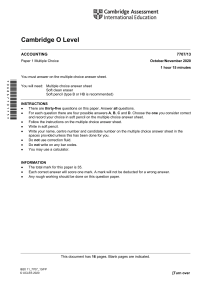

Checkpoint – Topic 2 Revision in Estimated Useful Life A firm buys a non-current asset at the beginning of 2016 for $120,000. The estimated useful life is 10 years, with no scrap value. The firm uses the straight-line method of depreciation. On 1 January 2020 the estimated useful life is shortened to a total of 8 years with a scrap value of $20,000. How much is the appropriate depreciation expense for 2020? $16,200 $15,000 $14,000 $13,000 Change of Accounting Policies Which of the following is a case of change in an accounting policy? A change from FIFO method to weighted average method of inventory valuation An increase in the straight-line depreciation rate for furniture and fixture from 20% to 30% per annum. Events after the Reporting Period While the financial statement of Vex Ltd for the year ended 30 September 2020 has not been approved by its board of directors, the following events are discovered: Cash amounting to $5,000 included in the statement of financial position at 30 September 2020 had been stolen on 28 September 2020. A item of equipment with a carrying amount of $25,000 included in the statement of financial position at 30 September 2020 had been stolen on 12 October 2020. Which of the above is an adjusting event? 1