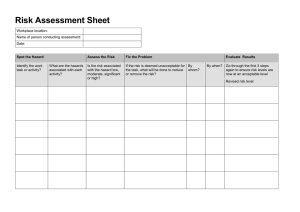

Risk Management

advertisement