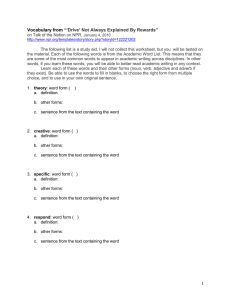

NEPAL BUDGET 2077/78 SUMMARY 1. Budget Highlights Fiscal Year Budget Allocation Current Expenditure Capital Expenditure Financial Management Total 2077/78 Amt (in Billions) 948.94 352.91 172.79 1,474.64 Fiscal Year 2077/78 Amt (in Billions) 889.62 60.52 299.50 225.00 1,474.64 Sources of Revenue Tax Revenue Foreign Grant Foreign Debt Internal Debt Total % 64.35% 23.93% 11.72% 100.00% % 60.33% 4.10% 20.31% 15.26% 100.00% Budget Allocation (Amt in Billions) for FY 2020/21 172.79, 12% 2076/77 Amt (in Billions) % Change % 957.1 62.43% -0.85% 408.01 26.62% -13.50% 167.86 10.95% 2.94% 1,532.97 100.00% -3.81% 2076/77 Amt (in Billions) % 981.14 64.00% 58.00 3.78% 298.83 19.49% 195.00 12.72% 1,532.97 100.00% Sources of Fund (Amt in Billions) for FY 2020/21 15% Current Expenditure 352.91, 24% Capital Expenditure 948.94, 64% Financial Management Change % -9.33% 4.34% 0.22% 15.38% -3.81% Tax Revenue Foreign Grant 20% 61% 4% Foreign Debt Internal Debt 2. Nepal achieved consistently high economic growth rate in the past few years. But due to Covid19 crisis, the estimated economic growth rate (revised) of GDP is 2.3% for the current fiscal year (FY 2076/77). Tourism, transportation, construction and manufacturing sectors are expected to shrink in the current fiscal year. 3. Average 9-months inflation for the current fiscal year is estimated at 6.5%. 4. There has been remarkable increase in access to banking and insurance services throughout the nation. In the current fiscal year, more than 1000 addition of new branches across the country and increase of insurance coverage facility from 56 lakh to 70 lakhs people. Nepal Budget 2077/78 Review: Impact on Capital Markets 5. Exports have increased by 12.9% whereas imports have decreased by 7.5% during 9 months of the current fiscal year. Due to this, there is significant improvement in balance of payment. Surplus has reached NPR 36.61 Arba & foreign exchange reserve has increased by NPR 1.17 kharba, reaching total of NPR 11.56 Kharba. 6. For FY 2076/77, the capital expenditure and revenue mobilization have been both affected by COVID-19 pandemic. Only about 70% of total government expenditure planned for this fiscal year is estimated to be spent, i.e. NPR 10.73 kharba. 73.3% of budgeted current expenditure, 58.6% of budgeted capital expenditure and 78.8% of budgeted financial management expenditure estimated to be spent. 7. Government of Nepal (GoN) has targeted to provide health insurance access to the whole population within the next three years. Within the next fiscal year, at least 40% of population of each local body will have access to health insurance. GoN has allocated NPR 7.50 arba for health insurance expenditure. 8. Small & medium industries, cottage industries, and agriculture, manufacturing, hotel, tourism industries affected by corona will be provided credit at 5 % interest rate. Provision of refinancing loan of NPR 1 kharba to be provided under this. 9. Plan to create 40 thousand jobs through SKBBL program “Sana Kisan Karjha Scheme”. Sana Kisan Bikas Bank will be lent NPR 3.60 arba in order to provide assistance to several cooperatives. 10. Tax rebate, interest subsidy to be provided to airlines, travels agency, trekking agency, hotels and restaurants. 11. Nepse transaction will be made completely electrical technology based. 12. Capital market scope to be enhanced and debt instruments to be traded through secondary market. Stock dealer to start functioning by fiscal year 2077/78. Organization improvement will be done at SEBON, Nepse and CDSC. 13. Hedging of foreign currency will be encouraged and commodity market will be brought into functioning. 14. Hydropower projects with total capacity of 1300 MW expected to start production in fiscal year 2077/78 and added to national grid. Upper Sanjen, Rasuwagadhi, Upper Tamakoshi and Middle Bhotekoshi projects expected to be completed. 15. Construction of international transmission line of 400 KV capacity : Jhapa to Mahendranagar, Lapsiphedi – Ratamate – Hetauda, Lapsiphedi – Ratamate – Damauli – Butwal and Dhaklebar Muzaffarpur transmission lines to proceed forward. 16. Hydropowers holding licenses without starting construction for long periods will be discouraged by cancelling the licenses. 17. PPA of the hydropower projects will be conducted in competitive manner. 18. Digital Nepal Framework will be implemented. Policies regarding Information, Telecommunications and existing broadband policy will be modified and the fiber to the home program and reliable broadband internet services will be made available in all locations in Nepal within 2 years. The 4G service will be expanded nationwide within next year. 19. Only front workers (Health Professionals and Security Personnel) involved in Corona pandemic will be provided allowances. Travel allowance, fuel, furniture, new vehicles purchase as well as Nepal Budget 2077/78 Review: Impact on Capital Markets repair expenses will face cut in budget. Motivation allowances, overtime allowances, meeting allowances, lunch allowances and other types of allowances for government employees except the above mentioned front workers will be dismissed from 1st Shrawan 2077. 20. Corona virus insurance coverage of Rs 1 lakh to be provided for free of cost to temporary and permanent government staffs. 21. For FY 2076/77, micro, cottage and small industries and business person with annual transaction upto NPR 20 lakhs will get 75% exemption in tax, transaction between NPR 20 lakhs to NPR 50 lakhs will get 50% exemption in tax, and transaction between NPR 50 lakhs to NPR 1 crore will get 25% exemption in tax. 22. 20% exemption in income tax for aviation, transport service, hotel, travel and trekking agencies affected by the pandemic for fiscal year 2076/77. Nepal Budget 2077/78 Review: Impact on Capital Markets NEPAL BUDGET 2077/78 IMPACT ASSESSMENT ON CAPITAL MARKETS IMPACT ON OVERALL STOCK/CAPITAL MARKET The overall contraction in economic activities will slow down the activities of the individual companies from both the supply and demand sides. Revenues and profitability to be hit. Introduction of new instruments, start of commodity market and stock dealer service, and secondary market listing of debt instruments will help in expanding the scope of the capital markets. Complete digitization of NEPSE as well as structural improvement in SEBON, CDS and NEPSE will enhance the operational efficiency in the stock market. With the target of completing credit rating task of Nepal within six months, it will encourage the flow of foreign direct investments in the Nepalese market, as foreign investors seek country rating to quantify risks associated with investments in the country. Cut of allowances of Government Employees will reduce their disposable income resulting in decrease in investable fund. IMPACT ON DIFFERENT SECTORS Banking Sector Access of banking service will be expanded, thereby opening growth opportunities. Restructuring and further expansion of convenient loan ( 5% lending rate) provided by banking sector to corona hit industries may help in the credit growth Trading of debt instruments issued by the banks in the secondary market will make them attractive to the investors, enabling more BFIs to go for debentures. This will give banks the option to manage liquidity efficiently. The digitization of NEPSE can provide big opportunity for banking sector in terms of expanding their services in stock trading business. Insurance Access of insurance service, especially health insurance, will be expanded, thereby opening growth opportunities. The fund allocation for insurance coverage for 40% of population of each local body will impact health insurance business. This could have a huge positive impact on growth in the insurance sector. However, it depends upon the modality which government uses to implement this program, i.e. self-operated by government or through existing insurance companies. The business of insurance company is expected to grow as the insurance facility will be made affordable and accessible to the general public. Non-life insurance will be benefited from the promotion of agro insurance and micro insurance. The government policies support the expansion of market reach of the insurance sector, hence, the increment in business and subsequently, profitability of the insurance companies can be expected. Nepal Budget 2077/78 Review: Impact on Capital Markets Extension in the insurance of industries and public transportation affected by lockdown might increase the claim ratio and expenses of the insurance companies. Free Corona Virus Insurance of Rs. 100,000 to all the permanent and temporary government employees of Nepal Government might give opportunity in business increment for the government owned non-life insurance company, i.e. Rastriya Beema Company Ltd, if government decides to insure through it. Hydroelectricity Construction of 400 KV capacity inter-nation electricity transmission line will reduce the evacuation risk of electricity generated for hydropower projects. This will also encourages new hydro projects in the country. By discouraging and cancelling the licenses of hydropower companies holding license for long period without construction will force timely construction of the projects. Competitive method for the PPA might negatively impact on the profitability of new projects. However, this might also enforce the companies to improve operational efficiency. Hotels Tax rebate, interest subsidy to be provided to hotels will help to reduce the incurred loss by decreasing their expenses. 20% exemption in tax for the hotel sectors will give some financial relief. However, for the hotels listed in Nepse, it is more likely that they will register loss for this year due to lockdown brought about by pandemic. Manufacturing and Processing The business of manufacturing companies is expected to contract. Providing 50% rebate in electricity used by industries in no-peak hours will help in reducing the electricity expense of the manufacturing companies. Microfinance Loan based fund scheme will help Sana Kisan Laghubitta Bittiya Sanstha (SKBBL) to increase credit growth with low cost of fund. Promotion of agro insurance and micro insurance is expected to be done through microfinance companies, thereby increasing their scope and business volume. The growth and expansion in the agro insurance and micro insurance will also help to safeguard the lending of microfinance companies. Tax exemptions for micro, cottage and small industries will help the customers of microfinance, decreasing probability of defaults and increasing timely repayments. Others Implementation of Digital Nepal Framework might provide opportunity to Nepal Telecom (NTC) for the expansion of its internet services all over the Nepal. Nepal Budget 2077/78 Review: Impact on Capital Markets