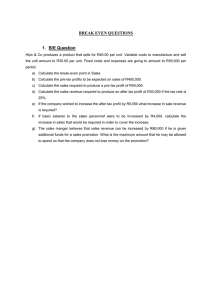

1. East Company manufactures and sells a single product with a positive contribution margin. If the selling price and the variable expense per unit both increase 5% and fixed expenses do not change, what is the effect on the contribution margin per unit and the contribution margin ratio? A) B) C) D) Contribution margin per unit No change Increase Increase Increase Contributio n margin ratio No change Increase No change Decrease 2. The contribution margin ratio always increases when the: A) break-even point increases. B) break-even point decreases. C) variable expenses as a percentage of net sales decrease. D) variable expenses as a percentage of net sales increase. 3. If a company increases its selling price by $2 per unit due to an increase in its variable labor cost of $2 per unit, the break-even point in units will: A) decrease. B) increase. C) not change. D) change but direction cannot be determined. 4. The following information relates to the break-even point at Pezzo Corporation: Sales dollars..................... Total fixed expenses......... $120,00 0 $30,000 If Pezzo wants to generate net operating income of $12,000, what will its sales dollars have to be? A) $132,000 B) $136,000 C) $168,000 D) $176,000 1 5. The following information relates to Snowbird Corporation: Sales at the break-even point......... Total fixed expenses...................... Net operating income..................... $312,50 0 $250,00 0 $150,00 0 What is Snowbird's margin of safety? A) $62,500 B) $187,500 C) $100,000 D) $212,500 6. The following information relates to Zinc Corporation for last year: Sales........................................................... Net operating income................................. Degree of operating leverage..................... $500,00 0 $25,000 5 Sales at Zinc are expected to be $600,000 next year. Assuming no change in cost structure, this means that net operating income for next year should be: A) $30,000 B) $45,000 C) $50,000 D) $125,000 7. Tice Company is a medium-sized manufacturer of lamps. During the year a new line called “Horolin” was made available to Tice's customers. The break-even point for sales of Horolin is $200,000 with a contribution margin of 40%. Assuming that the profit for the Horolin line during the year amounted to $100,000, total sales during the year would have amounted to: A) $300,000 B) $420,000 C) $450,000 D) $475,000 2 8. Birney Company has prepared the following budget data: Sales.............................................................. 150,000 units Selling price.................................................. $25 per unit Variable expenses......................................... $15 per unit Fixed manufacturing expenses..................... $800,000 Fixed selling and admin. expenses............... $700,000 An advertising agency claims that an aggressive advertising campaign would enable the company to increase its unit sales by 20%. What is the maximum amount that the company can pay for advertising and obtain a net operating income of $200,000? A) $100,000 B) $200,000 C) $300,000 D) $550,000 9. Moruzzi Corporation is a single-product company that expects the following operating results for next year: Sales........................................................... Contribution margin per unit..................... Contribution margin ratio.......................... Degree of operating leverage..................... $320,00 0 $0.20 25% 8 How many units would Moruzzi have to sell next year to break-even? A) 50,000 B) 200,000 C) 280,000 D) 350,000 10. Frank Company manufacturers a single product that has a selling price of $20.00 per unit. Fixed expenses total $45,000 per year, and the company must sell 5,000 units to break even. If the company has a target profit of $13,500, sales in units must be: A) 6,000 B) 5,750 C) 6,500 3 D) 7,925 11. Mason Enterprises has prepared the following budget for the month of July: Selling price per unit Variable cost per unit Product A............... $10.00 $4.00 Product B............... Product C............... $15.00 $18.00 $8.00 $9.00 Unit sales 15,00 0 20,00 0 5,000 Assuming that total fixed expenses will be $150,000 and the sales mix remains constant, the break-even point would be closest to: A) $276,008 B) $235,292 C) $294,545 D) $141,278 12. Mark Corporation produces two models of calculators. The Business model sells for $60, and the Math model sells for $40. The variable expenses are given below: Busines s Variable production costs per unit................................... Variable selling and administrative expenses per unit.... Model $15 $9 Math Mode l $16 $6 The fixed expenses are $75,000 per month. The expected monthly sales of each model are: Business, 1,000 units; Math, 500 units. The break-even point for the expected sales mix is (round to nearest whole unit): A) 833 of each B) 1,667 Business and 833 Math C) 1,667 of each D) 833 Business and 1,667 Math 13. Assume the following cost information for Fernandez Company: Selling price Variable costs $120 per unit $80 per unit 4 Total fixed costs Tax rate $80,000 40% What minimum volume of sales dollars is required to earn an after-tax net income of $30,000? A. $465,000 B. $330,000 C. $390,000 D. $165,000 5