22. Speculating with Currency Put Options. Bulldog, Inc., has sold Australian dollar put options at a premium of £.01 per unit, and an exercise price of £.42 per unit. It has forecasted the Australian dollar’s lowest level over the period of concern as shown in the following table. Determine the net profit (or loss) per unit to Bulldog, Inc., if each level occurs and the put options are exercised at that time. ANSWER: Possible value of Australian dollar £0.38 £0.39 £0.40 £0.41 £0.42 Net profit / loss per unit to Bulldog Ltd if value occurs -£0.03 (0.38-0.42+0.01) -£0.02 (0.39-0.42+0.01) -£0.01 (0.40-0.42+0.01) £0.00 (0.41-0.42+0.01) £0.01 (0.42-0.42+0.01) 23. Hedging with Currency Derivatives. A U.S. professional football team plans to play an exhibition game in the United Kingdom next year. Assume that all expenses will be paid by the British government, and that the team will receive a check for 1 million pounds. The team anticipates that the pound will depreciate substantially by the scheduled date of the game. In addition, the National Football League must approve the deal, and approval (or disapproval) will not occur for three months. How can the team hedge its position? What is there to lose by waiting three months to see if the exhibition game is approved before hedging? 20 ANSWER: The team could purchase put options on pounds in order to lock in the amount at which it could convert the 1 million pounds todollars. The expiration date of the put option should correspond to the date in which theteam would receive the 1 million pounds. If the deal is not approved, the team could let the put options expire. If the team waits three months, option prices will have changed by then. If the pound has depreciated over this three-month period, put options with the same exercise price would command higher premiums. Therefore, the team may wish to purchase put options immediately. The team could also consider selling futures contracts on pounds, but it would be obligated to exchange pounds for dollars in the future, even if the deal is not approved. 24. Speculating With Currency Options. When should a speculator purchase a call option on Australian dollars? When should a speculator purchase a put option on Australian dollars? ANSWER: Speculators should purchase a call option on Australian dollars if they expect the Australian dollar value to appreciate substantially over the period specified by the option contract. Speculators should purchase a put option on Australian dollars if they expect the Australian dollar value to depreciate substantially over the period specified by the option contract. 25. Speculating with Currency Futures. Assume that the euro’s spot rate has moved in cycles over time. How might you try to use futures contracts on euros to capitalize on this tendency? How could you determine whether such a strategy would have been profitable in previous periods? ANSWER: Use recent movements in the euro to forecast future movements. If the euro has been strengthening, purchase futures on euros. If the euro has been weakening, sell futures on euros. Strategy s profitability can be determined by comparing the amount paid for each contract to the amount for which each contract was sold. Chapter 7: International Arbitrage and Interest Rate Parity (IRP) 1. Locational Arbitrage. Explain the concept of locational arbitrage and the scenario necessary for it to be plausible. ANSWER: Locational arbitrage can occur when the spot rate of a given currency varies among locations. Specifically, the ask rate at one location must be lower than the bid rate at another location. The disparity in rates can occur since information is not always immediately available to all banks. If a disparity does exist, locational arbitrage is possible; as it occurs, the spot rates among locations should become realigned. 2. Locational Arbitrage. Assume the following information: Bid price of New Zealand dollar Ask price of New Zealand dollar Beal Bank £0.020 £0.022 Yardley Bank £0.018 £0.019 Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had £1,000,000 to use. What market forces would occur to eliminate any further possibilities of locational arbitrage? ANSWER: Yes. Steps: Purchase NZ$ at Yardley bank for £0.019 (£1,000,000/£0.019=52,631,579NZ$) Sell the NZ$ to Beal Bank for £0.020 (52,631,579NZ$ *£0.020 = £1,052,632 ) Generate the profit. (£1,052,632-£1,000,000=£52,632) The large demand for New Zealand dollars at Yardley Bank will force this bank's ask price on New Zealand dollars to increase. The large sales of New Zealand dollars to Beal Bank will force its bid price down. Once the ask price of Yardley Bank is no longer less than the bid price of Beal Bank, locational arbitrage will no longer be beneficial. 3. Triangular arbitrage. Explain the concept of triangular arbitrage and the scenario necessary for it to be plausible. ANSWER: Triangular arbitrage is possible when the actual cross exchange rate between two currencies differs from what it should be. The appropriate cross rate can be determined given the values of the two currencies with respect to some other currency. 4. Triangular Arbitrage. Assume the following information: Quoted Price Value of Canadian dollar in U.S. dollars $.90 Value of New Zealand dollar in U.S. dollars $.30 Value of Canadian dollar in New Zealand dollars NZ$3.02 21 Given this information, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage? ANSWER: Yes.The appropriate cross exchange rate should be 1 Canadian dollar = 3 New Zealand dollars. Thus, the actual value of the Canadian dollars in terms of New Zealand dollars is more than what it should be. One could obtain Canadian dollars with U.S. dollars, sell the Canadian dollars for New Zealand dollars and then exchange New Zealand dollars for U.S. dollars. With $1,000,000, this strategy would generate $1,006,667 thereby representing a profit of $6,667. [$1,000,000/$.90 = C$1,111,111* 3.02 = NZ$3,355,556 * $.30 = $1,006,667]. The value of the Canadian dollar with respect to the U.S. dollar would rise. The value of the Canadian dollar with respect to the New Zealand dollar would decline. The value of the New Zealand dollar with respect to the U.S. dollar would fall. 5. Covered Interest Arbitrage. Explain the concept of covered interest arbitrage and the scenario necessary for it to be plausible. ANSWER: Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a forward contract to sell that currency when the investment matures. Covered interest arbitrage is plausible when the forward premium does not reflect the interest rate differential between two countries specified by the interest rate parity formula. If transactions costs or other considerations are involved, the excess profit from covered interest arbitrage must more than offset these other considerations for covered interest arbitrage to be plausible. 6. Covered Interest Arbitrage. Assume the following information: Spot rate of Canadian dollar $0.80 90-day forward rate of Canadian dollar $0.79 90-day Canadian interest rate 4.00% 90-day US interest rate 2.50% Given this information, what would be the yield (percentage return) to a US investor who used covered interest arbitrage? (Assume the investor invests $1,000,000). What market forces would occur to eliminate any further possibilities of covered interest arbitrage? ANSWER: = $1,000,000/$0.80 = C$1,250,000 = C$1,250,000 * (1+0.04) = C$1,300,000 = C$1,300,000 * 0.79 = $1,027,000 Yield = ($1,027,000 - $1,000,000) / $1,000 = 2.7% which exceeds the yield in the US over the 90-days period. The Canadian’s dollar spot rate should rise and its forward rate should fall; in addition, the Canadian interest rate may fall and the US interest may rise. 7. Covered Interest Arbitrage. Assume the following information: Spot rate of Mexican peso $0.100 180-day forward rate of Mexican peso $0.098 180-day Mexican interest rate 6.00% 180-day US interest rate 5.00% Given this information, is covered interest rate arbitrage worthwhile for Mexican investors who have pesos to invest? Explain the answer. ANSWER: To answer this question, begin with an assumed amount of pesos and determine the yield to Mexican investors who attempt covered interest arbitrage. Assumed initial amount is MXP 1,000,000. MXP 1,000,000 * $0.100 = $100,000 $100,000 * (1+0.05) = $105,000 $105,000 / $0.098 = MXP 1,071,429 Yield= (MXP 1,071,429 – MXP 1,000,000) / MXP 1,000,000 = 7.14% which exceeds their domestic yield. Thus, it is worthwhile for the Mexican investor. 8. / 9. Interest rate parity. Explain the concept of interest rate parity. Provide the rationale for its possible existence. 22 ANSWER: Interest rate parity states that the forward rate premium (or discount) of a currency should reflect the differential in interest rates between two countries. If interest rate parity did not exist, covered interest arbitrage could occur (in the absence of transaction costs and foreign risk), which should cause market forces to move back toward conditions which reflect interest rate parity. 10. Inflation Effects on the Forward Rate. Why do you think currencies of countries with high inflation rates tend to have forward discounts? ANSWER: These currencies have high interest rates, which cause forward rates to have discounts as a result of interest rate parity. 11. Covered Interest Arbitrage in Both Directions. Assume that the existing U.S. one-year interest rate is 10 percent and the Canadian one-year interest rate is 11 percent. Also assume that interest rate parity exists. Should the forward rate of the Canadian dollar exhibit a discount or a premium? If U.S. investors attempt covered interest arbitrage, what will be their return? If Canadian investors attempt covered interest arbitrage, what will be their return? ANSWER: The Canadian dollar's forward rate should exhibit a discount because its interest rate exceeds the U.S. interest rate. U.S. investors would earn a return of 10 percent using covered interest arbitrage, the same as what they would earn in the U.S. Canadian investors would earn a return of 11 percent using covered interest arbitrage, the same as they would earn in Canada. 12. Interest rate parity. Why would UK investors consider covered interest arbitrage in France when the interest rate on euros in France is lower than the UK interest? ANSWER: If the forward premium on euros more than offsets the lower interest rate, investors could use covered interest arbitrage by investing in euros and achieve higher returns than in the UK. 13. Interest rate parity. Consider investors who invest in either US or British one-year Treasury bills. Assume zero transaction costs and no taxes. a. ‘If interest rate parity exists, then the return for UK investos who use covered interest arbitrage will be the same as the return for UK Treasury bills.’ Is the statement true or false? If false, correct the statement. b. ‘If interest rate parity exists, then the return for British investors who use covered interest arbitrage will be the same as the return for British investors who invest in British Treasury bills.’ Is the statement true or false? If false, correct the statement. ANSWER: a. TRUE b. TRUE 14. Changes in forward premiums. Assume that the Japanese yen’s forward rate currently exhibits a premium of 6% and that interest rate parity exists. If US interest rates decrease, how must this premium change to maintain interest rate parity? Why might we expect the premium to change? ANSWER: The premium will decrease in order to maintain IRP, because the difference between the interest rates is reduced. We would expect the premium to change because as US interest rates decrease, US investors could benefit from covered interest arbitrage if the forward premium stays the same. The return earned by US investors who use covered interest arbitrage would not be any higher than before, but the return would now exceed the interest rate earned in the US. Thus, there is downward pressure on the forward premium. 15. Changes in forward premiums. Assume that the forward rate premium of the euro was higher last month than it is today. What does this imply about interest rate differentials between the US and Europe today compared to those last month? ANSWER: The interest rate differential is smaller now than it was last month. 16. Interest rate parity. If the relationship that is specified by interest rate parity does not exist at any period but does exist on average, then covered interest arbitrage should not be considered by US firms. Do you agree or disagree with this statement? Explain. ANSWER: Disagree. If at any point in time, interest rate parity does not exist, covered interest arbitrage could earn excess returns (unless transaction costs, tax differences, offset the excess returns…). 17. Covered interest arbitrage in both directions. The one-year interest rate in New Zealand is 6%. The one-year U.S.interest rate is 10%. The spot rate of the New Zealand dollar (NZ$) is $.50. The forward rate of the New Zealand dollar is $.54. Is covered interest arbitrage feasible for U.S. investors? Is it feasible for New Zealand investors? In each case, explain why covered interest arbitrage is or is not feasible. ANSWER: To determine the yield from covered interest arbitrage by U.S. investors, start with an assumed initial investment, such as $1,000,000. $1,000,000/$.50 = NZ$2,000,000 * (1.06) = NZ$2,120,000 * $.54 =$1,144,800 NZ$2,000,000 * (1.06) = NZ$2,120,000 NZ$2,120,000 * $.54 =$1,144,800 23 Yield = ($1,144,800 - $1,000,000)/$1,000,000 = 14.48% Thus, U.S. investors can benefit from covered interest arbitrage because this yield exceeds the U.S. interest rate of 10%. To determine the yield from covered interest arbitrage by New Zealand investors, start with an assumed initial investment, such as NZ$1,000,000. NZ$1,000,000 * $.50 = $500,000 * (1.10) = $550,000/$.54 = NZ$1,018,519 $500,000 * (1.10) = $550,000 $550,000/$.54 = NZ$1,018,519 Yield =(NZ$1,018,519 - NZ$1,000,000)/NZ$1,000,000 = 1.85% Thus, New Zealand investors would not benefit from covered interest arbitrage since the yield of 1.85% is less than the 6% that they could receive from investing their funds in New Zealand. 18. Limitations of Covered Interest Arbitrage. Assume that the one-year U.S. interest rate is 11 percent, while the one-year interest rate in Malaysia is 40 percent. Assume that a U.S. bank is willing to purchase the currency of that country from you one year from now at a discount of 13 percent. Would covered interest arbitrage be worth considering? Is there any reason why you should not attempt covered interest arbitrage in this situation? (Ignore tax effects.) ANSWER: Covered interest arbitrage would be worth considering since the return would be 21.8 percent, which is much higher than the U.S.interest rate. Assuming a $1,000,000 initial investment, $1,000,000 * (1.40) * 0.87 =$1,218,000 Yield = ($1,218,000 - $1,000,000)/$1,000,000 = 21.8% However, the funds would be invested in Malaysia, which could cause some concern about default risk or government restrictions on convertibility of the currency back to dollars. 19. Covered Interest Arbitrage in Both Directions. Assume that the annual U.S. interest rate is currently 8 percent and Germany’s annual interest rate is currently 9 percent. The euros one-year forward rate currently exhibits a discount of 2 percent. a. Does interest rate parity exist? ANSWER: No, because the discount is larger than the interest rate differential. b. Can a U.S. firm benefit from investing funds in Germany using covered interest arbitrage? ANSWER: No, because the discount on a forward sale exceeds the interest rate advantage of investing in Germany. c. Can a German subsidiary of a U.S. firm benefit by investing funds in the United States through covered interest arbitrage? ANSWER: Yes, because even though it would earn 1 percent less interest over the year by investing in U.S. dollars, it would be able to sell dollars for 2 percent more than it paid for them (it would be buying euros forward at a discount of 2 percent). 20. Covered Interest Arbitrage. The South African rand has a one-year forward premium of 2 percent. One-year interest rates in the U.S. are 3 percentage points higher than in South Africa. Based on this information, is covered interest arbitrage possible for a U.S. investor if interest rate parity holds? ANSWER: No, covered interest arbitrage is not possible for a U.S.investor. Although the investor can lock in the higher exchange rate in one year, interest rates are 3 percent lower in South Africa. 21. Deriving the Forward Rate. Assume that annual interest rates in the U.S. are 4 percent, while interest rates in France are 6 percent. a. According to IRP, what should the forward rate premium or discount of the euro be? b. If the euros spot rate is $1.10, what should the one-year forward rate of the euro be? ANSWER: a. p = (1.04) / (1.06) -1 = -0.0189 or -1.89% Discount. b. F = $1.10 * (1 - 0.0189) = $1.079 22. Covered Interest Arbitrage in Both Directions. The following information is available: You have $500,000 to invest The current spot rate of the Moroccan dirham is $0.110. The 60-day forward rate of the Moroccan dirham is $.108. 24 The 60-day interest rate in the U.S. is 1 percent. The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? ANSWER: a. Covered interest arbitrage would involve the following steps: 1. Convert dollars to Moroccan dirham: $500,000/$.11 = MD 4,545,454.55 2. Deposit the dirham in aMoroccan bank for 60 days. You will have MD 4,545,454.55 * (1.02) = MD 4,636,363.64 in 60 days. 3. In 60 days, convert the dirham back to dollars at the forward rate and receive MD 4,636,363.64 * $.108 = $500,727.27 The yield to the U.S. investor is ($500,727.27/$500,000) - 1 = .15%. Covered interest arbitrage did not work for the investor in this case. The lower Moroccan forward rate more than offsets the higher interest rate in Morocco. b. Yes, covered interest arbitrage would be possible for a Moroccan investor. The investor would convert dirham to dollars, invest the dollars at a 1 percent interest rate in the U.S., and sell the dollars forward 60 days. Even though the Moroccan investor would earn an interest rate that is 1 percent lower in the U.S., the forward rate discount of the dirham more than offsets that differential. 23. Testing Interest Rate Parity. Describe a method for testing whether interest rate parity exists. Why are transactions costs, currency restrictions, and differential tax laws important when evaluating whether covered interest arbitrage can be beneficial? ANSWER: At any point in time, identify the interest rates of the U.S. versus some foreign country. Then determine the forward rate premium (or discount) that should exist according to interest rate parity. Then determine whether this computed forward rate premium (or discount) is different from the actual premium (or discount). Even if interest rate parity does not hold, covered interest arbitrage could be of no benefit if transactions costs or tax laws offset any excess gain. In addition, currency restrictions enforced by a foreign government may disrupt the act of covered interest arbitrage. 24. Testing IRP. The one-year interest rate in Singapore is 11 percent. The one-year interest rate in the U.S. is 6 percent. The spot rate of the Singapore dollar (S$) is $.50 and the forward rate of the S$ is $.46. Assume zero transactions costs. a. Does interest rate parity exist? ANSWER: No, because the discount is larger than the interest rate differential. b. Can a U.S. firm benefit from investing funds in Singapore using covered interest arbitrage? ANSWER: No, because the discount on a forward sale exceeds the interest rate advantage of investing inSingapore. 25. Differences among Forward Rates. Assume that the 30-day forward premium of the euro is -1 percent, while the 90-day forward premium of the euro is 2 percent. Explain the likely interest rate conditions that would cause these premiums. Does this ensure that covered interest arbitrage is worthwhile? ANSWER: These premiums could occur when the euros 30-day interest rate is above the U.S. 30-day interest rate, but the euros 90day interest rate is below the U.S. 90-day interest rate. Covered interest arbitrage is not necessarily worthwhile, since interest rate parity may still hold. 26. Deriving the Forward Rate. Before the Asian crisis began, Asian central banks were maintaining a somewhat stable value for their respective currencies. Nevertheless, the forward rate of Southeast Asian currencies exhibited a discount. Explain. ANSWER: The forward rate for the Asian currencies exhibited a discount to reflect that differential between the Asian country's interest rate and the U.S. interest rate, in accordance with interest rateparity (IRP). If the forward rate had not exhibited a discount, a U.S. investor could have conducted covered interest arbitrage by converting dollars to the foreign currency, investing in the foreign country, and simultaneously selling the foreign currency forward. 27. Economic Effects on the Forward Rate. Assume that Mexicos economy has expanded significantly, causing a high demand for loanable funds there by local firms. How might these conditions affect the forward discount of the Mexican peso? ANSWER: Expansion in Mexico creates a demand for loanable funds, which places upward pressure on Mexican interest rates, which increases the forward discount on theMexican peso (or reduces the premium). 28. Interpreting a Large Forward Discount. The interest rate in Indonesia is commonly higher than the interest rate in the U.S., which reflects a higher expected rate of inflation there. Why should Nike consider hedging its future remittances from Indonesia to the U.S. parent even when the forward discount on the currency (rupiah) is so large? ANSWER: Nike may still consider hedging under these conditions because the alternative is to be exposed to the risk that the rupiah may depreciate over the six-month period by an amount that exceeds the degree of the discount. A large forward discount implies that 25 the nominal interest rate in Indonesia is much higher than in the U.S., which may suggest a higher rate of expected inflation. Thus, there may be severe downward pressure on the rupiahs spot rate over time. 29. Change in the Forward Premium. At the end of this month, you (owner of a U.S. firm) are meeting with a Japanese firm to which you will try to sell supplies. If you receive an order from that firm, you will obtain a forward contract to hedge the future receivables in yen. As of this morning, the forward rate of the yen and spot rate are the same. You believe that interest rate parity holds. This afternoon, news occurs that makes you believe that the U.S. interest rates will increase substantially by the end of this month, and that the Japanese interest rate will not change. However, your expectations of the spot rate of the Japanese yen are not affected at all in the future. How will your expected dollar amount of receivables from the Japanese transaction be affected (if at all) by the news that occurred this afternoon? Explain. ANSWER: If U.S. interest rates increase, then the forward rate of the yen will exhibit a premium. Therefore, if you hedge your receivables at the end of this month, the dollar amount to be received would be higher. 30. Interpreting Changes in the Forward Premium. Assume that interest rate parity holds. At the beginning of the month, the spot rate of the Canadian dollar is $.70, while the one-year forward rate is $.68. Assume that U.S. interest rates increase steadily over the month. At the end of the month, the one-year forward rate is higher than it was at the beginning of the month. Yet, the one year forward discount is larger (the one-year premium is more negative) at the end of the month than it was at the beginning of the month. Explain how the relationship between the U.S. interest rate and the Canadian interest rate changed from the beginning of the month until the end of the month. ANSWER: The forward discount at the beginning of the month implies that the U.S. interest rate is lower than the Canadian interest rate. During the month, the Canadian interest rate must have increased by a greater degree than the U.S. interest rate. At the end of the month, the gap between the Canadian dollar and the U.S. dollar is greater than it was at the beginning of the month. This results in a more pronounced forward discount. Chapter 8: Relationships among Exchange Rates, Inflation, and Interest Rates 1. PPP. Explain the theory of purchasing power parity (PPP). Based on this theory, what is a general forecast of the values of currencies in countries with high inflation? ANSWER: PPP suggests that the purchasing power of a consumer will be similar when purchasing goods in a foreign country or in the home country. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal purchasing power. Currencies in countries with high inflation will be weak according to PPP, causing the purchasing power of goods in the home country versus these countries to be similar. 2. Rationale of PPP. Explain the rationale of the PPP theory. ANSWER: When inflation is high in a particular country, foreign demand for goods in that country will decrease. In addition, that country’s demand for foreign goods should increase. Thus, the home currency of that country will weaken; this tendency should continue until the currency has weakened to the extent that foreign country’s goods are no more attractive than the home country’s goods. Inflation differentials are offset by exchange rate changes. 3. Testing PPP. Explain how you could determine whether PPP exists. Describe a limitation in testing whether PPP holds. ANSWER: One method is to choose two countries and compare the inflation differential to the exchange rate change for several different periods. Then, determine whether the exchange rate changes were similar to what would have been expected under PPP theory. A second method is to choose a variety of countries and compare the inflation differential of each foreign country relative to the home country for a given period. Then, determine whether the exchange rate changes of each foreign currency were what would have been expected based on the inflation differentials under PPP theory. A limitation in testing PPP is that the results will vary with the base period chosen. The base period should reflect an equilibrium position, but it is difficult to determine when such a period exists. 4. Limitations of PPP. Explain why PPP does not hold. ANSWER: PPP does not consistently hold because there are other factors besides inflation that influences exchange rates. Thus, exchange rates will not move in perfect tandem with inflation. In addition, there may not be substitutes for traded goods. Therefore, even when a country’s inflation increases, the foreign demand for its products will not necessarilydecrease (in the manner suggested by PPP) if substitutes are not available. 5. Testing PPP. Inflation differentials between the U.S. and other industrialized countries have typically been a few percentage points in any given year. Yet, in many years annual exchange rates between the corresponding currencies have changed by 10 percent or more. What does this information suggest about PPP? ANSWER: The information suggests that there are other factors besides inflation differentials that influence exchange rate movements. Thus, the exchange rate movements will not necessarilyconform to inflation differentials, and therefore PPP will not necessarily hold. 26 6. PPP Applied to the Euro. Assume that several European countries that use the euro as their currency experience higher inflation than the United States, while two other European countries that use the euro as their currency experience lower inflation than the United States. According to PPP, how will the euros value against the dollar be affected? ANSWER: The high European inflation overall would reduce the U.S. demand for European products, increase the European demand for U.S. products, and cause the euro to depreciate against the dollar. According to the PPP theory, the euro's value would adjust in response to the weighted inflation rates of the European countries that are represented by the euro relative to the inflation in the U.S. If the European inflation rises, while the U.S. inflation remains low, there would be downward pressure on the euro. 7. PPP. Japan has typically had lower inflation than the United States. How would one expect this to affect the Japanese yen’s value? Why does this expected relationship not always occur? ANSWER: Japan’s low inflation should place upward pressure on the yen’s value. Yet, other factors can sometimes offset this pressure. For example, Japan heavily invests in U.S. securities, which places downward pressure on the yen’s value. 8. Interactive Effects of PPP. Assume that the inflation rates of the countries that use the euro are very low, while other European countries that have their own currencies experience high inflation. Explain how and why the euros value could be expected to change against these currencies according to the PPP theory. ANSWER: According to the PPP theory, the euros value would increase against the value of the other European currencies, because the trade patterns would shift in response to the inflation differential. There would be an increase in demand for the euro by these other European countries that experienced higher inflation because they will increase their importing of products from those European countries whose home currency is the euro. 9. Arbitrage and PPP. Assume that locational arbitrage ensures that spot exchange rates are properly aligned. Also assume that you believe in purchasing power parity. The spot rate of the British pound is $1.80. The spot rate of the Swiss franc is .3 pounds. You expect that the one-year inflation rate is 7 percent in the U.K., 5 percent in Switzerland, and 1 percent in the U.S. The one year interest rate is 6% in the U.K., 2% in Switzerland, and 4% in the U.S. What is your expected spot rate of the Swiss franc in one year with respect to the U.S.dollar? ANSWER: SF spot rate in $ = 1.80 * .3 = $.54. Expected % change in SF in one year = (1.01) / (1.05) - 1 = 3.8% Expected spot rate of SF in one year = $.54 * (1 - .038) = $51.94 10. IFE. Assume that the nominal interest rate in Mexico is 48 percent and the interest rate in the United States is 8 percent for oneyear securities that are free from default risk. What does the IFE suggest about the differential in expected inflation in these two countries? Using this information and the PPP theory, describe the expected nominal return to U.S. investors who invest in Mexico. ANSWER: If investors from the U.S. and Mexico required the same real (inflation-adjusted) return, then any difference in nominal interest rates is due to differences in expected inflation. Thus, the inflation rate in Mexico is expected to be about 40 percent above the U.S. inflation rate. According to PPP, the Mexican peso should depreciate by the amount of the differential between U.S. and Mexican inflation rates. Using a 40 percent differential, the Mexican peso should depreciate by about 40 percent. Given a 48 percent nominal interest rate in Mexico and expected depreciation of the peso of 40 percent, U.S. investors will earn about 8 percent. 11. IFE. Shouldn’t the IFE discourage investors from attempting to capitalize on higher foreign interest rates? Why do some investors continue to invest overseas, even when they have no other transactions overseas? ANSWER: According to the IFE, higher foreign interest rates should not attract investors because these rates imply high expected inflation rates, which in turn imply potential depreciation of these currencies. Yet, some investors still invest in foreign countries where nominal interest rates are high. This may suggest that some investors believe that (1) the anticipated inflation rate embedded in a high nominal interest rate is over estimated, or (2) the potentially high inflation will not cause substantial depreciation of the foreign currency (which could occur if adequate substitute products were not available elsewhere), or (3) there are other factors that can offset the possible impact of inflation on the foreign currencys value. 12. IFE. Beth Miller does not believe that the international Fisher effect (IFE) holds. Current one-year interest rates in Europe are 5 percent, while one-year interest rates in the U.S. are 3 percent. Beth converts $100,000 to euros and invests them in Germany. One year later, she converts the euros back to dollars. The current spot rate of the euro is $1.10. a. According to the IFE, what should the spot rate of the euro in one year be? b. If the spot rate of the euro in one year is $1.00, what is Beths percentage return from her strategy? c. If the spot rate of the euro in one year is $1.08, what is Beths percentage return from her strategy? d. What must the spot rate of the euro be in one year for Beths strategy to be successful? ANSWER: a. ef = (1 + ih ) / (1 + if ) – 1 27 ef = (1.03 ) / (1.05 ) - 1 = -1.90 % If the IFE holds, the euro should depreciate by 1.90 percent in one year. This translates to a spot rate of $1.10 * (1 - 1.90%) = $1.079. b. 1. Convert dollars to euros: $100,000/$1.10 = 90,909.09 2. Invest euros for one year and receive €90,909.09 * 1.05 = €95,454.55 3. Convert euros back to dollars and receive €95,454.55 * $1.00 = $95,454.55 The percentage return is $95,454.55/$100,000 - 1 = 4.55%. c. 1. Convert dollars to euros: $100,000/$1.10 = €90,909.09 2. Invest euros for one year and receive € 90,909.09 * 1.05 = € 95,454.55 3. Convert euros back to dollars and receive €95,454.55 * $1.08 = $103,090.91 The percentage return is $103,090.91/$100,000 -1 = 3.09%. d. Beth’s strategy would be successful if the spot rate of the euro in one year is greater than $1.079. 13. Implications of IFE. Assume U.S. interest rates are generally above foreign interest rates. What does this suggest about the future strength or weakness of the dollar based on the IFE? Should U.S. investors invest in foreign securities if they believe in the IFE? Should foreign investors invest in U.S. securities if they believe in the IFE? ANSWER: The IFE would suggest that the U.S. dollar will depreciate over time if U.S. interest rates are currently higher than foreign interest rates. Consequently, foreign investors who purchased U.S. securities would on average receive a similar yield as what they receive in their own country and U.S. investors that purchased foreign securities would on average receive a yield similar to U.S. rates. 14. Implications of IFE. Explain the international Fisher effect (IFE). What is the rationale for the existence of the IFE? What are the implications of the IFE for firms with excess cash that consistently invest in foreign Treasury bills? Explain why the IFE may not hold. ANSWER: The IFE suggests that a currency’s value will adjust in accordance with the differential in interest rates between two countries. The rationale is that if a particular currency exhibits a high nominal interest rate, this may reflect a high anticipated inflation. Thus, the inflation will place downward pressure on the currency’s value if it occurs. The implications are that a firm that consistently purchases foreign Treasury bills will on average earn a similar return as on domestic Treasury bills. The IFE may not hold because exchange rate movements react to other factors in addition to interest rate differentials. Therefore, an exchange rate will not necessarily adjust in accordance with the nominal interest rate differentials, so that IFE may not hold. 15. Forecasting the Future Spot Rate Based on IFE. Assume that the spot exchange rate of the Singapore dollar is $.70. The oneyear interest rate is 11 percent in the United States and 7 percent in Singapore. What will the spot rate be in one year according to the IFE? (You may use the approximate formula to answer this question.) ANSWER: $.70 * (1 + .04) =$.728 16. IFE Applied to the Euro. Given the recent conversion of several European currencies to the euro, explain what would cause the euros value to change against the dollar according to the IFE. ANSWER: If interest rates change in these European countries whose home currency is the euro, the expected inflation rate in those countries change, so that the inflation differential between those countries and the U.S.changes. Thus, there may be an impact on the value of the euro, because a change in the inflation differential affects trade flows and therefore affects the exchange rate. 17. IFE Application to Asian Crisis. Before the Asian crisis, many investors attempted to capitalize on the high interest rates prevailing in the Southeast Asian countries although the level of interest rates primarily reflected expectations of inflation. Explain why investors behaved in this manner. Why does the IFE suggest that the Southeast Asian countries would not have attracted foreign investment before the Asian crisis despite the high interest rates prevailing in those countries? ANSWER: The investors' behavior suggests that they did not expect the international Fisher effect (IFE) to hold. Since central banks of some Asian countries were maintaining their currencies within narrow bands, they were effectively preventing the exchange rate from depreciating in a manner that would offset the interest rate differential. Consequently, superior profits from investing in the foreign countries were possible. If investors believed in the IFE, the Asian countries would not attract a high level of foreign investment because of exchange rate expectations. Specifically, the high nominal interest rate should reflect a high level of expected inflation. According to purchasing power parity (PPP), the higher interest rate should result in a weaker currency because of the implied market expectations of high inflation. 28 18. Comparing Parity Theories. Compare and contrast interest rate parity, purchasing power parity (PPP), and the international Fisher effect (IFE). ANSWER: IRP can be evaluated using data at any one point in time to determine the relationship between the interest rate differential of two countries and the forward premium (or discount). PPP suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. IFE suggests a relationship between the interest rate differential of two countries and the percentage change in the spot exchange rate over time. IFE is based on nominal interest rate differentials, which are influenced by expected inflation. Thus, the IFE is closely related to PPP. 19. Integrating IRP and IFE. Assume the following information is available for the U.S. and Europe: U.S. Europe Nominal interest rate 4% 6% Expected inflation 2% 5% Spot rate $1.13 One-year forward rate $1.10 Does IRP hold? According to PPP, what is the expected spot rate of the euro in one year? According to the IFE, what is the expected spot rate of the euro in one year? Reconcile your answers to parts (a) and (c). ANSWER: IRP p = (1+ Ih) / (1+ If) – 1 p = (1+0.04) / (1+0.06) – 1 p = -0.0189 or -1.89% Therefore, the forward rate of the euro will be: $1.13 * (1-0.0189) = $1.109. IRP does not hold in this case. PPP ef = (1+Ih) / (1+If) -1 ef= (1+0.02) / (1+0.05) – 1 ef= (1.02 / 1.05) – 1 ef= -0.029 or -2.86% The expected spot rate of the euro in one year according to PPP will be: $1.13 * (1-0.029) = $1.097 IFE ef= (1+Ih) / (1+If) -1 ef= (1+0.04) / (1+0.06) – 1 ef= -0.0189 or -1.89% The expected spot rate of the euro in one year according to the IFE will be: $1.13 * (1-0.0189) = $1.109 Answer a) and c) combined say that the forward rate premium or discount is exactly equal to the expected percentage appreciation or depreciation of the euro. 20. IRP. The one-year risk-free interest rate in Mexico is 10%. The one-year risk-free rate in the U.S. is 2%. Assume that interest rate parity exists.The spot rate of the Mexican peso is $.14. a. What is the forward rate premium? b. What is the one-year forward rate of the peso? c. Based on the international Fisher effect, what is the expected change in the spot rate over the next year? d. If the spot rate changes as expected according to the IFE, what will be the spot rate in one year? e. Compare your answers to (b) and (d) and explain the relationship. ANSWER: Forward premium: p= (1+0.02) / (1+0.10) – 1 p= (1.02) / (1.10) – 1 p= -0.073 or -7.27% According to the interest rate parity (IRP), the forward is -7.27% or discount. Forward rate of the peso: = $.14 * (1-0.073) = $0.1298 29 Spot rate according to IFE: ef= (1+Ih) / (1+If) -1 ef= (1+0.02) / (1+0.10) – 1 ef= (1.02) / (1.10) – 1 ef= -0.0727 or -7.2728% Expected change in peso is: -7.2728%. According to the international Fisher effect, the spot rate over the next year will be: $0.14 * (10.0727) = $0.1298 $0.14 * (1-0.0727) = $0.1298 When IRP holds, the forward rate premium and the expected % change in the spot rate are derived in the same manner. Thus, the forward premium serves as the forecasted percentage change in the spot rate according to IFE. 21. Applying IRP and IFE. Assume that Mexico has a one-year interest rate that is higher than the U.S. one-year interest rate. Assume that you believe in the international Fisher effect (IFE), and interest rate parity. Assume zero transactions costs. Ed is based in the U.S. and he attempts to speculate by purchasing Mexican pesos today, investing the pesos in a risk-free asset for a year, and then converting the pesos to dollars at the end of one year. Ed did not cover his position in the forward market. Maria is based in Mexico and she attempts covered interest arbitrage by purchasing dollars today and simultaneously selling dollars one year forward, investing the dollars in a risk-free asset for a year, and then converting the dollars back to pesos at the end of one year. Do you think the rate of return on Ed’s investment will be higher than, lower than, or the same as the rate of return on Marias investment? Explain. ANSWER: Marias rate of return will be higher. Since interest rate parity exists, she will earn whatever the local risk-free interest rate is in Mexico. Ed’s expected rate of return is whatever the risk-free rate is in the U.S.(based on the IFE). 22. IRP versus IFE. You believe that interest rate parity and the international Fisher effect hold. Assume the U.S. interest rate is presently much higher than the New Zealand interest rate. You have receivables of 1million New Zealand dollars that you will receive in one year. You could hedge the receivables with the one-year forward contract. Or you could decide to not hedge. Is your expected U.S. dollar amount of the receivables in one year from hedging higher, lower, or the same as your expected U.S. dollar amount of the receivables without hedging? Explain. ANSWER: The expected amount is the same, because the forward rate reflects the interest rate differential, and the expected spot rate (if you do not hedge) according to IFE reflects the interest rate differential. 23. Comparing PPP and IFE. How is it possible for PPP to hold if the IFE does not? ANSWER: For the IFE to hold, the following conditions are necessary: (1) Investors across countries require the same real returns, (2) The expected inflation rate embedded in the nominal interest rate occurs, (3) The exchange rate adjusts to the inflation rate differential according to PPP. If conditions (1) or (2) do not hold, PPP may still hold, but investors may achieve consistently higher returns when investing in a foreign countrys securities. Thus, IFE would be refuted. 24. IRP, PPP, and Speculating in Currency Derivatives. The U.S. three-month interest rate (unannualized) is 1%. The Canadian three-month interest rate (unannualized) is 4%. Interest rate parity exists. The expected inflation over this period is 5% in the U.S. and 2% in Canada. A call option with a three-month expiration date on Canadian dollars is available for a premium of $.02 and a strike price of $.64. The spot rate of the Canadian dollar is $.65. Assume that you believe in purchasing power parity. a. Determine the dollar amount of your profit or loss from buying a call option contract specifying C$100,000. ANSWER: The expected change in the Canadian dollars spot rate is: (1.05) / (1.02) - 1 = 2.94%. Therefore, the expected spot rate in 3 months is $.65* (1.0294) = $.66911. The net profit per unit on a call option is $.66911- $.64 -$.02 = $.00911. For the contract, the net profitis $.00911 * 100,000 = $911. b. Determine the dollar amount of your profit or loss from buying a futures contract specifying C$100,000. ANSWER: According to IRP, the futures rate premium should be: (1.01) / (1.04) 1 = 2.88% Therefore, the futures rate should be: $.65 * (1 - .0288) = $.6313. Recall that the expected spot rate in 3 months is: $.65* (1.0294) = $.66911. The expected net profit per unit from buying a futures contract is: $.66911- $.6313 = $.03781. For the contract, the net profit is $.03781* 100,000 =$4,341. 25. Real Interest Rate. One assumption made in developing the IFE is that all investors in all countries have the same real interest rate. What does this mean? 30 ANSWER: The real return is the nominal return minus the inflation rate. If all investors require the same real return, then the differentials in nominal interest rates should be solely due to differentials in anticipated inflation among countries. 26. Inflation and Interest Rate Effects. The opening of Russia's market has resulted in a highly volatile Russian currency (the ruble). Russia's inflation has commonly exceeded 20 percent per month. Russian interest rates commonly exceed 150 percent, but this is sometimes less than the annual inflation rate in Russia. a. Explain why the high Russian inflation has put severe pressure on the value of the Russian ruble. ANSWER: As Russian prices were increasing, the purchasing power of Russian consumers was declining. This would encourage them to purchase goods in the U.S. and elsewhere, which results in a large supply of rubles for sale. Given the high Russian inflation, foreign demand for rubles to purchase Russian goods would be low. Thus, the rubles value should depreciate against the dollar, and against other currencies. b. Does the effect of Russian inflation on the decline in the rubles value support the PPP theory? How might the relationship be distorted by political conditions in Russia? ANSWER: The general relationship suggested by PPP is supported, but the rubles value will not normally move exactly as specified by PPP. The political conditions that could restrict trade or currencyconvertibility can prevent Russian consumers from shifting to foreign goods. Thus, the ruble may not decline by the full degree to offset the inflation differential between Russia and the U.S. Furthermore, the government may not allow the ruble to float freely to its proper equilibrium level. c. Does it appear that the prices of Russian goods will be equal to the prices of U.S. goods from the perspective of Russian consumers (after considering exchange rates)? Explain. ANSWER: Russian prices might be higher than U.S. prices, even after considering exchange rates, because the ruble might not depreciate enough to fully offset the Russian inflation. The exchange rate cannot fully adjust if there are barriers on trade or currency convertibility. d. Will the effects of the high Russian inflation and the decline in the ruble offset each other for U.S. importers? That is, how will U.S. importers of Russian goods be affected by the conditions? ANSWER: U.S. importers will likely experience higher prices, because the Russian inflation may not be completelyoffset by the decline in the rubles value. This may cause a reduction in the U.S. demand for Russian goods. 27. Changes in Inflation. Assume that the inflation rate in Brazil is expected to increase substantially. How will this affect Brazil’s nominal interest rates and the value of its currency (called the real)? If the IFE holds, how will the nominal return to U.S. investors who invest in Brazil be affected by the higher inflation in Brazil? Explain. ANSWER: Brazil’s nominal interest rate would likely increase to maintain the real return required by Brazilian investors. The Brazilian real would be expected to depreciate according to the IFE. If the IFE holds, the return to U.S. investors who invest in Brazil would not be affected. Even though they now earn a higher nominal interest rate, the expected decline in the Brazilian real offsets the additional interest to be earned. 28. Interpreting Inflationary Expectations. If investors in the United States and Canada require the same real interest rate, and the nominal rate of interest is 2 percent higher in Canada, what does this imply about expectations of U.S. inflation and Canadian inflation? What do these inflationary expectations suggest about future exchange rates? ANSWER: Expected inflation in Canada is 2 percent above expected inflation in the U.S. If these inflationary expectations come true, PPP would suggest that the value of the Canadian dollar should depreciate by 2 percent against the U.S. dollar. 29. Source of Weak Currencies. Currencies of some Latin American countries, such as Brazil and Venezuela, frequently weaken against most other currencies. What concept in this chapter explains this occurrence? Why don’t all U.S.-based MNCs use forward contracts to hedge their future remittances of funds from Latin American countries to the U.S. even if they expect depreciation of the currencies against the dollar? ANSWER: Latin American countries typically have very high inflation, as much as 200 percent or more. PPP theory would suggest that currencies of these countries will depreciate against the U.S. dollar (and other major currencies) in order to retain purchasing power across countries. The high inflation discourages demand for Latin American imports and places downward pressure in their Latin American currencies. Depreciation of the currencies offsets the increased prices on Latin American goods from the perspective of importers in other countries. Interest rate parity forces the forward rates to contain a large discount due to the high interest rates in Latin America, which reflects a disadvantage of hedging the securrencies. The decision to hedge makes more sense if the expected degree of depreciation exceeds the degree of the forward discount. Also, keep in mind that some remittances cannot be perfectly hedged anyway because the amount of future remittances is uncertain. 30. Deriving Forecasts of the Future Spot Rate. As of today, assume the following information is available: U.S. Mexic o 31 Real rate of interest required by investors 2% 2% Nominal interest rate 11% 15% Spot rate $.20 One-year forward rate $.19 a. Use the forward rate to forecast the percentage change in the Mexican peso over the next year. b. Use the differential in expected inflation to forecast the percentage change in the Mexican peso over the next year. c. Use the spot rate to forecast the percentage change in the Mexican peso over the next year. ANSWER: ($.19 - $.20) /$.20 = .05, or 5% 11% - 15% = -4%; the negative sign represents depreciation of the peso. zero percent change Solution to Continuing Case Problem: Blades, Inc. 1. What is the relationship between the exchange rates and relative inflation levels of the two countries? How will this relationship affect Blades Thai revenue and costs given that the baht is freely floating? What is the net effect of this relationship on Blades? ANSWER: The relationship between exchange rates and relative inflation rates is summarized by the purchasing power parity (PPP) theory. When one country’s inflation rate rises relative to that of another, the demand for the former country’s currency declines as its exports decline (due to its higher prices). Furthermore, consumers and firms in the country with higher inflation tend to increase their importing. Thus, the absolute form of PPP states that prices of similar products of two different countries should be equal when measured in a common currency. The relative form of PPP states that prices of similar products of different countries will not necessarily be the same when measured in a common currency because of market imperfections. However, it states that the rate of change in the prices of products should be similar. Both forms of the theory suggest that the currency of the country with the higher level of inflation should depreciate to offset the inflation differential. Since the baht has become a freely floating currency, the currency should be expected to depreciate due to the high inflation levels prevailing in Thailand. Blades revenue generated in Thailand will be negatively affected by PPP. Because of Blades export arrangement, it is unable to increase its prices in line with Thai levels of inflation. However, since Blades exports are denominated in baht, a depreciation of the baht will result in a conversion of baht into fewer dollars. Blades cost of goods sold generated in Thailand will increase as Thai exporters adjust their prices according to Thai inflation rates. However, the high prices resulting from high levels of inflation inThailand may be somewhat offset by a depreciation of the baht. Since Blades generates net cash inflows from its Thai operations, it will be negatively affected by PPP. Chapter 9: Forecasting Exchange Rates 1. Motives for forecasting. Explain corporate motives for forecasting exchange rates. ANSWER: Several decisions of MNCs require an assessment of the future. Future exchange rates will affect all critical characteristics of the firm such as costs and revenues. To be more specific, various operations of MNCs use exchange rate projections, including hedging, short-term financing and investing, capital budgeting decisions, long-term financing, and earnings assessment. Such operations will be more effective if exchange rates are forecasted accurately. 2. Technical Forecasting. Explain the technical technique for forecasting exchange rates. What are some limitations of using technical forecasting to predict exchange rates? ANSWER: Technical forecasting involves the review of historical exchange rates to search for arepetitive pattern that may occur in the future. This pattern would be the basis for future exchange rate movements. Even if a technical forecasting model turns out to be valuable, it will no longer be valuable once other market participants use it. This is because their actions in the market due to the model’s forecast will cause the currency values to move as suggested by the model immediately instead of in the future. Also, MNCs often prefer long-term forecasts. Technical forecasting is typically conducted for short time horizons. 3. Fundamental Forecasting. Explain the fundamental technique for forecasting exchange rates. What are some limitations of using a fundamental technique to forecast exchange rates? ANSWER: Fundamental forecasting is based on underlying relationships that are believed to exist between one or more variables and a currency’s value. Given these relationships, a change in one or more of these variables (or a forecasted change in them) will lead to a forecast of the currency’s value. Even if a fundamental relationship exists, it is difficult to accurately quantify that relationship in a form applicable to forecasting. Even if the relationship could be quantified, there is no guarantee that the historical relationship will persist in the future. It is difficult to determine the lagged impact of some variables. It is also difficult to incorporate some qualitative factors into the model. 32 4. Market-Based Forecasting. Explain the market-based technique for forecasting exchange rates. What is the rationale for using market-based forecasts? If the euro appreciates substantially against the dollar during a specific period, would market-based forecasts have overestimated or underestimated the realized values over this period? Explain. ANSWER: Market-based forecasts should reflect an expectation of the market on future rates. If the market’s expectation differed from existing rates, then the market participants should react by taking positions in various currencies until the current rates do reflect an expectation of the future.The market determines the spot exchange rate and forward exchange rate. These market-based rates can be used to forecast since if they were not good indicators of the future rates, speculators would take positions. This speculative movement would force the rates to gravitate toward the expectation of the future spot rate. Market-based forecasts would have under estimated the realized values of the euro over this period because the actual values were above the spot rates and forward rates quoted earlier. 5. Mixed Forecasting. Explain the mixed technique for forecasting exchange rates. ANSWER: Mixed forecasting involves a combination of two or more techniques. The specific combination can differ in terms of techniques included and the weight of importance assigned to each technique. 6. Detecting a Forecast Bias. Explain how to assess performance in forecasting exchange rates. Explain how to detect a bias in forecasting exchange rates. ANSWER: Performance can be evaluated by computing the absolute forecast error as a percentage of the realized value for all periods where a forecast was necessary. Then an average of this type of error can be computed. This average can be compared among all currencies or among all forecasting models. A forecast bias exists from consistently underestimating or overestimating exchange rates. If the majority of points are above the 45 degree perfect forecast line, then the forecasts generally underestimate the realized values. If the majority of points are below the 45 degree perfect forecast line, then the forecasts generally overestimate the realized values. 8. Limitations of a Fundamental Forecast. Syracuse Corp. believes that future real interest rate movements will affect exchange rates, and it has applied regression analysis to historical data to assess the relationship. It will use regression coefficients derived from this analysis, along with forecasted real interest rate movements, to predict exchange rates in the future. Explain at leas tthree limitations of this method. ANSWER: First, the timing of the impact of real interest rates on exchange rates may differ from what is specified by the model. Second, the forecasted real interest rates may be inaccurate, causing inaccurate forecasts of the exchange rate.Third, the sensitivity of exchange rates to real interest rate movements may change in the future (differ from what was determined when using historical data). Fourth, the model has ignored other factors that also influence exchange rates. 9. Consistent Forecasts. Lexington Co. is a U.S.-based MNC with subsidiaries in most major countries. Each subsidiary is responsible for forecasting the future exchange rate of its local currency relative to the U.S. dollar. Comment on this policy. How might Lexington Co. ensure consistent forecasts among the different subsidiaries? ANSWER: If each subsidiary uses its own data and techniques to forecast its local currency’s exchange rate, its forecast may be inconsistent with forecasts of other currencies by other subsidiaries. Subsidiary forecasts could be consistent if forecasts for all currencies were based on complete information from all subsidiaries (its beta). 10. Forecasting with a Forward Rate. Assume that the four-year annualized interest rate in the United States is 9% and the four-year annualized interest rate in Singapore is 6%. Assume interest rate parity holds for a four-year horizon. Assume that the spot rate of the Singapore dollar is $.60. If the forward rate is used to forecast exchange rates, what will be the forecast for the Singapore dollar’s spot rate in four years? What percentage appreciation or depreciation does this forecast imply over the four-year period? ANSWER: Country: Four-year compounded return: US Singapure (1.09)4 – 1 = 41% (1.06)4 – 1 = 26% Premium: = (1+0.41) / (1+0.26) – 1 = (1.41 / 1.26) – 1 = 0.119 or 11.9% 33 Thus, the four-year forward rate should contain an 11.9% premium above today’s spot rate of $.60, which means the forward rate is $.60 × (1 + 0.119) = $0.6714. The forecast for the Singapore dollar’s spot rate in four years is $0.6714, which represents an appreciation of 11.9% over the four-year period. 11. Foreign Exchange Market Efficiency. Assume that foreign exchange markets were found to be weak-form efficient. What does this suggest about utilizing technical analysis to speculate in euros? If MNCs believe that foreign exchange markets are strong-form efficient, why would they develop their own forecasts of future exchange rates? That is, why wouldn’t they simply use today’s quoted rates as indicators about future rates? After all, today’s quoted rates should reflect all relevant information. ANSWER: Technical analysis should not be able to achieve excess profits if foreign exchange markets are weak-form efficient. Today’s rates do not provide information about the range of possible outcomes. MNCs may desire to assess the range of possible outcomes. 13. Forecasting Exchange Rates of Currencies That Previously Were Fixed. When some countries in Eastern Europe initially allowed their currencies to fluctuate against the dollar, would the fundamental technique based on historical relationships have been useful for forecasting future exchange rates of these currencies? Explain. ANSWER: Fundamental forecasting typically relies on historical relationships between economic factors and exchange rate movements. However, if exchange rates were not allowed to move in the past, historical relationships would not help predict future exchange rates of these currencies. 15. Forecasting the Euro. Cooper, Inc., a U.S.-based MNC, periodically obtains euros to purchase German products. It assesses U.S. and German trade patterns and inflation rates to develop a fundamental forecast for the euro. How could Cooper possibly improve its method of fundamental forecasting as applied to the euro? ANSWER: It should use data for all countries participating in the euro (not just the Germandata), as the euro’s exchange rate is affected by all transactions between euros and dollars, not just the German transactions. 16. Forward Rate Forecast. Assume that you obtain a quote for a one-year forward rate on the Mexican peso. Assume that Mexico’s one-year interest rate is 40 percent, while the U.S. one-year interest rate is 7 percent. Over the next year, the peso depreciates by 12 percent. Do you think the forward rate overestimated the spot rate one year ahead in this case? Explain. ANSWER: A quoted forward rate for the Mexican peso would contain a large discount because of the high interest rate in Mexico relative to the U.S. Assuming that the discount exceeds 12 percent; the forward rate would have actually underestimated the future spot rate in this example. 17. Forecasting Based on PPP versus the Forward Rate. You believe that the Singapore dollar’sexchange rate movements are mostly attributed to purchasing power parity. Today, the nominal annual interest rate in Singapore is 18%. The nominal annual interest rate in the U.S. is 3%. You expect that annual inflation will be about 4% in Singapore and 1% in the U.S. Assume that interest rate parity holds. Today the spot rate of the Singapore dollar is $.63. Do you think the one-year forward rate would underestimate, overestimate, or be an unbiased estimate of the future spot rate in one year? ANSWER: The forward rate will likely underestimate the future spot rate. The inflation differential suggests that the Singapore dollar should decline slightly. Yet, the forward rate would have a large discount due to the interest differential. Thus, the forward rate would predict a very weak Singapore dollar, which means that it would underestimate the future spot rate. 18. Interpreting an Unbiased Forward Rate. Assume that the forward rate is an unbiased but not necessarily accurate forecast of the future exchange rate of the yen over the next several years. Based on this information, do you think Raven Co. should hedge its remittance of expected Japanese yen profits to the U.S. parent by selling yen forward contracts? Why would this strategy be advantageous? Under what conditions would this strategy backfire? ANSWER: If the forward rate is an unbiased forecast, the amount of dollars received from remittances when hedging should be the same (on average, over time) as the amount of dollars received from remittances when not hedging. Under these conditions, Raven may be able to more accurately predict the dollar cash flows that will result from remitted foreign cash flows, without reducing the expected amount of dollar cash flows received. This strategy could backfire in those periods that the spot rate of yen at the time of remittances exceeds the previously agreed uponforward rate at which the yen would be converted to dollars. Solution to Continuing Case Problem: Blades, Inc. 1. Considering both Blades’ current practices and future plans, how can it benefit from forecasting the baht-dollar exchange rate? ANSWER: Blades can benefit from forecasting the baht-dollar exchange rates in various ways. First, Blades currently generates net cash inflows denominated in Thai baht. The dollar value of these cash flows is sensitive to the future baht-dollar exchange rate, and Blades may decide to hedge these cash flows based on the exchange rate forecast. Second, Blades may establish asubsidiary in Thailand in the near future. Earnings generated by this subsidiary may be remitted back to the parent, and a forecast of future exchange rates may again help Blades in making hedging decisions. Alternatively, earnings may be invested in Thailand, which would be more attractive if the baht is expected to appreciate. Conversely, if Blades plans to borrow short- or long-term funds in Thailand, it 34 would benefit from a depreciation of the baht. Forecasting the baht-dollar exchange rates will aid Blades in making both short-term and long-term decisionsregarding its Thai operations. 2. Which forecasting technique (i.e., technical, fundamental, or market-based) would be easiest to use in forecasting the future value of the baht? Why? ANSWER: A market-based forecast is the easiest to use. A fundamental forecast is more sophisticated, but is not necessarily more accurate. 3. Blades is considering using either current spot rates or available forward rates to forecast the future value of the baht. Available forward rates currently exhibit a large discount. Do you think the spot or the forward rate will yield a better market-based forecast? Why? ANSWER: The forward rates will likely yield more accurate results. The forward rate of the baht exhibits a discount, which reflects the higher nominal interest rate in Thailand (according to interest rate parity) and the higher expected inflation associated with the higher nominal interestrate. Thus, there could be future downward pressure on the baht. Conversely, using the current spot rate to forecast future spot rates of the baht would imply that the baht’s value will remain unchanged. 4. The current 90-day forward rate for the baht is $.021. By what percentage is the baht expected to change over the next quarter according to a market-based forecast using the forward rate? What will be the value of the baht in 90 days according to this forecast? ANSWER: According to the market-based forecast, the baht is expected to change by: ($.021 – $.023)/$.023 = –8.70%. Thus, the baht is expected to depreciate using this forecast. The forecasted value of the baht in 90 days using this forecast is $.021, the forward rate. 5. Assume that the technical forecast has been more accurate than the market-based forecast in recent weeks. What does this indicate about market efficiency for the baht-dollar exchange rates? Do you think this means that technical analysis will always be superior to other forecasting techniques in the future? Why or why not? ANSWER: A more accurate forecast using historical information than when using the spot rate as a forecast would indicate that the foreign exchange rate market for the Thai baht is inefficient in the weak form; today’s exchange rate does not reflect all historical information. 6. What is the expected percentage change in the value of the baht during the next quarter based onthe fundamental forecast? What is the forecasted value of the baht using this forecast? If the valueof the baht 90 days from now turns out to be $.022, which forecasting technique is the most accurate? (Use the absolute forecast error as a percentage of the realized value to answer the last part of this question.) ANSWER: The expected change in the value of the baht according to the fundamental forecast is: (.3)(–2%) + (.15)(–5%) + (.55)(– 10%) = –6.85%.Thus, the baht is expected to depreciate by 6.85 percent over the next quarter. The forecasted value of the baht in 90 days using a fundamental forecast is: $.023 × (1 – .0685) = $.0214. The absolute forecast errors as a percentage of the realized value will therefore be ($.02162 – $.022)/$.022 = 1.73% for the technical forecast, ($.0214 – $.022)/$.022 = 2.73% for the fundamental forecast, and ($.021 – $.022)/$.022 = 4.54% for the market-based forecast if the realized value of the baht turns out to be $.022 in 90 days. Thus, the technical forecast is the mostaccurate. 7. Do you think the technique you have identified in question 6 will always be the most accurate? Why or why not? ANSWER: No, the technical forecast will probably not always be the most accurate. First, the foreign exchange market for the Thai baht may become more efficient over time, rendering the use of historical information for forecasting purposes less accurate. Second, due to unfavorable economic conditions and the recent conversion of the baht to a freely floating exchange rate system, there is much uncertainty surrounding the baht-dollar exchange rates. The high volatility of the baht-dollar exchange rate may yield very different forecasting accuracy levels for the different forecasting techniques in subsequent periods. Chapter 10: Measuring exposure to exchange rate fluctuations 1. Transaction versus Economic Exposure. Compare and contrast transaction exposure and economic exposure. Why would an MNC consider examining only its “net” cash flows in each currency when assessing its transaction exposure? ANSWER: Transaction exposure is due only to international transactions by a firm. Economic exposure includes any form by which the firm’s cash flow will be affected. Foreign competition may increase due to currency fluctuations. This could affect the firm’s cash flow, but did not affect the value of any ongoing transactions. Thus, it represents a form of economic exposure but not transaction exposure. Transaction exposure is a subset of economic exposure. Consideration of all cash flows in a particular currency is not necessary when some inflows and outflows offset each other. Only net cash flows are necessary. 3. Factors That Affect a Firm’s Transaction Exposure. What factors affect a firm’s degree of transaction exposure in a particular currency? For each factor, explain the desirable characteristics that would reduce transaction exposure. 35 ANSWER: Currency variability—low level is desirable. Currency correlations—low level is desirable for currencies that are net inflows, while a high level is desirable for pairs of currencies in which one currency shows future net inflows while the other currency shows future net outflows. 4. Currency Correlations. Kopetsky Co. has net receivables in several currencies that are highly correlated with each other. What does this imply about the firm’s overall degree of transaction exposure? Are currency correlations perfectly stable over time? What does your answer imply about Kopetsky Co. or any other firm using past data on correlations as an indicator for the future? ANSWER: Its exposure is high since all currencies move in tandem — no offsetting effect is likely. If one of these currencies depreciates substantially against the firm’s local currency, all others will as well, and this reduces the value of these net receivables. No! Thus, past correlations will not serve as perfect forecasts of future correlations. Firms can not presume that past correlations will be perfectly accurate forecasts of future correlations. Yet, historical data may still be useful if the general ranking of correlations is somewhat stable. 5. Currency Effects on Cash Flows. How should appreciation of a firm’s home currency generally affect its cash inflows? How should depreciation of a firm’s home currency generally affect its cash outflows? ANSWER: Appreciation of the firm’s home currency reduces inflows since the foreign demand for the firm’s goods is reduced and foreign competition is increased. Depreciation of the firm’s home currency should increase inflows since it will likely increase foreign demand for the firm’s goods and reduce foreign competition. 6. Transaction Exposure. Fischer Inc., exports products from Florida to Europe. It obtains supplies and borrows funds locally. How would appreciation of the euro likely affect its net cashflows? Why? ANSWER: Fischer Inc. should benefit from the appreciation of the euro, because it should experience a strong demand for its products when the euro has more purchasing power (can obtain dollars at a low price). 7. Exposure of Domestic Firms. Why are the cash flows of a purely domestic firm exposed to exchange rate fluctuations? ANSWER: If the firm competes with foreign firms that also sell in a given market, the consumers may switch to foreign products if the local currency strengthens. 8. Measuring Economic Exposure. Memphis Co. hires you as a consultant to assess its degree of economic exposure to exchange rate fluctuations. How would you handle this task? Be specific. ANSWER: Regression analysis can be used to determine the relationship between the firm’s value and exchange rate fluctuations. Stock returns can be used as a proxy for the change in the firm’s value. The time period can be segmented into two subperiods so that regression analysis can be run for each subperiod. The sign and magnitude of the regression coefficient will imply how the firm’s value is influenced by each currency. Also, the coefficients can be compared among subperiods for each currency to determine how the impact of a currency is changing over time. 9. Factors That Affect a Firm’s Translation Exposure. What factors affect a firm’s degree of translation exposure? Explain how each factor influences translation exposure. ANSWER: The greater the percentage of business conducted by subsidiaries, the greater is the translation exposure. The greater the variability of each relevant foreign currency relative to the headquarters’ home (reporting) currency, the greater is the translation exposure. The type of accounting method employed can also affect translation exposure, 10. Translation Exposure. Consider a period in which the U.S. dollar weakens against the euro. How will this affect the reported earnings of a U.S.-based MNC with European subsidiaries? Consider a period in which the U.S. dollar strengthens against most foreign currencies. How will this affect the reported earnings of a U.S.-based MNC with subsidiaries all over the world? ANSWER: The consolidated earnings will be increased due to the strength of the subsidiaries’ local currency (the euro). The consolidated earnings will be reduced due to the weakness of the subsidiaries’ local currencies. 11. Transaction Exposure. Aggie Co. produces chemicals. It is a major exporter to Europe, where its main competition is from other U.S. exporters. All of these companies invoice the products in U.S. dollars. Is Aggie’s transaction exposure likely to be significantly affected if the eurostrengthens or weakens? Explain. If the euro weakens for several years, can you think of anychange that might occur in the global chemicals market? ANSWER: If the euro strengthens, European customers can purchase Aggie’s goods with fewer euros. Since Aggie’s competitors also invoice their exports in dollars, Aggie Company will not gain a competitive advantage. Nevertheless, the overall demand for the product could increase because the chemicals are now less expensive to European customers. If the euro weakens, European customers will need to pay more euros to purchase Aggie’s goods. Since Aggie’s competitors also invoice their exports in dollars, Aggie Company may not necessarily lose some of its market share. However, the overall European demand for chemicals could decline because the prices paid for them have increased. If the euro remained weak for several years, some companies in Europe may begin to produce the chemicals, so that customers could avoid purchasing dollars with weak euros. That is, the U.S.exporters could be priced out of the European market over time if the euro continually weakened. 36 12. Economic Exposure. Longhorn Co. produces hospital equipment. Most of its revenues are in the United States. About half of its expenses require outflows in Philippine pesos (to pay for Philippine materials). Most of Longhorn’s competition is from U.S. firms that have no international business at all. How will Longhorn Co. be affected if the peso strengthens? ANSWER: If the peso strengthens, Longhorn will incur higher expenses when paying for the Philippine materials. Because its competition is not affected in a similar manner, Longhorn Company is at a competitive disadvantage when the peso strengthens. 13. Economic Exposure. Lubbock, Inc., produces furniture and has no international business. Its major competitors import most of their furniture from Brazil and then sell it out of retail stores in the United States. How will Lubbock, Inc., be affected if Brazil’s currency (the real) strengthens over time? ANSWER: If the Brazilian real strengthens, U.S. retail stores will likely have to pay higher prices for the furniture from Brazil, and may pass some or all of the higher cost on to customers. Consequently, some customers may shift to furniture produced by Lubbock Inc. Thus, Lubbock Inc. is expected to be favorably affected by a strong Brazilian real. 14. Economic Exposure. Sooner Co. is a U.S. wholesale company that imports expensive high-quality luggage and sells it to retail stores around the United States. Its main competitors also import high-quality luggage and sell it to retail stores. None of these competitors hedge their exposure to exchange rate movements. The treasurer of Sooner Co. told the board of directors that the firm’s performance would be more volatile over time if it hedged its exchange rate exposure. How could a firm’s cash flows be more stable as a result of such high exposure to exchange rate fluctuations? ANSWER: If Sooner Company hedged its imports, then it would have an advantage over the competition when the dollar weakened (since its competitors would pay higher prices for the luggage), and could possibly gain market share or would have a higher profit margin. It would beat a disadvantage relative to the competition when the dollar strengthened and may lose market share or be forced to accept a lower profit margin.When Sooner Company does not hedge, the amount paid for imports would depend on exchange rate movements, but this is also true for all of its competitors. Thus, Sooner is more likely to retain its existing market share. 15. PPP and Economic Exposure. Boulder, Inc., exports chairs to Europe (invoiced in U.S. dollars) and competes against local European companies. If purchasing power parity exists, why would Boulder not benefit from a stronger euro? ANSWER: If purchasing power parity exists, a stronger euro would occur only because the U.S.inflation is higher than European inflation. Thus, the European demand for Boulder’s chairs may not be affected much since the inflated prices of U.S.-made chairs would have offset the European consumer’s ability to obtain cheaper dollars. The European consumer’s purchasing power of European chairs versus U.S. chairs is not affected by the change in the euro’s value. 16. Measuring Changes in Economic Exposure. Toyota Motor Corp. measures the sensitivity of its exports to the yen exchange rate (relative to the U.S. dollar). Explain how regression analysis could be used for such a task. Identify the expected sign of the regression coefficient if Toyota primarily exports to the United States. If Toyota established plants in the United States, how might the regression coefficient on the exchange rate variable change? ANSWER: The dependent variable is a percentage change (from one period to the next) in Toyota’s export volume to the U.S. The independent variables are (1) the percentage change in the yen’s value with respect to the dollar, (2) a measure of the strength of the U.S. economy, and (3) any other factors that could affect the volume of Toyota’s exports. The regression coefficient related to the exchange rate variable (as defined here) would be negative, since a decrease in the yen’s value is likely to cause an increase in the U.S. demand for Toyota’s built in Japan. If Toyota established plants in the U.S., dealers do not need to purchase Toyotas in Japan. Thus, the demand for Toyotas is less sensitive to the exchange rate, which should cause the regression coefficient for the exchange rate variable to decrease. 17. Impact of Exchange Rates on Earnings. Cieplak, Inc., is a U.S.-based MNC that has expanded into Asia. Its U.S. parent exports to some Asian countries, with its exports denominated in the Asian currencies. It also has a large subsidiary in Malaysia that serves that market. Offer at least two reasons related to exposure to exchange rates why Cieplak's earnings were reduced during theAsian crisis. Chapter 11: Managing transaction exposure 1. Consolidated Exposure. Quincy Corp. estimates the following cash flows in 90 days at its subsidiaries as follows: Net Position in Each Currency Measured in the Parent’s Currency (in 1000s of units). Subsidiary Currency 1 Currency 2 A +200 -300 B +100 -40 C -80 +200 37 Currency 3 -100 -10 -40 Determine the consolidated net exposure of the MNC to each currency. ANSWER: The net exposure to Currency 1 is 120,000 units; the net exposure to Currency 2 is –140,000 units; the net exposure to Currency 3 is –150,000 units. 2. Money Market Hedge on Receivables. Assume that Stevens Point Co. has net receivables of 100,000 Singapore dollars in 90 days. The spot rate of the S$ is $0.50, and the Singapore interes trate is 2% over 90 days. Suggest how the U.S. firm could implement a money market hedge. Be precise. ANSWER: The firm could borrow the amount of Singapore dollars so that the 100,000 Singapore dollars to be received could be used to pay off the loan. This amounts to (100,000 /1.02) = about S$98,039, which could be converted to about $49,020 (S$98,039 * S$0.50) and invested. The borrowing of Singapore dollars has offset the transaction exposure due to the future receivables in Singapore dollars. 3. Money Market Hedge on Payables. Assume that Vermont Co. has net payables of 200,000 Mexican pesos in 180 days. The Mexican interest rate is 7% over 180 days, and the spot rate of the Mexican peso is $.10. Suggest how the U.S. firm could implement a money market hedge.Be precise. ANSWER: If the firm deposited MXP 186,916 (computed as MXP 200,000/1.07) into a Mexican bank earning 7% over 6 months, the deposit would be worth 200,000 pesos at the end of the six-month period. This amount would then be used to take care of the net payables. To make the initial deposit of 186,916 pesos, the firm would need about $18,692 (computed as 186,916 ×$.10). It could borrow these funds. 4. Invoicing Strategy. Assume that Citadel Co. purchases some goods in Chile that are denominated in Chilean pesos. It also sells goods denominated in U.S. dollars to some firms’ inChile. At the end of each month, it has a large net payables position in Chilean pesos. How can it use an invoicing strategy to reduce this transaction exposure? List any limitations on the effectiveness of this strategy. ANSWER: It could invoice its exports to Chile in pesos; the pesos received would then be used to make payment on the imports from firms in Chile. One limitation is that the Chilean firms may not agree to this (although they likely would); if they are willing, limitations of the invoicing strategy occur if (1) the timing does not perfectly match up, or (2) the amounts received versus paid do not perfectly match up. 5. Hedging with Futures. Explain how a U.S. corporation could hedge net receivables in euros with futures contracts. Explain how a U.S. corporation could hedge net payables in Japanese yen with futures contracts. ANSWER: The U.S. corporation could agree to a futures contract to sell euros at a specified date in the future and at a specified price. This locks in the exchange rate at which the euros could be sold.The U.S. corporation could purchase yen futures contracts that provide for yen to be received in exchange for dollars at a specified future date and at a specified price. The firm has locked in the rate at which it will exchange dollars for yen. 6. Hedging with Forward Contracts. Explain how a U.S. corporation could hedge net receivables in Malaysian ring it with a forward contract. Explain how a U.S. corporation could hedge payables in Canadian dollars with a forward contract. ANSWER: The U.S. corporation could sell ring it forward using a forward contract. This is accomplished by negotiating with a bank to provide the bank ring it in exchange for dollars at aspecified exchange rate (the forward rate) for a specified future date.The U.S. corporation could purchase Canadian dollars forward using a forward contract. This is accomplished by negotiating with a bank to provide the bank U.S. dollars in exchange for Canadian dollars at a specified exchange rate (the forward rate) for a specified future date. 8. Benefits of Hedging. If hedging is expected to be more costly than not hedging, why would a firm even consider hedging? ANSWER: Firms often prefer knowing what their future cash flows will be as opposed to the uncertainty involved with an open position in a foreign currency. Thus, they may be willing to hedge even if they expect that the real cost of hedging will be positive. 9. Real Cost of Hedging Payables. Assume that Suffolk Co. negotiated a forward contract to purchase 200,000 British pounds in 90 days. The 90-day forward rate was $1.40 per British pound. The pounds to be purchased were to be used to purchase British supplies. On the day the pounds were delivered in accordance with the forward contract, the spot rate of the British pound was $1.44. What was the real cost of hedging the payables for this U.S. firm? ANSWER: The U.S. dollars paid when hedging = $1.40(200,000) = $280,000. The dollars paid if unhedged = $1.44(200,000) = $288,000. The real cost of hedging payables = $280,000 – $288,000 = –$8,000. The U.S. dollars paid when hedging = $1.40(200,000) = $280,000. The dollars paid if unhedged= $1.34(200,000) = $268,000. The real cost of hedging payables = $280,000 – $268,000 =$12,000. 38 10. Real Cost of Hedging Receivables. Assume that Bentley Co. negotiated a forward contract to sell 100,000 Canadian dollars in one year. The one-year forward rate on the Canadian dollar was $.80. This strategy was designed to hedge receivables in Canadian dollars. On the day the Canadian dollars were to be sold in accordance with the forward contract, the spot rate of the Canadian dollar was $.83. What was the real cost of hedging receivables for this U.S. firm? Repeat the question, except assume that the spot rate of the Canadian dollar was $.75 on the day the Canadian dollars were to be sold in accordance with the forward contract. What was the real cost of hedging receivables in this example? ANSWER: The nominal amount of hedged receivables = $.80(100,000) = $80,000. The nominal amount of receivables if unhedged = $.75(100,000) = $75,000. The real cost of hedging receivables is $75,000 – $80,000 = –$5,000.The nominal amount of hedged receivables = $.80(100,000) = $80,000. The nominal amount of receivables if unhedged = $.83(100,000) = $83,000. The real cost of hedging receivables =$83,000 – $80,000 = $3,000. 7. Real Cost of Hedging Payables. Assume that Loras Corp. imported goods from New Zealand and needs 100,000 New Zealand dollars 180 days from now. It is trying to determine whether to hedge this position. Loras has developed the following probability distribution for the New Zealand dollar: 39 11. Forward versus Money Market Hedge on Payables. Assume the following information: 90-day U.S. interest rate = 4%. 90-day Malaysian interest rate = 3%. 90-day forward rate of Malaysian ring it = $.400. Spot rate of Malaysian ring it = $.404. Assume that the Santa Barbara Co. in the United States will need 300,000 ringgit in 90 days. It wishes to hedge this payables position. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated costs for each type of hedge. ANSWER: If the firm uses the forward hedge, it will pay out 300,000*($.400) = $120,000 in 90days. If the firm uses a money market hedge, it will invest (300,000/1.03) = 291,262 ringgit now in aMalaysian deposit that will accumulate to 300,000 ringgit in 90 days. This implies that thenumber of U.S. dollars to be borrowed now is (291,262 × $.404) = $117,670. If this amount is borrowed today, Santa Barbara will need $122,377 to repay the loan in 90 days (computed as$117,670 × 1.04 = $122,377). In comparison, the firm will pay out $120,000 in 90 days if it uses the forward hedge and $122,377 if it uses the money market hedge. Thus, it should use the forward hedge. 12. Forward versus Money Market Hedge on Receivables. Assume the following information: 180-day U.S. interest rate = 8%. 180-day British interest rate = 9%. 180-day forward rate of British pound = $1.50. Spot rate of British pound = $1.48. Assume that Riverside Corp. from the United States will receive 400,000 pounds in 180 days.Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated revenue for each type of hedge. ANSWER: If the firm uses a forward hedge, it will receive 400,000* ($1.50) = $600,000 in 180days. If the firm uses a money market hedge, it will borrow (400,000/$1.09) = 366,972 pounds, to beconverted to U.S. dollars and invested in the U.S. The 400,000 pounds received in 180 days will pay off this loan. The 366,972 pounds borrowed convert to about $543,119 (computed as366,972 × $1.48), which when invested at 8% interest will accumulate to be worth about$586,569.In comparison, the firm will receive $600,000 in 180 days using the forward hedge, or about$586,569 in 180 days using the money market hedge. Thus, it should use the forward hedge. 13. Currency Options. Relate the use of currency options to hedging net payables and receivables.That is, when should currency puts be purchased, and when should currency calls be purchased? Why would Cleveland, Inc., consider hedging net payables or net receivables with currency options rather than forward contracts? What are the disadvantages of hedging with currency options as opposed to forward contracts? ANSWER: Currency call options should be purchased to hedge net payables. Currency put options should be purchased to hedge net receivables. Currency options not only provide a hedge, but they provide flexibility since they do not require a commitment to buy or sell a currency (whereas the forward contract does). A disadvantage of currency options is that a price (premium) is paid for the option itself. The only payment by a firm using a forward contract is the exchange of a currency as specified in the contract. 14. Currency Options. Can Brooklyn Co. determine whether currency options will be more or less expensive than a forward hedge when considering both hedging techniques to cover net payables in euros? Why or why not? ANSWER: No. The amount paid out when using a forward contract is known with certainty. However, the amount paid out when using currency options is not known until the period is over (since the firm has the flexibility to exercise the option only if it is feasible). Thus, the MNC cannot determine whether currency options will be more or less expensive than forward contracts when hedging net payables. 15. Long-term Hedging. How can a firm hedge long-term currency positions? Elaborate on each method. ANSWER: Long-term forward contracts are available to cover positions of five years or longer in some cases (for major currencies). Currency swaps are available whereby an arrangement is made for two firms to swap currencies for a specified future time period at a specified exchange rate. Banks often act as middle men linking up two firms who can help each other (each firm will have what the other firm will need). Parallel loans can be used to exchange currencies and re-exchange the currencies at a specified future exchange rate and date. 16. Leading and Lagging. Under what conditions would Zona Co.’s subsidiary consider using a“leading” strategy to reduce transaction exposure? Under what conditions would Zona Co.’s subsidiary consider using a “lagging” strategy to reduce transaction exposure? ANSWER: If a subsidiary expected its currency to depreciate against an invoice currency on goods it imported, it may “lead” its payments (make payments early). If a subsidiary expected its currency to appreciate against an invoice currency on goods it imported, it may “lag” its payments (make a late payment). 17. Cross-Hedging. Explain how a firm can use cross-hedging to reduce transaction exposure. ANSWER: If a firm cannot hedge a specific currency, it can use a forward contract on a currency that is highly correlated with the currency of concern. 40 18. Currency Diversification. Explain how a firm can use currency diversification to reduce transaction exposure. ANSWER: If a firm has net inflows in a variety of currencies that are not highly correlated with each other, exposure is not as great as if the equivalent amount of funds were denominated in a single currency. This is because not all currencies will depreciate against the firm’s home currency simultaneously by the same degree. There may be a partial offsetting effect due to a diversified set of inflow currencies. If the firm has net outflows in a variety of currencies, the same argument would apply. 23. Forward versus Options Hedge on Payables. If you are a U.S. importer of Mexican goods and you believe that today’s forward rate of the peso is a very accurate estimate of the future spot rate, do you think Mexican peso call options would be a more appropriate hedge than the forward hedge? Explain.ANSWER: If the forward rate is close to or exceeds today’s spot rate, the forward hedge would be preferable because the call option hedge would require a premium to achieve about the samelocked-in exchange rate. If the forward rate was much lower than today’s spot rate, the calloption could be preferable because the firm could let the option expire and be better off. 24. Forward versus Options Hedge on Receivables You are an exporter of goods to the United Kingdom, and you believe that today’s forward rate of the British pound substantially underestimates the future spot rate. Company policy requires you to hedge your British pound receivables in some way. Would a forward hedge or a put option hedge be more appropriate? Explain. ANSWER: A put option would be preferable because it gives you the flexibility to exchange pounds for dollars at the prevailing spot rate when receiving payment. 25. Forward Hedging. Explain how a Malaysian firm can use the forward market to hedge periodic purchases of U.S. goods denominated in U.S. dollars. Explain how a French firm can use forward contracts to hedge periodic sales of goods sold to the United States that are invoiced in dollars. Explain how a British firm can use the forward market to hedge periodic purchases of Japanese goods denominated in yen. ANSWER: A Malaysian firm can purchase dollars forward with ringgit, which locks in the exchange rate at which it trades its ringgit for dollars.The French firm could purchase euros forward with dollars.The British firm can negotiate a forward contract with a bank to exchange pounds for yen at a future point in time. 41 26. Continuous Hedging. Cornell Co. purchases computer chips denominated in euros on a monthly basis from a Dutch supplier. To hedge its exchange rate risk, this U.S. firm negotiates a three-month forward contract three months before the next order will arrive. In other words, Cornell is always covered for the next three monthly shipments. Because Cornell consistently hedges in this manner, it is not concerned with exchange rate movements. Is Cornell insulated from exchange rate movements? Explain. ANSWER: No! Cornell is exposed to exchange rate risk over time because the forward rate changes over time. If the euro appreciates, the forward rate of the euro will likely rise over time, which increases the necessary payment by Cornell. 27. Hedging Payables with Currency Options. Malibu, Inc., is a U.S. company that imports British goods. It plans to use call options to hedge payables of 100,000 pounds in 90 days. Three call options are available that have an expiration date 90 days from now. Fill in the number of dollars needed to pay for the payables (including the option premium paid) for each option available under each possible scenario. 32. Comparison of Techniques for Hedging Receivables. a. Assume that Carbondale Co. expects to receive S$500,000 in one year. The existing spot rate of the Singapore dollar is $.60. The one-year forward rate of the Singapore dollar is $.62. Carbondale created a probability distribution for the future spot rate in one year as follows: 42 Put option hedge (Exercise price = $0.63; premium = $0.04). 43 44 45 Chapter 12: Managing economic and translation exposure 1. Reducing Economic Exposure. Baltimore, Inc., is a U.S.-based MNC that obtains 10 percent of its supplies from European manufacturers. Sixty percent of its revenues are due to exports toEurope, where its product is invoiced in euros. Explain how Baltimore can attempt to reduce its economic exposure to exchange rate fluctuations in the euro. ANSWER: Baltimore Inc. could reduce its economic exposure by shifting some of its U.S.expenses to Europe. This may involve shifting its sources of materials or even part of its production process to Europe. It could also reduce its European revenue but this is probably not desirable. 2. Reducing Economic Exposure. UVA Co. is a U.S.-based MNC that obtains 40 percent of its foreign supplies from Thailand. It also borrows Thailand’s currency (the baht) from Thai banks and converts the baht to dollars to support U.S. operations. It currently receives about 10 percent of its revenue from Thai customers. Its sales to Thai customers are denominated in baht. Explain how UVA Co. can reduce its economic exposure to exchange rate fluctuations. ANSWER: UVA Company has periodic outflow payments in Thai baht that are substantially more than its Thai baht inflow payments. UVA could reduce its economic exposure by attempting to increase sales in Thailand, which would generate additional Thai baht inflows. 3. Reducing Economic Exposure. Albany Corp. is a U.S.-based MNC that has a large government contract with Australia. The contract will continue for several years and generate more than half of Albany's total sales volume. The Australian government pays Albany in Australian dollars. About 10 percent of Albany's operating expenses are in Australian dollars; all other expenses are in U.S. dollars. Explain how Albany Corp. can reduce its economic exposure to exchange rate fluctuations. ANSWER: Albany may ask the Australian government to provide payment in U.S. dollars. Alternatively, Albany could attempt to shift some of its expenses to Australia, by either purchasing Australian supplies or shifting part of the production process to Australia. These strategies will increase Australian dollar outflows, so that the Australian dollar inflows and outflows are more balanced. 4. Tradeoffs When Reducing Economic Exposure. When an MNC restructures its operations to reduce its economic exposure, it may sometimes forgo economies of scale. Explain. ANSWER: An MNC may attempt to use several production plants. The production could be increased in countries whose home currency is weak (since demand for products in those countries would be higher). However, to have such flexibility requires that production plants are scattered. Consequently, the firm forgoes the economies of scale that may be achieved by establishing one large production plant. 5. Exchange Rate Effects on Earnings. Explain how a U.S.-based MNC's consolidated earnings are affected when foreign currencies depreciate. ANSWER: A U.S.-based MNC's consolidated earnings are reduced by the translation effect when foreign currencies depreciate. Foreign earnings are translated at the average exchange rate over the fiscal year, so low values of foreign currencies result in a low level of consolidated earnings. 6. Hedging Translation Exposure. Explain how a firm can hedge its translation exposure. ANSWER: A firm can hedge translation exposure by selling forward the currency of the firm's foreign subsidiary. Thus, if the foreign currency depreciates, the translation loss will be somewhat offset by the gain on the short position created by the forward contract. 46 7. Limitations of Hedging Translation Exposure. Bartunek Co. is a U.S.-based MNC that has European subsidiaries and wants to hedge its translation exposure to fluctuations in the euro’s value. Explain some limitations when it hedges translation exposure. ANSWER: The limitations are as follows. First, Bartunek Inc. needs to forecast its foreign subsidiary earnings and may forecast inaccurately. Thus, it will hedge against a level of foreign earnings that differs from actual foreign earnings. Second, forward contracts are not available for all currencies, although Bartunek will not be affected by this limitation since forward contracts in euros are available. Third, translation losses are not tax-deductible, while gains on forward contracts used to hedge translation exposure are taxed. Fourth, transaction exposure may be increased as a result of hedging translation exposure. 8. List and explain the limitations of hedging translation exposure. ANSWER: There are five limitations in hedging translation exposure. 1. Inaccurate earnings forecasts. A subsidiary’s forecasted earnings for the end of the year are not guaranteed. Moreover, if the actual earnings turned out to be much higher, ant if the subsidiary’s currency weakens during the year, the translation loss would likely exceed the gain generated from the forward contract strategy. 2. Inadequate forward contracts for some currencies . Forward contracts are not available for all currencies. Thus, an MNC with some subsidiaries in some smaller countries may not be able to obtain forward contracts for the currencies of concern. 3. Accounting distortions. 4. Increased transaction exposure. This is the most critical limitation with a hedging strategy (forward or money market hedge) on translation exposure since a MNC may increase its transaction exposure. 5. A translation loss is not a real loss. 9. Comparing Degrees of Economic Exposure. Carlton Co. and Palmer, Inc., are U.S.-based MNCs with subsidiaries in Mexico that distribute medical supplies (produced in the United States) to customers throughout Latin America. Both subsidiaries purchase the products at cost and sell the products at 90 percent markup. The other operating costs of the subsidiaries are very low. Carlton Co. has a research and development center in the United States that focuses on improving its medical technology. Palmer, Inc., has a similar center based in Mexico. The parent of each firm subsidizes its respective research and development center on an annual basis. Which firm is subject to a higher degree of economic exposure? Explain. ANSWER: Carlton Company is subject to a higher degree of economic exposure because it does not have much offsetting cost in Mexico. Palmer Inc. incurs costs in Mexico for its research and development center. 10. Comparing Degrees of Translation Exposure. Nelson Co. is a U.S. firm with annual export sales to Singapore of about S$800 million. Its main competitor is Mez Co., also based in the United States, with a subsidiary in Singapore that generates about S$800 million in annual sales. Any earnings generated by the subsidiary are reinvested to support its operations. Based on the information provided, which firm is subject to a higher degree of translation exposure? Explain. ANSWER: Since Nelson Company does not have any subsidiaries, its exposure to exchange rate fluctuations would not be classified as translation exposure. Conversely, Mez Company is subject to translation exposure. Chapter 13 – Foreign direct investment (FDI) MNCs commonly consider foreign direct investment because it can improve their profitability and enhance shareholder wealth. In most cases, MNCs engage in FDI because they are interested in boosing revenues, reducing costs or both. Revenue-related motives 1. Attrack new sources of demand (Establish a subsidiary or acquire a competitor in a new market) 2. Enter profitable market (Acquire a competitor that has controlled its local market) 3. Exploit monopolistic advantages (Establish a subsidiary in a market where competitors are unable to produce the identical produc t; sell products in that country) 4. React to trade restrictions (Establish a subsidiary in a market where tougher trade restrictions will adversely affect the firm’s export volume) 5. Diversify internationally (Establish a subsidiary in markets whose business cycles differe from those where existing subsidiaries are based) Cost-related motives 1. Fully benefit from economies of scale (increases production and possibly greater production efficiency) 2. Use foreign factors of production (cheap land and labor) 3. Use foreign raw materials (cheap and accessible raw materials) 4. Use foreign technology (participate in a joint venture in order to learn about a production process or other operations) 5. React to exchange rate movements (establish a subsidiary in a new market where the local currency is weak but is expected to strengthen over time) 47 Barriers to FDI: Barriers that protect local firms or consumers, barriers that restrict foreign ownership, ‘red tape’ barriers (procedural and documentation requirements), industry barriers, political instability. Some governments allow international acquisition but impose special requirements on MNCs that desire to acquire a local firm. Chapter 14 – Multinational capital budgeting Subsidiary versus parent perspective – Some would say the subsidiary’s perspective should be used because it will be responsible for administering the project and there will be shareholders with interests only in the subsidiary. However, if the parent is financing the project, then it should be evaluating the results from its point of view. The feasibility of the subsidiary can vary with the perspective because the net after-tax cash inflows to the subsidiary can differ substantially from those to the parent. Such differences can be due to several factors such as: tax differentials, restrictred remittances, excessive remittances, exchange rate movements. 48