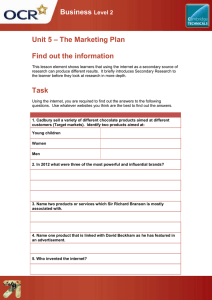

Course : ECON6093 - Business Economics Effective Period : September 2020 Pricing and Output Decisions: Imperfect Competition (2) Session 6 Thank you LEARNING OBJECTIVES 1.Distinguish the features of 4 market structures 2.Explain the concept of Structure-ConductPerformance 3.Distinguish profit maximization under competitive market, monopoly and oligopoly 4.Analyze decision making process with game tehory 5.Point out different type of price setting Alternative Aims to Profit Maximisation • Alternative aims – separation of ownership and control – the principal–agent problem – managerial utility maximisation – profit satisficing • Sales revenue maximisation (short run) – equilibrium output and price • comparisons with short-run profit maximising Sales revenue maximising price and output £ MC Q1 is the profitmaximising output, where MC = MR P1 AR O Q1 Q MR Sales revenue maximising price and output £ MC Q2 is the sales revenue maximising output where MR = 0 P1 P2 AR O Q1 Q2 Q MR Alternative Aims to Profit Maximisation – Profit satisficing Where decision makers in a firm aim for a target level of profit rather than the absolute maximum level. – Sales revenue maximisation An alternative theory of the firm which assumes that managers aim to maximise the firm’s short-run total revenue. – Growth maximisation An alternative theory which assumes that managers seek to maximise the growth in sales revenue (or the capital value of the firm) over time. Alternative Aims to Profit Maximisation • Alternative aims – separation of ownership and control – the principal–agent problem – managerial utility maximisation – profit satisficing • Sales revenue maximisation (short run) – equilibrium output and price • comparisons with short-run profit maximising – implications for advertising – implications for the consumer Alternative Aims to Profit Maximisation • Growth maximisation – measuring ‘growth’ – equilibrium for growth maximising firm? • difficult to identify short-run equilibrium – firm’s approach to profits • virtually impossible to identify long-run equilibrium Alternative Aims to Profit Maximisation • Multiple aims – behavioural theories of the firm – satisficing and the setting of targets • different stakeholders with different aims • various possible targets • potential conflicts between targets – organisational slack • a way of reconciling conflicting aims? • cutting slack with ‘just-in-time’ methods – the consumer’s interest Pricing in Practice • Do firms know their costs and revenues? – difficulties in identifying the profit-maximising price and output – difficulties in predicting rivals’ behaviour • Cost-based pricing – p = AFC + AVC + Profit mark-up – the use of a profit mark-up on AC • choosing the level of output • choosing the mark-up Choosing the output and profit mark-up £ P1 f The firm could choose a higher mark-up, but a lower output … ... or a lower mark-up and a higher output P2 AC h g j D O Q1 Q2 Q Pricing in Practice • Do firms know their costs and revenues? – difficulties in identifying the profit-maximising price and output – difficulties in predicting rivals’ behaviour • Cost-based pricing – the use of a profit mark-up on AC • choosing the level of output • choosing the mark-up • equilibrium price and output? • variations in the mark-up Pricing in Practice • Price discrimination – meaning of price discrimination • charging different prices to different consumers for reasons unrelated to costs • the prices depend on price elasticity of demand Price discrimination P Revenue from a single price P1 Total revenue D O 200 Q Price discrimination P Additional revenue from charging some customers the higher price P2 P2 P1 D O 150 200 Q Pricing in Practice • Price discrimination (cont.) – conditions for price discrimination • firm must be able to set its price • markets must be separate • demand elasticity must differ between markets – examples • inter-temporal pricing • peak-load pricing – advantages to the firm • higher profits • possibility of cross-subsidisation Pricing in Practice • Pricing and the product life cycle – the four stages • launch – first mover advantage • growth – rapid growth in sales • maturity – slow down in sales growth • decline – extension strategies Sales per period The stages in a product’s life cycle O Time The stages in a product’s life cycle Sales per period Product not becoming obsolete Product becoming obsolete O (1) Launch (2) Growth (3) Maturity (4) Decline Time Pricing in Practice • Pricing and the product life cycle – the four stages • launch • growth • maturity • decline – competition and pricing in each stage The stages in a product’s life cycle Sales per period Product not becoming obsolete Product becoming obsolete O (1) Launch (2) Growth (3) Maturity (4) Decline Time Course : ECON6093 - Business Economics Effective Period : September 2020 Business Growth and Strategy Session 6 Acknowledgement These slides have been adapted from: Essential Economic for Business 6th Edition JOHN SLOMAN, ELIZABETH JONES LEARNING OBJECTIVES 1.Analyze business environmental with PEST, Porter’s Five Forces and Value Chain 2.Distinguish various business strategy based on Porter’s Generic Strategy 3.Distinguish profit maximization under competitive market, monopoly and oligopoly 4.Identify internal and external growth strategy 5.Identify the challenges faced by SME Strategic Analysis • Strategic management The management of the strategic long-term decisions and activities of the business. – strategic and day-to-day management – the components of strategic management • strategic analysis • strategic choice • strategic implementation Strategic Analysis • Strategic analysis of the external business environment – PEST / STEEPLE analysis – Competitive Advantage the various factors, such as lower costs or a better product, that give a firm an advantage over its rivals. – five forces of competition • In 1980, Professor Michael Porter of Harvard Business School identified five factors which are likely to affect an organisation’s competitiveness and success Five forces of competition Potential entrants Threat of new entrants Bargaining power of suppliers Suppliers Industry competitors Rivalry among existing firms Threat of substitutes Substitute products Bargaining power of buyers Buyers Strategic Analysis – five forces of competition • actions of ‘complementors’ (a 6th force) Firms producing complementary goods (products that are used together) • government (an alternative 6th force) • The business environment (cont.) – identifying and analysing competitive factors • but problem of uncertainty – limitations of the five forces model • importance of co-operation and collaboration Strategic Analysis • Internal strategic analysis: value chain analysis Value-chain analysis, also developed by Michael Porter, is concerned with how each of these various operations adds value to the product and contributes to the competitive position of the business. – primary activities • inbound logistics • operations • outbound logistics • marketing and sales • service Strategic Analysis • Value chain analysis (cont.) – secondary activities • procurement • technological development • human resources management • firm infrastructure The value chain After-sales service Marketing and sales Outbound logistics Operations Inbound logistics Strategic Choice • Environment- or market-based choices – As an extension of his Five Forces Model of competition, Porter argued that there are three fundamental (or ‘generic’) strategies that a business might adopt: • Cost leadership - Competing through lower costs • Differentiation - competing by producing a product different from rivals’ products • Focus - producing a specialised product for a market niche Porter’s Generic Strategy Strategic Choice • Internal resource-based strategic choices – Resource-based strategy focuses on exploiting a firm’s internal organisation and production processes in order to develop its competitive advantage. – What the firm will seek to exploit or to develop is one or more ‘core competencies’. – Core competencies The key skills of a business that underpin its competitive advantage. VRIO Framework Growth Strategy • Growth by internal or external expansion Alternative growth strategies GROWTH OF A FIRM Internal expansion (1) Horizontal expansion Same product, but increase in market share or diversification into new varieties External expansion Strategic alliances Mergers and acquisitions (1) Horizontal integration Merger or acquisition of firms producing same product at the same stage of production (2) Vertical integration Same product, but expanding to different stages of the productive process (2) Vertical integration Merger or acquisition of firms producing at different stages of same process (3) Conglomerate (3) Conglomerate Diversification - introduction of totally different products Diversification – merger or acquisition of firms producing totally unrelated products Airline strategic alliances Adria, Aegean, Aeroflot, Aerolineas Argentinas, AeroMexico, Air Europa, Air France, 19% Alitalia, China Airlines, China Eastern, China Southern, Czech Airlines, Delta, Garuda Indonesia, Kenya Airways, KLM, Korean Air, MEA, Saudia, TAROM, Vietnam Airlines, Xiamen Air Air Canada, Air China, Air India, Air New Zealand, ANA, Asiana Airlines, Austrian, Avianca, Brussels Airlines, Copa 22% Airlines, Croatia Airlines, Egyptair, Ethiopian Airlines, EVA Air, Polish Airlines, Lufthansa, Scandinavian Airlines, Shenzen Airlines, Singapore Airlines, South African Airways, Swiss, TAP Portugal, Thai, Turkish Airlines, United Airlines American Airlines, BA, Cathay Pacific, Finnair, Iberia, Japan Airlines, LATAM, Malaysia Airlines, Qantas, Qatar Airways, Royal Jordanian, S7 Airlines, SriLankan Airlines, FIJI Airways, Royal Air Maroc 16% Star Alliance Figures show percentages of total worldwide revenue passenger kilometres (RPKs) (2017) Financing Growth and Investment • Sources of business finance – internal sources • ploughed-back profit – external sources • banks – mainly short- and medium-term finance • stock market – longer-term finance • problem of 'short-termism' – international sources Financing Growth and Investment • The role of the Stock Exchange – primary market – secondary market – advantages • brings together savers and firms seeking finance • regulates firms and helps encourage confidence • facilitates mergers and takeovers • reduces transaction costs of investment finance – disadvantages • cost of getting listed • public scrutiny • possible short-termism and instability Financing Growth and Investment • Is the stock market efficient? – the efficient market hypothesis • share prices reflect information about firms' current and expected future performance – implications of stock market efficiency • benefit of speculation diminishes as efficiency increases • perfect efficiency and share prices following a 'random walk' Starting Small • EU definition of SMEs – by number of employees • micro enterprises: <10 employees • small enterprises: 10 – 49 employees • medium enterprises: 50 – 249 employees – by turnover EU SME definitions Criterion Micro Small Medium 9 49 249 2a. Maximum annual turnover €2m €10m €50m 2b. Maximum annual balance sheet total €2m €10m €43m 3. Maximum % owned by one, or jointly by several, enterprise(s) not satisfying the same criteria 25% 25% 25% 1. Maximum number of employees Note: to qualify as an SME criteria 1 and 3 must be met and either 2a or 2b Starting Small • Competitive advantage and small firms – flexibility – quality of service – production efficiency and low overheads – product development – innovation Starting Small • Problems facing small businesses – selling and marketing – funding R&D – management skills – less ability to gain economies of scale • The role of entrepreneurs – what is an entrepreneur? – international comparisons of entrepreneurship • the Global Entrepreneurship Monitor (GEM) 60 50 New Nascent Established 40 30 20 10 Note: Unweighted average is of 53 countries (missing data for Israel) Source: Based on data in Global Entrepreneurship Monitor,Global Report 2018/19, Table 1 Average 0 France Italy Japan Germany Qatar China UK Greece Poland India Taiwan USA Netherlands Canada Brazil Lebanon Angola Entrepreneurial Activity (% of working population) Entrepreneurial activity Starting Small • Problems facing small businesses – selling and marketing – funding R&D – management skills – less ability to gain economies of scale • The role of entrepreneurs – what is an entrepreneur? – international comparisons of entrepreneurship • the Global Entrepreneurship Monitor (GEM) – attitudes towards entrepreneurship – policies towards entrepreneurship . Thank You TEXTBOOK: Essential Economic for Business 6th Edition JOHN SLOMAN ELIZABETH JONES