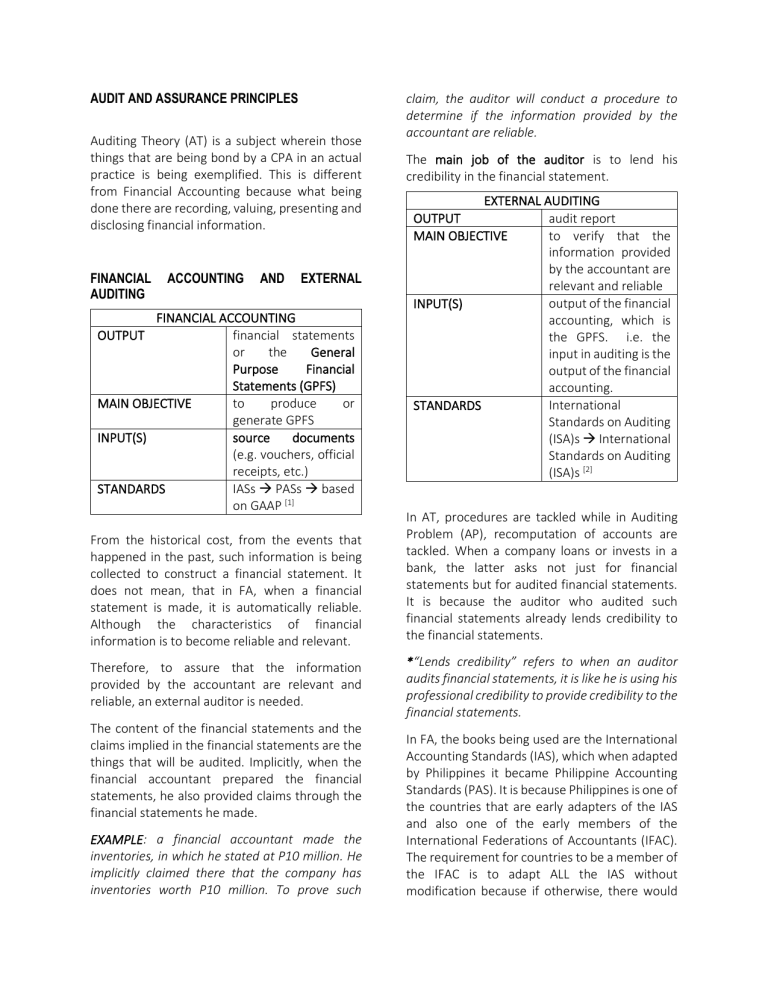

AUDIT AND ASSURANCE PRINCIPLES Auditing Theory (AT) is a subject wherein those things that are being bond by a CPA in an actual practice is being exemplified. This is different from Financial Accounting because what being done there are recording, valuing, presenting and disclosing financial information. FINANCIAL AUDITING ACCOUNTING AND EXTERNAL FINANCIAL ACCOUNTING financial statements or the General Purpose Financial Statements (GPFS) MAIN OBJECTIVE to produce or generate GPFS INPUT(S) source documents (e.g. vouchers, official receipts, etc.) STANDARDS IASs → PASs → based on GAAP [1] OUTPUT From the historical cost, from the events that happened in the past, such information is being collected to construct a financial statement. It does not mean, that in FA, when a financial statement is made, it is automatically reliable. Although the characteristics of financial information is to become reliable and relevant. Therefore, to assure that the information provided by the accountant are relevant and reliable, an external auditor is needed. The content of the financial statements and the claims implied in the financial statements are the things that will be audited. Implicitly, when the financial accountant prepared the financial statements, he also provided claims through the financial statements he made. EXAMPLE: a financial accountant made the inventories, in which he stated at P10 million. He implicitly claimed there that the company has inventories worth P10 million. To prove such claim, the auditor will conduct a procedure to determine if the information provided by the accountant are reliable. The main job of the auditor is to lend his credibility in the financial statement. EXTERNAL AUDITING OUTPUT audit report MAIN OBJECTIVE to verify that the information provided by the accountant are relevant and reliable INPUT(S) output of the financial accounting, which is the GPFS. i.e. the input in auditing is the output of the financial accounting. STANDARDS International Standards on Auditing (ISA)s → International Standards on Auditing (ISA)s [2] In AT, procedures are tackled while in Auditing Problem (AP), recomputation of accounts are tackled. When a company loans or invests in a bank, the latter asks not just for financial statements but for audited financial statements. It is because the auditor who audited such financial statements already lends credibility to the financial statements. *“Lends credibility” refers to when an auditor audits financial statements, it is like he is using his professional credibility to provide credibility to the financial statements. In FA, the books being used are the International Accounting Standards (IAS), which when adapted by Philippines it became Philippine Accounting Standards (PAS). It is because Philippines is one of the countries that are early adapters of the IAS and also one of the early members of the International Federations of Accountants (IFAC). The requirement for countries to be a member of the IFAC is to adapt ALL the IAS without modification because if otherwise, there would be a need to file for justifications of the modifications made in the standards which would take a lot of time. [1] In Auditing, GAAP remains vital because the financial statements to be audited are based on it. In order to assess the financial statements whether the information provided are proper, the reason why the financial accountant made those must be understood or known by the auditor. [2] However, the procedures to conduct an audit of historical financial information must be based on ISAs or PSAs. Generally, there are two types of auditor: 1. Internal auditor- he is an employee of the company in which its financial statements are being audited by himself. The company engages him to audit the policies whether if it is being implemented properly or not. - has bias because the company itself hired him. His main objective is to is to check if the policies of the company are updated or not for the company to improve to cope up with the changing situations. 2. External auditor-the main objective of this subject is to become an external auditor. He is not an employee of the company that is being audited but of auditing firms in usual. - His primary goal is to audit the historical financial information (HFI)[3] of different companies. He can have several clients to audit that is why this is under the category of public practice. [3] it not being called as audit of financial statements because “financial statement” is a general thing. For example, Statement of Financial Position and Audit of Financial Position. It means that the entirety of the FS is audited. But when referred as “audit of historical financial information”, the components of the financial position, cash flow or comprehensive income are only being audited. It is HFI because the accounts and amounts are stated based on historical cost therefore the contents that will be audited are the historical costs. The costs are referred as historical costs because the amounts are based on past transactions. OVERVIEW OF THE AUDIT (FIVE MAJOR COMPONENTS) 1. AUDIT PLANNING (pre planning phase or proper planning phase) – this topic involves the necessary skills and the technical qualifications to determine the readiness on taking the audit. a. pre planning phase – requisites for auditability the company. In this phase, whether or not the company is auditable will be known because there are some clients that are not auditable. b. proper planning phase – audit program and procedures. This involves creating programs, formulating strategies on conducting the entire audit procedures. 2. FRAMEWORK OF ENTITY’S INTERNAL CONTROL – this determines the status of the internal control of the company. Internal control involves policies and procedures that are being implemented by the management in charge of the governance, i.e. these are the policies approved by the Board of Directors that are being implemented in the company that will be audited. – If the internal control is unknown, the auditor would not be able to determine if the amounts provided by the accountant is reliable or not. EXAMPLE: the accountant determines which inventories are included and not included. He did not assure that the amount of the inventories, which is P10 million, is reliable or not. Then the auditor will check the amount provided through conducting procedures. First the internal control of the inventory will be checked to determine if there is a lapse in the internal control, in which the amount provided by the accountant and the amount determined by the author did not match. Internal control involves policies. Therefore, the question is what are the company’s policies in maintaining the inventory. Was it FIFO or Weighted Average? Are there CCTVs installed in the warehouse? 3. ASSESSMENT OF INTERNAL CONTROL – this involves assessment of internal control whether the policies are being operated effectively. It includes control risk assessment whether high or low (attributes or characteristics). – The risk has something to do with uncertainty, doubt. Control risks are the risks which imply that the policies of the company cannot detect error in the financial statement. As the doubt or risk increases, the tendency that the policies of the company are not effective also increases. Increasing risks = policies are not effective Decreasing risks = policies are effective EXAMPLE: the assessment of the auditor is that the company has a high control risk, is there a high chance that the its financial statements are wrong or not reliable? YES. Therefore, the auditor will conduct several tests to ensure that the financial statements of the company are reliable. The higher the risk, the more there would be tests to conduct. If the risks are low, there would be lesser tests to conduct. This is because the assurance that the FS are reliable and /or the policies are effective are inversely proportional with the risks. ↑ risks ↓ policy effectiveness ↓ reliability of FS ↓ risks ↑ policy effectiveness ↓ reliability of FS 4. SUSTANTIVE TESTING – this is the actual auditor’s procedure pertaining to the monetary values in the financial statements. This amount of substantive testing to be conducted by the auditor is based on the assessment of the internal control. ↑ risks ↑ procedures to conduct ↓ risks ↓ procedures to conduct 5. AUDIT REPORT