Uploaded by

toma hawk

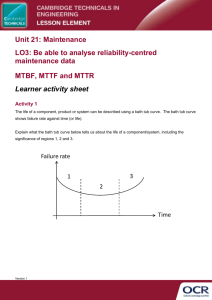

Reliability Supplement: Operations Management Instructor's Manual

advertisement

SUPPLEMENT TO CHAPTER 4 RELIABILITY Teaching Notes 1. 2. 3. The Main topics of this chapter are Quantifying Reliability Role of Redundancy Availability Reliability is a measure of the ability of a product, part, or system to perform its intended function under a prescribed set of conditions. Quantitative methods include the use of probabilities (addition, multiplication, complements) in determining reliability and the use of Exponential and Normal distributions in determining the mean time between failures (used in availability). Students seem to have some difficulty with Exponential distribution, especially if they have not had it in their statistics courses. The coverage of Exponential distribution can be omitted without loss of continuity. The Normal distribution should be included because it paves the way for later use of inventory management and quality control sampling theory. Answers to Discussion and Review Questions 1. Reliability is a measure of the ability of a product or service to perform its intended function under a prescribed set of conditions, i.e. not failing. 2. If a product is composed of a large number of parts, it can conceivably have a low reliability because its reliability is a function of the products of the individual reliabilities. For example if a product has 20 parts, each with a reliability of .99, and all must operate, the overall product reliability will only be about .99 20 = .818. 3. Redundancy refers to backup parts or systems built into a product (or service). Their purpose is to increase reliability by taking over in the event that a primary part or system fails. Solutions 1. a. P(operate) = .92 = .81 b. .9 .9 .9 .9 [.90 + .10(.90)] [.90 + .10(.90)] = .9801 c. [.90 + .99(.10)(.90)]2 = .9783 2. .96 x .96 x .99 x .99 = .9033 3. X3 = .92 x = .9726 Instructor’s Manual, Chapter 4 Supplement 53 Solutions (continued) 4. C = (10P) 2 per component 2 (10P) 2 = 173 100P2 = 86.5 P2 = .865 P = .93 5. a. 97 x .97 x .99 = .9315 b. .9315 + (1 - .9315) x .9315 = .9953 [i.e., P(work) + P(not work) x P(backup works)] c. .9315 + [(1 - .9315) x .98 x .9315] = .994 [i.e., P(work) + [P(not work) x P(switch works) x P(backup works)] 6. a. .98 x .95 x .94 x .90 = .7876 b. If 1st: [.98 + (1 - .98) x .98] x .95 x .94 x .90 = .8034 If 2nd: .98 x [.95 + (1 - .95) x .95] x .94 x .90 = .8270 If 3rd: .98 x .95 x [.94 + (1 – .94) x .94] x .90 = .8349 If 4th: .98 x .95 x .94 x [.90 + (1 - .90) x .90] = .8664 [i.e., for any case, P(all other work) x P(that one fails) x P(backup works)] The fourth component should be backed up. c. The one with a reliability of .90 since it poses the greatest risk of failure. The system reliability will then be .86814. 7. a. #1: Pline = .99 x .96 x .93 = .8839 P(line works) + P(line fails) x P(backup works) = .8839 + [(1 - .8839) x (.8839)] = .9865 #2: .99 .96 .93 .99 .96 .93 .99 .96 .93 .99 .96 .93 P: .99 + [(1 - .99) x .99] .96 + [(1 - .96) x .96] = .9999 = .9984 Overall: .9999 x .9984 x .9951 = .9934 Plan 2 is better (.9934 > .9865) .93 + [(1 - .93) x .93] = .9951 b. In #1 the system will fail if any one original and any one backup fail. In #2 the system will fail only if a component and its backup fail. c. Space for a line versus space for individual backups, ease of shifting to backups when needed, possible cost differences. 54 Operations Management, 2/ce 8. a. Solutions (continued) 8. a. Rsystem = .8839 + [(1 - .8839) x .98 x .8839] = .9845 The decrease in reliability is .9865 - .9845 = .002 a. Rsystem = (.99 + [(1 - .99) x .98 x .99])(.96 + [(1 - .96) x .98 x .96])(.93 + [(1 - .93) x . 98 x .93]) = .9997 x .9976 x .9938 = .9911 The decrease in reliability is .9934 - .9911 = .0023 9. x = reliability x5 = .98 x = .996 10. [x + (1 – x)x](x4) = x5 + (1 –x)x5 = 2x5 – x6 = x5 (2 - x) = .98 x = .995 [by trial and error] 11. Not completed in time means no team completes in time: P(not team #1) x P(not team #2) x P(not team #3) = (1 – .9) x (1 – .8) x (1 – .7) = .1 (.2) (.3) = .006 12. a. (1) (2) (3) T 39 48 60 b. (1) (2) (3) 33 15 6 e–T/MTBF .2725 .2019 .1353 T/MTBF 1.3 1.6 2.0 1.1 .5 .2 [from Table 4S-1] 1 – .3392 = .6608 1 – .6065 = .3935 1 – .8187 = .1813 1– (e–T/MTBF) c. T (1) (2) (3) (4) 13. 50% 85% 95% 99% approx .7 1.9 3.0 4.6 21 mo. 57 90 138 MTBF = 30 months a. T = 30 months 30 T / MTBF = = 1 .0 30 1 – e–T/MTBF = 1 – .3679 = .6321 b. 1 – e–T/MTBF = .10, so e–T/MTBF = .90. Hence, T/MTBF = .10 T = .10(30 months) = 3 months. Instructor’s Manual, Chapter 4 Supplement 55 Solutions (continued) 14. MTBF = 5,000 hours a. T = 6,000 T / MTBF = 6,000 =1.2 5,000 F (T) e–T/MTBF = .3012 b. T = 1,000 T / MTBF = 1,000 = .2 5,000 .1813 –T/MTBF 1–e = 1 – .8187 = .1813 c. P(1,000 ≤ x ≤ 6,000) = .8187 –.3012 .5175 15. MTBF = 6 years T a. >9 b. <12 c. 9<T<12 d. >21 0 .5175 1,000 .3012 6,000 hours .8647 T/MTBF e–T/MTBF F (T) 1.5 .2231 2.0 1 – .1353 = .8647 .8647 – (1 - .2231) =.0878 3.5 .0302 .2231 .0302 .0878 16. µ = 41 mo. σ = 4 mo. 0 9 12 21 years 38 − 41 = −.75. Probability = .2266 (From App. B Table B) 4 a. < 38 : z = b. 40 < T < 45 : z = 40 − 41 = −.25. Probability = .5 - .4013 = .0987 (From App. B Table B) 4 45 − 41 =1.00. Probability = .3413 (From App. B Table A) 4 Total probability = .4400 z 45 = c. µ ± 2 months is µ ± .5σ = 2(.1915) = .3830 (App. B Table A) .1915 c. .0987 b. .3413 .1915 a. 41 .2266 38 56 41 40 41 45 39 41 43 Operations Management, 2/ce Solutions (continued) 17. µ = 6 years .9987 σ = .5 years a. (1) (2) 5−6 = −2.00 .5 1 − .0228 = .9772 (Appendix B, Table B) > 5 yr : z = .9772 -2 0 6−6 = 0.00 .5 = .5000 7.5 − 6 = +3.00 (3) .5 = .9987( Appendix B, Table B) .5000 21. 22. -4 0 < 4 yr : z = 2% 20. 0 4−6 = −4.00 .5 Therefore, approximately zero. a. 2%: Find 2% in App. A Table B: z is -2.055. µ + zσ = 6 - 2.055(.5) = 4.97 yr. b. 5%: Find 5% in App. A Table B: z is -1.645. µ + zσ = 6 - 1.645(.5) = 5.18 yr. b. 19. 3 > 6 yr : z = 7.5 yr : z = 18. 0 5% -2.055 0 4.97 6 MTBF MTBF + MTR MTBF Availability = MTBF + MTR 142 Availability A = = .953 142 + 7 65 Availability B = = .970 65 + 2 Availability = Current Availability = z-scale yr-scale -1.645 0 z-scale 5.18 6 yr-scale 40 300 = .93 b. = .98 40 + 3 300 + 6 50 a. = .962 50 + 2 a. 100 = .962 100 + 4 Instructor’s Manual, Chapter 4 Supplement 57 a. Increase in MTBF = (.05)(100) = 5 hrs. New MTBF = 100 + 5 = 105 hrs. 105 105 Availability = = = .9633 105 + 4 109 b. Reduction in MTR = (.1)(4 hrs.) = .4 hrs. New MTR = 4 hrs - .4 hrs = 3.6 hrs. 100 Availability = = .9653 100 + 3.6 Since .9653 > .9633, designer should choose to reduce MTR, especially because it costs less. 23. a. X −µ 4 − 4.7 = = −2.33 σ .3 P(Z ≤ −2.33) = .0099 (from Appendix B, Table B) Z = We would expect approximately 1% of the batteries to fail before the warranty period ends. b. Since 54 months = 4.5 years, X = 4.5. X −µ 4.5 − 4.7 = = −.67 σ .3 P(Z ≤ −.67) = .2514 (from Appendix B, Table B) Z = We would expect approximately 25% of the batteries to fail before the warranty period ends. Therefore, for each individual battery, the company would have to charge 25 – 1 = 24% of (price of the battery + $5) more. c. In addition to price of the battery, the company should consider: 1. Possible lost future sales of this type of battery as well as lost sales of other products manufactured and sold by the company due to a high volume of replaced batteries; 2. Possible loss of good will, reputation, and poor image in the market due to higher failure rate; 3. The capacity to handle the additional load of battery production and battery exchanges due to failures; 4. The amount of additional business generated as a result of adding the premium battery. (In other words the company must consider the trade-off between the additional business generated from the premium battery vs. the cannibalization of the current base and the existing batteries.) 58 Operations Management, 2/ce a. Increase in MTBF = (.05)(100) = 5 hrs. New MTBF = 100 + 5 = 105 hrs. 105 105 Availability = = = .9633 105 + 4 109 b. Reduction in MTR = (.1)(4 hrs.) = .4 hrs. New MTR = 4 hrs - .4 hrs = 3.6 hrs. 100 Availability = = .9653 100 + 3.6 Since .9653 > .9633, designer should choose to reduce MTR, especially because it costs less. 23. a. X −µ 4 − 4.7 = = −2.33 σ .3 P(Z ≤ −2.33) = .0099 (from Appendix B, Table B) Z = We would expect approximately 1% of the batteries to fail before the warranty period ends. b. Since 54 months = 4.5 years, X = 4.5. X −µ 4.5 − 4.7 = = −.67 σ .3 P(Z ≤ −.67) = .2514 (from Appendix B, Table B) Z = We would expect approximately 25% of the batteries to fail before the warranty period ends. Therefore, for each individual battery, the company would have to charge 25 – 1 = 24% of (price of the battery + $5) more. c. In addition to price of the battery, the company should consider: 1. Possible lost future sales of this type of battery as well as lost sales of other products manufactured and sold by the company due to a high volume of replaced batteries; 2. Possible loss of good will, reputation, and poor image in the market due to higher failure rate; 3. The capacity to handle the additional load of battery production and battery exchanges due to failures; 4. The amount of additional business generated as a result of adding the premium battery. (In other words the company must consider the trade-off between the additional business generated from the premium battery vs. the cannibalization of the current base and the existing batteries.) 58 Operations Management, 2/ce