Management Accounting Assignment: Cost Analysis & Income Statement

advertisement

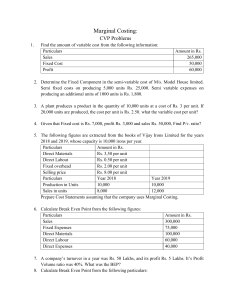

College of Business Administration, University of Sharjah Mgt. Acc. and Control Systems - 0306613 Fall Semester (2019/2020) Assignment 1 Mustafa Al Rashedi U19102890 1) Units produced and sold Particulars 80,000 100,000 120,000 Variable Cost Fixed Costs 240,000.00 320,000.00 560,000.00 300,000.00 320,000.00 620,000.00 360,000.00 320,000.00 680,000.00 Variable Cost Fixed Costs 3 4 7 3 3.2 6.2 3 2.67 5.67 Total Costs Total Costs Cost per unit Total Cost per unit Variable cost per unit is = 240,000/80,000 = AED 3.00 per unit Variable cost at AED 3.00 per unit remains same irrespective of units produced. So, the Variable Cost per unit remains same in all 3 cases. Since units produced differ – FC per unit changes to AED 3.2 and AED 2.67 when production increases to 100,000 and 120,000 respectively 2) Contribution Income format Particulars Amount (in $) Sales 715,000.00 (-) Variable Expenses 330,000.00 Contribution Margin 385,000.00 (-) Fixed Expenses 320,000.00 Net Operating Income 65,000.00 Sales = Units produced x Selling price 110,000 units x $6.50 = $715,000 Variable expenses = Units produced x Variable cost per unit 110,000 units x $3 = $330,000 Contribution Margin = Sales – Variable Expenses $715,000-$330,000 = $385,000 Fixed expenses remain same at $320,000 Net Operating Income = Contribution Margin – Fixed Expenses $385,000-$320,000 = $65,000.