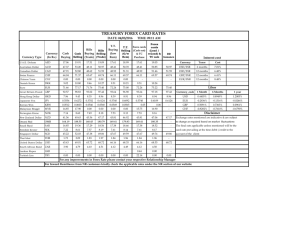

What Is Forex? Share on FacebookShare on Twitter What is forex? Quite simply, it’s the global market that allows the exchange of one currency for another. If you’ve ever traveled to another country, you usually had to find a currency exchange booth at the airport, and then exchange the money you have in your wallet into the currency of the country you are visiting. You go up to the counter and notice a screen displaying different exchange rates for different currencies. You find “Japanese yen” and think to yourself, “WOW! My one dollar is worth 100 yen?! And I have ten dollars! I’m going to be rich!!!” When you do this, you’ve essentially participated in the forex market! You’ve exchanged one currency for another. Or in forex trading terms, assuming you’re an American visiting Japan, you’ve sold dollars and bought yen. Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have left over (Tokyo is expensive!) and notice the exchange rates have changed. It’s these changes in the exchanges rates that allow you to make money in the foreign exchange market. The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world. Compared to the “measly” $22.4 billion per day volume of the New York Stock Exchange (NYSE), the foreign exchange market looks absolutely ginormous with its $5 TRILLION a day trade volume. That’s trillion with a “t”. Let’s take a moment to put this into perspective using monsters… The largest stock market in the world, the New York Stock Exchange (NYSE), trades a volume of about $22.4 billion each day. If we used a monster to represent the NYSE, it would look like this… Looks intimidating. Some may even find it sexy. You hear about the NYSE in the news every day… on CNBC… on Bloomberg…on BBC… heck, you even probably hear about it at your local gym. “The NYSE is up today, blah, blah”. When people talk about the “market”, they usually mean the stock market. So the NYSE sounds big, it’s loud and likes to make a lot of noise. But if you actually compare it to the forex market, it would look like this… Oooh, the NYSE looks so puny compared to the forex market! It doesn’t stand a chance! Check out the graph of the average daily trading volume for the forex market, New York Stock Exchange, Tokyo Stock Exchange, and London Stock Exchange: The currency market is over 200 times BIGGER! It is HUGE! But hold your horses, there’s a catch! That huge $5 trillion number covers the entire global foreign exchange market, BUT daily trading volume from retail traders (that’s us) make up between 5-6% of overall volume, or between $300-400 billion. So you see, the forex market is definitely huge, but not as huge as the others would like you to believe. We don’t like to exaggerate. We just keepin’ it real. Aside from its size, the market also rarely closes! The forex market is open 24 hours a day and 5 days a week, only closing down during the weekend. (What a bunch of slackers!) So unlike the stock or bond markets, the forex market does NOT close at the end of each business day. Instead, trading just shifts to different financial centers around the world. The day starts when traders wake up in Sydney then moves to Tokyo, London, Frankfurt and finally, New York, before trading starts all over again in Sydney! In the next section, we’ll reveal WHAT exactly is traded in the forex market. What Is Traded In Forex? Share on FacebookShare on Twitter What is traded in forex? The simple answer is MONEY. Because you’re not buying anything physical, forex trading can be confusing. Think of buying a currency as buying a share in a particular country, kinda like buying stocks of a company. The price of the currency is usually a direct reflection of the market’s opinion on the current and future health of its respective economy. In forex trading, when you buy, say, the Japanese yen, you are basically buying a “share” in the Japanese economy. You are betting that the Japanese economy is doing well, and will even get better as time goes. Once you sell those “shares” back to the market, hopefully, you will end up with a profit. In general, the exchange rate of a currency versus other currencies is a reflection of the condition of that country’s economy, compared to other countries’ economies. By the time you graduate from this School of Pipsology, you’ll be eager to start working with currencies. Major Currencies While there are potentially lots of currencies you can trade, as a new trader, you will probably start trading with the “major currencies.” Symbol USD EUR JPY GBP CHF CAD AUD NZD Country United States Eurozone Japan Great Britain Switzerland Canada Australia New Zealand Currency Dollar Euro Yen Pound Franc Dollar Dollar Dollar Nickname Buck Fiber Yen Cable Swissy Loonie Aussie Kiwi Currency symbols always have three letters, where the first two letters identify the name of the country and the third letter identifies the name of that country’s currency. Take NZD for instance. NZ stands for New Zealand, while D stands for dollar. Easy enough, right? The currencies included in the chart above are called the “majors” because they are the most widely traded ones. We’d also like to let you know that “buck” isn’t the only nickname for USD. There’s also: greenbacks, bones, benjis, benjamins, cheddar, paper, loot, scrilla, cheese, bread, moolah, dead presidents, and cash money. So, if you wanted to say, “I have to go to work now.” Instead, you could say, “Yo, I gotta bounce! Gotta make them benjis son!” Fun fact: Did you also know that in Peru, a nickname for the U.S. dollar is Coco, which is a pet name for Jorge (George in Spanish), a reference to the portrait of George Washington on the $1 note? They call me Coco yo! Buying And Selling Currency Pairs Share on FacebookShare on Twitter Forex trading is the simultaneous buying of one currency and selling another. Currencies are traded through a broker or dealer, and are traded in pairs. For example the euro and the U.S. dollar (EUR/USD) or the British pound and the Japanese yen (GBP/JPY). When you trade in the forex market, you buy or sell in currency pairs. Imagine each currency pair constantly in a “tug of war” with each currency on its own side of the rope. Exchange rates fluctuate based on which currency is stronger at the moment. Major Currency Pairs The currency pairs listed below are considered the “majors.” These pairs all contain the U.S. dollar (USD) on one side and are the most frequently traded. The majors are the most liquid and widely traded currency pairs in the world. Currency Pair EUR/USD USD/JPY GBP/USD USD/CHF USD/CAD AUD/USD NZD/USD Countries FX Geek Speak Eurozone / United States United States / Japan United Kingdom / United States United States/ Switzerland United States / Canada Australia / United States New Zealand / United States “euro dollar” “dollar yen” “pound dollar” “dollar swissy” “dollar loonie” “aussie dollar” “kiwi dollar” Major Cross-Currency Pairs or Minor Currency Pairs Currency pairs that don’t contain the U.S. dollar (USD) are known as cross-currency pairs or simply as the “crosses.” Major crosses are also known as “minors.” The most actively traded crosses are derived from the three major non-USD currencies: EUR, JPY, and GBP. Euro Crosses Currency Pair EUR/CHF EUR/GBP EUR/CAD EUR/AUD EUR/NZD EUR/SEK EUR/NOK Countries FX Geek Speak Eurozone / Switzerland Eurozone / United Kingdom Eurozone / Canada Eurozone / Australia Eurozone / New Zealand Eurozone / Sweden Eurozone / Norway “euro swissy” “euro pound” “euro loonie” “euro aussie” “euro kiwi” “euro stockie” “euro nockie” Yen Crosses Currency Pair EUR/JPY GBP/JPY CHF/JPY CAD/JPY AUD/JPY NZD/JPY Countries FX Geek Speak Eurozone / Japan United Kingdom / Japan Switzerland / Japan Canada / Japan Australia / Japan New Zealand / Japan “euro yen” or “yuppy” “pound yen” or “guppy” “swissy yen” “loonie yen” “aussie yen” “kiwi yen” Pound Crosses Pair GBP/CHF GBP/AUD GBP/CAD GBP/NZD Countries United Kingdom / Switzerland United Kingdom / Australia United Kingdom / Canada United Kingdom / New Zealand FX Geek Speak “pound swissy” “pound aussie” “pound loonie” “pound kiwi” Other Crosses Pair AUD/CHF Countries Australia / Switzerland FX Geek Speak “aussie swissy” AUD/CAD AUD/NZD CAD/CHF NZD/CHF NZD/CAD Australia / Canada Australia / New Zealand Canada / Switzerland New Zealand / Switzerland New Zealand / Canada “aussie loonie” “aussie kiwi” “loonie swissy” “kiwi swissy” “kiwi loonie” Exotic Currency Pairs No, exotic pairs are not exotic belly dancers who happen to be twins. Exotic currency pairs are made up of one major currency paired with the currency of an emerging economy, such as Brazil, Mexico or Hungary. The chart below contains a few examples of exotic currency pairs. Wanna take a shot at guessing what those other currency symbols stand for? Depending on your forex broker, you may see the following exotic currency pairs so it’s good to know what they are. Keep in mind that these pairs aren’t as heavily traded as the “majors” or “crosses,” so the transaction costs associated with trading these pairs are usually bigger. Currency Pair USD/BRL USD/HKD USD/SAR USD/SGD Countries FX Geek Speak United States / Brazil United States / Hong Kong United States / Saudi Arabia United States / Singapore “dollar real” “dollar riyal” USD/ZAR USD/THB USD/MXN USD/DKK USD/SEK USD/NOK USD/RUB USD/PLN United States / South Africa United States / Thailand United States / Mexico United States / Denmark United States / Sweden United States / Norway United States / Russia United States / Poland “dollar rand” “dollar baht” “dollar mex” “dollar krone” “dollar stockie” “dollar nockie” “dollar ruble” or “Barney” “dollar zloty” It’s not unusual to see spreads that are two or three times bigger than that of EUR/USD or USD/JPY. So if you want to trade exotics currency pairs, remember to factor this in your decision. G10 Currencies The G10 currencies are ten of the most heavily traded currencies in the world, which are also ten of the world’s most liquid currencies. Traders regularly buy and sell them in an open market with minimal impact on their own international exchange rates. Country United States European Union United Kingdom Japan Australia New Zealand Canada Switzerland Norway Sweden Denmark Currency Name dollar Currency Code USD euro EUR pound GBP yen dollar dollar dollar franc krone krona krone JPY AUD NZD CAD CHF NOK SEK DKK BRIICS BRIICS is the acronym coined for an association of five major emerging national economies: Brazil, Russia, India, Indonesia, China and South Africa. Originally the first four were grouped as “BRIC” (or “the BRICs”). BRICs was a term coined by Goldman Sachs to name today’s new high-growth emerging economies. BRIICS is the term used by the OECD, the rich-country think tank adds Indonesia and South Africa. Country Brazil Russia India Indonesia China South Africa Currency Name real ruble rupee rupiah yuan rand Currency Code BRL RUB INR IDR CNY Forex Market Size And Liquidity Share on FacebookShare on Twitter Unlike other financial markets like the New York Stock Exchange (NYSE) or London Stock Exchange (LSE), the forex market has neither a physical location nor a central exchange. The forex market is considered an Over-the-Counter (OTC), or “interbank” market due to the fact that the entire market is run electronically, within a network of banks, continuously over a 24-hour period. This means that the spot forex market is spread all over the globe with no central location. Trades can take place anywhere as long as you have an Internet connection! The forex OTC market is by far the biggest and most popular financial market in the world, traded globally by a large number of individuals and organizations. In an OTC market, participants determine who they want to trade with depending on trading conditions, the attractiveness of prices, and the reputation of the trading counterparty. The chart below shows the seven most actively traded currencies. *Because two currencies are involved in each transaction, the sum of the percentage shares of individual currencies totals 200% instead of 100% The dollar is the most traded currency, taking up 84.9% of all transactions. The euro’s share is second at 39.1%, while that of the yen is third at 19.0%. As you can see, most of the major currencies are hogging the top spots on this list! The Dollar is King in the Forex Market You’ve probably noticed how often we keep mentioning the U.S. dollar (USD). If the USD is one-half of every major currency pair, and the majors comprise 75% of all trades, then it’s a must to pay attention to the U.S. dollar. The USD is king! In fact, according to the International Monetary Fund (IMF), the U.S. dollar comprises roughly 64% of the world’s official foreign exchange reserves! Because almost every investor, business, and central bank own it, they pay attention to the U.S. dollar. There are also other significant reasons why the U.S. dollar plays a central role in the forex market: The United States economy is the LARGEST economy in the world. The U.S. dollar is the reserve currency of the world. The United States has the largest and most liquid financial markets in the world. The United States has a stable political system. The United States is the world’s sole military superpower. The U.S. dollar is the medium of exchange for many cross-border transactions. For example, oil is priced in U.S. dollars. Also called “petrodollars.” So if Mexico wants to buy oil from Saudi Arabia, it can only be bought with U.S. dollar. If Mexico doesn’t have any dollars, it has to sell its pesos first and buy U.S. dollars. Speculation in the Forex Market One important thing to note about the forex market is that while commercial and financial transactions are part of the trading volume, most currency trading is based on speculation. In other words, most of the trading volume comes from traders that buy and sell based on intraday price movements. The trading volume brought about by speculators is estimated to be more than 90%! The scale of the forex market means that liquidity – the amount of buying and selling volume happening at any given time – is extremely high. This makes it very easy for anyone to buy and sell currencies. From the perspective of a trader, liquidity is very important because it determines how easily price can change over a given time period. A liquid market environment like forex enables huge trading volumes to happen with very little effect on price, or price action. While the forex market is relatively very liquid, the market depth could change depending on the currency pair and time of day. In our forex trading sessions part of the school, we’ll tell you how the time of your trades can affect the pair you’re trading. In the meantime, here are a few tricks on how you can trade currencies in gazillion ways. We even narrowed it down to four! The Different Ways To Trade Forex Share on FacebookShare on Twitter Because forex is so awesome, traders came up with a number of different ways to invest or speculate in currencies. Among these, the most popular ones are spot forex, currency futures, currency options, and currency exchange-traded funds (or ETFs). Currency Futures Futures are contracts to buy or sell a certain asset at a specified price on a future date (That’s why they’re called futures!). FX futures were created by the Chicago Mercantile Exchange (CME) way back in 1972, when bell bottoms and platform boots were still in style. Since futures contracts are standardized and traded on a centralized exchange, the market is very transparent and well-regulated. This means that price and transaction information are readily available. Currency Options An “option” is a financial instrument that gives the buyer the right or the option, but not the obligation, to buy or sell an asset at a specified price on the option’s expiration date. If a trader “sold” an option, then he or she would be obliged to buy or sell an asset at a specific price at the expiration date. Just like futures, options are also traded on an exchange, such as the Chicago Mercantile Exchange (CME), the International Securities Exchange (ISE), or the Philadelphia Stock Exchange (PHLX). However, the disadvantage in trading FX options is that market hours are limited for certain options and the liquidity is not nearly as great as the futures or spot market. Currency ETFs Exchange-traded funds or ETFs are the youngest members of the forex world. A currency ETF offers exposure to a single currency or basket of currencies. Here’s a list of the most popularly traded currency ETFs. ETFs are created and managed by financial institutions who buy and hold currencies in a fund. They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks. Like currency options, the limitation in trading currency ETFs is that the market isn’t open 24 hours. Also, ETFs are subject to trading commissions and other transaction costs. Spot Forex Market In the spot market, currencies are traded immediately or “on the spot,” using the current market price. What’s awesome about this market is its simplicity, liquidity, tight spreads, and round-theclock operations. It’s very easy to participate in this market since accounts can be opened with as little as $50! (Not that we suggest you do) – you’ll learn why in our Capitalization lesson! Aside from that, most forex brokers usually provide charts, news, and research for free. In the School of Pipsology, when it comes to the specific way to trade currencies, we’ll be primarily talking about the spot forex market. Quiz Time! What is Forex? Browse All Quizzes How well do you know the foreign exchange market?