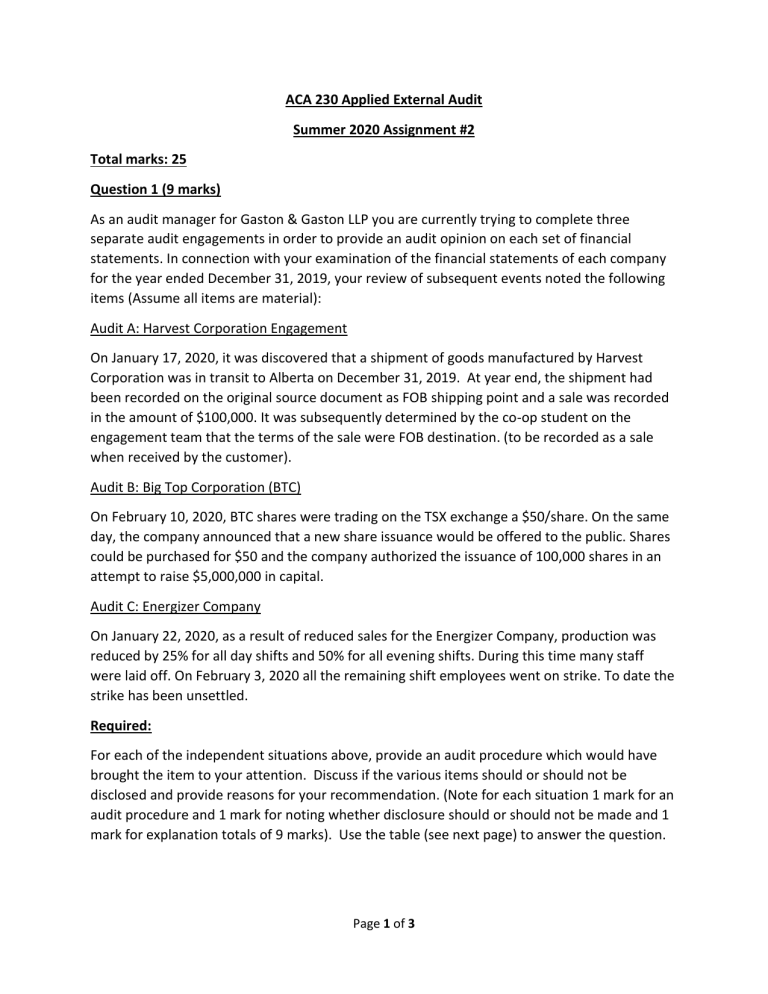

ACA 230 Applied External Audit Summer 2020 Assignment #2 Total marks: 25 Question 1 (9 marks) As an audit manager for Gaston & Gaston LLP you are currently trying to complete three separate audit engagements in order to provide an audit opinion on each set of financial statements. In connection with your examination of the financial statements of each company for the year ended December 31, 2019, your review of subsequent events noted the following items (Assume all items are material): Audit A: Harvest Corporation Engagement On January 17, 2020, it was discovered that a shipment of goods manufactured by Harvest Corporation was in transit to Alberta on December 31, 2019. At year end, the shipment had been recorded on the original source document as FOB shipping point and a sale was recorded in the amount of $100,000. It was subsequently determined by the co-op student on the engagement team that the terms of the sale were FOB destination. (to be recorded as a sale when received by the customer). Audit B: Big Top Corporation (BTC) On February 10, 2020, BTC shares were trading on the TSX exchange a $50/share. On the same day, the company announced that a new share issuance would be offered to the public. Shares could be purchased for $50 and the company authorized the issuance of 100,000 shares in an attempt to raise $5,000,000 in capital. Audit C: Energizer Company On January 22, 2020, as a result of reduced sales for the Energizer Company, production was reduced by 25% for all day shifts and 50% for all evening shifts. During this time many staff were laid off. On February 3, 2020 all the remaining shift employees went on strike. To date the strike has been unsettled. Required: For each of the independent situations above, provide an audit procedure which would have brought the item to your attention. Discuss if the various items should or should not be disclosed and provide reasons for your recommendation. (Note for each situation 1 mark for an audit procedure and 1 mark for noting whether disclosure should or should not be made and 1 mark for explanation totals of 9 marks). Use the table (see next page) to answer the question. Page 1 of 3 Audit Audit Procedure (1 mark) Disclosure or Adjustment with Explanation (2 marks) A: Harvest Corporation Engagement B: Big Top Corporation (BTC) C: Energizer Company Question 2 (16 marks) The following are four unrelated situations. For each situation, identify the appropriate type of audit opinion and give reasons. State any assumptions that may be necessary. A) King City Construction Ltd. is in the business of providing construction for government structures (for example highways and bridges). Most of King City’s projects are long term in nature and thus King City uses the percentage of completion method for revenue recognition. King City is aggressive in its revenue recognition compared to the industry. Your review of this year's contracts indicates that several projects look as if they will be high in revenue for the first two years, and then have negligible earnings for the next three years. (4 marks) B) OakPlus Manufacturing Limited constructs furniture out of oak wood. The furniture is respected for its durability and craftsmanship. Last year, the company received a letter from a governmental agency advising that it had been found that the factory was located on contaminated land that leaked hazardous chemicals into the air. This was a preliminary letter stating that a full investigation into the health effects was underway. Management stated that everything is OK - the investigation was terminated. However, the lawyer refused to sign the legal letter with respect to several lawsuits with respect to employee claims for long term disability due to a nervous disorder that affected employees' ability to work. Neither the investigation nor the lawsuits are disclosed in the notes to the financial statements. (4 marks) C) Metallix Ltd. is a construction company that builds and repairs hospitals. An architect does the design, and four different small construction companies are used to build the hospitals. You are worried that some of the projects that span the April year end may result in material losses, even though income has been reported in the coming year. Management has refused permission for you to enter construction sites, as they feel that the construction sites will be dangerous and they do not want to be exposed to such liability. (4 marks) D) Greencorp is a charitable organization devoted to maintaining national parks. Fund raising is handled primarily by means of electronic mail and door to door canvassing by volunteers. Page 2 of 3 Volunteers conducting canvassing provide receipts at the door using prenumbered receipts. Funds raised by email are sent receipts by email. (4 marks) Use the following table format for your answer: Identify type of Situation appropriate audit Explanation (3 marks each) opinion (1 mark) A B C D Page 3 of 3